In the fast-paced realm of e-commerce, accounting specialists have a unique role in ensuring the financial success of online businesses. Understanding the nuanced differences between revenue and earnings is paramount, as these concepts directly impact the profitability of e-commerce ventures.

Let’s explore the specificities of revenue and earnings in e-commerce, highlighting their critical disparities, significance, and specialized strategies for managing revenue and earnings to drive higher profits.

Understanding revenue

Revenue is the lifeblood of any business. It refers to the total amount of money generated from the sale of goods, provision of services, subscriptions, or advertising. It is the top-line figure that reflects the company’s overall sales performance.

Revenue consists of different components, depending on the nature of the business. For example, a retail company’s revenue primarily comes from the sales of products, while a software company may earn revenue from software licenses or subscriptions. Understanding the various sources of revenue is essential for assessing a company’s business model and growth potential.

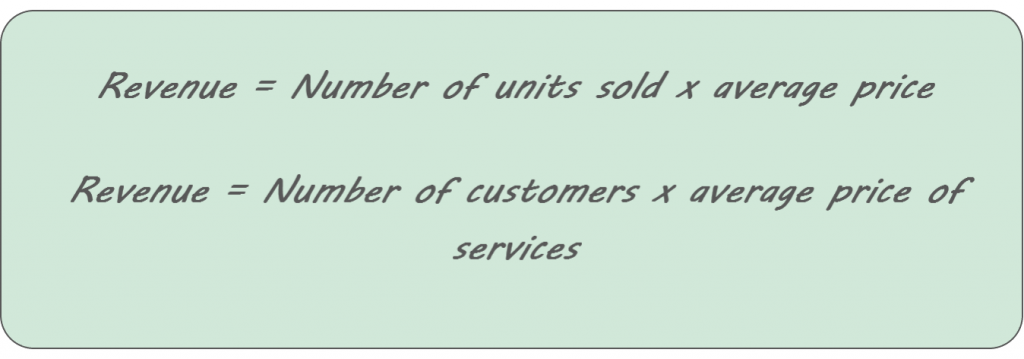

To calculate revenue, you can multiply the price of each unit sold by the number of units sold during a given period. For instance, if a company sells 1,000 units of a product at $10 each, the revenue generated would be $10,000. It’s worth mentioning that for service-based companies, the calculation will include the number of customers and the average price of services.

Understanding earnings

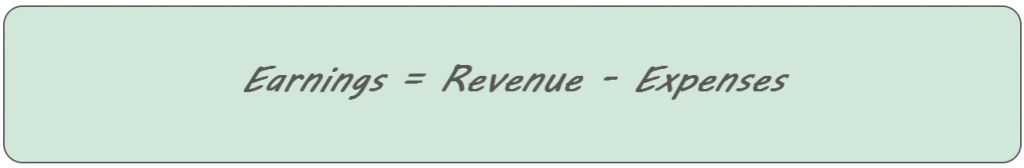

While revenue provides an overview of a company’s sales performance, earnings delve deeper by analyzing profitability. Earnings, often referred to as net income or profit, represent the residual amount obtained after subtracting expenses from revenue.

Earnings encompass all the costs and deductions associated with running a business, including production costs, operating expenses, taxes, and interest. It reflects the true financial performance of a company and determines its profitability.

Calculating earnings, in very general, involves deducting all expenses from the revenue. If a company generates $10,000 in revenue but incurs $8,000 in expenses, the earnings would be $2,000. Earnings are a critical metric for investors and stakeholders as they indicate the company’s ability to generate sustainable profits.

💡 Ready to dive deeper into your business finances? Synder Insights has the answers you need – explore now!

Revenue vs. earnings: key differences

Both revenue and earnings are two critical terms in the world of business and finance. While they are related, it is essential to understand the distinction between them. Let’s look at what makes them different.

Timing of recognition

Revenue is recognized when a transaction occurs, regardless of whether the cash is received. On the other hand, earnings are recognized when all associated expenses have been accounted for and the revenue is realized.

Treatment of expenses and deductions

Revenue does not take into account expenses and deductions. It represents the total income generated. Earnings, however, reflect the net profit obtained after deducting all relevant costs.

Relationship between revenue and earnings

Revenue serves as the foundation for earnings. While high revenue indicates significant sales activity, it does not guarantee profitability. Earnings demonstrate how effectively a company manages its costs and expenses.

Influence on financial statements and investor perception

Revenue is reported on the income statement, highlighting the company’s sales performance. Earnings, however, provide a comprehensive view of profitability and are crucial for assessing a company’s financial health. Investors often pay close attention to earnings as it affects their perception of a company’s value and growth potential.

Importance of the revenue and earnings analysis

Analyzing revenue and earnings is essential for understanding a company’s financial performance and making informed decisions. Let’s break down the reasons why businesses should prioritize this analysis.

Assessing business performance and growth

Revenue and earnings analysis allows businesses to evaluate their performance over time. By comparing revenue and earnings from different periods, companies can identify trends, patterns, and areas for improvement. It helps in determining whether the company is growing steadily or facing challenges.

Evaluating profitability and efficiency

Earnings provide insights into a company’s profitability. By comparing earnings with revenue, businesses can assess their profit margins and identify potential areas of cost reduction. This analysis helps in optimizing operations, improving efficiency, and maximizing profitability.

Making informed financial decisions

Revenue and earnings analysis assists in making informed financial decisions. By understanding the financial health of a company, businesses can plan investments, allocate resources effectively, and determine pricing strategies. It provides a solid foundation for budgeting, forecasting, and strategic decision-making.

Attracting investors and stakeholders

Investors and stakeholders closely scrutinize a company’s revenue and earnings to assess its potential for growth and profitability. Transparent and consistent reporting of revenue and earnings enhances investor confidence, improves access to capital, and strengthens relationships with stakeholders.

Common challenges in revenue and earnings reporting

While revenue and earnings analysis is essential, there are several challenges associated with their reporting.

Revenue recognition complexities

Revenue recognition can be complex, particularly in industries with long-term contracts or multiple deliverables. Companies must comply with accounting standards and ensure accurate and transparent revenue recognition practices.

Accounting principles and standards

Different accounting principles and standards govern revenue and earnings recognition. Businesses need to stay updated with the applicable guidelines, such as the Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), to ensure compliance and consistency in reporting.

Potential for manipulation or misinterpretation

Revenue and earnings figures can be manipulated or misinterpreted, leading to inaccurate financial reporting. It is crucial for companies to establish internal controls, conduct regular audits, and provide clear disclosures to maintain the integrity of their financial statements.

Impact of industry-specific factors

Different industries have unique revenue and earnings dynamics. For example, software companies may have recurring revenue from subscriptions, while manufacturing companies may face fluctuating revenue due to market demand. Understanding industry-specific factors is crucial for accurate analysis and comparison.

Revenue and earnings management tips for a higher profit

Managing revenue and earnings effectively helps maintain accurate reporting on revenue and earnings and is crucial for maximizing profitability. Here are some valuable tips to help you optimize your financial performance and achieve higher profits.

Implement accurate and transparent reporting practices

Companies should establish robust systems and processes to accurately track and report revenue and expenses.

Maintain accurate and transparent financial records to reflect revenue and expenses. Implement robust accounting systems and internal controls to maintain the integrity of your financial data.

Conduct regular financial analysis to track key financial ratios, such as gross profit margin, net profit margin, and return on investment. Analyze trends and variances to identify areas for improvement and make data-driven decisions.

Align revenue recognition policies with accounting standards

You might want to bolster revenue recognition policies and keep with accounting standards to ensure accurate and compliant financial reporting. Following recognized standards like GAAP or IFRS helps businesses maintain consistency, transparency, and comparability in financial statements.

Regular policy reviews keep practices up-to-date with regulatory requirements. Compliance builds trust with stakeholders and demonstrates a commitment to transparent reporting.

Seek professional guidance for interpreting complex standards and identifying areas for improvement. Aligning policies mitigates misstatements, regulatory penalties, and reputational damage, ensuring accurate revenue reporting and maintaining financial integrity.

Monitor and control expenses effectively

Effective expense management is crucial for maintaining healthy earnings. Companies should regularly analyze their expenses, identify areas for cost reduction, and implement cost-control measures.

Identify areas where you can reduce costs without compromising quality or customer satisfaction. Look for opportunities to negotiate better deals with suppliers or explore alternative vendors.

Optimize your inventory levels to avoid overstocking or understocking. Utilize inventory management systems to monitor stock levels, streamline ordering processes, and minimize carrying costs.

Embrace automation and digital tools to streamline operations and reduce manual errors. Automated processes can improve efficiency, reduce costs, and free resources for other revenue-generating activities.

Leverage strategies for revenue and earrings growth

A business needs to approach growth strategically to unlock all the potential for revenue growth. At this point, it’s critical to keep exploring, testing, and applying various growth strategies: from targeted marketing campaigns to personalized experiences – there’s plenty you can do to boost sales and maximize revenue per customer.

You might want to implement targeted marketing campaigns to attract new customers and increase sales. Identify untapped markets and develop strategies to reach them.

Enhance customer satisfaction and loyalty through exceptional customer service, personalized experiences, and loyalty programs. Repeat business and referrals can significantly boost revenue.

Capitalize on existing customer relationships by offering additional products or services that complement their purchases. This strategy can lead to increased revenue per customer.

Optimize pricing strategies

Regularly evaluate your pricing strategies and compare them to industry benchmarks. Consider factors such as production costs, market demand, competitor pricing, and perceived value to determine optimal pricing levels.

Differentiate your offerings by providing additional value to customers. You might want to include after-sales support, extended warranties, or exclusive access to premium features. The added value justifies higher pricing.

Utilize pricing algorithms and data analytics to adjust prices in real time based on various factors such as demand, seasonality, and customer behavior. Dynamic pricing ensures you capture maximum revenue opportunities.

Invest in employee training and development

Provide training programs to enhance employees’ expertise and efficiency. It can contribute to higher productivity, reduced errors, and increased customer satisfaction.

Encourage employees to share ideas for revenue growth and cost-saving initiatives. Recognize and reward innovation to motivate your workforce and foster a culture of continuous improvement.

Seek professional guidance and expertise

Given the complexities of revenue and earnings reporting, it is beneficial for businesses to seek professional guidance from accountants, auditors, or financial advisors. These experts can provide insights, ensure compliance, and offer valuable recommendations for optimizing financial performance.

Conclusion

Revenue and earnings are two essential metrics that provide insights into a company’s financial performance, profitability, and growth potential. While revenue reflects the total income generated, earnings delve deeper into profitability after deducting expenses. Understanding the differences between revenue and earnings and conducting thorough analysis is crucial for businesses to make informed decisions, attract investors, and achieve sustainable growth. By adhering to best practices and maintaining transparent reporting, businesses can ensure accuracy and integrity in their revenue and earnings management, thereby establishing a strong foundation for success.

.png)