Bank reconciliation is vital for ensuring the accuracy and integrity of a company’s financial records. It involves comparing the transactions recorded in a company’s accounting books with those in its bank statements. This process helps identify any discrepancies, errors, or fraudulent activities that may have occurred.

Today, I suggest exploring why bank reconciliations are essential for businesses to maintain financial health and should be a priority for every business owner or financial manager.

Key takeaways

- Regular bank reconciliation is crucial for businesses to maintain financial accuracy, detect errors, and prevent fraudulent activities.

- Neglecting regular bank reconciliations can lead to inaccurate financial records, increased fraud risk, and potential compliance issues.

- Following best practices and conducting efficient reconciliations can help businesses ensure the integrity of their financial data and meet regulatory requirements effectively.

Automate your record keeping and reconciliation with Synder! Sign up for our all-inclusive 15-day free trial and experience the benefits firsthand. Or, if you prefer a more personal touch, reserve a spot at our Weekly Product Demo to see smart accounting automation in action.

What is bank reconciliation?

Without much of ado, let’s start with defining reconciliation.

Bank reconciliation is the process of comparing the transactions recorded in a company’s accounting records with those shown on its bank statements. It’s like double-checking your financial records to make sure they match up with what the bank says. This is important because sometimes mistakes happen, or there might be transactions that you forgot to record.

Imagine you’re keeping track of all the money coming in and going out of your business in a notebook. Now, your bank also keeps track of these transactions. So simply put, bank reconciliation is making sure that your notebook matches the bank’s records.

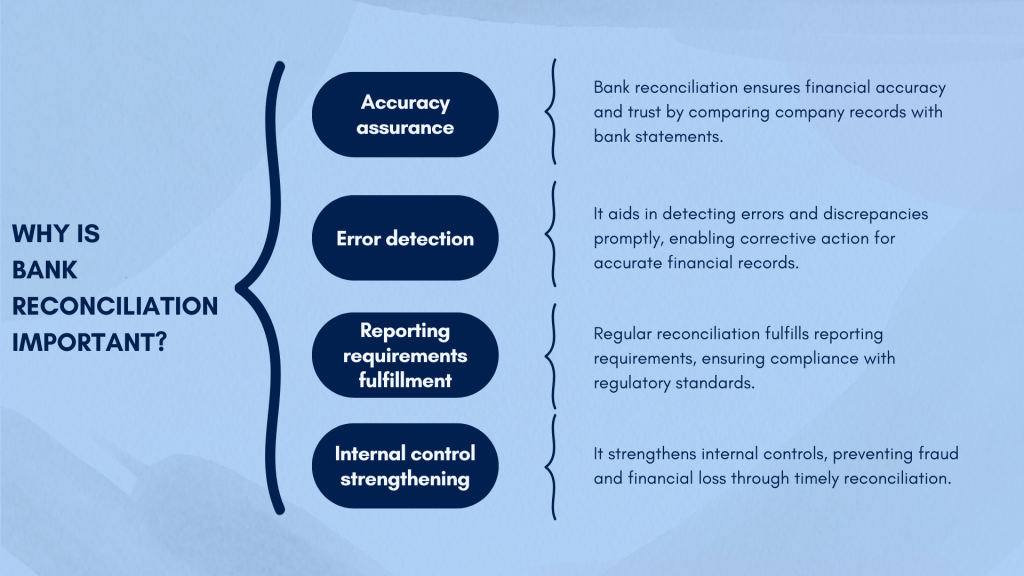

Why is bank reconciliation important for businesses?

This process is necessary for businesses because it helps ensure the accuracy of their financial records.

Regularly reconciling accounts allows businesses to catch errors, identify discrepancies, and even detect fraudulent activities. It’s like having a safety net for your finances, making sure everything adds up correctly.

Here’s how it works.

- By comparing the transactions recorded in a company’s accounting records with those in its bank statements, bank reconciliation helps ensure the accuracy of the company’s financial records. This is essential for making informed business decisions and maintaining the trust of stakeholders.

- Bank reconciliation helps detect errors or discrepancies in the company’s financial records, such as incorrect amounts or missing transactions. By identifying these issues promptly, businesses can take corrective action to ensure the accuracy of their financial records.

- Regular bank reconciliation is often required for financial reporting purposes, such as preparing financial statements or tax returns. Not skipping reconciliations, businesses do themselves a favor, ensuring that their financial reports are accurate and comply with regulatory requirements.

- Bank reconciliation is an essential internal control mechanism that helps prevent and detect errors, fraud, or unauthorized transactions. By reconciling regularly, businesses can strengthen their internal controls and reduce the risk of financial loss or non-compliance.

This way, it’s a crucial step for businesses to verify the accuracy of their financial records.

You might want to learn more about why reconciliation is important.

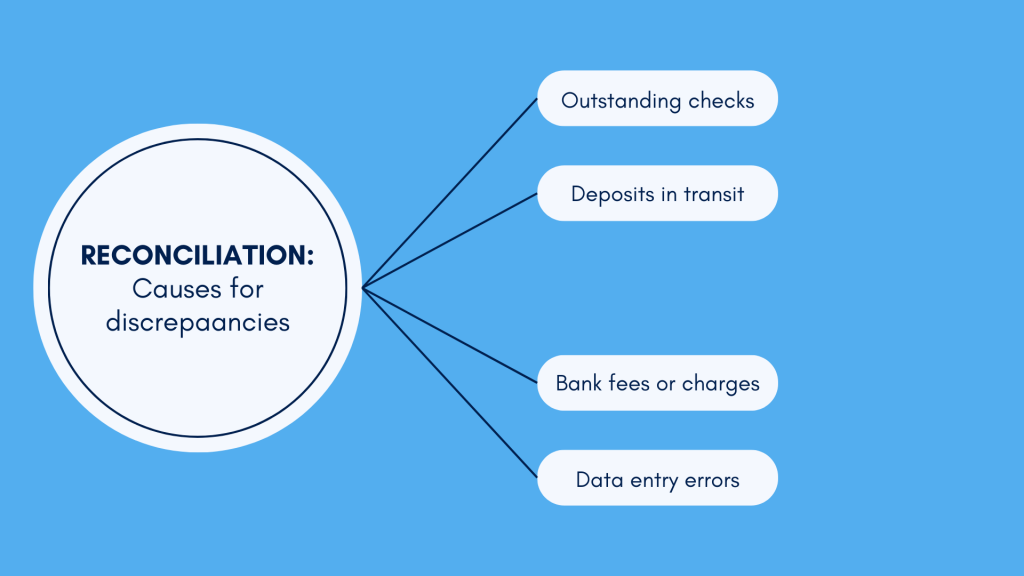

What are the potential discrepancies between a company’s accounting records and a bank statement?

We spoke about discrepancies. In simple terms, they are incorrections, or, if you will, differences between a company’s accounting records and bank statements.

They can occur due to various reasons. Let’s look at the most typical ones.

Outstanding checks

Outstanding checks are checks that have been issued by the company but have not yet been cashed by the recipient. They will appear in the company’s records but may not show up in the bank statement until they are cashed.

Deposits in transit

Deposits made by the company that have not yet been processed by the bank are usually called deposits in transit. They will show up in the company’s records but, since they haven’t been processes yet, may not present in the bank statement. Theu’ll appear there later, when processed.

Bank fees or charges

Sometimes, banks charge fees for services or transactions, such as monthly account maintenance fees or overdraft charges. These fees may not always be recorded in the company’s accounting records.

Data entry errors

Human error can occur when recording transactions in the company’s books or when the bank processes transactions. These errors can result in discrepancies between the two sets of records.

Identifying and reconciling these discrepancies is essential for ensuring the accuracy of the company’s financial records and detecting any potential issues or errors.

How does regular bank reconciliation help detect errors, fraud, or unauthorized transactions?

Regular bank reconciliation acts as a safeguard against errors, fraud, or unauthorized transactions by comparing the transactions recorded in a company’s accounting records with those in its bank statements.

It helps detect these issues in various ways.

#1 – Error detection

By reconciling regularly, businesses can spot errors in their accounting records or bank statements, such as incorrect amounts or missing transactions. This allows them to correct these errors promptly and ensure the accuracy of their financial records.

#2 – Fraud detection

Bank reconciliation can help detect fraudulent activities, such as unauthorized withdrawals or fraudulent checks. By comparing the transactions in the company’s records with those in its bank statements, businesses can identify any suspicious or unauthorized transactions and take appropriate action.

#3 – Detection of unauthorized transactions

Bank reconciliation can also help businesses identify unauthorized transactions, such as payments made to unauthorized vendors or employees. By reconciling regularly, businesses can ensure that all transactions are legitimate and authorized.

The outcomes of neglecting regular bank reconciliation for a business?

Neglecting regular bank reconciliations can spell trouble for businesses.

Without this essential financial practice, discrepancies between internal records and bank statements can go unnoticed, leading to inaccurate financial reporting and eroding stakeholder trust.

On top of that, the lack of oversight increases the risk of undetected fraudulent activities, posing threats to a company’s financial stability and reputation.

Let’s break down some of the most gruesome outcomes of neglecting bank reconciliations.

Inaccurate financial records

Without regular reconciliation, there is a higher risk of errors or discrepancies in the company’s financial records. This can lead to inaccurate financial reporting, which can have serious implications for the business’s decision-making process and overall financial health.

Increased risk of fraud

Without regular reconciliation, fraudulent activities may go undetected for longer periods, increasing the risk of financial loss for the business. Fraudulent transactions, such as unauthorized withdrawals or fraudulent checks, can have a significant impact on the company’s finances and reputation.

Compliance issues

Regular bank reconciliation is often required for regulatory compliance and financial reporting purposes. Failing to perform regular reconciliation can result in non-compliance with regulatory requirements, which may lead to penalties or legal consequences for the business.

Difficulty in tracking cash flow

Without regular reconciliation, businesses may find it challenging to track their cash flow accurately. This can make it difficult to manage finances effectively and make informed business decisions.

Best practices for conducting efficient and accurate bank reconciliations on a regular basis

To conduct efficient and accurate bank reconciliations on a regular basis, businesses can follow several accounting best practices. Let’s break them down.

- Schedule regular reconciliations

You might want to set a schedule for reconciling bank accounts, such as monthly or weekly, and stick to it. Regular reconciliation helps ensure that errors or discrepancies are identified promptly and addressed accordingly. - Use accounting software

Consider using accounting software or automated reconciliation tools to streamline the reconciliation process. These tools can help save time and reduce the risk of human error. - Verify all transactions

It might be wise to double-check each transaction in the company’s accounting records against those in its bank statements. Ensure that all transactions are accounted for and accurately recorded. - Investigate discrepancies

If you identify any discrepancies during the reconciliation process, investigate them promptly to determine the cause. This may involve contacting the bank or reviewing transaction records for accuracy. - Document the reconciliation process

It’ll never hurt to keep detailed records of the reconciliation process, including the steps taken and any discrepancies identified. This documentation can serve as evidence of compliance with regulatory requirements and help address any audit inquiries.

Businesses can follow these best practices to conduct efficient and accurate bank reconciliations on a regular basis, ensuring the accuracy of their financial records and compliance with regulatory requirements.

How does accounting software help bank reconciliation?

Automating bank reconciliation with accounting software goes beyond just connecting your bank account. It also involves integrating various sales channels and financial records seamlessly. Here’s a more detailed explanation of how accounting software achieves this:

Integration of sales channels

Modern accounting software often offers integration with various sales channels, such as ecommerce platforms, point-of-sale systems, and payment gateways. This integration allows the software to pull in sales data directly from these channels, eliminating the need for manual data entry.

Automatic import of transactions

Once integrated, the accounting software automatically imports transactions from all connected sales channels. This includes sales invoices, receipts, and payment information.

Matching transactions

The software then matches these imported transactions with corresponding entries in your accounting records. For example, a sale made through your ecommerce platform will be matched with the corresponding sales invoice recorded in your accounting software.

Importing transactions from a bank account

Simultaneously, the software imports bank transactions from your connected bank account(s). This includes deposits, withdrawals, fees, and other banking activities.

Automated matching and reconciliation

Using sophisticated algorithms, the accounting software automatically matches imported bank transactions with corresponding sales and expense transactions. It identifies discrepancies and flags unmatched transactions for review.

Review and adjustments

You can review the matched transactions to ensure accuracy. Any discrepancies or unmatched transactions can be investigated and resolved. The software also allows you to make adjustments and corrections as needed.

Streamlined reconciliation process

With all transactions imported and matched, the reconciliation process becomes streamlined and efficient. The software automates much of the reconciliation work, saving time and reducing the risk of errors.

Real-time financial insights

By automating the gathering and reconciliation of financial records, accounting software provides you with real-time insights into your financial position. You can quickly see your cash flow, revenue, and expenses, enabling you to make informed decisions with confidence.

Accounting software, as you can see, automates the entire process, saving you time, reducing manual effort, and ensuring a high level of accuracy in your financial records,. This way, it empowers you to manage your business finances more effectively.

How to level up reconciliation with Synder

Synder is a tool that helps businesses manage their finances more efficiently, especially when it comes to reconciliation using QuickBooks.

Synder simplifies this process by automatically syncing data between a business’s various payment platforms (like PayPal, Stripe, Shopify, etc.) and QuickBooks. This means that instead of manually entering each transaction into QuickBooks and then cross-referencing it with bank statements, Synder does it automatically.

This way, Synder helps businesses save time and reduce errors. It eliminates the need for manual data entry, which can be time-consuming and prone to mistakes. So, businesses can trust that their financial records in QuickBooks are always up-to-date and accurate, making the reconciliation process much smoother.

Final word

Long story short, regular bank reconciliation is essential for businesses to ensure financial accuracy, detect discrepancies, and prevent fraud. Neglecting this practice can lead to inaccurate records, increased fraud risk, and potential compliance issues. By embracing best practices and committing to diligent reconciliation efforts, businesses can safeguard their assets, foster trust among stakeholders, and navigate financial complexities effectively.

Bank reconciliation remains integral to financial management, enabling businesses to uphold accuracy, detect discrepancies, and adhere to regulatory requirements. Prioritizing regular reconciliation is crucial for maintaining financial health, fostering resilience, and ensuring sustained success in today’s dynamic business environment.

Share your thoughts

Do you regularly reconcile your bank statements? Please, share in the comments section below. We’re fond of good stories!

.png)

Excellent article!

Thank you!