As a business owner, it’s crucial to have a seamless payment processing solution that ensures efficient sales transactions and enhances customer satisfaction. Square, a leading payment processing platform, offers merchants a suite of services and products to fulfill their payment needs and efficiently manage payments.

In this article, we will provide an expert overview of Square, its products, processing fees, professional services, and solutions. By understanding what Square is and how it works, you’ll be well-equipped to make informed decisions about your business’s payment processing.

Understanding Square: an overview

Square is a financial technology company that offers a range of services and products to facilitate seamless payment processing and business management. Founded in 2009, Square enables small businesses and individuals to accept credit card payments through its innovative hardware and software solutions.

Square products

Square’s suite of products has revolutionized the payments landscape by offering accessible, user-friendly, and feature-rich Square solutions for businesses and individuals alike. Let’s look at Square products in more detail.

Square Point of Sale (POS)

Square Point of Sale, commonly known as Square POS, is the flagship product of the company. It is a user-friendly and versatile payment processing solution that allows businesses of all sizes to accept card payments effortlessly. With Square POS, merchants can use their smartphones or tablets as point-of-sale systems, transforming them into powerful tools for managing inventory, tracking sales, and generating reports. The ease of use, affordability, and extensive feature set have made Square POS a favorite among small businesses, pop-up shops, and even established retailers.

Square Register

Square Register is a more comprehensive hardware solution that offers a full point-of-sale experience. It combines a sleek, purpose-built device with powerful software to provide a seamless checkout process for both merchants and customers. Square Register integrates with various peripherals such as barcode scanners, receipt printers, and cash drawers, making it suitable for businesses with more complex needs. Its intuitive interface, robust analytics, and customization options have made it a popular choice for restaurants, salons, and retail stores.

Square Terminal

Square Terminal is a portable all-in-one payment solution designed for businesses on the move. It combines a card reader, receipt printer, and touchscreen display into a compact device, enabling merchants to accept payments anywhere with ease. Whether it’s a food truck, a trade show booth, or a delivery service, Square Terminal empowers entrepreneurs to process transactions swiftly and securely, eliminating the need for clunky traditional payment terminals.

Square for Restaurants

Recognizing the unique needs of the restaurant industry, Square developed a specialized product called Square for Restaurants. This comprehensive platform offers a range of features tailored to the restaurant business, including table management, menu customization, order management, and kitchen display integration. By streamlining operations and providing real-time insights, Square for Restaurants empowers restaurant owners and staff to deliver exceptional dining experiences while optimizing efficiency.

Square’s commitment to innovation extends beyond its core products. The company has also expanded its ecosystem by introducing ancillary services such as Square Capital, which provides small business loans, and Square Payroll, a solution for managing employee compensation.

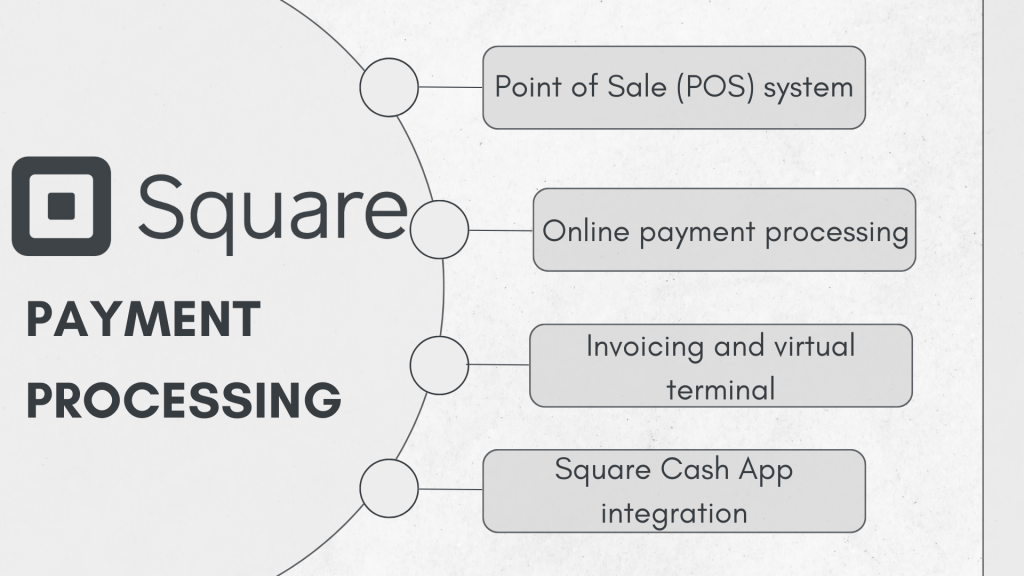

Key features of Square payment processing

Square payment processing offers a range of key features that empower businesses to optimize their payment operations. From a user-friendly Point of Sale (POS) system to seamless online payment processing, invoicing capabilities, and integration with the Square Cash App, Square provides a comprehensive set of tools to streamline transactions and enhance the customer experience. Let’s explore these key features in detail, highlighting the benefits they offer to businesses of all types and sizes.

Point of Sale (POS) system: enhancing in-person transactions

Square’s POS system is at the core of its solutions. Designed to streamline in-person transactions, the Square POS system offers intuitive software and hardware solutions. By incorporating Square products such as card readers, terminals, and stands, businesses can process credit card transactions seamlessly, improving the overall customer experience.

Online payment processing: expanding your reach

With Square’s online payment processing, businesses can effortlessly accept payments on their websites or through the Square Online Store. By integrating Square’s software into their e-commerce platforms, merchants can securely process online transactions and expand their customer base. Square’s online solutions simplify the checkout process, increasing conversion rates and reducing cart abandonment.

Invoicing and virtual terminal: streamlining billing processes

Square’s invoicing feature simplifies the billing process for professional services. Businesses can create and send professional invoices directly to clients, facilitating timely payments and improving cash flow. Additionally, Square’s virtual terminal enables businesses to accept payments remotely, making it convenient for phone or mail orders.

Square Cash App integration: offering flexibility for customers

Square’s integration with the Square Cash App expands the range of payment options available to customers. By embracing Square’s Cash App integration, businesses can accept payments from customers who prefer using the app. This integration provides additional flexibility and convenience, enhancing the overall payment experience for both businesses and customers.

Pros and cons of Square payment processing

Square, a prominent player in the fintech industry, offers a comprehensive suite of tools and services that cater to the needs of merchants. However, like any other payment processing option, Square comes with its own set of advantages and disadvantages that businesses must consider before making a decision.

Square pros

In addition to its user-friendly software and hardware solutions, Square goes above and beyond to ensure that businesses of all sizes and types can benefit from its versatile offerings. Whether you’re a small startup or a large enterprise, Square has tailored solutions to meet your specific needs.

Transparent payment processing fees

When it comes to processing fees, Square maintains transparency and competitiveness. Businesses can rest assured that they won’t be hit with unexpected charges or hidden fees. By offering competitive rates, Square enables businesses to effectively manage their costs and maximize their revenue.

Comprehensive professional services

Square doesn’t stop at providing payment processing solutions. They understand that businesses often require comprehensive professional services to thrive. That’s why they offer a range of services including exceptional customer support, dedicated account management, and detailed reporting.

With Square’s professional services, businesses have access to a team of experts who are ready to assist and guide them through any challenges they may encounter. Whether it’s troubleshooting technical issues, resolving payment disputes, or answering questions about account management, Square’s support staff is dedicated to ensuring a seamless experience for their customers.

Reporting and analytics

The reporting and analytics features provided by Square are designed to empower businesses with valuable insights. Through detailed sales reports, businesses can track their performance, identify trends, and make informed decisions to drive growth. Inventory management becomes more efficient as Square’s reporting tools help businesses understand product demand and optimize their stock levels. Additionally, the ability to analyze customer behavior allows businesses to tailor their marketing strategies and enhance customer satisfaction.

Security and protection

Security is a top priority for Square, especially when it comes to payment processing. They have implemented stringent measures to safeguard sensitive card and online processing data. By adhering to industry-leading security standards, including encryption and tokenization, Square ensures that businesses and their customers can trust the integrity and confidentiality of their transactions.

Square cons

However, there are some limitations that don’t allow Square to be a perfect fit to every business. So, you might want to consider them.

Regional limitations on advanced features

Square operates in various regions worldwide, but it’s important to note that not all advanced features may be available in every region where the company operates. Due to factors such as regulatory requirements, technological infrastructure, or market demand, certain advanced features offered by Square may be limited to specific regions. This means that customers in certain areas might not have access to the full range of features and functionalities that Square provides in other regions. It’s essential for users to check the availability of specific features in their respective regions to ensure they can make the most out of Square’s offerings.

Potential account holds and transaction limits

In order to manage risks associated with high-risk industries, Square may implement account holds and transaction limits as precautionary measures. This is done to protect both Square and its users from fraudulent activities, potential financial losses, or any other form of risk that may arise in these industries.

Account holds involve temporarily restricting access to funds within an account, while transaction limits refer to placing caps on the amount or frequency of transactions that can be processed.

Although these measures can help mitigate risks, they may have temporary impacts on cash flow for businesses operating in such industries. It’s crucial for users in high-risk sectors to be aware of these potential holds and limits and plan their operations accordingly.

Dependency on internet connectivity

Square is primarily an online-centric platform, relying on stable internet connectivity to provide real-time processing for its services. Since Square’s operations heavily rely on internet access, any disruption or instability in the internet connection can impact the platform’s ability to process transactions promptly and efficiently. This could lead to delays or interruptions in the payment processing and overall user experience. It is important for Square users to ensure they have reliable internet connectivity, especially during critical business operations, to minimize any potential disruptions.

Additionally, Square may also provide offline payment options or alternative methods to mitigate the impact of temporary internet connectivity issues, but these options may have limitations compared to the real-time processing capabilities.

How Square works: a step-by-step guide to Square for businesses

As mentioned above, Square is not only a user-friendly solution but also a powerful tool that simplifies various aspects of managing transactions and payments. Its ease of use makes it accessible to individuals and businesses alike. If you’re eager to start utilizing Square’s capabilities to enhance your financial transactions, here’s a quick guide on how to make Square work for you.

Step #1 – sign up for a Square account

Go to the Square website – squareup.com – and click on the “Get Started” or “Sign Up” button. Enter your business information, such as your name, email address, and create a secure password. Follow the prompts to complete the account registration process.

Step #2 – choose your square hardware

Square offers a range of hardware options to suit different business needs. Some popular choices include Square Readers, which are small card readers that plug into a mobile device’s audio jack or connect wirelessly via Bluetooth. Other options include POS systems like Square Stand, which turns an iPad into a full-featured point-of-sale system, or Square Terminal, a standalone payment terminal. Browse the available hardware options on the Square website and select the one that best fits your requirements.

Step #3 – set up Square hardware

Once you receive your Square hardware, carefully follow the instructions provided in the packaging to set it up. The setup process will vary depending on the specific device, but typically involves connecting the hardware to your smartphone, tablet, or computer. This can be done through Bluetooth pairing or by plugging the device into the audio jack or USB port. Follow the prompts on your device’s screen to complete the hardware setup.

Step #4 – download Square Point-of-Sale app

To utilize Square’s payment processing capabilities, download the Square Point of Sale (POS) app on your smartphone or tablet. The app is available for iOS devices through the App Store and for Android devices through Google Play. Once the app is installed, open it and sign in using your Square account credentials.

Step #5 – connect hardware to the Square POS app

With the Square POS app open on your device, connect your Square hardware (such as a card reader or POS system) to the app. This connection allows the hardware to communicate with the app and process payments seamlessly. Depending on the device and hardware you’re using, you may need to follow specific instructions provided by Square to establish the connection. In most cases, you’ll pair the hardware with your device via Bluetooth or physically connect it using the appropriate cable.

Step #6 – add your products or services

Within the Square POS app, you can create a catalog of your products or services. To do this, access the app’s settings or menu and select the “Items” or “Products” option. Here, you can add individual items by providing details such as item names, descriptions, prices, and any applicable taxes. You can also organize your products into categories for easier navigation. This catalog will be used when processing transactions, allowing you to quickly select items for purchase.

Step #7 – start accepting payments

Once your Square hardware is connected and your products or services are added, you’re ready to accept payments. When a customer wants to make a purchase, open the Square POS app and navigate to the “Checkout” or “Sales” section. Here, you can manually enter the transaction amount if needed or select items from your product catalog. Square also provides additional features, such as the ability to apply discounts or add custom notes to transactions.

Step #8 – choose payment method

Square supports various payment methods to accommodate your customers’ preferences. When processing a transaction, you can let the customer choose their desired payment method. Square accepts all major credit and debit cards, including Visa, Mastercard, American Express, and Discover. Additionally, Square supports mobile wallet payments like Apple Pay, Google Pay, and Samsung Pay. You can also accept cash payments, although Square’s primary focus is on card and digital payments.

Step #9 – process the payment

Depending on the chosen payment method, the transaction can be processed in different ways. If the customer is paying with a card, they can insert or swipe their card in a Square reader, or tap it if the card supports contactless payments. In some cases, you may need to manually enter the card information into the Square POS app if the card is not present or cannot be swiped. For mobile wallet payments, the customer will use their device to make the payment by tapping it on the Square reader or holding it close to the device. If the payment is in cash, simply input the cash amount received in the Square POS app.

Step #10 – complete the transaction

Once the payment is processed successfully, you can provide a receipt to the customer. Square offers multiple options for issuing receipts. You can send digital receipts via email or text message to the customer by entering their contact information in the Square POS app. Square also supports printing receipts using compatible receipt printers. If you choose to print receipts, make sure you have a compatible printer connected to your device or POS system.

Step #11 – manage your Square account

As a Square user, you have access to a range of features to manage your business efficiently. Within your Square account, you can explore various tools and settings to track sales, generate reports, manage inventory, and gain insights into your business performance. The Square POS app and online dashboard allow you to view transaction history, sales analytics, and customer data. Square also offers additional services like employee management, appointment scheduling, and e-commerce integrations, which can be set up and managed through your account.

Step #12 – receive deposits

After processing transactions, Square deposits your funds into your linked bank account. By default, Square deposits funds on a next-business-day basis, but you can customize your deposit schedule to meet your business needs. Depending on your account settings and processing volume, it may take one to two business days for funds to appear in your bank account. Square provides a clear breakdown of each deposit within your account dashboard, allowing you to track your earnings and reconcile transactions.

Remember that while this guide provides a general overview of how Square works for businesses, there may be additional features or options available based on your specific business type, location, or Square subscription plan. It’s always a good idea to explore Square’s official resources, such as their website, support documentation, or customer service, for the most up-to-date and detailed information tailored to your business needs.

Conclusion

Making the long story short, Square is a comprehensive payment processing platform that offers a suite of services and products to businesses of all sizes. It provides businesses with a user-friendly Point of Sale (POS) system, online payment processing solutions, invoicing capabilities, and integration with the Square Cash App. Square’s mission is to empower businesses by simplifying payment processes and enhancing customer experiences.

While there may be regional limitations on advanced features, potential account holds and transaction limits for high-risk businesses, and dependency on internet connectivity, Square remains a reliable and secure payment processing platform. With transparent processing fees, comprehensive professional services, and efficient reporting and analytics, Square is a versatile solution that helps businesses streamline their operations and drive growth.

.png)