If you run an ecommerce business, you must know how to file taxes correctly and efficiently to remain compliant. Ecommerce businesses have to deal with various types of taxes, such as sales tax, income tax, self-employment tax, payroll tax, and others that make tax management challenging.

In this blog post, we’ll explain what an ecommerce business is for the IRS, which taxes you have to file, how to report your revenue and expenses, and what deductions you can claim. We’ll also provide tips and resources to help you file your taxes smoothly and accurately.

What is an ecommerce business for the IRS?

An ecommerce business is a business that sells goods or services online, either through its website or through a third-party platform such as Amazon, eBay, Shopify, or Etsy.

The IRS doesn’t have a specific definition of an ecommerce business, but it treats it as any other type of business for tax purposes.

Which taxes do ecommerce businesses have to file?

As an ecommerce business owner, you must file several types of taxes at the federal, state, and local levels. The most common are sales tax, income tax, self-employment tax, Federal Insurance Contributions Act (FICA) taxes, Federal Unemployment Tax Act (FUTA) taxes, and VAT or GST taxes.

The following table summarizes the typical rates you’ll have to pay for each tax.

| Tax | Rate or Range of Rates |

| Sales tax | 0% – 10.25% |

| Income tax | 10% – 37% |

| Self-employment tax | 15.3% of net earnings from self-employment |

| Federal Insurance Contributions Act (FICA) taxes | 15.3% of wages |

| Federal Unemployment Tax Act (FUTA) taxes | 6% of the first $7,000 of wages paid to each employee per year |

| Property tax | Varies by state and locality |

| VAT or GST | Varies by country (Not paid in the US) |

Having covered the above, let’s look at each tax separately to see how it applies to your ecommerce business.

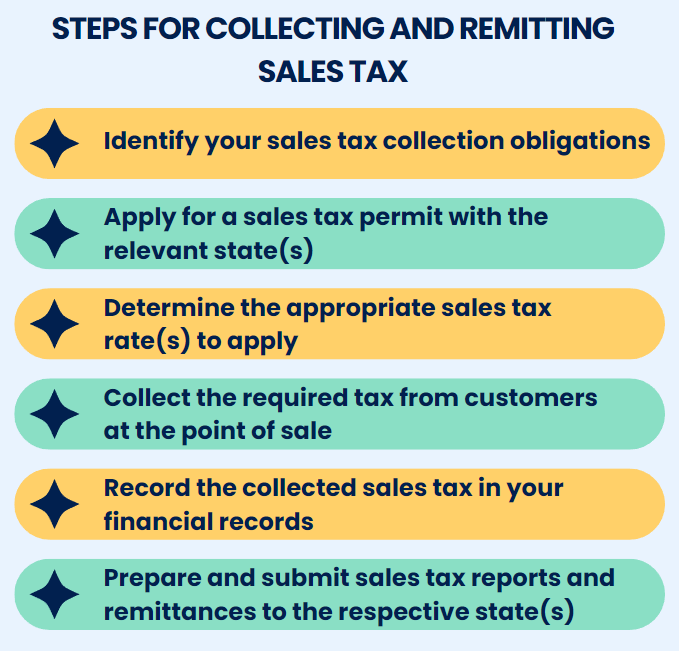

#1 Sales tax for ecommerce businesses

Sales tax is one of the most complicated and confusing taxes for ecommerce businesses. Unlike income taxes, which the federal government and some states levy, sales taxes are levied by each state and sometimes by local jurisdictions within a state.

Each state has its own rules and rates for sales tax, which can vary depending on the type of product or service sold, the location of the seller and the buyer, and other factors. Some states also have exemptions or special rules for certain products or services, such as clothing, food, digital goods, or shipping charges.

Nexus, economic nexus, and sales tax

As an ecommerce business owner, whether you have to collect and remit sales tax from your customers depends on whether you have a nexus or an economic nexus in that state or jurisdiction.

You have a nexus in a state if:

- Your business has a physical location, hires employees, or keeps inventory in that state.

- You may also have a nexus in a state if you have affiliates there who refer customers to your website for a commission.

You have an economic nexus in a state if:

- You exceed a certain amount of sales or revenue in that state, even if you have no physical presence there. The threshold for sales taxes varies by state, but it’s usually $100,000 or 200 transactions per year.

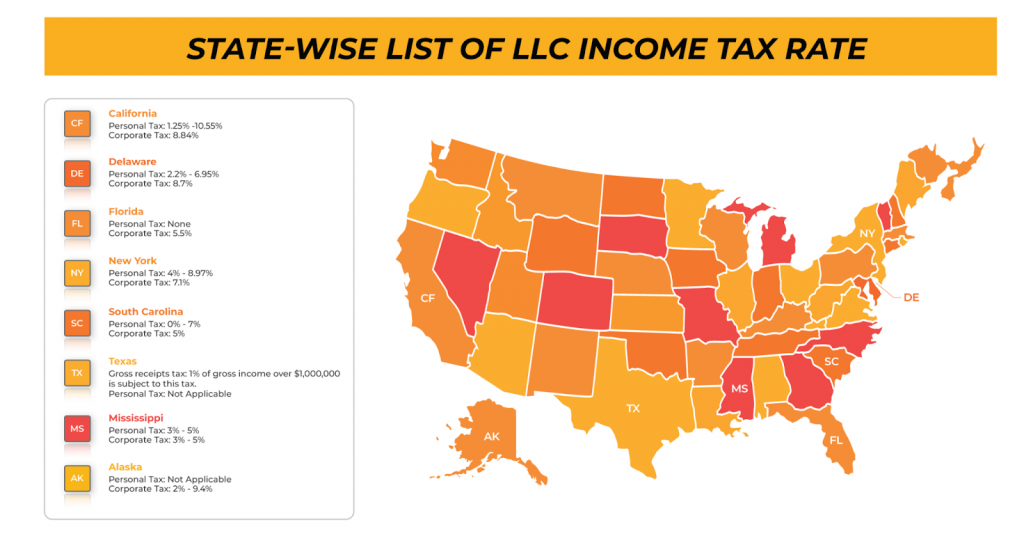

#2 Filing income tax for ecommerce businesses

Income taxes are another major tax that affects ecommerce businesses. As an ecommerce business owner, you have to file income tax returns with the federal government and with some states, depending on your business structure and your net income level.

How you file income taxes for your ecommerce business depends on your business structure. There are three main types of business structures to choose from:

- Sole proprietorship

- Limited liability company (LLC)

- Corporation

Each one has its advantages and disadvantages regarding taxation, liability, complexity, and flexibility.

- Income tax for a sole proprietorship

A sole proprietorship is the simplest and most common business structure for ecommerce businesses. Think of it as a business that has one owner. This owner is also the only employee.

If you run your ecommerce business as a sole proprietorship, you must report your business income and expenses on Schedule C, attached to your personal income tax return (Form 1040).

- Income tax for an ecommerce LLC

An LLC is a type of business structure that combines some of the features of a sole proprietorship and a corporation.

A key benefit of an LLC is that you can choose how you want to be taxed by the IRS. The four options are:

- Disregarded entity, which is an LLC with only one member treated as a sole proprietorship for tax purposes. If you run your ecommerce business as a disregarded entity, you must also report your business income and expenses on Schedule C (Form 1040).

- Partnership, which is an LLC with two or more members that doesn’t pay income tax. Instead, it passes the company’s income on to its members, who report it on their personal income tax returns. If you run your ecommerce business as a partnership, you must file Form 1065 and issue Schedule K-1 (Form 1065) to each partner, showing their share of the partnership’s income and losses. Each partner then reports their share of the partnership’s income and losses on Schedule E (Form 1040).

- S corporation, which is similar to a partnership in that it passes through its income and losses to its members, who report them on their personal income tax returns. Doing so avoids double taxation and reduces its members’ self-employment tax liability since only the wages paid to them are subject to FICA taxes, not the entire net income of the business. If you run your ecommerce business as an S corporation, you must file Form 1120S and issue Schedule K-1 to each member. Each member then reports their share of the income and losses of the S corporation on Schedule E (Form 1040).

- C corporation, in which case your LLC has to file Form 1120 and pay income tax as an entity at the corporate tax rate of 21%. Additionally, if it distributes dividends to its members, they must report them on their personal income tax returns (Form 1040), resulting in double taxation.

- Income tax for an ecommerce corporation

An ecommerce corporation is a type of business structure different from an LLC, consisting of a group of shareholders governed by a board of directors and its officers. Like an LLC, it can choose to be taxed by the IRS as an S corporation or a C corporation with similar tax rules and requirements.

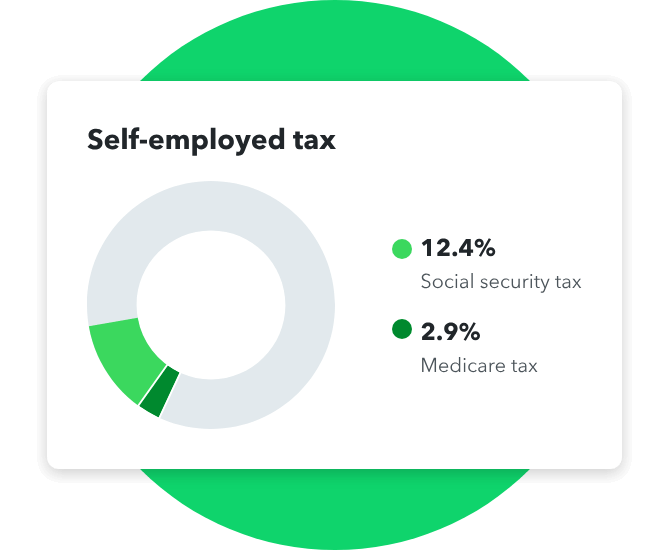

#3 How to file ecommerce self-employment tax

Self-employment tax is a tax imposed on net earnings from self-employment by the federal government to fund Social Security and Medicare programs.

The total self-employment tax rate is 15.3%, but it’s split into 12.4% for Social Security tax and 2.9% for Medicare tax.

Not all ecommerce businesses require you to pay self-employment tax, but if you do, you must pay the tax on 92.35% of your net profit from your business, up to a maximum amount of $160,200 in 2023 for Social Security tax. There’s no limit for Medicare taxes, but if you earn more than $200,000 (single filers) or $250,000 (joint filers), you have to pay an additional 0.9% Medicare surtax.

If you run your ecommerce business as a sole proprietorship or a disregarded entity, you must pay self-employment tax on your net profit from your business. You may also need to pay self-employment tax if you run your ecommerce business as a partnership or an S corporation.

However, if you run your ecommerce business as a C corporation, you don’t have to pay self-employment tax on the business’s income since it’s taxed separately at the corporate level.

#4 Payroll taxes for ecommerce businesses

Payroll taxes are taxes employers have to withhold from their employees’ wages and remit to the federal government on their behalf. Payroll taxes include federal income tax withholding, Social Security and Medicaid (FICA), and Federal Unemployment Tax Act (FUTA) taxes.

Sole proprietorships or disregarded entities don’t pay payroll taxes since you aren’t an employee of your own business. However, if you hire any employees for your business, for example, an ecommerce live chat specialist, you’ll have to pay payroll taxes for them.

If you run your ecommerce business as a partnership, an S corp, or a C corp, you must pay payroll taxes for yourself and your employees.

#5 Property tax for ecommerce businesses

Property tax is a tax imposed on the assessed value of real and personal property by state and local governments. Real property includes land and buildings, while personal property includes machinery, equipment, furniture, inventory, etc.

In the case of ecommerce businesses, typical real property includes offices, warehouses, and, in some cases, physical stores; personal property can include things like servers and personal computers.

Property tax rates and rules vary by state and locality, depending on the type and value of the property.

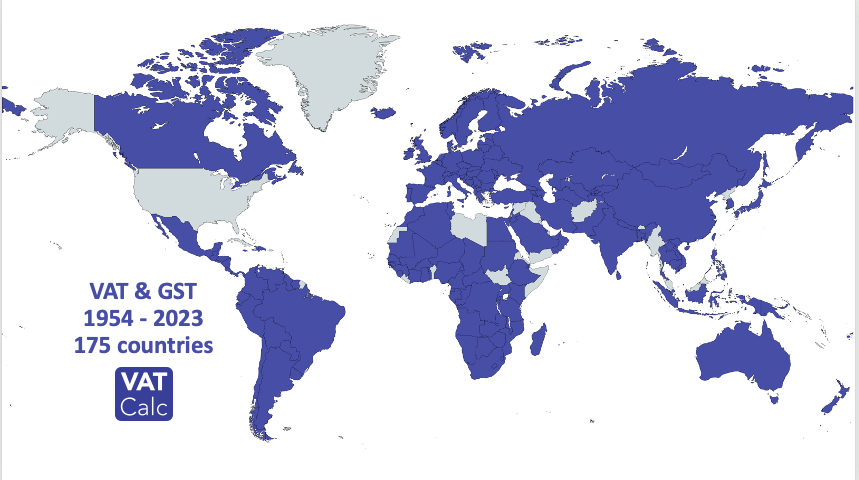

#6 VAT and GST for ecommerce businesses

Value Added Tax (VAT) and Goods and Services Tax (GST) are types of indirect taxes imposed on the value added to goods and services by sellers in some countries (but not in the US). VAT or GST rates and rules vary by country and sometimes by product or service.

Suppose you sell goods or services online to customers in countries that charge VAT or GST, such as Canada, Australia, New Zealand, or the European Union (E.U.).

In that case, you may have to register for VAT or GST in those countries and collect and remit that tax from your customers based on their location and the product or service sold.

Reporting revenue as an ecommerce business

An important part of tax management as an online business is reporting revenue correctly. Your revenue is the money you receive from selling goods or services online before deducting any expenses or costs. Ecommerce business owners must report revenue from internet sales accurately and consistently.

You have to report your revenue from all sources, such as:

- Your website

- Third-party platforms (such as Amazon, eBay, Shopify, or Etsy)

- Payment processors (such as PayPal, Stripe, or Square)

- Affiliates (such as Google Adsense)

- Sales made via any third party b2b sales companies

Depending on your business structure and the type of income, you have to report your revenue in different forms. For example:

- Sole proprietorships or disregarded entities report revenue on Schedule C (Form 1040) as gross receipts.

- Ecommerce businesses registered as partnerships or S corporations must report revenue on Form 1065 or Form 1120S as ordinary income.

- Finally, C corporations must report revenue on Form 1120 as gross income.

Reporting deductions for ecommerce businesses

As an ecommerce business owner, you can deduct your business expenses from your revenue to reduce your taxable income and tax liability. Possible deductions include:

- Employee salaries, wages, and benefits

- Supplies

- Office expenses

- Commissions and fees

- Legal and professional services

There may be other expenses that you can deduct for your ecommerce business, depending on its nature and scope. Some examples are:

- Advertising and marketing expenses

- Travel and entertainment expenses

- Education and training expenses

- Insurance premiums

Reporting inventory and Cost of Goods Sold

If you sell goods online through your ecommerce business, you must report your inventory and Cost of Goods Sold (COGS) on your income tax return. COGS is deducted as an expense, reducing your taxable income and tax liability. Understanding COGS is crucial for ecommerce businesses to effectively manage finances and can be considered a form of pre-tax deduction, as it directly reduces taxable income before tax calculation.

Inventory is the value of the goods you have on hand for sale. COGS is the direct cost of producing or acquiring the goods you sell during the year. You must report your inventory and COGS in different forms depending on your business structure.

You can calculate your COGS using the following formula:

COGS = Beginning inventory + Purchases — Inventory at year-end

3 Tips to make ecommerce taxation easier

Tip #1 Keep well-organized records

The first step to proper tax reporting is to keep your records in order throughout the year. Doing so will make it easier to guarantee compliance with all relevant federal and state tax laws and regulations.

Tip #2 Apply for free tax return preparation from the IRS

The VITA and TCE programs are free tax preparation services the IRS offers to taxpayers who can’t afford to hire a tax specialist, such as low-income, elderly, disabled, or limited-English-speaking taxpayers.

If you qualify for the program, you’ll find trained and certified volunteers who’ll help you file your federal and state returns every year, free of charge.

Tip #3 Seek professional help

If you don’t qualify for the VITA or TCE programs and are overwhelmed with sales taxes at the end of the year, and potential schedule C tax form filings become overwhelming the best you can do is to hire a qualified and certified tax professional to take care of everything for you (read: help you with your sales tax return).

Employer of Record or EOR services can also provide valuable tax-related support, such as helping businesses understand and navigate local tax regulations and help with employee income tax withholding and payroll taxes.

EOR services and their expertise in tax compliance and global workforce management can contribute to smoother and more accurate tax filing processes, particularly when dealing with cross-border ecommerce operations.

Closing thoughts: Keep a close eye on your sales tax and other ecommerce taxation

Filing taxes for ecommerce businesses is no simple task. To be a part of the Internet economy, you must deal with various types of taxes at different levels of government, such as sales tax, income tax, self-employment tax, payroll tax, property tax, and VAT or GST, as well as multiple different tax forms.

You must also choose the best business structure for your ecommerce business, report your revenue and expenses accurately and consistently, and claim your deductions wisely.

If this is your first time reporting sales taxes as an ecommerce business, our best advice is to keep your records in order and seek a professional to help you out.

For actionable insights and more detailed guidance, consider exploring various tax tips for small businesses.

.png)