The balance sheet is a financial document, offering a snapshot of a company’s financial health at a specific moment. It outlines what a company owns (assets), what it owes (liabilities), and its overall equity. Understanding the balance sheet is essential for investors, creditors, and company management as it helps assess liquidity, solvency, and overall financial stability.

In this article, we explore the balance sheet in detail and how to create it to reflect a company’s financial standing.

Key takeaways

- The balance sheet is a critical financial statement that provides a snapshot of a company’s financial health at a particular moment. It outlines the company’s assets, liabilities, and shareholders’ equity, helping investors, creditors, and management assess liquidity, solvency, and overall financial stability.

- The balance sheet consists of assets, liabilities, and shareholders’ equity. Assets represent resources owned by the company, while liabilities denote the company’s financial obligations to external parties. Shareholders’ equity reflects the residual interest in the company’s assets after deducting liabilities.

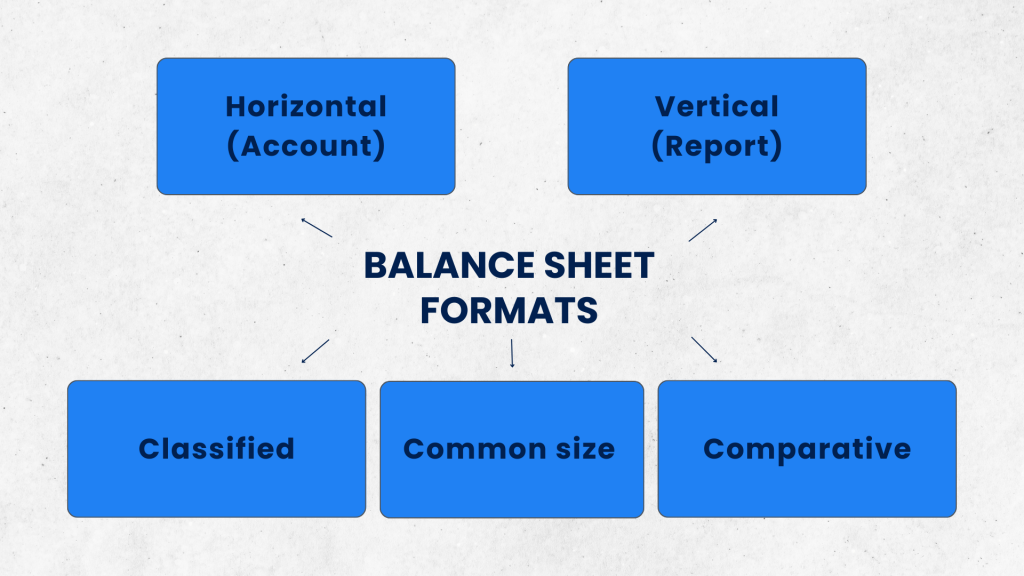

- The balance sheet can come up in various formats, including horizontal, vertical, classified, common-size, and comparative balance sheets. The preparation involves defining the reporting period, gathering financial data on assets and liabilities, calculating shareholders’ equity, and ensuring that the accounting equation (Assets = Liabilities + Equity) is balanced.

Let’s break down a balance sheet first

A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific moment. Along with the profit and loss and the cash flow statement, the balance sheet makes it the financial reporting trio every business should maintain. It presents the company’s assets, liabilities, and shareholders’ equity.

Let’s look at its components in more detail.

What are assets?

Assets are resources owned by the company that hold economic value and can be tangible or intangible. Tangible assets include cash, accounts receivable, inventory, property, plant, and equipment. Intangible assets encompass patents, trademarks, copyrights, and goodwill. Assets are typically listed in order of liquidity, with the most liquid assets appearing first.

Related:

What Is an Asset in Accounting? The Impact and Importance of Assets in Business

What are liabilities?

Liabilities represent the company’s financial obligations or debts to external parties. They can be classified as current liabilities, which are due within one year, and non-current liabilities, which are payable beyond one year. Examples of liabilities include accounts payable, short-term loans, long-term debt, and deferred tax liabilities.

Related:

Liabilities in Accounting Decoded: What Is a Liability & How Can It Impact Your Business?

What’s shareholders’ equity?

Shareholders’ equity, also known as owners’ equity or stockholders’ equity, reflects the residual interest in the company’s assets after deducting liabilities. It represents the shareholders’ ownership stake in the company. Shareholders’ equity includes common stock, preferred stock, retained earnings, and additional paid-in capital.

Related:

Equity Financing: A Comprehensive Guide on Understanding This Type of Financing

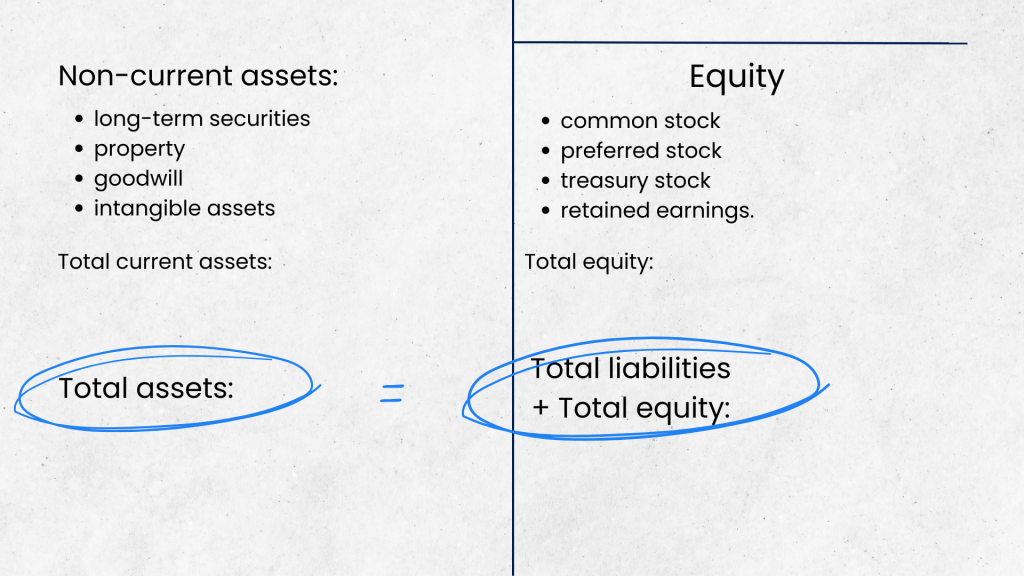

What is the formula of a balance sheet?

The balance sheet follows the accounting equation: Assets = Liabilities + Equity, being the fundamental principle of accounting.

It signifies that the total value of a company’s assets must be equal to the sum of its liabilities and shareholders’ equity. This equation ensures a balanced representation of the company’s financial position, highlighting the financing of its resources through external debt or internal investment by shareholders.

By maintaining this balance, the balance sheet provides a comprehensive overview of the company’s financial health, liquidity, and solvency. Investors, creditors, and management rely on the balance sheet to assess the company’s performance, make informed decisions, and gauge its ability to meet financial obligations.

What is the basic format of a balance sheet?

When it comes to presentation, balance sheets come in various formats. The horizontal (account) and vertical (report) layouts are the most frequently used ones. Classified, common-size, and comparative balance sheet formats are more specific. Let’s look at them all in more detail.

#1 – Horizontal (Account) balance sheet

The horizontal balance sheet places assets on the left side of the page and liabilities and equity on the right. The layout reflects the idea of balancing and visualizes the accounting equation.

This format is advantageous when you aim to condense all information onto a single page. However, it becomes challenging to include ending balances for multiple reporting periods.

Businesses that prefer concise financial reporting, such as small enterprises or startups, often opt for the horizontal balance sheet format.

#2 – Vertical (Report) balance sheet

The vertical balance sheet presents information in a single column, starting with asset line items, followed by liabilities, and concluding with shareholders’ equity.

Each category lists items in decreasing order of liquidity. Due to its simplicity and clarity, many accounting software utilize this balance sheet format.

Vertical balance sheets are a frequent choice of accounting departments and financial analysts for routine financial reporting and analysis purposes.

#3 – Classified balance sheet

The classified balance sheet aggregates assets, liabilities, and shareholders’ equity into subcategories, enhancing readability.

Accountants typically maintain consistency in classification structure across multiple periods for improved comparability.

Large corporations with diverse operations often utilize classified balance sheets to organize multiple accounts for presentation and analysis.

#4 – Common-size balance sheet

Apart from standard information, the common-size balance sheet provides percentages of total assets or liabilities and shareholders’ equity. This format facilitates trend analysis and aids in understanding relative changes in account sizes over time.

Financial analysts and investors often rely on the common-size balance sheets to track changes in the composition of assets, liabilities, and equity across different periods.

#5 – Comparative balance sheet

Comparative balance sheets offer a side-by-side comparison of an entity’s financial position at different periods. This way, it helps evaluate changes in liquidity levels and identify trends over extended periods.

Lenders, creditors, and financial planners frequently utilize comparative balance sheets to assess the organization’s financial stability and performance across various reporting periods.

As you can see, each balance sheet format serves specific purposes and is chosen based on the organization’s reporting requirements and analytical needs.

What are the steps to prepare a balance sheet: how to make a balance sheet stap by step

Preparing a balance sheet involves several steps, such as determining the reporting date and period, gathering necessary financial data, and balancing all the parts of it to ensure the result falls into the fundamental accounting principle mentioned above.

That’s why a balance sheet comprises three key sections – each represents a part of the equation.

To compile a balance sheet, you might want pertinent financial data from your general ledger for the control period at hand to fill in the balance sheet sections.

At this point, it might be worth noting that your success in making an informative balance sheet highly depends on the quality and accuracy of the data you’re putting in. You might want transaction data from all your sales channels accurately reflected in your accounting (general ledger).

And here, Synder comes up as a helping hand. It can integrate your accounting with 25+ systems and platforms (think of Stripe, PayPal, Amazon, Walmart, Shopify, and more) and make it a single source of truth about your numbers. So you can always have accurate figures ready for financial reporting.

Learn more about how Synder can help your business by booking a seat at the Weekly Public Demo with one of our Customer Support specialists or explore Synder yourself with a free 15-day trial.

Let’s look at the steps involved in creating a balance sheet.

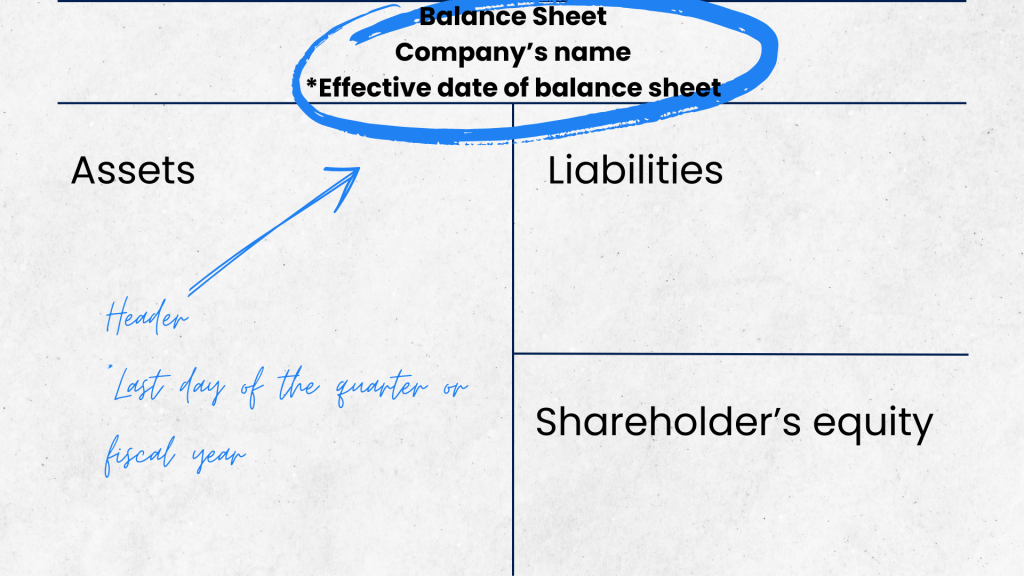

Step#1 – Define a reporting period and reporting date

Start by determining the specific date and period for which you want to prepare the balance sheet.

The reporting date is typically the last day of the reporting period, which could be quarterly, annually, or another specified timeframe. For instance, if you choose to report quarterly, your reporting date would be the last day of the quarter, such as March 31st for the first quarter of the year.

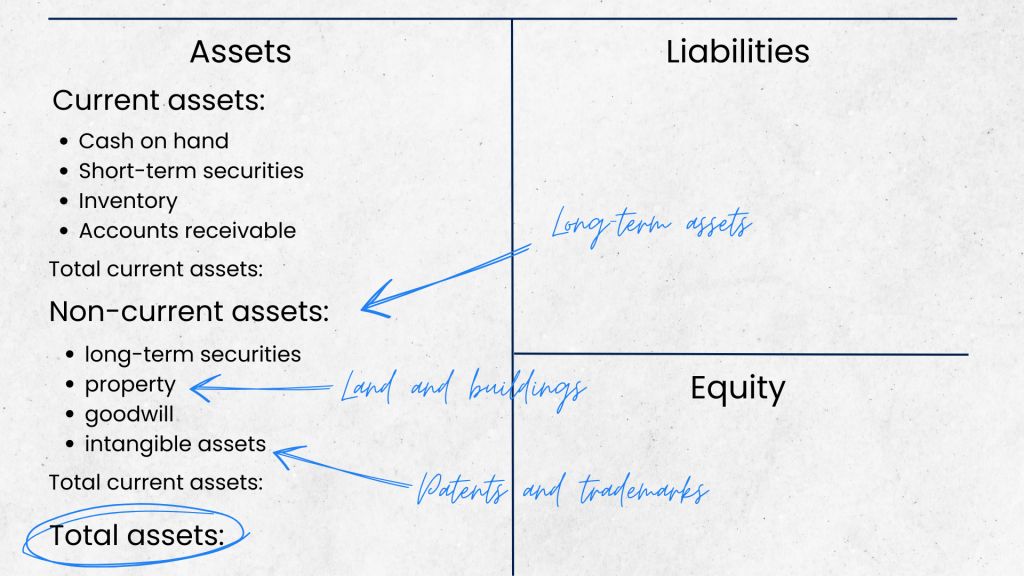

Step #2 – Gather your assets

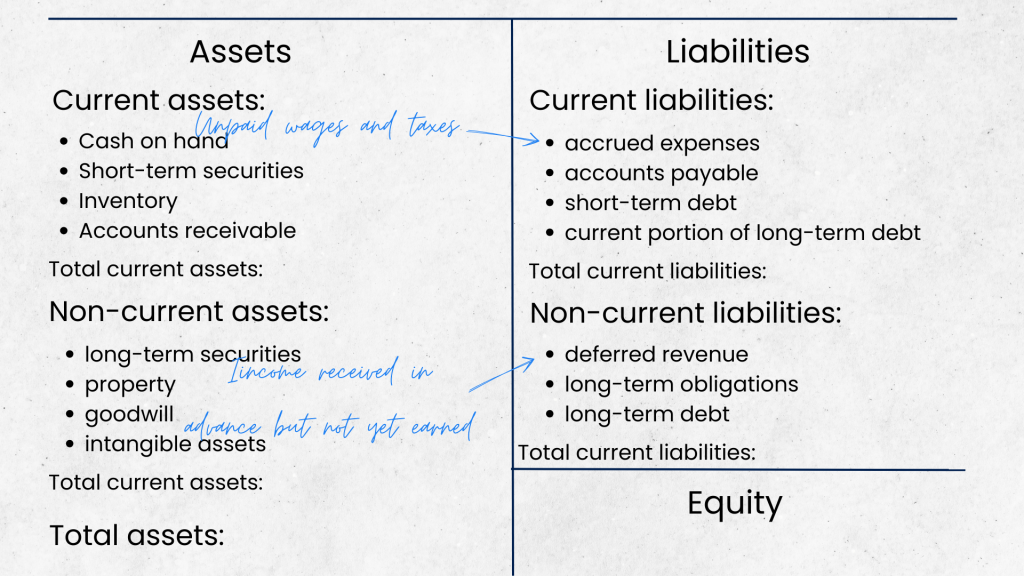

To start, gather details regarding the company’s assets for the chosen reporting period. As mentioned, assets refer to the resources owned by the company that hold value. They typically fall into two main categories: current assets and non-current assets.

Current assets

Current assets encompass items that you expect to be converted into cash or used up within a year, such as cash on hand, short-term securities, inventory (goods available for sale), and accounts receivable (money owed by customers).

Non-current assets

Non-current assets are long-term investments and resources expected to benefit the company beyond a year, including long-term securities, property (land and buildings), goodwill (the value of a company’s brand and reputation), and intangible assets (such as patents and trademarks).

Calculating total assets

After categorizing assets into current and non-current, calculate the subtotal for each category and then combine them to determine the total assets for the company during the specified reporting period.

Step #3 – Gather your liabilities

Moving forward, proceed to collect data on your company’s liabilities for the designated reporting period. Liabilities, as you may recall, represent your company’s financial obligations and are also divided into two main categories: current and non-current liabilities.

Current liabilities

Current liabilities comprise financial obligations expected to be settled within the next year.

This category includes accrued expenses (such as unpaid wages and taxes), accounts payable (money owed to suppliers for goods or services), short-term debt (loans due within the next year), and the current portion of long-term debt (the portion of long-term loans due within the next year).

Non-current liabilities

Non-current liabilities comprise financial obligations that extend beyond the next year. This category includes deferred revenue (income received in advance but not yet earned), long-term obligations like leases, and long-term debt (loans due over an extended period).

Calculating total liability

Once you gathered data on current and non-current liabilities, subtotal each category and then calculate the total liabilities for the company during the specified reporting period.

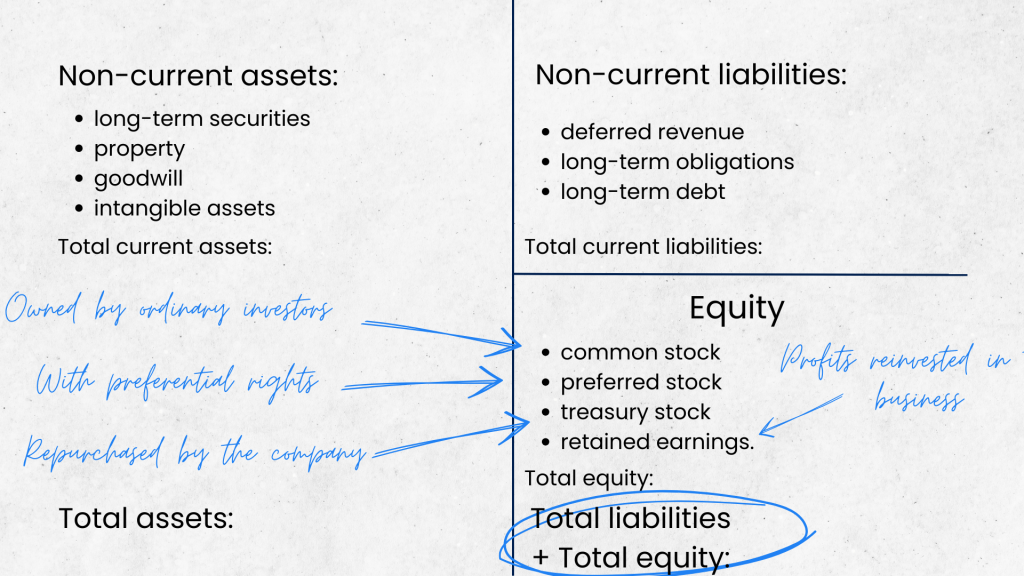

Step #4 – Determine equity

Calculating shareholders’ equity is crucial in completing the balance sheet.

In smaller businesses owned by a single individual, we usually use the term owner’s equity, signifying the owner’s business share. In contrast, larger companies with multiple shareholders may have more complex shareholders’ equity structures, including common stock (owned by ordinary investors), preferred stock (with preferential rights), treasury stock (repurchased by the company), and retained earnings (profits reinvested in the business).

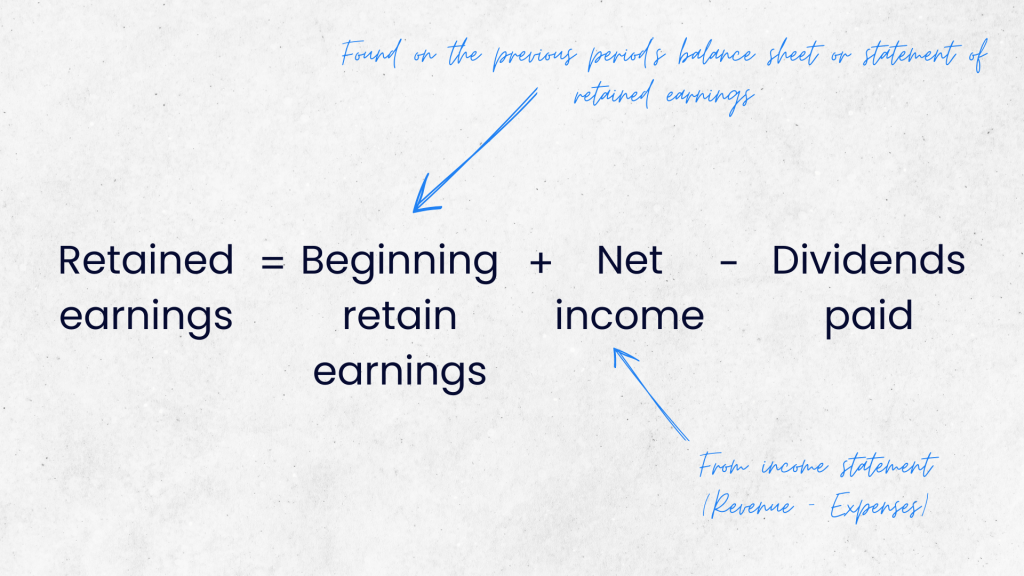

Finding retained earnings

Retained earnings denote the portion of the company’s net income withheld and reinvested rather than distributed as dividends to shareholders. These components are typically derived from financial statements, such as the income statement and statement of retained earnings, allowing investors and stakeholders to assess the company’s financial health and ownership composition and evaluate its overall performance and stability.

To calculate retained earnings, you might use the following formula:

Retained Earnings = Beginning Retained Earnings + Net Income – Dividends Paid

Here’s a breakdown of each component.

Beginning retained earnings represents the retained earnings from the previous accounting period. It serves as the starting point for the current period’s retained earnings calculation and can be found on the previous period’s balance sheet or statement of retained earnings. Here’s where you can exactly locate:

- Balance sheet

Beginning retained earnings from the previous period can be found under the shareholders’ equity section. It represents the accumulated profits or losses that weren’t distributed to shareholders as previous period dividends. - Statement of retained earnings

The statement of retained earnings specifically focuses on changes in retained earnings over a specific period, usually quarterly or annually. It begins with the beginning retained earnings from the previous period and then accounts for net income or net loss for the current period, as well as dividends paid to shareholders. The ending retained earnings balance is then calculated (and this is the figure you need).

Net income is the total revenue earned by the company minus all expenses, taxes, and interest for the current accounting period. If the company incurs a net loss, this figure is used instead.

Dividends paid to shareholders during the accounting period represent the portion of profits distributed to shareholders. They are typically reported in the cash flow statement within the financing activities section.

Step #5 – Add liabilities to equity, compare to assets

Finally, ensure that the balance sheet equation is satisfied by comparing the total assets to the sum of total liabilities and shareholders’ equity.

The equation must balance, signifying that the company’s resources are financed through debt (liabilities) or owners’ investment (equity). Any discrepancy indicates errors in the preparation of the balance sheet and requires investigation and correction.

What role do balance sheets play in financial analysis and decision-making for investors and creditors?

The balance sheet is a handy tool for financial analysis and decision-making. It provides investors and creditors critical insights into a company’s financial position to assess risks and opportunities associated with investments and lending activities.

Investors consider the balance sheet a crucial document to examine before making investment decisions. Looking through the asset composition and trends allows investors to assess the company’s liquidity, solvency, and overall financial performance. They can analyze the company’s ability to generate returns on investments and manage its debts effectively. Additionally, investors use the balance sheet to understand the company’s capital structure and assess its long-term viability.

For creditors, the balance sheet helps evaluate the company’s creditworthiness and money lending risks. Creditors analyze the company’s assets to determine the collateral available for securing loans and assess its ability to meet debt obligations. They also evaluate the company’s leverage and debt-to-equity ratio to gauge its financial stability and repayment capacity. This way, the balance sheet helps creditors make informed lending decisions and mitigate financial risks.

Final word: a business owner might also whant to know how to prepare and read the balance sheet

To wrap it up, it’s worth adding that the balance sheet isn’t just for investors and creditors. Business owners can use it to understand their company’s finances better. While creating a balance sheet might not always be a business owner’s task, knowing how it works and where the numbers come from can offer invaluable insights into the company’s financial picture.

Understanding the balance sheet helps business owners see what they own, what they owe, and how much the business is worth. It allows them to make wiser decisions about spending, saving, and planning for the future. Even though the balance sheet process may seem complex, learning about it can help business owners manage their finances more effectively and steer their company toward success.

Ultimately, the balance sheet is a key resource for business owners to stay on top of their financial game and make informed choices for their company’s growth and stability.

Share your thoughts

Have you ever tried to prepare a balance sheet? Or maybe you’re a balance sheet master? What helps to prepare it faster and more accurate? Any tips, tricks, recommendations? Share your thoughts in the comments section below.

%20(1).png)

Good thorough content on Financial Statements