Assets are an essential part of any business. Establishing a profitable company requires you to acquire various resources to help start and maintain your operations. You need to get the right equipment, assemble teams of employees, and find ways to distinguish your brand from competitors.

Aside from acquisition, you must also ensure proper documentation and accounting of your resources. This practice will include accounting for tangible and intangible assets alike.

While tangible assets include physical items, equipment, and property, intangible assets are non-physical items that still provide financial value to your company.

This article will discuss the definition and types of intangible assets and how you can account for them in your company’s books.

What are intangible assets?

Intangible assets are often defined in contrast to tangible assets. As the name suggests, tangible assets are physical and measurable. Employees can handle and control them physically. They’re one of the most common types of assets you can find in a company’s portfolio.

Examples of tangible assets include vehicles, land, property, supplies, inventory, and equipment. These are material possessions that any business can acquire throughout its lifetime. Determining their value is usually more straightforward.

In contrast, intangible assets lack physical form. They are non-physical assets that often provide long-term value to a company; some even increase in value over time. Despite their lack of a physical form, they could be indispensable to a business and could be critical to its long-term success.

Both intangible and tangible assets are recorded on a company’s balance sheet. These figures help investors, creditors, and banks assess the value of a company.

Intangible assets can fall into two main categories: indefinite and definite.

Indefinite intangible assets stay with the company or holder for their entire life or as long as the business continues to operate. A typical example is a business’s brand name.

Conversely, a definite intangible asset has a separate lifespan from the company and is restricted to a specific period. Its value can expire when not nurtured or due to legal restrictions. Examples include patents and client relationships.

Examples of intangible assets

Intangible assets can take various forms. Despite their lack of a physical or manipulable form, they offer significant benefits to companies that have them. Here are some of the most well-known examples of intangible assets one may recognize:

Brands

A business or organization’s brand is one of its most important intangible assets. A brand sets a business apart from its competitors and other entities.

A cohesive brand consists of several elements that work together to build a unified whole. These elements often include the brand name and marketing materials like packaging, logos, advertising messages, etc.

Investing in your brand can significantly contribute to your company’s brand equity. Some customers prefer paying more for a recognizable and reliable brand over a generic option.

For example, Shopify has built its brand through a strong brand identity, effective marketing, and good business practices. Now, the platform has become one of the most recognizable and preferred brands in ecommerce.

Intellectual property

Intellectual property is an intangible asset enjoying legal protection. It refers to intellectual creations unique to or created by your company. No business, organization, or individual can use another entity’s intellectual property without legal authorization.

While intellectual property originates from ideas, they also need concrete realization. Ideas alone aren’t intellectual property, and intellectual property laws won’t be able to protect them.

Examples of intellectual property can include the following:

- Trademarks

- Patents

- Franchises

- Digital assets

- Trade secrets

If you spot any unauthorized use or infringement of your intellectual property, you may take legal action against the offending parties. It’d be wise to consult an intellectual property lawyer to help protect your intangible assets.

You can also visit an intellectual property organization’s local chapter or office.

Goodwill

Goodwill refers to the intangible assets that arise when one company acquires another. It signifies the potential value the acquiring company can get from the acquisition, often linked to gaining a competitive advantage.

Specifically, goodwill is the portion of the acquisition cost exceeding the combined net fair value of all assets and liabilities in the transaction.

Some components of goodwill include the following:

- Company reputation

- Brand recognition

- Positive employee relationships

- Devoted customer base

- Exclusive technology

Intangible assets accounting

It’s difficult to place a value on intangible assets and account for them in a company’s books. Nonetheless, accounting for intangible assets is necessary to ensure you maximize their usage and recognize their contributions to the company’s overall value.

All assets, both tangible and intangible, must be included in your company’s balance sheet. Your balance sheet is a financial document that outlines your business’s equity, liabilities, and assets.

Assets will take priority and will become the first entries on your balance sheet. Intangible assets come after your current assets, which are assets readily convertible into cash.

Aside from putting your intangible assets into your balance sheet, you must also amortize them and incorporate the amortized sum into your income statement.

Amortization of intangible assets

In accounting, amortization refers to spreading an intangible asset’s cost across a specific period. This practice provides a more accurate picture of your company’s financial situation. It can also help distribute your tax obligations evenly over the useful life of the intangible assets.

An intangible asset’s useful life refers to the duration it contributes to your company’s value. For example, a patent has a useful life of 20 years, while a copyright lasts 70 years after the author/creator’s passing.

For this reason, one can only amortize intangible assets with a finite useful life, like patents.

Calculating the amortization expense for an intangible asset involves three steps:

1. Determining the initial cost

2. Identifying the asset’s useful life

3. Calculating its residual value

The residual value of an intangible asset refers to its worth after its usefulness expires. While this concept may apply to tangible assets, intangible assets don’t have residual value.

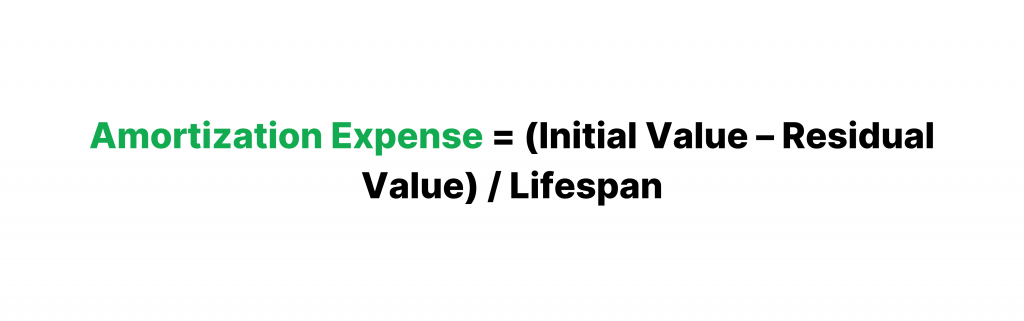

To calculate your amortization expense, use this formula:

Let’s say you apply for a patent that lasts 20 years and spend $20,000. You only need to divide the initial value by its lifespan ($20,000/20), as intangible assets have no residual value.

Instead of recording the lump expense of $20,000, you can record the amortization expense of $1,000 for 20 years. Not amortizing this large amount could throw off the figures on your financial records and tax forms.

Amortization and depreciation have some similarities in accounting. However, amortization only applies to intangible assets, while depreciation is for tangible assets.

Recording amortization expenses

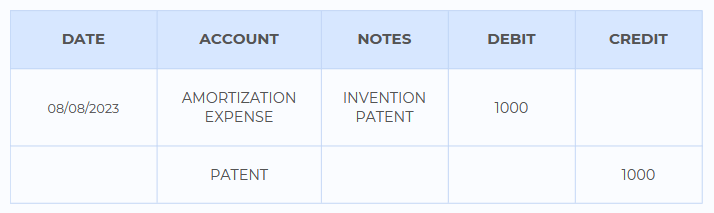

It’s necessary to document amortization costs in your accounting records, much like a depreciation expense journal entry. You can accomplish this by debiting the amortization expense account and crediting the intangible asset account, similar to how you would manage a journal entry. This way, you ensure that your entries balance each other out.

Debiting your amortization expense account is necessary since it’s an expense. Debits increase expenses, while credits lower them. You credit your intangible asset account since it’s an asset.

The amortization process allows you to increase your expenses and decrease your assets. It helps you write off your expenses and reduce your taxable income.

If we use the same example, you can outline your intangible asset amortization in this way:

Writing off intangible assets

Amortization is an excellent way to organize your books and claim tax deductions for your intangible assets.

To initiate the write-off process of your intangible assets, you can use Form 4562. You can also use this form for the depreciation of your tangible assets. The Internal Revenue Service (IRS) discusses the document’s requirements and provides further instructions on its website.

Classic asset valuation methods

Your assets are significant factors in determining the value of your company. Evaluating the worth of your tangible and intangible assets helps you better understand your company’s economic standing.

Several situations may call for a comprehensive valuation of your assets. These circumstances may include the following:

- Selling the company

- Need for financing

- Addition of new partners or members

- Tax requirements

Businesses can explore different ways to calculate the value of their assets. The three most common approaches are the market, cost, and income valuation methods.

Each method has advantages and disadvantages, which you must carefully weigh based on your company’s industry, characteristics, and other factors.

Market valuation method

There are two main approaches to the market valuation method.

The first approach examines comparable companies or firms and analyzes factors like price/earnings ratios and other valuation markers. Then, you establish an average valuation derived from these comparisons and apply it to your company.

This approach is relatively straightforward. However, its main drawback lies in its imprecision. Markets tend to overvalue or undervalue companies. Moreover, this approach doesn’t consider valuation disparities due to company-specific factors.

The second market valuation approach is similar to real estate comparisons. This strategy involves a sales analysis of similar properties or assets and determines the value based on recent sales or listing prices of comparable companies.

Cost valuation method

The cost valuation method uses the substitution principle. The principle posits that investors wouldn’t pay more for an asset than they would for a substitute asset providing an equivalent utility.

The cost valuation method has two potential starting points: reproduction and replacement costs.

- Reproduction cost. This cost refers to the estimated cost of creating an exact duplicate of a particular asset using identical materials, construction methods, standards, and design. It also incorporates the asset’s deficiencies, excesses, and outdated aspects.

- Replacement cost. The replacement cost refers to the cost of replacing an existing asset with a new one with similar utility within a specified date.

The main advantage of the cost valuation method is that it illustrates a clear value for a specific asset, considering current market costs and environments. However, it’ll need a lot of data and calculations.

Income valuation method

This approach works on the notion that an asset’s current full cash value is equivalent to the present value of the future cash flows it could generate throughout its economic lifespan.

The income valuation method requires comprehensive analysis. It entails the highest level of model risk as it relies on several assumptions. Nevertheless, the effort, detail, and analysis necessary for this valuation method can lead to a more precise assessment.

Businesses can use this valuation method alongside other approaches, such as the cost valuation approach. Combining different valuation methods allows companies to assess their assets more accurately.

Valuation of Intangible Assets

It can be challenging to conduct a valuation of intangible assets due to their lack of a physical form. While the principles governing classic valuation methods may still be helpful in the context of intangible assets, they might be difficult to apply.

For this reason, companies can use these five valuation approaches specific to intangible assets. These methods still work based on classic valuation techniques while tailoring them to suit the characteristics of intangible assets.

Relief from royalty method

This method calculates the hypothetical royalty rates your company could save by owning a specific asset. Owning an intangible asset implies that a firm doesn’t have to pay for its use.

The Relief from Royalty Method (RRM) incorporates market and income elements. Companies often use this approach to appraise trademarks and computer software.

With and without method

This approach calculates the value of the intangible asset by finding the difference between a discounted cash flow model that considers the asset and one that doesn’t.

Multi-period excess earnings method

This valuation method isolates cash flows associated with a particular intangible asset and then discounts them to their present value.

Companies usually use this method for assets that are the primary source of a company’s value. Examples of tangible assets that might benefit from this approach include customer relationships and software.

Real option pricing

Companies use this approach for assets that aren’t currently generating revenue or cash flows but may do so in the future. Real option pricing can cover the “time value” inherent in these assets. Undeveloped patents are a common candidate for this valuation approach.

Replacement cost method less obsolescence

Similar to the cost approach, this method takes the replacement cost of an intangible asset and adjusts it for obsolescence. In this context, obsolescence is similar to the depreciation of tangible assets.

How companies acquire intangible assets

Companies can acquire intangible assets in two primary ways: by creating them internally or acquiring them from other entities.

A business can create and develop intangible assets in-house. For example, they can establish their brand by working with their internal marketing team to create logos, trademarks, messaging guidelines, etc. Similarly, a manufacturing company might apply for patents to protect their original inventions.

The other way a company can get an intangible asset is through a purchase. When one company buys another, it often acquires the intangible assets already associated with that business. These assets could include brand recognition, customer relationships, and intellectual property.

Final words: Maximize the value of your asset capital

Intangible and tangible assets are significant factors in determining the overall economic value of a company. Proper accounting and valuation help you monitor these assets, create accurate financial reports, and show your company’s profitability.

Through these practices, you can assure investors and shareholders while increasing goodwill toward your company.

.png)