Navigating the complexities of financial management is a crucial task for any business looking to thrive in today’s competitive marketplace. Understanding the role of a Chief Financial Officer (CFO) and the innovative concept of fractional CFO services can be a game-changer, especially for small to medium-sized enterprises.

Let’s explore how these services can be the compass that guides a business toward strategic growth and savvy investment.

Contents

1. What are CFO services or fractional CFO and how do they differ from traditional accounting?

2. Why outsourced CFO services can be a good solution for small and medium businesses?

3. What value can CFOs bring to small or medium-sized ecommerce and SaaS businesses?

4. How do CFO services integrate with a business’s existing financial team or infrastructure?

5. What should business owners expect in terms of outcomes when engaging a CFO service?

What are CFO services or fractional CFO and how do they differ from traditional accounting?

Think of a fractional CFO (Chief Financial Officer) as a financial advisor who helps a business make smart money decisions. Most of the time, they work part-time, or when the company needs them, so it’s more cost-effective. In a nutshell, their job is to help the business plan its finances, figure out how to save money and grow financially. They also help with big financial moves, like getting loans or merging with another company. So they’re essentially like a money coach for the company.

Traditional accounting and CFO service solution: The difference

Having seen what a CFO service and fractional CFO stand for, let’s now look at the accountant’s role in your company. Here are some important aspects of an accountant’s job:

- Accountants financial record-keepers, they ensure all the money is done right and follow the rules.

- They work regularly, not just when the business needs them.

- Their main job is to keep track of the money that’s coming in and going out, make sure everything is done correctly for taxes, and keep a history of the company’s money.

In simple terms, a fractional CFO helps a business with big financial plans and advice, while traditional accountants focus on keeping track of the money and following the rules. Both are important, but they do different things for a company’s finances.

Why outsourced CFO services can be a good solution for small and medium businesses?

Hiring outsourced CFO services is a smart move for smaller businesses that need someone to manage their money but can’t afford a full-time financial boss. These services are flexible, meaning businesses can get expert money advice whenever they need it without having to hire someone long-term. This helps them plan their financial future, make efficient money moves, and smartly grow their business.

Outsourced CFOs bring specialized knowledge and experience that may not be available in-house. They can offer insights into financial strategy, risk management, capital raising, financial reporting, and more, tailored to the company’s specific needs.

By providing an unbiased, fresh perspective on the business’s financial health and strategies, they can be invaluable for decision-making.

Outsourced CFOs often have a network of contacts and access to resources that can be beneficial for the business, including potential investors, lenders, and strategic partners.

All in all, outsourced CFO services provide a flexible, cost-effective way for businesses to manage their financial operations, plan their financial strategy, and navigate complex financial landscapes.

What value can CFOs bring to small or medium-sized ecommerce and SaaS businesses?

Outsourced CFOs can enhance ecommerce and SaaS businesses in many ways. Let’s look at some of the most crucial aspects:

- Financial game plan: CFOs can help create a plan to manage the company’s money better. This plan should match the company’s goals, like making more sales or reaching new customers.

- Budget and saving: CFOs can help figure out how to spend money wisely and save some for later, so the company has enough for important things.

- Money magic: CFOs can work on finding ways to make the company’s money grow, like finding new investors, making sure the company has enough cash, and expanding to new places.

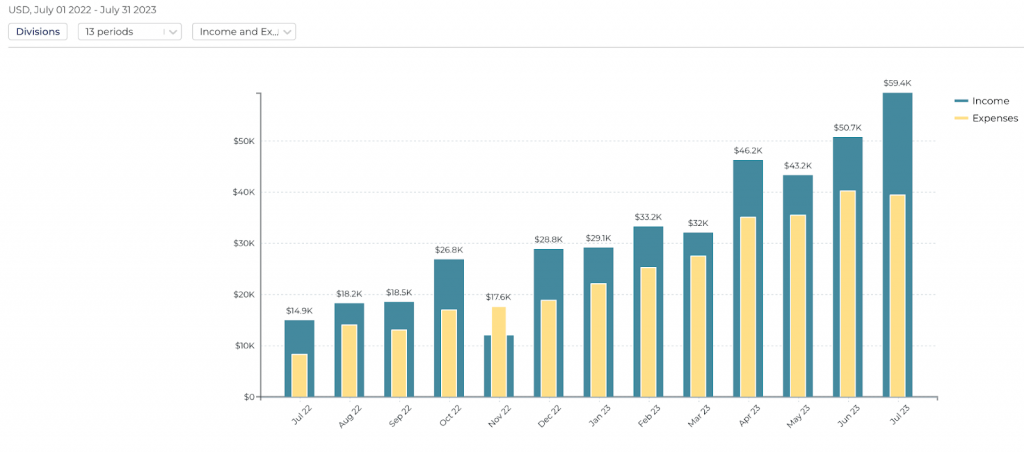

In July of 2022, in my bookkeeping practice, I signed up a new client who wanted advice on how to grow her profits, stay within the budget, and take home a certain amount of money consistently.

After we caught her books up, created the budget and discussed the plan she should follow to reach her goals, her revenue and profit soared.

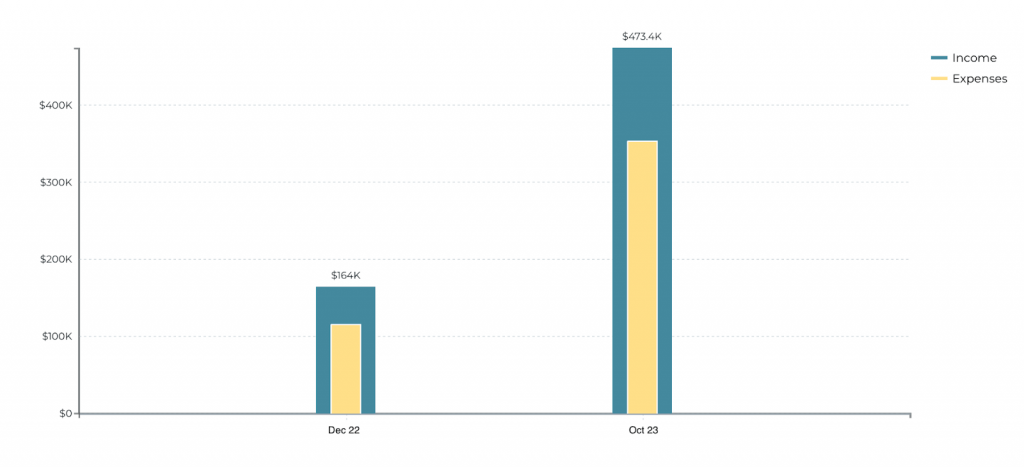

This client is on the trajectory of hitting $500k in Gross Revenue in 2023.

How do CFO services integrate with a business’s existing financial team or infrastructure?

Integrating CFO services with a company’s existing financial team is done through a collaborative and strategic approach, much like choosing the right Square vs Stripe solutions or the best accounting software for medium business.

Initial assessment and strategic alignment

First, this expert checks how things are currently being done with the company’s money. This helps in understanding the existing financial situation. Then, they figure out where the company needs extra help.

Collaboration with the in-house team

They work closely with the existing financial team. The CFO usually provides guidance, training, and support. This collaboration aims to enhance the team’s skills and ensure consistency in financial practices. They might also suggest using better software to manage the money.

System integration and process improvement

CFOs create integrated systems across the company to make everything about money simpler and smarter. They make sure that any new implementation complements the current infrastructure.

The expert also helps the company make important financial plans and decisions and ensures that everyone gets clear reports and numbers to understand how well the company is doing.

Feedback and continuous improvement

Last but not least, they keep a close watch to make sure everything is working well and make changes if needed. An outsourced CFO will continuously improve financial processes and address any issues in collaboration with the existing team.

What should business owners expect in terms of outcomes when engaging a CFO service?

When a business owner brings in a CFO, this expert will help the business with planning its finances, keeping its money safe, finding ways to save money, and making sure all the financial paperwork is clear and correct. But that’s not all that the engagement of outsourced CFO services can bring to a business. Key outcomes typically include:

- improved financial strategy and planning;

- enhanced financial reporting and analysis;

- cost management and efficiency;

- risk management and compliance;

- capital raising and funding strategies;

- improved cash flow management;

- tax planning and optimization;

- process improvement and system implementation;

- business valuation and M&A support;

- training and team development;

- strategic decision support;

- enhanced investor and stakeholder relations.

Conclusion

The journey through financial management with a fractional CFO at the helm is one marked by strategic foresight, efficiency, and growth.

By setting clear expectations, working in tandem with existing financial teams, and focusing on tailored financial strategies, businesses can expect to not only navigate but also capitalize on the financial challenges and opportunities that lie ahead. With the right financial expertise in place, the path to sustainable growth and success becomes clearer and more attainable.

.png)

It was fascinating to know that fractional CFO services provide insights into financial strategy. My friend wants to better manage their finances. I think it’s time for him to work with a fractional CFO service to ensure their financial health.

Hi Victoria, it’s great to hear that you found the information on fractional CFO services useful! These services offer expert insights and strategic financial guidance which can be crucial for maintaining and improving financial health, particularly for growing businesses. It’s an effective way to gain high-level financial expertise without the commitment of a full-time CFO. Best of luck to your friend in this endeavor!

I like that you talked about how CFO services are flexible, which means businesses could get expert money advice whenever they need it without having to hire someone long-term. I was reading the book I borrowed yesterday and I learned a little bit about the role of CFOs. It was pretty interesting to know that CFO services are actually being offered now too.

Hi Luke, it’s great to hear that you found the information about flexible CFO services interesting, especially in the context of what you learned from your reading. Indeed, the option to access CFO-level expertise without the commitment of a long-term hire can be a game-changer for many businesses. These services provide valuable financial insights and strategies tailored to specific needs, allowing businesses to navigate complex financial landscapes more effectively. The evolving role of CFOs and the availability of such services reflect how financial management is adapting to meet the diverse needs of today’s businesses. If you have any more questions or thoughts on the topic, feel free to share!

One of the best posts I have ever come across. Not only did I learn a lot of hidden things, but I also got to know so many new things as well. Keep uploading and encouraging us.

Thank you so much for your kind words and encouragement! We’re thrilled to hear that you found our post valuable and enlightening. Our goal is to continuously provide insightful and informative content that helps our readers discover new things and deepen their understanding. Stay tuned for more posts, and thank you again for your support!