Accounting plays a crucial role in business by organizing and analyzing financial information. Setting up an accounting system is vital for businesses as it ensures orderly tracking of income, expenses, and other financial activities. The most significant benefit of an accounting system is its ability to provide clarity and transparency in financial operations, enabling informed decision-making and strategic planning for business growth and stability.

How to set up an efficient accounting system? Let’s find out.

Level up your accounting with smart automation! Integrate financial data from all your sales channels in your books to have always accurate records ready for reporting, analysis, and taxation. See it in action with a 15-day free trial or spare a spot at our weekly public demo to have your questions answered.

Understanding accounting system

Before diving into the setup of an accounting system, it’s crucial to grasp the fundamentals of what an accounting system entails and the various types available.

What is an accounting system?

An accounting system is a structured framework comprising processes, procedures, and controls designed to handle financial data collection, recording, classification, summarization, and reporting. Essentially, it’s like the engine that drives a company’s financial operations, ensuring accuracy, transparency, and compliance with regulatory standards.

The main goal of an accounting system is to provide a clear and accurate view of the company’s finances, like how much money it’s making, spending, and saving. This way, it helps business owners understand how well their business is doing financially, spot problems early on, and make decisions to improve profits and stability backed by accurate and correct numbers.

Related:

Reporting (P&L and Balance Sheet): A Feature Overview

Importance of setting up an accounting system for a business

Setting up an accounting system is important for businesses, regardless of size or industry. Here’s why:

Accurate financial tracking

An accounting system serves as the financial backbone of a business, meticulously recording and organizing all monetary transactions. It tracks income, expenses, assets, and liabilities in a systematic manner, ensuring that every financial move is accounted for. This accuracy is crucial for understanding the company’s financial health and making informed decisions about its future direction.

Informed decision-making

With reliable financial data at their fingertips, business owners and managers can make informed decisions to drive growth and profitability. By analyzing financial reports generated by the accounting system, they can identify trends, pinpoint areas of strength or weakness, and allocate resources effectively to maximize returns on investment.

Compliance with tax regulations

Tax compliance is a non-negotiable aspect of running a business, and an accounting system ensures adherence to tax regulations. Maintaining accurate records of income, expenses, and deductions throughout the year can help streamline the tax filing process and minimize the risk of errors or audits.

Insights into business performance

Beyond tax compliance and day-to-day operations, an accounting system provides valuable insights into overall business performance and profitability. A business can analyze financial metrics such as profit margins, cash flow, and return on investment to evaluate their success, identify improvement areas, and formulate strategies for long-term sustainability.

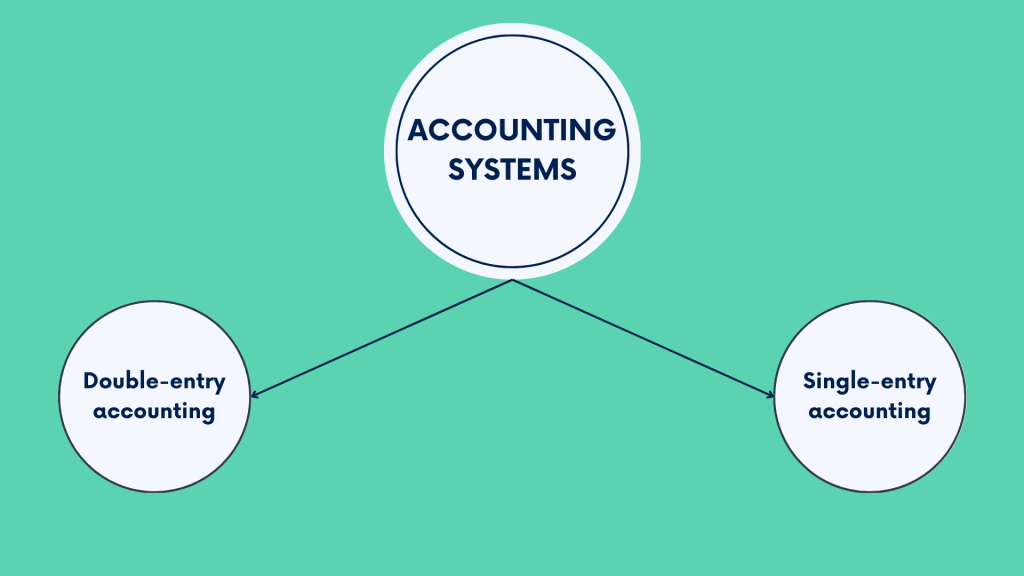

What are the different types of accounting systems?

Depending on the business’s characteristics and particular needs, a business may choose one of the following types of accounting systems: single-entry and double-entry accounting. Let’s look at them in more detail.

Single-entry system – a typical choice for small businesses, startups, and sole proprietors

The single-entry system supposes recording financial transactions only once, usually in a cash book or spreadsheet. In this system, each transaction is entered as a single line entry, indicating income or expense.

Single-entry accounting is often associated with cash accounting. Still, they’re not the same. In cash accounting, you record transactions based on when cash flows in or out of the business. It focuses on tracking actual cash receipts and payments, making it more straightforward than accrual accounting, where you record transactions when they occur, regardless of when the cash changes hands. While both methods can go with single-entry accounting, it’s more commonly associated with cash accounting due to its simplified nature and emphasis on cash transactions.

While the single-entry system offers simplicity and ease of use, it may not provide the detailed financial insights or comprehensive reporting capabilities of double-entry accounting.

Despite its limitations, the single-entry system remains a basic yet practical approach to accounting. It might suit businesses with straightforward financial structures (like small businesses, early stage startups, or sole proprietors), allowing them to track income and expenses efficiently while minimizing the administrative burden associated with more complex accounting methods.

Double-entry system – medium and large-size businesses’ choice

The double-entry system is an accounting practice favored and chosen by medium to large-sized businesses for its comprehensive approach to financial management. And for some businesses, double-entry accounting is an obligation.

The double-entry system records each financial transaction in at least two separate accounts. It ensures balance and accuracy in the books by adhering to the fundamental principle that every debit entry should come with a corresponding credit entry. This method maintains equilibrium and provides a holistic view of the company’s financial position, enabling businesses to generate more sophisticated financial reports, analyze performance trends, and make informed strategic decisions.

The double-entry system is often associated with the accrual accounting method. It offers greater flexibility and depth in financial analysis compared to single-entry accounting.

Understanding the distinctions between these accounting systems empowers businesses to select the approach that best aligns with their operational needs, scale, and complexity, laying the groundwork for effective financial management.

Related:

Accrual Accounting vs Cash Accounting: What Is the Difference Between Accrual and Cash Accounting?

Beyond Basic Bookkeeping: Setting the Stage for Success With Double-Entry Bookkeeping

Considerations when setting up an accounting system

Setting up an accounting system requires careful consideration of various factors to ensure its effectiveness and suitability for the business. Let’s take a closer look at the key considerations.

Size and complexity of the business

The size and complexity of the business play a crucial role in determining the type of accounting system needed. Small businesses may opt for simpler systems, while larger enterprises may require more robust solutions to handle extensive transactions and reporting requirements.

Industry-specific regulations and requirements

Different industries may have specific regulations and reporting requirements that businesses need to adhere to. A business might want to choose an accounting system that can accommodate these industry-specific needs and ensure compliance with relevant regulations.

Budget constraints

Budget considerations are important when selecting an accounting system. Businesses need to balance their financial resources with the features and functionality offered by various accounting software options. So, choosing a system that provides the necessary features within budgetary constraints seems a good idea.

Scalability and future growth

An accounting system should be scalable to accommodate the business’s growth and evolving needs over time. Businesses should consider whether the chosen system can scale up to handle increased transaction volumes, additional users, and expanded reporting requirements as the business grows.

Accessibility and security of financial data

Accessibility and security are critical factors when it comes to financial data. Businesses need an accounting system that provides secure access to financial information for authorized users while protecting sensitive data from unauthorized access or cyber threats.

How to set up your accounting system

Now that we’ve explored the considerations, let’s delve into the practical steps to set up an effective accounting system.

Step #1 – Assess your accounting needs

Begin by identifying the specific requirements and objectives of your business. Determine the key features and functionality you need from an accounting system to meet your business goals.

Step #2 – Choose accounting software

Select accounting software that aligns with your business needs, budget, and technical expertise. Consider factors such as ease of use, scalability, integration capabilities, and customer support when evaluating software options.

Step #3 – Set up a chart of accounts

Create a chart of accounts tailored to your business’s financial structure. Define categories to classify income, expenses, assets, liabilities, and equity, ensuring consistency and accuracy in financial reporting.

Step #4 – Establish financial procedures

Define clear and standardized processes for recording transactions, invoicing, bill payments, and payroll. Establishing financial procedures helps ensure consistency, accuracy, and efficiency in financial operations.

Step #5 – Implement internal controls

Develop internal controls to safeguard against errors, fraud, and misuse of funds. Implement measures such as segregation of duties, approval processes, and regular audits to mitigate risks and ensure the integrity of financial data.

Step #6 – Train staff

Provide comprehensive training on accounting software, financial procedures, and compliance requirements to staff members involved in financial management. Proper training ensures that employees understand their roles and responsibilities and can effectively use the accounting system.

Step #7 – Regularly review and update

Continuously monitor the effectiveness of the accounting system and make adjustments as needed to ensure accuracy, efficiency, and compliance. Regularly review financial processes, update procedures, and incorporate feedback to optimize the system’s performance.

Conclusion

In conclusion, setting up an efficient accounting system is essential for businesses to manage their finances effectively, make informed decisions, and ensure compliance with regulations. You might want to consider the size and complexity of your business and its accounting needs before setting up accounting alongside industry-specific requirements, your budget, and financial data security. This way, you’re most likely to choose the right accounting system to support long-term success. Investing time and resources in establishing your financial processes can pay off by driving growth, mitigating risks, and achieving financial stability.

Continue reading:How to deal with QuickBooks Error 80070057?

Share your thoughts

Any thoughts, any questions? We’d love to hear from you. Feel free to share your thoughts in the comments section below!

.png)