In today’s ecommerce, businesses are on a constant quest for efficient payment solutions that can handle transactions with ease. And here comes Stripe Connect, a specialized payment platform that’s changing the game for online marketplaces, crowdfunding ventures, and businesses in the on-demand economy. With its ability to simplify complex multi-party payments and a host of versatile features, Stripe Connect is the go-to choice for businesses looking to scale and thrive in the digital age.

Today we’re going to talk about the peculiarities of Stripe Connect, uncovering its benefits and challenges. We’ll walk you through the nitty-gritty of syncing Stripe Connect accounts with your accounting platform, ensuring your financial tracking is accurate and efficient. Plus, we’ll guide you in reconciling Stripe Connect income in your financial records, offering a holistic approach to managing your finances.

Ready to tap into the world of Stripe Connect? Let’s get started!

Contents:

2. What is the difference between Stripe and Stripe Connect?

3. Challenges of using Stripe Connect

4. How to sync Stripe Connect with your books: Synder solves the problem

5. How to reconcile Stripe Connect income in your books

Key takeaways

- Stripe Connect is a specialized platform designed for online marketplaces, crowdfunding, and on-demand businesses. Its ability to simplify complex payment processes and offer versatile features makes it a game-changer in the digital age.

- Businesses can sync Stripe Connect accounts with accounting platforms like QuickBooks using tools such as Synder. This ensures accurate financial tracking and seamless reconciliation of income, even when dealing with multiple revenue streams.

- Stripe Connect empowers businesses to transform their operations into multifaceted platforms, integrating various “mini-businesses” into their payment ecosystem. This fosters collaboration, innovation, and revenue generation within the digital landscape.

- While Stripe Connect offers immense benefits, businesses may face challenges in managing multiple revenue streams within the platform. However, solutions like Synder provide streamlined processes for syncing and managing finances effectively.

- By leveraging Stripe Connect and complementary tools like Synder, businesses can navigate the complexities of online commerce with confidence. They can optimize their operations, drive growth, and achieve success in the ever-evolving digital economy.

What is Stripe Connect?

Stripe Connect serves as a highly tailored payment infrastructure, meticulously crafted by Stripe to cater to the distinctive needs of online marketplaces, crowdfunding platforms, and businesses operating within the on-demand economy. Within this ecosystem, Stripe Connect emerges as a pivotal facilitator, offering an array of specialized account options to accommodate diverse business models. Among these options, Stripe Connect Express stands out as a particularly efficient tool, streamlining the onboarding process for sellers seeking to join your marketplace swiftly.

However, Stripe Connect is more than just a mechanism for facilitating transactions; it represents a paradigm shift in business operations. It enables companies to transform their enterprise into a multifaceted platform. Through Stripe Connect, businesses can seamlessly register and integrate other “mini-businesses” into their payment ecosystem. These mini-businesses, ranging from independent sellers to service providers, become integral components of the overarching platform that deals with transactions under a unified framework.

Stripe Connect functionality

Central to the functionality of Stripe Connect is its ability to manage payment interactions within this interconnected web of mini-businesses and customers. By facilitating seamless transactions and overseeing the flow of funds, Stripe Connect empowers platform owners to orchestrate and optimize the payment process effectively. As transactions occur through connected accounts, platform owners receive commissions or fees, serving as a financial incentive for fostering a vibrant and thriving ecosystem.

Put simply, Stripe Connect goes beyond traditional payment processing limits, offering a holistic solution that not only facilitates transactions but also fosters the growth and sustainability of online marketplaces, crowdfunding ventures, and on-demand businesses.

What is the difference between Stripe and Stripe Connect?

Stripe is a versatile payment processing platform suitable for businesses of all sizes, enabling them to accept payments online through various channels. On the other hand, Stripe Connect is a specialized offering within the Stripe ecosystem, designed specifically for businesses operating as online marketplaces, crowdfunding platforms, or on-demand service providers. Stripe Connect facilitates multi-party payment flows within these platforms, allowing businesses to manage sub-accounts, handle fund flows, and apply fees or commissions. While both Stripe and Stripe Connect are offerings from Stripe, Inc., they serve distinct purposes tailored to different types of businesses and payment processing needs.

Challenges of using Stripe Connect

One common issue businesses face when using Stripe Connect is the management of multiple revenue streams from different entities or companies within the Stripe platform. For example, a business may receive partnership revenue from one company, affiliate revenue from another, course revenue from yet another one, sponsorship revenue from a separate entity, and even small revenue from yet another source. The challenge arises when these entities set up their own accounts within Stripe, all tied to the main business account with a shared logo.

The problem becomes evident when the business attempts to integrate Stripe with accounting software like QuickBooks. While the integration allows them to select one of these revenue sources—typically the main one—it often doesn’t provide a straightforward way to add and manage the additional revenue streams. This limitation can lead to difficulties in accurately tracking and managing finances when dealing with multiple revenue sources within Stripe Connect.

How to sync Stripe Connect with your books: Synder solves the problem

Synder streamlines the process of syncing your Stripe Connect accounts with your accounting platform, ensuring that you accurately record your income. Synder automatically tracks the commissions you earn from sales on your connected accounts, treating them as your actual income.

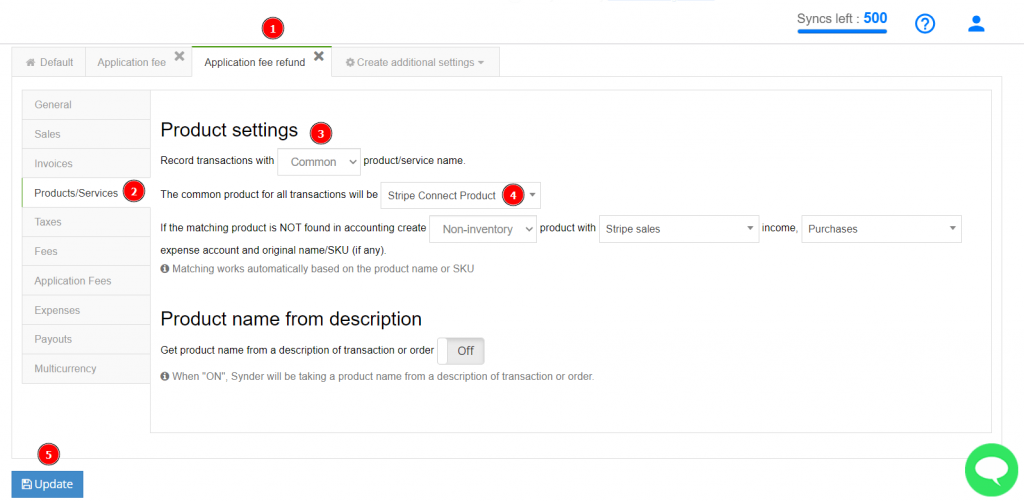

In Synder, you can view Application fees and, in case of sales refunds, Application fee refunds, both of which reflect the commissions received through your Stripe Connect accounts. Synder generates Sales receipts for income and Refund receipts for refunds, ensuring that your financial records remain accurate.

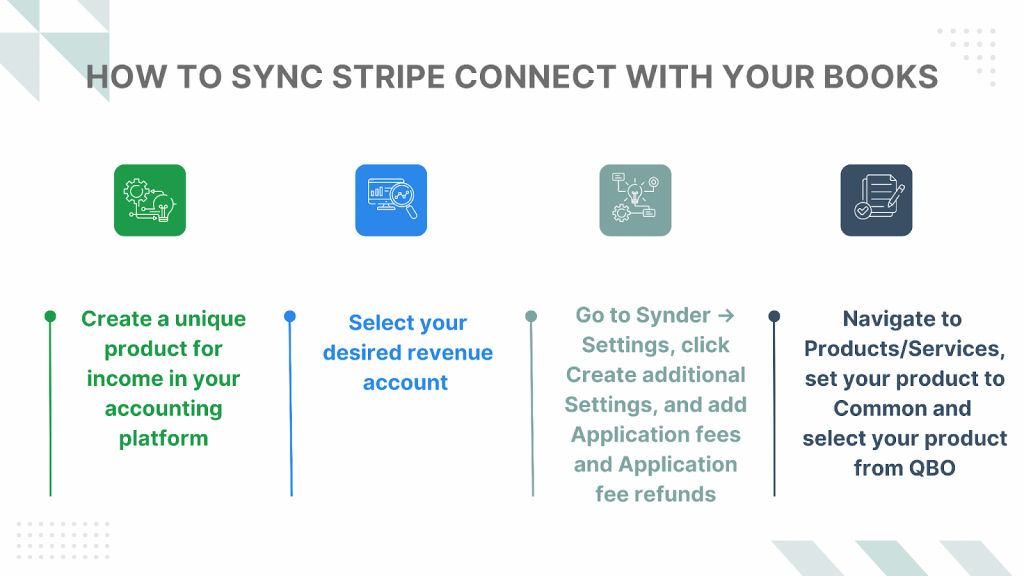

By default, these transactions are synced as regular income into a default income category (e.g., Stripe income). However, you have the flexibility to map them to a specific account in your Profit and Loss statement by following these steps:

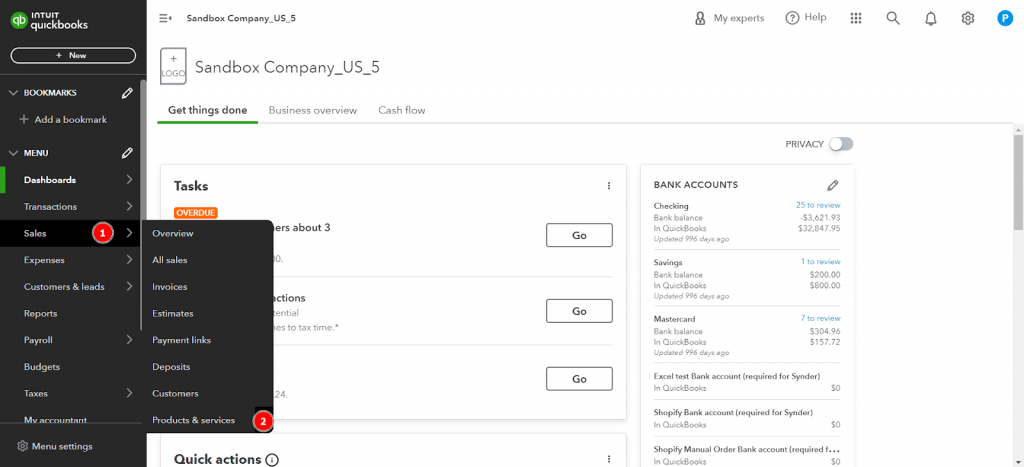

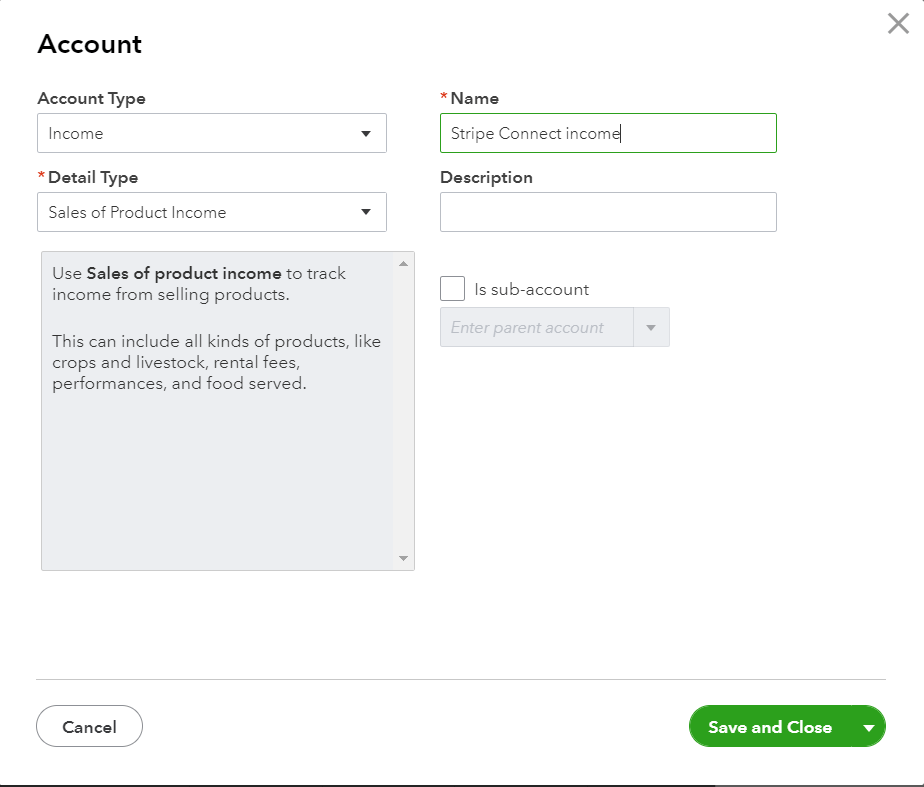

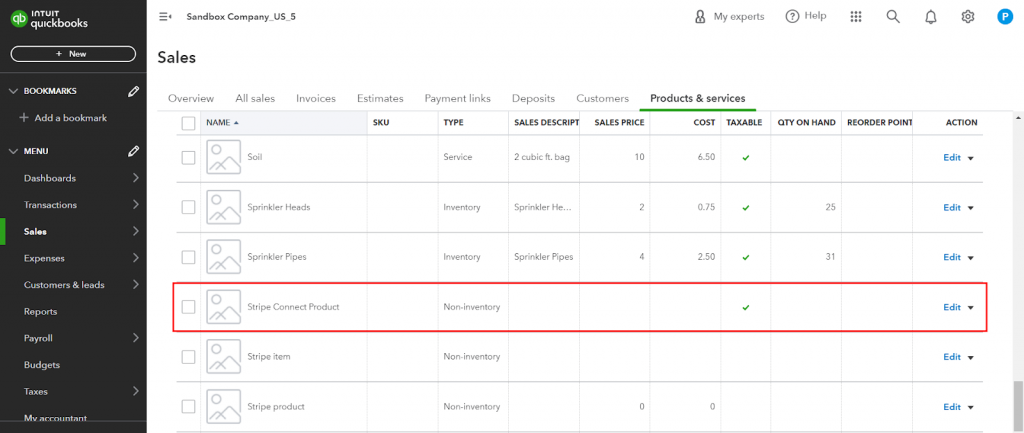

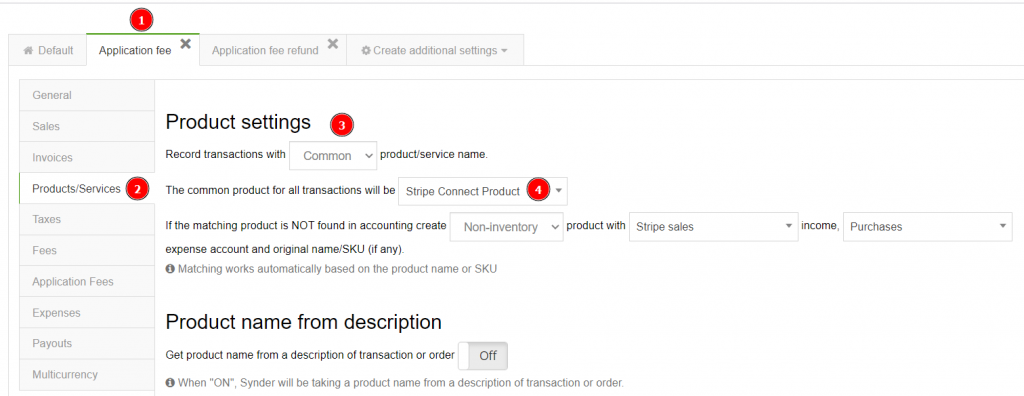

- Create a unique product for income in your accounting platform by navigating to Sales → Products and Services in QuickBooks Online (QBO). You can name it as you prefer (e.g., Stripe Connect product).

- In the Income account field for the product, select your desired revenue account (e.g., Stripe Connect income).

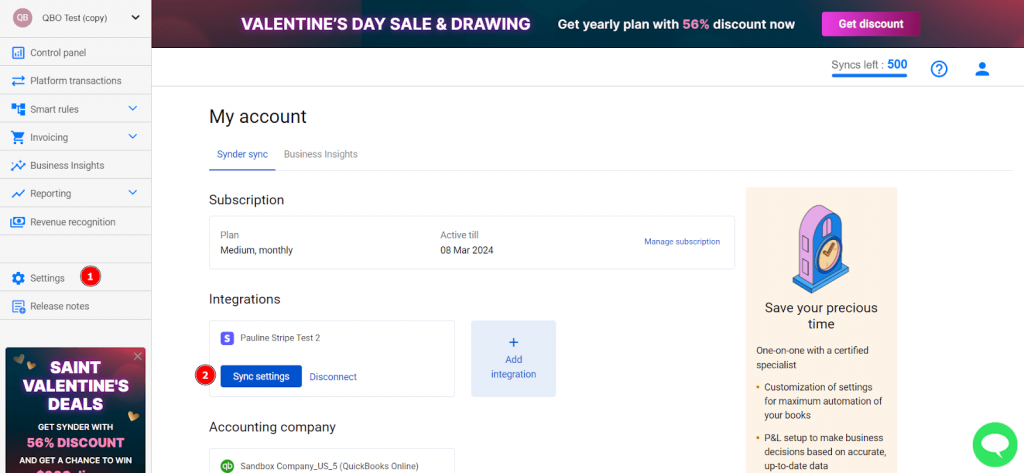

- Go to Synder → Settings, click Create additional Settings, and add Application fees and Application fee refunds to your settings.

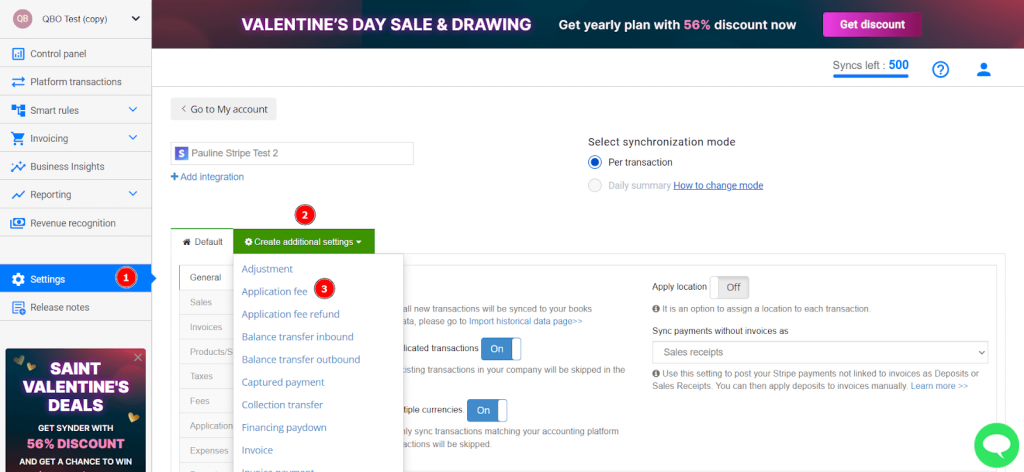

- In both of the new tabs, navigate to the Products/Services section and set your product to Common. Then, select your product from QBO (e.g., Stripe Connect product).

This configuration ensures that all Stripe Connect receipts use the same product and are categorized under your chosen revenue account in your Profit and Loss statement. Save your new settings by clicking the Update button at the bottom.

Once these steps are complete, you can sync your application fees to your accounting platform and review your Profit and Loss statement to see your income.

Feel like Synder may be the right solution for your business? Go for a 15-day free trial before making a committed decision or visit the Weekly Public Demo to get comprehensive answers to all questions by Synder specialists.

How to reconcile Stripe Connect income in your books

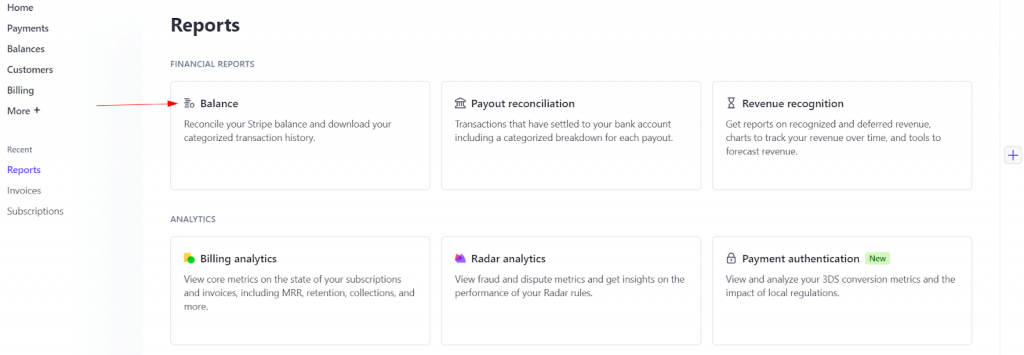

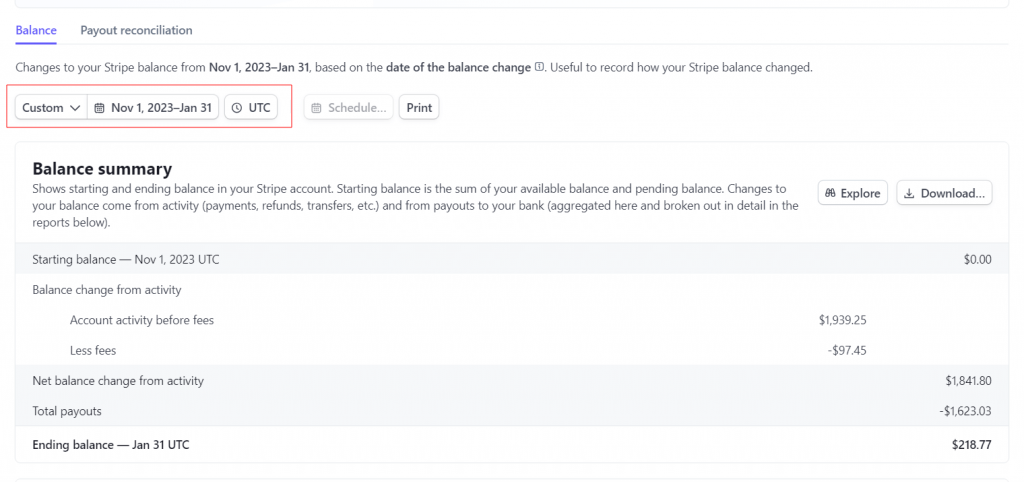

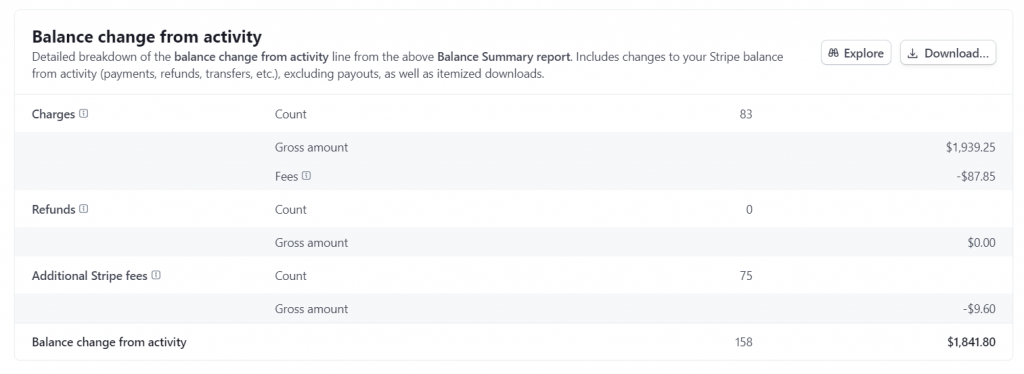

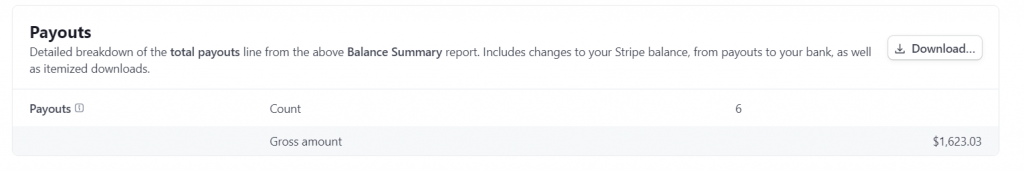

To reconcile Stripe Connect income, you can use a Balance change from activity report from your Stripe account and compare it with your net Stripe Connect income in QBO. Here’s how:

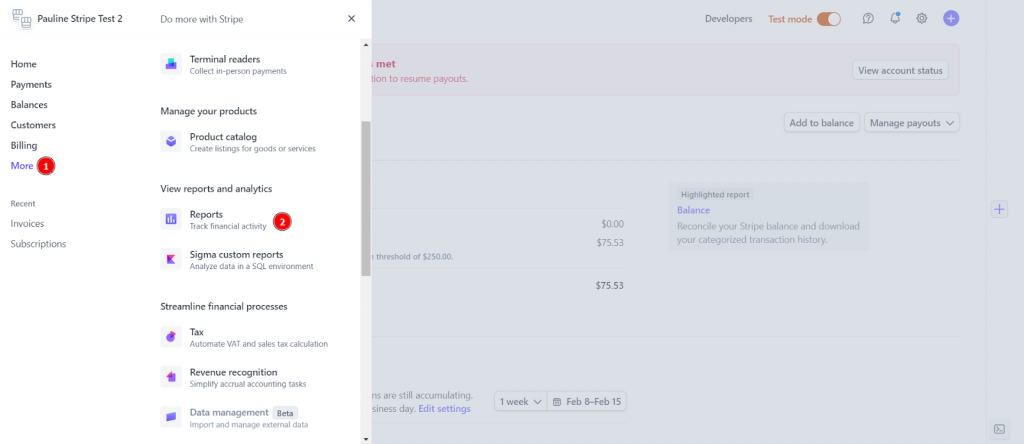

- In Stripe, go to Reports → Balance. Then, select your connected account and specify the date range to view the report for a particular month.

- Look for the Platform earnings category in the report, which reflects your income from your selected connected account.

- In your accounting system, such as QuickBooks Online, open your Profit and Loss statement to review the income recorded there.

This reconciliation process allows you to accurately track your Stripe Connect income in your books, ensuring that your bookkeeping remains fully automated and error-free, streamlining financial management for your ecommerce business.

In summary

In today’s online business world, finding smooth payment solutions is crucial. That’s where Stripe Connect comes in. It’s a specialized platform transforming life of online marketplaces, crowdfunding, and on-demand businesses. With its knack for simplifying complex payments and offering versatile features, Stripe Connect is the top choice for businesses aiming to grow in the digital age.

Moreover, with the integration of Synder, businesses can seamlessly synchronize their Stripe Connect accounts with their accounting platforms. This integration ensures precise recording of income by automatically tracking commissions earned from sales on connected accounts. Synder empowers businesses to maintain accurate financial records, facilitating efficient financial management and informed decision-making. With Stripe Connect and Synder working in tandem, businesses can navigate the intricacies of online commerce with confidence, driving growth and success in the digital age.

Learn more about how to apply taxes on Stripe and Stripe payment links.

Have you ever had any issues syncing Stripe Connect to your books? Share your experience with us. Your stories are greatly appreciated!

.png)

Excellent article! Stripe connect seems useful.