Ecommerce businesses heavily rely on ecommerce platforms to help them reach customers, manage sales and inventory, and offer smooth buying experiences. These platforms and marketplaces play a significant role in operating a business, regardless of whether you do it yourself or through an ecommerce-as-a-service provider. Yet, managing finances is equally essential. QuickBooks Online bridges this gap. You can link ecommerce platforms to QuickBooks to track sales, expenses, and inventory in one place. Compatibility, at this point, is vital.

Let’s look at the best ecommerce platforms and marketplaces that integrate with QuickBooks Online (directly or through third-party solutions). As a bonus, we’ll learn how to connect them all using just one tool.

Contents:

2. QuickBooks payment gateway integration

3. How can integration help QuickBooks ecommerce accounting?

4. What ecommerce platforms integrate with QuickBooks

- Shopify

- WooCommerce

- BigCommerce

- Magento

- Squarespace Commerce

- Etsy

- eBay

- Amazon

- Wix

- Ecwid

- The challenge of connecting multiple platforms

5. The one to rule them all: accounting and ecommerce platforms under one roof with Synder

6. How to integrate QuickBooks with an ecommerce marketplace or website?

Key takeaways

- Shopify, WooCommerce, BigCommerce, Magento, Squarespace Commerce, Etsy, eBay, Amazon, Wix, and Ecwid are the platforms that integrate with QuickBooks Online.

- QuickBooks is excellent for ecommerce accounting due to its features for tracking sales, managing expenses, and monitoring inventory.

- You can connect all the ecommerce platforms and marketplaces you sell through with QuickBooks (and payment processors) and do it using only one solution. One for all. Hint – it’s Synder, and you’ll learn how to do it and leverage the integration to the full.

What is QuickBooks?

Let’s start from the very beginning (which is, we all know, a very good place to start) and look at QuickBooks and its capabilities related to ecommerce business real quick.

QuickBooks is one of the most widely used accounting software in the US and worldwide. Created by Intuit, it aims to help businesses manage their financial tasks efficiently, including bookkeeping, invoicing, payroll, and tax preparation.

QuickBooks comes in a desktop and cloud-based version – called QuickBooks Desktop and QuickBooks Online – catering to various business needs and sizes.

It’s user-friendly and offers extensive functionality, making it a preferred choice for small and medium-sized enterprises (SMEs) and larger corporations. QuickBooks provides businesses with accurate financial insights, simplifies financial reporting, and enables better decision-making based on real-time data.

Is QuickBooks good for ecommerce?

QuickBooks is well-suited for ecommerce businesses because it offers features specifically designed to account for online sales, from multi-platform sales tracking to inventory management.

Let’s sneak a peek into what makes QuickBooks fit for ecommerce accounting.

Track sales across channels

One key feature is the ability to track sales and income from various sources, such as online storefronts, marketplaces, and payment processors. This way, ecommerce businesses can keep accurate records of their revenue streams.

Track ecommerce expenses

QuickBooks allows users to track expenses related to ecommerce operations, such as inventory purchases, shipping costs, and advertising expenses, helping businesses understand their financial performance and optimize profitability.

Manage and track inventory

Inventory management is another critical feature that allows ecommerce businesses to track stock levels, monitor product costs, and adjust inventory quantities as needed. As a result, there’s more control over product availability to meet customer demand while minimizing excess inventory costs.

In a nutshell, QuickBooks provides ecommerce businesses with the tools they need to effectively manage their accounting and finances, helping them stay organized, compliant, and financially healthy.

Find out about free QuickBooks alternatives.

QuickBooks payment gateway integration

Before we get to ecommerce integrations, it’s worth mentioning that QuickBooks can perfectly integrate with payment processors.

PayPal, Square, Stripe, and others can be connected directly to your QuickBooks account. So, when a customer makes a payment through any of these processors, QuickBooks automatically records the transaction details, including the amount, payment method, and customer information.

This integration offers several advantages for businesses.

It simplifies reconciliation, as all incoming payments are accurately recorded in your accounting software without manual input.

It provides real-time visibility into your cash flow, allowing you to monitor incoming payments and track revenue more efficiently.

It also improves financial reporting by consolidating payment data alongside other income sources in your QuickBooks account.

Adding ecommerce platforms to this connection can help you turn your accounting into a single source of truth about your sales, products, and customer behavior.

How can integration help QuickBooks ecommerce accounting?

So, why do we consider QuickBooks integration integral to running a business? Why do you need it at all?

Technically, QuickBooks integration refers to connecting QuickBooks with other software, like an ecommerce platform, payment system, payroll software, etc., to facilitate data flow and automate synchronization between the systems.

Business-wise, QuickBooks integration aims to enhance financial and operational processes, eliminating the need for manual data entry and reducing the chances of errors. It ensures that critical business data, such as sales, inventory, customers, and financial transactions, is updated simultaneously across systems.

For a business, it means improved data accuracy and saved time and costs, but more importantly, it’s having a comprehensive view of various business aspects’ performance in one place. The latter allows for a deeper and broader analysis of a business’s performance, comparing data sets against one another to figure out dependencies and make necessary tweaks based on correct numbers, eliminating assumptions from decision-making.

What is an integrated platform?

You might have stumbled upon ecommerce platforms being called integrated solutions. To clarify it, we’ll quickly look at what this term means.

In simple terms, integrated platforms are different software systems or services that can talk to each other without any hiccups directly or through connectors. So, these platforms can work together, sharing important information. For example, your online store’s sales data can flow into your accounting software without you manually entering it.

In other words, we call a solution integrated if it allows you to integrate it with other systems. And that’s what many ecommerce platforms do.

Data and processes you can synchronize

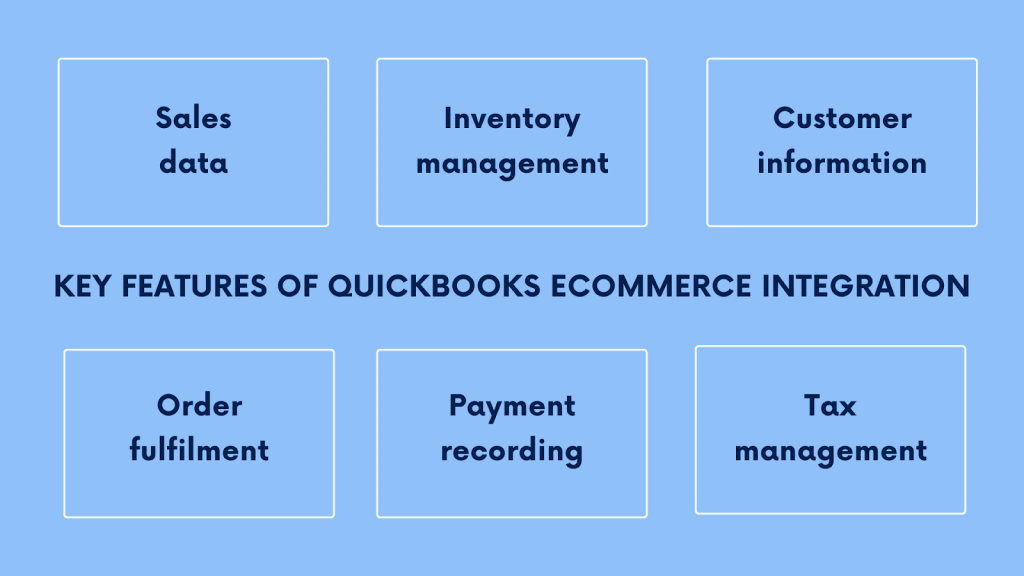

Since we talk about QuickBooks integration with ecommerce platforms, let’s look at key data points and processes you can synchronize within it (we mentioned some earlier, but here’s a more detailed overview).

- Sales data

The integration allows automatic transfer of sales transactions from the ecommerce platform to QuickBooks, ensuring that revenue and sales records are up-to-date.

- Inventory management

The integration enables real-time synchronization of inventory levels between the ecommerce platform and QuickBooks. You can accurately track stock levels, preventing overselling or stockouts.

- Customer information

Customer data, such as names, contact details, and purchase history, can be synced between the two systems. It helps better customer relationship management and personalized marketing efforts.

- Order fulfillment

Order details, shipping information, and tracking numbers can be transferred from the ecommerce platform to QuickBooks, streamlining the order-to-cash process.

- Payment processing

The integration allows for the smooth processing of online payments, ensuring accurate and detailed payment recording in QuickBooks.

- Tax management

QuickBooks integration with ecommerce platforms helps with automated tax calculations, making tax compliance more efficient.

There’s no surprise that integration is about automating operations regarding data fetching and recording, so you no longer need to do it manually. It’s a virtue, as it takes quite a chunk out of your plate as an ecommerce business owner, bookkeeper, or accountant.

What ecommerce platforms integrate with QuickBooks: 10 solutions you might want to consider for QuickBooks Online

Without much further ado, let’s get to ecommerce platforms and marketplaces that integrate with QuickBooks Online. So far, we’ve chosen the ten most popular solutions, so I’ve no doubt you might find those interesting. It’s still worth mentioning that this market is growing, so it might be wise to keep an eye on it as more solutions come to light, offering more convenience, access to new, untackled audiences (like TikTok, for instance), and interesting ecommerce features – you’ve got the idea.

Ecommerce integrations listed below can connect to QuickBooks Online either through built-in or third-party solutions. It can pose several challenges (I’ll talk about those a bit further on), but we’ll get to how you can address them.

Let’s go then.

#1 – Shopify

Shopify is a popular ecommerce platform that enables businesses to create and customize online stores to sell products. So far, it’s one of the leaders in the market, offering a means of running an ecommerce business from A to Z, covering product management, inventory, payment processing, marketing and promotions, etc. In other words, it covers your back at every point of your ecommerce journey as a seller.

Read about the best products to sell on Shopify.

How does it work?

Users sign up for a Shopify account and choose a suitable pricing plan. They can then customize their store by selecting a template, adding products, setting up payment gateways, and configuring shipping options. Shopify provides an intuitive dashboard where users can manage orders, track inventory, and analyze sales data.

What’s Shopify’s advantage for sellers?

The advantage for sellers is Shopify’s extensive and versatile app store, offering a range of plugins and integrations that allow sellers to enhance their store’s functionality. You can add more advanced analytics, integrate with social media platforms, or optimize for search engines. Whichever the need, you’re most likely to find the options to cater to it.

Besides, Shopify provides its payment processor, Shopify Payments, that allows you to offer your customers a flexible and convenient means of paying for their purchases. It also means that you might not need to bother implementing additional payment gateways to your store.

How does Shopify connect with QuickBooks?

To connect with QuickBooks Online, Shopify users can leverage third-party apps in the app store. These apps help integrate and synchronize sales, expenses, and inventory data between Shopify and QuickBooks Online. Sellers can choose from various integration tools based on their specific requirements and preferences.

#2 – WooCommerce

WooCommerce is, by nature, a free plugin for WordPress websites that enables businesses to transform their sites into fully functional online stores. It offers product management features, order processing, payment gateway integration, and customizable design options.

How does it work?

To use the WooCommerce plugin, you need to install it on your WordPress website and configure it to your liking. You can add products, set up pricing and shipping options, and customize the store’s design using WordPress themes and extensions. WooCommerce features a particularly user-friendly interface where you can manage orders, track inventory, and analyze sales data.

What’s the catch for sellers?

WooCommerce is a flexible and scalable solution. As an open-source platform, WooCommerce allows for extensive customization and supports a wide range of extensions to add advanced product variations, implement custom checkout processes, or integrate with various third-party services. So, if your website is on WordPress, you have your back covered with a convenient ecommerce solution you can run and manage in a familiar environment.

How does it connect with QuickBooks?

QuickBooks offers its QuickBooks Sync for WooCommerce plugin that allows you to connect both systems directly. There are also several plugins WooCommerce provides. As you link your WooCommerce with QuickBooks, you can automate the process of syncing sales, customers, and products between them. Some connectors allow sellers to configure the integration settings to ensure that a business’s preferred financial data is accurately transferred between the two platforms.

Learn more about WooCommerce and QuickBooks integration.

#3 – BigCommerce

BigCommerce is a cloud-based ecommerce platform that helps businesses create and manage online stores. It offers a comprehensive suite of features, including customizable templates, built-in marketing tools, and advanced analytics.

How does it work?

You don’t need to install anything. Just sign up for a BigCommerce account, choose a suitable pricing plan based on your needs and budget, and you’re good to go. BigCommers offers plenty of templates you can choose from to design your store. It allows for adding products, configuring payment gateways, and setting up pricing and shipping options. The admin dashboard within BigCommerce is where you manage orders, track inventory levels, and monitor sales performance.

What’s the benefit for sellers?

BigCommerce’s robust built-in feature set is its outstanding advantage. Unlike other platforms that rely heavily on third-party apps, BigCommerce offers a wide range of built-in functionalities that cater to various ecommerce needs. From multi-channel selling and inventory management to advanced SEO tools and marketing automation – BigCommerce provides everything businesses might need to succeed online.

How does BigCommerce connect with QuickBooks?

BigCommerce offers native integration options that allow users to sync orders, customers, and inventory data directly with QuickBooks Online. Sellers can configure the integration settings within the BigCommerce dashboard to ensure seamless synchronization between the two platforms. It eliminates the need for third-party plugins and simplifies managing financial data.

Learn more about BigCommerce integrations.

#4 – Magento

Magento is an open-source ecommerce platform offering a range of features that allow creating, setting up, and running an online store, even if you’re a non-tech-savvy user. Those include customizable templates, advanced product management tools, and robust security solutions.

How does Magento work?

To start with Magento, you get to download and install it to your web server. Then you proceed with creating your online stores. Originally, you get a basic store featuring the most necessary aspects. You can tweak the look and feel of it by selecting a theme, adding products, and configuring payment and shipping options. As a result, it’s a fully-fledged online shop, through which you can offer and sell your products, accept payments, etc. For more advanced and fancy functionality, you have Magento’s native and third-party plugins you can download and implement in your store. Magento provides a powerful admin panel where users can manage orders, track inventory levels, and analyze sales data.

What’s the candy for sellers?

Magento’s benefit, as mentioned, is its extensive customization options. This platform is the king of plugins – you can find a plugin for whatever you want to improve or introduce in your store. Besides, with access to the source code, developers can tailor the platform to meet specific business requirements, so with some technical help, you can fine-tune your store to do what you want it to do. Whether integrating with third-party services, implementing custom workflows, or optimizing for performance – Magento offers the flexibility to build a unique and scalable ecommerce solution.

How does Magento connect with QuickBooks?

As I mentioned, you can utilize extensions available in the Magento Marketplace to integrate with QuickBooks Online. These extensions automate sales, customers, and products synchronization between Magento and QuickBooks Online. You can configure the integration settings within the Magento admin panel to ensure accurate and timely synchronization of your financial data. Otherwise, you can use POS for QuickBooks that pre-built integrates with Magento to sync data in real time and manage all operations seamlessly.

#5 – Squarespace Commerce

Squarespace Commerce is an integrated platform that allows users to create and manage online stores alongside their Squarespace websites. It offers many customizable templates and built-in marketing solutions and provides access to Squarespace’s tools for website building.

How does it work?

Running a website on Squarespace, you can enable the Commerce feature to help you add an online store to it. You can then select your store’s template, add products to the catalog, set up payment gateways, and select shipping options. Squarespace Commerce allows you to manage orders, track inventory, analyze sales data, and more from an intuitive management interface.

What’s the advantage for sellers?

Squarespace’s biggest virtue is seamless integration with its website-building tools. Unlike standalone ecommerce platforms, Squarespace Commerce offers a cohesive solution that allows users to create and manage their online stores within the same platform as their websites. This integration provides a unified brand experience and simplifies managing online presence.

How does it connect with QuickBooks?

While Squarespace doesn’t offer native integration with QuickBooks Online, users can still integrate them through third-party apps. You can also export sales data in a format compatible with QuickBooks Online and import it manually, but frankly, unless you have specific data you want to integrate, I don’t see how the latter is better than automated data integration.

Here’s a Squarespace vs. Wix comparison you might want to read.

#6 – Etsy

Etsy is an online marketplace specializing in handmade, vintage, and unique goods. As a seller, you can create your storefront within the Etsy platform and list your products for sale.

How does it work?

Starting with Etsy is pretty straightforward – you sign up for an Etsy seller account and create product listings. Etsy allows you to customize your storefronts by adding photos, product descriptions, and pricing information. You can also manage orders, communicate with customers, and promote listings within the marketplace. Some of these services come with a price – seller fees – that you might pay for this or that functionality.

How does Etsy stand out for sellers?

Etsy’s biggest advantage for sellers is built-in audience and marketplace visibility. With millions of active buyers browsing the platform, Etsy provides access to a large and diverse customer base. The exposure can help you increase sales and reach new audiences without investing heavily in marketing efforts.

How does it connect with QuickBooks?

Etsy sellers can use third-party integrations or manually import sales data into QuickBooks Online (again, the latter is just to mention).

Here’s more about Etsy and QuickBooks integration.

#7 – eBay

eBay is a renowned online marketplace where users can buy and sell almost (if not) everything, from rare Victorian pins and vintage posters to kitchenware to houses. As a seller, you can create listings for new and used items, manage orders, and engage with buyers through the eBay platform.

How does it work?

You start with creating an eBay seller account and listing products for sale with detailed descriptions, pricing, and shipping information. eBay provides you with tools for managing these listings, processing orders, accepting payments, and contacting your customers. You can also utilize eBay’s advertising and promotion features to increase your listings’ visibility within the marketplace. Just as on Etsy, you pay eBay seller fees to use its services.

What’s the goody for sellers?

eBay’s sellers benefit from its large and diverse customer base. People from all over the world visit the marketplace daily. So, eBay offers sellers significant opportunities and exposure to a global audience. This broad reach can help significantly increase sales by adding eBay to their sales channels and quickly grow their businesses.

How does eBay connect with QuickBooks?

Multiple third-party solutions allow you to integrate eBay with QuickBooks. You can synchronize sales and other critical business data between the platforms.

Find out more details on eBay integration with QuickBooks.

#8 – Amazon

Amazon is one of the leading online marketplaces globally, offering a vast selection of products across various categories. Think of anything, and you can find it on Amazon (and if you can’t, the thing just doesn’t exist). Sellers can create listings, manage inventory, and fulfill orders through the Amazon platform.

How does it work?

Once you create an Amazon seller account, you can list your products for sale on the platform. Amazon provides tools for managing listings, monitoring inventory levels, and processing orders. Sellers can also take advantage of Amazon’s fulfillment services, allowing them to store inventory in Amazon warehouses and fulfill orders through Amazon’s logistics network.

What’s Amazon’s advantage for sellers?

Amazon for sellers is, first of all, an extensive reach. And by extensive, I mean huge. Millions of people use it globally. Also, it provides super convenient fulfillment services, taking a significant part of the work on itself. It can be a perfect fit for more classic ecommerce businesses and dropshipping. Sellers can store inventory in Amazon warehouses and leverage Amazon’s logistics network for order fulfillment, streamlining the shipping process and improving customer satisfaction.

How does it connect with QuickBooks?

Amazon allows third-party solutions to fetch various data through its API (Application Programming Interface. So, these solutions can retrieve sales, orders, inventory, customer information, and other data directly from Amazon’s seller account. Integrating Amazon with QuickBooks helps sellers automate the process of transferring this data into it, making it easier to manage their finances.

Here, you might want to read about the best products to sell on Amazon FBA.

#9 – Wix

Wix is a super convenient website builder known for ages. It also offers ecommerce functionality through Wix Stores. Users can create online stores using multiple Wix’s customizable templates, manage products, and process orders.

How does it work?

If you have a Wix website, you can add ecommerce functionality by enabling Wix Stores and selecting a suitable pricing plan. It’ll allow you to create a fully-fledged online store, add and manage products, connect payment gateways, and set up shipping. Wix provides an intuitive drag-and-drop interface, helping users design their store and manage their online presence.

What can it offer sellers?

The most significant benefit of using Wix for sellers is its easy-to-use interface and the ability to use plenty of tools to build and manage their online stores within the same platform as their websites. It saves the day, as you don’t have to search for third-party solutions, helping you introduce ecommerce functionality to your website and add another app to your business toolset to learn and manage.

How does it connect with QuickBooks?

To integrate with QuickBooks Online, Wix users can utilize third-party apps from the Wix App

Market. These apps facilitate the synchronization of sales and financial data between Wix and QuickBooks Online, allowing sellers to streamline their accounting processes and manage their finances more efficiently.

#10 – Ecwid

Ecwid is an ecommerce platform that enables businesses to sell products across multiple online channels, including websites, social media, and marketplaces. It offers features such as customizable storefronts, product management tools, and built-in marketing solutions.

How does it work?

Users can sign up for an Ecwid account and kick-start their online stores by adding products, configuring pricing and shipping options, and customizing the design of their storefronts. Ecwid provides tools for managing orders, tracking inventory levels, and analyzing sales data. Additionally, Ecwid offers integrations with various online platforms and marketplaces, allowing users to reach customers wherever they are.

What’s the Ecwid’s advantage?

Ecwid’s advantage for sellers is its multi-channel selling capabilities. It offers integrations with multiple online channels, as mentioned. This way, Ecwid enables businesses to reach customers across different platforms and marketplaces, expanding their reach and increasing sales opportunities.

How does it connect with QuickBooks?

Ecwid offers built-in integration options that allow users to sync sales and financial data directly with QuickBooks Online. You can configure the integration settings within the Ecwid dashboard to ensure seamless synchronization of sales, expenses, and inventory data between Ecwid and QuickBooks Online, streamlining your accounting processes and improving efficiency.

The challenge of connecting multiple platforms

Before we proceed, it’s worth mentioning that integrating multiple ecommerce platforms and marketplaces with QuickBooks can present significant challenges for ecommerce accounting.

While you have tools available to facilitate integration, they often only allow connecting one platform at a time. It means you may need to use various third-party integration tools or QuickBooks’ direct integration tools for each platform, adding complexity to the process. Managing multiple authentication details and setup configurations can become overwhelming.

However, the most critical challenge lies in the data duplication and inconsistency risk.

For instance, if you sell through Shopify and accept payments with Shopify Payments and Stripe, using separate solutions to integrate sales and payment data from these sources can lead to duplicate transactions. This risk multiplies as you add more ecommerce platforms and marketplaces to the mix.

Is there a way to address it? It’s ridiculously simple – using a single solution to integrate whichever ecommerce platforms and payment processors you might be using with QuickBooks.

And we’re getting to how you can do it right away.

The one to rule them all: accounting and ecommerce platforms under one roof with Synder

Synder is an ecommerce and accounting automation software aiming to enhance the finance management aspect of business operations as it provides a range of essential features that cater to the specific needs of ecommerce businesses.

- Multi-channel data synchronization

Synder acts as a bridge between various ecommerce platforms and payment gateways with accounting software, enabling automatic and real-time data synchronization in two modes: per transaction or a single daily summary entry. Synder supports integration with popular ecommerce platforms like Shopify, WooCommerce, BigCommerce, Etsy, Amazon, eBay, payment gateways, and accounting software (25+ altogether), catering to a wide range of online businesses.

- Duplicate entries detection

With its unique functionality, Synder keeps your records free from errors, duplicate entries, or discrepancies. It recognizes those and won’t let them in.

- Rollback feature

Should you realize that data sync doesn’t go as desired, you can roll back all changes and start again with adjusted settings.

- Historical data sync

Synder allows you to sync historical sales data from any platform as far back as the platform lets you go.

- Transaction categorization

The tool categorizes transactions from the ecommerce platform into appropriate accounts in QuickBooks, saving time on doing it each time manually.

- Bank reconciliation

It simplifies bank reconciliation by comparing and matching transactions recorded in QuickBooks with corresponding deposits in the bank account. And it does it fast (some users claim it’s faster than generating a statement).

How can you benefit from Synder’s capability to connect ecommerce platforms with accounting?

Now, let’s look at what choosing Synder as your ecommerce integration solution can bring you in a bit more detail. Because simply importing data from a sales channel to QuickBooks is not it.

Automated sales data sync

Synder automates the synchronization of sales data between the ecommerce platforms and QuickBooks. This feature ensures that sales transactions, including order and payment information, and transaction details, like seller or payment processing fees and taxes, are accurately reflected in QuickBooks. Synder does it for you automatically upon setting it up, so you can save time and reduce the risk of data entry errors.

Real-time inventory tracking

With Synder, businesses can track inventory levels simultaneously across the ecommerce platform and QuickBooks. When a sale occurs, inventory quantities are automatically updated in both systems, preventing overselling and helping maintain accurate stock levels.

Customer data synchronization

Efficient customer data management is crucial for ecommerce businesses. The QuickBooks Synder integration enables seamless synchronization of customer information between the ecommerce platform and QuickBooks. It ensures that customer details, such as names, contact information, and purchase history, are up-to-date in both systems.

Multicurrency support

For ecommerce businesses operating in global markets, Synder offers multicurrency support. It automatically converts transactions made in different currencies into the business’s base currency, simplifying accounting for international sales.

Check out a true story of how Synder helped a business manage its multicurrency transactions.

Tax automation

Tax calculations and compliance can be complex for ecommerce businesses. QuickBooks Synder simplifies tax management by automatically tracking taxes based on transaction data and mapping tax rates to the appropriate tax accounts in QuickBooks. This feature ensures accurate tax reporting and helps businesses stay on track with tax regulations.

Workflow automation with Smart Rules

Smart Rules in Synder allow users to create customized automation workflows based on specific triggers and actions. You can tailor the rules to match your business’s unique needs and handle repetitive tasks error-free and with less time investment.

For example, you can set up Smart Rules to automatically categorize transactions based on certain criteria, such as transaction amount, description, or payment method.

Besides, Smart Rules can automate tasks such as applying sales taxes based on location or shipping address.

Deep ecommerce analytics

You can use Synder’s ecommerce analytics and reporting option to have a deeper and broader look at your business’s performance, including sales, customers, and products. You can assess your overall performance or break it down by channels. You can track critical ecommerce KPIs, customer behavior patterns, and product performance to understand your business’s dynamics and elaborate actionable strategies for profitability and growth.

Financial analytics and preparing for taxation

You can also automatically generate accurate financial statements for analysis, audits, and taxation matters. Whichever the need is, you’ll have your balance sheet, income, and cash flow statements neat and accurate.

Sign up for a 15-day free trial today or spare a spot at our Weekly Public Demo to learn more about Synder’s powerful functionality.

Learn more about Synder QuickBooks integration capabilities in the article “Synder’s QuickBooks Desktop Smart Rules Feature: Defining the Future of Accounting”.

How to integrate QuickBooks with an ecommerce marketplace or website?

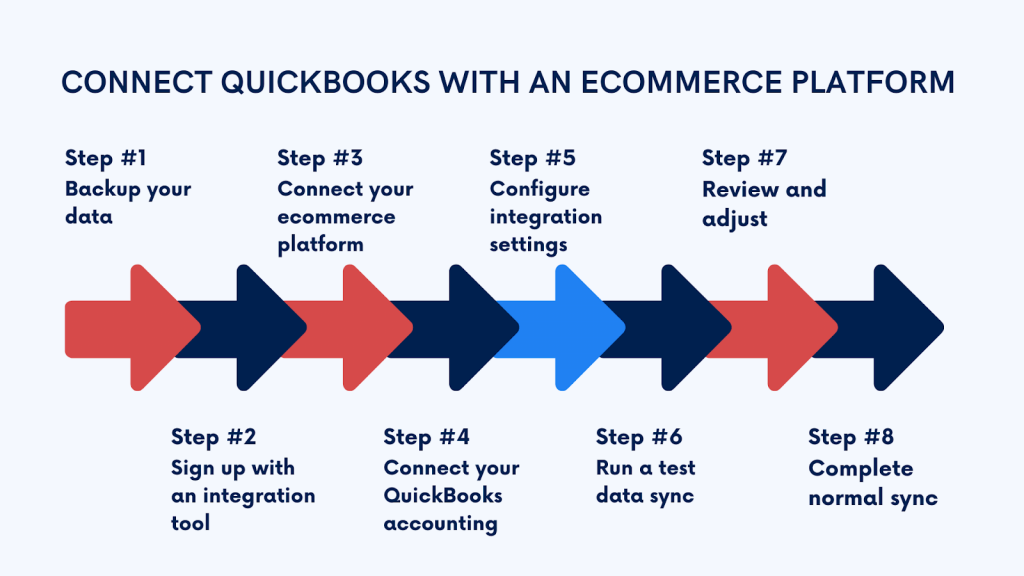

Now let’s get down to some common steps and best practices for integrating QuickBooks and ecommerce platforms. I’ll be using Synder as an example. Still, the general principles and basics are pretty much the same across various integration solutions.

Step #1 – Backup your data

Before initiating the integration process, make sure to back up your accounting and sales data. You might want to do it in QuickBooks and the ecommerce platform to integrate. It includes accounts, sales, expenses, inventory, customer information – everything. You might want to do it to have a copy of your data in case of any issues during the integration process.

Step #2 – Sign up and create your account in Synder

At this initial step, decide what Synder services to use. You can select either Synder Sync, an integration tool, or Synder Insights – the analytics functionality. You can go with both if you want to.

Next, you provide your business name, address, time zone, products you sell, and some more details.

Step #3 – Connect your platforms

Here, you can select all the platforms you’d like to integrate with Synder. There might be eBay, Amazon, your Shopify store, etc. The thing is, you can tick all you need and connect them all at once.

Besides, here, you might want to add all the payment processors you use to receive payments. Again, you tick them – and you’re all good.

Important note: In Synder, you can always return to this step to add more ecommerce and payment platforms, should you need them.

Step #4 – Connect your QuickBooks accounting

If you imagine Synder as some connecting device with all your ecommerce and payment platforms on one end, on the other end will be your QuickBooks. And you’re connecting it at this step.

It’s pretty straightforward – you select it from the available options and grant Synder access.

Step #5 – Configure integration settings

Usually, at this step, you configure your integration preferences. It might include selecting and mapping data to sync, choosing the frequency of data synchronization, etc., depending on the software you use.

In Synder, for example, you can decide whether you want a per transaction sync or you better go with daily summaries of transactions. You can also choose whether to allow auto-sync to let it synchronize transactions in the background, as they occur, or start synchronization manually every time you need it. You might prefer to apply or not apply taxes, whether to fetch product names within transactions, and some more.

Step #6 – Test data sync

A common recommendation is to conduct a test data sync to verify that data transfers accurately between the systems. You might want to check that sales transactions, inventory levels, and customer data are synchronized correctly.

Step #7 – Review and adjust

After the test sync, review the data in QuickBooks and your ecommerce platform to ensure consistency and accuracy. Make any necessary adjustments or corrections in the integration app settings.

In Synder, if things go wrong during synchronization (sometimes, it might happen due to misconfiguration or other reasons), you can roll back all the synced transactions, make necessary corrections, and sync ones more.

At this point, you might want to contact the support team to help you figure out the cause of the problem and fix it.

Step #8 – Complete initial sync

Once you’re satisfied with the integration setup, perform a full data sync to ensure that all current or historical data is transferred to QuickBooks accurately.

Basically, that’s it. The process might slightly change from software to software, but, as I mentioned, the basics are pretty much similar. You sign up, add your ecommerce platform and QuickBooks account, and go through the settings to finalize the integration. Backup is important, so never skip it, as well as testing the integration on a small bit of data before a full-blown sync.

TL;DR

- QuickBooks Online is a top accounting software that helps ecommerce businesses manage finances efficiently, offering features like sales tracking, expense management, and inventory tracking, making it ideal for ecommerce. You can integrate it with ecommerce platforms to enhance accounting processes by automating data synchronization. It can save loads of time and ensure better accuracy, helping businesses make informed decisions based on correct data.

- The best ecommerce platforms you might want to consider, as they integrate with QuickBooks, include Shopify, WooCommerce, BigCommerce, Magento, eBay, Amazon, Etsy, Squarespace, Wix, and Ecwid.

- These platforms offer native or third-party integration options with QuickBooks. However, managing multiple integrations can be challenging due to data duplication and inconsistency risks. Synder can help you integrate many ecommerce platforms with QuickBooks, bringing all your financial data into one place to manage. It offers features like multi-channel data synchronization, real-time inventory tracking, customer data synchronization, tax automation, and workflow automation with Smart Rules. Besides, Synder provides deep ecommerce and financial analytics, helping businesses make data-driven decisions for growth and profitability.

Final words

Integrating QuickBooks with ecommerce platforms offers many advantages for online businesses, helping improve the efficiency and accuracy of financial management. The integration automates data synchronization, eliminating manual data entry and reducing the risk of errors. Businesses gain real-time insights into their performance and enhance various operations, like order processing or inventory management. Tax compliance becomes more manageable, and overall bookkeeping processes are simplified.

As a result, businesses can focus on growth, providing exceptional customer experiences, and making informed decisions for sustainable success.

Share your thoughts

Do you manage a multi-channel ecommerce business? How do you handle your accounting in QuickBooks? What tools and tactics do you use to integrate your sales into it? Share your thoughts in the comments section below. We appreciate good discussion!