Accrual accounting is a widely used financial accounting method that’s essential for any business that seeks to maintain accurate financial records. It’s a method of recording and tracking financial transactions occurring throughout a business’s activity.

Accrual accounting may be more complex than cash-based accounting and requires a greater understanding of business operations. Still, it also provides more accurate insights into the company’s overall financial health.

This text will explore the key concepts and benefits of accrual accounting and how it can be used to manage a business’s finances effectively. We’ll also discuss the differences between accrual accounting and cash accounting methods, as well as some practical tips for implementing and managing an accrual accounting system.

So, read on to learn more about accrual accounting in general, how it works, why it’s essential to your business success, and how you can efficiently implement it in the ecommerce industry.

Contents:

2. What is accrual accounting?

3. What is an accrual accounting example?

5. Accrual accounting vs cash accounting

6. How does accrual accounting work?

7. Benefits of accrual accounting for your business

8. How to set up and successfully manage an accrual accounting system

What are accruals?

Before we get to the nitty-gritty of accrual accounting, let’s first answer this: what exactly is an accrual when it comes to accounting?

In accounting, “accrual” refers to the recognition of revenue or expenses that have been earned or incurred, respectively but haven’t yet been recorded in the accounting system. The accrual method of accounting recognizes revenue and expenses when they’re earned or incurred, regardless of when the money is actually received or paid.

Accrual accounting is based on the matching principle, as we’ll shortly see, which requires that expenses be matched with the revenue they help generate in the same accounting period. By recording accruals, a company can ensure that its financial statements provide a more accurate picture of its financial performance and position.

Now that we’ve got that cleared out, we’ll delve into the essential question: what is accrual accounting?

What is accrual accounting?

By definition, accrual accounting is one of the accounting solutions businesses can choose from to do their books. The accrual accounting system allows companies to record their revenues and expenses as soon as they occur, notwithstanding whether the actual money was received or paid.

Companies using the accrual accounting method that implies recording account receivables and accounts payable can usually have a more accurate picture of their profitability in the long term.

We understand that it might seem a little complicated, so let’s explain with an example.

What is an accrual accounting example?

Let’s use a small business scenario as an example of how accrual accounting works in comparison to cash accounting.

Imagine you own a web design business. You complete a project for a client in March, but the client is invoiced and doesn’t pay you until April. Additionally, you ordered a new computer in March, which you received and started using the same month, but you won’t pay for it until May.

Here’s how the transactions would look under both cash accounting and accrual accounting:

| Transaction | Date Incurred | Date Paid | Cash Accounting | Accrual Accounting |

| Revenue from a client project | March | April | Recognized in April (when cash is received) | Recognized in March (when the service was provided) |

| Purchase of a new computer | March | May | Recognized in May (when cash is paid out) | Recognized in March (when the computer was received and used) |

In cash accounting, transactions are recorded only when cash changes hands. So, the revenue from the client project would be recorded in April (when you receive the money), and the expense for the new computer would be recorded in May (when you pay for it).

In accrual accounting, however, transactions are recorded when they’re earned or incurred, no matter when the cash is received or paid out. This means the revenue for the web design project is recorded in March (when the work was completed and the invoice was sent). The expense for the computer is also recorded in March (when the computer was delivered and put into use), regardless of the payment dates.

This method provides a more accurate picture of the company’s financial situation during a specific time period, as it matches revenues to the time periods in which they’re earned and matches expenses to the time periods in which they’re incurred.

What is the basic rule for accrual accounting?

The basic rule of accrual accounting is the matching principle. This principle dictates that companies should recognize revenue and expenses in the period in which they are incurred, regardless of when the cash transactions occur.

Here’s a breakdown of how this works:

- Revenue recognition: Revenue is recorded when it’s earned, no matter when it’s received. This means that if a service is provided or a product is delivered in a given accounting period, the revenue for that service or product should be recognized in that same period, even if the customer hasn’t paid yet.

- Expense recognition: Similarly, expenses are recorded when they’re incurred, not when they’re paid. For example, if a company receives goods or services in a given accounting period, it should recognize the expense in that same period, even if the payment is made at a later date.

These rules ensure that financial statements reflect the actual financial position of the business during a particular time frame.

Take the first step towards flawless financial management and learn how our software can transform your accounting experience. Explore Synder and revolutionize your accounting workflow!

Types of accruals

In the framework of accrual accounting, there are various types of accruals used to ensure that financial transactions are recorded in the correct accounting period. Here are some of the common types:

Revenue accruals

These are revenues that have been earned but not yet received. For example, a company that has provided services but hasn’t yet invoiced the customer would use a revenue accrual to record the income in the period the service was provided.

Expense accruals

These occur when an expense has been incurred but not yet paid. For instance, a business may have received goods from a supplier but hasn’t received the invoice or made the payment yet. The cost of these goods would be recorded as an expense in the period they were received.

Prepaid expenses

This type of accrual accounting adjusts for expenses that have been paid in advance. For example, if a business pays for a year’s worth of insurance, it’d recognize the expense each month for a portion of the paid amount rather than all at once when the payments are made.

Deferred revenue

This refers to the money received by a business for goods or services not yet provided. The business records this as a liability (deferred revenue) until the goods or services are delivered, at which point it recognizes the revenue.

Accrued depreciation

This isn’t a separate transaction like the others but rather part of accrual accounting. Depreciation spreads the cost of an asset over its useful life and is recorded periodically, typically monthly or annually, even though no cash transaction takes place.

These different types of accruals reflect the efforts to adhere to the matching principle, ensuring that each financial period accurately reflects the economic activity that occurred during that period.

Accrual accounting vs cash accounting

Accrual accounting and cash accounting are two fundamental accounting methods that differ mainly in the timing of when revenue and expenses are recognized. Here’s a comparison to illustrate the differences.

| Accrual accounting | Cash accounting | |

| Timing of revenue recognition | Revenue is recognized when earned, regardless of when the payments are actually received. | Revenue is recognized only when cash is received. |

| Timing of expense recognition | Expenses are recognized when incurred, regardless of when they are paid. | Expenses are recognized only when cash is paid out. |

| Financial picture | Provides a more complete and accurate picture of a company’s financial situation because it matches revenues with the expenses related to them, regardless of when cash transactions occur. | Provides a view of cash flow, showing how much cash is actually on hand at any given time. |

| Complexity | More complex as you need to track receivables and payables and make adjusting entries. | Simpler to maintain because it only requires tracking cash flow; no need for adjusting entries. |

As a result, having an accrual can definitely aid in decision-making, compliance with accounting standards, and overall better matching of revenue and expenses in comparison to cash accounting.

Learn more about the difference between accrual accounting and cash accounting.

How does accrual accounting work?

As was said above, accrual accounting works by following two fundamental principles: the revenue recognition principle and the expense recognition principle.

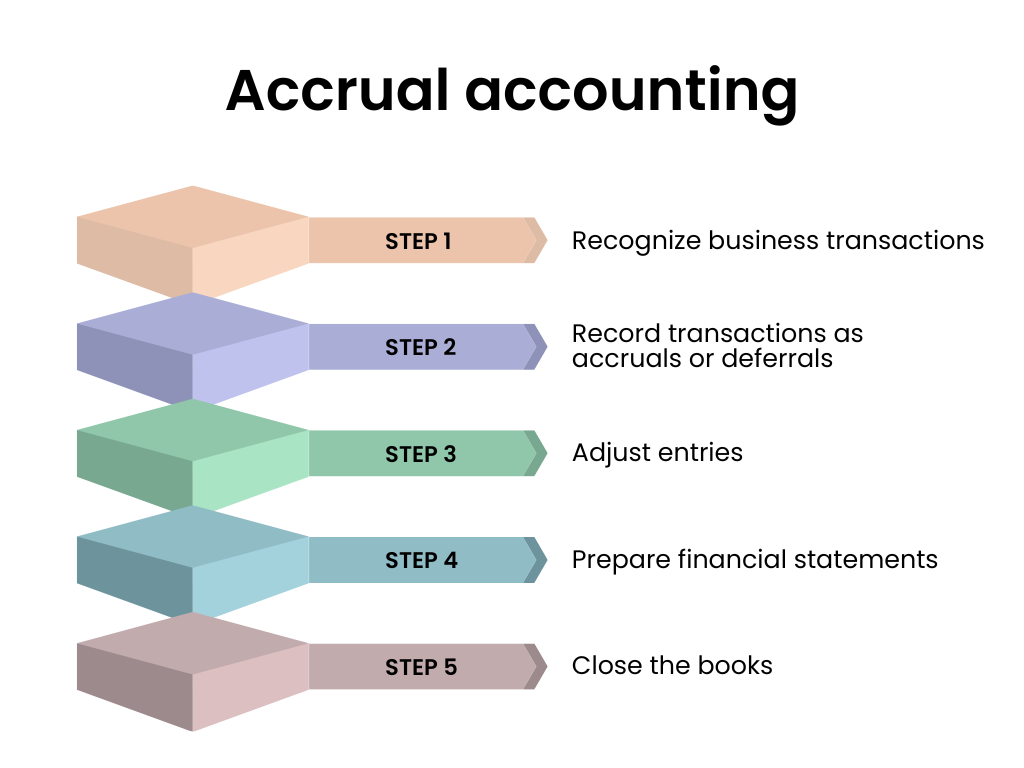

Here’s how accrual accounting typically works in a series of steps:

Step 1: Recognize business transactions

Every economic event that affects the financial position of the business, which can be reasonably measured, is recognized as a transaction.

Step 2: Record transactions as accruals or deferrals

Transactions are recorded using the accrual method if:

- an expense or revenue has been incurred but not yet paid or received – an accrual (for example, wages for the last week of the fiscal year might not be paid until the following year; although the cash isn’t paid out yet, the expense is recorded in the current year’s financial statements).

- an expense or revenue has been paid or received in advance – a deferral (for instance, if a company pays in advance for six months of insurance, the expense isn’t recognized all at once but rather deferred and recognized on a monthly basis).

Step 3: Adjust entries

Adjusting entries are made at the end of the accounting period to account for accruals and deferrals. For example, if the office rent hasn’t been paid by the end of the period, an adjusting entry will record the rent expense and a corresponding liability.

Step 4: Prepare financial statements

After adjusting entries are made, the company prepares its financial statements. Under accrual accounting, these statements reflect the company’s actual financial status and performance over the accounting period, because they match revenues and expenses to when they’re earned and incurred.

Step 5: Close the books

Finally, at the end of the accounting period, temporary accounts such as revenue and expense accounts are closed out to a permanent summary account, typically Retained Earnings.

Benefits of accrual accounting for your business

Compared to cash-based accounting, accrual accounting has some definitive advantages for businesses big and small alike.

No matter whether you run an accounting business, an ecommerce shop, or have a company in any other industry, accrual accounting can provide you with the benefits listed below.

More accurate financial statements

Accrual accounting provides a more accurate reflection of a company’s financial performance and position because it recognizes revenue and expenses in the accounting period in which they occur, regardless of when the money is actually received or paid. This allows for better business and financial management in general.

Better matching of revenue and expenses (more balanced books)

The accrual basis of accounting matches revenue and expenses to the accounting period in which they’re incurred, providing a more accurate picture of the financial performance of your company. This means that your books will be better balanced, as there’ll be no unrecorded expenses or revenues, and all the figures will match. It’s essential for auditing and ensures that the books are easy to understand and manage.

Compliance with accounting standards

In many countries, accounting standards require the use of accrual accounting to prepare financial statements. Complying with these standards can help ensure that the financial statements of a company are accepted and trusted by stakeholders, including investors, lenders, and regulatory bodies.

Better decision-making

Accrual accounting provides a more complete picture of a company’s financial situation, which can aid with making informed decisions about investments, expenditures, and other financial matters. As a result, accurate accounting records will allow you to start making better long-term financial decisions for your company. For example, you’ll be able to efficiently assess the financial viability of new projects, as well as manage cash flow, determine a company’s creditworthiness, and make strategic investments.

Improved tax planning

Accrual accounting can be used for tax planning purposes, such as managing income and expenses to minimize tax liability in a given year.

Better tracking of cash flow

Accrual accounting provides a more accurate picture of a company’s cash flow by accounting for revenue and expenses as they’re incurred, regardless of when the money is actually received or paid.

How to set up and successfully manage an accrual accounting system

Setting up and managing an accrual accounting system might require some preparation and best practices you might want to follow.

Here are some steps for setting up and successfully managing an accrual accounting system:

Understand your revenue recognition policies

Develop clear policies for recognizing revenue and expenses that are consistent with generally accepted accounting principles (GAAP). This will ensure that you’re recording transactions in the correct accounting period.

Set up your chart of accounts

Create a chart of accounts that reflects the specific needs of your business. This will help you track revenue and expenses in a way that makes sense for your operations.

Implement controls and checks

You might want to introduce control and check procedures within your accounting process to ensure the accuracy of recorded data and prevent fraud. They might involve regular audits or other means of checking and confirming accounting accuracy.

Keep your accounting data up to date

It’s also important to keep your accounting data up to date. The good rule of thumb here may be recording new transactions as soon as they occur and updating your books regularly.

Regular reconciliation of your books might also be of help

Regularly reconcile your accounts to ensure that your accruals are accurate and up-to-date. At this point, you might consider using accounting automation software as the best means of keeping your records accurate and reconciling without flaws and discrepancies.

Synder is a solution that can help sync and reconcile all your financial data in a matter of seconds. If you’re interested to see how Synder can help you scale your business, sign up for a free trial or visit a Weekly Public Demo.

Generate financial statements

Use your accounting software to generate financial statements, such as income statements and balance sheets, on a regular basis. This will help you monitor the financial performance of your company and make informed decisions about your operations.

Seek professional help

If you’re unsure about how to set up or manage an accrual accounting system, consider seeking professional help from an accountant or bookkeeper. They can provide guidance and support for your company to help ensure that your accrual accounting system is set up and managed effectively.

Accrual accounting: Final words

Accrual accounting is one of the fundamental accounting systems a business can choose for managing its financial records. In contrast to cash-based accounting, accrual accounting recognizes revenue and expenses when they’re earned or incurred, regardless of when the money is actually received or paid.

By using accrual accounting, businesses can provide a more accurate and comprehensive picture of their financial performance and position, which can aid in decision-making, compliance with accounting standards, and better matching of revenue and expenses. This is why accrual accounting is generally considered a better choice for a business because it allows for more accuracy of the books and a better overview of a company’s profitability.

Overall, accrual accounting is an essential tool for businesses of all sizes and industries to effectively manage their finances and support their long-term growth and success.

.png)