Amortization expense is a critical accounting concept, pivotal for understanding a business’s financial statements. It involves allocating the cost of intangible assets over their useful life, reflecting their consumption and utility in generating revenue. This article aims to explore amortization expense in-depth, covering its calculation, impact on financial statements, and relevance across various sectors.

Amortization: Basics to know

Definition

Amortization expense is an accounting term that refers to the systematic allocation of the cost of an intangible asset over its useful life. In simpler terms, it represents the process of expensing the cost of an intangible asset, such as patents, trademarks, copyrights, or goodwill, over the period during which it is expected to contribute to revenue generation. This allocation is done to match the expense of acquiring the asset with the revenue it generates, adhering to the accounting principle of matching expenses with revenues. Amortization expense reduces the book value of the intangible asset on the balance sheet and is recorded as an expense on the income statement.

Learn what an asset is in accounting and its importance in business.

Amortization vs. depreciation

Depreciation is an accounting method used to allocate the cost of a tangible fixed asset over its useful life. It represents how much of the asset’s value has been used up over time. Depreciation is a crucial concept in accounting and finance because it helps businesses spread out the expense of an asset so that it is matched with the revenue it generates, adhering to the matching principle in financial reporting.

Amortization and depreciation are both accounting methods used to allocate the cost of an asset over its useful life, but they have distinct applications and principles. Understanding these differences is crucial for proper financial accounting and reporting. Here’s a detailed comparison:

Nature of assets

- Amortization: Applies to intangible assets. Intangible assets are non-physical assets that provide economic benefits to a business, such as patents, trademarks, copyrights, and goodwill.

- Depreciation: Pertains to tangible assets. Tangible assets are physical assets used in business operations, like machinery, buildings, vehicles, and equipment.

Basis of allocation

- Amortization: The cost is allocated based on the estimated useful life of the intangible asset. Often assumes that the benefit from the asset is received evenly over its life.

- Depreciation: The cost is spread out over the asset’s useful life, considering wear and tear, decay, or obsolescence. The pattern of allocation can vary based on the expected usage and wear of the asset.

Calculation methods

- Amortization: Most commonly uses the straight-line method. The cost (minus any residual value, which is rare for intangibles) is divided evenly over the asset’s useful life.

- Depreciation: Offers various methods, such as the straight-line, declining balance, and units of production methods. The method chosen depends on the nature of the asset and how its benefits are consumed.

Residual/salvage value

- Amortization: Intangible assets typically have no residual value. The entire cost of the asset is usually amortized.

- Depreciation: Takes into account the salvage value of the asset. Depreciation is calculated on the cost of the asset minus its estimated salvage value.

Impact on financial statements

- Amortization: Recorded as an expense on the income statement. Reduces the book value of intangible assets on the balance sheet through accumulated amortization.

- Depreciation: Also recorded as an expense on the income statement. Reduces the book value of tangible assets on the balance sheet through accumulated depreciation.

Revision of value and useful life

- Amortization: The useful life of an intangible asset can be reassessed, but changes are less frequent. Goodwill, a significant intangible asset, is not amortized but tested annually for impairment.

- Depreciation: Tangible assets often undergo revaluation, and their useful life and salvage value may be adjusted based on wear, market conditions, and technology changes.

Tax implications

Both amortization and depreciation are deductible expenses for tax purposes, but rules and regulations can vary significantly between different types of assets.

Application in business decisions

- Amortization: Important for businesses with significant intangible assets (e.g., software companies, intellectual property-heavy industries).

- Depreciation: Crucial for capital-intensive businesses (e.g., manufacturing, transportation).

While both amortization and depreciation serve the purpose of allocating the cost of assets over their useful lives, they apply to different types of assets and follow different calculation methods and principles. Amortization deals with intangible assets and usually employs a straight-line method, assuming no residual value. In contrast, depreciation pertains to tangible assets, offers several calculation methods, and considers salvage value. Both significantly impact a company’s financial statements and tax calculations.

How to understand whether to amortize or depreciate an asset?

To decide whether to amortize or depreciate an asset, identify if the asset is tangible or intangible, determine its useful life, adhere to relevant accounting and tax regulations, and conduct regular reviews. This approach ensures that the allocation of the asset’s cost over its useful life aligns with accounting principles and provides an accurate reflection of its contribution to the business.

How to calculate amortization expense

Calculating amortization expense involves spreading the cost of an intangible asset over its useful life. Here’s a guide on how to calculate amortization expense, primarily using the most common method, the straight-line method.

1. Identify the cost of the intangible asset

- Initial purchase price: Determine the purchase price of the intangible asset.

- Additional costs: Add any additional costs incurred to prepare the asset for its intended use. This could include legal fees for a patent or costs associated with securing a trademark.

2. Determine the useful life of the asset

Estimate the number of years the asset will contribute to generating revenue for the business. This period is known as the ‘useful life’ of the asset. The useful life can vary depending on the nature of the asset and company policy.

3. Consider the residual value (if applicable)

In some cases, an intangible asset might have a residual value at the end of its useful life, although this is less common than with tangible assets. If there is a residual value, it should be subtracted from the cost of the asset to determine the amount to be amortized.

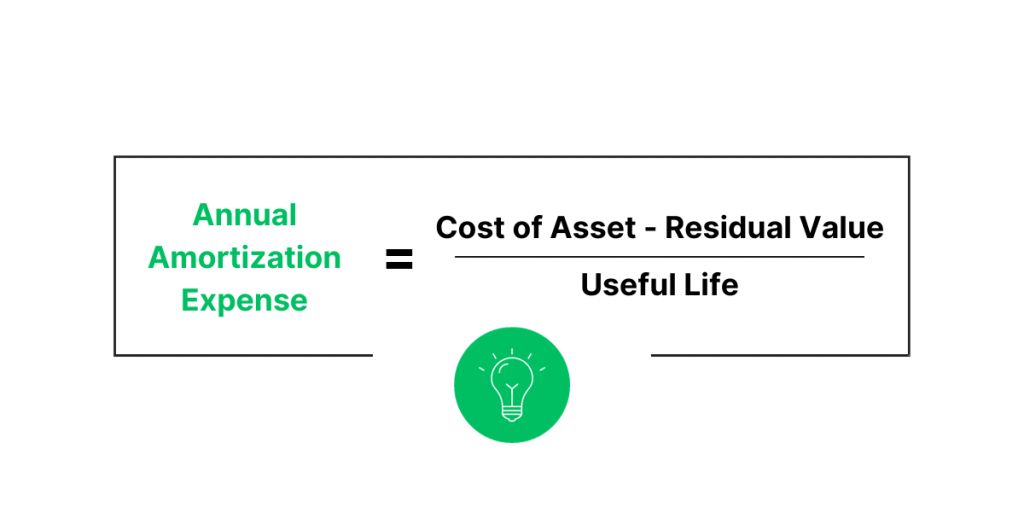

4. Calculate the annual amortization expense (Straight-line method)

This method divides the depreciable amount of the asset (cost minus residual value) evenly over its useful life.

Example calculation

Suppose a company acquires a patent at a cost of $50,000. The patent has a useful life of 10 years and no expected residual value at the end of this period. The annual amortization expense calculation would be:

Cost of Asset: $50,000

Residual Value: $0

Useful Life: 10 years

Annual Amortization Expense = ($50,000 – $0)/10 = $5,000

So, the annual amortization expense for the patent would be $5,000.

Note

- While the straight-line method is the most common, other methods like the declining balance method or the units of production method may be used, depending on the nature of the asset and the company’s accounting policies.

- The useful life and residual value of the asset should be reviewed periodically, and the amortization expense should be adjusted if there are significant changes.

Learn the top 8 accounting challenges facing businesses today.

Other methods of amortization expense calculation

Besides the straight-line method, there are other methods to calculate amortization expense for intangible assets. These methods are less commonly used for intangibles than for tangible assets, but they can still be applicable in certain circumstances.

1. Declining balance method

This is an accelerated depreciation method that can also be used for amortization. It results in higher expenses in the early years of an asset’s life, with the amount decreasing over time.

Calculation

Multiply the book value of the asset at the beginning of the year by a fixed rate (often double the straight-line rate).

Example

If the straight-line rate is 20% (based on a 5-year useful life), the double declining balance rate would be 40%. For a $100,000 asset, the first year’s amortization would be $40,000, then 40% of the remaining book value in subsequent years.

2. Units of production method

This method ties amortization to the usage or production level of the intangible asset, making it more suitable for assets whose benefit is directly linked to production output.

Calculation

Determine the total estimated units the asset will produce or be used for over its life. Then, calculate the amortization per unit. Multiply this rate by the actual units produced or used in a period to find the amortization expense.

Example

If a software is expected to process 500,000 data units over its life and costs $200,000, the per-unit amortization is $0.40. If 50,000 units are processed in a year, the annual amortization expense would be $20,000.

3. Sum-of-the-years’-digits method

An accelerated method where more of the asset’s cost is expensed in the earlier years. It’s less common for intangible assets but can be applied in theory.

Calculation

Add together the digits for each year of the asset’s useful life (for 5 years, it would be 1+2+3+4+5=15). For each year, calculate a fraction (the year’s digit divided by the sum of the digits) and multiply this by the depreciable base.

Example

For a 5-year life asset worth $100,000, the first year’s expense is 5/15 of the depreciable amount. The second year is 4/15, and so on.

4. Full expensing method

In certain cases, particularly for small and low-value intangible assets, companies might choose to expense the entire cost in the year of purchase.

This method is usually applied when the asset’s cost is relatively low or its useful life is very short.

Choosing the Right Method

The choice of method depends on the nature of the intangible asset, the pattern in which the asset’s economic benefits are expected to be consumed, and the accounting policies of the company. In practice, the straight-line method is most commonly used for intangible assets due to its simplicity and because the pattern of economic benefit from such assets is often evenly spread over their useful lives. However, if the benefit from the asset decreases over time, or if it’s linked to production levels, alternative methods like the declining balance or units of production might be more appropriate.

Learn how to avoid mistakes in accounting.

Amortization of loans

Amortization of loans refers to the process of paying off a loan over time through regular payments. This concept is most commonly applied to mortgages, car loans, and personal loans. Here’s how it works:

Structure of an amortization schedule

An amortization schedule is typically presented in a table format. Each row represents a payment period, usually a month, and the columns detail:

- Payment number: Indicates the payment sequence.

- Beginning balance: The amount of principal outstanding at the beginning of the period.

- Scheduled payment: The total amount due for that period, which remains constant in a standard fully amortizing loan.

- Principal: The portion of the scheduled payment that goes towards paying down the original amount borrowed.

- Interest: The portion of the scheduled payment allocated to interest, which is calculated on the current outstanding principal balance.

- Ending balance: The remaining principal balance after the payment is made.

Changing proportions over time

In the early stages of a loan, the interest component of each payment is high because it is calculated on a larger principal balance. As the principal decreases over time, the interest portion of each payment reduces, while the portion applied to the principal increases.

Total interest over life of loan

The schedule also helps in understanding the total interest that will be paid over the life of the loan. Initially, it might seem that the borrower is making little progress in reducing the principal, but over time, as the interest portion decreases, the rate at which the principal is paid down accelerates.

Effect of loan terms

The length of the loan (loan term) and the interest rate are crucial factors that affect the amortization schedule. Longer-term loans will generally have lower monthly payments, but result in higher total interest paid over the life of the loan. Conversely, a higher interest rate will increase the total cost of the loan.

Visual representation

Some amortization schedules are accompanied by graphs or charts that visually represent how the proportions of principal and interest change over the life of the loan.

Loan modifications

If a borrower refinances the loan, makes extra payments, or misses payments, the original amortization schedule is modified. Extra payments reduce the principal faster, potentially shortening the loan term and reducing the total interest paid.

Importance for budgeting and planning

For borrowers, understanding the amortization schedule is important for budgeting and financial planning. It provides a clear picture of how much they owe at any given time and how long it will take to pay off the loan.

In summary, an amortization schedule is a powerful tool for borrowers to understand and manage their loans effectively. It not only helps in visualizing the repayment structure but also in making informed decisions about refinancing, prepayments, or adjusting the loan term.

Accounting for amortization expense

In accounting, the treatment of amortization expense is a critical aspect of accurately representing a company’s financial position and performance. Amortization expense, which pertains to the systematic allocation of the cost of intangible assets, impacts both the income statement and the balance sheet.

Recording on the income statement

Periodic expense recognition. Amortization expense is recognized periodically, typically on an annual basis. It appears as an expense on the income statement, which reduces the company’s net income for the period.

Matching principle. This practice aligns with the accounting principle of matching, where expenses are reported in the same period as the revenues they help to generate. By amortizing the cost of an intangible asset, a company spreads out the expense over the period the asset contributes to generating revenue.

Impact on the balance sheet

Reduction of asset value. On the balance sheet, amortization expense gradually reduces the book value of the intangible asset. This is reflected in the asset’s carrying amount (original cost minus accumulated amortization).

Accumulated amortization account. A contra-asset account, typically titled “Accumulated Amortization,” is used to track the total amortization expense recognized to date. This account is subtracted from the gross amount of intangible assets to present their net book value.

Keep your balance sheet in tune with Synder Sync. Learn how the software eases the bookkeeping and accounting processes!

Amortization and cash flow

It’s important to note that amortization expense is a non-cash expense. It does not involve an actual outflow of cash when it is recorded. Instead, it represents the allocation of a cost already incurred (when the intangible asset was acquired).

While it reduces net income, amortization expense is added back to the net income in the operating activities section of the cash flow statement. This adjustment is made because it is a non-cash expense, and the statement aims to reflect the actual cash generated or used by operating activities.

Tax implications

For tax purposes, amortization can provide a tax benefit as it reduces taxable income. The deductibility of amortization depends on tax laws and regulations, which may vary depending on the type of intangible asset and jurisdiction.

Note: Companies must adhere to specific reporting requirements for amortization in their tax filings, which might differ from the treatment in their financial statements.

Periodic review and adjustments

The useful life of an intangible asset should be reviewed periodically. If expectations significantly change, the remaining carrying amount of the asset should be amortized over its revised remaining useful life. Additionally, intangible assets should be reviewed for impairment, and if an asset’s market value declines significantly, an impairment loss may need to be recognized.

In summary, the accounting for amortization expense is a crucial process in financial reporting, ensuring that the cost of intangible assets is systematically and rationally allocated over their useful lives. This practice not only aids in accurately depicting a company’s profitability and financial health but also ensures compliance with accounting standards and principles.

Learn how to power your accounting practice with AI.

Importance of amortization

Amortization is important for several reasons, particularly in the context of business, accounting, and personal finance:

Financial planning and budgeting

For individuals and businesses, understanding the amortization of loans helps in planning monthly budgets and long-term financial strategies. Knowing how much needs to be paid, when, and how much of it goes towards interest versus principal allows for better financial management and decision-making.

Accurate financial reporting

In accounting, amortization of intangible assets is crucial for accurate financial reporting. It ensures that the cost of the asset is accurately reflected in the company’s financial statements over the period it provides benefits. This leads to a more accurate representation of a company’s financial health and performance.

Tax implications

Amortization schedules for loans and the amortization of assets have significant tax implications. For loans, the interest portion of the payments is often tax-deductible, particularly in the case of mortgages. For businesses, amortization of intangible assets is a non-cash expense that reduces taxable income.

Cash flow management

Understanding the amortization of loans helps in managing cash flow, an essential aspect for both individuals and businesses. It allows borrowers to anticipate their future financial obligations, ensuring that they have adequate funds to cover these obligations when they come due.

Informed decision making

When taking out a loan, understanding the amortization process helps in making informed decisions about the terms of the loan. For example, shorter-term loans typically have higher monthly payments but result in less total interest paid over the life of the loan.

Asset valuation

For businesses, amortization is crucial in determining the true value of intangible assets over time. This is important for investment analysis, business valuations, and when considering mergers or acquisitions.

Compliance with accounting standards

Proper amortization practices are required to comply with accounting standards such as GAAP and IFRS. Compliance ensures that a business’s financial statements are fair and consistent, which is vital for investors, regulators, and other stakeholders.

Impact on profitability

Since amortization of assets is recorded as an expense, it affects the profitability shown in the income statement. This impacts how investors and analysts perceive the company’s performance.

Conclusion

Amortization expense is a vital element in financial accounting, reflecting the usage of intangible assets in a business. Its correct calculation and reporting are essential for presenting an accurate picture of a company’s financial health and aiding in informed decision-making. Comprehensive knowledge of amortization is thus indispensable for professionals in finance, accounting, and business management.

Are you an Amazon business owner? Learn more about Amazon payment methods.

%20(1).png)