Small business owners understand the importance of efficient financial management. Keeping a close eye on cash flow, managing expenses, and ensuring smooth transactions are vital for success. In this regard, the QuickBooks Checking account has emerged as a valuable tool.

Let’s look at the technical aspects of QuickBooks Checking, its features, and how it benefits small business owners.

Disclaimer:

The information below is a general overview of the subject. At this point, please don’t consider it legal or financial advice. For all your finance management matters, please turn to professionals. For more details on QuickBooks Checking account, please turn directly to the service provider.

What is a QuickBooks checking account?

As a small business owner, you understand the struggle of managing finances efficiently that other business owners often face. At this point, you might’ve also heard about QuickBooks Checking accounts as a solution designed to address these needs.

A QuickBooks Checking Account is a specialized business bank account tailored to meet the unique financial requirements of small business owners. This account works with QuickBooks, a popular software for managing business finances and accounting.

If you need to refresh your knowledge of a checking account, feel free to read our article: Checking Account as a Type of Bank Account: Understanding the Nature of Checking Accounts

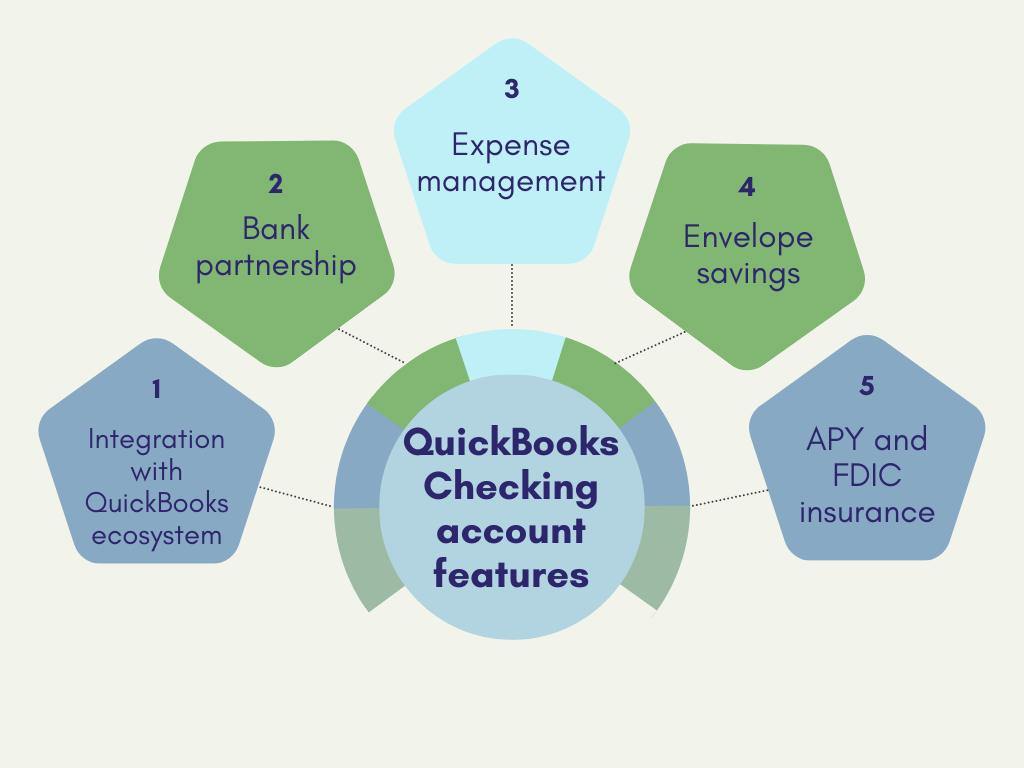

QuickBooks Checking features and benefits for SMBs

Now, why should small businesses consider QuickBooks Checking? Let’s look at some features it offers small business owners.

- Integration with QuickBooks ecosystem

QuickBooks Checking provides small business owners with the convenience of seamless integration into the QuickBooks ecosystem. This integration offers a holistic view of your business finances, simplifying your financial management processes.

- Bank partnership

Green Dot Bank, a member of the FDIC, partners with QuickBooks to make QuickBooks Checking possible. This partnership assures customers that their funds are FDIC insured up to $250,000, providing high security and confidence.

- Expense management

This account can handle bill pay, helping your business meet its financial obligations on time. With QuickBooks Checking, business owners can efficiently manage expenses, schedule payments, and maintain a healthy financial reputation.

- Envelope savings

Another feature you might find interesting is the support of the so-called envelope system. QuickBooks Checking account allows users to create up to 9 envelopes for saving money for future expenses. This feature provides business owners with a useful tool for predicting cash flow. This way, you can allocate funds for specific purposes, aiding in budgeting and ensuring you meet your financial goals.

QuickBooks Checking account offers a host of other features that can be beneficial to businesses. It offers APY and FDIC insurance, helping small business owners simplify their financial operations with a complete financial solution. You can also sign up for Quickbooks Payments for easy payment processing. So you can use bpth for more efficient finance management.

We’ll look at some of these features in more detail below.

Partnering with Green Dot Bank

Partnering with Green Dot Bank has been a significant development for QuickBooks users who rely on the Checking Account ecosystem. Green Dot Bank provides a secure and robust financial platform. Green Dot Bank and QuickBooks have partnered to create a trustworthy and excellent service, combining their expertise and convenience. As a result, QuickBooks Checking is now a game-changer in business banking, delivering peace of mind to its users.

Green Dot Bank is a member of the FDIC, which is part of their partnership. When you choose QuickBooks Checking for your business, your protect your bank account thanks to the FDIC partnership. Small business owners must trust Green Dot Bank to handle their funds securely.

Identity verification and approval process

Signing up for QuickBooks Checking and partnering with Green Dot Bank requires some steps to ensure you transactions security. They include identity verification and approval, which helps safeguard your financial information and prevent fraud.

This process involves a series of checks and verifications to confirm your identity and approve your account. It may include providing personal information and documents and verifying your financial history. These steps are in place to safeguard your funds and prevent unauthorized access to your account.

FDIC insurance: your peace of mind

As mentioned earlier, partnering with Green Dot Bank for your QuickBooks Checking account has significant advantages. One of the most notable is FDIC insurance coverage. Customers who opt for QuickBooks Checking are FDIC-insured for up to $250,000. This insurance provides a safety net, guaranteeing that your funds will remain protected in the unlikely event of bank insolvency.

For small business owners, this level of financial security is invaluable. It helps safeguard your working capital, savings, and business transactions. So, you can focus on growing your business without worrying about the safety of your funds.

Partnering with Green Dot Bank for your QuickBooks Checking account can be a wise choice for small business owners. Especially those seeking for their funds security and access to many financial tools and services.

A closer look at annual percentage yield (APY) and other financial aspects

As a business owner, you might want to manage your finances effectively, making the most of your idle funds. Knowing what is the annual percentage yield (APY) might help you if you have a QuickBooks Checking Account.

APY is the interest your account can earn within a year, expressed as a percentage of your average daily balance. For small business owners, this means you can make your money work for you, even when it’s not in active use.

The APY offered by QuickBooks Checking account can vary, and it’s essential to understand the terms and conditions associated with it. This interest can help you earn a passive income, thereby increasing your overall profitability.

Fees or minimum balance requirements: what to expect

Before committing to a business bank account, it’s essential to understand any associated fees and minimum balance requirements. QuickBooks Checking Account ensures transparency in this regard, enabling small business owners to make informed decisions about their financial management.

Fees and minimum balance requirements can vary depending on the particular account and usage. But QuickBooks provides detailed information on monthly maintenance fees, transaction fees, or other charges. The users have access to a fee schedule, helping them budget accordingly.

The deposit sweep program

The Deposit Sweep Program allows you to maximizeyour account’s potential by moving excess funds into an interest-bearing account. In essence, it’s another way to ensure that your money always works for you, even when you’re not actively using it.

The Deposit Sweep Program helps you balance maintaining the liquidity required for daily operations and earning interest on the surplus funds. For businesses that experience fluctuating cash flow, it can help make the most of the available capital.

Deposit Sweep Program comes with automation. It minimizes the need for manual fund transfers, making it a hassle-free way to optimize your account’s performance.

Accessibility and convenience

Small business owners know that time and accessibility are crucial in managing finances. QuickBooks Checking Account has recognized these needs and offers a range of features that cater to accessibility and convenience.

Accessing over 19,000 all-point ATMs

A QuickBooks Checking account comes with access to over 19,000 allpoint ATMs across the United States. At this point, you can easily find a nearby ATM to make withdrawals or deposits. This extensive network means you’re never far from your money, ensuring that your business operations can continue smoothly without delays.

It’s worth mentioning that with a QuickBooks Checking account, you can use allpoint ATMs without incurring additional charges. It helps you save money in the long run, being an advantage compared to other traditional business bank accounts. Those might have limited ATM partnerships and impose fees for using ATMs outside their network.

QuickBooks Checking deposit processing

Efficient deposit processing is vital for small businesses to maintain a steady cash flow. QuickBooks Checking Account offers quick and hassle-free deposit processing, ensuring your funds are available for business needs without unnecessary delays.

At large, deposits you make through a QuickBooks Checking account need one business day processing. So, you don’t have to wait for too long to access the money you received from your clients or customers. This expedited processing time sets QuickBooks Checking apart from some traditional banks that may take longer to clear deposits.

For small business owners, it can be a game-changer. It allows you to make time-sensitive payments, invest in opportunities as they arise, and keep your cash flow healthy.

How to obtain and manage your QuickBooks Checking account

With no monthly fees, minimum balances, and no instant deposit fees, QuickBooks Checking account is an effective financial management tool. It helps cash flow forecasting and has an interest-earning potential. Here’s how you can start and efficiently manage your QuickBooks Checking account.

Getting your QuickBooks Checking account

To get your QuickBooks Checking Account, you first need to sign up for QuickBooks Payments. Upon approval, you’ll automatically receive your QuickBooks Checking Account. You’ll also receive your physical QuickBooks debit card in the mail within seven to ten business days.

Connecting your bank account

After receiving your QuickBooks Checking Account, you’ll want to link your bank account to streamline transactions and transfers. Here’s how:

- Navigate to Banking services, then select QuickBooks Checking.

- Choose Transfer and then select Transfer money.

- Select Add a Bank and provide your bank name, account type, account number, and routing number.

- QuickBooks will send two small deposits to your account within three business days. Once you see these deposits in your bank account, return to QuickBooks to verify the transactions.

- To verify your bank, enter the two deposit amounts sent by QuickBooks. The order in which you enter them doesn’t matter. Confirm your verification.

Please note that some banks may not require verification. In this case, you can select Add to connect your bank.

Transferring money in and out

Transferring money into and out of your QuickBooks Checking Account is straightforward.

Transferring money in:

- Go to Banking services, then select QuickBooks Checking.

- Choose Transfer and then select Transfer money.

- Enter the amount you wish to transfer.

- In the From dropdown, select your connected bank account.

- In the To dropdown, choose your QuickBooks Checking account.

- Complete the transfer by selecting Next and then Finish transfer.

Transferring money out:

- Go to Banking services, then select QuickBooks Checking.

- Select Transfer and then Transfer money.

- Enter the amount to transfer.

- In the From dropdown, select your QuickBooks Checking account.

- In the To dropdown, choose your connected bank account.

- Complete the operation the same way you did for transferring money.

Paying bills

You can use your QuickBooks Checking Account to pay bills. To do this, follow these steps:

- Navigate to Banking services, then select QuickBooks Checking.

- Choose Pay bill and follow the prompts to schedule payments – whether by paper check or ACH.

Managing your QuickBooks Checking account

Managing your QuickBooks Checking Account is essential for staying on top of your financial activities. Here’s how to effectively manage your account.

Reviewing your transfers:

- Visit Banking services, then select QuickBooks Checking.

- In the Recent activity section, select View all.

- You can filter the list by selecting All, Money in, or Money out. For more details on individual transactions, click on them.

Checking monthly statements

- Go to Banking services, then select QuickBooks Checking.

- Select “View account,” then choose “Manage” and “Monthly Statements.” You can access your monthly statements here.

Getting help with your debit card:

- If you need assistance with your QuickBooks debit card, go to Banking services, then select QuickBooks Checking.

- Select View account, then choose Manage. Here, you can opt to Replace card or Reset Pin to receive help with your debit card.

As you can see, obtaining your QuickBooks Checking Account might take less then 30 minutes. Its user-friendly interface and various features allow managing it with ease. QuickBooks Checking simplifies financial operations, streamlines transactions, and keeps your business finances in check.

Bottom line

As you can see, the QuickBooks Checking account is a game-changer for small business owners. It offers an integrated, secure, and highly convenient financial management solution.

QuickBooks Checking accounts come with seamless connection to the QuickBooks ecosystem and strong partnership with Green Dot Bank. They also offer a range of features like bill pay and the innovative envelope savings system). They help business owners to streamline their financial operations and maintain a healthy financial reputation.

The added benefits of annual percentage yield (APY), FDIC insurance coverage, and a transparent fee structure enhance its value. The Deposit Sweep Program and efficient deposit processing underscore the emphasis on financial efficiency. When time and accessibility are crucial, a QuickBooks Checking account might be invaluable for small business owners. It allows them to focus on growth and success while simplifying the complexities of financial management.

%20(1).png)