Assets are a crucial component of your balance sheet. You can use your company’s assets to generate revenue or as collateral when obtaining a loan. In accounting, assets fall into several types, and people may often lack an understanding of their differences and how to handle them.

Let’s look at what assets mean in accounting.

Key takeaways

- Assets are essential resources owned by a business, and effective asset management involves strategic planning, acquisition, utilization, maintenance, and disposal to optimize performance and maximize returns.

- Various asset valuation methods provide insights into asset value, allowing businesses to make informed financial decisions and align their asset portfolio with strategic objectives, ultimately enhancing financial performance and shareholder value.

- Effective asset management and risk mitigation strategies are crucial for sustainable growth and resilience, given the significant implications of changes in assets on financial statements, business performance, and decision-making processes.

What are assets?

First thing first, what are assets?

By definition, assets are resources a company owns or controls that hold economic value, which can be measured and expressed in monetary terms. These resources are expected to provide future benefits to the company, such as generating revenue or reducing expenses.

Examples of assets include cash, inventory, equipment, property, investments, and even patents or trademarks.

Simply put, they are a company’s valuable resources.

In accounting, assets play a fundamental role in assessing a company’s financial standing.

Analyzing the types and quantities of assets a company holds, along with how effectively it manages and utilizes them, can tell stakeholders about its operational efficiency, liquidity, and potential for growth.

Automate your accounting with Synder and have always accurate balance sheet for a deep asset overview! Sign up for our all-inclusive 15-day free trial and experience the benefits firsthand. Or, if you prefer a more personal touch, reserve a spot at our Weekly Product Demo to see smart accounting automation in action.

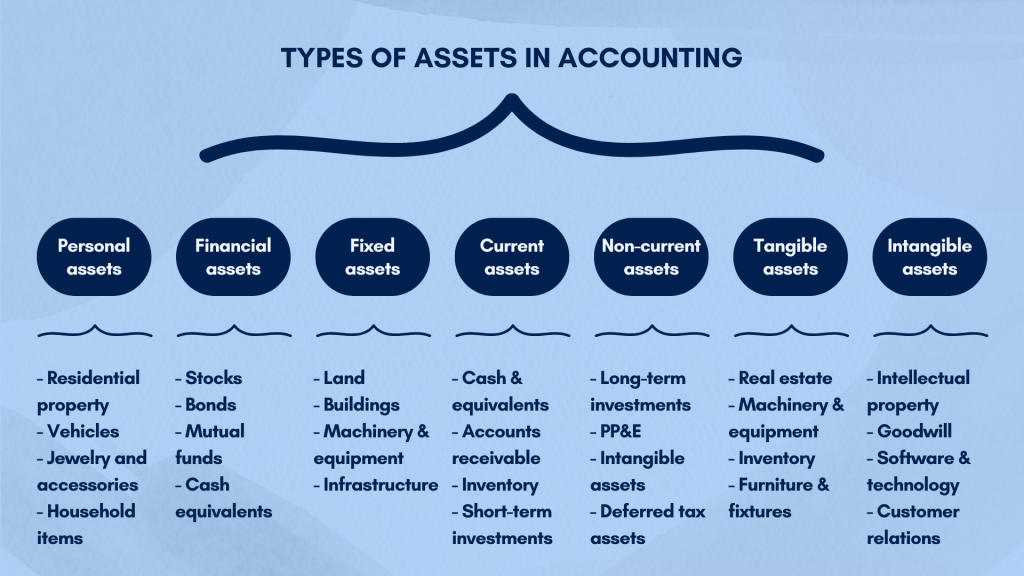

Assets classification in accounting: what are the main types of assets?

Assets can be classified into different categories based on their characteristics and expected usage.

Assets can be classified into various categories based on their nature, purpose, and expected duration of use. Understanding the different types of assets is crucial for effective financial management and reporting.

Let’s look at the various asset types in more detail.

1. Personal assets

Personal assets encompass possessions owned by individuals for personal use or enjoyment. These assets hold sentimental or practical value to the owner and are not typically utilized for income generation or business purposes.

Speaking of personal assets, we may mean:

- Residential property, including homes or condominiums owned for personal residence.

- Vehicles, comprising cars, motorcycles, or recreational vehicles used for personal transportation.

- Jewelry and accessories, such as watches, rings, or designer handbags.

- Household items, including furniture, appliances, electronics, and other goods used within the home.

Personal assets are not recorded on a company’s balance sheet but are important considerations for individuals in managing their personal finances and estate planning.

It’s good to know, but let’s focus more on business-related assets.

2. Financial assets

Financial assets represent instruments that confer ownership rights or claims to future cash flows or financial benefits. These assets are primarily held for investment purposes and can be easily bought, sold, or traded in financial markets.

Let’s look at some financial assets examples.

- Stocks, which is ownership stakes in publicly traded companies, providing dividends and potential capital appreciation.

- Bonds, being debt securities issued by governments or corporations, promising periodic interest payments and repayment of principal at maturity.

- Mutual funds, meaning pooled investment vehicles that invest in a diversified portfolio of stocks, bonds, or other securities.

- Cash equivalents, denoting highly liquid assets such as money market funds, treasury bills, or short-term certificates of deposit.

Financial assets play a crucial role in investment portfolios, allowing investors to diversify risk, earn returns, and achieve their financial goals.

3. Fixed assets

Fixed assets, also known as property, plant, and equipment (PP&E), are tangible assets used in business operations with a useful life exceeding one accounting period. These assets are essential for conducting core business activities and are recorded on the balance sheet at their historical cost.

Here’s what fixed assets about.

- Land – real property used for building facilities, manufacturing plants, or agricultural purposes.

- Buildings, such as offices, warehouses, factories, or retail outlets.

- Machinery and equipment, including industrial machinery, vehicles, computers, and tools used in production processes.

- Infrastructure, such as roads, bridges, utilities, and other long-term assets providing essential services.

Fixed assets are subject to depreciation, representing the gradual allocation of their cost over their useful lives to reflect their consumption or obsolescence.

4. Current assets

Current assets are assets expected to be converted into cash or consumed within one year or one operating cycle, whichever is longer. These assets are crucial for maintaining liquidity and funding day-to-day operations.

- Cash and cash equivalents, including cash on hand, bank balances, and short-term investments with maturities of less than one year.

- Accounts receivable, being amounts owed to the company by customers for goods or services provided on credit.

- Inventory, such as raw materials, work-in-progress, or finished goods held for sale or production.

- Short-term investments, such as marketable securities or financial instruments with maturities of less than one year.

Current assets provide the necessary liquidity for meeting short-term obligations and operating expenses, ensuring the smooth functioning of business operations.

5. Non-current assets

Non-current assets, also known as long-term assets, are assets expected to provide economic benefits beyond the current accounting period. These assets play a significant role in supporting the long-term growth and sustainability of a business.

Examples of non-current assets include:

- Long-term investments, such as equity investments in other companies, bonds, or financial instruments held for strategic purposes.

- Property, Plant, and Equipment – fxed assets used in business operations with a useful life exceeding one year.

- Intangible assets, being the non-physical assets such as patents, trademarks, copyrights, or goodwill.

- Deferred tax assets, including tax benefits or credits that will be realized in future periods.

Non-current assets are crucial for generating future revenue streams, enhancing competitive advantages, and creating long-term shareholder value.

6. Tangible assets

Tangible assets are physical assets that have a physical form and can be touched or felt. These assets provide tangible benefits and often have a direct impact on business operations.

Let’s break them down.

- Real estate, includinng land, buildings, warehouses, or other physical properties used for business purposes.

- Machinery and equipment used in manufacturing or production processes.

- Inventory – physical goods held for sale, including raw materials, work-in-progress, or finished products.

- Furniture and fixtures, being office furniture, fixtures, or equipment used for administrative purposes.

Tangible assets are essential for conducting operational activities and may have significant financial value reflected on the balance sheet.

7. Intangible assets

Intangible assets are non-physical assets that lack a physical form but have value due to their intellectual or legal rights. These assets are vital for creating competitive advantages and driving long-term profitability.

Hete’s what falls into the intangible assets category.

- Intellectual property, such as patents, trademarks, copyrights, or trade secrets protecting unique ideas, inventions, or brands.

- Goodwill, which is the premium paid for acquiring a company above its tangible assets’ fair value, representing its reputation, customer relationships, or brand recognition.

- Software and technology, including software licenses, proprietary technologies, or digital assets enhancing business operations or product offerings.

- Customer relationships, inclusing customer lists, contracts, or agreements providing access to recurring revenue streams.

Intangible assets contribute to a company’s intellectual capital, brand value, and market positioning, playing a crucial role in driving business growth and innovation.

As you can see, some assets may fall into several categories, or, if you will, types, and that’s quite common.

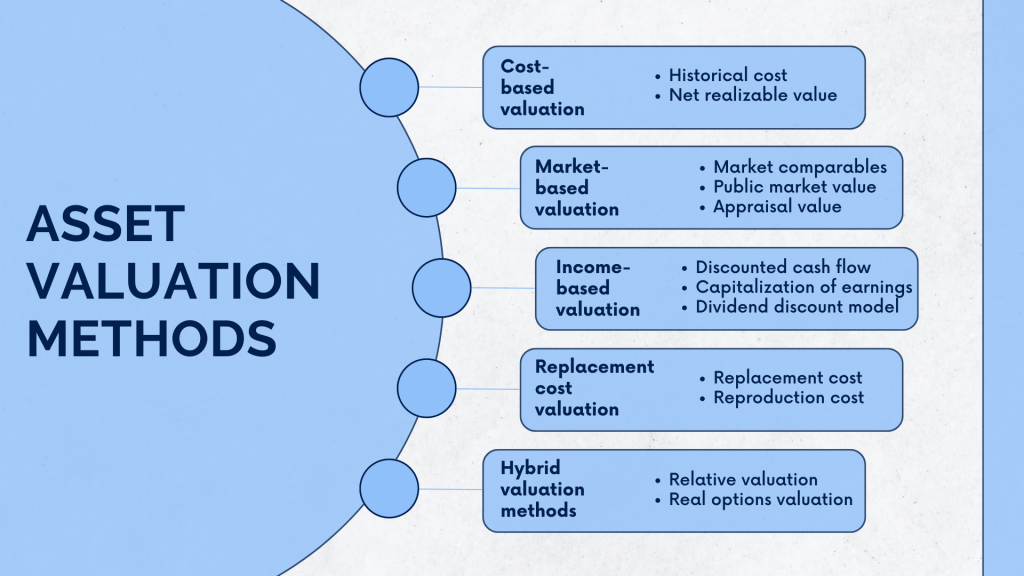

How are assets valued: commonly used asset valuation methods

Valuing assets accurately is crucial for businesses and investors to make informed financial decisions, assess performance, and determine the true worth of their resources. Various asset valuation methods are used to determine the monetary value of assets on the balance sheet. Each method has its advantages, limitations, and suitability depending on the type of asset and the purpose of valuation. Here are some commonly used asset valuation methods:

Method #1 – Cost-based valuation

Cost-based valuation, also known as historical cost valuation, involves valuing assets based on their original acquisition cost. Under this method, assets are recorded on the balance sheet at the price paid to acquire or produce them, including all costs directly attributable to bringing the asset to its present condition and location.

Here’s a couple of cost-based asset valuation methods.

- Historical cost

Assets are valued at their original purchase price, including acquisition costs, taxes, and transportation expenses. - Net realizable value (NRV)

For inventory or receivables, assets are valued at the estimated selling price less any estimated costs necessary to make the sale.

Cost-based valuation methods are simple to apply and provide a reliable basis for financial reporting. However, they do not necessarily reflect the current market value of assets, especially in periods of inflation or deflation.

Method #2 – Market-based valuation

Market-based valuation relies on market prices and comparable transactions to determine the value of assets. This approach assumes that the fair value of an asset is based on what similar assets are currently selling for in the market.

Market-based valuation methods include:

- Market comparables

Assets are valued by comparing them to similar assets that have recently been sold in the market, considering factors such as age, condition, location, and demand. - Public market value

For publicly traded securities or real estate, assets are valued based on their market price as quoted on stock exchanges or through real estate listings. - Appraisal value

Independent appraisers assess the value of assets based on market conditions, industry trends, and comparable sales data.

Market-based valuation methods provide a more accurate reflection of current market conditions and investor sentiment. However, they may not be suitable for unique or specialized assets with limited market activity.

Method #3 – Income-based valuation

Income-based valuation methods estimate the value of assets based on their expected future income or cash flow generation potential. These methods are commonly used for income-producing assets such as real estate, businesses, or investment properties.

Here are income-based valuation methods.

- Discounted cash flow (DCF)

Assets are valued by discounting the projected future cash flows they are expected to generate to their present value using a discount rate that reflects the risk and time value of money. - Capitalization of earnings

Assets are valued based on their ability to generate earnings or profits, applying a capitalization rate to the expected annual income stream. - Dividend discount model (DDM)

For stocks or equity investments, assets are valued based on the present value of expected future dividend payments.

Income-based valuation methods focus on the earning potential and intrinsic value of assets, providing insights into their long-term investment viability. However, they require accurate financial projections and assumptions about future performance.

Method #4 – Replacement cost valuation

Replacement cost valuation involves valuing assets based on the cost of replacing them with equivalent assets at current market prices. This method assumes that the value of an asset is determined by the cost of acquiring a similar asset with similar utility and functionality.

Here are some cost valuation methods

- Replacement cost

Assets are valued based on the cost of acquiring new or similar assets in the current market, considering factors such as technological advancements, quality, and specifications. - Reproduction cost

Assets are valued based on the cost of reproducing or rebuilding them to their current condition and specifications, including labor, materials, and overhead expenses.

Replacement cost valuation provides a realistic assessment of the amount required to replace assets in case of loss or damage. However, it may not consider factors such as depreciation, obsolescence, or changes in market conditions.

Factor #5 – Hybrid valuation methods

Hybrid valuation methods combine elements of different valuation approaches to provide a more comprehensive assessment of asset value. These methods may incorporate aspects of cost-based, market-based, income-based, or replacement cost valuation techniques to address specific valuation challenges or capture different dimensions of asset value. Hybrid valuation methods include:

- Relative valuation

Assets are valued based on a combination of market multiples, financial ratios, and intrinsic valuation metrics to assess their relative attractiveness compared to industry peers. - Real options valuation

Assets are valued based on the flexibility or optionality they provide, considering the potential upside and downside scenarios and the value of deferring investment decisions.

Hybrid valuation methods offer flexibility and customization in assessing asset value, allowing for a more nuanced understanding of complex valuation situations. However, they may require sophisticated modeling techniques and expertise to implement effectively.

Choosing the most appropriate asset valuation method depends on various factors, including the nature of the asset, the purpose of valuation, market conditions, and regulatory requirements.

How does asset management impact business operation?

Asset management plays a critical role in the efficient functioning and long-term success of businesses across various industries. Effective asset management encompasses the strategic planning, acquisition, utilization, maintenance, and disposal of assets to optimize their performance, minimize costs, and maximize returns. Here’s how asset management impacts business operations:

Optimal resource allocation

Asset management ensures that resources are allocated efficiently to support business operations and achieve organizational objectives.

Analyzing asset utilization, performance, and lifecycle costs helps businesses identify underutilized or redundant assets and reallocate resources to areas of higher priority or strategic importance. This optimization of resource allocation enhances productivity, reduces waste, and improves overall operational efficiency.

Better operational performance

Proper maintenance and upkeep of assets are essential for ensuring their reliable performance and longevity. Asset management involves implementing preventive maintenance programs, conducting routine inspections, and addressing maintenance issues promptly to minimize downtime and disruptions to operations.

Proactive asset management enables businesses to enhance operational performance, minimize equipment failures, and maintain a competitive edge in the market.

Improved asset utilization

Effective asset management involves maximizing the utilization of assets to extract the maximum value from investments. By monitoring asset utilization metrics such as uptime, capacity utilization, and efficiency ratios, businesses can identify opportunities to optimize asset usage and eliminate inefficiencies. This may involve adjusting production schedules, implementing flexible work practices, or investing in technology upgrades to enhance asset productivity and utilization rates.

Cost reduction

Asset management strategies focus on minimizing costs associated with asset acquisition, ownership, and maintenance while maximizing returns on investment. By adopting cost-effective procurement practices, negotiating favorable vendor contracts, and implementing efficient maintenance and repair processes, businesses can reduce operational expenses and improve profitability. Additionally, asset management helps identify opportunities for cost-saving initiatives such as energy efficiency measures, asset consolidation, and outsourcing non-core activities.

Regulatory compliance

Compliance with regulatory requirements and industry standards is essential for mitigating risks and maintaining business continuity. Asset management involves ensuring that assets meet relevant regulatory and safety standards, adhering to environmental regulations, and implementing proper documentation and record-keeping practices. By maintaining compliance with applicable regulations, businesses can avoid penalties, legal liabilities, and reputational damage while fostering trust and credibility with stakeholders.

Strategic business decisions

Asset management provides valuable insights and data-driven analysis to support strategic decision-making processes. Businesses can make informed decisions regarding asset investments, upgrades, and divestitures by tracking key performance indicators (KPIs), conducting asset lifecycle assessments, and performing scenario analysis. Asset management enables them to align their asset portfolio with strategic goals, anticipate market trends, and capitalize on emerging opportunities for growth and expansion.

Risk management

Proactive risk management is essential for safeguarding assets, protecting business continuity, and preserving shareholder value. Asset management involves identifying and mitigating risks associated with asset performance, maintenance, obsolescence, and regulatory compliance.

You might want to implement risk mitigation strategies to minimize exposure to potential threats and disruptions, ensuring resilience and sustainability in the face of uncertainty.

Sustainability and environmental impact

Asset management practices increasingly emphasize sustainability and environmental stewardship as businesses strive to reduce their carbon footprint and minimize environmental impact. Asset management involves evaluating the environmental footprint of assets, implementing eco-friendly technologies and practices, and promoting resource conservation throughout the asset lifecycle.

Consider prioritizing sustainability initiatives to enhance their brand reputation, attract environmentally-conscious customers, and contribute to a greener, more sustainable future.

How do changes in assets affect financial statements and business performance?

Changes in assets can have profound implications on financial statements and business performance, influencing key metrics such as profitability, liquidity, solvency, and efficiency.

Here’s how changes in assets affect financial statements and business performance

Impact on the balance sheet

Changes in assets directly impact the balance sheet, which provides a snapshot of a company’s financial position at a specific point in time. Assets are recorded on the balance sheet at their historical cost or fair market value, depending on the accounting standards and valuation principles applied. Here’s how changes in assets affect the balance sheet:

Asset values

Increases or decreases in asset values directly affect the total assets reported on the balance sheet. For example, acquisitions or investments in new assets increase total assets, while asset impairments or write-offs decrease total assets.

Asset composition

Changes in the composition of assets, such as acquisitions, disposals, or reclassifications, alter the asset mix reported on the balance sheet. These changes may impact the overall risk profile, liquidity, and long-term growth prospects of the business.

Impact on the income statement

Changes in assets indirectly impact the income statement, which summarizes a company’s financial performance over a specific period. Certain asset-related transactions and events are reflected in the income statement, influencing revenue, expenses, and profitability metrics. Here’s how changes in assets affect the income statement:

Depreciation and amortization

Depreciation and amortization expenses represent the systematic allocation of the cost of assets over their useful lives. Changes in asset values or useful lives impact depreciation and amortization expenses, thereby affecting net income and profitability.

Impairment charges

Asset impairments occur when the carrying value of assets exceeds their recoverable amount. Impairment charges are recognized as expenses on the income statement, reducing net income and profitability.

Gains or losses on asset disposals

Gains or losses realized from the sale or disposal of assets are reported as non-operating items on the income statement, affecting net income and profitability.

Impact on the cash flow statement

Changes in assets directly impact the cash flow statement, which provides insights into a company’s cash inflows and outflows from operating, investing, and financing activities. Asset-related transactions, such as purchases, sales, and investments, influence cash flow metrics and liquidity management.

Here’s how changes in assets affect the cash flow statement.

Operating activities

Changes in assets affect cash flows from operating activities, particularly through changes in working capital items such as accounts receivable, inventory, and accounts payable. Increases in assets require additional cash outflows, while decreases in assets result in cash inflows.

Investing activities

Asset acquisitions, disposals, and investments are classified as cash flows from investing activities on the cash flow statement. Cash outflows from asset purchases are offset by cash inflows from asset sales or disposals.

Financing activities

Asset financing activities, such as borrowing or issuing debt to finance asset acquisitions, are reported as cash flows from financing activities. Changes in assets may require additional financing or capital raising activities to support business operations and growth initiatives.

Inpact on business performance

Changes in assets have broader implications for business performance, influencing key performance indicators (KPIs), operational efficiency, and strategic decision-making. Asset-related changes affect various aspects of business performance.

Let’s break it down.

Profitability

Changes in asset values, depreciation expenses, and impairment charges directly impact profitability metrics such as net income, gross profit margin, and return on assets (ROA).

Liquidity

Asset changes affect liquidity ratios such as the current ratio and quick ratio, which measure a company’s ability to meet short-term obligations using its current assets.

Solvency

Asset changes impact solvency ratios such as the debt-to-equity ratio and interest coverage ratio, which assess a company’s ability to meet long-term debt obligations and interest payments.

Efficiency

Changes in asset utilization and turnover ratios, such as inventory turnover and asset turnover, reflect operational efficiency and resource allocation effectiveness.

Leveraging financial statements to better understand assets

As you can see, assets affect a company’s financial statements. Therefore, financial reports, namely balance sheets and income statements, are the best way to understand assets, as they display the nature of a business’s assets, liabilities, equity, revenues, and expenses. Data accuracy is crucial in these reports because it helps minimize the likelihood of making decisions based on incorrect information.

At this point, you might want to take advantage of the area of accuracy by using accounting software, like Synder, for example, to generate financial statements. It is perhaps one of the significant values available to you, as well as the time and efficiency gains due to automation.

Synder will assist in presenting accurate balance sheets and profit and loss statements. Its core purpose is to integrate your financial activity from various sources, including payment gateways like Stripe or PayPal, sales channels like Shopify, and others (30+ altogether), into your accounting solution of choice, be it QuickBooks, Xero, Sage Intacct, or its native accounting.

Let’s look at how it works.

- Automated data synchronization

Synder automates bringing your financial data from multiple sources into your accounting software. This automation ensures that all transactions are accurately recorded, reducing the chances of manual errors that could skew your balance sheet or P&L statement. - Categorization and classification

Synder intelligently categorizes and classifies transactions based on predefined rules or customizable settings, ensuring that each transaction is allocated to the correct account, which is crucial for maintaining the accuracy of your financial reports. - Real-time updates

Syncing transactions in real-time or on schedule allows you to have up-to-date financial information. So, you can generate neat balance sheets and P&L statements that reflect your current financial position and performance. - Reconciliation assistance

Synder helps faster reconciliation by matching transactions between your bank feeds and accounting software so that your balance sheet accurately reflects the actual funds and liabilities you have. - Multi-currency support

When you trade in multiple currencies or make payments and receive money through various channels in different currencies, Synder helps you to convert those transactions to your home currency so that while preparing the balance sheet and the statement of profit and loss accounts, all the financial transactions made through various channels and in different currencies can be combined easily. - Customizable reporting

Besides, Synder allows you to generate customizable financial reports to cater to your business needs. You can adjust parameters such as date ranges, account categories, and presentation formats to obtain the necessary insights.

Bottom line

As you can see, assets are vital to a company’s financial health and success. Effective asset management involves strategic planning, valuation, and risk mitigation. By using various asset valuation methods and proactive management strategies, businesses can improve financial performance, achieve sustainable growth, and maintain a competitive edge. A comprehensive approach to asset management enables businesses to enhance profitability, liquidity, and shareholder value, positioning them for long-term success and resilience.

Learn how to power up your accounting practice with QuickBooks certification.

Share your thoughts

Share your thoughts and experience in the comments section below. We’re fond of good stories!

.png)