Having a multifaceted overview of finances and business performance is vital for a company’s success. It’s like having a clear map—helping leaders understand where they are, where they’ve been, and where they’re heading. The challenge lies in managing diverse financial data from various sources efficiently. Here’s where accounting software integration steps in, ensuring that all financial tools communicate seamlessly, automating tasks, reducing errors, and providing real-time business performance insights.

Today, we’re discussing accounting software integration, its benefits and challenges, and how to approach this integration wisely.

Hop on reading to learn more about accounting software integration:

1. Breaking down accounting integration: What is an integrated accounting system?

2. Major benefits of integrating accounting software with other systems

3. Choosing the best integration for your accounting software

4. How to build an integrated accounting system: An example of using Synder

Breaking down accounting integration: What is an integrated accounting system?

Let’s break down accounting software integration first.

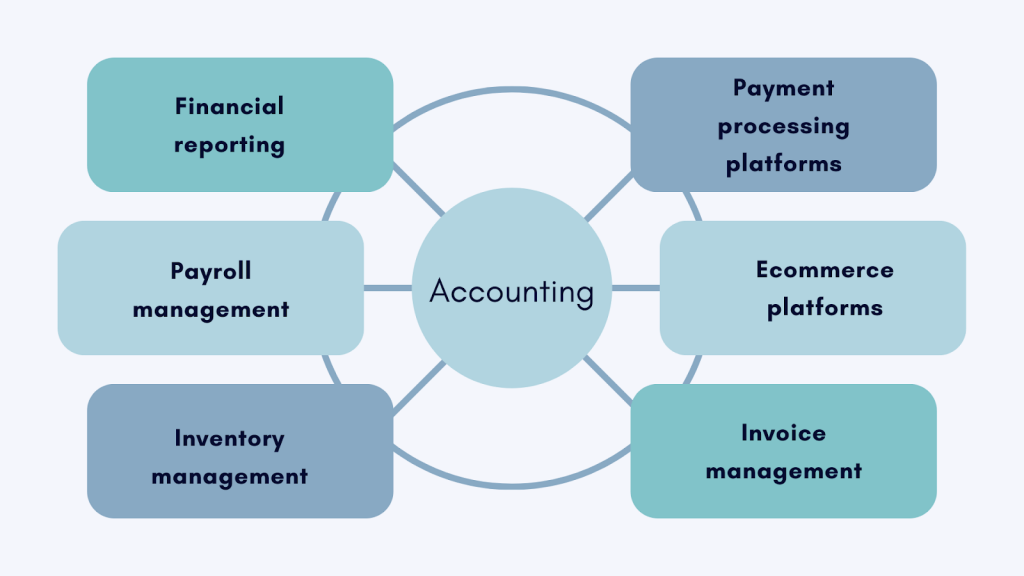

In its classical meaning, accounting software integration is a strategic process of bringing together different financial software tools within a company. The aim is to make these tools work together, allowing for efficient communication and collaboration across various financial tasks, making it an integrated accounting system.

In practical terms, this means connecting different financial modules, such as payroll, accounts payable, and general ledger, to share information automatically. At this point, a company eliminates manual data entry, ensuring that changes made in one part of the system are instantly reflected in all connected areas.

I purposefully mentioned the classical meaning because in modern business, things change fast. Today, most accounting software has all those different modules (like payroll, invoicing, AR, etc.) already incorporated in the functionality as features. Moreover, it often comes with multi-user access, meaning that several responsible people can work together, covering their aspect of business accounting.

Meanwhile, a company might use other systems that contain business-related and financial data. It brings us to a broader meaning of integrated accounting.

What’s integrated accounting today?

As I said, running a business involves using many different software and systems. Like, how does a business receive (and make) payments? How do they sell their products or services?

Provided the huge shift to the online sales model, it’s pretty safe to say that businesses might deal with several payment processing systems (think of PayPal, Square, or Stripe, whatever) and a bunch of ecommerce platforms (such as Shopify or Wix, or BigCommerce). If we speak about online retail, you may confidently add Amazon, eBay, Walmart, or any other online marketplace that comes to your mind.

And all these are sources of a business’s financial (and other business-critical) data.

So yes, when we talk about accounting integration, it often involves making all these payment systems and ecommerce platforms work together smoothly with a company’s accounting. So, when someone purchases something online, the sale details are automatically added to the accounting system. It’s like connecting the dots, helping businesses manage their money and sales more efficiently within a single ecosystem.

Major benefits of integrating accounting software with other systems

Building an integrated accounting system yields several key benefits that contribute to the overall success of a business. We’ll look at them real quick before getting down to how you can find the best integrations for your accounting and create an integrated accounting system.

Benefit #1 – Simplified and efficient finance management

Integrated accounting simplifies the management of a company’s finances by connecting different tools into a single ecosystem. This connectivity reduces the need for manual data entry, allowing information to flow across the system. It minimizes the likelihood of errors, omissions, duplicates, and discrepancies in the accounting records. Consequently, it results in accurate financial statements and faster accounts reconciliation (as you get rid of the part of your workflow where you’re spending hours finding and correcting erroneous entries in your general ledger).

Benefit #2 – A comprehensive overview of your finances with a centralized data hub

The centralization of financial data is probably the sweetest part of integrated accounting. Having all your financial and business-critical data (like sales, products, and customers) put together in one place, where everyone interested can instantly see and analyze it, sounds like an approach you might want to consider. It gives you a 360-degree view of your business performance and real-time insights into your sales, products, and customer trends and behavior. As a result, you can stop making decisions based on guesswork and start relying on real numbers instead.

Benefit #3 – Time savings through automation

This one is pretty obvious, but we’ll still break it down. Saving time is one of the primary purposes of automation. Speaking of mundane, standard, repetitive tasks (data entry, creating and sending invoices, generating financial reports—anything you’re likely not happy about doing), machines can do it faster and more accurately. And it’s a blessing, as instead, you can redirect efforts toward more impactful things. Analyze, find the flaws or opportunities, and build strategies that work (that actually is what managing a business means).

Benefit #4 – Adaptability to business growth

When built the right way, integrated systems are scalable, evolving seamlessly with the growth of a business. This adaptability ensures you can handle increased data volumes and more complex financial transactions without rebuilding a new system from scratch.

Benefit #5 – Enhanced security and data protection

Integrated accounting systems often incorporate robust security features, including data encryption and access controls. This fortified security infrastructure safeguards sensitive financial information from unauthorized access. Besides, there’s no more need for you to log into many different solutions to reach for your data—the tools within an integrated system communicate and share data automatically. At this point, you don’t have to handle multiple credentials. Moreover, when giving financial specialists access to the system, you don’t have to share log-ins for the most sensitive data sources (like payment systems). So you aren’t afraid that this data will be corrupted in some way, giving you more confidence and peace of mind.

Choosing the best integration for your accounting software

With all the benefits integrated accounting brings, you might want to approach accounting integration wisely. At this point, finding the perfect fit for your unique business needs can be challenging. To address the challenge, you might want to analyze and strategically select integrations to complement your existing accounting system.

Below are some considerations that can help when choosing the best integrations for your accounting system, ensuring a harmonious blend of functionality and efficiency. We’ll look at it as if building the system from scratch, but you can adjust the process to your situation.

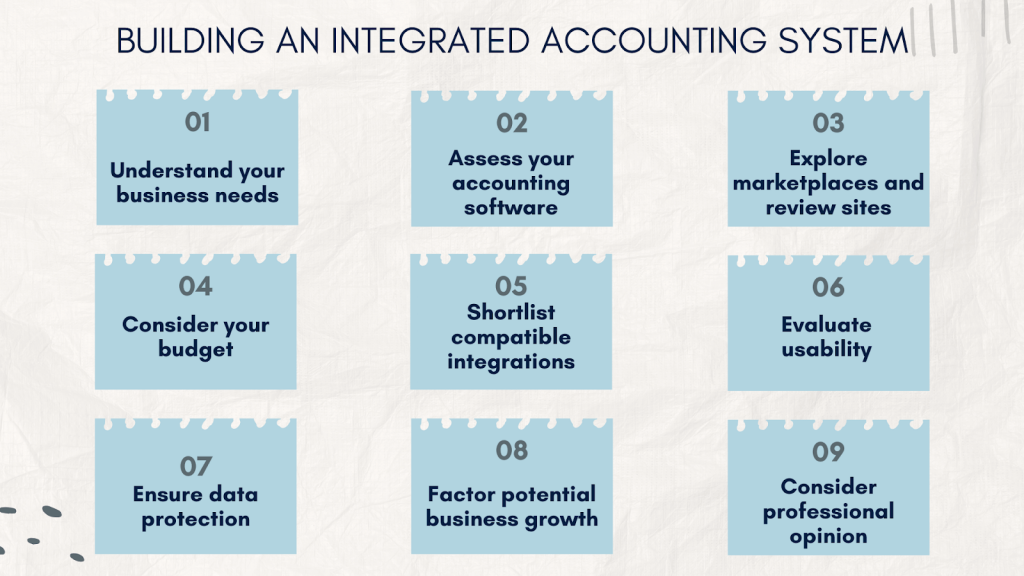

1. Understanding your business needs

It’s like a mantra already, but I’ll repeat it (after all, that’s what you usually do with mantras). Thoroughly assess your business needs. You know your business, its aspects, what processes it involves, and the specific accounting pain points you might want to address. Understand the unique requirements of your industry, the size of your business, and any future growth projections. This critical self-evaluation will guide you in selecting integrations to target your business challenges, picking up a stack of tools to integrate, and figuring out whether you can handle the integration with your accounting software capabilities or might need a third-party integration solution to bring them all together.

2. Assessing your existing accounting software

Before diving into integrations, take a look at your current accounting software. Evaluate its features and functionalities to understand whether it provides a solid foundation for an integrated system (if it technically allows for any integrations). This way, you’ll see whether your solution is good to go with or whether a more sophisticated solution is what you need. You can also see what functionality you lack and would like to complement with integrations. Usually, the most popular accounting platforms, like QuickBooks or Xero, come with integration capabilities and even offer extensive app marketplaces, making them suitable for expansion through integrations.

3. Looking through marketplaces and software review sites

I’ve just mentioned the marketplaces, and those are where you can begin your integration journey. You might want to explore the marketplace associated with your current accounting software. Usually, they offer plenty of native and third-party integrations to address specific business needs. Additionally, software review sites like G2, Capterra, or Software Advice provide many options. You can filter them based on your requirements and read user ratings and reviews, sharing real-life experiences with this or that solution.

4. Understanding your budget

Today, the pricing of accounting software and business tools can differ from attractive to expensive, so you might want to consider your budget. Determine the specificity of your requirements and assess the demand for the integrations and the integration solution. This step is not to miss, especially if your business is at the early stage or you just started (and your budget is pretty tight). You might consider starting small, gradually adding the necessary functionality as you grow, and optimizing your expenses.

5. Picking compatible integrations

After considering the budget, ensure the selected integration flawlessly connects with your existing setup. Compatibility is key to avoiding disruptions in your workflow and building a unified accounting system. To beat the compatibility issue, you might need an integration tool to help you connect the necessary functionality even if your accounting software doesn’t support it (below, I’ll explain how it works in an example).

6. Evaluating usability

User-friendliness is a crucial factor in preventing unnecessary complications. Look for integrations with intuitive interfaces, straightforward setup processes, and clear instructions. If you understand how an app functions before installation, you can prevent any inadvertent errors in your financial records.

7. Ensuring data protection

Whatever you choose, financial data safety should never be compromised. Prioritize integrations with strong security measures, such as two-factor authentication and encryption. This way, you ensure that sensitive information remains confidential and protected from unauthorized access.

In scenarios where multiple individuals handle bookkeeping and accounting, consider integrations offering role-based access. This feature allows you to assign specific roles to employees, limiting their access to sensitive information based on their responsibilities.

8. Bearing in mind potential business growth

Optimism about business growth is commendable, and your chosen integration should be able to accommodate it. Evaluate whether the software has the scalability to address increased accounting demands as your business expands. Planning for the future ensures a seamless transition without data migration challenges.

9. Considering professional opinion

When in doubt or faced with unfamiliar features, don’t hesitate to seek the opinion of an accountant or financial specialist. Their expertise can provide clarity, ensuring that the integrated system you’re building aligns precisely with your business requirements, ultimately safeguarding your investment.

How to build an integrated accounting system: An example of using Synder

Now that we have an idea of integrated accounting software and integrated accounting systems, we can proceed to how to build one.

At this point, we’ll be using Synder as an example. Why Synder? It’s a multifaceted accounting software, first thing. And it can work as a double agent—be the general player or an intelligent connector between your accounting and other business and financial tools. This flexibility makes it a great option to illustrate how you can put everything together and build up an integrated system based on its native accounting capabilities or your existing accounting software.

You might want to bear in mind that some other accounting solutions on the market can do somewhat similar things, and depending on your business needs and some other factors, you might as well go with the option that seems to fit your bill better.

Step #1 – Starting with Synder

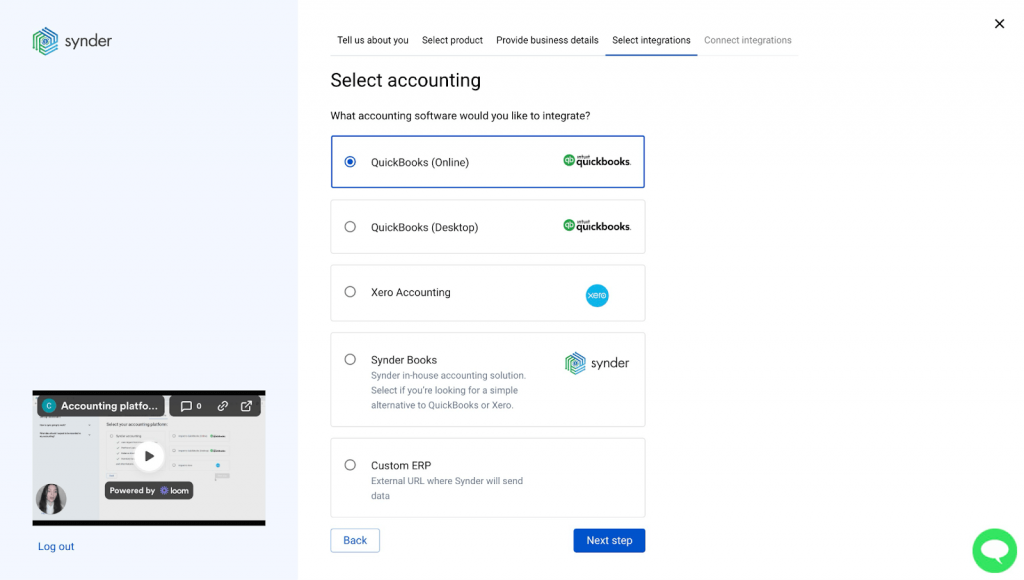

Step #2 – Connecting your accounting platform

Now, let’s see how quickly you can set up your integrated accounting system, at least its basis. Here’s a hint: a couple of clicks fast. At this point, you can think of Synder as a central data hub to which you connect your accounting on one end, and on the other end, you connect all the necessary sources of your sales and transaction data.

Let’s get to the first step.

As you sign in to your Synder account and choose a product to go with—Synder Sync for synchronizing your transactions or Synder Insights for comprehensive business reporting and performance insights (or you can go with both)—you’ll be asked to connect your accounting platform. Here, you can choose from several options, including Synder itself.

You select the option, follow the provided steps, fill out the necessary information, and proceed to the next move.

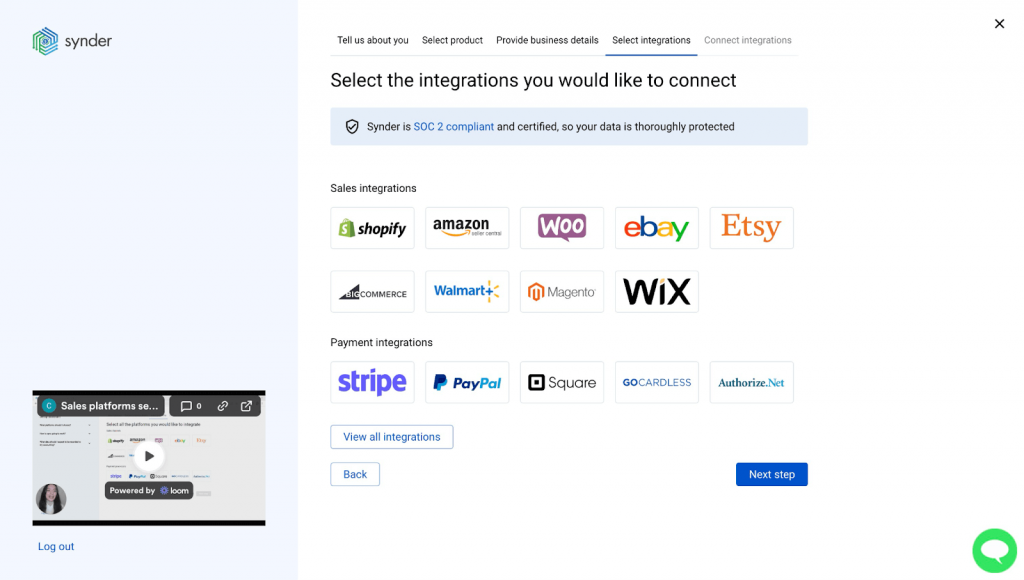

Step #3 – Integrating your sales platforms

Done with accounting, you can go on and connect all your sales platforms, including payment processors, ecommerce platforms and marketplaces, buy-now-pay-later options, etc. (Synder integrates with 25+ platforms, so it’s highly likely the one (or ones) you use are on the list). Again, it’s a matter of clicks to set up the connection.

Step #4 – Finalizing the setup

The next thing you might need to do is set up your integration. At this stage, you can:

- Enable auto-import to allow Synder to synchronize transactions from all the connected sources with accounting automatically without prior confirmation;

- Enable duplicate detector to skip syncing transactions that already exist in your ledger;

- Allow to apply payments to the matching unpaid invoices automatically;

- Allow or forbid synchronizing transactions in foreign currencies.

Please bear in mind that you can always change this setup if your preferences change in the future.

It’s a simplified view of an integrated accounting system setup. Definitely, your business might have peculiar needs and workflows. At this point, Synder offers various settings (including automated tax calculations and more) to help you tweak your accounting close to perfection. Besides, you can always turn to the support team to help you set up complex workflows.

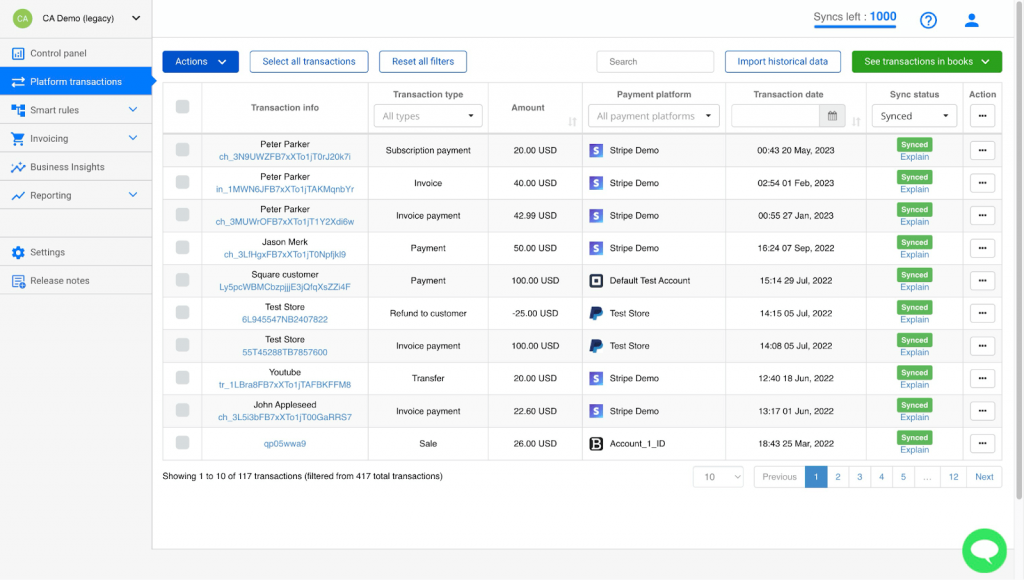

Step #5 – Leveraging your automated data integration to the full

When everything is set up and done, you’ll see all your transactions synchronized and accurately categorized in accounting. You can track the synced transactions via an informative dashboard, from where you can easily manage the system. You can also create and send invoices, receive payments via payment links, set up Smart Rules to automate various workflows, generate accurate financial statements, perform accounts reconciliation, and more.

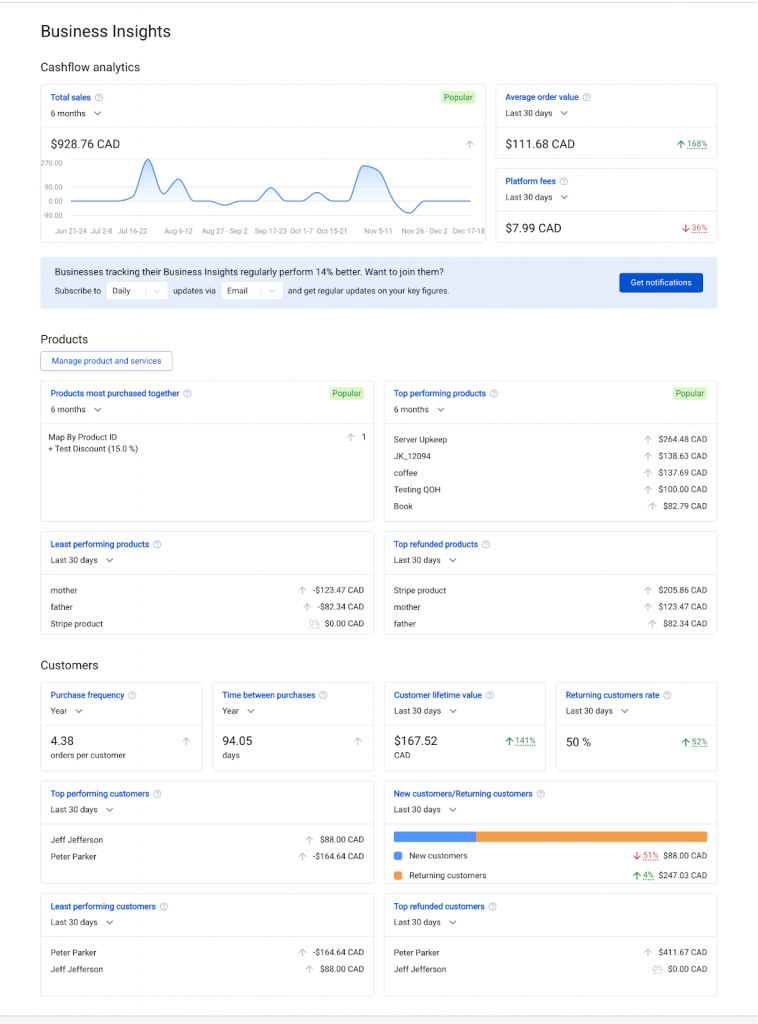

But transaction data integration is probably the bare minimum you have using Synder. You can walk an extra mile in leveraging it with Synder Insights – comprehensive business analytics and reporting.

Here’s the thing. When Synder captures sales and payment data from your channels, it grabs all the granular details on sales, products, and customers. In Synder Insights, you can see all this data through a general dashboard, organized in various reports, helping you track your sales, customer behavior, product trends, and business performance KPIs.

At this point, you can improve your decision-making, tracking your actual business numbers in real-time and building growth strategies based on them.

As you can see, this example is a brief overview of a potential integrated accounting system setup. With it, I wanted to demonstrate that accounting software integration can be a pretty straightforward process and not necessarily super lengthy. But regardless of how long an accounting integration initiative might take you, the result would pay off every minute and all the effort.

Bottom line

To sum up the story, integrating accounting software is crucial for managing finances in today’s business world. It goes beyond combining typical financial tools, including various payment systems and ecommerce platforms. The perks are clear: it streamlines finance tasks, offers a central data hub, saves time through automation, adapts to business growth, and ensures better security.

However, getting there requires careful steps. Businesses should understand their unique needs, assess current accounting software, check marketplaces and reviews, consider budget constraints, ensure compatibility, prioritize user-friendliness and data protection, and plan for future growth. Seeking professional advice can help align the integration with specific business requirements. Ultimately, accounting software integration is more than a tech upgrade. It’s a smart investment in business success.

.png)