As your ecommerce business grows, so does the complexity of managing taxes across various jurisdictions. Recognizing this challenge, Stripe introduced “Stripe Tax” – a powerful tool designed to automate the cumbersome task of tax calculation and compliance. With ecommerce projected to constitute an ever-increasing fraction of global retail sales, the need for efficient and accurate tax solutions like Stripe Tax becomes all the more crucial.

This article aims to take a deep dive into the tax calculations with Stripe and how this tool can not only aid businesses in ensuring they remain compliant with changing tax laws but also provide a seamless checkout experience for customers, no matter where they’re shopping from.

If you’re a merchant looking to bring all your Stripe transactions, taxes, fees, discounts, refunds, and more, into your accounting software, check out Synder!

This article has been prepared for informational purposes only and gives a general overview of calculating taxes with Stripe Tax. It’s not intended to provide any tax advice. It’s always best to consult with a tax professional to ensure that taxes are properly calculated and reported.

Contents:

1. Need for automated tax solutions

Need for automated tax solutions

With the shift to online platforms comes a slew of complexities, especially in the realm of taxation. We’ll now review some of the challenges posed by tax compliance for online businesses and the paramount importance of automated tax solutions.

Challenges faced by online businesses to tax obligations and compliance:

- Multiple jurisdictions/locations: Online businesses often cater to a global audience. This means they need to navigate and comply with tax regulations in numerous countries, states, or regions. Each jurisdiction can have its own tax rates, rules, and exceptions.

- Changing tax laws: Tax regulations aren’t static. They’re subject to revisions and updates. For an online business, keeping track of these changes across all regions they serve can be a daunting task.

- Complex tax rules: Certain products or services might be taxed differently even within the same jurisdiction. For example, some digital products might have different VAT rates than physical goods in parts of the European Union.

- Record-keeping: Ecommerce platforms must maintain accurate records of all transactions, including the taxes collected. This information is critical for periodic tax filings and potential audits.

- Risk of non-compliance: Failure to comply with tax regulations can lead to hefty fines and penalties. It also poses a reputational risk for businesses.

As a business owner, automating your ecommerce tax processes provides many benefits. This not only streamlines efficiency with fast tax calculations but also minimizes errors, ensuring you remain legally compliant. Plus, as your business expands to new locations, such solutions adapt seamlessly, always keeping pace with the local tax laws.

What is Stripe Tax?

Stripe Tax is a tool developed by Stripe, a leading online payment processing platform. This solution is designed to help businesses automate the calculation and collection of taxes, such as sales tax, VAT (Value Added Tax), and GST (Goods and Services Tax), for online transactions.

Important tax terms

If the above description of Stripe Tax seems to be unclear due to different tax-related terms, you can learn more about it in this section. However, if you’re familiar with the terminology just head straight to the Stripe Tax features below.

VAT and GST

VAT (Value-Added Tax) and GST (Goods and Services Tax) are both consumption taxes levied on the value added at each stage of production or distribution. In many ways, they function similarly, but the primary difference often lies in terminology and regional preference. Some countries refer to their consumption tax system as VAT, while others use GST. In essence, while they have operational similarities, the specific rules, rates, and implementation details might differ based on the country’s legislation. So, while they share the core principles, they aren’t strictly the same.

Sales tax

Sales tax is a consumption tax imposed by governments on the sale of goods and services. Typically, it’s levied at the point of sale in a retail environment.

Sales tax is a percentage added to the purchase price of goods or services. The rate can differ by region and certain items, like food or medicine, might be exempt. What’s more, the tax can be based on either the seller’s or buyer’s location. Retailers collect this tax and send it to the government.

Tax rate

A tax rate is the percentage at which an individual or corporation is taxed. It represents the proportion of the taxable income or the taxable value of a good, service, or property that is owed to the government in the form of taxes. Among the tax rates, you can include income tax rate, sales tax rate, property tax rate, or capital gain tax rate.

Tax rates can be either “flat,” where everyone pays the same rate regardless of income or value, or “progressive,” where the rate increases as the taxable amount increases. Some systems also have “regressive” rates, where the tax rate decreases as the taxable amount increases. Different countries and jurisdictions have varying tax rates and structures depending on their fiscal policies and needs.

Find out how Synder handles multi-tax and multicurrency.

Exclusive tax vs. inclusive tax

Both exclusive tax and inclusive tax pricing modes have their merits and are suited to different situations. The choice between exclusive and inclusive tax largely depends on the business’s target audience, regional tax norms, and the nature of the product or service being offered. For instance, in some regions like the European Union, it’s common to use inclusive tax pricing for consumer goods. On the other hand, in countries like the United States, exclusive tax pricing is more prevalent.

Exclusive tax

In the exclusive tax model, the price of the product or service is listed separately from the tax. The tax is then added to the listed price at the point of sale.

With exclusive tax, it’s easier for consumers to compare prices of products or services across different vendors or regions since the base price is untainted by tax variations. However, customers might be caught off guard by the final price, as the listed price will be lower than the total amount they have to pay after tax.

In regions with varying tax rates or when selling various products with different tax rates, calculations can become complicated for customers.

Inclusive tax

In the inclusive tax model, the listed price of a product or service already includes the tax. This means the price you see is the price you pay. Customers appreciate the straightforwardness of knowing the final cost upfront without needing to make additional calculations. This, in turn, reduces the risk of customers abandoning their purchase at the checkout upon realizing the additional tax costs.

If tax rates change, businesses might need to adjust their listed prices, which can confuse or deter customers. Also, it can make it harder for consumers to compare base prices of products or services if taxes vary between regions or vendors.

Stripe Tax: Key features

Stripe Tax has been engineered with the primary objective of simplifying tax complications for online businesses. Let’s explore its standout features.

Automatic tax calculation

Stripe Tax uses real-time data and advanced algorithms to automatically calculate the appropriate sales tax, VAT, or GST for each transaction. This calculation considers the product or service being sold, the location of the business, and the location of the customer.

This feature eliminates the need for businesses to manually determine tax rates or apply complex tax rules. It ensures accuracy and compliance in every transaction, regardless of its complexity.

Integration with Stripe products

Stripe Tax is designed to work in unison with the other Stripe offerings, from Stripe Payments to Stripe Billing and Stripe Subscriptions. Users get a centralized view of their transactions, including detailed tax breakdowns, within their Stripe account.

With just a few clicks or minor code adjustments, businesses can activate Stripe Tax on their existing Stripe setup (this depends on what Stripe products they’re already using).

Support for multiple countries and regions

Stripe Tax supports tax calculations for a vast number of countries and jurisdictions, making it ideal for businesses with a global customer base (50 countries and all US states). By understanding the nuances of tax laws in different regions and locations, Stripe Tax ensures businesses remain compliant no matter where their customers are based.

Learn how Synder simplifies tracking taxes and sales by countries and states.

Real-time updates

Tax rates and regulations change. Stripe Tax monitors these changes in real time and updates its system accordingly. With these automatic updates, businesses can be confident that they’re always charging the correct tax rates without having to constantly monitor global and local tax news.

Invoices and reporting

Stripe Tax generates comprehensive invoices that detail the tax calculations for each transaction, making it transparent for both businesses and their customers.

Businesses get access to detailed tax reports, helping them understand their tax liabilities and simplifying the process of tax filing and remittance. The robust documentation ensures businesses are well-prepared for potential tax audits, reducing associated risks.

Want to find out more about the way Stripe works? Check out our article ‘What is Stripe Application Fee?‘

Setting up Stripe Tax

Setting up Stripe Tax accurately is essential for businesses aiming to simplify their tax compliance needs. Below is a step-by-step guide to integrating and activating Stripe Tax and customizing its settings.

It’s important to note that Stripe Tax is a calculation tool that charges you per tax calculation. That means that a fee will apply to every tax calculation in all locations where you’re registered to collect tax.

Integration and activation

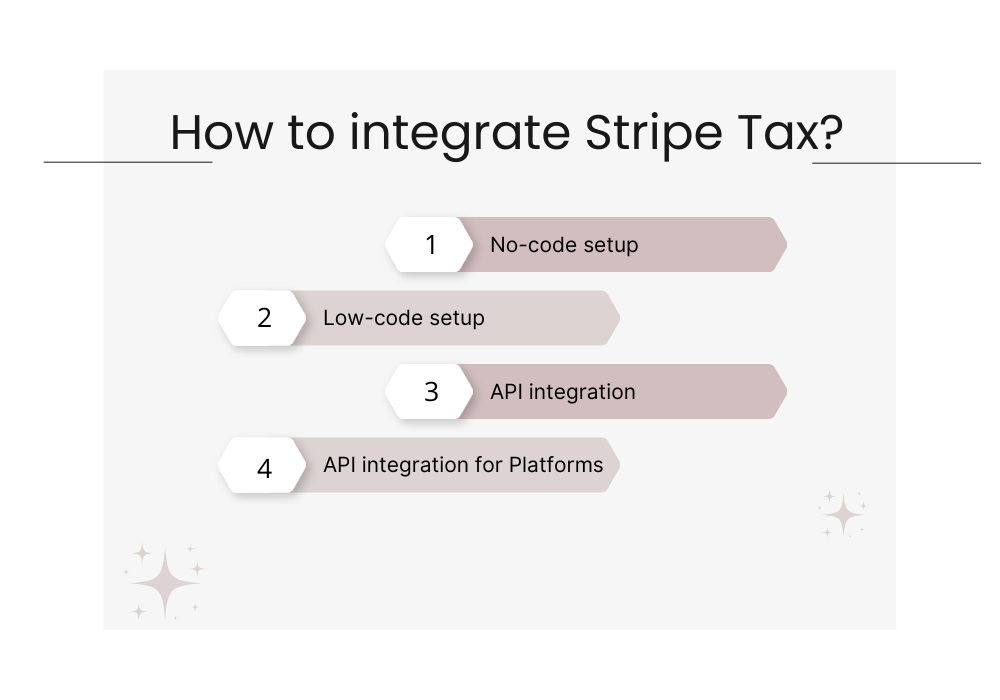

There are 4 main ways you can integrate and activate your tax calculation with Stripe Tax: no code (as simple as pulling a toggle on Stripe Dashboard), low-code (adding a single line of code only), Stripe API integration and Stripe API integration for platforms.

It’s best to see which Stripe products you already use and what suitable solutions for integrating them with Stripe Tax are.

Setting up

To start using Stripe Tax, you need to first set it up according to your specifications. You’ll need to determine the following elements:

- Put the origin address: This is usually based on your Stripe business address, so you need to make sure that it’s correct.

- Select a preset tax code: Choose a preset product or service tax code and, if applicable to your location, also the default shipping tax code.

- Input the registration: Stripe offers a monitoring tool for tracking potential registration needs. To ensure accurate tax calculations, input your active tax registrations in Stripe’s tax settings.

- Include or exclude taxes in prices: To compute a tax using a product’s price, you must identify what’s known as tax behavior. There are three tax behavior options with Stripe Tax:

- Exclusive: Tax isn’t part of the product’s price but is added to it.

- Inclusive: The product’s price already includes the tax.

- Automatic: Tax determination is based on currency. In USD and CAD, tax is excluded, but for other currencies, it’s included in the price.

- Advanced settings (if applicable): Depending on your business needs, you might want to set up tax thresholds, specify customer exemptions, or define custom tax rates for particular products or regions.

Testing

Before fully implementing Stripe Tax, it’s wise to run some test transactions to ensure it’s working correctly. This helps identify any potential issues or inconsistencies in tax calculations. After a test purchase, review the breakdown of the taxes charged to ensure accuracy.

Regular maintenance

Even though Stripe Tax provides real-time updates on changing tax rates, periodically review settings to ensure they align with your business’s evolving needs. Regularly reconcile the taxes collected through Stripe with your accounting records. Use the reports generated by Stripe Tax for compliance documentation.

No tax reporting and filing

It’s important to stress that Stripe Tax, as mentioned above, is a calculation tool, which means it doesn’t deal with tax reporting, remitting, or filing. You’ll need to use different software or employ the help of a tax professional familiar with ecommerce and digital transactions to file your taxes.

Nevertheless, Stripe Tax helps business owners by providing detailed information on all calculated and collected taxes that can then be used for tax reporting, remitting, and filing.

Tax compliance and management with Stripe Tax: Closing thoughts

Stripe Tax is a powerful solution tailored for online businesses seeking to navigate the complexities of tax compliance seamlessly. Its primary strength lies in automatic tax calculations, taking into account various factors like product type, business location, and customer location.

The platform’s integration with the other Stripe services, vast support for different countries, real-time updates on tax regulations, and comprehensive invoicing and reporting features further accentuate its utility. However, while it streamlines the tax calculation process, businesses should be mindful that Stripe Tax doesn’t handle the subsequent stages of tax reporting, remittance, or filing. Instead, it provides detailed records to aid in these tasks, necessitating additional tools or professionals for completion.

In essence, Stripe Tax is an invaluable tool in the tax compliance toolkit of an ecommerce business, simplifying calculations while ensuring businesses remain updated and compliant.

Do you sell products using Amazon? Find out how Synder simplifies Amazon sales tax collection.

.png)