Understanding owner distributions is crucial for businesses as it directly impacts their financial health, shareholder relations, and long-term viability. They indicate a company’s profitability, stability, and commitment to delivering value to its stakeholders.

Today, we suggest exploring owner distributions, their mechanics, tax implications, legal considerations, and their role in financial planning. Hop on reading!

Key takeaways

- Owner distributions indicate a company’s financial health and commitment to delivering value to its shareholders. Consistent distributions can instill confidence among investors and lenders, signaling stability and a focus on shareholder returns.

- It’s crucial to differentiate between owner distributions and salaries or wages. While the latter is compensation for work performed, owner distributions represent returns on investment or ownership stakes in the business. Understanding this distinction helps clarify tax treatment and financial reporting.

- Prudent distribution practices can enhance investor confidence and support capital-raising efforts. By demonstrating responsible financial management and a commitment to shareholder value, companies with a consistent history of distributions are more likely to attract investors and secure financing for future growth and expansion.

What is owner distribution?

Let’s start with defining owner distributions.

Owner distribution refers to the money or assets a business’s owners take out of the company for themselves.

These distributions are essentially payments to the owners for their investment in the business or as a reward for their ownership.

Let’s look at how it works. When a business makes a profit, the owners may decide to take a part of it out of the company for themselves. It can happen regularly or at specific times, depending on the company’s policies and financial situation.

Owner distributions can take different forms, such as cash payments, shares of stock, or other business assets, being a way for owners to reap the benefits of their investment in the business.

Owner distribution vs. owner’s draw

Speaking about business structures like sole proprietorships, partnerships, and certain types of pass-through entities such as LLCs, owner distributions are usually called owner’s draws. Owner’s draws represent the direct withdrawal of funds or assets for the business owner’s personal use or expenses.

We usually record owner’s draws as reductions in the owner’s equity or capital accounts within the company’s financial records. This distinction helps differentiate owner’s draws from formal distributions of profits or dividends, which may occur in other business structures like corporations.

Owners need to understand this terminology to ensure accurate financial reporting and compliance with tax regulations. Working closely with accountants or financial advisors can help owners properly manage and document their draws following accounting standards and tax laws.

How do distributions differ from salaries or wages?

It’s important to note that owner distributions are not the same as salaries or wages.

- Owner distributions

Owner distributions represent profits or assets that business owners, such as shareholders or partners, receive from the company. These distributions are not tied to the day-to-day operations or labor performed by the owners. Instead, they reflect the return on their investment or ownership stake in the business. Essentially, they’re a way for owners to share in the company’s success by receiving a portion of its profits.

Owner distributions, as mentioned, are typically taken periodically or as determined by the owners based on the company’s profitability and financial health.

From an accounting perspective, owner distributions are recorded as reductions in the owner’s equity section of the balance sheet.

- Salaries or wages

Salaries and wages, on the other hand, are payments made to the business’s employees in exchange for the work they perform. Unlike owner distributions, salaries and wages are compensation for the time, skills, and effort employees contribute to the company’s operations.

The amounts paid in salaries or wages are typically agreed upon between the employer and the employee and vary based on the job role, experience, and performance.

In accounting, salaries and wages are considered expenses for the business and are recorded as such on the income statement.

In simple terms, while employees get paid for their work, owners receive distributions as a return on their investment in the company.

It’s also worth mentioning that not all profits are distributed to owners. Some profits might be reinvested back into the business for things like expansion, equipment upgrades, or paying off debts. The decision on how much to distribute to owners versus reinvesting in the business depends on various factors, including the company’s financial goals and obligations.

Owner distribution is what type of account?

You might want to know how to account for owner distributions correctly. In other words, under which account do you need to record them? At this point, let’s recall what accounts are in accounting and then delve into the type of accounts to which owner distributions typically belong.

What are accounts in accounting?

In accounting, we speak of accounts as the fundamental units for organizing and tracking financial transactions within a business. These accounts form the backbone of a company’s financial reporting system, enabling accurate recording, classification, and analysis of monetary flows and resource allocations.

Accounts typically fall into several categories based on the nature of the transactions they capture. These categories include assets, liabilities, equity, revenues, and expenses. Each account category plays a specific role in reflecting various aspects of a company’s financial position, performance, and activities.

In what account type distributions belong?

Now, back to owner distributions, they find their place within the equity accounts category.

Equity accounts represent the ownership interests and claims of shareholders or proprietors in the business. These accounts show the value of assets that remain after accounting for liabilities.

By allocating owner distributions to specific equity accounts, businesses can accurately track the flow of resources to owners while maintaining clarity and transparency in their financial records.

How can you find owner distributions in financial statements?

In financial statements, therefore, owner distributions appear in the equity section alongside other types of equity. This section gives an overview of the company’s ownership structure, delineating the owner’s claims on the company’s assets and earnings.

It is worth noting that sometimes, owner distributions appear in the equity section as dividends paid. It can happen when the distributions come exclusively as cash payments. Owner distributions encompass a broader spectrum of payments made to owners, including dividends but also other forms of distributions, such as bonuses, stock repurchases, or draws in partnerships.

While we’re here, let’s look at other equity types that you can find in financial statements alongside owner distributions.

- Common stock

Common stock represents the initial capital contributed by shareholders to the company in exchange for ownership rights. It reflects the par value or the amount paid per share for the company’s common stock. - Preferred stock

Preferred stock is a type of equity that typically carries preferential rights over common stock in terms of dividends and liquidation preferences. It represents ownership in the company but often with specific privileges attached, such as priority in dividend payments. - Additional paid-in capital

Additional paid-in capital, also known as contributed capital over par value, reflects the amount of capital contributed by shareholders above the par value of the company’s stock. It represents the premium paid by investors for acquiring shares beyond their nominal value. - Retained earnings

Retained earnings represent the cumulative net income or profits retained by the company after paying dividends to shareholders. It reflects the portion of earnings reinvested back into the business for growth, expansion, or debt reduction. - Treasury stock

Treasury stock represents shares of a company’s stock that it has repurchased from the open market. It is recorded as a reduction in shareholders’ equity and reflects the company’s investment in its own shares. - Accumulated other comprehensive income (AOCI)

AOCI includes gains and losses that have not yet been realized or included in net income. These items, such as unrealized gains or losses on available-for-sale securities or foreign currency translation adjustments, are recorded in the equity section until they are recognized in the income statement. - Stock options and equity compensation

If the company issues stock options, restricted stock units (RSUs), or other forms of equity-based compensation to employees or executives, the value of these instruments may be reflected in the equity section.

Do you pay taxes on distributions?

What you need to know about owner distributions, as a business owner, is the tax implications for both business owners and the company itself. Let’s take a quick look at taxation related to owner distributions and explore strategies for optimizing tax liabilities.

Owners pay taxes on distributions received from the company

So, owners are typically subject to taxes on distributions received from the company. The taxation of owner distributions varies based on the business’s legal structure and the nature of the distributions.

For example, in a pass-through entity like a partnership or S corporation, owners report their share of business profits and losses on their personal tax returns, and they are taxed accordingly on any distributions received.

What is the tax treatment for owner distributions compared to other forms of income?

We mentioned that owner distributions differed from salaries and wages. Therefore, their tax treatment also varies from that of other income forms.

While salaries and wages are subject to income tax withholding and payroll taxes, owner distributions belong to individual-level taxes based on the owner’s personal tax rate.

Moreover, owner distributions from certain types of entities, such as S corporations, may have implications for self-employment taxes. Distributions from C corporations may be subject to double taxation, where the corporation pays taxes on its profits, and shareholders are taxed again on distributions received.

Additionally, owner distributions may be treated differently for tax purposes depending on whether they represent a return of capital, a distribution of profits, or a combination of both.

Understanding the tax treatment applicable to owner distributions is essential for effective tax planning and compliance. And here is where you’d fancy an accountant’s or tax professional’s help, so don’t skip it.

How to optimize tax liabilities?

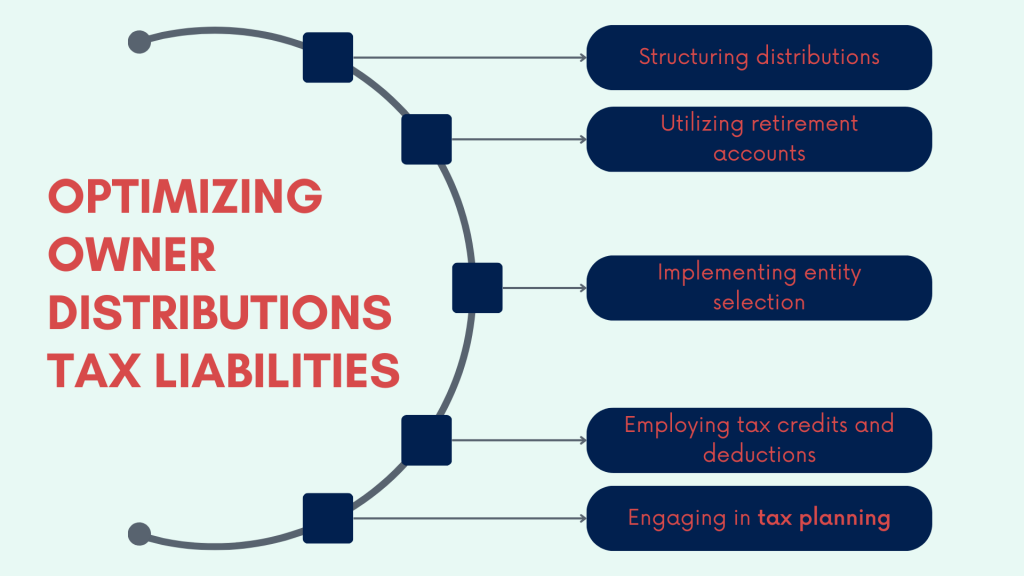

Several strategies can help business owners optimize tax liabilities associated with owner distributions. We’ll look at some of them just to understand the idea. But again, it’s what you’re paying your accountant for (if they do taxes) – their professional advice is your best strategy.

#1 – Structuring distributions wisely

Owners can strategically plan the timing and frequency of distributions to minimize tax liabilities. Coordinating distributions with their overall tax situation and considering marginal tax rates can help owners mitigate tax burdens while maximizing cash flow.

#2 – Utilizing retirement accounts

Business owners may explore options to contribute distributions to tax-advantaged retirement accounts, such as IRAs or 401(k) plans. Contributions to these accounts might reduce current tax liabilities while allowing for tax-deferred retirement savings growth.

#3 – Implementing entity selection

Choosing the appropriate business structure can have significant implications for tax treatment. Consulting with tax professionals to assess the pros and cons of different entity types, such as partnerships, S corporations, or limited liability companies (LLCs), can help optimize tax efficiency and liability management.

#4- Employing tax credits and deductions

Owners might consider leveraging available tax credits and deductions to offset tax liabilities related to owner distributions. These may include deductions for business expenses, credits for research and development activities, or utilization of investment tax credits where applicable.

#5 – Engaging in comprehensive tax planning

Regular tax planning and consultation with tax advisors are essential for identifying opportunities to minimize tax exposure while ensuring compliance with tax laws and regulations. Proactive tax planning allows owners to navigate taxes effectively and decide on distributions and financial management wisely.

Understanding mechanics

Now, let’s delve deeper into how owner distributions work and the factors that influence them.

What factors influence the amount of owner distributions?

Several factors influence the amount of owner distributions, including the company’s profitability, cash flow, financial obligations, and strategic goals. Higher profits and healthy cash reserves generally allow for larger distributions, while financial commitments and growth initiatives may limit the amount available for distribution.

Company profits, cash flow, and financial health serve as crucial factors that influence the feasibility of owner distributions. Let’s explore these determinants in more detail.

#1 – Company profits

Profits represent the surplus funds generated by a company after deducting expenses from its revenues. Healthy profits indicate that the company’s operations are generating sufficient income to cover its costs and generate returns for its owners.

When a company is profitable, it has more resources available to allocate towards owner distributions. Profits are a primary source of funds for distributions, as they represent the financial rewards of the company’s activities.

#2 – Cash flow

Cash flow refers to the movement of cash into and out of a business over a specific period. It represents the net amount of cash generated or consumed by the company’s operations, investments, and financing activities.

Strong cash flow is essential for supporting owner distributions because it ensures that the company has sufficient liquidity to meet its financial obligations and fund distributions to owners. Positive cash flow indicates that the company is generating more cash inflows than outflows, providing the financial flexibility to support distributions without jeopardizing its operations.

#3 – Financial health

Financial health encompasses the overall company’s stability and solvency, reflecting its ability to meet its financial obligations and sustain its operations over the long term.

A sound financial position is critical for supporting owner distributions because it instills confidence in investors, creditors, and stakeholders regarding the company’s ability to honor its commitments and maintain operational stability.

Factors contributing to financial health include manageable debt levels, adequate liquidity, strong profitability, and effective risk management practices.

How to determine owner distribution amount?

Determining the amount of owner distributions or owner’s draws involves assessing various financial factors and personal needs. While there isn’t a specific formula like you might find for other financial calculations, you still can approach it systematically. Here’s a simplified process.

- Assess financial health

Review the company’s financial statements, including the balance sheet, income statement, and cash flow statement, to understand its financial health and profitability. - Consider profitability

Evaluate the company’s profitability by analyzing its net income and operating performance. Determine the portion of profits available for distribution after accounting for expenses, taxes, and other financial obligations. - Evaluate cash flow

Assess the company’s cash flow position to ensure sufficient liquidity for ongoing operations and financial commitments. Consider factors such as cash reserves, accounts receivable, and accounts payable. - Assess personal financial needs

Consider your personal financial needs and obligations outside the business, such as living expenses, savings goals, debt repayments, and taxes. Determine the amount required to cover personal expenses and achieve financial goals. - Balance business and personal needs

Strike a balance between the financial needs of the business and your personal financial requirements. Consider the impact of the distribution or draw on the company’s financial stability and growth prospects. - Set a reasonable amount

Based on the profitability assessment, cash flow, and personal financial needs, determine a reasonable amount for the owner distribution or draw. Consider setting aside a portion of profits for reinvestment in the business to support future growth and expansion. - Document the decision

Document the decision-making process and rationale for the distribution or draw. Maintain transparency and accountability in financial decision-making.

How to record the owner’s distribution or owner’s draw withdrawal in accounting

Now that you have figured out how much you might want to withdraw as owner distribution, you need to record this withdrawal in accounting. Recording owner’s distributions or owner’s draws in accounting involves creating journal entries to reflect the withdrawal from the business.

Here’s how you can do it, simply put.

- Identify the transaction

Determine the date and amount of the owner’s distribution or draw withdrawal. - Debit the owner’s draw or distribution account

Debit the owner’s draw or distribution account to decrease the balance. This account represents the amount to be withdrawn by the owner for personal use or expenses. - Credit the cash account

Credit the cash account to reflect the decrease in the company’s cash balance resulting from the owner’s withdrawal. This entry represents the funds leaving the business. - Record the journal entry

Create a journal entry to record the transaction, including the date, accounts debited and credited, and the withdrawal amount. - Document the transaction details

Document the purpose of the withdrawal and any other relevant information for record-keeping and audit purposes.

Let’s look at an example of a journal entry to record an owner’s distribution or draw withdrawal.

- Date: [Date of Withdrawal]

- Description: Owner’s Distribution/Draw Withdrawal

- Debit: Owner’s Draw or Distribution Account [Amount Withdrawn]

- Credit: Cash Account [Amount Withdrawn]

For example, if the owner withdrew $5,000 as a distribution or draw from the business, the journal entry would look like this:

- Date: January 31, 20XX

- Description: Owner’s Distribution Withdrawal

- Debit: Owner’s Draw Account $5,000

- Credit: Cash Account $5,000

You might want to ensure the journal entry is accurate and documented to maintain transparency and compliance with accounting principles. It’s also critical to regularly reconcile bank statements and accounting records to verify the accuracy of financial transactions and maintain financial integrity.

Balancing owner’s distribution with business needs

Balancing owner distributions with the needs of the business requires careful consideration and strategic planning. Here’s how businesses can do it.

Striking a balance between distributing profits and retaining capital

Businesses face a crucial decision when balancing the distribution of profits to owners and retaining capital for future needs. To strike the right balance, they need to consider several factors.

Factor #1 – Financial position

Assessing the company’s financial position involves analyzing its current assets, liabilities, and stability. A company with healthy financial metrics, such as substantial cash reserves and manageable debt levels, may have more flexibility to distribute profits to owners without jeopardizing its financial health.

Factor #2 – Growth prospects

Evaluating growth prospects entails examining the company’s market opportunities, competitive landscape, and potential for expansion. Businesses operating in growing industries or with innovative products may prioritize reinvesting profits to fuel growth initiatives, such as research and development, marketing campaigns, or geographic expansion.

Factor #3 – Capital requirements

Understanding capital requirements involves identifying the financial resources needed to support ongoing operations, investments, and strategic initiatives. Businesses must assess their short-term and long-term capital needs, including funding for inventory, equipment purchases, facility expansion, and technology upgrades.

Factor #4 – Aligning short-term returns with long-term sustainability

Finding the appropriate balance between distributing profits and retaining capital requires careful consideration of short-term returns versus long-term sustainability and growth objectives. While distributing profits may provide immediate returns to owners, retaining capital can bolster the company’s financial resilience and support future growth opportunities.

For example, a startup in the technology sector may choose to reinvest a significant portion of its profits into research and development to enhance product innovation and stay competitive in the market. By prioritizing long-term sustainability over short-term returns, the company aims to position itself for continued growth and success.

A mature company with an established market presence and stable cash flows may opt to distribute a portion of its profits to shareholders while retaining sufficient capital to fund routine operations and strategic investments. This balanced approach allows the company to reward shareholders while preserving financial flexibility and mitigating risk.

What are some best practices for managing owner distributions?

Implementing best practices for managing owner distributions is essential for financial stability and long-term growth promotion. Let’s explore these practices in more detail:

#1 – Maintaining a conservative approach to distributions

Adopting a conservative approach to distributions might involve prudence and caution when disbursing profits to owners. Rather than distributing all available profits, businesses should retain a portion as a financial cushion to weather unexpected challenges or capitalize on growth opportunities.

For example, a manufacturing company may set aside a part of its profits to build reserves for equipment maintenance, inventory replenishment, or economic downturns. By maintaining a conservative stance, businesses can enhance their financial resilience and mitigate the risk of liquidity shortages.

#2 – Conducting regular financial assessments

Regular financial assessments are vital for evaluating the company’s financial performance, identifying trends, and assessing its capacity for owner distributions. These assessments involve analyzing key financial metrics, such as revenue growth, profitability, cash flow, and liquidity ratios.

Businesses should conduct periodic reviews of their financial statements, cash flow forecasts, and budgetary projections to assess the feasibility of owner distributions. By monitoring financial performance closely, businesses can make informed decisions about the timing and magnitude of distributions while identifying areas for improvement or risk mitigation.

#3 – Aligning distribution policies with strategic objectives and financial projections

Aligning distribution policies with strategic objectives and financial projections might ensure that distribution decisions are consistent with the company’s long-term goals and financial outlook. At this point, you might want to consider your growth plans, capital investment needs, and shareholder expectations.

For example, a technology startup focused on rapid expansion may prioritize reinvesting profits into product development and market expansion initiatives, deferring significant distributions to shareholders in favor of fueling growth. On the contrary, a family-owned business nearing retirement may opt for more substantial distributions to provide income for owners in their later years.

So, aligning distribution policies with strategic objectives might help businesses balance rewarding owners and preserving capital for future growth opportunities.

How do distributions impact the company’s ability to raise capital or attract investors?

Owner distributions play a crucial role in shaping investor perceptions and influencing the company’s ability to raise capital. Let’s delve deeper into how owner distributions impact capital raising and investor confidence

Signaling financial health and stability

Owner distributions serve as indicators of the company’s financial health and stability. When a company consistently distributes profits to its owners, it signals that the business is generating healthy returns and has sufficient cash flow to support distributions.

For example, a company that regularly pays dividends to its shareholders demonstrates financial strength and stability, which can instill confidence among potential investors and lenders.

Demonstrating commitment to shareholder value

Owner distributions reflect the company’s commitment to delivering value to its shareholders. By returning profits to owners, the company acknowledges shareholders’ investment and seeks to reward them for their support and participation in the business.

Companies that prioritize shareholder value through prudent distribution practices are more likely to attract investors who are seeking reliable returns and long-term growth prospects.

Enhancing investor confidence

Prudent distribution practices can enhance investor confidence by demonstrating responsible financial management and a commitment to sustainable growth. Investors are more inclined to invest in companies that demonstrate transparency, accountability, and a track record of delivering returns to shareholders.

For instance, a publicly traded company that maintains a consistent dividend policy and provides clear communication about its financial performance and distribution plans can foster trust and confidence among investors, thereby facilitating capital-raising efforts.

Supporting capital-raising efforts

Owner distributions can support capital-raising efforts by attracting investors who are seeking income-generating opportunities or long-term investment prospects. Companies with a history of prudent distribution practices may find it easier to access capital markets, secure financing, or negotiate favorable terms with lenders.

Being able to generate consistent returns for shareholders through distributions can enhance the company’s valuation and market perception, making it a more attractive investment opportunity.

Bottom line

Long story short, owner distributions are worth your attention as a business owner (no mattew whether you’re a SaaS startup, a retail company, or an Amazon Marketplace seller). By understanding their nuances and doing them right, businesses can demonstrate their financial health, commitment to shareholder value, and readiness to attract investors and raise capital.

Distinguishing owner distributions from salaries and wages also clarifies tax treatments and financial reporting, ensuring compliance and transparency in financial operations.

Businesses should consider best practices in managing owner distributions, optimizing tax liabilities, and aligning distribution policies with strategic objectives. Implementing these strategies can help approach owner distributions effectively, promote sustainable growth, and enhance shareholder value, making sound financial decisions that propel them toward long-term success and resilience in the marketplace.

Share your thoughts

Share your thoughts and experience in the comments section below. We’re fond of good stories!

.png)