If you’re reading this, I’m going to assume that your job revolves around accounting. And if that’s the case, then it makes sense that you’d be curious to learn about a new standard that rose to the surface in 2020 and covers revenue recognition. Or you might be a business owner, who has an obligation to comply with all the rules and regulations that are put in place to protect consumers.

Either way, you may have heard of ASC 606, but what exactly is it? Is it something you need to be aware of? If so, how can you tell if your company’s subscription model falls under this standard? We’ll answer all these questions and more as we go over everything you need to know about ASC 606.

Contents:

2. Why do I need to know about ASC 606 form if I work in accounting?

3. How is ASC 606 different from previous standards to recognize revenue?

5. What if I don’t have subscriptions?

What is ASC 606?

ASC 606 stands for “Accounting Standards Codification 606,” which is a set of accounting principles issued by the Financial Accounting Standards Board (FASB) in the United States. ASC 606, also known as “Revenue from Contracts with Customers,” is a comprehensive revenue recognition standard that outlines how companies should recognize revenue from customer contracts.

ASC 606 was introduced to provide a consistent framework for recognizing revenue across different industries and to replace the previous revenue recognition guidance in U.S. Generally Accepted Accounting Principles (GAAP). The standard is applicable to all companies that enter into contracts with customers to transfer goods or services.

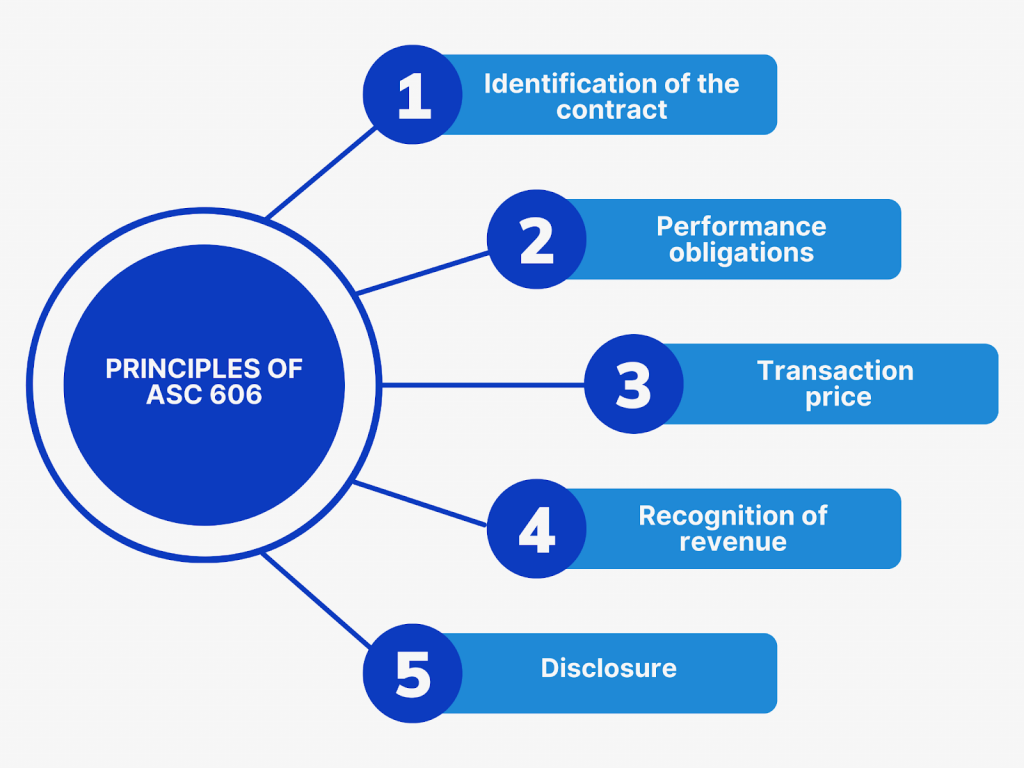

Key principles of ASC 606

- Identification of the contract with the customer: Companies need to determine whether a contract with a customer exists, and it should be in writing or orally agreed upon and should specify the rights and obligations of both parties.

- Performance obligations: Companies must identify the separate performance obligations within a contract, which are distinct goods or services that the customer can benefit from on their own or with other resources.

- Transaction price: The transaction price is the amount of consideration that a company expects to receive in exchange for the goods or services it provides to the customer. Companies need to allocate the transaction price to each performance obligation.

- Recognition of revenue: Revenue is recognized when a company satisfies a performance obligation by transferring control of the promised goods or services to the customer.

Learn more about how to maximize revenue recognition and revenue recognition cycle.

- Disclosure: ASC 606 requires companies to provide enhanced disclosures in their financial statements to help users of financial statements understand the nature, timing, and uncertainty of revenue and cash flows arising from customer contracts.

ASC 606 introduced a more principles-based approach to revenue recognition, which is intended to improve comparability across different industries and reduce the potential for revenue manipulation. It became effective for public companies in fiscal years beginning after December 15, 2017, and for private companies in fiscal years beginning after December 15, 2018.

Companies needed to assess their contracts and revenue recognition practices to ensure compliance with ASC 606 and make any necessary adjustments to their financial reporting processes. The standard has had a significant impact on financial reporting, especially for companies with complex customer contracts and multiple performance obligations.

Why do I need to know about ASC 606 form if I work in accounting?

Most accounting standards are complicated (especially how they can change over time), and tend to be more relevant for larger companies than smaller ones. But ASC 606 is different — it applies across all industries regardless of size or sector specialization (unless some other standards take over). In addition, even if your company doesn’t sell products or services yet, this might be something worth learning about just so that when others ask about it in interviews, you’ll have an answer ready.

There are many reasons to be aware of ASC 606 even if your organization doesn’t have any subscriptions or deferred revenue today. If you’re negotiating a contract with terms that will result in some element of your business being classified as a subscription, or if you’re trying to figure out how much non-cash revenue should go on the books when dealing with non-monetary exchanges (such as advertising), then understanding what constitutes “subscription” might be helpful.

Prepare for tax season and automate your accounting with Synder! Sync all your transaction data from your ecommerce and payment platforms into the books and enjoy a smooth reconciliation. Create a free account to test all the features available or join our Weekly Public Demo.

How is ASC 606 different from previous standards to recognize revenue?

You may be wondering why this new standard exists. Well, previous standards were too broad, and businesses (and accountants, tax preparers) needed more specific guidance to comply with them. ASC 606 was developed as a narrower standard that can be applied to many situations, but owners need to be aware of it to ensure they’re in compliance.

ASC 606, also known as the “Revenue from Contracts with Customers” standard, represents a significant departure from previous revenue recognition standards in the United States. Here are some key differences between ASC 606 and its predecessors, such as ASC 605 (formerly known as SOP 97-2) and other guidance:

A. Principles-based vs. rules-based

ASC 606 is more principles-based, focusing on core principles for recognizing revenue, as opposed to the more rules-based approach of previous standards. This allows for greater flexibility in application and reduces the need for extensive industry-specific guidance.

B. Five-step model

ASC 606 for revenue recognition introduces a five-step model for recognizing revenue, providing a structured approach to revenue recognition. The five steps are:

- Identify the contract with the customer.

- Identify the performance obligations in the contract.

- Determine the transaction price.

- Allocate the transaction price to the performance obligations.

- Recognize revenue when the performance obligations are satisfied.

C. Emphasis on control

ASC 606 places a greater emphasis on the transfer of control of goods or services to the customer as the key criterion for recognizing revenue. Previous standards often used criteria such as risks and rewards, delivery, or completion to determine when revenue should be recognized.

D. Multiple-element arrangements

Under previous standards, companies often used complex and industry-specific guidance to account for multiple-element arrangements (i.e., contracts with multiple deliverables). ASC 606 provides a more consistent and principles-based approach to allocating revenue to individual performance obligations within such contracts.

E. Changes in presentation

ASC 606 introduces new presentation requirements, including separate disclosure of contract assets, contract liabilities, and performance obligations. It also requires additional qualitative and quantitative disclosures to help users of financial statements better understand revenue recognition.

F. Transition methods

ASC 606 allows companies to choose between two transition methods: full retrospective adoption or modified retrospective adoption. This flexibility in transition was not available under previous standards.

G. Impact on specific industries

ASC 606 may have a more significant impact on certain industries, such as software and telecommunications, where multiple-element arrangements and upfront fees were common. The new standard can change the timing and pattern of revenue recognition for many companies in these industries.

H. Enhanced disclosures

ASC 606 requires more extensive disclosures about revenue recognition policies, judgments, and estimates, providing users of financial statements with more information about the nature and timing of revenue recognition.

In a nutshell, ASC 606 is a more consistent, principles-based, and transparent approach to revenue recognition. Now companies need to assess and adapt their revenue recognition practices to comply with ASC 606, while the standard largely depends on the nature of the company’s contracts and business activities, which you’ll be reading about in the following sections.

Who needs ASC 606?

ASC 606 applies to a wide range of businesses across various industries that enter into contracts with customers to provide goods or services. The standard is designed to provide a consistent framework for revenue recognition regardless of the industry. Here are some examples of businesses that need to implement ASC 606:

- Software companies: Businesses that sell software licenses, subscriptions, or software-as-a-service (SaaS) solutions to customers are often impacted by ASC 606. It affects how they recognize revenue related to software sales and services.

- Telecommunications companies: Telecommunications providers that offer services like mobile plans, internet services, or bundled services to customers need to implement ASC 606 to account for the revenue generated from these contracts.

- Manufacturers: Manufacturing companies that have contracts with customers for the sale of products or equipment, along with any associated warranties or services, must comply with ASC 606.

- Construction companies: Construction firms that enter into contracts for construction projects, including long-term contracts, need to apply ASC 606 to recognize revenue over the contract’s duration.

- Professional services firms: Businesses in consulting, legal, accounting, and other professional service industries must implement ASC 606 for contracts they have with clients for services rendered.

- Retailers: Retail companies that offer loyalty programs or extended warranties, as well as those with gift card programs, may be affected by ASC 606 due to how they recognize revenue from these activities.

- Subscription-based businesses: Companies that offer subscription-based services, such as streaming services, magazines, or membership clubs, need to follow ASC 606 to account for subscription revenue over time.

- Healthcare providers: Healthcare organizations with contracts for patient services, insurance claims, or medical procedures are subject to ASC 606 requirements for revenue recognition.

- Airlines: Airlines with frequent flier programs and other customer loyalty programs may need to adjust their revenue recognition practices based on ASC 606.

- Nonprofit organizations: Not-for-profit entities that have contracts or grants with donors or grantors that specify the transfer of goods or services must follow ASC 606 for revenue recognition.

It’s important to note that ASC 606 is a comprehensive standard applicable to a broad range of industries and businesses. The standard was developed to provide a unified approach to revenue recognition, making financial reporting more consistent and transparent across different sectors. Therefore, companies that have contracts or arrangements with customers, regardless of their industry, need to assess their revenue recognition practices and ensure compliance with ASC 606 when applicable.

What if I don’t have subscriptions?

While ASC 606 is often referenced in connection with revenue-generating entities like software companies, it’s important to note that ASC 606 applies to all types of businesses and not just those with a subscription component. In fact, ASC 606 is applicable to any entity that has revenue — including those that sell goods instead of services.

This means that even if your company isn’t using software or technology as part of its operations, you may still need to adopt this standard.

Even if you don’t think that ASC 606 will affect your business directly, it’s important to be aware of this (and other) accounting standards because they have a significant impact on your customers and suppliers, as well as who you hire.

When to implement ASC 606

It’s important to note that while ASC 606 became effective on the specified dates, its impact on companies may vary significantly depending on the nature of their contracts and revenue recognition practices. Companies should carefully assess their contracts, consider any potential changes to revenue recognition, and ensure they are in compliance with the standard.

On June 3, 2020, the Financial Accounting Standards Board (FASB) issued an Accounting Standards Update to provide a limited deferral of the effective dates for certain entities regarding Accounting Standards Update No. 2014-09, Revenue from Contracts with Customers (Topic 606). Originally, this update had varying effective dates for different types of entities, with public business entities, certain not-for-profit entities, and certain employee benefit plans being required to apply the guidance starting from annual reporting periods beginning after December 15, 2017, and all other entities beginning after December 15, 2018.

In August 2015, the FASB issued Accounting Standards Update No. 2015-14, which deferred the effective date for all entities by one year. Public business entities and certain others were required to apply the guidance starting from annual reporting periods beginning after December 15, 2017, while all other entities began after December 15, 2018, with early adoption permitted.

The June 2020 update further defers the effective date for entities that are not public business entities and have not yet issued their financial statements reflecting the adoption of Revenue. These entities may choose to adopt the guidance starting from annual reporting periods beginning after December 15, 2019, and for interim reporting periods within annual reporting periods beginning after December 15, 2020. This deferral provides immediate relief for certain entities affected by the original effective dates of the revenue recognition standard.

Since accounting standards and regulations may change over time, it’s advisable to consult with a qualified accountant or financial professional who can provide guidance specific to your company’s situation and ensure compliance with current accounting standards.

Conclusion

ASC 606 is here to stay, so it’s important that you understand as much as possible about this new standard. No one can guarantee that it won’t affect your business in some way, but if you keep up with the news and industry changes like this one, then you’ll be prepared when it does come time to implement.

Learn more with our article Difference between ASC 606 and IFRS 15.

.png)