Imagine running a successful business with customers from all corners of the world, each with their unique orders and payment timelines. This can be manageable at first, but as the amount of transactions increases, things can quickly become complicated. However, the accounts receivable subledger can help you with tracking the money your customers owe.

But how exactly does it work? And what sets a subledger apart from a general ledger? Keep reading to find out, today we’ll uncover all the tricky parts of the accounts receivable subledger.

Key takeaways:

- The general ledger records summarized transactions, while the subledger stores more detailed records of specific transaction types.

- The accounts receivable subledger represents company income, while the accounts payable subledger represents expenses.

- The accounts receivable subledger tracks detailed records of the money customers owe to your business.

- Identifying discrepancies in the subledger and making necessary adjustments is essential before finalizing the reconciliation process.

Contents:

1. What is the difference between a ledger and a subledger?

2. What is the subledger of accounts receivable?

3. What is the main difference between accounts receivable and accounts payable subsidiary ledger?

4. How to reconcile accounts receivable subledger to general ledger?

6. FAQ

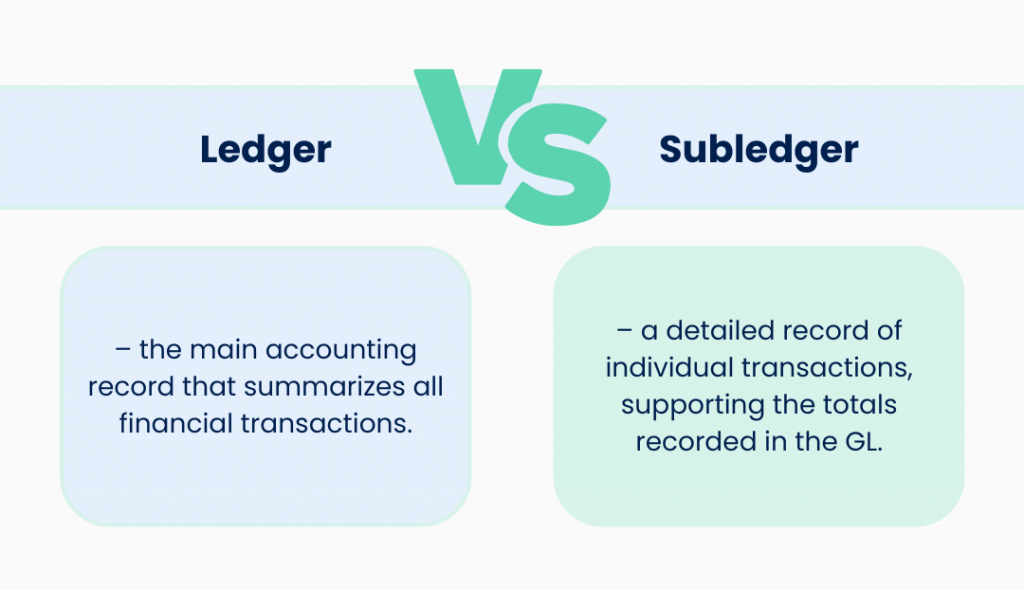

What is the difference between a ledger and a subledger?

Before diving into more details regarding particular accounts, let’s get into the basics. How do a ledger and a subledger differ? Is a subledger part of a ledger? Let’s explore.

The general ledger is the primary accounting record of a company, summarizing all financial transactions. In contrast, a subledger, also known as a subsidiary ledger, is a detailed record of a specific type of transaction, such as accounts receivable or accounts payable.

So to say, subsidiary ledgers are more narrowly focused and contain more detailed information.

All transactions in a subledger share one or more common characteristics. For instance, the asset category may include subledgers for cash accounts, accounts receivable, inventory, investments, and fixed assets.

Note: The listed transactions in each subsidiary ledger account should match the related general ledger accounts.

What is the purpose of subledger accounts in the general ledger?

The purpose of subledger accounts in the general ledger is to provide detailed information about specific types of transactions. It can show the account status and amounts owed by a specific customer. Accountants use subaccounts to organize the general ledger, especially in large organizations, where maintaining all transactions solely in the general ledger can become cumbersome.

What is the subledger of accounts receivable?

Simply put, a subledger of accounts receivable is a detailed record that tracks all the money customers owe to a company. It lists each customer’s unpaid invoices and the amounts they need to pay. This helps the company know exactly who owes them money and how much, supporting the overall summary of accounts receivable in the main ledger.

For example, while the general ledger may show a total accounts receivable balance of $100,000, it won’t specify which customer owes how much. This detailed information can be found only in the accounts receivable subsidiary ledger.

To ensure accuracy, a company’s accountant frequently reconciles the balance in each customer account with the accounts receivable balance in the general ledger.

How is subledger information posted to the general ledger?

The information contained in a subledger is typically totaled and summarized in a control account within the general ledger which reflects the activity recorded in the subledger but without all the details. This approach maintains the organizational structure of the chart of accounts while keeping the general ledger free of unnecessary details.

For example, a subledger for accounts receivable will include detailed journal entries with the date, purchase price, customer name, and cost of goods sold for each transaction. In contrast, the general ledger entry in the control account would represent only a total and summary of multiple similar entries within the subledger.

Eager to learn more about accounting specifics? Book a slot on Synder’s upcoming webinar with accounting professionals.

What is the main difference between accounts receivable and accounts payable subsidiary ledger?

The difference is pretty obvious. The accounts receivable subsidiary ledger, which tracks money owed to the company by customers, is the opposite of the accounts payable subsidiary ledger, which tracks money the company owes to suppliers.

| Feature | Accounts receivable subsidiary ledger | Accounts payable subsidiary ledger |

| Purpose | Tracks money owed by customers | Tracks money the company owes to suppliers |

| Contents | Detailed records of credit sales and customer payments | Detailed records of purchases and payments to suppliers |

| Types of records | Invoices issued to customers, payments received, credit memos | Invoices received from suppliers, payments made, credit memos |

| Impact on financial statements | Affects AR in the balance sheet and revenue in the income statement | Affects AP in the balance sheet and expenses in the income statement |

As you can see from the main differences discussed above, choosing between accounts receivable and accounts payable isn’t an option—both are essential. As a business owner, it’s important to track both aspects of your cash flow—income and expenses—for a complete and accurate financial picture of your business performance in a particular period of time.

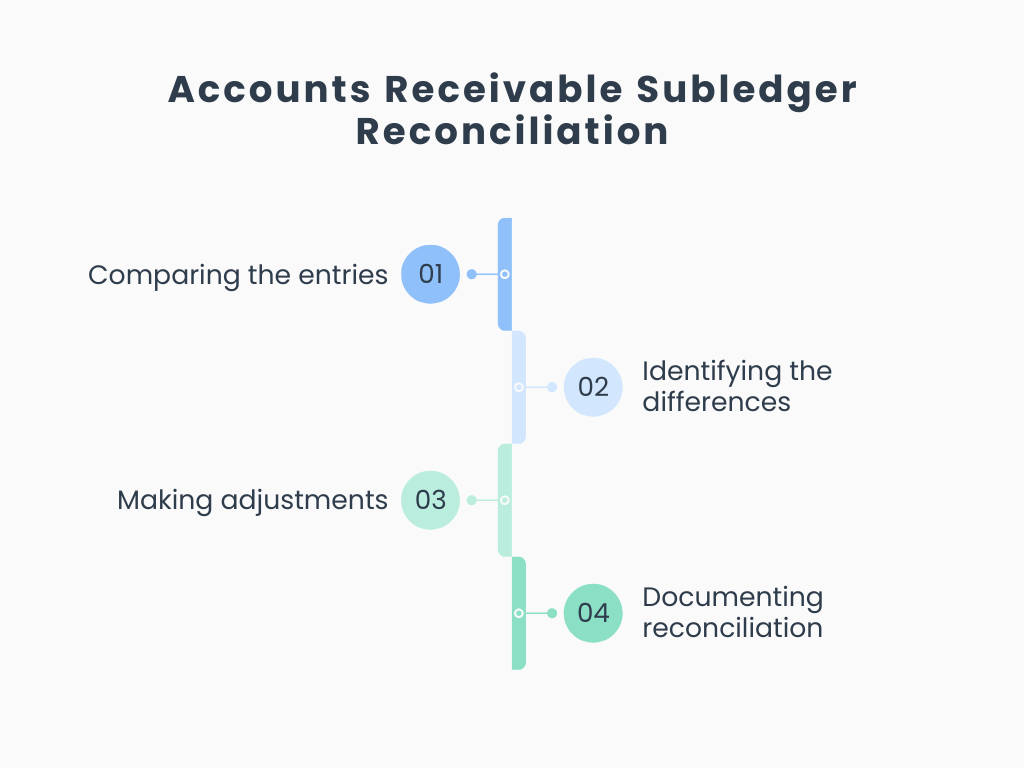

How to reconcile accounts receivable subledger to general ledger?

The balance in each customer account is periodically reconciled with the accounts receivable balance in the general ledger. This reconciliation process involves comparing the general ledger account balance with the total of the subledger, identifying any discrepancies, and making the necessary adjustments.

Overall, the whole process can be divided into 4 main steps:

But let’s get into more detail.

Step #1. Comparing the entries

First, obtain the accounts receivable subledger records, detailing each customer transaction, and the accounts receivable account records from the general ledger, summarizing all receivables.

Once the reports are generated, compare the ending balance in the subledger with the ending balance in the general ledger. They should match; discrepancies indicate inconsistencies that need further investigation.

Note: Ensure both reports cover the same date range.

Step #2. Identifying the differences

If the balances don’t match, identify potential discrepancies. These could be due to timing differences, missing transactions, or errors. Examine individual transactions in the subledger and their corresponding entries in the general ledger.

- Ensure that all transactions are recorded for the same period.

- Check that all credit sales, payments received, and any adjustments (like credit memos or write-offs) are accurately recorded in both reports.

- Identify any transactions that might be missing in either the subledger or the general ledger.

Step #3. Making adjustments

To align the balances, make necessary adjustments to the subledger or the general ledger. Correct errors in the subledger to reflect the true state of accounts.

Make adjusting journal entries in the general ledger to rectify any discrepancies. For example, if a payment was recorded in the subledger but not in the general ledger, an adjusting entry should be made.

Step #4. Documenting reconciliation

Prepare a reconciliation statement documenting the process, discrepancies found, and adjustments made. This serves as a record for future reference and audits.

It’s recommended to perform reconciliation on a monthly or quarterly basis to maintain accuracy in financial records and prevent large discrepancies from accumulating over time.

Automate the reconciliation process with Synder Sync, an advanced accounting automation solution. Join a Weekly Public Demo to explore the potential of accounting automation or start a 15-day free trial to experience its benefits firsthand.

Example of reconciliation

Now that we’ve gone through the main steps of accounts receivable reconciliation, let’s look at an example with a hypothetical company.

Subledger report: Example

Let’s assume there are three main customers: Customer A, B, and C.

The subledger report below provides a detailed record of their invoice and payment amounts:

| Customer | Invoice date | Invoice amount | Payment date | Payment amount |

| Customer A | 2024-06-1 | $5,000 | 2024-06-10 | $5,000 |

| Customer B | 2024-06-2 | $7,000 | 2024-06-12 | $7,000 |

| Customer C | 2024-06-3 | $8,000 | 2024-06-15 | $4,000 |

General ledger report: Example

The general ledger report below offers a summarized view of the total invoices and payments for accounts receivable:

| Account | Total invoices | Total payments |

| Accounts receivable | $20,000 | $16,000 |

Reconciliation steps

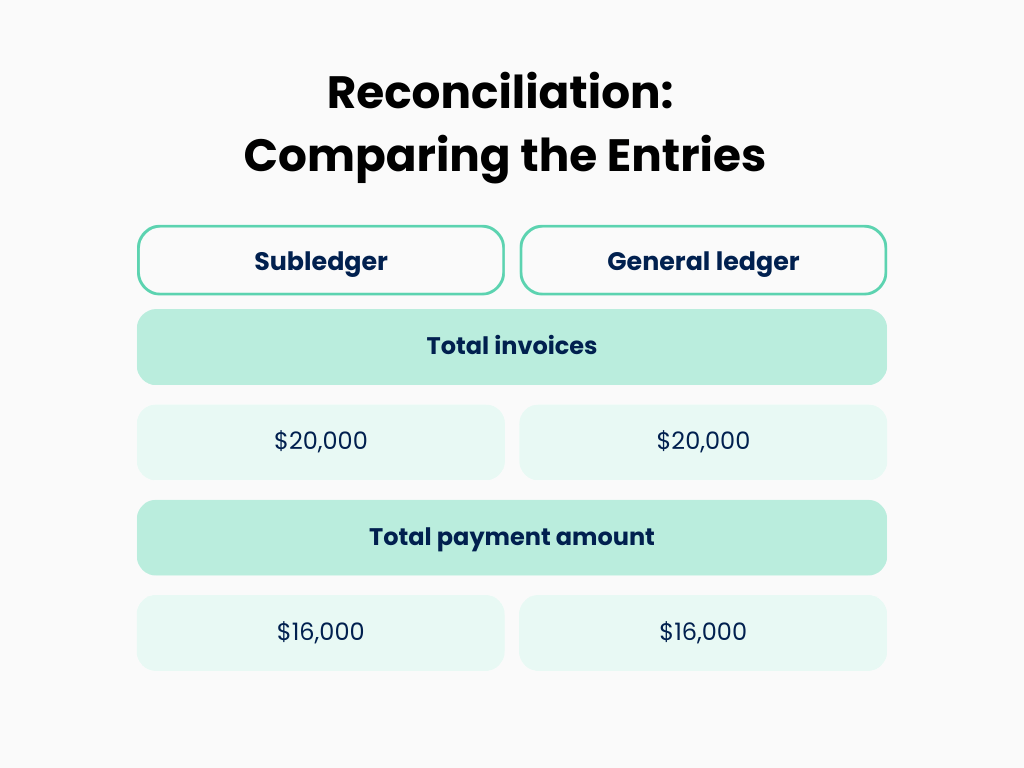

Step #1. Comparing the entries

First, let’s calculate the subledger total invoices and total payment amount:

$5,000 (Customer A) + $7,000 (Customer B) + $8,000 (Customer C) = $20,000

$5,000 (Customer A) + $7,000 (Customer B) + $4,000 (Customer C) = $16,000

Now, moving to the general ledger:

General ledger total invoices = $20,000

General ledger total payments = $16,000

The totals match, indicating no discrepancies in the invoice and payment summaries.

Step #2. Identifying differences

Next, let’s compare the individual transactions:

- Customer A: All entries match.

- Customer B: All entries match.

- Customer C: Invoice amount matches, but the payment amount in the subledger ($4,000) shows a partial payment against an invoice of $8,000. The remaining $4,000 is still outstanding.

Step #3. Making adjustments

Adjust the subledger to reflect that Customer C still owes $4,000.

Note: No adjustment is needed in the general ledger as it accurately shows the summary totals.

Step #4. Documenting reconciliation

The reconciliation statement will be the following:

- Discrepancy found: Partial payment from Customer C.

- Action taken: Confirmed the remaining balance of $4,000 for Customer C in the subledger.

Conclusion

Even though running a successful business can be incredibly rewarding, it requires all the right knowledge and tools to ensure smooth operations. The accounts receivable subledger is one such essential tool, providing detailed insights into the income of your business.

While the whole process might seem complicated at first glance, we hope that by breaking down each step of the reconciliation process, we’ve made it more logical and accessible. Now you know exactly where to start.

Share your thoughts

Has this article been helpful? Do you have any additional questions or tips for others solving the same challenges? Drop a comment below, and let’s talk!

FAQ

What are the two basic types of ledgers?

The two basic types of ledgers are the general ledger, which summarizes all financial transactions, and subledgers, which provide detailed records for specific accounts like accounts receivable and accounts payable.

What is a subledger account?

A subledger account is a detailed record that tracks individual transactions within a specific category, such as accounts receivable or accounts payable. It provides in-depth information on each transaction, supporting the summarized totals recorded in the general ledger.

Can a subledger be attached to multiple ledgers?

No, a subledger is typically linked to a single general ledger account. This ensures that the detailed information in the subledger supports and aligns with the summary data in the corresponding general ledger account and there’s no mess in the books.

What is subledger journal entry?

A subledger journal entry records individual transactions, such as sales or payments. These entries capture the specifics of each transaction, including dates, amounts, and parties involved. The transactions are then summarized and posted to the general ledger, where they contribute to the overall financial totals.

What goes under accounts receivable?

Accounts receivable includes all money owed to the business by customers for credit sales. It includes detailed records of invoices issued to customers, payments received, and outstanding balances.

Is the accounts receivable ledger an asset?

Yes, the accounts receivable ledger is considered an asset. The reason is that it represents the money that the company expects to collect from its customers for goods or services sold on credit.

.png)