As we’re looking eagerly into the new year, let’s talk about something that’s been on a lot of minds lately: the big “R” word, recession. With our eyes focused on the forecasters and their predictions, we keep wondering: Will there be a recession in 2024? The truth is, they haven’t quite come to a consensus, and that’s leaving a lot of us scratching our heads, not knowing what to expect.

Now, for those running ecommerce businesses, this kind of uncertainty can feel a bit like trying to plan a picnic under cloudy skies. Should you pack sunscreen, your raincoat, or both? But here’s the deal: not knowing exactly what’s coming doesn’t mean you can’t be prepared. In fact, it’s a great reminder that being ready for anything – sunshine or rain – is part of what makes a business strong.

In this article, we’ll explore how to safeguard your ecommerce business and your money, no matter what the economic forecasters throw our way. We’re talking about the real-deal strategies that help you keep your business humming along, even when the economic weather is unpredictable.

What is a recession?

Let’s start with the basics: what really is a recession? In short, a recession is when the economy isn’t doing well for a while, often shown by things like people spending less money and businesses struggling.

One way to determine if there’s a recession is by looking at something called economic contraction over a certain time. This basically means the economy is shrinking instead of growing.

A common way to spot this is when the economy shrinks for 2 three-month periods (i.e. 2 quarters) in a row. That adds up to six months in total.

Trends and challenges affecting the ecommerce landscape

Understanding the industry landscape is a good starting point to feel more confident during times of slowdown and recession. It helps you beat the competition and answer customers’ expectations in the best way possible. Let’s look at some trends and challenges defining the current ecommerce landscape.

Extended competition and the need to stand out in an oversaturated market

The change in customer behavior due to the pandemic inspired a giant leap toward the ecommerce business model making the industry boom which keeps growing. As a result, the ecommerce space became overpopulated, so the competition for each customer increased. Inevitably, it augmented the costs of marketing and customer acquisition, making the most popular marketing channels less effective.

Making it personal: The growing customer expectation

Today, customers expect personalized experiences. They’re willing to share personal data with brands, in response, they want companies to recognize them, remember their interests, and provide offers and recommendations that resonate with them. Moreover, customers expect these experiences to be cross-platform and cross-device.

Tapping into international markets for growth

As the domestic landscape is becoming a bit overcrowded and more competitive, cross-border trade is where ecommerce businesses go to surpass the growth limits of domestic markets. Cross-border trade has challenges like providing shipping or payment options or operating with different currencies. However, it allows for expanding business to new and less saturated markets.

Accessing fast, flexible funding without the traditional red tape

Securing an influx of money has always been among the biggest concerns for ecommerce businesses. Classic types of funding, such as loans and credit lines, usually require long approval times and can be unavailable for smaller companies that don’t yet have enough assets or equity.

However, some new funding options are becoming available for ecommerce businesses today, such as inventory financing or revenue-based financing. They are more accessible, flexible in terms of payments, take comparatively little time to approve, and don’t require collateral or sharing equity.

Summing it up, the ecommerce landscape becomes more challenging for businesses but, at the same time, provides some opportunities that might help prepare for the slowdown.

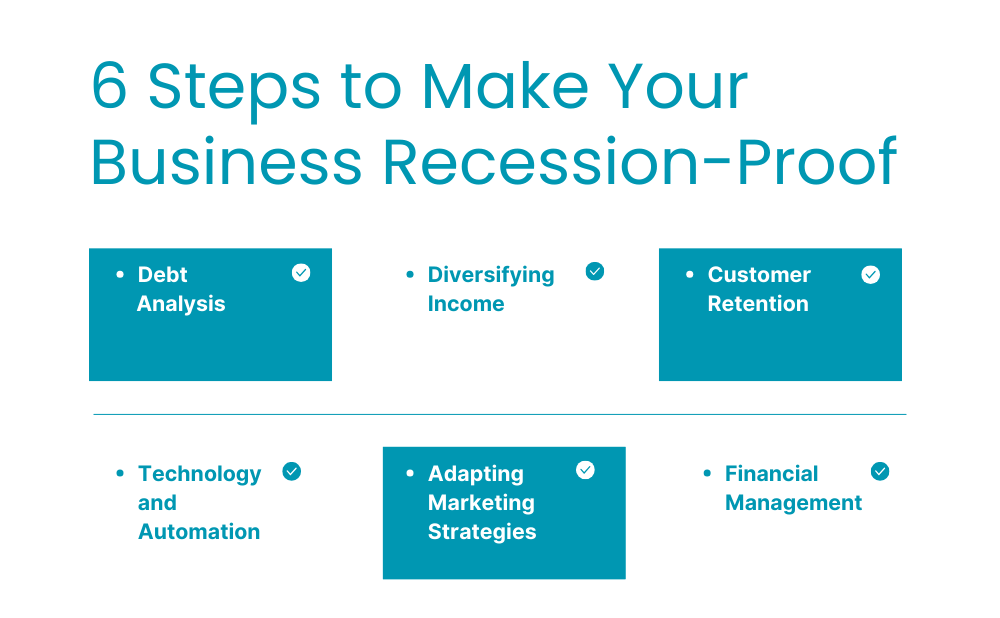

How to prepare for a recession: Ecommerce-tailored strategies for proactive business owners

When it comes to gearing up for a recession, there’s no magic one-size-fits-all solution. It’s more like preparing for a big game where you need both a good defense and a solid offense to win. This means mixing up different strategies to not just survive the tough times, but also to find ways to thrive.

Defensive strategies – Guarding the goal

It’s all about protecting what you’ve got. In business terms, this means cutting unnecessary costs, saving as much money as you can, and making sure you don’t have all your eggs in one basket. These strategies include avoiding taking on too much debt or making sure you have a cushion of cash to fall back on if things get rough.

Offensive strategies – Scoring the goals

On the other hand, you’ve got your offensive strategies. In a recession, this could mean finding new markets for your products, coming up with innovative ideas that meet the changing needs of your customers, or even smartly investing in areas of your business that could grow, even when times are tough.

By combining careful, protective steps (defense) with growth-oriented moves (offense), you can set your business up not just to weather the storm of a recession, but to come out of it stronger and ready for the next big play.

Let’s review them in detail.

1. Know your bottom line to survive an economic downturn

Knowing your numbers is an excellent overall practice. However, it becomes vital in the face of a financial downturn like a recession. A key to survival is having a 360-degree view of your finances, such as your sales, cost of sales, operating expenses, taxes, and payment provider fees that you pay – i.e. everything that goes in and out of your account. You can define what’s bringing you more money quicker and what’s eating up your margins so that you can make changes to ensure more cash flow. Here, the volume of available data and its accuracy can be a game-changer.

The biggest challenge is that an ecommerce business can use multiple solutions to retrieve data from different sources, e.g., Amazon, eBay, Etsy, Stripe, etc., and integrate it with accounting. So data may get into accounting in different formats, leading to duplicates and other discrepancies and inaccuracies. Moreover, each solution comes with its UI, credentials, subscription, etc. Meanwhile, some solutions offer integration of multiple platforms, allowing you to have your data in a single ecosystem.

You can review and rethink the software you use and decide whether you can choose a single solution that can integrate all (or at least the majority) of your sales channels. Apart from cutting subscription costs, you might benefit from more accurate data to analyze and save the time you otherwise spend on managing multiple solutions.

2. Optimize your inventory management during a recession

Excess inventory is one of the major margin eaters for an ecommerce business. A recession usually means slower sales which increases the risk of overstocking. As a result, you face augmented carrying costs and higher amounts of obsolete stock that you’ll have to sell off drastically below your margins or write off completely. To avoid such situations, you’ll need to track your inventory more frequently and review your inventory management procedures. Here are some solutions:

- Track your best-selling and worst-selling groups of products with Synder Insights to predict the demand more accurately and adjust ordering rules to have enough stock on hand to cover your customer needs and prevent goods from sitting on your shelves for too long.

- Clean up the excess stock by selling it at a discounted price. Though your margins will be pretty thin, you’ll still benefit from cutting your carrying costs.

- Optimize your packaging to reduce fulfillment and logistics costs.

- In some cases, it can be wiser to switch to a dropshipping model to save money on shipping and warehousing costs.

- You can also negotiate stretching payment terms with your suppliers to win some more cash on hand.

With Synder Insights, you can have all the necessary data consolidated in handy reports giving you plenty of useful insights into your business, customer behavior, product performance, and many more.

3. Make customer loyalty work for you

As a recession negatively affects customers’ purchasing power, acquiring new customers requires more effort, and its cost drastically increases. Customers are more reluctant to buy non-essential goods and it takes them longer to make a purchasing decision.

What’s more, in times of uncertainty, they tend to buy more from trusted brands and vendors. That’s why, during a slowdown, it’s essential to re-engage with your existing customers and put more effort into customer retention rather than try to win new ones. Here are some ideas that can help you double down on the retention practices:

- Thoroughly analyze your customer data, such as purchase frequency, the time between purchases, and what products they buy, to set up personalized outreach campaigns to encourage people to come and buy from you again.

- Identify your highest-value customers and think about tailoring your customer experience around answering their needs.

- Think about offering your existing customers some unique added value to increase their loyalty. There are plenty of things you can do from special prices for repeated purchases through bundle discounts to adding little gifts with their orders.

- Consider introducing a subscription model for your regular customers’ favorite products. This approach can turn satisfied customers into repeat buyers, providing you with a steady stream of recurring revenue.

- Think about extending your product shipping and picking options to give your customers a wider choice and ensure they don’t drop off during checkout just because your shipping option is inconvenient. Depending on whether you also have a brick-and-mortar shop or you operate exclusively online, you can think of adding a buy-online-pickup-in-store or buy-online-pickup-anywhere option. The latter allows customers to have their orders shipped to convenient commercial locations like pharmacies, grocery stores, etc. It also allows you to cut some shipping costs.

4. Optimize your best marketing activities

It’s often believed that during a recession, marketing activities are something you can drastically cut. However, such an approach is a bit short-sighted and can hamper your bottom line in the long run. A wiser tactic can be optimizing your marketing activities to ensure maximal efficiency. So instead of simply cutting marketing budgets, there are some options you can try to implement:

- Reassess your brand message and positioning to understand whether it resonates with the changing customer needs and stands out from the competition.

- Cut some costs by exploring and engaging with new audiences. In the conditions of increased competition, marketing budgets might also increase due to higher advertising costs on the most popular channels. You can explore new marketing platforms that start gaining popularity and try to go with TikTok, for example, instead of Facebook.

- Assess the time and effort needed to run some of the activities and think about outsourcing them to agencies or freelance marketers specializing in them.

5. Secure additional financial resources

Having some extra cash can sometimes be a lifesaver. Anything can happen, and during a recession, suppliers can also face hardships that might prevent them from fulfilling your orders in time. So if you haven’t thought about applying for financing yet, it might be an idea to consider.

However, you need to carefully choose the type of funding so that it doesn’t cost you more than it can bring in. While classic options, such as business loans and credit lines, can be difficult to get and also take a long time to approve, there are some unconventional options tailored for ecommerce business needs.

- Revenue-based financing – an option where you get funding from investors who receive a percentage of your gross revenues in exchange for the money they invest. It’s a more convenient option for a funded business, as there are no fixed payments: they vary based on the level of the business’s income. So in a lower-revenue month, for example, your payment sum will be lower. Moreover, you don’t need to share the ownership with the investor, as you do with equity financing.

- Inventory financing – is a short-term loan that a company acquires to purchase products to sell later. These very products serve as the collateral for the loan. It’s easier to get as businesses don’t need to rely on personal or business credit history and assets to qualify. Instead of giving you money, lenders purchase the goods you can later sell and return the investment. This option helps you have more money on hand for your operation.

6. Prepare an emergency fund

Preparing for a recession with an emergency fund is one thing that is best done when there is no recession. It’s one of those defense strategies that you can dive into when you’re doing well. Let’s explore how to save money for leaner times.

Figure out how much you need

First things first, you need to know how much to save. A good rule of thumb is to have enough to cover at least 3-6 months of your business expenses. This includes things like your website hosting, inventory costs, employee salaries, and marketing expenses.

Look at your current business expenses and see where you can save some money. Maybe you can find a cheaper supplier or cut back on non-essential services. These savings can go straight into your emergency fund.

Open a separate savings account

Set up a savings account just for your emergency fund. This keeps your emergency money separate from your regular business funds, so you’re not tempted to dip into it for everyday expenses.

If you’re just starting, it’s okay if you can’t put a lot of money into your emergency fund right away. Start with whatever you can, even if it’s a small amount. Be regular with your financial input. Setting up automatic transfers from your main account to your emergency savings can make this easier.

Keep your money liquid

Make sure your emergency savings are easy to access. You don’t want your money tied up in investments that you can’t sell off quickly. The whole point is to have cash available if you hit a rough patch.

Review and adjust regularly

As your business grows and changes, so will your emergency fund needs. Periodically review how much you have saved and how much you’re spending, and adjust your savings goals accordingly.

7. Manage debt

Navigating through debt management is an essential part of a good recession-proof plan. We’ll outline key strategies including debt analysis, restructuring, and prudent borrowing, to help you effectively manage and reduce your financial obligations.

Debt analysis and prioritization

In the first step of managing your ecommerce business’s debts effectively, conduct a thorough debt analysis. This means taking a close look at all your existing financial obligations, including any loans, credit lines and amounts you owe to vendors or suppliers.

Once you have a complete overview of your debts, the next step is strategic debt prioritization. This strategy involves categorizing your debts based on their urgency and cost, with a focus on addressing high-interest debts first. This approach not only helps reduce your overall financial burden but also streamlines your repayment efforts, allowing for more efficient and effective debt management.

Debt restructuring

Debt restructuring is also a vital strategy. One effective approach is negotiating better terms with your lenders. You can negotiate for extended payment periods reducing the monthly burden. Alternatively, you might be able to secure reduced interest rates, which can significantly lower the total amount you’ll pay over time. Achieving more favorable loan terms can provide much-needed breathing room for your business’s cash flow and overall financial health.

Another key aspect of debt restructuring is consolidating multiple debts into a single loan. This strategy can streamline your financial obligations, replacing several different payments with one regular payment, often at a lower overall interest rate.

Prudent borrowing

If you’re considering borrowing money, it’s good to adopt a ‘caution first’ approach. Before taking on additional debt or utilizing credit, critically assess the necessity of the debt and evaluate the potential return on investment (ROI). It’s important to ensure that the debt will contribute to significant business and efficiency growth, outweighing the cost of borrowing.

Be wary of falling into a cycle of compounding debt, where new debt is acquired to pay off existing loans and credits. This practice can lead to a buildup of financial obligations and should be avoided unless it’s part of a well-considered financial strategy.

8. Embrace technology and automation

Technology can be a lifesaver during a recession but also outside of it. Automation helps you save money, save time, and generally increases the efficiency and accuracy of your business operations.

The benefits of implementing cost-effective automation tools and technologies:

- Work smarter, not harder: Automation tools can handle repetitive tasks like managing inventory, processing orders, or even answering basic customer queries. This means you spend less time on mundane tasks and more on growing your business.

- A website that wows: Your website is your storefront. Enhancements like faster load times, mobile optimization, and intuitive navigation can make browsing your site a breeze for customers.

- Cut costs, not corners: By automating, you reduce the need for a large workforce to manage everyday operations, which helps in cutting costs. But it’s not just about saving money; it’s about investing it where it counts.

- Personalized shopping experiences: Machine learning algorithms can track individual customer preferences and behavior, offering them personalized product recommendations. It’s like having a personal shopper for each customer.

- Smart operations: AI can also help in optimizing logistics, predicting the best shipping routes, or even managing your stock levels automatically, ensuring you’re never overstocked or understocked.

- Engaging through tech: From chatbots that provide instant customer service to augmented reality (AR) that lets customers ‘try before they buy’ right from their phone, tech can take customer engagement to a whole new level.

- Safe and secure shopping: Implementing the latest in cybersecurity ensures your customers can shop with peace of mind, knowing their data is safe.

9. Don’t forget about your personal finances

While this guide focuses squarely on an ecommerce business recession plan, the recession won’t happen only in your office, it’ll come into your home too. That’s why this article would be incomplete without a section about your personal finances. Here are some strategies to consider.

Build a robust emergency fund

Similar to your business emergency savings, you need to create a fund for your home finance as well. Aim to save enough to cover at least 3-6 months of living expenses. To bolster your savings, create a personal budget that prioritizes essential expenses. Cut back on non-essential spending to conserve cash. This might mean delaying big purchases or finding more cost-effective alternatives for everyday expenses.

This fund acts as a financial safety net to cover personal expenses in case the business income fluctuates or stops during the recession.

Take control of your credit

In preparing for a recession, it’s crucial to manage your credit wisely. Credit cards can be a double-edged sword; they’re useful for managing cash flow but can also lead to high-interest debt if not handled carefully. Prioritize paying down high-interest cards and consider transferring balances to cards with lower rates.

Be mindful of your credit utilization ratio, as a good credit score can be a lifeline in tough economic times, especially if you need to negotiate better terms on loans or open new lines of credit for emergency purposes.

Reassess your retirement strategy

Economic downturn can be particularly worrisome for those nearing retirement. It’s important to review your retirement plans and possibly adjust investment strategies to be more conservative. Avoid making hasty decisions with retirement funds, like early withdrawals, which can lead to penalties and long-term setbacks. Instead, focus on maintaining a diverse portfolio and consider consulting with a financial advisor to navigate through the recession without jeopardizing your future retirement.

Safeguard your child’s education during a recession

If you have children, the cost of education, from school fees to college tuition, must be considered when preparing for a recession. This might mean increasing contributions to education savings accounts when possible or exploring scholarship and financial aid options. For those in school or planning to attend, consider the potential impact of a recession on student loans and the job market post-graduation, and plan accordingly.

Maximize your insurance benefits during a recession

Insurance is a critical component of recession planning. Review your policies—whether it’s health, life, or property insurance—to ensure adequate coverage. In tough times, the last thing you want is to be hit with an unexpected expense that isn’t covered. Additionally, some insurance policies, like certain life insurance plans, can offer cash value components that might be utilized in emergencies.

Safeguard your home during a recession

For many, their home is their most significant investment. In recession times, it’s essential that your home is not at risk. If you have a mortgage, consider refinancing to a lower interest rate to reduce monthly payments. If you’re renting, create a budget that ensures you can continue to afford your home, even if income becomes tight. Remember, having a secure place to live provides not just physical shelter but also emotional stability during challenging economic periods.

Avoid mixing business and personal finances

Keep personal and business finances separate. This helps in better tracking and management of funds and ensures that personal financial health is not wholly dependent on the business.

For business owners, this means having separate bank accounts and credit cards for your business. Not only does this make tracking business expenses easier, but it also simplifies tax preparation and improves financial management. Additionally, maintaining this separation helps protect your personal assets from business debts or legal issues and vice versa.

Seek professional advice

Consult with a financial advisor for personalized advice and guidance. They can help you make informed decisions about investments, savings, insurance, and debt management. Be on the lookout for any government assistance programs, tax relief, or benefits that you may qualify for during a recession. These can provide some financial relief in tough times.

10. Plan for recovery

Nothing lasts forever and a recession – this too shall pass. That’s why, it’s good to look into the future and plan for recovery time. Here’s how you can plant the seeds for future growth and come out stronger:

Preparing for the post-recession market and how to capitalize on the economic recovery

Keep an eye out for signs of economic recovery. It’s like noticing the first buds in spring – a signal to get ready. As the market revives, reassess your product line. What worked during the recession might not be the best fit for a recovering economy. Think of it as pruning your garden to encourage new growth.

Customers who might have pulled back during tougher times could now be ready to spend again. It’s time to rekindle those relationships with fresh marketing efforts, like sending out new deals or launching a ‘we’ve missed you’ campaign.

Strategic investments during the recession that can yield long-term benefits

During a recession, certain resources, like advertising space or talent, may become more affordable. Investing in these can give you a head start when the economy picks up.

Use this time to strengthen your business foundation – whether it’s upgrading technology, training your team, or improving customer service processes.

Learning from the recession to build a more resilient and adaptable business model

Every challenge teaches something valuable. Analyze what strategies worked during the recession and which didn’t to develop a business model that can withstand a future economic downturn. This might mean diversifying your product range, exploring new markets, or building a more flexible cost structure.

Steps to prepare for a recession: Summing up

So there you have it, a complete playbook for weathering a recession with your ecommerce business. Remember, tough times don’t last, but tough businesses do. By being smart with your finances, keeping a close eye on your debts, leveraging technology, and staying connected with your customers, you’re setting your business up not just to survive a recession, but to come out on the other side stronger and more resilient. Keep these strategies in mind, and you’ll be ready to face whatever the economic future holds. Let’s keep pushing forward, adapting, and growing, no matter what the market throws our way!

%20(1).png)