In today’s digital age, the way businesses accept payments and manage transactions has transformed significantly. Traditional cash registers are being replaced by sophisticated payment processing solutions that streamline operations and enhance customer experiences. One such solution is the Square Business Account.

We will explore what a Square Business Account is, its core features, the benefits it offers, and the reasons why you might need one for your business. Additionally, we will walk you through the process of obtaining a Square Business Account.

Understanding Square Business Account

A Square Business Account is a digital payment and point-of-sale solution that empowers businesses to accept payments from various sources seamlessly. It serves as a comprehensive platform that combines payment processing capabilities, inventory management tools, reporting and analytics features, and integration with other business systems. With a Square Business Account, businesses can efficiently handle their transactions and gain valuable insights into their operations.

Seamless payment processing capabilities

One of the primary features of a Square Business Account is its ability to process payments seamlessly, a point of comparison often considered in the Square vs Stripe debate. It enables businesses to accept payments through various channels, including credit and debit cards, mobile wallets, and contactless payments. With Square’s card readers and terminals, businesses can turn their smartphones or tablets into portable cash registers, allowing for convenient and secure transactions on the go.

Inventory and sales management tools

Managing inventory and sales is a crucial aspect of running a successful business. Square Business Account provides powerful tools to streamline these processes. Businesses can easily track their inventory, set up stock alerts, and manage product variations. The system also allows for effortless creation and customization of items, as well as bulk imports and exports of inventory data. By staying on top of inventory, businesses can ensure they have the right products available at all times.

Reporting and analytics features

Understanding key business metrics and gaining insights into sales performance is essential for making informed decisions. Square Business Account offers robust reporting and analytics features that provide businesses with valuable data. Users can generate sales reports, view transaction histories, and analyze customer trends. These insights can help businesses identify their top-selling products, optimize pricing strategies, and devise effective marketing campaigns.

Integration with other business systems

To streamline operations further, Square Business Account integrates seamlessly with other business systems. It can be integrated with accounting software, such as QuickBooks, allowing for automatic synchronization of transaction data. This integration simplifies bookkeeping and eliminates the need for manual data entry. Additionally, Square can be integrated with e-commerce platforms, enabling businesses to accept online payments and synchronize inventory across multiple sales channels, effectively demonstrating how to choose a location for an ecommerce business.

Benefits of Square Business Account

The adoption of a Square Business Account offers numerous benefits to businesses of all sizes and industries. Let’s explore some of the key advantages:

- Streamlined payment processes

By using a Square Business Account, businesses can streamline their payment processes and improve operational efficiency, a key consideration for those evaluating accounting software for medium businesses. They can accept payments from multiple sources, including cards, mobile wallets, and contactless payments. The versatility of payment options ensures that businesses cater to a broader customer base and do not miss out on sales opportunities. Furthermore, Square’s payment processing is quick and secure, providing peace of mind to both businesses and their customers.

- Enhanced customer experience

In today’s fast-paced world, providing a convenient and seamless experience to customers is crucial for business success. A Square Business Account enables businesses to offer various payment options, making it easier for customers to make purchases. Whether it’s a physical store, an online shop, or a pop-up event, businesses can accept payments effortlessly, providing a hassle-free experience to their customers. Additionally, Square supports mobile payment solutions and contactless payments, keeping up with the modern preferences of tech-savvy consumers. Moreover, Square Business Account allows businesses to set up loyalty programs and rewards, fostering customer retention and loyalty.

- Efficient business management

Managing a business involves handling multiple aspects, and Square Business Account helps simplify these tasks. With its inventory tracking and management tools, businesses can easily monitor stock levels, track product performance, and streamline reordering processes. The reporting and analytics features provide valuable insights into sales trends, customer behavior, and revenue patterns. By leveraging this data, businesses can make data-driven decisions to optimize their operations, improve profitability, and identify areas for growth. Furthermore, the integration capabilities of Square Business Account streamline workflows and eliminate manual data entry, saving time and reducing the chances of errors with competitive Square credit card fees.

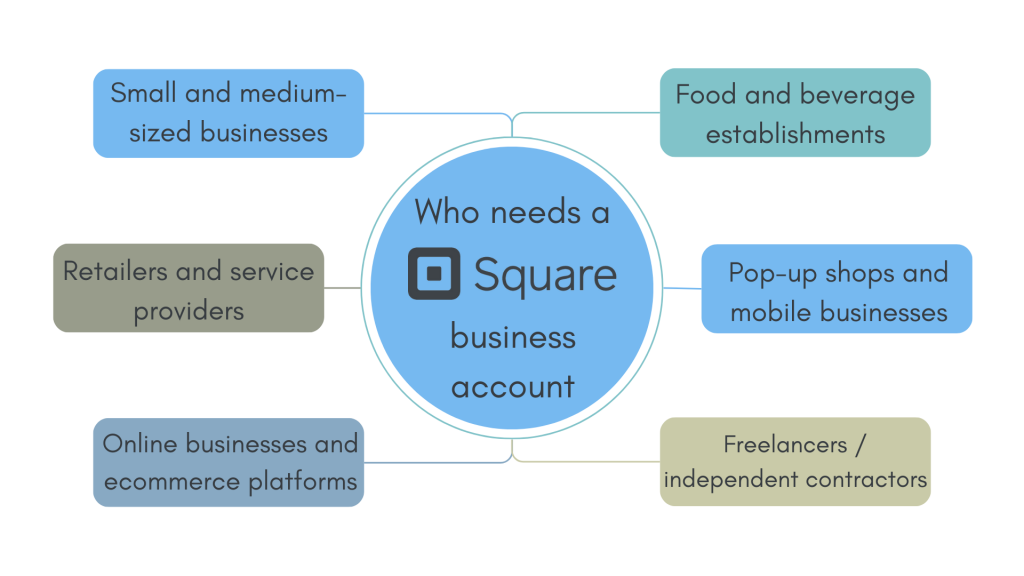

Who might need a Square Business Account?

The versatility of Square Business Account makes it suitable for various types of businesses. Here are some examples of who might benefit from having a Square Business Account:

- Small and medium-sized businesses

Square Business Account caters to the needs of small and medium-sized businesses, offering them affordable and user-friendly payment solutions.

- Retailers and service providers

Whether it’s a brick-and-mortar store, a salon, a restaurant, or a service-based business, Square Business Account provides the tools necessary to accept payments and manage transactions efficiently.

- Online businesses and ecommerce platforms

For businesses operating in the online realm, Square offers ecommerce integrations that facilitate online payments and sync inventory across different platforms.

- Pop-up shops and mobile businesses

Square’s portable hardware options make it ideal for pop-up shops, food trucks, and businesses that operate on the go.

- Food and beverage establishments

Square Business Account offers specialized features for food and beverage businesses, such as menu customization, order management, and kitchen ticket printing.

- Freelancers and independent contractors

Square Business Account is also suitable for individuals offering freelance services or operating as independent contractors. It provides a professional and convenient way to accept payments and track income.

How to get a Square Business Account?

Getting started with a Square Business Account is a simple and straightforward process. Follow these steps to set up your account:

- Visit the Square website or download the Square app on your smartphone or tablet.

- Click on the “Sign Up” or “Get Started” button to create a new account.

- Provide the necessary information about your business, including your business name, location, contact details, and bank account information. This information is required for Square to verify your identity and facilitate payment processing.

- Choose the type of Square hardware that suits your business needs. Square offers various options, including card readers, terminals, and point-of-sale systems. Select the hardware that best fits your requirements and budget.

- Customize your Square settings and preferences. This includes configuring tax settings, tipping options, receipt customization, and loyalty programs. Take the time to personalize these settings according to your business requirements.

- If desired, explore the integrations offered by Square and connect your Square Business Account with other essential business systems such as accounting software and e-commerce platforms. This integration will streamline your workflows and provide a more cohesive business ecosystem.

- Once your account is set up, you can start accepting payments using your Square hardware or through the Square app. Square offers a range of payment options, including swipe, chip, and contactless payments.

Bottom line

In today’s fast-paced business landscape, leveraging digital payment solutions is crucial for success. Square Business Account provides businesses with a comprehensive platform for seamless payment processing, efficient inventory management, and valuable analytics insights. Whether you run a small retail store, operate a mobile business, or manage an online shop, a Square Business Account offers numerous benefits and simplifies your day-to-day operations. By embracing this powerful tool, businesses can enhance customer experiences, streamline processes, and position themselves for growth in the digital age. So why wait? Unlock the power of Square Business Account and take your business to new heights.

%20(1).png)