While small and large businesses have their own problems and strategies, the midsize companies are packed with a mix of both. They move into major problems with a very limited set of resources, which again is made complicated by the exogenous pressures of high inflation, high interest rates, and rapidly changing technologies. For stable growth in such companies, strategies need to be adapted quickly.

The good news is that nearly all the recent accounting software offers simple and easy tools to manage one’s finances and generate reports. Yet, there may not be a one-size-fits-all solution, since needs will vary based on revenue and growth. This guide will help you identify key features and challenges to choose the best accounting software for your midsize business.

Now, let’s break it down step by step.

Key takeaways:

- Midsize businesses often need to address the challenges faced by large enterprises but with a limited budget of smaller businesses.

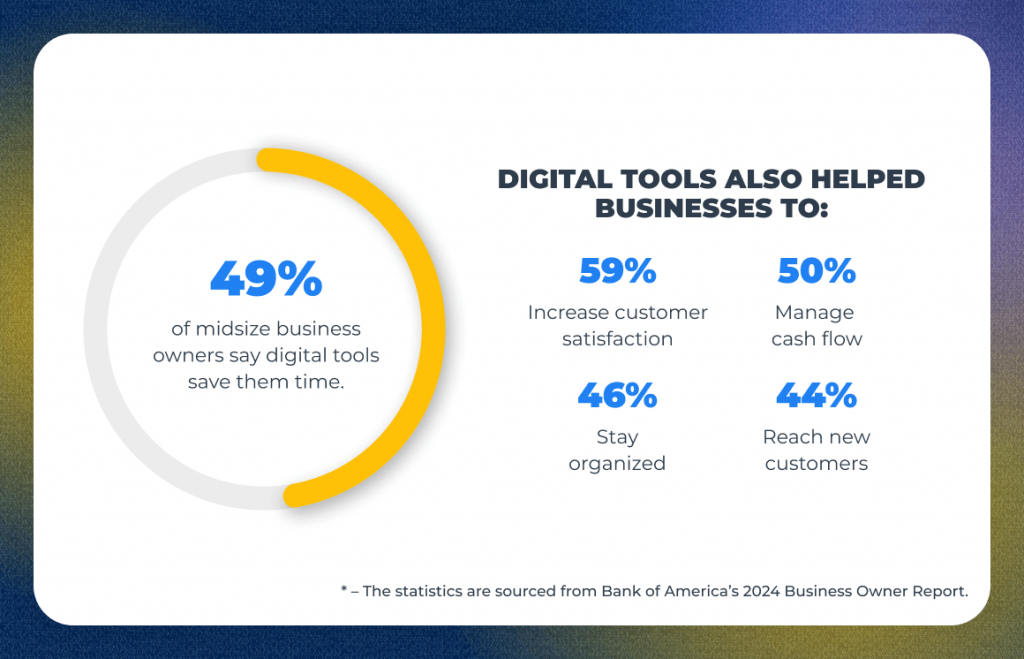

- About a half of midsize business owners agree that implementing digital tools saved them time and boosted overall performance.

- The most essential step in choosing the right accounting software is to analyze your business’s pain points and identify the most critical tasks that need automation.

- Before fully integrating new software into daily operations, it’s wise to test its capabilities using a free trial with a small portion of your data.

Contents:

- Chapter 1: Midsize business & the role of accounting software in business management

- Chapter 2: What features to look for in software for midsize business accounting?

- Chapter 3: Top-4 accounting software for midsize businesses

- Chapter 4: How to prepare for accounting software integration

- Chapter 5: Best practices of implementing accounting software by midsize businesses

- Conclusion

Chapter 1: Midsize business & the role of accounting software in business management

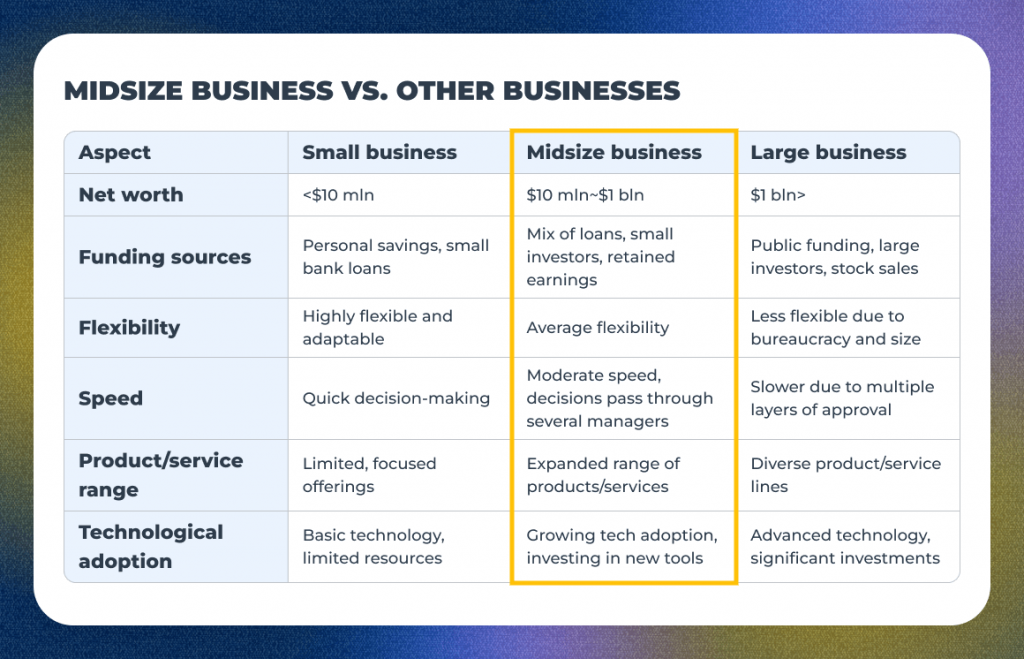

We’ve already mentioned that the midsize business case is a little tricky. That’s why before diving into the specifics of accounting software, it’s essential to understand the nature of midsize businesses in general and how they differ from small and large enterprises.

Midsize business and how it differs from other businesses

Simply put, midsize businesses often experience the “middle child” syndrome—too large to be as agile as small businesses while lacking the vast resources of large businesses. As midsize businesses are standing between two polar opposites—small and large corporations—they need to balance the possibilities of automation with a keen awareness of their limitations, all while keeping a sharp eye on profitability and quality.

| DID YOU KNOW? 38% of businesses fail within the first years due to exhausting their cash reserves or being unable to secure additional capital. |

If you think this sounds overwhelming and challenging, you’re not alone. Managing a business is never easy, but don’t lose hope just yet. That’s exactly why we’re here: to help you understand the main challenges midsize businesses face and find effective ways to overcome them.

Let’s take a look at the table below, which shows the main differences between the three business sizes: small business, midsize, and large.

Based on the information presented in the table, we can make the following conclusions:

- These businesses are typically in an ongoing growth phase, they’re expanding operations, entering new markets, or broadening product lines.

- Midsize companies may handle large volumes of transactions and engage in more complex supply chains. This increases the need for sophisticated management systems with advanced financial reporting, multicurrency transactions, and integrated inventory management.

- Midsize businesses often have limited staffing compared to larger corporations, but the workload is still bigger than that of small businesses.

- To manage their growing complexity, midsize businesses are often in search of automation for routine tasks such as invoicing, payroll, and financial reconciliation.

It’s good to point out that higher interest rates can lead to bigger returns on reserves, encouraging midsize companies to invest more in areas like technology or R&D that they might have previously considered too costly. And with a focus on long-term results, midsize businesses find that implementing accounting software aligns perfectly with their strategic goals.

Accounting software’s main benefits

To avoid being unfounded, let the numbers speak for themselves.

According to Bank of America’s 2024 Business Owner Report, businesses that implement digital strategies experience positive outcomes and higher overall efficiency. Digital strategies help increase customer satisfaction, manage cash flow, stay organized, and even reach new customers.

The infographic above shows the statistics for digital tools in general, including CRM, financial, and other business management automation solutions. But what can accounting software do to help midsize businesses?

1. Tracking of transactions across platforms

Midsize businesses often operate across multiple sales channels, such as Shopify, Amazon, Etsy, and Walmart. Not to mention the usage of various payment platforms like Stripe, PayPal, and Square. Accounting software can seamlessly track and consolidate transactions from these diverse platforms into a single, cohesive system.

For example, using accounting automation software like Synder Sync, businesses can automatically synchronize transactions from over 30 different platforms, and centralize, view and categorize them in a single data hub – their accounting software.

| GET MORE INSIGHTS: Learn how Synder helped TJAYZ manage sales from over four sales channels, including Amazon, eBay, and Etsy. > Read the full story |

2. Staying compliant

Compliance with financial regulations is essential for midsize businesses, particularly those operating in multiple jurisdictions. Integrated functionality within accounting software ensures that all financial activities adhere to the required standards and regulations.

For example, just like many other tools, Sage Intacct provides features that can handle various compliance requirements across different regions. This ensures that businesses meet local and international financial reporting standards, reducing the risk of legal issues and penalties.

3. Providing detailed data analysis

Advanced data analysis capabilities within accounting software allow midsize businesses to gain deeper insights into their financial performance. This can inform strategic decisions, helping businesses optimize operations and identify growth opportunities.

Software solutions like QuickBooks and Xero offer powerful analytics tools that generate detailed financial reports, such as P&L statements, Balance Sheets, and Cash Flow statements.

Chapter 2: What features to look for in software for midsize business accounting?

Clearly, not all accounting software midsize businesses use is alike. Indeed, depending upon your needs and requirements, you may already have a short list of prospects in mind. Taking a closer look, however, you can find among them quite a different array of features and functionality.

So, how to choose the right one?

If you know what you want the software to do for you, you’re already halfway through. But here are the most typical features to look for in software for medium businesses:

1. Double-entry bookkeeping

This foundational accounting method ensures that every financial transaction affects at least two accounts, maintaining the balance between assets, liabilities, and equity. This balance is essential for accurate financial reporting of business performance.

2. Financial reporting

Comprehensive financial reporting features allow businesses to generate detailed reports, as mentioned in the previous chapter. With such reports, it’s easier to track income and expenses based on ongoing records and create new strategies and approaches when necessary.

3. Integration with sales and payment sources

Seamless integration with sales and payment platforms ensures that all transactions are automatically recorded in the accounting system, reducing manual entry and errors. This integration provides real-time synchronization and comprehensive financial oversight.

4. Revenue recognition for subscriptions

Accurate revenue recognition is vital for businesses with subscription models. The software should comply with accounting standards and provide tools for tracking and recognizing subscription-based income accurately over time.

| RELEVANT READ: Learn how Synder helped Yoodli automate revenue recognition for Stripe subscriptions. > Read the full story |

5. Multicurrency support

One of the most important factors for businesses engaged in selling across multiple countries is the ability to manage transactions in different currencies. The software should handle currency conversion and track exchange rates, thereby providing accurate financial records.

Chapter 3: Top-4 accounting software for midsize businesses

Now that you’ve outlined the key features and factors to consider when choosing accounting software, it’s time to dive into research. Since the market is flooded with options, we’ve done it for you. To help you navigate, we’ve compiled a list of the top four giants in accounting software that are likely to meet your midsize business needs.

QuickBooks Online

| G2 rating: 4.0 out of 5 stars |

One of Intuit’s software products, QuickBooks Online, is a widely used accounting software that caters to the needs of midsize businesses with its powerful features, like GST and VAT tracking, and ease of use. It offers cloud-based access, making it a convenient choice for businesses with remote or distributed teams.

Key features:

- Invoice customization and tracking;

- Income and expense tracking;

- Financial reporting;

- Integrations with CRM, payroll, and inventory management systems.

Advantages:

✔️ Accessibility;

✔️ Integration capabilities;

✔️ Intuitive and straightforward interface.

Disadvantages:

❌ Subscription costs;

❌ Limited customization;

❌ Limited inventory management.

| HOW SYNDER CAN HELP: Synder automates data synchronization and provides seamless integration across multiple platforms, such as Shopify, Amazon, Stripe, etc., connecting them to QuickBooks Online. Recording the real-time data from these channels, the software allows users to categorize and classify the transactions as they want so that there are zero discrepancies in the reconciliation process. For QuickBooks Online, Synder also provides GAAP-compliant revenue recognition for Stripe subscriptions, helping you account for and recognize revenue correctly. → Learn more about Synder’s QuickBooks Online integration |

QuickBooks Desktop

| G2 rating: 4.3 out of 5 stars |

QuickBooks Desktop is one more product made by Intuit. This locally installed accounting software provides advanced features and detailed control over financial management. The software is particularly suitable for businesses that prefer a desktop-based solution with comprehensive capabilities.

Key features:

- Built-in payroll processing;

- Employee time tracking;

- 1099 Form preparation by payments categorization;

- 200+ built-in customizable reports.

Advantages:

✔️ Comprehensive features;

✔️ Good at handling larger datasets;

✔️ Greater control over data security.

Disadvantages:

❌ Limited mobility;

❌ Complex setup and maintenance;

❌ Upgrade costs.

| HOW SYNDER CAN HELP: As with the previous software, Synder automates the synchronization of transactions from multiple sales platforms and payment processors directly into the QuickBooks Desktop account. The integration reduces manual data entry, ensures accurate and timely financial records, and streamlines the reconciliation process. Synder supports all 2012-2024 QuickBooks Pro, Premier, and Enterprise versions. → Learn more about Synder’s QuickBooks Desktop integration |

Xero

| G2 rating: 4.3 out of 5 stars |

Xero is a cloud-based accounting software known for its user-friendly interface and powerful features tailored to midsize businesses. It offers extensive integration options and advanced reporting capabilities that can be managed through a personalized accounting dashboard.

Key features:

- Real-time bank reconciliation;

- Invoice creation and delivery;

- Digital purchase orders management;

- Multi-currency accounting with over 160 currencies on the Premium Plan.

Advantages:

✔️ User-friendly interface;

✔️ Extensive integrations;

✔️ Mobile access.

Disadvantages:

❌ Limited payroll features;

❌ Customer support is rather slow;

❌ Learning curve for advanced features.

| HOW SYNDER CAN HELP: Synder offers features such as real-time data synchronization, multicurrency support, and detailed financial reporting. The tool facilitates seamless reconciliation of transactions, helping businesses maintain clean books and providing valuable insights into sales and financial performance. → Learn more about Synder’s Xero integration |

Sage Intacct

| G2 rating: 4.3 out of 5 stars |

Sage Intacct is an AI-powered cloud-based accounting management solution designed for growing businesses. It provides advanced features for financial reporting, compliance, and automation, making it a top choice for midsize companies with complex accounting needs.

Key features:

- Integrated HR and Payroll module;

- Advanced reporting with a real-time SaaS metrics;

- Automated billing and invoicing;

- Fixed assets management.

Advantages:

✔️ Advanced financial management;

✔️ Customizable financial reports;

✔️ Compliance and security.

Disadvantages:

❌ A more expensive option;

❌ Complex implementation;

❌ Additional user training may be required.

| HOW SYNDER CAN HELP: Synder enhances the workflow with Sage Intacct by automating the synchronization of multi-channel sales and payment data with the help of comprehensive daily journal entries, ensuring accurate and compliant financial records. It provides real-time data synchronization, which helps streamline financial processes and maintain up-to-date books for a hassle-free reconciliation process. → Learn more about Synder’s Sage Intacct integration |

Bonus: Synder Sync – accounting automation software

| G2 rating: 4.7 out of 5 stars |

As you may notice, Synder Sync is not a standalone accounting software but an automation tool for your chosen accounting software solution. The tool serves as a bridge between the sales channels, payment platforms, POS systems, etc., and accounting software (any of the four mentioned above). For now, over 30 platforms are available for integration, and more can be added upon request.

Synder integrates the systems within a minute and can start recording ongoing and historical data, including transaction fees, tax, sales details, and more, right away. It’s a highly customizable tool that can be tailored to your specific needs eliminating human errors on manual routine tasks. While the initial configuration might take a while, once set up, the process is seamless—simply sync your data and enjoy flawless reconciliation.

Key features:

- Income and expense tracking with all the transaction details for detailed reports;

- Automated categorization of data synced based on your own settings;

- Pre-matching of payouts in the accounting software for an error-free reconciliation;

- Revenue recognition for Stripe subscriptions;

- Invoice creation and customization;

- COGS reports creation.

Have questions regarding Synder’s ability to meet your needs? Feel free to book a seat at our webinar or sign up for a 15-day free trial to learn more about how it can help your business.

Chapter 4: How to prepare for accounting software integration

Now that you’ve already covered the initial steps of identifying your business requirements and choosing the right software, it’s time to move on to the next phase. Let’s see what else is necessary to keep under control when integrating the software into the workflow.

1. Prepare for data migration

Before migrating, clean your existing data to remove duplicates and correct errors. Just in case, create multiple backups of your current data from Excel or the accounting software that has been in use to prevent any loss during the migration process. This serves as a safety net if any issues arise during the transition.

2. Set up a project plan

Develop a detailed project plan with clear milestones, deadlines, and assigned roles. This plan should cover all phases of a new business software implementation process. Keep all the stakeholders fully informed throughout the project and make sure that they’re on board with the change.

3. Ensure device and security compatibility

Check the compatibility of existing devices with the new software. Ensure all hardware meets the new system’s minimum requirements, and upgrade if necessary.

Review and enhance security protocols to protect sensitive financial data. This includes setting up appropriate user permissions and roles within the new system.

4. Conduct testing

Perform test migrations to identify and resolve any issues before the final transition. This can involve testing the chosen midsize business accounting software on a free trial before the actual purchase of a full subscription plan. Most tools offer essential functionalities during their free trials, allowing potential users to get a full picture of the software’s features.

After confirming everything is in order and having the team members test the primary functions, you can fully integrate specific accounting software into your daily operations.

Chapter 5: Best practices of implementing accounting software by midsize businesses

Pawp is a pet care service offering a 24/7 digital health clinic and telehealth services since 2020. As a subscription-based business, Pawp faced a significant challenge with manual revenue recognition, especially as they work with two payment platforms, Stripe and PayPal.

Initially, Pawp used QuickBooks Online to manage its books. This was enough during its early days of business. However, as their volume grew, they needed an additional automation tool to manage and track revenue recognition more efficiently. They needed a solution to make the QuickBooks Online dashboard a single source of truth with the most detailed subscription data from Stripe.

And that’s when they found Synder RevRec. What were the results? After Synder was implemented, the software:

- Automates sync of subscription changes from Stripe to QuickBooks;

- Syncs and matches invoices from multiple platforms;

- Recognizes revenue when earned;

- Enhances QuickBooks reporting details.

| READ PAWP’S FULL STORY: > How Synder Helps Pawp Achieve Granular QuickBooks Reporting for Stripe Subscriptions |

And that’s how Pawp, and many other businesses facing similar problems, can streamline their revenue recognition process and business management, ensuring accurate and real-time financial data.

Conclusion

Running a midsize business is all about striking the right balance, and choosing the best accounting software plays a pivotal role in achieving that. The right digital tool, equipped with the specific features your business needs, can optimize operations and achieve accurate financial reporting. By carefully following the steps in this guide and exploring midsize accounting software solutions, you can confidently pave the way toward financial success.

.png)