Accounts Payable might sound like just another tricky part of your accounting system, but if you pay attention to it and calculate it correctly, it can tell you a lot about how well your business is doing. It shows how smartly the company is handling its money, how well it’s working with the people it buys things from, and even hints at how smooth its day-to-day operations are.

This article is going to break down what Accounts Payable really means, why it’s so important, and how you can figure it out using some simple math. We’ll also explore how this number affects a company’s cash flow and its overall efficiency.

Unlock your financial potential with Synder accounting software. Streamline your accounting with our cutting-edge automation solution for online transactions.

TL;DR

- Knowing how to calculate Accounts Payable (AP) can give you a clear picture of what your business owes, helping you avoid cash crunches.

- Staying on top of your AP calculations ensures you can use credit wisely, keep suppliers happy, and even save money with early payment discounts.

- Understanding your AP turnover ratio and days payable outstanding (DPO) can tell you if you’re paying bills too quickly or slowly, impacting your cash flow and bargaining position.

- Effective AP management through these formulas equips you with the knowledge to make smarter financial decisions for your business’s growth.

Contents:

1. Understanding Accounts Payable

2. Do I need to track Accounts Payables in my small business?

3. Do I need to calculate Accounts Payable?

4. Calculating Accounts Payable

5. Basic calculation of Accounts Payable’s ending balance: AP Formula

6. How to calculate the Accounts Payable ending balance in a company?

7. Accounts Payable (AP) ratios: What a business should know

- The formula for the Accounts Payable turnover ratio

- How the Accounts Payable turnover ratio looks in business situations

- What can your business learn from the AP turnover ratio?

8. The concept of ‘days’ in Accounts Payable

Understanding Accounts Payable

Accounts Payable, often abbreviated as AP, represents one of the most essential aspects of a company’s short-term liabilities. Let’s discover what it truly is, why it’s significant in business finance, and gain an overview of the payable process.

What is Accounts Payable?

At its core, Accounts Payable refers to the amounts a company owes to its suppliers or vendors for goods and services received but not yet paid for.

These amounts are often a result of purchasing on credit, a common business practice that allows companies to buy goods now and pay for them later.

The term “payable”, in the context of Accounts Payable, means expected to be paid.

This liability is recorded on the company’s balance sheet under current liabilities and represents a promise to pay an amount within a specified period.

Overview of the payable process

The Accounts Payable process, while varying slightly between companies, generally follows these steps:

- Purchase order creation: The company places an order for goods or services.

- Goods or service receipt: The company receives and accepts the goods or services, often recording it on a receiving report.

- Invoice receipt and verification: The supplier sends an invoice to the company. This invoice is then matched to the purchase order and the receiving report to ensure everything aligns.

- Invoice entry and approval: The invoice details are entered into the accounting system or accounting automation software, and the necessary approvals are secured for payment.

- Payment processing: After all verifications and approvals, the payment is scheduled and processed. When the amount is actually paid depends on the agreement between the company and the suppliers (e.g. net 30 days).

- Reconciliation and reporting: The Accounts Payable ledger is reconciled with the supplier statements, and necessary reports are generated for internal use and auditing purposes.

Do I need to track Accounts Payables in my small business?

If your business uses cash accounting, transactions are recorded only when cash changes hands. This means that expenses aren’t recorded when they’re incurred but rather when they’re paid. Consequently, there wouldn’t be an “Accounts Payable” in the same sense, because liabilities aren’t recognized until the payment is actually made.

If your business uses accrual accounting, the approach is quite different. You record expenses and revenues when they are incurred or earned, regardless of when cash is exchanged. This approach includes the use of Accounts Payable (AP) for tracking money owed for purchases made on credit.

In other words, you need to track Accounts Payable when you use the accrual accounting method and you buy goods or services on credit. Otherwise, you don’t.

Elevate your accrual accounting with Synder! Simplify your financials with our intuitive software. Book our Weekly Public Demo to see how we can help, and start your free trial today—no credit card required.

How AP helps you get an accurate financial picture

Without the use of AP to track obligations on credit, businesses might struggle with managing cash flow effectively. The accrual method, by including AP, allows for better anticipation of future cash needs and helps ensure that there’s enough cash on hand to cover upcoming liabilities.

On the flip side, using cash accounting can make a business’s financials appear more volatile. Without AP, expenses are only recognized when paid, potentially leading to periods that show high profits (if expenses are low because bills haven’t been paid yet) followed by periods of low profits (when those expenses are paid). This can make it harder to understand the company’s ongoing financial obligations and performance.

Do I need to calculate Accounts Payable?

Now that we’ve established that AP can be very beneficial, let’s find what you can get from calculating Accounts Payable metrics:

- Improves financial strategy: Calculating Accounts Payable helps monitor debt levels, identify trends, and address potential cash flow issues before they become problematic. This proactive approach supports better financial health and planning.

- Optimizes cash flow: By keeping track of AP, your company can strategically time its payments to maximize its working capital. This means you can make the most of the credit terms offered by suppliers, balancing cash inflows and outflows without jeopardizing the liquidity.

- Strengthens supplier relationships: Regular calculation and monitoring of AP ensure that payments to suppliers are made on time. This punctuality helps in maintaining positive relationships with suppliers, securing favorable terms, and avoiding supply chain disruptions.

- Unlocks cost savings: Understanding AP dynamics allows companies to identify opportunities for early payment discounts offered by vendors. Such savings can significantly reduce overall procurement costs, contributing to the bottom line.

Learn how to automate your accounting for accurate records, financial statements, and insights.

Calculating Accounts Payable

In the following sections, we’ll introduce you to essential formulas for calculating AP, setting you up with the knowledge you need. By mastering these formulas, you’ll be able to shine a light on your company’s financial commitments and how effectively you’re meeting them.

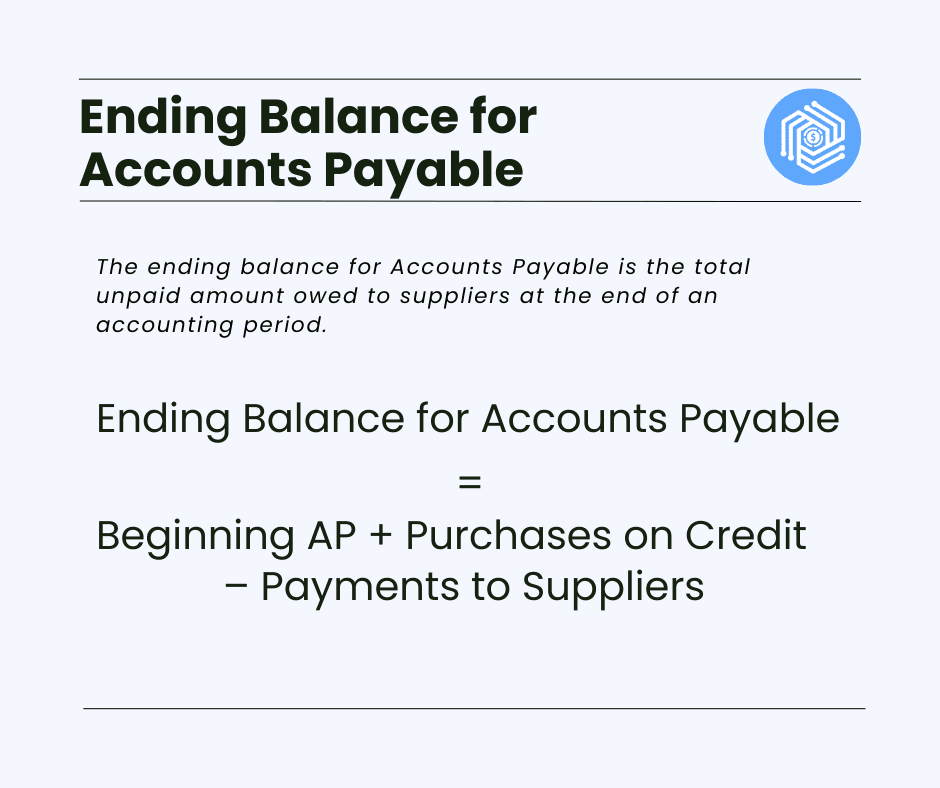

Basic calculation of Accounts Payable’s ending balance: AP Formula

The ending balance for Accounts Payable is the total amount of money a business owes to its suppliers or vendors for goods and services received but not yet paid for at the end of an accounting period. This figure reflects all outstanding obligations that the company is yet to settle with its creditors.

Formula:

Ending AP = Beginning AP + Purchases on Credit – Payments to Suppliers

Where:

Beginning AP shows the opening balance of the Accounts Payable at the start of the period. It represents the total unpaid amounts owed to suppliers from the previous period(s).

Purchases on credit indicate the total value of goods and services purchased on credit during the period. Essentially, these are the new obligations or debts incurred.

Payments to suppliers are the total payments made towards settling Accounts Payable during the period. This amount will reduce the outstanding liability.

How to calculate basic Accounts Payable:

Step 1. Begin by noting down the opening balance of the Accounts Payable for the period (Beginning AP).

Step 2. Add any new amounts owed to suppliers or vendors due to credit purchases during the period.

Step 3. Subtract any payments made to suppliers during this timeframe. The result provides the ending Accounts Payable amount.

How to calculate the Accounts Payable ending balance in a company?

Accounts Payable comes to life when we move from theory to practice. Through tangible scenarios and real-world transactions, we can better appreciate its impact on a business’s day-to-day financial operations, so let’s have a look at the calculation of the Accounts Payable ending balance.

Practical examples

- At the beginning of January, XYZ Corp. has an Accounts Payable balance of $50,000. During January, the company purchases goods worth $30,000 on credit. By the end of the month, they make payments totaling $40,000 to suppliers.

Using the formula:

Ending AP = $50,000 (Beginning AP) + $30,000 (Purchases on Credit) – $40,000 (Payments)

Ending AP = $40,000 for January

- Imagine a bakery, Sweet Delights, starts February with no Accounts Payable (new business). In February, they buy ingredients worth $5,000 on credit terms. They manage to pay off $2,000 by the end of February.

Using the formula:

Ending AP = $0 (Beginning AP) + $5,000 (Purchases on Credit) – $2,000 (Payments)

Ending AP = $3,000 for February

These examples show you how your Accounts Payables can inform your company’s overall financial management, affecting everything from cash flow to supplier relationships and operational efficiency.

Accounts Payable (AP) ratios: What a business should know

Beyond just representing the amount a business owes to its vendors or suppliers, Accounts Payable can provide deep insights into the company’s operational and financial health when used in various financial ratios. One such metric is the AP turnover ratio.

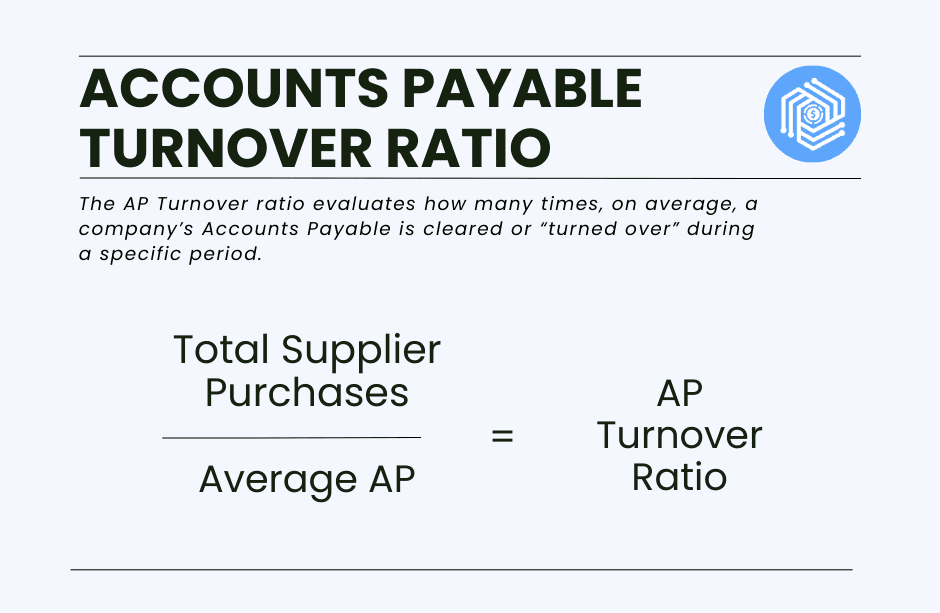

The formula for the Accounts Payable turnover ratio

The AP turnover ratio evaluates how many times, on average, a company’s Accounts Payable is cleared or “turned over” during a specific period (often a year).

Formula:

AP Turnover Ratio = Total Supplier Purchases / Average Accounts Payable

Where:

Total supplier purchases represent the total amount a company spends on buying goods or services.

Average Accounts Payable is determined by adding the beginning and ending AP for a period and dividing by two.

How to calculate the Accounts Payable turnover ratio:

Step 1. Calculate the total supplier purchases for the period (this excludes any cash purchases).

Step 2. Determine the average Accounts Payable by adding the beginning and ending AP, then dividing by two.

Step 3. Apply the formula to ascertain how effectively a company is settling its payables.

How the Accounts Payable turnover ratio looks in business situations

Getting a handle on how fast your business pays its bills can really tell you a lot about how you’re managing your money. Think of the Accounts Payable turnover ratio as a report card that shows how often you’re paying off what you owe each year. And by flipping that number around, we can figure out how many days, on average, you take to pay a bill. Let’s explore what these figures reveal about your business’s money habits and how smoothly things are running.

How often payments are made

Let’s say a company has an AP Turnover ratio of 10 for the year. This means the company has managed to pay off its bills about 10 times over the course of that year. In simpler terms, they’re staying on top of their obligations and clearing their Accounts Payable pretty regularly.

How long it takes to pay

Now, looking at the flip side, if we take the reciprocal of the AP Turnover ratio (which is just a fancy way of saying we divide 1 by the turnover ratio), we get an idea of how long it takes the company to pay its bills. With an AP Turnover of 10, it works out to be around 36.5 days on average to settle up (365 days ÷ 10). So, on average, the company takes a little over a month to pay off its invoices for that year.

What can your business learn from the AP turnover ratio?

The AP turnover ratio is invaluable as it offers a clear window into a company’s short-term liquidity and its efficiency in settling short-term obligations.

Higher turnover rate

A high ratio indicates that a company is paying off its suppliers at a faster rate. This could be due to efficient working capital management, good cash reserves, or favorable credit terms from suppliers.

Lower turnover rate

A lower ratio may suggest potential cash flow issues or that the company is availing of lengthy credit terms from its suppliers. It could also indicate potential disputes with suppliers or dissatisfaction with delivered goods/services.

Comparative analysis

By comparing the AP turnover ratio across periods or with industry peers, companies can identify trends, anomalies, or areas of improvement. It helps businesses benchmark their payment practices.

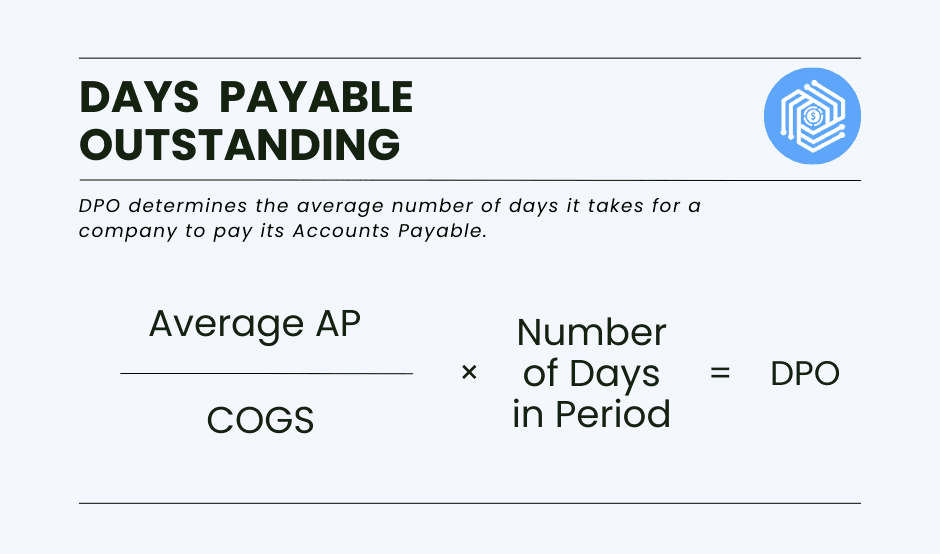

The concept of ‘days’ in Accounts Payable: What is days payable outstanding (DPO)?

Accounts Payable is a key metric on its own, but when we start looking into the duration, or the number of days involved in Accounts Payable, it opens up a whole new perspective on a company’s financial management. Here, we’ll delve into what days outstanding payable (DOP) means, its significance, and how it can be interpreted.

Days payable outstanding (DPO) formula

DPO determines the average number of days it takes for a company to pay its Accounts Payable.

Formula:

DPO = (Average Accounts Payable / Cost of Goods Sold) x Number of Days in Period

Where:

Average Accounts Payable can be derived by adding the starting and ending Accounts Payable for a period, and then dividing by two.

Cost of Goods Sold (COGS) represents the costs directly involved in producing the goods or services sold by the company during the period.

Number of days in period usually represents a quarter (90 or 91 days) or a year (365 or 366 days), depending on the timeframe being evaluated.

Determining the days payable outstanding (DPO):

Step 1. Calculate the average Accounts Payable (as described above).

Step 2. Find the cost of goods sold (COGS) for the period from the income statement.

Step 3. Use the formula to derive the average number of days taken to clear payables.

Why is calculating DPO useful to a business?

While days payable outstanding is a straightforward concept, its implications and what it signifies about a company’s operations, strategies, and financial health are profound.

Spotting cash flow trends

A rising DPO can hint that your business is holding onto cash longer, which could be smart planning or a sign of tighter cash flow. On the flip side, a lower DPO suggests you’re paying bills swiftly, possibly to snag discounts or meet supplier terms. Keeping an eye on DPO helps you understand and manage your cash flow better.

Boosting operational smarts

Changes in your DPO can reveal a lot about how smoothly your business runs. A longer DPO might show you’re good at negotiating with suppliers to get more time to pay, boosting your business’s leverage. But if the reason for a long DPO is internal inefficiency, it’s a heads-up to streamline your processes.

Comparing with competitors

Your DPO doesn’t just tell you about your own business; it also tells you how you stack up against others in your field. If your DPO is much higher than average, it could mean you’re out-negotiating competitors or it could warn of potential cash issues. Either way, it’s a valuable insight into where you stand in the industry.

Conclusion

The AP formulas do more than just reveal what you owe; they offer a clear picture of your financial commitments at any given moment. More importantly, keeping an eye on these numbers over time sheds light on your company’s financial well-being and how smoothly it operates.

Whether you’re looking to tighten up your budget, negotiate better terms with suppliers, or just make sure you’re on solid financial ground, mastering these formulas is a step in the right direction.

As businesses evolve and the financial complexity grows, grounding oneself in the fundamentals, like Accounts Payable, ensures informed and data-driven decision-making.

Read more about Revenue Recognition.

Share your experience

Have you applied these concepts within your own business? Did you find certain strategies particularly effective for managing cash flow or negotiating with suppliers? Perhaps you’ve encountered challenges along the way? We’d love to hear your stories and insights.

.png)

Thanks for the article!

You’re most welcome, David!