Online payment systems have become integral to businesses and e-commerce platforms. Consumers expect convenient and secure payment options, while businesses strive to provide seamless transactions that protect sensitive customer information. One such popular payment gateway that meets these requirements is Authorize.Net. If you’ve ever wondered how Authorize.Net ensures secure transactions, this comprehensive guide will provide you with a detailed overview of its features, benefits, and functionalities.

Authorize.Net: What is it?

At its core, Authorize.Net is an online payment gateway that enables businesses to accept payments securely over the internet. Acting as the bridge between buyers and sellers, Authorize.Net processes payment information and ensures secure and reliable payment transactions.

Authorize.Net simplifies the payment process by securely transmitting payment information from the customer to the merchant’s bank for authorization. The merchant then receives a response indicating whether the transaction is approved or declined. This seamless process allows businesses to accept payments through various channels, such as websites, mobile apps, and retail stores, while maintaining the highest level of security.

Key features and benefits of Authorize.Net

User-friendly interface

Authorize.Net offers a user-friendly interface that allows businesses to customize their payment process and create a seamless checkout experience for customers. Merchants can brand their payment pages, provide multiple payment options, and simplify the checkout process, resulting in higher conversion rates.

Acceptance of major credit cards

Authorize.Net supports the acceptance of all major credit cards, including Visa, Mastercard, American Express, and Discover. This broad acceptance ensures that businesses can cater to a wide range of customers and maximize their sales potential.

Robust fraud detection and prevention

Security is paramount in online transactions. Authorize.Net incorporates robust fraud detection and prevention tools to safeguard against unauthorized transactions. It employs advanced technologies, such as Address Verification System (AVS), Card Code Verification (CVV/CVC), and real-time transaction analysis, to identify and prevent fraudulent activities, providing peace of mind to both businesses and consumers.

Recurring billing and subscription management

One notable feature of Authorize.Net is its recurring billing and subscription management functionality. This feature allows businesses with subscription-based models to automate recurring payments, making managing memberships, subscriptions, and recurring service fees easier. It streamlines the billing process and ensures timely and accurate payments, saving both time and resources for businesses.

Secure customer data storage

Authorize.Net takes the responsibility of securing customer data seriously. It adheres to the highest industry standards, including Payment Card Industry Data Security Standard (PCI DSS) compliance. By securely storing customer data, businesses can provide a convenient and efficient shopping experience without compromising the security of sensitive information.

How does Authorize.Net work?

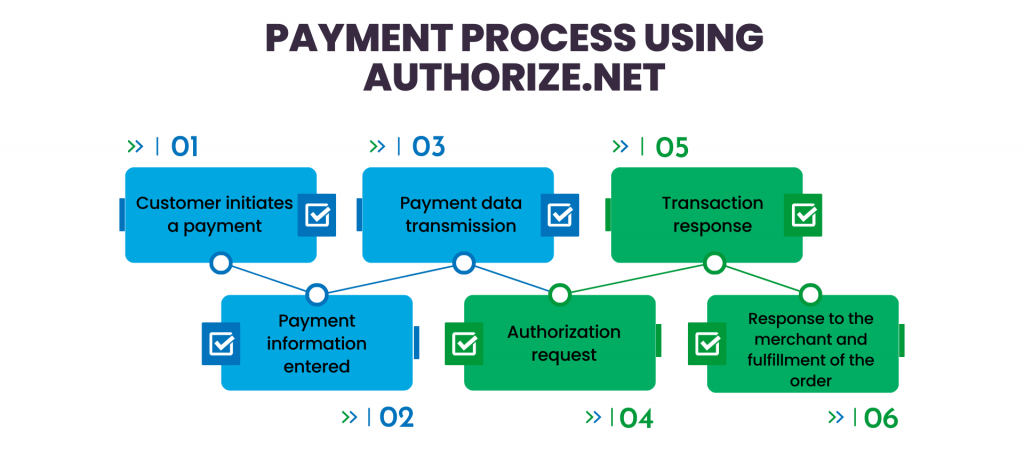

Authorize.Net works seamlessly behind the scenes to facilitate secure online transactions. Here’s a step-by-step breakdown of the payment process using Authorize.Net:

1. The customer selects products or services and proceeds to the checkout page on the merchant’s website or mobile app.

2. The customer enters their payment information, including credit card details, billing address, and contact information, into the secure payment page provided by Authorize.Net.

3. Authorize.Net securely transmits the payment information from the customer’s browser or mobile device to its servers using industry-standard encryption technologies.

4. Authorize.Net sends an authorization request to the payment processor or the customer’s issuing bank. This request includes the payment details, such as the transaction amount, customer information, and credit card details.

5. The payment processor or the issuing bank validates the transaction and sends a response back to Authorize.Net. This response indicates whether the transaction is approved or declined.

6. Authorize.Net forwards the response to the merchant, who receives immediate notification of the transaction status.

7. If the transaction is approved, the merchant proceeds with order fulfillment, ensuring that the products or services are delivered to the customer.

By handling the payment process, including secure data transmission and authorization requests, Authorize.Net ensures that businesses can focus on providing excellent products and services while leaving the complexities of payment processing to the experts.

Authorize.Net pricing and fees

Understanding the pricing structure of a payment gateway is crucial for businesses to assess its affordability and sustainability. Authorize.Net offers transparent pricing, with transaction fees, monthly fees, and additional charges based on the chosen pricing plan. Let’s explore the different elements of Authorize.Net pricing.

Authorize.Net transaction fees

Authorize.Net charges a per-transaction fee, typically a fixed percentage of the transaction amount. The transaction fee may vary depending on the chosen pricing plan:

- All-in-one transaction fee: 2.9% per transaction + $0.30;

- Payment gateway transaction fee: $0.10per transaction, daily batch fee $0.10;

- International payments fee: 1.5% per transaction;

- E-check processing fee: 0.75% per transaction.

Authorize.Net monthly fees

The monthly fee charged by Authorize.Net covers access to the payment gateway and the range of features and services it provides to merchants. It’s important to note that while the monthly fee covers essential features, additional charges for certain value-added services or advanced features may not be included in the base fee.

The fixed monthly fee without additional services is $25 per month.

Authorize.Net additional charges

Authorize.Net may have additional charges for specific services, such as advanced fraud protection tools or value-added features. These charges are optional and can be customized according to the merchant’s requirements.

It’s important for businesses to carefully consider their transaction volume, average ticket size, and specific needs when selecting an appropriate pricing plan to ensure that Authorize.Net remains cost-effective for their operations.

Authorize.Net integrations with the other platforms

Authorize.Net seamlessly integrates with numerous e-commerce platforms, shopping carts, and third-party applications. This flexibility enables businesses to incorporate the payment gateway into their existing systems without major disruptions. The availability of pre-built integrations simplifies the setup process and reduces the time and effort required to start accepting payments online.

Moreover, you can integrate this payment gateway with your accounting system to keep all the records in one place. Synder provides an easy way to sync Authorize.Net and the accounting software you are using, whether it’s QuickBooks Online/Desktop or Xero. Along with Authorize.Net, you can connect other sales channels in one ecosystem with the help of Synder and put your multi-channel accounting on autopilot.

Check what Synder can offer you.

Alternatives to Authorize.Net

While Authorize.Net is a popular payment gateway, it’s essential for businesses to consider alternatives based on their specific requirements. Here are a few notable alternatives worth exploring.

PayPal

PayPal is one of the most widely recognized online payment platforms, offering secure and convenient payment options for businesses and consumers worldwide. It provides an all-in-one solution with features such as invoicing, recurring billing, and international payments.

Stripe

Stripe is a developer-friendly payment gateway that offers a wide range of features and customization options. It provides seamless integrations, extensive developer tools, and flexible pricing plans, making it suitable for businesses of all sizes.

Check our article, where we’ve compared PayPal and Stripe, to learn more about the two giants – PayPal vs Stripe.

Square

Square offers a comprehensive suite of payment solutions, including point-of-sale systems, e-commerce solutions, and mobile payment options. It caters to small and medium-sized businesses and is known for its user-friendly interface and transparent pricing.

Learn more about Square Point Of Sale.

When considering alternatives, businesses should evaluate factors such as features, pricing, ease of integration, scalability, and customer support to choose the payment gateway that best aligns with their needs and growth plans.

Check out our complex comparison Magento vs WooCommerce.

Conclusion

In the world of online payments, Authorize.Net has established itself as a trusted and reliable payment gateway, empowering businesses to accept secure payments from customers worldwide.

With its recurring billing and subscription management features, Authorize.Net simplifies the management of subscription-based models, automating recurring payments and streamlining billing processes.

As e-commerce continues to evolve, Authorize.Net remains at the forefront, ensuring secure and convenient payment processing for businesses of all sizes. By embracing innovation, staying ahead of security threats, and adapting to changing customer expectations, Authorize.Net continues to play a vital role in enabling businesses to thrive in the digital landscape.

Learn more about What is a Prenote and Best apps for Receipts.

.png)