Starting your own business comes with many challenges, which can be confusing even for experienced business owners. And if you’re new to this, you might just feel overwhelmed – but don’t worry, there’s a way to master the chaos. So, what is a good starting point?

Learning the basic principles of accounting.

In business, appreciating the theory behind accounting is as important as applying it practically. But what if formulas and financial statements start to feel like a maze? This is where a professional or special software may help you cope. Stay tuned to see how understanding accounting principles can change the game.

Contents:

1. An overview of basic accounting and its terms

2. 11 Basic accounting principles

3. Simplify your bookkeeping: How Synder manages accrual accounting

4. Conclusion

Key takeaways

- Accounting principles provide a basis for objective measurement of business performance.

- All publicly traded companies in the United States must follow GAAP, a set of guidelines established by the Financial Accounting Standards Board (FASB), to ensure the quality and consistency of financial reporting.

- Mastering accounting principles and using the right tools can secure your business’s present and future, positioning it for growth and helping it handle financial challenges.

An overview of basic accounting and its terms

The definition of basic accounting sounds pretty simple: it’s a process of recording every transaction happening in your business.

For example, let’s say you have a small woodwork business, and you want to develop and grow in this sphere. You have the skill and talent, and even a small room where all the magic is happening. So what’s your next step?

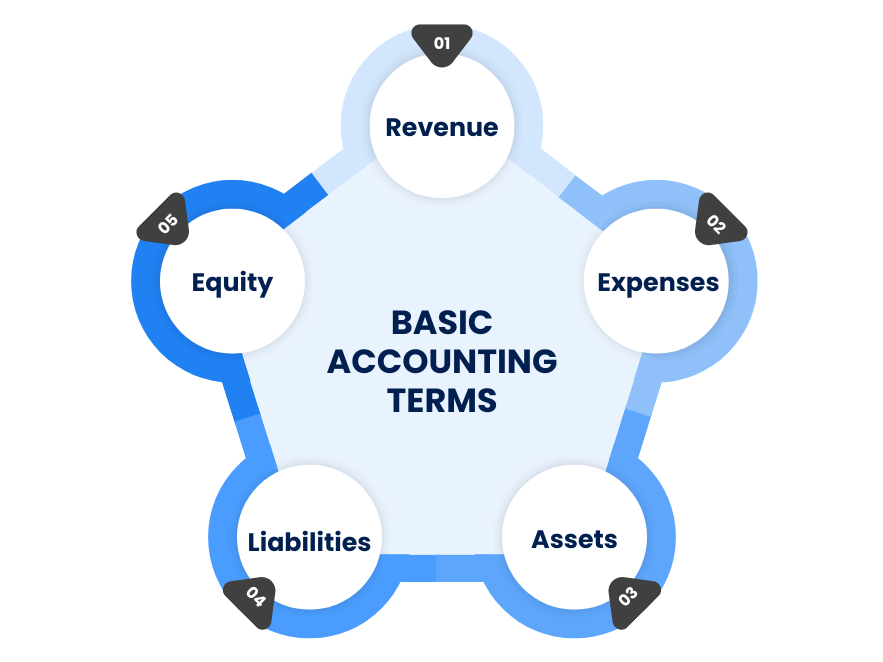

To start the actual work, you need to understand accounting processes – how people regulate their money flow. A good first step would be making sure you know five transaction types:

- Revenue – (also known as sales) the financial information reflecting the customers’ value for the product. Revenue it’s actually what you’re going to gain by selling services or something else.

- Expenses – the required cost of operations to generate revenue and run your business.

- Assets – the material and nonmaterial resources owned by the company that may be used in the future to generate value.

- Liabilities – what your company owes to creditors, usually a sum of money.

- Equity – the difference between your assets and liabilities, the difference between what you own and what you owe.

It’s essential to keep in mind all these small details of the whole picture to provide your business with up-to-date information about the accounting process. Records of all your transactions, taxes, projections, etc., help understand the financial situation better.

All these transaction types are reflected in your financial statements – P&L and balance sheet. Without these financial statements, you won’t have an objective answer to urgent matters.

Accounting does not work as it wants, but according to certain rules that are established by various authoritative bodies. We’ll talk about them further and make sure that such abbreviations as GAAP are no longer a sealed secret for you

What is GAAP?

The Financial Accounting Standards Board (FASB) sets accounting guidelines for private companies, non-profits, and various industry groups. Together with the Governmental Accounting Standards Board (GASB), they developed Generally Accepted Accounting Principles (GAAP). The FASB specifically creates the standards that all publicly traded companies must follow when reporting their financial statements. These principles help improve the quality of financial information that companies report.

Note: By law, accountants representing all publicly traded companies in the US must comply with GAAP.

Private businesses, non-profit organizations and other industry groups can adopt specific GAAP principles as they see fit. However, these basic principles aren’t universal across all industries or jurisdictions. The International Financial Reporting Standards (IFRS) is the most widely used set of accounting principles in EU countries.

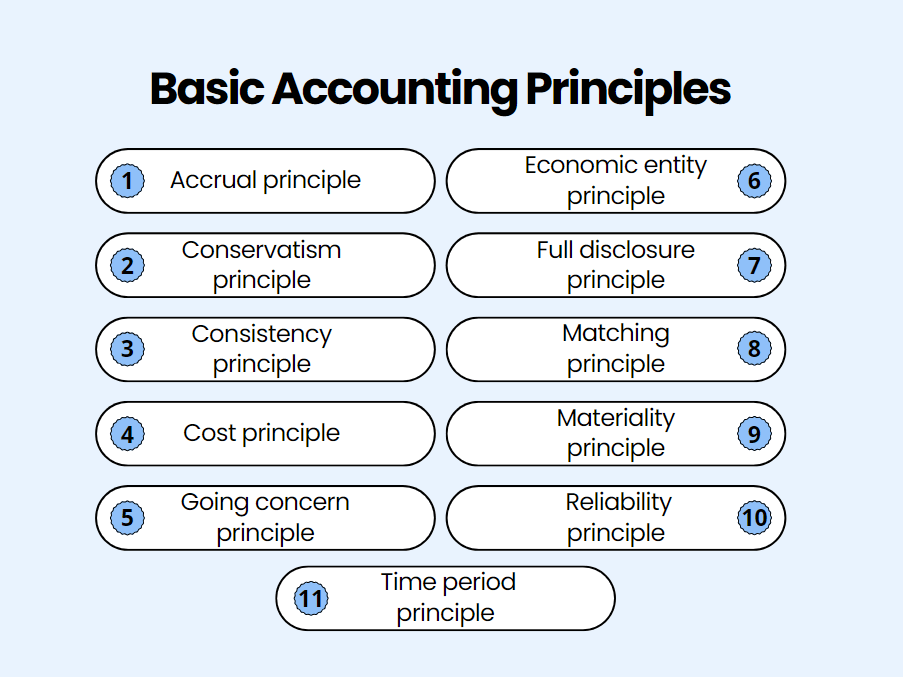

11 Basic accounting principles

Accounting principles form the foundation of all financial reporting. Understanding these concepts is a must for anyone aiming to work in finance, be an effective business owner or manage a company.

We collected 11 main principles that you need to know. Our research spans but is not limited to the Giovanni Rigters book “Accounting for Beginners & Dummies: Fundamental Principles of Financial Management”.

Let’s take a closer look at each concept from this list:

1. Accrual principle

The accrual principle includes two main accounting methods: accrual basis and cash basis.

In the accrual principle, revenue and expenses are recorded when they happen, not when the money is exchanged. For example, an invoice is recorded when it’s issued, not when it’s paid.

In contrast, cash basis accounting records income only when invoices are paid and expenses only when bills are settled. This method tracks actual cash flow.

2. Conservatism principle

The conservatism principle advises expecting losses rather than hoping for profits. It means recording expenses and liabilities as soon as they occur but only recording assets and revenue when they are certain. This way, conservatism principle results in lower reported profits due to delayed recognition of assets and revenue.

3. Consistency principle

According to this principle, businesses must follow the same accounting principle to record financial transactions to ensure consistency.

Auditors primarily focus on this principle, which emphasizes consistency in how businesses prepare their financial information. If there are any changes in these practices or policies, they should be clearly noted in the financial statements.

4. Cost principle

This principle states that assets (including equity investments, liabilities, and both short-term and long-term assets) should be recorded at their original cost when purchased. This original cost is objective and shows the true value of the asset. It can’t be changed due to inflation or depreciation, ensuring clear and precise records.

5. Going concern principle

Going concern principle refers to a company’s ability to continue making money and avoid liquidation or bankruptcy. Viable companies should consider themselves going concerns, indicating they have the resources and financial stability to keep operating. If a company is no longer a going concern, it may face issues like credit denial, significant losses, lawsuits, or financial instability.

6. Economic entity principle

Bank and bookkeeping records should not be mixed. Each transaction should be recorded under the correct part of the business it belongs to, such as a specific government agency or corporation. This helps keep financial records clear and makes it easier to separate and review different business activities during an audit.

7. Full disclosure principle

The principle says that all the bookkeeping methods adopted by a business should be recorded in the financial statements’ footnotes, balance sheet or in any other places in the financial document. Full disclosure principle ensures that accountants include all the necessary information into financial documents.

8. Matching principle

The matching principle entails that the earned income and related expenses must be accounted for in the same accounting period. If the income and expenses don’t correlate, the costs must be charged to expenses. The concept of the matching principle highlights the necessity of recording the cause and effect of revenues and expenses.

9. Materiality principle

The principle states that according to the US securities and exchange fee, it’s recommended to record items that represent at least 5% of all assets on a balance sheet, even though GAAP standards don’t enforce the recording of immaterial transactions, highlighting the fundamental balance between debits and credits in accounting.

Note: Materiality principle varies from business to business since the items that are considered material are different for each organization.

For example, a large multinational corporation might see a $1 million expense as immaterial and not record it separately, while a small local business would see the same amount as very important and make sure it is clearly documented in their financial statements.

10. Reliability principle

This concept entails only recording transactions that can be proven by official documents that auditors review.

Reliability principle requirement is that accountants are able to present accurate and relevant information in an organization’s bookkeeping records using proven evidence that the transaction exists. The examples of the documents that can be accepted as actual evidence are invoices, purchase receipts, bank statements, canceled checks, etc.

11. Time period principle

Time period principle mandates creating accounting reports over a standard period.

This principle states that businesses should create bookkeeping records at the same time when they generate their financial statements to create the so-called consistency in reporting and allows managers to track the overall business performance based on various metrics from the records created on a monthly, quarterly, or annual basis.

Simplify your bookkeeping: How Synder manages accrual accounting

Understanding accounting principles is a must, but it doesn’t guarantee that your accounting will go smoothly. When working with bookkeeping records manually, errors can sneak in and mistakes can occur. To avoid such situations, a good rule of thumb is to use accounting software that can automate almost 75% of accounting tasks.

One of such solutions is Synder Sync, which provides a unique opportunity to enhance your workflow without any additional effort of entering an endless stream of numbers. When working with accrual accounting, such a tool is indispensable.

So which accounting features for ecommerce do you get by sacrificing your sleepless nights spent on calculating transactions? Synder does:

- Records ongoing transactions

- Customizes and organizes data

- Syncs payments from sales channels/payment platforms

- Automates the syncing process in settings

Want to know more? Let’s explore how Synder handles accrual accounting for 4,500+ businesses out there.

Summary Sync

Synder offers two data reporting modes: Summary Sync and Per Transaction. In the Summary Sync mode, Synder creates a single journal entry every day that summarizes your sales for each platform. Each daily entry shows aggregated taxes, taxes paid on behalf of the business (withheld taxes), payment processing fees, other platform fees, gift cards, discounts, and tips.

If you require a higher level of details in your books, you can go with the Per Transaction sync, which will record each transaction with all the necessary information (sale and customer information).

Reconciliation with Summary Sync

Reconciliation is easy and accurate with daily journal entries. The software uses a clearing account to track each payment processor’s balance. When money is transferred to the bank, the same amount moves from the clearing account to the checking account. To reconcile, just confirm the automatic match in the bank feed. That’s it!

Profitability reports

Synder helps you see sales profitability by accurately reflecting inventory in Sales, COGS, and Assets accounts. With Synder’s Summary sync and COGS tracking module, it calculates COGS based on daily product sales, auto-syncs costs or uploads your cost file, updates your books with the correct COGS, and reduces the Inventory Asset account.

Synder’s software provides complete information for your P&L statement, including details like discounts, taxes, and gift cards, and updates your Balance Sheet. This makes it easy to analyze your business health and sales profitability.

Improve the efficiency and productivity of your business with Synder and join the Weekly Public Demo, or opt for a 15-day free trial to check by yourself how Synder can save you time.

Conclusion

If you want a good, stable business, start with quality accounting. Use a properly configured accounting tool that complies with all necessary principles and automates tasks correctly. Lay a solid foundation for your business with well-organized accounting now.

Mastering accounting not only secures your business now, but also helps it grow in the future. And choosing the right accounting software, creating a proper accounting management system and generating timely cash flow statements are the key to success. Ready to strengthen your financial foundation and drive your business forward? It’s time to start.

FAQs

What are the basic concepts of accounting?

Basic accounting concepts in business include revenues, expenses, equity, assets, and liabilities. These elements are recorded in documents like balance sheets, income statements, and cash flow statements.

What are the US GAAP standards?

Generally Accepted Accounting Principles (GAAP) are a set of accounting rules and standards created and regularly updated by the Financial Accounting Standards Board (FASB).

How does IFRS differ from GAAP?

GAAP is more detailed and specific, requiring more disclosures. It focuses on the historical cost of assets. In contrast, IFRS is more flexible and high-level, requiring fewer disclosures and allowing more flexibility in asset valuation. For more information read GAAP vs IFRS: A Comprehensive Comparative Analysis

Why do we need principles in bookkeeping?

Accounting principles are important because they ensure financial data is recorded accurately, which is crucial for business growth. They also help businesses comply with legal requirements, avoiding potential fines and legal issues.

.png)

Good

Hi Anastasia. Thank you for the article. It is really useful for fresh student learning accounts.

Thank you for your feedback! Ensuring our content is both educational and useful to our audience is our top priority.

This is a straightforward and crispy method of understanding the subject. It is beneficial and gives confidence too.

Thanks to you

Your blog is comprehensive and well-written, as it addresses almost every facet of the skills that will be in high demand.

Thanks for the article! Was great to learn about the accounting principles.

Anastasia Su’s article on basic accounting principles is super helpful! It breaks down complex concepts into easy-to-understand info, perfect for beginners or pros. I love the “Fantastic Four” steps, making accounting feel less daunting. The detailed explanation of principles like “Revenue Recognition and Conservatism is spot-on.” The article also dives into the importance of accounting software, like Snyder Sync, which is a game-changer. Overall, it’s a must-read for anyone wanting to understand and ace the accounting game!