Running a business can be challenging, with tasks like bookkeeping often sidelined due to their tedious and time-consuming nature. It happens to entrepreneurs to find themselves in a situation where they’ve neglected bookkeeping for an extended period, only to face the daunting task of reconciling months of financial data, especially with tax season approaching. However, there’s hope. Catch up bookkeeping exists precisely for these scenarios, offering help to businesses grappling with overdue financial records.

Today, we’re looking at catch up bookkeeping in more detail. Let’s go!

Key takeaways

- Catch-up bookkeeping is essential for businesses facing neglected or disorganized financial records, providing an opportunity to rectify discrepancies, ensure compliance with regulations, and make informed decisions based on accurate data.

- The catch-up approach in accounting involves systematic reconciliation and updating of past financial records, employing methodologies such as data collection, reconciliation of accounts, error correction, adjustment of entries, and comprehensive documentation and reporting.

- Catch-up bookkeeping benefits businesses by ensuring regulatory compliance, accurate financial reporting, informed decision-making, tax compliance and planning, preventing financial mismanagement, and maintaining their reputation with stakeholders. Efficient organization and professional assistance streamline the process, enhancing accuracy and efficiency in financial management.

What is catch up bookkeeping?

If you suggested catch up bookkeeping is something about catching up with your bookkeeping, you’re right. It’s exactly it.

Catch up bookkeeping refers to reconciling and organizing financial records that have been neglected or fallen behind over a certain period.

It often occurs when businesses or individuals fail to maintain regular bookkeeping practices due to time constraints, lack of resources, or other priorities. The primary purpose of catch up bookkeeping is to ensure that all financial transactions are accurately recorded, categorized, and accounted for, providing a clear and up-to-date picture of the business’s financial health.

Why is catch up bookkeeping important for businesses?

For businesses, accurate and up-to-date financial records are crucial for making informed decisions, complying with tax regulations, and presenting financial information to stakeholders such as investors and lenders.

Without proper bookkeeping, businesses may struggle to track expenses, monitor cash flow, and identify areas for improvement or cost-saving measures. Similarly, individuals who manage their finances or operate small businesses rely on accurate bookkeeping to track income, expenses, and savings, enabling them to budget effectively and plan for future financial goals.

At this point, catch up bookkeeping is a vital tool for businesses, helping regain control over their financial records, rectify any discrepancies or errors, and ensure compliance with accounting standards and regulatory requirements. It allows entities to reconcile bank statements, track outstanding invoices and bills, categorize expenses, and generate accurate financial reports for analysis and decision-making purposes.

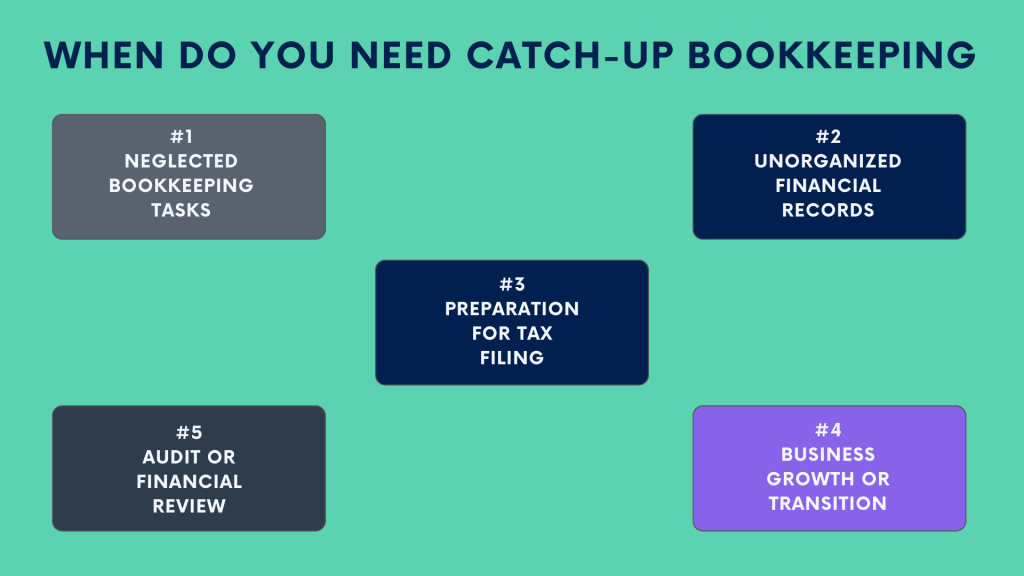

When might your business need catch-up bookkeeping?

Catch up bookkeeping becomes necessary for businesses under various circumstances, signaling the need to address overdue financial records and ensure accurate accounting practices. Let’s break down the scenarios in which your business might need to catch up on bookkeeping.

#1 – Neglected bookkeeping tasks

As mentioned above, businesses often require catch up bookkeeping when they neglect routine bookkeeping tasks due to other priorities or time constraints. For instance, during busy periods such as peak seasons or significant projects, entrepreneurs may defer bookkeeping responsibilities, leading to a backlog of financial transactions and documentation.

#2 – Unorganized financial records

When businesses struggle to maintain organized financial records, catch up bookkeeping becomes essential. Disorganized documentation, including scattered receipts, invoices, and bank statements, can hinder accurate financial reporting and decision-making. Businesses may realize the need for catch up bookkeeping when they encounter difficulties in accessing or interpreting financial data.

#3 – Preparation for tax filing

As tax season approaches, businesses must ensure that their financial records are up to date and compliant with tax regulations. Failure to maintain accurate records throughout the year can result in challenges during tax preparation, potentially leading to errors, penalties, or missed deductions. Catch up bookkeeping, especially when pondering questions like Does an LLC get a 1099, enables businesses to reconcile transactions, categorize expenses, and ensure compliance with tax regulations.

#4 – Business growth or transition

During business growth or transition periods, such as expansion into new markets or changes in ownership, businesses may encounter increased complexities in their financial operations. As the scale and scope of business activities evolve, existing bookkeeping practices may become inadequate, necessitating catch-up bookkeeping to align with the changing needs and demands of the business.

#5 – Audit or financial review

Businesses may initiate catch-up bookkeeping in response to audits, financial reviews, or due diligence processes conducted by external parties such as investors, lenders, or regulatory authorities. These assessments require businesses to demonstrate transparency, accuracy, and compliance with accounting standards. Catch up bookkeeping allows businesses to address any discrepancies or irregularities identified during the review process and ensure the integrity of their financial reporting.

What is the catch up approach in accounting?

Now, let’s look at how it technically works.

The catch up approach in accounting refers to reconciling and updating financial records that have fallen behind schedule. It involves systematically reviewing past transactions, entries, and documentation to update accounting records.

Unlike regular accounting practices, which involve consistent and timely recording of financial transactions as they occur, the catch up approach focuses on addressing backlog and discrepancies that may have accumulated over time.

Methodologies of the catch up approach

The catch up approach employs several methodologies to streamline the process of reconciling and updating financial records.

Step #1 – Data collection and organization

The first step in the catch up approach involves gathering all relevant financial documents, including bank statements, invoices, receipts, and expense reports. You might want to systematically organize these documents to facilitate reconciliation and ensure no transactions have been omitted or overlooked.

Step #2 – Reconciliation of accounts

Once the financial documents are collected and organized, account reconciliation begins. This process involves comparing recorded transactions with bank statements and other financial records to identify discrepancies or errors. Reconciling accounts ensures accuracy and integrity in the financial reporting process.

Step #3 – Identification and correction of errors

As part of the catch up approach, accounting professionals meticulously review each transaction to identify any errors or inconsistencies. Common errors may include duplicate entries, missing transactions, or misclassified expenses. Correcting these errors is essential to maintain the accuracy and reliability of financial records.

Step #4 – Adjustment of entries

After identifying and correcting errors, adjustments may be necessary to reflect the real financial position of the business. Adjusting entries may involve accruals, deferrals, or corrections to ensure that financial statements accurately represent the financial performance and position of the business.

Step #5 – Documentation and reporting

Throughout the catch up process, you might want to maintain detailed documentation to track the progress of reconciliation efforts and provide an audit trail for future reference. Once the catch up process is complete, you need to generate comprehensive financial reports to summarize the updated financial position of the business.

Key differences from regular accounting practices

The catch up approach differs from regular accounting practices in several key aspects.

- Regular accounting practices emphasize the timely recording and updating of financial transactions as they occur, ensuring that financial records remain current and accurate.

- In contrast, the catch up approach focuses on rectifying past discrepancies and errors that may have accumulated due to neglect or oversight.

- While regular accounting practices prioritize proactive management of financial records, the catch up approach is reactive, addressing backlog and discrepancies after they have occurred.

Year end considerations of the catch up approach

The catch up approach often intensifies towards the end of the fiscal year when businesses aim to finalize their financial statements and prepare for annual audits or tax filings. Year-end deadlines create additional pressure to ensure that financial records are accurately reconciled and updated before the close of the fiscal year.

Implementing the catch up approach allows businesses to meet year-end reporting requirements, assess their financial performance, and make informed decisions for the upcoming fiscal period.

How can catch up bookkeeping help beat bookkeeping neglect consequenses?

Neglecting bookkeeping tasks can yield significant financial and operational consequences, leading to the accumulation of financial discrepancies and errors. It can hinder financial reporting and decision-making. Businesses may encounter challenges in managing cash flow effectively, potentially leading to liquidity issues and missed payments.

There are also compliance risks, as regulatory authorities mandate the maintenance of accurate financial records in adherence to accounting standards and tax regulations. Non-compliance can result in penalties, fines, and damage to the business’s reputation.

So merely catching up with your bookkeeping is not the reason you need it. It’s more of a critical component of your business’s financial management. It allows you to stay on track with your finances, comply with laws and regulations, and keep being a reputable business in the eyes of authorities and partners.

#1 – Compliance with regulatory requirements

One of the primary reasons catch up bookkeeping is necessary is to ensure compliance with regulatory requirements. As you know, businesses should maintain accurate and up-to-date financial records following accounting standards and tax regulations.

Failure to comply with these requirements can result in penalties, fines, or legal consequences. Catch up bookkeeping enables businesses to rectify any discrepancies or errors in their financial records and demonstrate compliance with regulatory authorities.

#2 – Accurate financial reporting

Accurate financial reporting is essential for businesses to assess their financial performance, make informed decisions, and attract investors or lenders.

Neglecting regular bookkeeping tasks can lead to incomplete or inaccurate financial records, undermining the reliability and credibility of financial reports. Catch up bookkeeping ensures that all financial transactions are properly recorded, categorized, and reconciled, providing stakeholders with a clear and transparent view of the business’s financial health.

#3 – Effective decision-making

Timely and accurate financial information is crucial for effective decision-making within businesses. Without access to up-to-date financial records, decision-makers may struggle to evaluate profitability, manage cash flow, or allocate resources efficiently.

Catch up bookkeeping enables businesses to access reliable financial data, empowering decision-makers to identify trends, assess performance, and implement strategic initiatives more confidently.

#4 – Tax compliance and planning

Tax compliance is a critical aspect of financial management for businesses and individuals. Neglecting regular bookkeeping tasks can result in errors or omissions in tax filings, leading to potential audits, penalties, or overpayment of taxes.

Catch up bookkeeping allows businesses and individuals to accurately report income, claim deductions, and fulfill tax obligations on time. Besides, it facilitates tax planning strategies, such as identifying deductible expenses or maximizing tax credits, to optimize tax liabilities.

#5 – Prevention of financial mismanagement

Neglected bookkeeping tasks can create opportunities for financial mismanagement or fraud within businesses. Without proper oversight and reconciliation of financial records, unauthorized transactions, duplicate payments, or misappropriation of funds may go unnoticed. Catch up bookkeeping helps identify irregularities or discrepancies in a business’s finances, enabling them to implement internal controls and safeguards to prevent potential financial risks or losses.

#6 – Preservation of business reputation

Maintaining accurate and transparent financial records is essential for preserving the reputation and credibility of businesses. Inaccurate or incomplete financial reporting can erode trust among stakeholders, including customers, suppliers, and investors. At this point, catch-up bookkeeping helps businesses demonstrate their commitment to integrity, transparency, and sound financial management practices, enhancing their reputation and fostering long-term relationships with stakeholders.

How can businesses organize their catch up bookkeeping process?

When embarking on catch up bookkeeping, it’s crucial for businesses to establish a systematic approach to organize their financial records effectively. Here are some practical steps and strategies to consider

Step #1 – Assesment of current state

Before diving into catch up bookkeeping, it’s imperative to conduct a thorough assessment of your current financial records. It involves scrutinizing various aspects to ensure accuracy and completeness. Here’s how you can proceed.

- Review accounts

Begin by reviewing all financial accounts, including bank statements, credit card statements, and loan accounts. Look for discrepancies, unauthorized transactions, or missing entries that could affect your financial records. - Check transaction logs

Examine transaction logs and journals to verify the accuracy of recorded transactions. Pay close attention to dates, amounts, and descriptions to identify any errors or omissions. - Reconcile balances

Reconcile bank balances with your accounting records to ensure consistency. Any discrepancies should be investigated and resolved promptly to maintain accuracy in financial reporting. - Identify outstanding invoices

Identify any outstanding invoices or payments receivable to accurately reflect the company’s financial obligations and assets. - Assess compliance

Evaluate your financial records for compliance with accounting standards, tax regulations, and internal policies. Address any non-compliance issues to mitigate risks and ensure adherence to legal requirements.

Such a comprehensive assessment can help identify areas requiring attention and develop strategies to rectify discrepancies or gaps in their financial records.

Step #2 – Gathering necessary documentation

Collecting relevant financial documents is the cornerstone of effective catch up bookkeeping. Here’s what you might need.

- Bank statements

Obtain bank statements for all accounts, including checking, savings, and credit card accounts, covering the period under review. - Invoices and receipts

Gather invoices, receipts, purchase orders, and payment records related to business expenses and transactions. Organize them chronologically to facilitate reconciliation and analysis. - Transaction records

Retrieve transaction records from financial institutions, online payment platforms, and accounting software systems. These records provide detailed insights into income, expenses, and cash flow activities. - Tax documents

Include relevant tax documents such as W-2 forms, 1099 forms, and annual tax returns. These documents aid in accurately reporting income and deductions for tax purposes. - Legal agreements

Collect copies of contracts, leases, loan agreements, and legal documents that impact the company’s financial obligations and rights.

Step #3 – Establishing priorities

Establishing priorities is essential for catch up bookkeeping. Organizing critical tasks based on urgency and impact can help you manage financial records more efficiently.

Here’s how you might want to prioritize some critical tasks.

- Reconciling bank accounts, credit cards, and other financial accounts might be given top priority, as it ensures that recorded transactions match actual bank statements, reducing the risk of errors and discrepancies in financial reporting.

- Categorizing expenses accurately is crucial for tracking spending patterns, budgeting, and tax preparation. Prioritize categorizing expenses based on their frequency and significance to the overall financial picture.

- Updating financial statements, including income statements, balance sheets, and cash flow statements, is essential for gaining insights into the business’s financial state. Prioritize updating financial statements to reflect the most current financial data accurately.

For example, a small business owner is catching up on bookkeeping tasks for the past six months. They might prioritize reconciling bank accounts for accuracy in cash flow, categorizing expenses to understand where money is being spent most, and updating financial statements to assess current profitability and financial position.

Step #4 – Categorizing business expenses and income

Accurate categorization of expenses and income is essential for meaningful financial analysis and reporting. Here’s how businesses can categorize their activities.

- Identify common categories

Define common expense categories such as utilities, rent, salaries, supplies, advertising, and travel expenses. Similarly, categorize income sources such as sales revenue, interest income, and investment gains. - Use subcategories

Break down major expense categories into subcategories for greater granularity and specificity. For example, under “utilities,” include subcategories for electricity, water, gas, and telecommunications expenses. - Allocate properly

Allocate expenses and income to the appropriate categories based on their nature and purpose. Avoid lumping unrelated transactions together, as this can distort financial reporting and analysis. - Update regularly

Review and update expense and income categories regularly to reflect changes in business operations, industry trends, or regulatory requirements.

Accurate categorization facilitates easier tracking, budgeting, and financial activities analysis, enabling businesses to make decisions based on relevant data and have an accurate financial health overview.

Step #5 – Reconcile accounts

Reconciling accounts is a fundamental aspect of catch up bookkeeping that ensures the accuracy and integrity of financial records. Here’s how to approach it.

- Match transactions

Begin by comparing bank statements with accounting records, such as general ledgers or transaction logs. Verify that all transactions in the accounting system match those listed on the bank statement. This process helps identify discrepancies, errors, or missing entries that may affect financial accuracy.

Suppose a business records a payment to a vendor in its accounting system. However, the bank statement doesn’t reflect the transaction. Reconciling accounts would involve investigating the discrepancy to ensure the payment was processed correctly. - Address outstanding items

Investigate any outstanding items, such as unreconciled transactions or discrepancies in balances, that arise during the reconciliation process. Promptly address these discrepancies to maintain financial integrity and accuracy in reporting.

In another scenario, if there’s a discrepancy in the balance between the accounting records and the bank statement, it’s crucial to identify the root cause. It could involve tracking down missing transactions, reconciling errors, or investigating fraudulent activity. - Resolve discrepancies promptly

In case you find discrepancies, you might want to take immediate steps to resolve them. Consider contacting financial institutions, correcting data entry errors, or looking for traces of fraudulent activity. Timely resolution of discrepancies helps prevent inaccuracies in financial reporting and ensures the reliability of financial statements.

Step #6 – Updating financial statements

Updating financial statements is a critical aspect of catch up bookkeeping, as it provides a business’s financial state outlook. Here’s how you can organize it.

- Review income statements

You might want to start by reviewing the income statement. This statement summarizes revenues, expenses, and profits over a specific period. Ensure that all income and expenses are accurately recorded and categorized.

For instance, if the business has incurred additional expenses during the catch-up period, such as unexpected repairs or marketing campaigns, these should be reflected in the income statement. - Balance sheet analysis

Analyze the balance sheet to assess the company’s financial position at a specific point in time. Review assets, liabilities, and equity (including owner distributions) to ensure they reflect the current state of the business. Verify that all accounts are reconciled and accurately classified.

For example, if the business has taken out a new loan or acquired assets during the catch-up period, these transactions should be reflected in the balance sheet. - Cash flow statement update

Update the cash flow statement to track the inflow and outflow of cash during the catch-up period. Analyze operating, investing, and financing activities to understand how cash is generated and used by the business. You might want to ensure that cash flow projections are realistic and reflective of actual financial activities.

If the business experiences significant fluctuations in cash flow during the catch-up period, such as seasonal variations or unexpected expenses, these should be reflected in the cash flow statement. - Ensure compliance

Verify that financial statements comply with accounting standards and regulatory requirements. Double-check calculations, disclosures, and formatting to ensure accuracy and transparency in financial reporting. - Compare periods

Compare updated financial statements with previous periods to identify trends, patterns, and areas for improvement. Analyze key performance indicators (KPIs) to assess financial stability, profitability, and growth prospects.

Effective organization of catch up bookkeeping is crucial for businesses to understand their finances, make decisions based on correct data, and meet legal requirements. Businesses can see where they stand financially, plan ahead, and avoid problems with taxes and regulations. Organized bookkeeping also helps run smoother and predict what’s coming, making it easier to grow and succeed in the long run.

Important step – Seek professional assistance by turning to accounting services

Seeking professional assistance for catch up bookkeeping is a smart move for businesses facing financial complexities or struggling with record-keeping. Professional accountants and bookkeepers offer expertise and experience, ensuring accurate and compliant financial records. They use advanced tools and efficient processes to streamline tasks, saving time and minimizing errors. By outsourcing catch up bookkeeping, businesses can focus on core activities while professionals handle intricate financial details, reducing the risk of penalties and legal issues.

Moreover, professional accountants provide strategic insights and guidance, helping businesses make informed decisions to improve profitability and cash flow. They stay updated on tax laws and regulations, ensuring compliance and mitigating the risk of audits or disputes. Outsourcing catch up bookkeeping allows businesses to concentrate on growth opportunities and customer service, ultimately driving long-term success and stability

How can businesses streamline their bookkeeping?

Streamlining the catch up bookkeeping process is essential for efficiency and accuracy. Here are actionable tips and strategies to streamline your catch up bookkeeping efforts:

Utilize accounting software

Investing in advanced tools like Microsoft Copilot for accounting software is crucial for modernizing your financial management processes, offering new levels of efficiency and insight. This software can drastically change how you handle accounting tasks, offering efficiency, accuracy, and scalability. This way, it isn’t just about embracing technology—it’s about optimizing your financial processes to drive business growth.

- Choosing the right software

You might consider popular options like QuickBooks, Xero, or FreshBooks, known for their comparative ease of use and comprehensive features, catering to the needs of businesses of various characters and sizes – from freelances to small and medium-sized companies, working in different industries – from service to SaaS to ecommerce. They streamline tedious tasks like data entry and reconciliation, saving time and minimizing errors.

- Automating tedious tasks

With accounting software, transactions can be automatically imported from bank feeds, sales channels, payment gateways, POS systems, and more, reducing manual data entry and simplifying reconciliation. This automation ensures ultimate accuracy in your financial records.

- Effortless report generation

One significant advantage of accounting software is its ability to generate various financial reports effortlessly. Whether it’s balance sheets, income statements, or cash flow statements, these reports offer valuable insights into your business’s financial health with just a few clicks.

- Integration and customization

You might want to choose software that aligns with your business needs and, which is no less significant, integrates with your existing systems. For instance, if you run an ecommerce business, prioritize software that integrates with your online store platforms, payment processing systems, ecommerce marketplaces, etc., for smoother operations.

Want to learn how to make the most of your accounting software integrations and make your life easier as a business (and earn kudos from your accountant)? Hop on our Weekly Public Demo to see how to do it with Synder, or explore it yourself with a 15-day all-inclusive free trial.

Outsource non-core tasks

Consider outsourcing non-core bookkeeping tasks to professional accounting services. Outsourcing allows you to focus on core business activities while ensuring that bookkeeping tasks are handled by skilled professionals.

Automate regular reviews

Schedule regular reviews of financial records to identify any discrepancies or anomalies promptly. Set up automated alerts and notifications within your accounting software to flag potential issues or irregularities.

Implement internal controls

Establish internal controls to safeguard against errors, fraud, and misuse of financial resources. Segregate duties, limit access to sensitive information, and implement approval processes for financial transactions.

Conduct periodic audits

Perform periodic audits of your financial records to validate the accuracy and integrity of data. Audits provide assurance that financial statements reflect the true financial position of the business and comply with regulatory requirements.

Invest in training and education

Continuously invest in training and education for your finance team to stay updated on accounting principles, regulations, and best practices. Knowledgeable and skilled staff are essential for maintaining accurate financial records.

By implementing these strategies, businesses can streamline their catch up bookkeeping process, enhance efficiency, and ensure the reliability of their financial information. Streamlined bookkeeping practices contribute to informed decision-making and long-term business success.

Bottom line

As you can see, catch-up bookkeeping helps businesses regain control over their financial records, ensuring accuracy, compliance, and informed decision-making. It allows them to rectify neglected or disorganized financial data, ensuring compliance with regulations and providing a clear picture of their financial health.

However, while catch-up bookkeeping can help retain control over finances, hiring an accountant may be a better long-term solution. Accountants geared with the right software can automate time-consuming and error-prone bookkeeping tasks, provide accurate reporting, and offer valuable insights for financial data analytics. They become trusted partners in managing finances and growing businesses effectively.

Share your thoughts

Share your thoughts and experience in the comments section below. We’re fond of good stories!

![All You Want to Know About Donation Receipts [Synder Guide]](https://synder.com/blog/wp-content/uploads/sites/5/2022/12/all-you-want-to-know-about-donation-receipts-1-260x195.jpg)

.png)