Companies are constantly looking for data and insights that can accurately assess the financial health of their business. Though sometimes overlooked, accounts payable turnover ratio is one of the metrics that sheds light on this aspect. It operates behind the scenes, quietly disclosing how quickly a business can settle its short-term debts within a given period. To both astute business operators and informed investors, this ratio acts as a financial GPS, charting a course through the intricacies of a company’s cash management techniques.

This article aims to delve into the importance of the accounts payable turnover ratio, its calculation, and interpretation, and the strategic insights it provides for efficient business management.

Contents:

1. What is accounts payable turnover?

2. Understanding accounts payable turnover ratio

- How to properly calculate the accounts payable turnover ratio?

- Calculating turnover ratio: A business example

3. Low vs high AP turnover ratio – how to interpret them?

5. What valuable information can accounts payable turnover provide for efficient business management?

What is accounts payable turnover?

Accounts payable turnover is the rate at which a company pays off its short-term debt to suppliers during a specified period. In other words, it shows the number of times a company pays off its accounts payable within a certain period.

Understanding a business’s accounts payable turnover can help both business owners and investors better understand the management and use of cash. It can help provide a glimpse into a company’s financial situation and operations and how they’re handling their short-term debt.

Understanding accounts payable turnover ratio

The accounts payable turnover ratio is a guiding key performance indicator (KPI) that can help adjust the performance of the business when used with additional information. It’s important to note that looking at the ratio solely can potentially impede financial analysis as it hyper-focuses on a single element of the financial playing field. To get the most out of this insight, you need to take into consideration some of the other aspects like the operating cash flow, the current ratio, and the cash conversion cycle. When looking at multiple elements, it’s much easier to get a clear picture of a company’s creditworthiness and ability to properly manage the cash flow.

From our experience, this is a ratio to keep in mind when reviewing the financials of a business to know what to investigate further telling you what action you need to take.

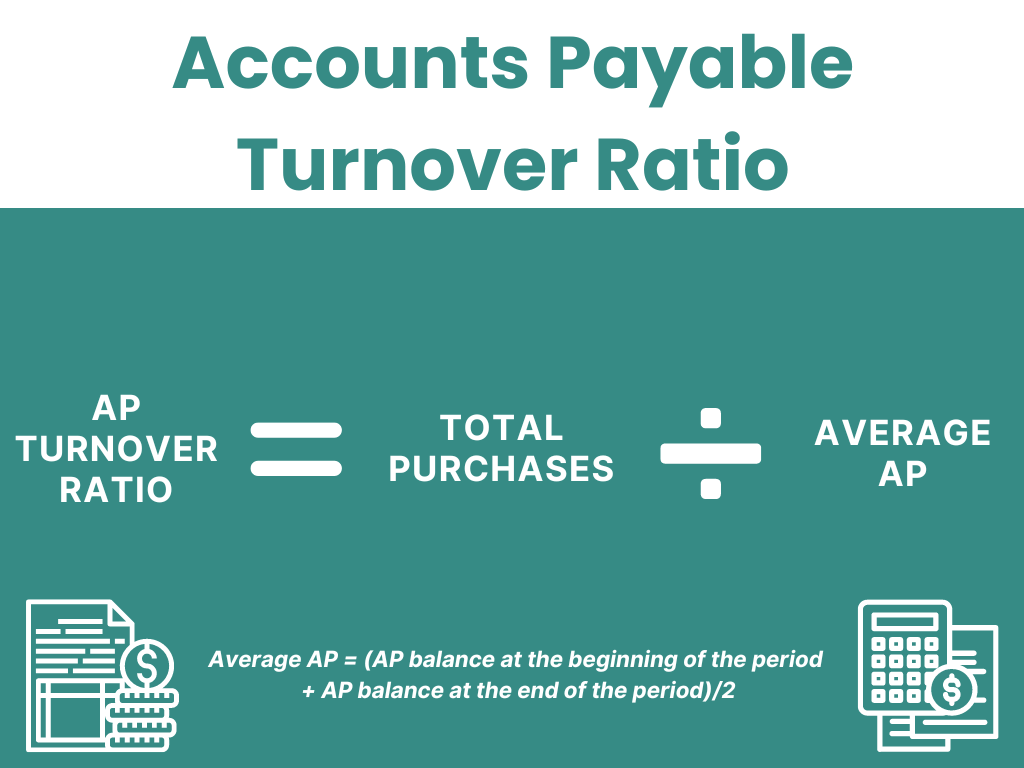

How to properly calculate the accounts payable turnover ratio?

Calculating the accounts payable turnover ratio can be done by dividing the total number of purchases during a given period by the average accounts payable balance for that same period. The simplest way to get the average AP is to take the AP balance at the beginning of the period plus the AP balance at the end of the period and divide by 2.

The equation is shown below:

Accounts Payable Turnover Ratio = Total Purchases / Average AP

The average AP is calculated as follows:

Average AP = (AP balance at the beginning of the period + AP balance at the end of the period)/2

Calculating turnover ratio: A business example

Now let’s explore the AP turnover ratio with the help of hypothetical business data.

If:

- A business wants to know their AP Turnover ratio for last year;

- They purchased $50 million of inventory during the year from their suppliers;

- At the start of the year, their Accounts Payable Balance was $5 million;

- At the end of the year, their Accounts Payable balance was $10 million;

Then: We’d use the equation mentioned above to calculate the AP turnover ratio for this business:

$50,000,000

(($5M + $10M)/2) = 6.67

This number tells us the company paid off their accounts payable 6.67 times during the year. The significance of the number will heavily depend on the other financial information related to the company as well as what industry they’re operating in. Without additional data, it’s difficult to determine if the ratio is good or bad.

Low vs high AP turnover ratio – how to interpret them?

Before diving into the nuances of a “high” and “low” accounts payable turnover ratio, it’s important to consider the type of business as well as the industry.

In general, a higher ratio number indicates that a company is paying off their accounts payable at a faster rate, which will often be preferable in industries that have inventory levels that consistently need refilling such as ecommerce businesses or retail stores. A high ratio in these circumstances might indicate that the business is moving inventory, resupplying it, and staying on top of the payments throughout the process.

A lower ratio indicates that the company is paying off the accounts payable at a slower rate. Whether this is good or bad depends on a number of factors. But one of the top considerations to keep in mind, alongside the industry, relates to supplier agreements. For example, take a company with an accounts payable turnover ratio of 12, meaning that they make roughly 1 payment a month over the course of the year. If their purchase agreements with suppliers actually indicate payments within 60 days instead of 30, a turnover ratio of 12 would imply that the company might be making payments at a pace that is faster than they need. This would lead most people looking into finances to question the usage of cash as well as if they’re truly leaning on credit in the right way to grow their business.

How the number of days outstanding (DPO) can help businesses better understand accounts payable turnover

The number of days it takes for a company to pay off its bills will directly affect the AP turnover depending on whether the time frame is larger or smaller. The more time passes before paying off the bills, the lower the AP turnover ratio as there are fewer remitted payments within a given period of time. The lower the DPO amount if invoices are paid more quickly the higher the AP turnover ratio.

Understanding DPO and turnover ratio for a SaaS business

When considering both the DPO and the AP turnover ratio, it’s important to keep in mind industry standards. They’ll give you a clue about whether or not your business keeps up with the others. For example, if the DPO of a SaaS business showed they are paying the bills faster than the other organizations in their field, that would reveal some issues with the cash flow management which is especially essential when you develop high-tech software as without that pivot in, a SaaS organization could potentially miss out on resources, and as a result, feature deliverables.

What valuable information can accounts payable turnover provide for efficient business management?

As previously mentioned, the accounts payable turnover helps identify creditworthiness as well as the effectiveness of a company’s cash flow management. Should a company be too eager to pay off the accounts payable amount when there’s more time available to retain the cash, it could mean losing opportunities a business might have if there was more cash on hand, as if you don’t take full advantage of the available credit, outside investors might question the creditworthiness of the business.

Another important aspect the accounts payable turnover ratio might shed light on is your relations with the supplier, which can identify if you need to spend more time negotiating payment terms to gain an advantage. If supplier relations are strong, there could potentially be more opportunities to extend the line of credit, which can open many more possibilities. Considering how difficult it is to raise funds at the moment, being able to tap into a longer payment period could provide a bit of extra cash on hand, which could benefit the other departments.

This ratio provides an early indicator of the areas in the business that need exploring and analyzing further. As we’ve mentioned before, looking only at the ratio can be misleading. You need to take into account various aspects of the ongoing financial review. This way, you can develop reasonable spending habits and possibly capitalize on supplier opportunities, which might eventually give you a competitive edge in the industry.

Accounts payable turnover: Closing thoughts

The accounts payable turnover ratio is a powerful indicator of a company’s financial health and cash flow management. When coupled with other financial metrics, it provides invaluable insights into a company’s operations. By understanding their accounts payable turnover ratio, businesses can better manage their cash flows, choose the right tactic for negotiations with suppliers, evaluate their creditworthiness, and make strategic decisions that foster growth and stability.

As the business environment continues to evolve, tools like the accounts payable turnover ratio will remain vital for companies striving for sustainable success.

.png)