Running and starting a small business can feel like you’re navigating uncharted waters. Amid the worries and challenges, one important aspect stands out: accounting. Besides financial management, accounting is a fundamental aspect of a business that can stand or fall. Imagine being confident you can handle tax season while also being able to plan for sustainable growth. It all starts with managing the books.

Let’s look at the reasons why bookkeeping is so important, what it covers, and how to overcome common mistakes.

Contents:

1. Why do small businesses need bookkeeping?

- What is bookkeeping?

- Bookkeeping vs. accounting

- Understanding debits and credits

- Single-entry vs double-entry accounting

3. Key bookkeeping components for small business

4. Setting up your small business’s bookkeeping system

6. Preparing for tax season: 6 tips

7. Common small businesses bookkeeping challenges

Key takeaways

- Small businesses rely on bookkeeping for organized records, tax preparation, transaction analysis, and profitability planning.

- Bookkeeping involves recording all financial activities like sales, purchases, payments, and receipts to maintain accurate financial reports and understand the company’s financial health.

- Small businesses often struggle with managing cash flow, dealing with overdue payments, and handling payroll efficiently. To overcome these challenges, it’s essential to maintain diligent and effective bookkeeping practices.

Why do small businesses need bookkeeping?

Bookkeeping is essential for small businesses, because it helps them organize, store and analyze financial data, allowing them to accurately assess their financial health.

But that is not all. The IRS requires businesses to keep certain records, including gross receipts, purchases, expenses, assets and more. Failure to comply with this requirement may result in penalties and fines.

Bookkeeping helps small businesses in the following ways:

Organized financial reports

By maintaining accurate records, businesses can create organized and detailed financial reports.

Let’s say you want to calculate how much you spent on office supplies over the past year. You can spend hours searching through every receipt and carefully tallying up all the expenses. On the other hand, if you consistently record every office supply purchase in your financial statements, you can easily get the total amount spent when you need it.

Tax preparation

Proper bookkeeping ensures that businesses are prepared for tax season, making it easier to file taxes accurately and on time

Why is it important? If you miss the tax filing deadline or file late, the IRS may impose a late-filing penalty. This penalty is usually 5% of the tax owed for each month or part of a month the return is overdue, up to 25% of your total tax bill. If your return is more than 60 days late, the minimum penalty is $485 or the entire amount of tax owed, whichever is less.

Budgeting

Keeping clear records for your small business is important for effective financial planning and budgeting. By keeping your records clear, organized and accurate, you gain insight into past performance to inform future strategies.

How and why did your revenue change? Did it change or remain stable all year? Have market changes affected your spending? You can find answers to these questions thanks to proper accounting. And after analyzing them, you can create a new plan and budget for the next year, which will create consistency in your work.

Bookkeeping basics

Whether you do your own bookkeeping or hire someone to do it, there are key elements to keep in mind. Some tasks should be performed regularly to stay on top of your records, while others are performed as needed for specific business needs.

What is bookkeeping?

Bookkeeping is about keeping track of a business’s financial activities. This means recording every transaction, such as:

- Sales;

- Purchases;

- Payments;

- Receipts;

You can do it on your own or hire bookkeepers to organize this information, make sure everything adds up correctly, and create reports that show how the business is doing financially. The main point is to have an accurate and current view of the company’s financial situation, which helps meet legal requirements.

In different sources you may have heard about bookkeeping and accounting as one and the same thing, but it is easy to get confused. To clearly understand the basics, you need to know the difference between these terms.

Bookkeeping vs. accounting

When you first look at them, bookkeeping and accounting might seem like they’re the same thing. But actually, they’re different. Accounting covers everything to do with keeping track of a business’s money, while bookkeeping is just a part of that whole process.

It’ll be much easier to understand if you compare key responsibilities of bookkeeper and accountant:

| Bookkeeper | Accounting |

| Recording financial transactions | Examining and analyzing financial statements |

| Entering debits and credits into a journal | Creating adjusting entries |

| Creating financial statements | Conducting audits |

| Managing payroll | Completing and submitting relevant tax returns |

And even though there are differences between these two, bookkeeping is a part of accounting, so we’ll continue to use them with the same meaning. Moreover, such things as debit and credit are the responsibilities of both the bookkeeper and the accountant.

Understanding debits and credits

In bookkeeping, the terms debit and credit might not match what we’re used to in everyday language. So let’s break them down.

- In accounting, a debit (DR) usually means value going into an asset or bank account, unlike when we use a debit card to take money out.

- On the other hand, a credit (CR) often represents value leaving an asset account, rather than getting credit like a loan or refund where money comes in.

Debits and credits are recorded in money units, but they’re not always cash. They can include gains, losses, and depreciation. That’s why they’re called “values”.

Single-entry vs double-entry accounting

Both single-entry and double-entry accounting are methods of recording data about financial transactions of companies. It is important to understand the differences because, for example, single-entry accounting can be prone to errors. There are no matching totals for income and debit, so a one-time entry does not allow you to double-check the correctness of accounting.

1. Single-entry accounting

Single-entry accounting, also called single-entry bookkeeping, is a simple way of tracking a company’s finances. With this method, each transaction is recorded just once. Income and expenses are listed in a single row, with positive values for income and negative values for expenses.

2. Double-entry accounting

Double-entry accounting is a bit more complex. It records every financial transaction twice, as debits and credits. For each entry made in one account, there must be a corresponding opposite entry in another account. For example, if you debit your assets account, you must credit your liabilities account at the same time.

This ensures that the total debits and credits balance out. Double-entry accounting not only tracks cash but also monitors the value of all of a company’s assets.

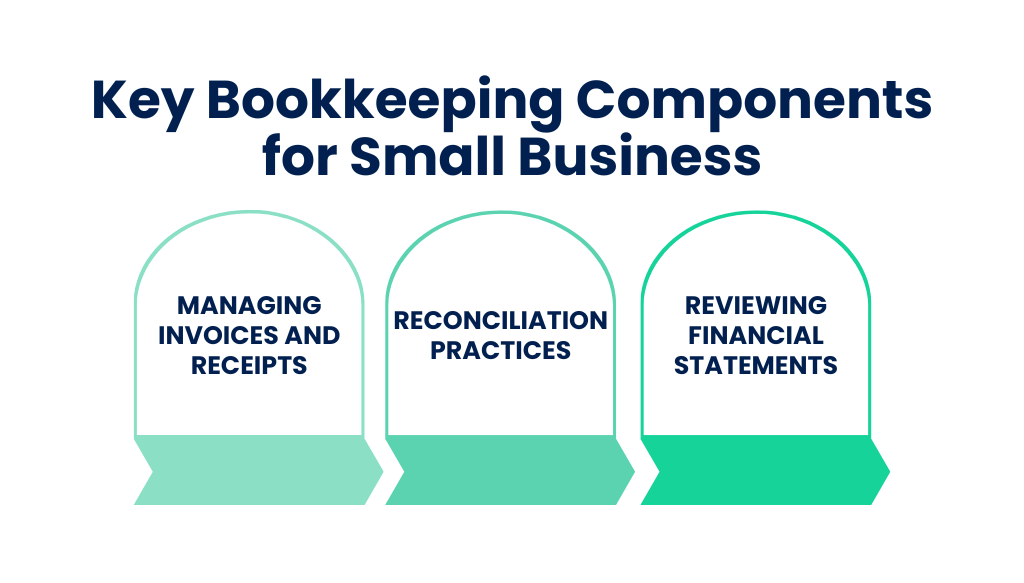

Key bookkeeping components for small business

If you’re responsible for your business’s bookkeeping, there are key things you need to do to keep everything in order. Some tasks need to be completed regularly to stay on top of things, while others are performed as needed for specific small business purposes.

Managing invoices and receipts

Invoices and receipts are very important for keeping track of your sales and expenses. To keep things organized, create a system for storing them, such as by date or type. By monitoring your bills and receipts, you’ll have all the documentation you need for taxes, financial reports, and planning your budget.

Reconciliation practices

Regularly comparing your recorded transactions with your bank and credit card statements is key to ensuring your books are accurate. This process, called reconciliation, helps you identify any errors or discrepancies.

This way, you can catch and correct any errors early on, keeping your financial statements in perfect condition and following accounting rules.

Reviewing financial statements

Reviewing financial statements is a critical task for small business bookkeeping to understand their financial health. This involves examining the income statement, balance sheet, and cash flow statement:

1. Income statement

This shows how much money your business made and spent during a specific time.

2. Balance sheet

It lists what small business owns, what it owes, and how much is left over for shareholders.

3. Cash flow statement

This keeps track of how money comes in and goes out of your business. It helps you see if your business has enough cash to pay its bills and expenses.

Setting up your small business’s bookkeeping system

Running your own business can be tough, especially when it comes to bookkeeping. Doing it manually is tedious and can lead to confusion and wasted time, even for accountants.

But there’s a solution: Synder Sync, an accounting software that makes managing your business finances easier.

Synder connects your sales channels and payment platforms, ensuring transactions are accurately recorded and classified in real-time. It updates financial records instantly, handling customer information, sales tax, invoices, and shipping costs to ensure consistency across platforms.

What Synder features will be very useful for small businesses?

- Rollback

This feature allows you to undo any changes made during synchronization, giving you the ability to adjust your financial records until they are perfectly aligned.

- Avoiding duplicate transactions

Synder conducts cross-checks to identify duplicates and inconsistencies, ensuring thorough financial records.

- Reconciliation

You can streamline your bank reconciliation process with just a few clicks in the Banking section, where information automatically synced by Synder is easily matched to your actual money transfers.

With Synder, you can simplify your bookkeeping tasks and improve your overall online sales process.

Try Synder’s free trial to see how it can improve your business operations, and join our informative Weekly Public Demo for additional insights and advice.

Accounting methods

When managing finances in your business, you have two main accounting methods to choose from: cash-based accounting and accrual-based accounting. Here’s a simplified overview:

Cash-based accounting

- Records transactions when money physically changes hands.

- Income is recorded upon receipt, and expenses are recorded when paid.

- Provides a clear snapshot of available assets and liabilities at any given time.

Accrual-based accounting

- Records transactions when they occur, regardless of when money is received or paid.

- Income and expenses are recorded as soon as they are incurred.

- Offers a more comprehensive view of financial status, including all incoming and outgoing funds, even those not yet received or paid.

It is important to differentiate between cash-based accounting and accrual-based accounting as they offer different perspectives on the financial health and performance of your business.

Cash-based accounting provides a clear picture of the actual flow of cash in and out of your business at any given time. On the other hand, accrual-based accounting gives you a more complete picture of your business’s financial health by recording transactions as they occur.

Cash-based accounting may be sufficient for very small businesses with simple transactions and immediate payment terms. However, as a business grows or becomes more complex, accrual-based accounting can provide a more accurate and in-depth view of its financial performance and position.

Regardless of the method you choose, you should have an understanding of your business’s financial health to prepare for tax season, as it is a very important part of running a business.

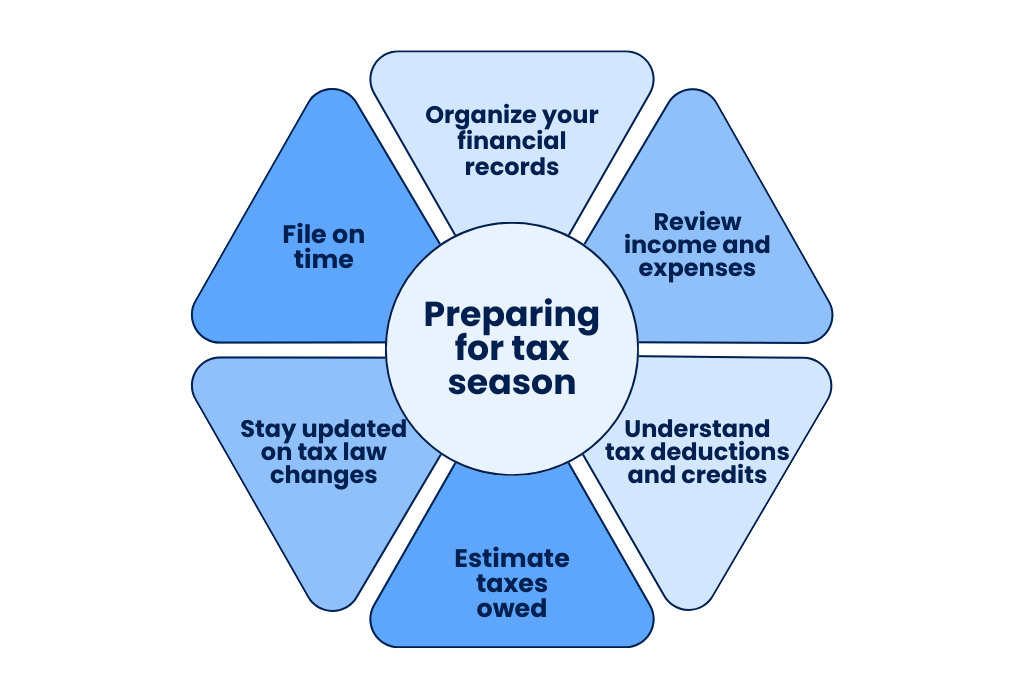

Preparing for tax season: 6 tips

Preparing for tax season is important because it can impact how your business operates. In order not to miss anything, you need to remember a few important points:

1. Organize your financial records

Gather all your financial documents, such as profit and loss statements, expense receipts, bank statements, and any other relevant records. Keeping your financial records organized throughout the year will make tax preparation much easier.

2. Review income and expenses

Take a close look at your income and expenses for the year to make sure everything is correct. Make sure your expenses are categorized properly, and look for any expenses that you can deduct to reduce your taxable income.

3. Understand tax deductions and credits

Learn about tax deductions and credits that small businesses can take advantage of, such as home office expense deductions, mileage credits, and tax credits specifically designed for small businesses. Using this information can help reduce the amount of taxes you owe.

4. Estimate taxes owed

Use your financial records to estimate how much taxes you owe for the year. If it looks like you might owe more than expected, consider making estimated tax payments to avoid penalties and interest for not paying enough.

5. Stay updated on tax law changes

Stay informed about any updates or changes to tax laws that could impact your business. If you’re unsure about how these changes might affect your taxes, consider speaking with a tax professional for guidance.

6. File on time

Make sure to submit your tax return by the deadline. For most small businesses, the deadline is March 15th, but extensions are available if you apply.

Common small businesses bookkeeping challenges

Cash flow

Around 82% of small businesses fail because of cash flow issues. To manage cash flow effectively, you need to focus on your accounts receivable and accounts payable.

It’s important to:

- Understand your breakeven point

- Keep extra cash on hand

- Collect payments from customers promptly

- Manage when you pay your bills

- Keep a close eye on your cash flow

- Regularly check your inventory

- Ask for deposits from customers

All of these tasks are part of your bookkeeping responsibilities. Remember, that late-paying or non-paying clients can seriously harm your small business.

To overcome this challenge, it’s crucial to keep track of your receivables diligently. Establish good invoicing practices and follow up promptly on unpaid invoices. Consider setting due dates and imposing late fees for overdue bills.

Payroll management

Managing payroll is essential for keeping your finances organized and following the law. This includes:

- Tracking hours;

- Calculating wages;

- Handling taxes and payments;

Efficient payroll processes ensure employees are paid correctly and on time, meeting all legal requirements. This builds trust and avoids costly legal issues.

However, handling payroll alone can be tough. That’s why many businesses use payroll services to save time, money, and stress. Choosing the right provider offers extra benefits.

Conclusion

Eventually, bookkeeping in the business is the basis for the boom and financial well-being of small businesses. Through accurate record keeping, mastering accounting basics, and employing the right methods, a company can benefit by obtaining data on its business performance, accomplishing any tax related obligation and planning for a better future. In the case of adequate small businesses accounting transactions, they will survive the odds and won’t be among those who failed to make it.

FAQs

What do bookkeepers do for a small business?

Qualified bookkeeper can help small businesses in managing their bookkeeping by overseeing different accounts, transactions, and reports. They gather, organize, and store financial records like cash flow statements, reconciliation statements, and profit and loss statements.

Can small businesses do their own bookkeeping?

Yes, small businesses can do their own bookkeeping. Many use simple accounting software and online resources. It’s important for owners to understand basic accounting and stay organized with financial records. As businesses grow, some may choose to outsource bookkeeping tasks. But you’ll still need some advice and you can use our directory to find a bookkeeper.

What kind of bookkeeping is used by small businesses?

Small businesses mainly use two accounting methods: cash-based and accrual. The cash-based method is simple, recording transactions only when cash is involved. It’s easy but may not be suitable for all businesses. On the other hand, the accrual method records transactions as they happen, regardless of cash flow, thereby reducing the chance of making errors.

.png)