The PayPal company, like many other payment processors, tries to enhance the experience of their users. That usually means creating new products or features. But it’s not often that they merge and rename offerings – all in the name of improvement. And that’s precisely the story behind the PayPal Balance account.

So today, we’ll follow the curious case of the PayPal Balance account and discover what lies behind the name and what benefits it has to offer its customers.

Keep on reading to learn more about:

1. Evolution of PayPal accounts

2. What is the PayPal Balance account?

3. How to open a PayPal Balance account

4. Money transfers to your PayPal Balance

5. Withdrawing money from your PayPal Balance

6. Benefits of using a PayPal Balance

7. Is the PayPal Balance account free?

Evolution of PayPal accounts

In the US, PayPal decided to make some changes to its Personal account offering – namely they simplified the choice and provided users with more features. They did that by merging two of their accounts: PayPal Cash account and PayPal Cash Plus accounts. This combined entity was renamed as a PayPal Balance account or just Balance account. It included all the features contained in a PayPal Cash Plus account, so for those who had the old account, the merger simply meant a new name. However, for PayPal Cash account holders it came with new functionalities.

What is the PayPal Balance account?

Unlike the standard PayPal account, which often acts as an intermediary between bank accounts or credit cards and online merchants, the PayPal Balance account, as the name suggests, allows users to store money (balance) directly within PayPal. This offers a plethora of advantages including faster transactions, easier refunds, and a centralized hub for online spending.

It’s important to note that PayPal Balance is linked to your Personal PayPal account, so in order to open a Balance account you need first to have an active Personal account. If you’d like to close your Balance account, you can do so without losing your Personal account on PayPal, but not vice versa. In other words, if you close your Personal account, your Balance account will automatically be closed too (unless you have some pending transactions, hold a negative balance, or have other instances that don’t permit account closure).

An overview of Balance account features

The Balance account stands out with a wide array of functionalities tailored for the modern user. First and foremost, they serve as a platform for receiving and holding funds, so you can utilize them for purchasing goods and services or for executing personal transactions, like sending money to loved ones or even requesting funds. If you wish to access your funds, it’s straightforward to transfer money from your Balance account to a linked debit card or personal bank account.

Beyond basic transactions

But there’s more to these accounts than just basic transactions. For instance, for those engaged in international transactions, these accounts offer the convenience of converting currencies. Additionally, eligible users have the opportunity to engage with certain cryptocurrencies, either by buying, holding, or selling them.

Enhanced accessibility with PayPal-branded cards

The versatility of PayPal Balance accounts is further underscored by their compatibility with in-store purchases, provided users have a PayPal-branded debit card. This same card also facilitates ATM withdrawals, adding another layer of accessibility to your funds.

Savings, direct deposits, and more unique offerings

Looking for ways to enhance your savings? The Balance account allows transfers to and from the PayPal Savings feature. Moreover, users can enjoy the Direct Deposit feature, streamlining the process of getting funds into their account. In the U.S., there’s the added advantage of depositing cash into the Balance account directly at various retail outlets. Lastly, a standout feature is the ability to digitize check proceeds via the remote check capture functionality, seamlessly transferring them into your Balance account.

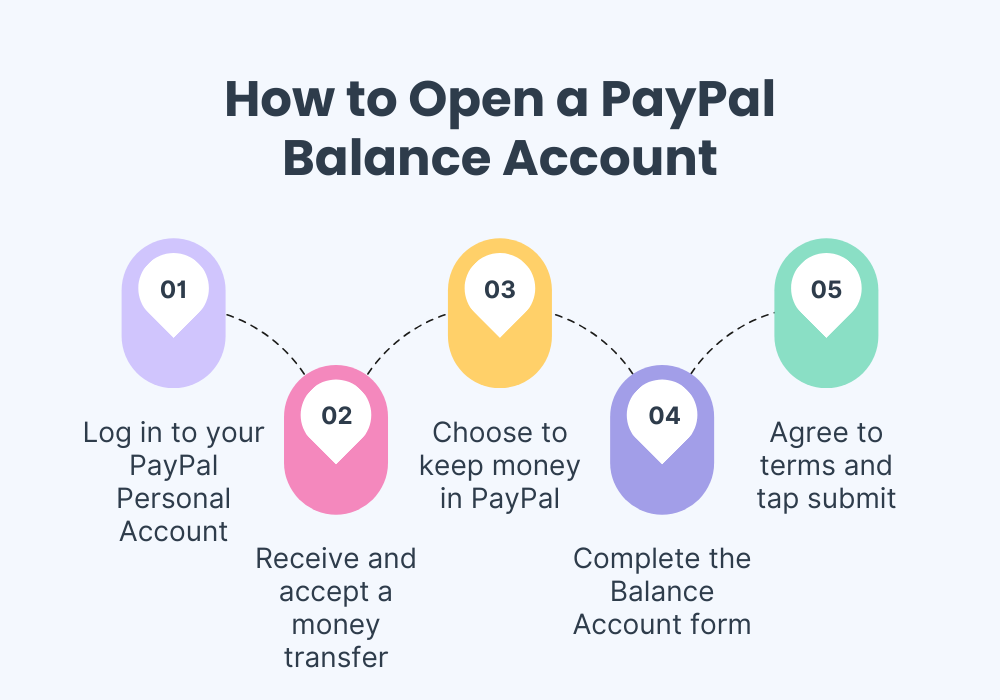

How to open a PayPal Balance account

To open a PayPal Balance account, you need to have a PayPal Personal account first, as noted previously. So, you can think of the Balance account as a feature or a separate account. This way or another, both are interlinked and in order to access it, you will use your regular PayPal Personal account credentials.

To create a Balance account, log in first to your PayPal Personal account. When you receive a money transfer, you’ll be prompted to accept it. Once you do, you’ll have two options: keep it in PayPal or transfer to bank. Choosing the first option will take you to a form where you’ll create your Balance account.

There, you’ll need to fill out your required identifying information (i.e. name, physical address, date of birth, and taxpayer identification number). After filling out your personal data, you’ll be asked to read the terms and conditions, and then click Confirm & Submit.

And you’re done! Now you can see your balance in the PayPal Balance account.

Want to know how to verify your PayPal account? Read our article about PayPal verification for Personal and Business accounts.

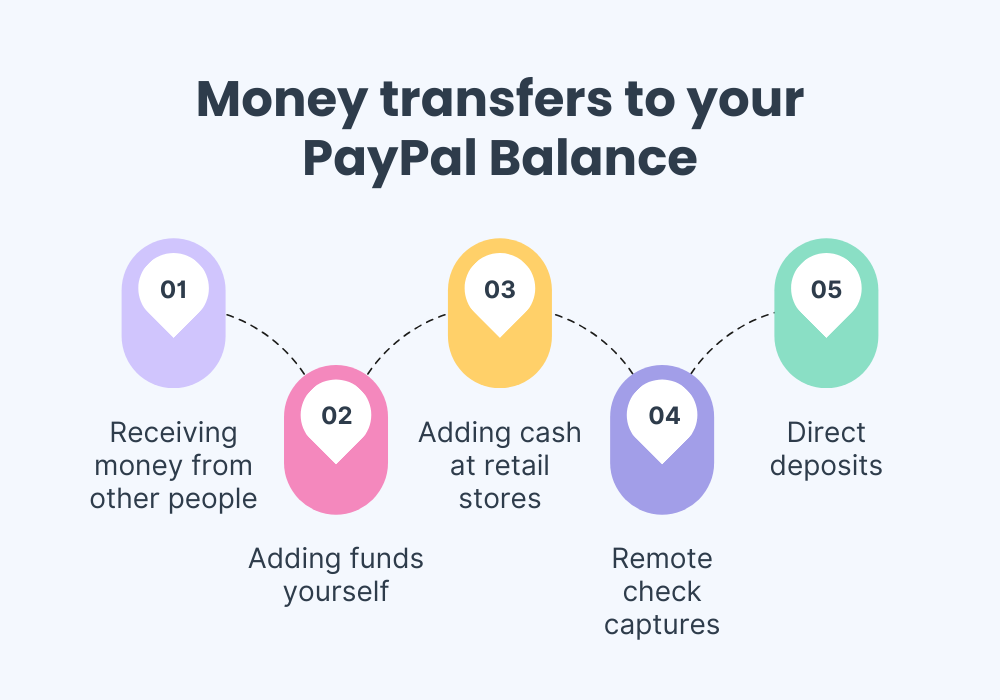

Money transfers to your PayPal Balance

Money can move to and from your PayPal Balance in various ways. Let’s review how it can happen.

Receiving money from other people into your account

Whenever another individual forwards the money to your Personal account, the sum is automatically deposited into your Balance account. If the transferred money happens to be in a currency that your Balance account doesn’t support, there are 2 options. Either you can create a balance in that specific currency within your account, or you can convert the amount to a supported currency.

Adding funds yourself to your PayPal Balance

If you’d like to make a transfer, you can easily do it from any bank account associated with your Personal account. For those who prefer using cards, adding funds through a linked Visa or Mastercard debit card is another viable option. Nonetheless, certain constraints are placed on the amounts you can transfer daily, weekly, and monthly.

Adding cash at retail stores

In addition to the conventional online methods, you have the flexibility to infuse your Balance account with cash physically at selected retail stores. Transactions can range from $20.00 to $500.00, but certain restrictions apply in terms of daily, weekly, and monthly limits, both in terms of amount and frequency.

Remote check captures

Another interesting feature is the remote check capture. While its availability might be region-specific, it’s an innovative way to add funds to your account.

Direct deposits for seamless salary and benefit transfers

A hassle-free method that you can use with your Balance account is the direct deposit feature. You can have your paycheck, or even entire government benefits or payments like tax refunds or Social Security payments, deposited straight into the PayPal Balance account.

Find out how to check your PayPal account history or cancel a payment on PayPal.

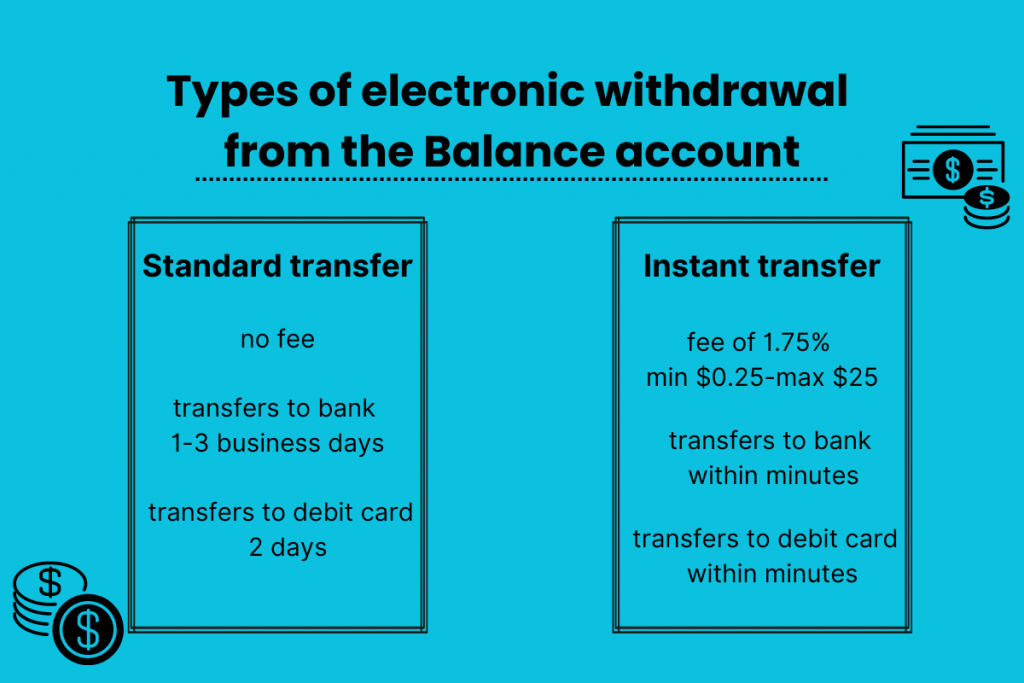

Withdrawing money from your PayPal Balance

There are several ways for users to withdraw money from their Balance account. These include:

- Making a standard transfer to a linked eligible debit card or bank account at no cost.

- Initiating an Instant Transfer to a linked eligible debit card or bank account, though this comes with fees.

- Those with a PayPal-branded debit card can also use ATMs to access their funds, but this may come with fees.

- Transferring funds to PayPal Savings.

- Requesting a physical check.

Withdrawal delays and limitations

For security reasons, there might be instances where a withdrawal is delayed. This could be due to the need to verify the authenticity of the withdrawal request or if there have been reversals on the Balance account like chargebacks or disputes.

Limitations placed on a personal account or a negative balance in any associated account could also affect withdrawals. Once any such issues are resolved, you may need to reinitiate the withdrawal.

Benefits of using a PayPal Balance

If you’re still unsure whether PayPal Balance is for you, read the below benefits for a more holistic view of the advantages this type of account offers its users.

Speed

Waiting for transactions, especially refunds, can be both frustrating and detrimental to cash flow. With a PayPal Balance account, users can avail quick transaction times. Refunds become almost instantaneous when vendors process them straight to the PayPal balance. This reduced waiting time translates to a smoother, more efficient online shopping experience.

Flexibility

At the heart of PayPal’s Balance account is flexibility, making it adapt to diverse financial needs. Whether one is indulging in retail therapy from their favorite online store, sharing the costs of a meal with friends, or keeping track of various subscriptions, the account allows for easy management and execution of transactions. Furthermore, users can maintain multiple currencies, which is especially beneficial for those who shop on international platforms or travel frequently.

Integration

The contemporary digital space is defined by its interconnectedness, and the Balance account doesn’t fall short. A wide array of third-party applications, ecommerce platforms, and other digital services integrate effortlessly with PayPal Balance. This integration isn’t just about making payments; it also means users can receive perks, discounts, and rewards on partnered platforms. Such seamless compatibility reinforces the PayPal Balance account as an essential tool for individuals seeking a comprehensive digital finance solution.

Security

PayPal is renowned for its robust encryption and fraud detection systems. Using the Balance account means that personal bank details are less frequently shared online, minimizing potential risks.

Learn how to avoid scammers on PayPal.

Easy accessibility

The Balance account, complemented by the user-friendly interface of the PayPal mobile app and website, ensures that checking balances, making transactions, or reviewing account activity is always a few clicks or taps away.

Is the PayPal Balance account free?

Opening up a PayPal Balance account doesn’t incur immediate fees or any standard monthly or weekly fees. So the short answer to the above question would be: yes. However, there are many different fee structures associated with money transfers, withdrawals, currency exchange, and more, which will be applied when you use the Balance account – in other words, there are per-transaction fees that you should be aware of.

Let’s look at the most common types of fees associated with the Balance account on PayPal.

- Transferring money from your Balance account to a linked bank account or eligible debit card using the standard option is free. This transfer usually takes 1-3 business days to a bank account or about 48 hours to a debit card. However, there’s a charge for the Instant Transfer option (1.75% with a minimum fee of $0.25 and a maximum of $25), which typically makes funds available in minutes.

- When you send personal transactions to friends or family with qualifying PayPal accounts outside the U.S. using your Balance account funds, a fee of 5% applies (a minimum of $0.99 fee; a maximum of $4.99 in fees).

- When you use the PayPal app to add money to your Balance account at selected stores, a fee between $3.74 and $3.95 is charged. The exact fee depends on the store.

- Using a PayPal-branded debit card to withdraw funds from an ATM may result in fees both from the ATM owner and as per the user’s Cardholder Agreement.

- When adding payroll or government checks with a pre-printed signature to your Balance account, a 1.00% fee applies, with a minimum charge of $5.00. However, if the check can’t be added, no fee is incurred. For non-payroll and non-government checks, there’s a 5.00% fee with a minimum of $5.00 when using the PayPal app for instant addition. If the check isn’t successfully added, no charges apply.

- Having a paper check mailed to you costs $1.50. Upon requesting a paper check, users are obligated to cash it within 180 days. If they fail to do so, the amount will be returned to the Balance account, but the $1.50 fee will be retained. Checks won’t be sent to post office boxes and are only dispatched to verified addresses.

While there are other types of fees associated with the PayPal balance, these should be the ones you’ll be dealing with the most.

For a full list of all PayPal Balance fees, please check PayPal’s site that deals with those fees.

PayPal Balance: Conclusion

The PayPal Balance account is more than just a place to store money; it’s a powerful tool designed to simplify, expedite, and secure online transactions. From personal transactions to direct deposits of your paycheck, you can use your PayPal Balance account in many areas of your life.

While not every feature is beneficial to all, it’s a good practice to review the offer and see whether PayPal Balance might be a good addition to your financial toolbox.

%20(1).png)

it’s good and interesting

How can you open a Balance Account without having to first receive a money transfer?

We are not aware of other options, however, it’s best to check with the PayPal support team as they are best equipped to help in such matters.