The business world today moves quickly and relies a lot on data. Accounting has been keeping up with these changes because it’s important to stay ahead to be successful. Artificial Intelligence (AI) has really changed the accounting field – many accounting programs now use AI, and its role is growing.

ChatGPT, a new advance in AI and machine learning, is being used in different parts of the business, making things faster and better in everything from research and coding to helping customers. Accountants can use this technology too.

In this article, we’re going to talk about how AI is used in accounting. We’ll explain how it helps, clear up some common wrong ideas about AI, and show real ways ChatGPT and other cutting-edge solutions can help with accounting work.

Key takeaways:

- AI helps eliminate much of the manual work in accounting, making things more accurate and reducing mistakes.

- ChatGPT is useful for many accounting tasks, like sorting transactions, calculating taxes, and predicting cash flow. It makes everyday accounting jobs easier.

- Even with all the new AI technology, we still really need human accountants. Their jobs are just changing to focus more on thinking deeply and giving advice.

- Right now, not all businesses use AI in their accounting, but more and more are starting to because they see how it can make things smoother and help them make better decisions.

- In addition to AI, which simplifies processes without full automation, there are comprehensive solutions for automating your accounting tasks.

Here’s what you’ll read about AI in accounting:

1. What is AI in general and ChatGPT in particular?

2. What is AI’s role in accounting?

3. How does AI transform the role of accountants?

4. Will AI replace accountants?

5. Synder is a tool every accountant should know about

6. How can Synder help you with your accounting?

7. AI trends in accounting in 2024

8. Practical use of AI in accounting on the example of ChatGPT

- Example #1: Easier categorization & and tips when balancing the books

- Example #2: Simplifying tax liability calculations

- Example #3: Accurate cash flow forecasting

- Example #4: Optimizing revenue recognition

9. Common concerns about AI in accounting

10. AI in accounting: People also ask

What is AI in general and ChatGPT in particular?

To begin with, it’s important to understand that AI, or Artificial Intelligence, stirs up many different opinions nowadays. There isn’t one clear-cut view of its impact on our lives or what it means for the future.

On one hand, some people see AI as a huge benefit. They believe it’s a breakthrough that can handle large amounts of information much quicker and more accurately than humans ever could. This advantage is seen as a way to push forward scientific discoveries, speed up technological advancements, and make many jobs more efficient. On the other hand, there are those who view AI more negatively, worrying it could replace human jobs or, in extreme cases, pose a danger to humanity itself. That’s why AI is often seen as a hot topic with widely differing viewpoints.

Rather than getting caught up in these debates, let’s focus on the facts and basics of AI to understand it better.

The definition of AI

AI, or Artificial Intelligence, in a nutshell, is the simulation of human intelligence in machines programmed to think and learn like humans. It involves developing computer systems capable of performing tasks that typically require human intelligence, such as:

- speech recognition,

- decision-making,

- problem-solving,

- and language understanding.

AI is a multi-disciplinary field encompassing various subfields, such as:

- machine learning,

- natural language processing,

- computer vision,

- robotics,

- and expert systems.

AI aims at creating intelligent systems that can perceive and understand the world, reason and make decisions, and communicate effectively.

As we’re going to explore the potential and capabilities of ChatCPT in accounting in particular, two of the AI subfields are the most interesting for us, namely:

- machine learning;

- and natural language processing.

1. Machine learning

Machine learning plays a fundamental role in AI by enabling systems to learn from data and improve performance over time without explicit programming. Algorithms make machine learning models identify patterns, extract meaningful insights, and predict or decide based on the input data. This ability to learn and adapt sets AI apart from traditional software systems.

2. Natural language processing

Natural language processing (NLP) is another essential aspect of AI, focusing on the interaction between computers and human language.

NLP allows machines to:

- understand,

- interpret,

- and generate human language in a contextually relevant and meaningful way.

This capability has paved the way for applications such as

- virtual assistants,

- chatbots,

- and language translation systems.

What is ChatGPT?

ChatGPT, developed by OpenAI, is an advanced language model – a specific example of an AI model that focuses on natural language processing. It’s gained significant attention for its ability to generate human-like text responses based on the input it receives.

ChatGPT uses deep learning techniques, specifically deep neural networks, to process and understand language. Besides, it relies on a vast knowledge base comprising a wide range of data sources, including:

- books,

- articles,

- and websites.

This helps develop a thorough understanding of human language.

Altogether, it makes ChatCPT capable of engaging in conversations, answering questions, and providing valuable insights across various topics, generating contextually relevant responses.

What is AI’s role in accounting?

Adopting artificial intelligence (AI) within the accounting sector isn’t just a trend—it’s a significant shift expected to grow at a high rate. A study by Mordor Intelligence projects a year-over-year growth rate of 30% for AI in accounting through 2027. Gartner’s finding suggests that 80% of Chief Financial Officers (CFOs) plan to increase their investment in AI technologies over the next two years.

But what’s fueling this investment and optimism towards AI in accounting?

An important aspect of modernizing accounting practices involves how accounting firms are utilizing AI to meet their specific needs. For instance, AI can ease traditionally manual and time-consuming tasks. This speeds up operations and significantly reduces the chances of human error, which can be costly and damaging to businesses. By minimizing these errors, companies ensure greater accuracy in their financial reporting, compliance, and decision-making processes.

In particular, accounting firms use AI for things like:

- Prediction,

- Timetable organization,

- Cash flow oversight,

- Streamlining workflows,

- Crafting emails and organizing inboxes,

- Handling invoices and managing expenses,

- Analyzing data,

- Facilitating business correspondence,

- Project coordination.

Despite the promising advancements, the current adoption rate of AI among accounting firms remains modest, with a steep increase anticipated in the near future. Over recent years, there has been a noticeable uptick in the integration of AI within the accounting sector. Firms, regardless of their scale, are increasingly embracing AI solutions to augment their services. This shift is motivated by the recognition of AI’s capacity to automate routine tasks, minimize errors, and liberate accountants to engage in more strategic advisory roles.

Nevertheless, the majority of accounting firms find AI adoption challenging for several reasons:

- It’s perceived as too new.

- Concerns regarding security remain prevalent.

- There are instances of incomplete, misleading, or inaccurate responses.

- The foremost concerns revolve around data security and privacy.

A significant portion of surveyed respondents, approximately two-thirds, expressed apprehensions about utilizing technologies like ChatGPT and generative AI for corporate or client-related tasks. Surprisingly, 73% of those surveyed currently have no intentions of leveraging such technology.

As one respondent said, “Generative AI doesn’t equate to genuine intelligence — it’s akin to text-based crowd-sourcing.”

Despite these reservations, around 15% of surveyed accounting firms either currently utilize AI or plan to do so in the near future. Although only 11% are presently using it extensively, a notable 51% anticipate its incorporation within the next six to twelve months.

How does AI transform the role of accountants?

AI technology has been transforming the usual ways of accounting for quite some time already. At this point, it’s safe to say that AI is changing the role of accountants, simplifying traditional accounting practices and enabling accountants to have more time to focus on higher-value tasks. We’ll quickly break down some key transformations brought about by AI.

Transformation #1.

AI algorithms have a high level of accuracy and can detect patterns, anomalies, and errors more effectively than humans. For instance, accountants can use AI to ensure greater accuracy in financial statements, minimize compliance risks, and adhere to accounting standards.

For example, an AI system might identify discrepancies in ledger entries that could indicate unintentional errors in manual data entry or potentially fraudulent activities, allowing for timely corrections and reducing the risk of financial misreporting.

Transformation #2.

AI enables accountants to analyze large volumes of financial data swiftly and accurately. Advanced data analytics tools powered by AI can provide valuable insights, identify trends, predict outcomes, and support decision-making processes.

For instance, AI may uncover a significant increase in sales revenue in a particular market segment, prompting further investigation into the factors driving this growth.

It can also predict future revenue trends based on historical data and market conditions, enabling a business to make informed decisions regarding resource allocation, pricing strategies, and expansion opportunities.

Transformation #3.

AI-based algorithms can detect suspicious patterns and anomalies in financial data, aiding in fraud detection and risk mitigation. For example, accountants can use AI tools to identify potential fraud cases, flag them for further investigation, and implement preventive measures.

Example: If an AI tool notices an unusual series of transactions occurring at odd hours or in atypical amounts, it could flag these for a detailed review, potentially uncovering a scheme to siphon funds or manipulate financial records.

Transformation #4.

AI models can analyze historical data, market trends, and economic indicators to generate accurate forecasts. Accountants can utilize AI-powered forecasting tools to make informed financial decisions, plan strategically, and optimize cash flow and resource allocation.

For instance, by analyzing seasonal sales patterns, economic trends, and consumer behavior, an AI forecasting model could predict the upcoming quarter’s revenue with high accuracy, helping a company prepare for expected demand fluctuations.

Transformation #5.

With routine tasks automated, accountants have more time to focus on providing advisory and value-added services to clients. They can use their expertise and insights gained from AI-driven analysis to offer strategic financial guidance, optimize business processes, and support growth initiatives.

For example, accountants could use AI-driven insights to advise a client on tax-saving strategies based on predictive models of tax code changes or to recommend investment opportunities identified through trend analysis.

Transformation #6.

Accountants need to stay updated with changing regulations and industry practices. AI-based platforms can provide real-time access to the latest accounting standards, regulatory updates, and industry insights, enabling accountants to continuously enhance their knowledge and skills.

Example: An AI-powered learning platform could personalize content delivery to an accountant’s learning style and professional focus areas, ensuring they’re always ahead of new regulatory requirements and industry best practices.

Will AI replace accountants?

It’s a question on many minds. Is AI poised to snatch your job away? It’s another one-million question. While AI has definitely caused significant changes, it doesn’t spell the end of accountancy as we know it. Here’s the rationale:

Rationale #1: Sophisticated decision-making requires human insight and expertise

Accounting requires knowing complex business transactions, rules, and industry details. Despite AI’s advancements, it lacks the capacity for human intelligence, discernment, ethical considerations, and innovation—essential elements for handling complex accounting scenarios.

Rationale #2: Communication with customers & trust are paramount

Building and maintaining relationships with clients are central to the profession, as accountants often become trusted advisors. Skills like good communication, understanding clients’ financial goals and challenges, and effective communication skills are areas where AI falls short.

Rationale #3: Supervision & interpretation are key

Human accountants are crucial in helping businesses deal with financial challenges. Although AI can handle data processing and analysis, it struggles to accurately interpret results, provide context, or offer strategic financial advice consistently.

According to a survey by Moss Adams, one of the nation’s largest accounting, consulting, and wealth management firms, AI in accounting is going mainstream. The study reveals that a large majority of accountants believe the technology will enhance rather than eliminate jobs and benefit the profession overall, driving productivity and business growth. For these reasons and more, AI is ready to complement rather than replace accountants.

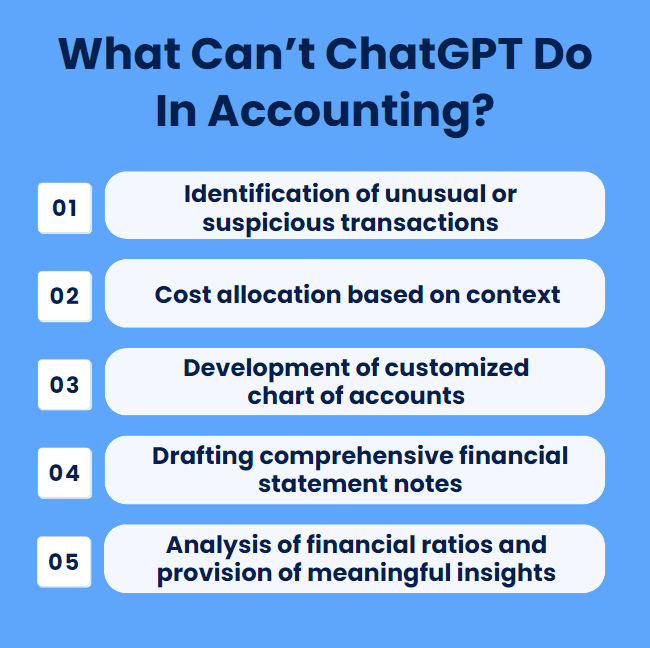

What can’t ChatGPT do in accounting?

While AI has made remarkable strides in automating repetitive and rule-based tasks and processing vast amounts of data at incredible speeds, there are distinct areas where the human touch remains indispensable. At this point, AI may encounter challenges or exhibit lower performance compared to human accountants fulfilling certain tasks. It highlights the unique strengths that human professionals bring to the field of accounting.

Back to our examples, while ChatGPT formally completed all the tasks, at some, an accounting professional is highly likely to outperform the artificial mind.

1. Identification of unusual or suspicious transactions

AI might not have the same deep understanding and intuition as human accountants, which could make it less capable of spotting suspicious transactions or potential fraud.

2. Cost allocation based on context

AI systems might find it difficult to completely understand the complexities and specific needs of a client’s business, which could result in mistakes when allocating costs.

3. Development of customized chart of accounts

While AI can create a basic chart of accounts, it might struggle to make a customized one that fits a client’s specific business or industry.

4. Drafting comprehensive financial statement notes

AI can generate basic financial statement notes. However, it can’t provide detailed explanations and give insights like human accountants can.

5. Analysis of financial ratios and provision of meaningful insights

While AI can perform the necessary computations for financial ratios, it may struggle to offer in-depth insights and recommendations based on those ratios, as human accountants are better equipped to provide valuable context and expert judgment.

It’s important to mention that human accountants are particularly skilled in these tasks because they can understand context, apply professional judgment, and offer customized advice based on their thorough understanding of a client’s unique situation.

Synder is a tool every accountant should know about

As we’ve explored, AI can significantly aid in simplifying accounting processes by offering support and guidance. However, it’s important to recognize that AI alone can’t undertake all accounting tasks on your behalf.

Luckily, there’s a solution that can bridge this gap effectively – Synder. Unlike AI, which simplifies processes without fully automating them, Synder offers a comprehensive solution for automating your accounting processes.

Creating an account and connecting your platforms allows you to tailor Synder’s settings to suit your specific needs. Synder excels in the seamless transfer of financial data between data sources—such as ecommerce platforms like Stripe, PayPal, and Shopify—and your accounting system, including QuickBooks Online, QuickBooks Desktop, Xero, or Synder Books.

The core advantage of using Synder lies in its ability to not just simplify but automate your accounting workflow. With just a few clicks, you can set up a system that manages your financial data efficiently, allowing you to enjoy the peace of mind and time to focus on strategic decisions.

How can Synder help you with your accounting?

1. No more manual entry

Synder automatically syncs sales, fees, refunds, and payouts from connected payment platforms into your accounting software.

Moreover, if your store uses supported payment gateways, connecting these to Synder will also yield automatic, detailed records of all financial transactions, including additional information from orders if it’s Shopify, for example.

2. Comprehensive data sync

The app ensures that every transaction detail, including customer information, items sold, taxes, shipping costs, and discounts, is accurately reflected in your accounting system.

3. Financial insights & reporting

Beyond just syncing transactions, Synder offers Business Insights, a feature that aggregates data across sales channels and payment gateways. It provides hourly updated insights into product performance, customer behavior, and key financial health indicators such as total sales and average order value.

Learn how to make smart business decisions using your data with our easy guide: “How to Get Business Insights from Data: Data Insights with Synder.”

4. Advanced features for data security

Synder incorporates features like duplicate detection and rollback options, giving store owners peace of mind by securing their accounting against errors and ensuring that any mistakes can be easily corrected.

5. Customization & configuration

After connecting your platforms to Synder, you can fine-tune settings to match their specific needs, including adjusting tax, item, or customer configurations.

The Smart Rules feature also helps fill in any gaps in data post-sync, such as applying classes or locations to transactions.

To tailor small business accounting to your unique requirements, delve into our article: “How to Add Classes in QuickBooks Online: Assign QuickBooks Online Classes Automatically Using Synder Smart Rules.”

6. Dive into your financial history

Ever wish you could easily look back at your financial data from the past three years? With Synder’s ‘Historical data import’ feature, you can. This is super handy for tax time or when you’re planning ahead, giving you a full, detailed view of your business finances over time.

Explore our related article, “Syncing Historical Data: A Feature Overview,” for an in-depth look at effective data management strategies.

7. No reconciliation headaches

Are you worried about matching your PayPal data with your bank account? Synder smooths out those wrinkles, making sure everything lines up perfectly. This allows you to focus more on growing your business and less on the nitty-gritty of numbers.

Similar read: Bank Reconciliation in Excel vs Reconcile with Synder: Manual Excel Bank Reconciliation vs Automated Bank Reconciliation

We could certainly spend more time highlighting the outstanding features of Synder, but experiencing it firsthand is far more engaging.

Therefore, we invite you to optimize your business processes and explore Synder features with a free trial. To gain more insights and tips, book your seat on the informative Weekly Public Demo offered by Synder.

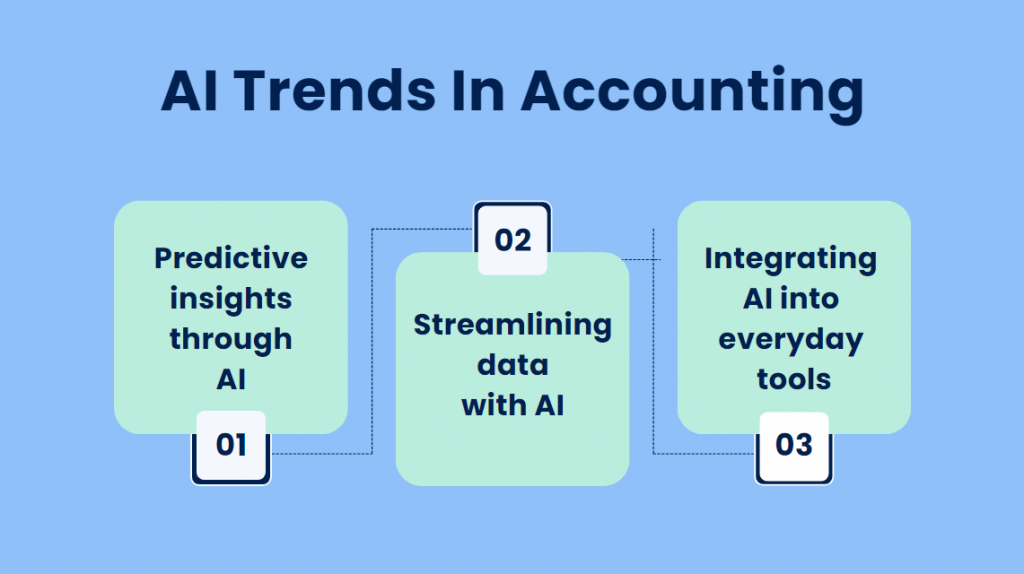

AI trends in accounting in 2024

Trend #1: Streamlining data with AI

Handling raw data in spreadsheets is often seen as a necessary evil in accounting—a time-consuming task that can drain hours of productivity. AI has started changing the game by efficiently organizing, summarizing, and analyzing financial data.

AI tools are essentially acting as digital assistants, enabling accountants to quickly make sense of vast amounts of information. This shift saves valuable time and significantly reduces the margin for human error, allowing professionals to focus on more strategic tasks.

Trend #2: Predictive insights through AI

The power of AI to forecast financial trends and identify risks before they become apparent is truly groundbreaking. By analyzing complex datasets, AI algorithms can spot patterns that might go unnoticed by the human eye, offering predictive insights that are invaluable for financial planning and risk management.

This capability allows businesses to anticipate future challenges and opportunities, making informed decisions that can steer them toward greater stability and growth.

Trend #3: Integrating AI into everyday tools

While standalone AI applications offer significant benefits, their true potential is unlocked when they’re integrated into the everyday software solutions used by accountants and finance professionals.

This integration means that advanced AI functionalities, like automated analytics and custom report generation, become part of the standard toolkit, accessible without needing to switch between applications. It represents a seamless blend of AI and traditional software, enhancing productivity and decision-making without disrupting familiar workflows.

Practical use of AI in accounting on the example of ChatGPT

At this point, I think that demonstration sometimes might be the best way to explain things. So we picked out some basic accounting tasks and asked ChatGPT (remember, it’s a language model that mimics human communication, so yes, you can literally ask it to do things for you) to solve them.

Let’s look at the results.

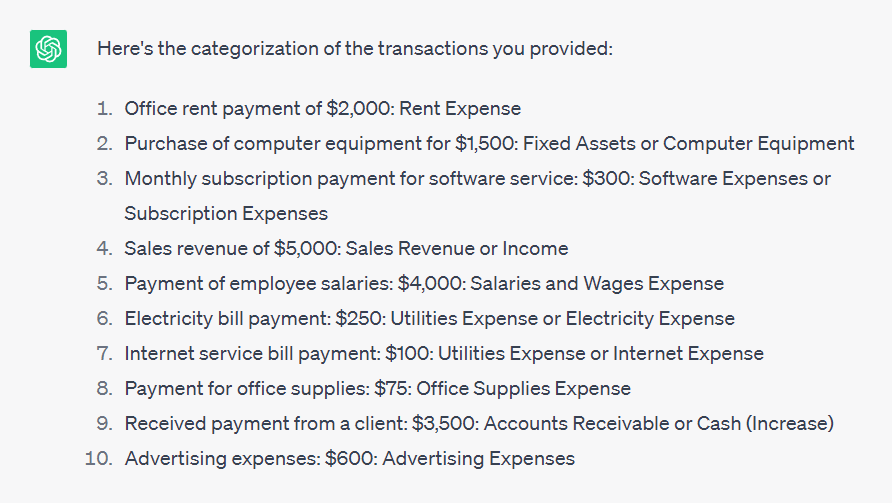

Example #1: Easier categorization & and tips when balancing the books

Traditionally, transaction categorization has been a labor-intensive task, prone to errors and inconsistencies. With the implementation of AI, ChatGPT can help accountants get a little closer to accurately categorized transactions and automated accounting.

By analyzing past transaction patterns and learning from them, ChatGPT can swiftly classify transactions into appropriate categories, reducing the need for manual intervention.

Moreover, balancing the books becomes more efficient with ChatGPT’s ability to detect discrepancies and suggest adjustments, ensuring the accuracy of financial statements.

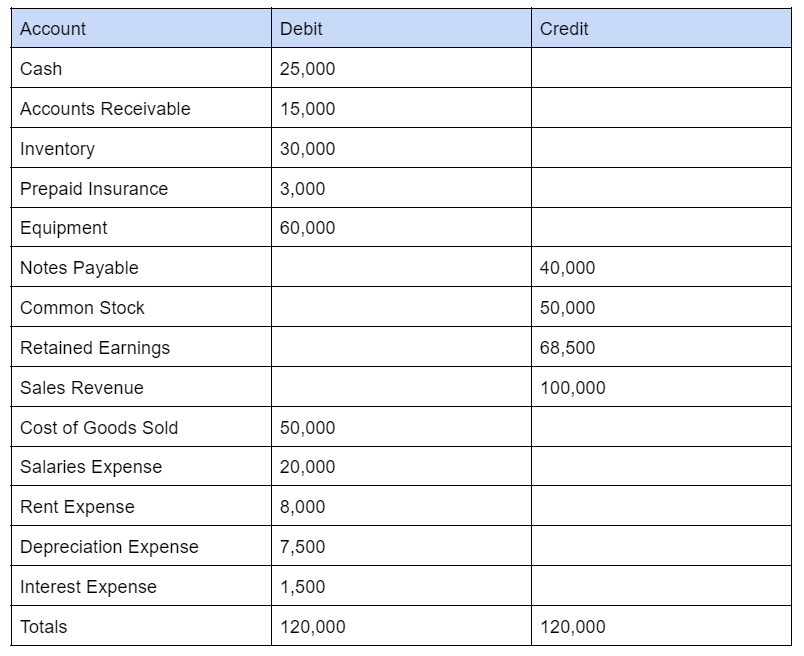

1. Transaction categorization

ChatGPT was given a list of ten transactions and asked to properly categorize them.

- Office rent payment of $2,000

- Purchase of computer equipment for $1,500

- Monthly subscription payment for software service: $300

- Sales revenue of $5,000

- Payment of employee salaries: $4,000

- Electricity bill payment: $250

- Internet service bill payment: $100

- Payment for office supplies: $75

- Received payment from a client: $3,500

- Advertising expenses: $600

The AI tool categorized the provided transactions in the following way:

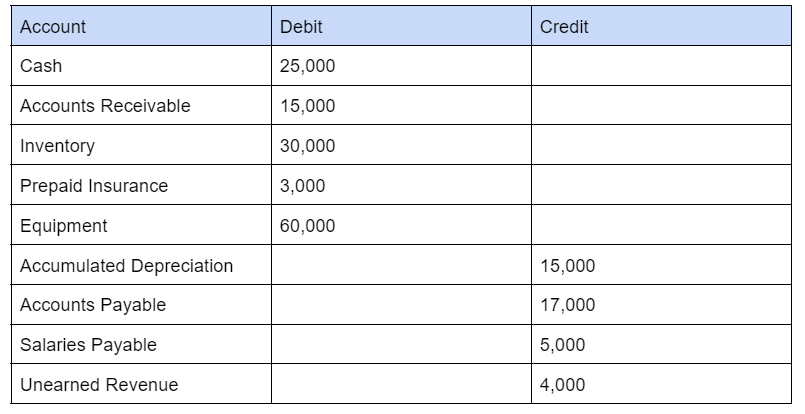

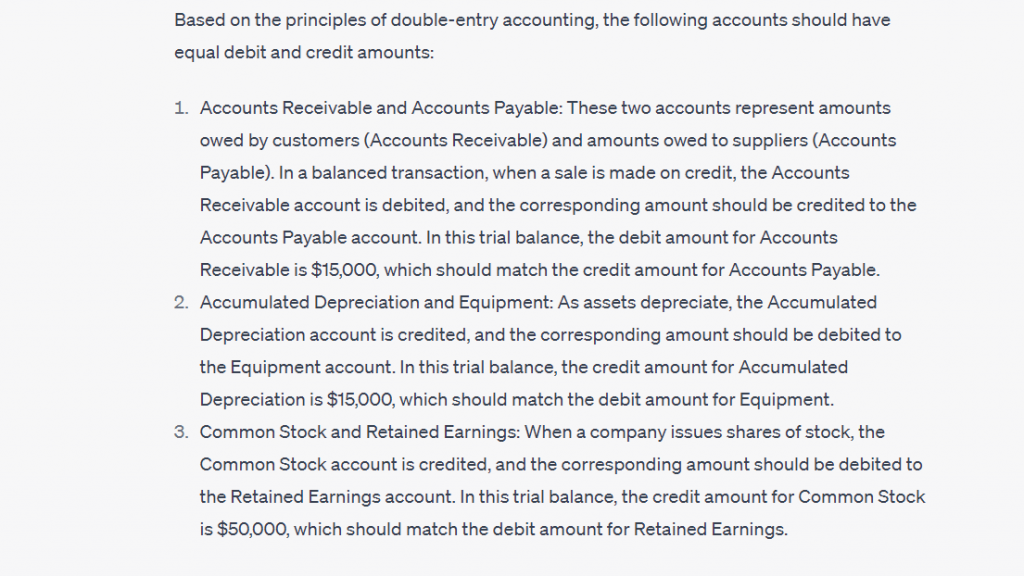

2. Detecting errors in the trial balance

ChatGPT was given an example of a trial balance where errors had sneaked in. So we asked it to find those errors.

ChatGPT found errors in the following accounts:

- Accounts Payable;

- Depreciation Expense;

- Retained Earnings;

ChatGPT found errors in the following accounts:

- Accounts Payable;

- Depreciation Expense;

- Retained Earnings.

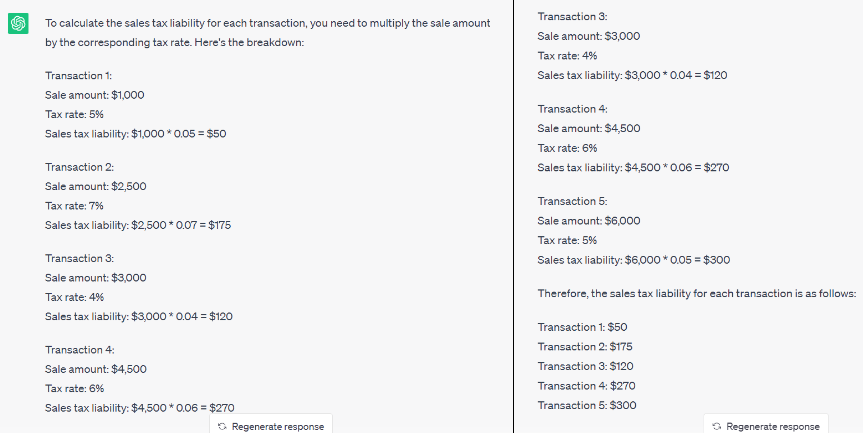

Example #2: Simplifying tax liability calculations

Tax calculations can be difficult, with various regulations and frequent updates. ChatGPT can simplify this process by utilizing its vast knowledge and computational abilities. AI-powered tax software can leverage ChatGPT to ensure accurate and compliant tax calculations.

ChatGPT can accurately determine sales tax and other tax liabilities by incorporating tax laws, rules, and exemptions, minimizing errors and reducing non-compliance risk.

For example, we asked ChatGPT to calculate sales tax liability, providing it with the following list of transactions and tax rates:

- Sale of $1,000 at a 5% tax rate;

- Sale of $2,500 at a 7% tax rate;

- Sale of $3,000 at a 4% tax rate;

- Sale of $4,500 at a 6% tax rate;

- Sale of $6,000 at a 5% tax rate.

And we got the following result:

- Transaction 1: $50

- Transaction 2: $175

- Transaction 3: $120

- Transaction 4: $270

- Transaction 5: $300

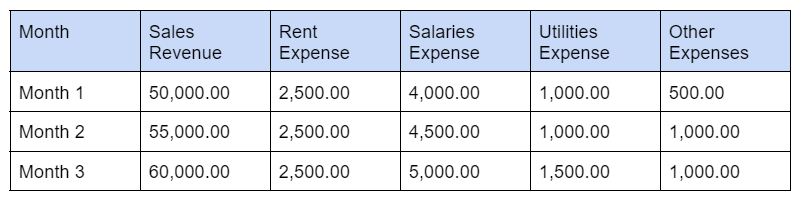

Example #3: Accurate cash flow forecasting

Cash flow forecasting is essential for businesses to effectively manage their finances. ChatGPT can play a pivotal role in this process by analyzing historical cash flow data, market trends, and external factors. By using AI-driven models, ChatGPT can provide accurate cash flow predictions, enabling businesses to make informed decisions, plan strategically, and mitigate potential cash flow challenges.

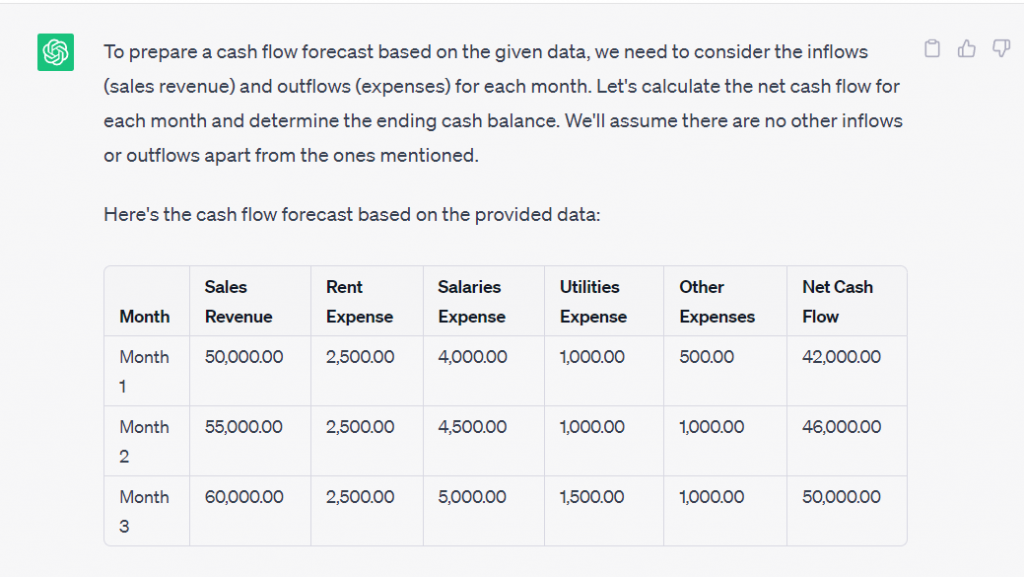

We gave ChatGPT the task of forecasting cash flow based on the provided data as follows:

ChatGPT provided the following answer, breaking down the steps it took to come to a final result.

1. First, it calculated net cash flow for each month.

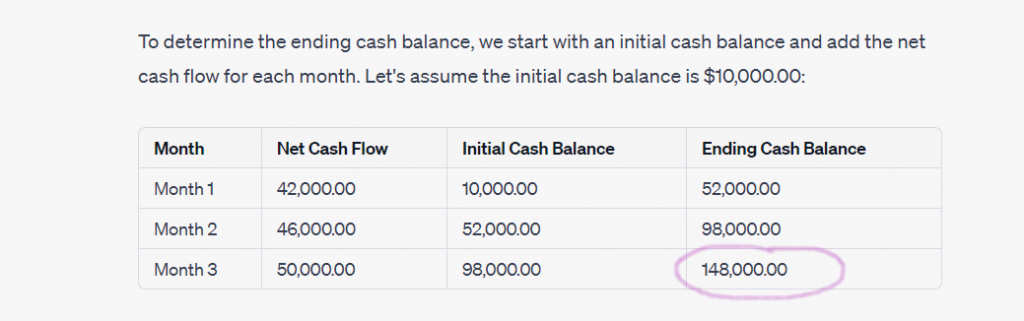

2. Next, ChatGPT determined the ending cash balances, assuming that the initial cash balance for this calculation would be 10,000.00. As a result, it forecasted the ending cash balance of $148,000.00 at the end of Month 3.

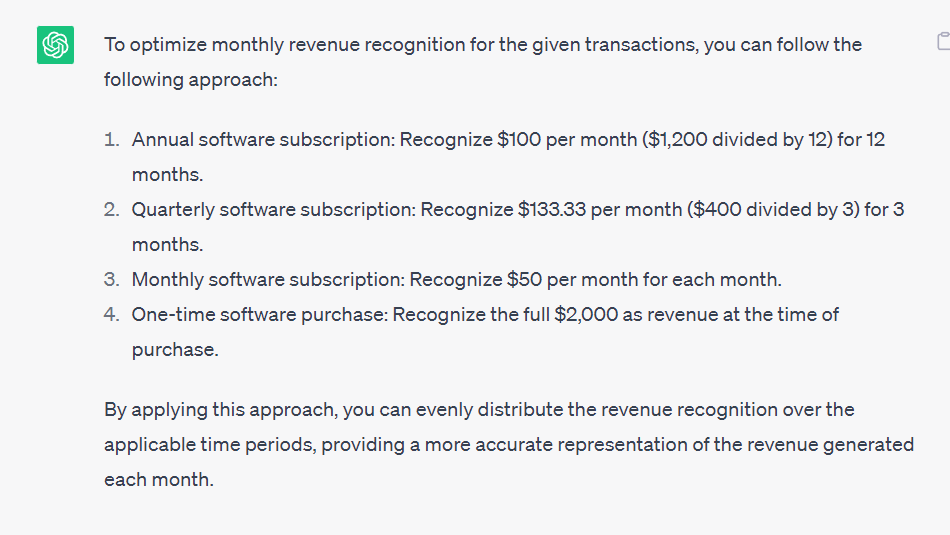

Example #4: Optimizing revenue recognition

Revenue recognition is a complex process that requires adherence to accounting standards and guidelines. ChatGPT can assist in optimizing revenue recognition by automating the identification and classification of revenue streams. By applying AI-enhanced revenue recognition solutions, ChatGPT can ensure compliance, enhance transparency, and minimize the risk of misstatements.

We asked ChatGPT to optimize revenue recognition for the following transactions:

- Annual software subscription: $1,200;

- Quarterly software subscription: $400;

- Monthly software subscription: $50;

- One-time software purchase: $2,000.

So, the tool came up with the following approach:

- Annual software subscription: Recognize $100 per month for 12 months.

- Quarterly software subscription: Recognize $133.33 per month for 3 months.

- Monthly software subscription: Recognize $50 per month.

- One-time software purchase: Recognize the full amount of $2,000 upon delivery.

We’ve already talked about some ways AI can help in accounting. But there’s more to it. Here are some other important things AI can do:

#1. Making sense of expenses and project

AI can organize and explain spending and project info well, allowing you to understand what’s going more easily.

#2. Spotting suspicious transactions

AI is good at noticing when something doesn’t look right with the money, which can help stop fraud.

#3. Helping make better financial decisions

AI can quickly look at financial numbers to help businesses see how they’re doing and decide what to do next.

#4. Finding ways to save money

By looking over financial details, AI can suggest smart ways to cut costs and be more efficient, helping the business save money.

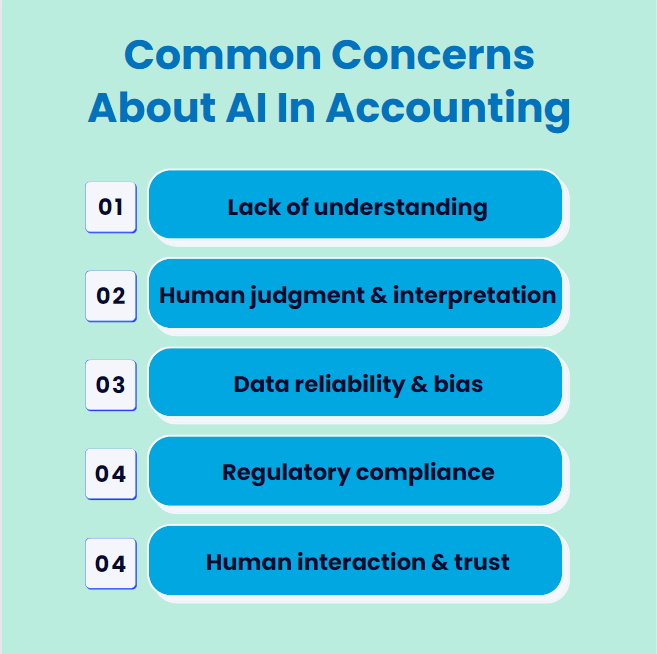

Common concerns about AI in accounting

Before getting to the practical part and showing examples of how ChatGPT can perform various accounting functions, we’ll look at general concerns about AI in accounting. It might help understand some of the counter-AI voices and see what areas of AI accounting might need more of your attention.

A common belief regarding the use of AI in accounting is the concern that AI can’t effectively handle the complexities and nuances involved in accounting practices. Some of the reasons behind this belief include:

Concern #1: Lack of understanding

There may be a lack of understanding about the capabilities and potential of AI in the accounting field. Skepticism arises when individuals aren’t fully aware of AI capabilities in automating repetitive tasks, analyzing data, and providing valuable insights.

Concern #2: Human judgment & interpretation

Accounting involves professional judgment and interpretation of financial data, regulations, and accounting principles. Critics argue that AI can’t make subjective decisions and apply professional judgment in complex scenarios, while those are considered essential aspects of the accounting profession.

Concern #3: Data reliability & bias

AI systems heavily rely on data, and concerns may arise regarding the reliability and biases within the data used for training AI models. If the training data is incomplete, inaccurate, or biased, it can potentially lead to errors neous outcomes and financial misrepresentations.

Concern #4: Regulatory compliance

Specific regulations and must-follow standards govern accounting practices. Skeptics may question whether AI systems can adhere to these regulations accurately and consistently, particularly considering the dynamic nature of accounting rules and the need for ongoing compliance updates.

Concern #5: Human interaction & trust

Accounting often involves interactions with clients, stakeholders, and regulatory bodies. Some believe that relying solely on AI systems may diminish the personal touch and human-to-human communication valued in accounting. Building trust with clients and stakeholders may also be a concern when AI systems are making critical financial decisions.

AI in accounting: Wrapping up

AI has a lot of power to change how we do accounting for the better. Even though some people might worry about it, it’s clear that AI won’t take away the job of an accountant. How well AI solutions, like ChatGPT, work depends a lot on the information you give them.

However, AI won’t be able to fully replace accountants as they’re really important in making AI work the right way. They have the experience and skills to spot important details, understand what AI is telling them, and make smart choices based on that. To take full advantage of AI in accounting, accountants and AI must team up. This helps accountants improve their work, do more, and give great advice to clients as everything becomes digital.

And don’t forget about Synder. It’s a big help in automating accounting tasks. It sorts out your financial data and does the boring jobs for you so accountants can think about the bigger picture and make wise decisions. By combining Synder with AI, you can streamline your accounting work even more.

AI in accounting: People also ask

1. Is AI replacing accountants?

AI isn’t t replacing accountants but is transforming the accounting profession. It automates repetitive tasks, allowing accountants to focus on more strategic and analytical work.

2. Can AI solve accounting problems?

Yes, AI can solve various accounting problems, especially those involving data processing, analysis, and anomaly detection, by automating calculations and identifying discrepancies in financial data.

3. Which accounting software has the best AI?

The “best” AI in accounting software can vary based on specific needs, but platforms like QuickBooks, Xero, and Sage are known for integrating advanced AI features to streamline accounting tasks.

4. Is AI the future of accounting?

Yes, AI is increasingly seen as the future of accounting due to its ability to enhance efficiency, accuracy, and insights in financial management, shifting the role of accountants towards more advisory capacities.

5. Can you use ChatGPT for accounting?

ChatGPT can assist with general accounting inquiries, explanations, and educational content. However, it shouldn’t replace professional accounting software or advice for specific financial decisions.

6. What are the risks of AI in accounting?

Risks include data privacy concerns, the potential for errors in decision-making if AI is improperly trained, and reliance on AI, leading to a skills gap in traditional accounting practices.

7. Can ChatGPT analyze bank statements?

ChatGPT can’t directly analyze bank statements due to privacy and technical limitations. It can provide guidance on how to interpret and manage financial statements but can’t process personal financial documents.

.png)

Awesome!

The ability to practice and apply what you’ve learned in a hands-on way is invaluable. Your post provides excellent insights into how interactive tools can enhance accounting education.

Definitely! Interactive tools are the way forward.

Interesting post. I’m glad I came across this page. I’m going to save it so I can read any more upcoming posts.