As a business owner, you might face various scenarios where financial discrepancies or customer concerns might need resolution, such as erroneous billings, product returns, overcharged invoices, etc. It’s where credit memos can assist, offering a structured approach to issue refunds, correct billing errors, or acknowledge returns, ensuring financial accuracy and enhancing customer satisfaction.

Let’s explore this essential concept. We’ll cover all things credit memos, from their functions and implications to implementation and management best practices.

Key takeaways

- Credit memos provide a formal approach to correct billing errors or acknowledge returns, fostering transparency and trust between businesses and customers. They help rectify mistakes or discrepancies in transactions, ensuring clarity and accuracy.

- Businesses issue credit memos for various reasons, including billing errors, product returns, and honoring discounts or promotional offers. Promptly addressing customer concerns and providing fair resolutions with credit memos helps businesses maintain positive relationships and encourage continued patronage.

- Credit memos impact accounting processes for both sellers and buyers, affecting accounts receivable, accounts payable, revenue recognition, inventory valuation, and financial statements. Understanding credit memos enables business owners to manage transactions effectively, resolve disputes, and uphold financial integrity, supporting long-term business growth and success.

What is a credit memo (credit memorandum)?

By definition, a credit memo – or they also call it credit memorandum – is a document used in financial transactions to acknowledge a reduction in the amount paid or owed by a customer to a business. It’s a formal acknowledgment that a credit has been issued to the customer’s account, often to correct errors, address customer concerns, or return. Essentially, a credit memo adjusts the customer’s account balance by reducing the amount owed, providing clarity and transparency in financial transactions.

In simple terms, a credit memo corrects mistakes or issues in transactions. At the same time, it explains or documents that correction.

For example, if a customer paid more than was necessary (for some reason) or received damaged goods, a credit memo would be issued to adjust the amount owed by the customer and to explain (or record, if you will) this correction. This way, it helps keep track of changes in accounts and ensures that transactions are accurate and transparent.

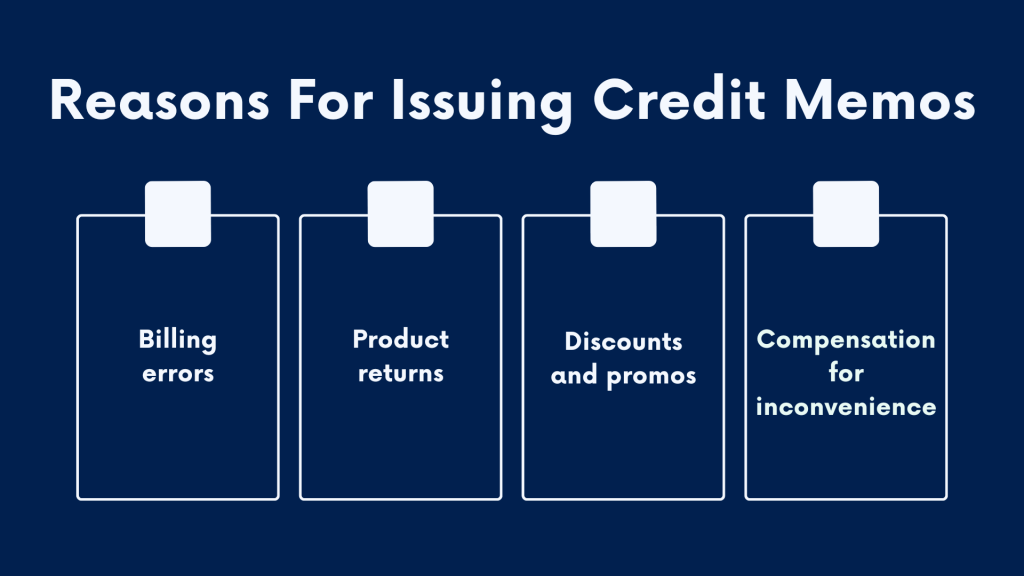

Why do businesses issue credit memos?

As mentioned, businesses issue credit memos to address various situations. Let’s look at those in more detail.

#1 – Billing errors

One common reason for issuing credit memos is to rectify billing errors. For instance, if you mistakenly overcharged a customer or billed them inaccurately, you utilize credit memos to adjust the charges and correct the error promptly.

Related:

Invoicing Software for Small Business: Invoice Software for Small Businesses to Consider

#2 – Product returns

Another significant scenario involves product returns. When customers return items due to defects, damages, or dissatisfaction, businesses issue credit memos to either refund the purchase amount or provide store credit. This process ensures fairness and encourages continued patronage.

Related:

Small Business Return Policy: How Return and Refund Process Can Be Good for Businesses

#3 – Discounts and promos

Moreover, credit memos can honor discounts, rebates, or promotional offers that may not have been applied correctly during the initial transaction. This practice helps maintain transparency and ensures customers receive the benefits they are entitled to.

#4 – Compensation for inconvenience

In cases where customers encounter inconvenience or dissatisfaction with products or services, businesses may issue credit memos as a gesture of goodwill. This compensation aims to acknowledge the issue and mitigate any negative impact on the customer experience, fostering trust and loyalty.

As you can see, businesses use credit memos to maintain positive customer relationships, resolve disputes amicably, and uphold financial accuracy.

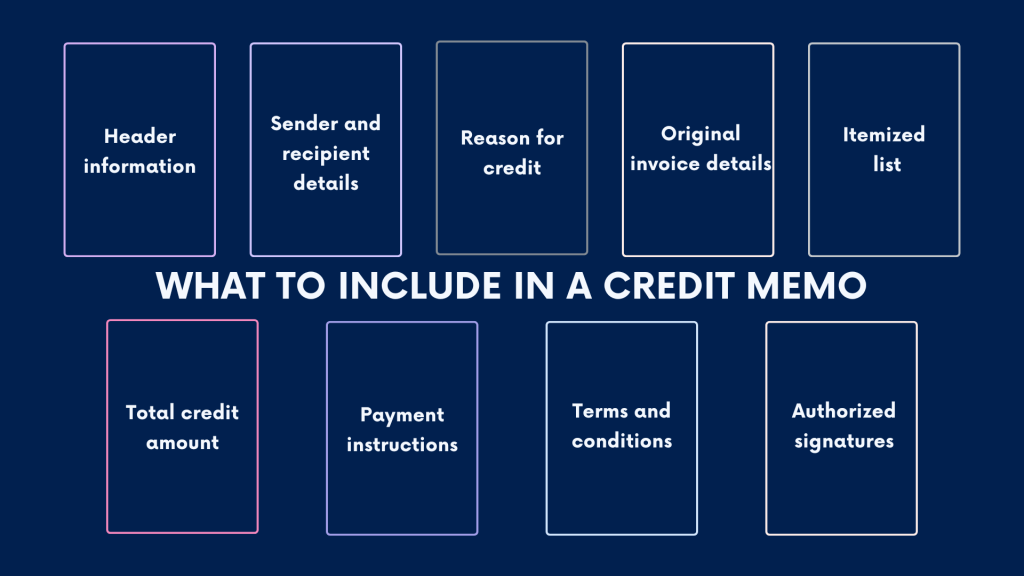

What information should be included in a credit memo?

Now that you know what a credit memo is and the reasons for issuing it, let’s look at what information it typically contains.

Header information

At the outset, a credit memo prominently displays the title “Credit Memo” to distinguish it from other financial documents. It includes the date of issuance and a unique reference number for easy identification and tracking purposes.

Sender and recipient details

The credit memo clearly states the name, address, contact information, and any relevant identifiers for both the sender (seller) and the recipient (buyer). These details ensure accurate correspondence and facilitate proper record-keeping.

Reason for credit

Next comes a detailed explanation of the reasons for issuing the credit memo. Common reasons include, as mentioned, returns, damaged goods, billing errors, discounts, or adjustments. Clarity regarding the reason for the credit helps both parties understand the transaction context.

Original invoice details

A credit memo should reference the original invoice number, date, and details related to the initial transaction. It allows easy credit reconciliation with the original transaction and helps avoid confusion or discrepancies.

Itemized list

You also provide an itemized breakdown of the goods or services you’re issuing the credit for. It includes the quantity, description, unit price, and total amount for each item or service. You might want to indicate any restocking fees or deductions to ensure transparency.

Total credit amount

You absolutely need to display the total amount of the issued credit, including any applicable taxes, fees, or adjustments summarized. This way, you provide a clear view of the financial impact of the credit on both parties involved in the transaction.

Payment instructions (if applicable)

You might also want to provide instructions on how the recipient should handle the credit if the credit results in a refund or adjustment to an outstanding balance. Whether through a refund, a reduction in future payments, or other means – clear guidance might help the proper credit utilization.

Terms and conditions

Any relevant terms and conditions associated with the credit memo, such as expiration dates, limitations on usage, or special conditions for refunds or exchanges, are included. These terms help govern the usage and validity of the credit.

Authorized signatures

A credit memo is usually signed by an authorized representative of the issuing party to validate its authenticity and approval. This signature ensures accountability and compliance with organizational policies and procedures.

All these elements within a credit memo facilitate transparent communication, accurate accounting, and effective resolution of financial transactions between buyers and sellers.

How does issuing a credit memo impact accounting for sellers and buyers?

Issuing a credit memo impacts the accounting for both sellers and buyers in many ways, including affecting accounts receivable and accounts payable balances, revenue recognition, inventory valuation, cash flow, and financial statement reporting. At this point, both parties might want to accurately record and reconcile credit memos to ensure the integrity of their financial records and compliance with accounting standards.

But let’s break it down.

Credit memo impact on sellers

Let’s start with how credit memos might impact sellers’ accounting.

Accounts receivable

Issuing a credit memo reduces the seller’s accounts receivable balance. This adjustment shows that the seller no longer expects to receive full payment for the originally invoiced goods or services.

Related:

What Is Accounts Receivable: Understanding Your AR Accounts

Revenue recognition

Credit memos related to a return, damaged goods, or billing errors may decrease the seller’s revenue. This adjustment reflects the reversal of previously recognized revenue associated with the goods or services covered by the credit memo.

Inventory

The credit memo issued due to returned or damaged goods might require adjustments in the seller’s inventory levels to account for those items. This adjustment impacts the valuation and reporting of inventory on the seller’s balance sheet.

Financial statements

Issuing a credit memo may necessitate adjustments to the seller’s financial statements. The reduction in accounts receivable and revenue and changes to inventory valuation will impact the seller’s income statement, balance sheet, and statement of cash flows.

Related:

How to Prepare Cash Flow Statement: A Guide to Effective Cash Flow Management

Credit memo impact on buyer’s accounting

Let’s proceed with how a credit memo impacts the other party’s accounting.

- Accounts payable

For the buyer, receiving a credit memo reduces the amount owed to the seller, decreasing the buyer’s accounts payable balance. This adjustment means the buyer is entitled to a credit or refund for the goods or services covered by the credit memo.

Related:

Accounts Payable Process: The Ultimate Guide to Full Cycle AP in 2024

- Cash flow

The credit memo for a refund or the owed amount reduction may positively impact the buyer’s cash flow. The buyer may have more cash available for other purposes as they have fewer outstanding payables.

- Financial statements

Getting a credit memo may require adjustments to the buyer’s financial statements. The decrease in accounts payable and any related adjustments to expenses or inventory will impact the buyer’s income statement, balance sheet, and statement of cash flows.

Related:

P&L Template: Understanding the Profit and Loss Statement (Plus a Template to Download)

- Purchase returns and allowances

A buyer might record credit memos related to returns or allowances as contra-expense accounts on their income statement. These accounts offset the original expense associated with the purchase and reflect the reduction in the cost of goods sold.

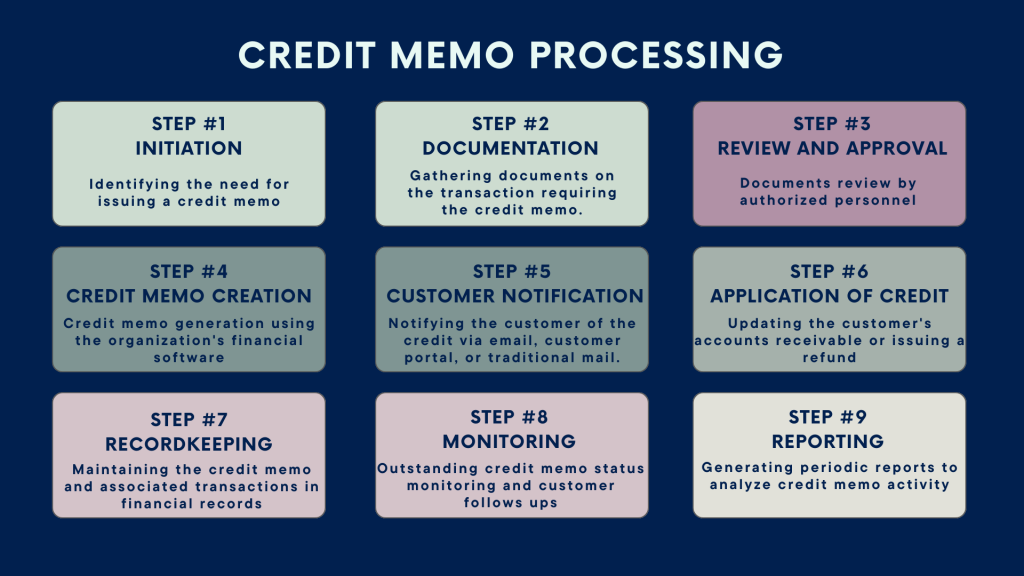

A credit memo lifecycle: processing a credit memo withing a business’s financial system

Credit memos are typically processed and managed within an organization’s financial system through a structured workflow that involves several key steps:

Step #1 – Initiation

The process usually begins when you identify a need for a credit memo due to one of the reasons, such as returns, damaged goods, billing errors, discounts, or adjustments.

Step #2 – Documentation

The requester, often a customer service representative or the accounting team member, gathers all necessary documentation related to the transaction requiring the credit memo. As mentioned, it may include original invoices, purchase orders, delivery receipts, or other relevant records.

Step #3 – Review and approval

The documentation then goes through the review by authorized personnel, such as supervisors, managers, or designated approvers. They ensure that the request meets the organization’s policies and procedures and that the credit memo is warranted based on the circumstances.

Step #4 – Generation of credit memo

Once approved, it’s time to generate the credit memo using the organization’s financial software or accounting system. The system typically allows users to input relevant details such as the reason for the credit, the original invoice number, itemized lists of products or services, and the total amount to be credited.

Step #5 – Notification to customer

After generating the credit memo, you might want to notify the customer of the credit. This notification may be sent electronically via email, through a customer portal, or by traditional mail, depending on the organization’s communication preferences and the customer’s contact information on file.

Step #6 – Application of credit

The organization might want to ensure the proper credit application to the customer’s account. It may involve updating the customer’s balance in the accounts receivable ledger or issuing a refund through the organization’s payment processing system.

Step #7 – Recordkeeping and documentation

A company might want to record and maintain the credit memo and associated transactions in their financial records for auditing, reconciliation, and reporting purposes. It might involve storing electronic copies of the credit memo, related correspondence, and supporting documentation in a centralized repository.

Step #8 – Monitoring and follow-up

The organization monitors the status of outstanding credit memos and follows up with customers to ensure timely resolution and closure of credit transactions. It means periodic reconciliation of accounts receivable balances and proactive communication with customers regarding open credits.

Step #9 – Reporting and analysis

You might want to generate periodic reports to analyze credit memo activity, trends, and patterns within the organization. It helps management identify areas for process improvement, assess the financial impact of credit transactions, and make informed decisions to optimize cash flow and customer satisfaction.

The difference between credit and debit memos

Unlike credit memos that you issue to decrease the amount you charge your customer, a debit memo is a document that indicates an increase in the amount owed to a business by a customer or another entity.

In simple terms, it requests and records additional charges, fees, or penalties the customer needs to pay.

Let’s look at the scenario where a customer makes a late payment on their credit card bill. The credit card company might issue a debit memo to note the late fee added to the customer’s account balance. Another example is a vendor who fails to deliver goods as agreed upon in a contract. The buyer, in this case, might issue a debit memo to the vendor, indicating a deduction from the owed payment due to the incomplete delivery.

Bottom line

Long story short, credit memos are essential documents that help businesses efficiently maintain transparency in financial transactions with their customers. Serving as formal records for issuing refunds or adjustments, they ensure sellers and buyers can address issues and maintain positive relationships.

For sellers, credit memos assist in accurately tracking accounts receivable, recognizing revenue correctly, and managing inventory levels. They also help in adhering to internal controls and regulatory standards. On the buyer’s side, credit memos simplify receiving refunds or adjustments for returned or damaged goods, contributing to better cash flow management and financial transparency.

Understanding the concept of credit memos is crucial for business owners as it enables them to effectively manage transactions, resolve disputes, and maintain trust with their customers, ultimately supporting long-term business success and growth.

Share your thoughts

Have you ever created or received credit memos? How do you handle them? What helps prepare them faster and more accurate? Any tips, tricks, recommendations? Share your thoughts in the comments section below.

.png)

Excellent article! Was helpful to learn about credit memo.

Thanks for you kind comment, David!