Pay is a very tangible medium between an employer and an employee. It’s like a rope that holds them together: the stronger the connection, the stronger the working alliance. As a result, payroll is the very part of business operations that’s equally crucial to both parties, which is why investing in a reliable management system for your payroll needs is so important.

We’ll review the key areas of payroll management and ideas for enhancing the process. And we’ll also look at software solutions as the most powerful remedy to payroll issues for small and medium business owners.

If you’re curious how to connect your accounting software with the Gusto payroll system using Synder, sign up for a free trial or book a demo.

Contents:

2. Errors and mistakes in how you manage your payroll

3. Payroll management before employing your first employee

4. The system of managing payroll for small and medium businesses

5. In-house payroll services team

6. Third-party payroll professionals

7. Payroll management software: What aspects of payroll administration does it handle?

8. Types of software for managing payroll

What is payroll?

By definition, payroll is the process of paying employees or independent contractors for the work they did during a given period of time. It also includes fulfilling payroll tax requirements and payments to the service providers responsible for various employee benefits.

A payroll system usually comprises keeping payroll records, collecting timesheets, calculating and distributing salaries, following your payroll policy, and preparing financial reports for employees and stakeholders with a breakdown of payments, taxes, bonuses, overtime, holiday pays, etc.

Errors and mistakes in how you manage your payroll

Errors, whether they occur during calculations or in payroll records, can lead to wrong net pay issued to employees or incorrect amounts of taxes paid to the government. Both options are totally undesirable and costly for a business. Moreover, in accounting, payroll goes into your business expenses, so proper management of payroll directly affects the accuracy of your accounting.

According to The Workforce Institute research, an estimated 82 million Americans – more than a half of the U.S. workforce – have experienced a problem with their paycheck during their career. This often happens because employers lack the necessary skills or enough knowledge in payroll management. The good news is, those gaps can be filled with proper training, outsourced help, and reliable software.

Payroll tax penalties

It can’t be emphasized enough how critical it’s for businesses to keep abreast of the myriad of the IRS compliance and other government agencies’ rules and regulations. The potential cost for companies that fail to meet deadlines or miss filing certain forms altogether can be devastating, especially for smaller businesses.

Late or inaccurate salary payments can result in falling under IRS penalties. According to the IRS, around 40% of small and medium businesses end up paying payroll penalties. Apart from affecting the finances, improper management of payroll negatively affects the reputation of a business and increases employee turnover. That’s why with tax matters, it’s always prudent to consult with a tax advisor, particularly when you’re just starting out.

Read our guide on IRS audit red flags & how to avoid getting tax audited by the IRS.

State and federal payroll taxes

Make it a mandatory element of your ongoing processes to review and know your State and Federal payroll tax regulations and changes. By being fully informed and up to date, you and your staff will avoid a significant amount of costly mistakes and delays.

To stay on top of various aspects of tax-related matters, the IRS has a helpful tool – Online Tax Calendar with reminders that’ll notify you about due dates, not only related to payroll but also tax dates in general. You can set reminders one or two weeks in advance to give yourself enough time to prepare the forms and documents.

In summary, improper management of payroll results in multiple issues for the employer such as inaccurate expenses in accounting, IRS payroll tax penalties, loss of key talent, high staff turnover, and even reputation problems. For an employee, payroll issues create financial difficulties, unnecessary stress, a strained work environment, and even a necessity to look for a more reliable workplace.

To get ahead with your tax management, check the IRS employment tax due dates click here.

Payroll management before employing your first employee

Payroll duties begin even before a person enters a work contract with your business. Deciding on the salaries, possible benefits, insurance plans, policy documents, and contracts – all those tasks should be ready before you start your first round of interviews.

You’ll need to have a good understanding of what personal information should and can be collected during the onboarding process. Data protection and handling of this sensitive information are usually regulated by the respective laws.

Appropriate IRS forms need to be collected during the hiring process: for an employee, it’s a W-4 form, while for an independent contractor (if the amount paid for the services is more than $600) it’s a W-9 form.

Different tax laws apply depending on the country or state, so if you’re hiring employees from outside of your location, you need to be aware of the appropriate payroll taxes and employment laws. This becomes even more important in the current economic climate, where more and more people choose the remote model of work.

The system of managing payroll for small and medium businesses: How to make your management of payroll effective

We’ve established how critical a proper payroll system is. Now let’s find ways in which a solid payroll management system can be created and effectively handled.

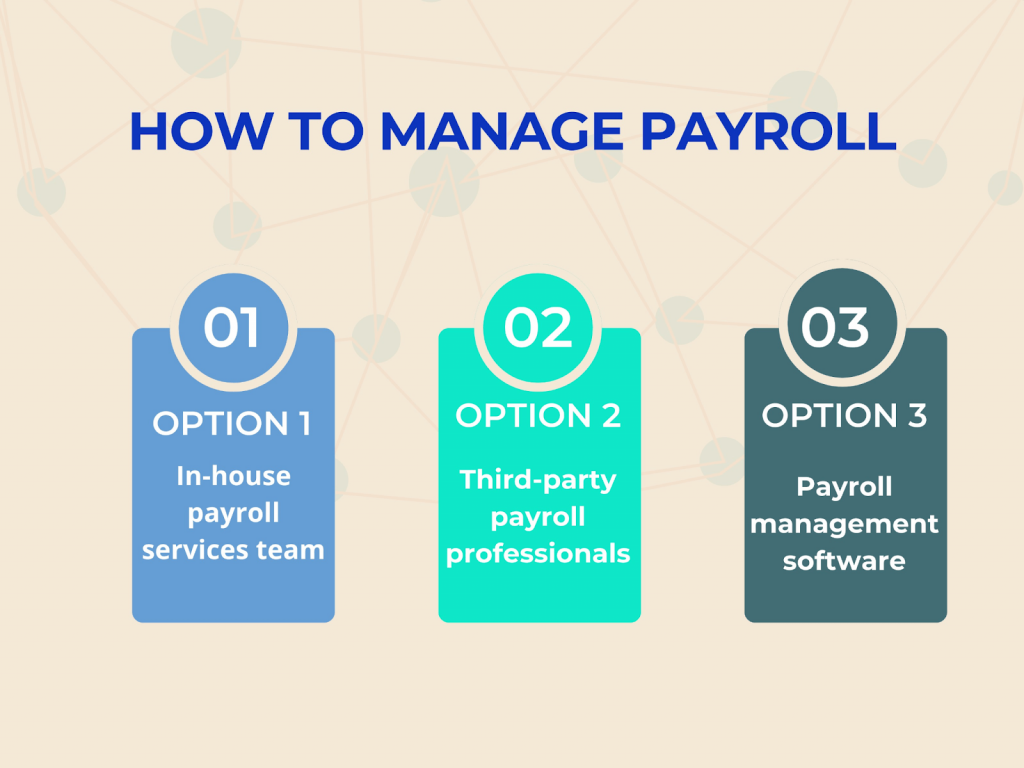

What choices do small and medium business owners have? There are several options at your disposal. We’ll provide a short overview of different types of payroll systems.

The first step is the evaluation of your payroll needs and your current payroll system. In other words, you assess where you’re currently in your business journey and where you expect to be in the next year or two.

Managing your payroll may be stressful if you aren’t a professional. So if you can delegate this task – consider it, as this is an investment that’ll pay out quickly. Consider all pros and cons for your business and decide whether to hire an in-house specialist or outsource payroll management to an external expert.

Relying on technology for the management of payroll is a great idea and – just stressing – whichever option you choose out of the bunch, payroll software will always be a part of the solution.

Usually, as your company grows, so does the number of employees. And since your payroll needs will become more complex, you might need to consider different options that’ll help you manage the payroll administration better. So let’s review them.

In-house payroll services team

When you’re running a small business, having a payroll department is obviously not your ultimate necessity. What you probably need is a single employee who can handle both payroll and human resources (HR) tasks. The fact that the same team members will be fulfilling different roles is commonplace with small businesses and startups.

Usually, in-house payroll specialists are also responsible for the overall HR, as these tasks intersect. Many of the onboarding tasks can be coordinated with the payroll, for instance, collecting IRS forms, updating personal information, or recording work relationship types (i.e. an employee or independent contractor).

Conduct regular training and education for your payroll management staff

One of the challenges facing payroll specialists and business owners who run payroll themselves is the ever-changing environment. Employment and labor laws change quite often. Moreover, not only does the federal government introduce specific payroll requirements, but also each state has a unique set of payroll rules, regulations, and procedures.

Ensuring that your business is compliant with the changes is critical, as even an inadvertent violation of payroll laws can tangibly hit your company and you as a business owner. Thus, ongoing education is essential for successful payroll management.

You can inquire about payroll education with the American Payroll Association, for example, or other organizations of the kind. Besides, many payroll and labor courses are available across the country, so you can easily find the one that suits you. And this will be an investment worth every penny.

Third-party payroll professionals

Getting outside assistance is more suitable if you can’t afford a full-time specialist yet, but need someone to handle the end-of-month payroll calculations. Usually, this payroll outsourcing option can be more beneficial for small companies with few employees.

However, that’s not the only reason to choose third-party payroll professionals as those work alliances can provide a business owner with much more than just payroll services.

You can browse Synder’s Accountants Directory and find a reliable specialist that will help you nail payroll management.

Payroll management with PEO

PEO is a special system that stands for Professional Employer Organization, where your payroll and many of your HR operations are handled by a third party that becomes a co-employer with you. It’s a unique type of business relationship that comes with certain advantages.

Since PEO shares employer status with you, it also shares the legal burden. Moreover, when filing tax forms, they’ll use their own Employer Identification Number (EIN), which further safeguards your business.

PEO are usually large companies so their access to insurance plans and other services and benefits comes at much better pricing than you as a small or medium business employer will be able to get.

Even though PEO shoulders a lot of payroll and HR responsibilities, you’ll still be in charge of all day-to-day tasks of your employees as well as decisions regarding hiring or letting off of your staff members.

If those services seem like a good fit for your business, for added security, choose the PEO that’s certified with the IRS.

Manage payroll with PSP

Another form of third-party payroll assistance is PSP, which stands for Payroll Service Provider. This type of business relationship doesn’t include legalities similar to PEO.

PSP is an external service provider that deals with your business payroll, and depending on the company, it can also offer some HR services.

With PSP, you simply enroll the payroll services of a third party, as you’d do with any other parts of your business, and they’ll handle the assigned tasks.

If your employees have any questions regarding their payroll, they’ll still need to contact you for this information. If any taxes are filed incorrectly, you’ll be the one bearing responsibility.

Of course, if you work with a reliable PSP, you should expect their payroll services to be accurate and trustworthy. But let’s stress once again: the legal burden here lies only with the employer.

3 ways a payroll service helps to keep your paychecks accurate and save your business money.

Payroll management software: What aspects of payroll administration does it handle?

When managing payroll, your primary partner is software, as no business owner should really calculate salaries, deductions, and taxes manually.

Payroll management software is a type of computer program or application designed to automate and streamline the process of managing employee compensation and related financial tasks within an organization. It’s commonly used by businesses and HR departments to handle various aspects of payroll processing such as:

Management of employee information

Payroll software stores and manages employee information such as names, addresses, contact details, tax withholding forms (e.g., W-4 in the United States), and banking details for direct deposit.

Time and attendance management system

Many payroll systems integrate with time-tracking and attendance systems to accurately calculate hours worked and apply relevant pay rates, including overtime and shift differentials.

Salary calculation system

The software calculates employee wages or salaries based on predefined pay rates, hours worked, and any other compensation factors, such as bonuses or commissions, or employee engagement platform results

Management of tax deductions

Payroll software calculates and deducts income taxes, Social Security, Medicare, and other withholdings based on employee information and tax regulations in the respective jurisdiction.

Employee benefit deductions

It can also handle deductions for employee benefits like health insurance, retirement contributions, and other voluntary deductions.

Direct deposit

Payroll systems facilitate direct deposit of employees’ paychecks into their bank accounts, eliminating the need for physical paper checks.

Payroll taxes management

These systems often generate payroll tax reports and help organizations remain compliant with tax laws by automating tax calculations and submissions.

Compliance

Payroll software helps organizations comply with labor laws and regulations by automatically applying the appropriate rules and policies.

Reporting

Users can generate various reports related to payroll, such as earnings statements, tax forms (e.g., W-2s in the U.S.), and other financial reports for record-keeping and reporting purposes.

Self-service portals

Some payroll software solutions offer self-service portals for employees to access their payroll information, view pay stubs, and make changes to their personal details.

Integration

Many payroll systems can integrate with other HR and accounting software to provide a seamless flow of data across different functions of an organization.

Mobile access

Some payroll management software offers mobile apps or web-based access, allowing users to manage payroll-related tasks on the go.

Using payroll management software can significantly reduce the manual effort required for payroll processing, minimize errors, enhance compliance, and improve overall efficiency in managing an organization’s payroll functions. The specific features and capabilities of payroll software may vary depending on the vendor and the organization’s needs.

Types of software for managing payroll

Various types of payroll software can handle all of a business’s payroll processing and related tax filings and payments. There are plenty of options available on the market, so you can choose the one that offers the payroll services you need.

One of the top-rated and very popular payroll software among small businesses is Gusto. With this app, you can accomplish many of the payroll tasks. It lets you:

- automatically sync worked hours;

- calculate salary payments;

- amend fields for additional hours and earnings, sickness, and annual leave;

- automatically calculate and file all relevant taxes for your customers;

- keep track of changing tax laws and update the calculations accordingly.

Gusto also has a multitude of easy-to-use HR management tools and compliance features, over 3,500 health insurance plans, and time-tracking tools. Users can also set and customize public and company holidays, which can be integrated with: Google, Outlook, and iCal.

Find out more about payroll apps for small businesses.

Key takeaways on using software for payroll management:

It synchronizes payroll systems with accounting software

Good payroll software can automate many tasks and integrate with other business operations, like HR and accounting. Those solutions can make your business operations easier and less prone to errors, as data is automatically pooled from the different parts into one system. So your ideal software is part of a bigger system (part of your whole system) rather than a disjointed element.

Though accounting systems, such as QuickBooks or Xero, often allow for basic payroll tasks, they can lack some needed functionality for efficient payroll management. So many business owners prefer to use separate solutions for more comprehensive payroll. One of the options is Gusto.

It manages the system for your payroll and accounting

As it’s necessary to reflect the payroll in accounting, you still need to bring payroll records from Gusto to your books. To improve your business processes, you can leverage Gusto and Synder integration which will automatically synchronize your employee records with your accounting platforms (Xero/QuickBooks).

All you need to do is connect both platforms to Synder, do the mapping, and get your employees’ data automatically updated across them. The job of Synder is to act like a bridge, bringing all your data into one place, and seamlessly synchronizing information across different channels. But that’s just one of many Synder’s features.

This software ensures the accuracy of your employee or product data through its duplicate detection feature, Smart Rules, categorization, rollback, and much more. Synder can integrate with more than 25 different payment gateways (Stripe, PayPal, Square, or Afterpay) or sales platforms (Amazon, Etsy, Shopify, and many more) to ensure that all the most accurate data is in your accounting system. More integrations are regularly added based on the customers’ needs.

With Synder, you can get 6 months of Gusto subscription for free. The exclusive offer is valid till January 31, 2024.

Final words on how to manage payroll effectively

Payroll management is a crucial aspect of running a business, as it directly impacts both the financial well-being of the organization and the livelihood of its employees. Errors in payroll can lead to costly consequences, including financial penalties, dissatisfied employees, and even legal issues. Therefore, it’s imperative for business owners to allocate the necessary attention and resources to payroll management.

One effective approach is to handle payroll in-house with the assistance of reliable payroll management software and dedicated payroll staff. With the right software solution, businesses can streamline the entire payroll process, automating time-consuming tasks such as calculating wages, tax deductions, and benefit contributions. This automation not only saves time but also minimizes the risk of human errors, ensuring that employees receive accurate and timely compensation.

Furthermore, payroll management software is instrumental in ensuring compliance with tax regulations and labor laws. Tax laws can be complex and subject to frequent changes, making it challenging for businesses to stay up-to-date and avoid costly mistakes. Trusted payroll software can help organizations navigate this regulatory landscape by automatically applying the correct tax rates and deductions, generating tax reports, and facilitating timely tax submissions. Additionally, the software can aid in managing employee benefits, tracking leave balances, and providing employees with easy access to their pay information through self-service portals.

Whether managed in-house or outsourced to a payroll service provider, payroll management software plays a pivotal role in safeguarding the financial stability of a business and promoting employee satisfaction.

Automate now by signing up for a 15-day free trial with Synder or visit their Weekly Public Demo to learn about how this software can benefit your business.

.png)

Thanks for helping me understand that there are a lot of payroll software options out there that you can use for your business when it comes to processing the pay of your people and the tax filings and payments that you have to make. It seems like it can be a tedious task to do if you are not trained for those things, and errors can be easily made if you haven’t handled those types of jobs in the past. So I believe that it is better to have a professional in that kind of industry to handle your finances for you so that you can also avoid errors that can lead to lawsuits or penalties, especially when it comes to taxes.

Hi Mia, you’re very welcome, and I’m glad to hear that the information was helpful! You’ve made an excellent point about the complexities and potential pitfalls of payroll processing. Indeed, navigating the intricacies of payroll, along with the associated tax filings and payments, can be quite challenging without the proper training and experience. Leveraging payroll software can streamline these processes significantly, but as you rightly mentioned, the expertise of a professional in the field adds a valuable layer of security and accuracy. This approach not only minimizes the risk of errors but also ensures compliance with tax laws and regulations, thereby protecting your business from potential legal and financial consequences. Thank you for emphasizing the importance of professional oversight in these critical areas. It’s an insightful addition to the conversation!

One of the best posts I have ever come across. Not only did I learn a lot of hidden things, but I also got to know so many new things as well. Keep uploading and encouraging us.

Thank you for your kind feedback!