Managing finances is a critical aspect of running a small business, and hiring an experienced accounting firm in Dallas can be a game-changer. However, finding the perfect accounting firm that aligns with your specific needs can be a daunting task.

We will delve into selecting accounting firms in Dallas to cover the needs of your business. From identifying your financial requirements to exploring the qualities to look for in an accounting firm, we’ll provide valuable insights and practical tips to help you make an informed decision. With the right accounting partner by your side, you can streamline your financial processes, optimize tax planning, and gain a competitive edge in the vibrant business landscape of Dallas.

Challenges in finding accountants

Small businesses often face challenges when searching for the ideal accounting firm. It’s crucial to address these challenges head-on and develop a strategic plan to find the right fit. Some common obstacles include:

Identifying specific financial needs

Many small business owners struggle to pinpoint the exact financial services they require. It is essential to assess your business’s unique needs, such as bookkeeping, tax planning, or industry-specific expertise.

Locating the best accountant

Finding the best accountant for your business can be overwhelming, especially if you are unsure where to start. We will provide guidance on effective strategies for discovering reputable accounting firms and professionals in Dallas.

Budget constraints

Small businesses often operate with limited budgets, making it crucial to find an accounting firm that fits within their financial capabilities. We will explore different pricing structures and discuss how to negotiate fees for accounting services.

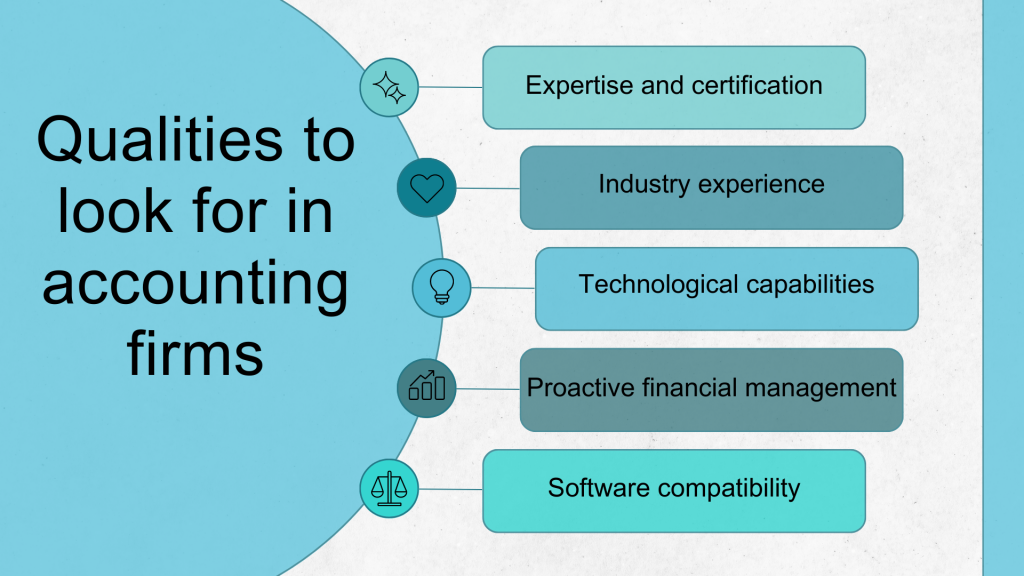

Qualities to look for in accounting firms

Choosing the right accounting firm involves considering several important qualities that ensure a successful partnership. We will discuss the following key attributes to look for in accounting firms:

- Expertise and certification

Accounting firms should employ professionals with relevant certifications, such as Certified Public Accountants (CPAs). We will delve into the importance of certification and how it can enhance the quality of services provided on the same level of the Big Four accounting firms.

- Industry experience

It is essential to find an accounting firm that understands your specific industry. We will explore the advantages of working with professionals who have experience working with businesses similar to yours.

- Technological capabilities

In today’s digital age, accounting firms must stay abreast of technological advancements. We will discuss the significance of cloud accounting and how it can enhance collaboration and efficiency between businesses and their accountants.

- Proactive financial management

A proactive accountant can provide valuable insights and strategies for saving money and optimizing cash flow. We will explore the importance of finding an accounting firm that goes beyond basic financial management.

- Software compatibility

Compatibility between your accounting software and the firm’s systems is crucial for seamless data sharing. We will discuss the benefits of working with accountants who are proficient in your preferred accounting software, such as QuickBooks, etc.

Different types of accounting services a business might consider

Dallas offers a variety of accounting services tailored to meet the unique needs of small businesses. We will explore the different types of accounting services available and how they can benefit your business:

- Certified Public Accountant (CPA)

CPAs are highly qualified professionals who have passed rigorous exams and met specific state requirements. We will explain the advantages of working with CPAs and guide you on how to find reputable CPAs in Dallas.

- Bookkeeping Services

Bookkeeping is the foundation of sound financial management. We will explore the importance of bookkeeping services and how they can help businesses maintain accurate financial records.

- Tax Planning and Preparation

Effective tax planning and preparation can save businesses significant amounts of money. We will discuss the role of accounting firms in tax planning and provide tips on finding experts in this field.

- Financial Advisory and Consulting Services

Accounting firms often offer financial advisory and consulting services to help businesses make informed decisions. We will explore the benefits of working with firms that provide comprehensive financial guidance.

How to find the perfect accounting firm in Dallas

With a thorough understanding of your financial needs and the qualities to look for in an accounting firm, it’s time to embark on the search for the perfect partner. We will provide a step-by-step guide on finding the best accounting firm in Dallas for your small business:

- Networking can be a powerful tool in finding reliable recommendations. You might want to tap into your personal and professional network to seek referrals and suggestions.

- Rushing the hiring process can lead to regrettable decisions. At this point, you might want to conduct thorough research and interview multiple candidates to find the best fit for your business.

- Entrusting your business’s finances to an accounting firm requires trust and reliability. So, you shouldn’t skip background checks to ensure the firm’s integrity and reputation.

- Budget considerations are crucial when selecting an accounting firm. Negotiating fees might help you reach a mutually beneficial agreement with your chosen firm.

The role of Dallas accounting firms in local industries

Dallas boasts a diverse and thriving business landscape, with several industries driving the city’s economic growth. We will explore the role of accounting firms in supporting these industries and the expertise they bring to the table. Some prominent industries we will focus on include:

Information Technology (IT)

In the fast-paced IT realm, companies face complex financial intricacies due to rapid innovation, unpredictable markets, and intense competition. Accounting firms specializing in the IT sector provide crucial guidance as financial navigators, equipped with deep expertise and industry-specific knowledge. They offer tailored services beyond bookkeeping and tax preparation, including financial forecasting, cost analysis, risk management, and investment advisory. By ensuring regulatory compliance and fostering collaboration, these firms help IT companies make informed financial decisions for sustainable growth.

Telecommunications

Accounting services specific to Dallas’s telecommunications industry are vital for financial stability and growth. These services include financial planning, bookkeeping, auditing, tax compliance, and reporting. They help companies make informed decisions, maintain accurate records, and comply with regulations, contributing to the industry’s thriving economy.

Transportation

Dallas, a major transportation hub, relies on accounting firms to effectively manage the finances of transportation companies. These firms provide essential services such as accurate financial reporting, cost optimization, and risk mitigation. By offering specialized expertise in the transportation sector, accounting firms help businesses make informed decisions, enhance profitability, and ensure compliance. They also assist with managing payroll, analyzing freight costs, and evaluating expansion opportunities.

Manufacturing and construction

Accounting firms provide specialized services to manufacturing and construction companies, aiding them in managing complex financial operations. These firms excel in record-keeping, financial statement analysis, budgeting, tax compliance, risk management, and financial decision-making support. By maintaining accurate financial records, analyzing statements, and offering guidance in tax planning and risk assessment, accounting firms ensure financial efficiency and stability. Their expertise assists companies in making informed decisions, allocating resources effectively, and navigating the intricate financial landscape of these industries.

Media and entertainment

The media and entertainment industry in Dallas has unique financial management requirements. Specialized accounting firms play a crucial role in addressing these needs. They provide tailored solutions for managing royalties, licensing agreements, production costs, and revenue recognition. These firms understand the complexities of royalty accounting and ensure accurate tracking and distribution of payments. They also assist in budgeting and cost control, help navigate licensing agreements, and ensure proper revenue recognition from diverse sources.

Pricing of accounting services in Dallas

Determining the pricing for accounting services in Dallas can indeed be a challenging task, as it entails considering various factors that influence the rates charged by accounting firms. These factors encompass the nature of the work involved, the reputation of the firm, its size, level of experience, and expertise. Let’s break it down.

Factors determining the cost of accounting services

The nature of the work plays a significant role in determining the pricing of accounting services. Different tasks within the realm of accounting, such as bookkeeping, financial statement preparation, tax planning, auditing, and advisory services, require varying levels of expertise, time commitment, and complexity. Consequently, accounting firms often base their pricing on the specific services requested and the resources required to complete them efficiently and accurately.

The reputation of an accounting firm is another crucial factor in pricing. Well-established and highly regarded firms with a proven track record of delivering exceptional results often command higher fees. The reputation of a firm is built over time through consistently providing quality services, maintaining client satisfaction, and possessing a strong expertise in the field. Clients may be willing to pay a premium for the assurance of working with a reputable firm that can meet their accounting needs effectively.

The size of the accounting firm also influences pricing. Larger firms tend to have more resources, a broader range of specialized professionals, and the ability to handle complex and extensive projects. As a result, they may charge higher rates to reflect their larger overhead costs and the added value they bring to clients in terms of expertise and capacity.

Experience and expertise are essential considerations when pricing accounting services. Firms with extensive experience in specific industries or with specialized knowledge in complex areas such as tax regulations, international accounting standards, or forensic accounting, often command higher fees. The level of expertise required to handle a particular engagement can significantly impact the pricing structure.

How to secure the optimal cost of accounting for your business?

When it comes to pricing structures, accounting firms employ various methods. Some firms charge an hourly rate, where clients pay for the actual time spent on their projects. Others may offer fixed fees for specific services or engagements, providing clients with certainty regarding the cost. In some cases, firms may use a blended rate, which combines different hourly rates for various professionals involved in the project.

To ensure a fair and reasonable cost for the accounting services they require, clients should take several steps.

- First, it is crucial to clearly communicate their needs and expectations to the accounting firm, providing all necessary details and relevant information. This enables the firm to accurately assess the scope of work and provide an appropriate pricing estimate. Additionally, clients should request a detailed breakdown of the services included in the proposed pricing, ensuring transparency and clarity regarding what they will receive in return for their investment.

- It is also advisable for clients to compare pricing and services offered by different accounting firms in Dallas. By obtaining multiple quotes and considering the reputation, expertise, and track record of each firm, clients can make informed decisions and negotiate the best possible deal.

However, while price is an important factor, it should not be the sole determining factor. Quality, reliability, and the ability to meet specific accounting needs should also be taken into account when selecting an accounting firm.

Want to learn more? Find out about Houston accounting firms with us or have a look at accounting firms in Atlanta!

Bottom line

Choosing the right accounting firm in Dallas is a crucial step towards unlocking financial success for your small business. By understanding your financial needs, exploring the qualities to look for in accounting firms, and following a strategic approach to finding the perfect partner, you can ensure seamless financial management and optimization. Dallas’s vibrant business landscape, diverse industries, and talented accounting professionals create an environment conducive to small business growth. With the right accounting firm by your side, you can navigate the intricacies of financial management with confidence, allowing you to focus on what you do best—growing your business and achieving your goals in the dynamic city of Dallas.

.png)