For those running their WooCommerce businesses, harmonizing operations with QuickBooks is essential to efficiently manage business operations. The WooCommerce QuickBooks (Intuit) integration, however, often presents a significant challenge, characterized by the need for seamless data exchange and accurate financial tracking.

Employ Synder, a cutting-edge financial tool designed to bridge the gap between WooCommerce and QuickBooks! Synder simplifies the synchronization of sales, expenses, and inventory data between WooCommerce and QuickBooks. By automating the data transfer process, Synder reduces the manual workload and significantly lowers the risk of errors that can occur with manual data entry. This integration empowers business owners and accountants to focus more on strategic decisions rather than getting bogged down by operational details.

In this article, we dig into the complexities of WooCommerce and QuickBooks integration and explore how Synder’s integration solution addresses these challenges, offering a seamless and error-free way to synchronize data across platforms.

Contents:

1. Reasons to implement WooCommerce + QuickBooks Online integration via Synder

2. How to set up the QuickBooks WooCommerce integration via Synder

3. Key features of the QuickBooks and WooCommerce integration via Synder

4. WooCommerce and QuickBooks integration FAQ

Reasons to implement WooCommerce + QuickBooks Online integration via Synder

Are you a business seeking to streamline your ecommerce and accounting processes? We have a solution. Implementing WooCommerce and QuickBooks Online integration via Synder offers several compelling benefits. Let’s look through the most significant ones.

Connection of additional sales channels and/or payment platforms

When operating a WooCommerce store, tracking all your sales and transactions is essential. Especially if you want to be sure your accounting software has complete data records needed for a comprehensive report. For that, it’s better to have the records from all the channels in use: your WooCommerce data and the records from additional platforms that have an impact on your bottom line.

Synder enables the integration of payment platforms other than WooCommerce Payments, allowing seamless syncing of all collected data directly into your QuickBooks account. If you have additional sales channels that bring you revenue, you can easily connect them to Synder as well to have a complete overview of your business performance across channels.

Learn about the payment options WooCommerce accepts.

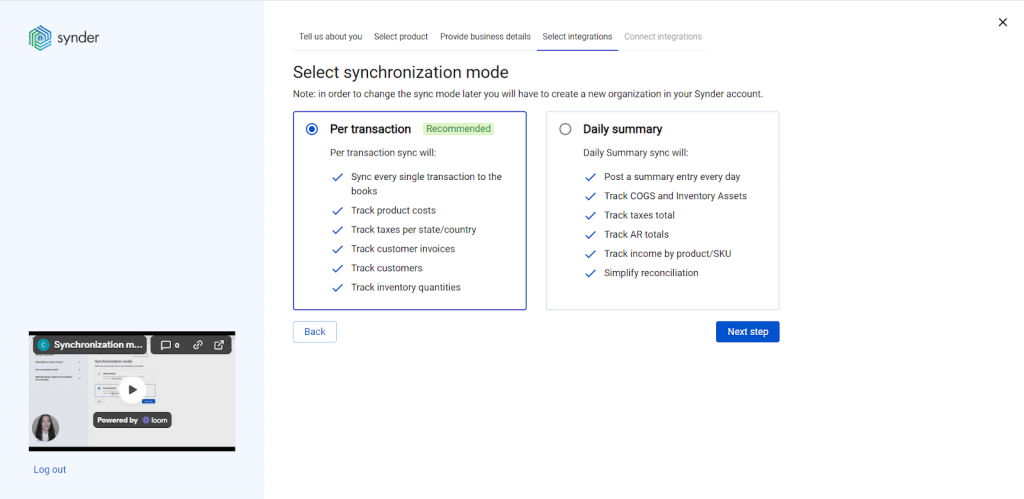

Per Transaction or Daily Summary sync options

Synder provides two distinct approaches for transaction synchronization: Per Transaction or Daily Summary sync, where all transactions from a given day are consolidated into a single entry. The Per Transaction mode offers more details of the records compared to the daily summary sync, which is better suited for handling a high volume of transactions.

Note: No customer data from WooCommerce is transferred to your QuickBooks when choosing the Daily Summary sync.

Data security

Holding a SOC 2 Type 2 Certification, Synder protects all the processing data on the highest level. Leveraging advanced encryption and secure connections, the software ensures the privacy and security of data transmitted between platforms like WooCommerce and QuickBooks, safeguarding your information to maintain its confidentiality and integrity.

Detailed reporting

Synder efficiently stores and syncs crucial accounting and bookkeeping details. This enables you to generate detailed and accurate P&L and Balance Sheet reports for your online business and control an ongoing cash flow. The software takes all income and expense records from the connected platform(s), WooCommerce, WooCommerce Payments and additional channels, if any, and stores them right into the QuickBooks Online account.

24/7 support

The Synder support team is available 24/7 via chat and email, ready to guide you through the entire process of integrating WooCommerce and QuickBooks. To offer a practical insight into the software’s operations, Synder’s specialists host Weekly Product Demo sessions. These sessions give a detailed demonstration of how the software works, providing a hands-on understanding of its functionality.

How to set up the QuickBooks WooCommerce integration via Synder

Now let’s create your account by following these step by step instructions below.

See the video below:

1. Create an account

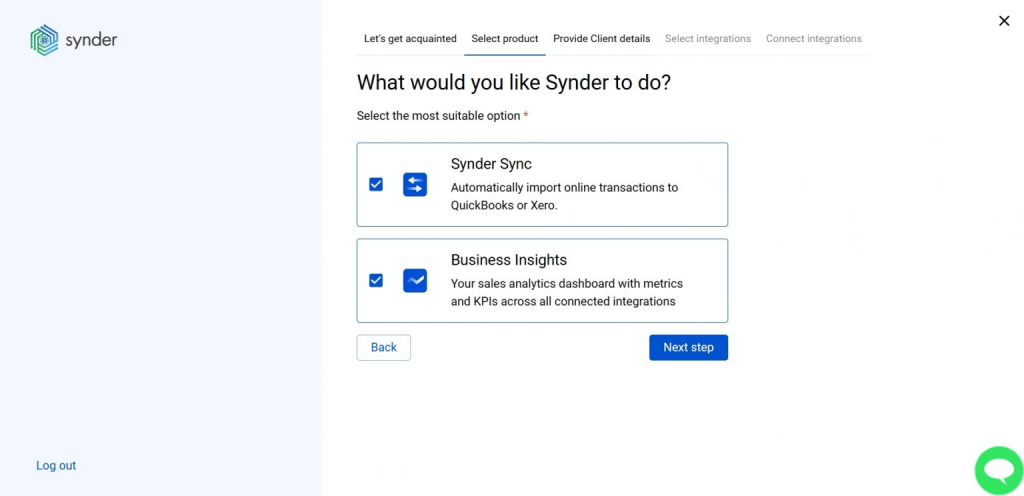

The first step of the WooCommerce integration with QuickBooks Online is choosing the initial product you’re going to utilize: Synder Sync or Synder Insights.

- Synder Sync – suitable for WooCommerce integration with QuickBooks if your main goal is to track the data from the accounting/bookkeeping point of view and to have access to comprehensive and detailed reports.

The main reason users choose Synder Sync: it helps with tax season preparation.

- Synder Insights – suitable for WooCommerce integration if your main goal is to track your KPI metrics performance to have a better understanding of your business analytics.

The main reason users choose Synder Insights: it gives an in-depth overview of the customers’ behavior, product performance and financial KPIs analytics.

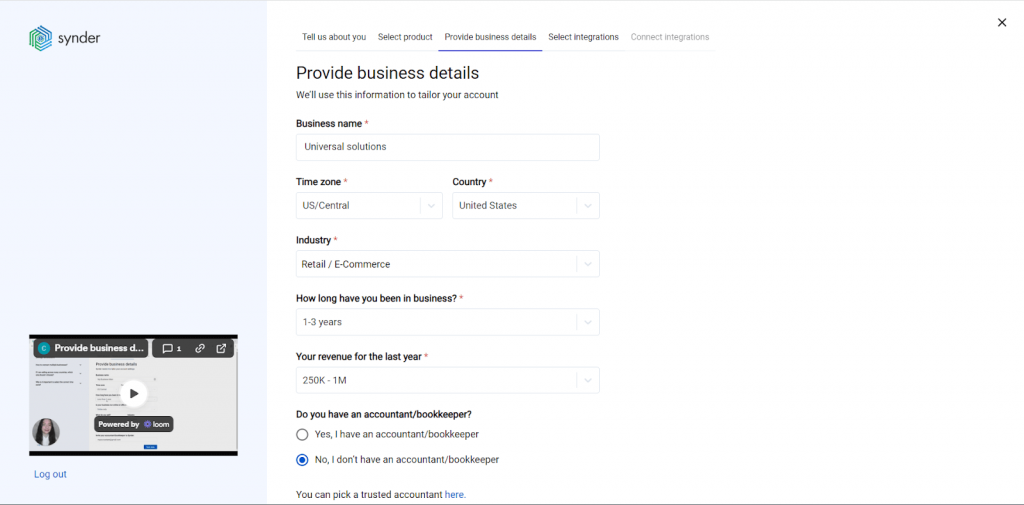

2. Set up the organization

Fill out the needed fields with information about your WooCommerce business. Synder asks you to fill out such details as the name of the organization, your time zone, country, business industry and the time you’ve been on the market.

This information will help us understand your requirements for WooCommerce integration with QuickBooks better. Further, we’ll be able to provide you with a personalized support service for the WooCommerce and QuickBooks integration based on your needs.

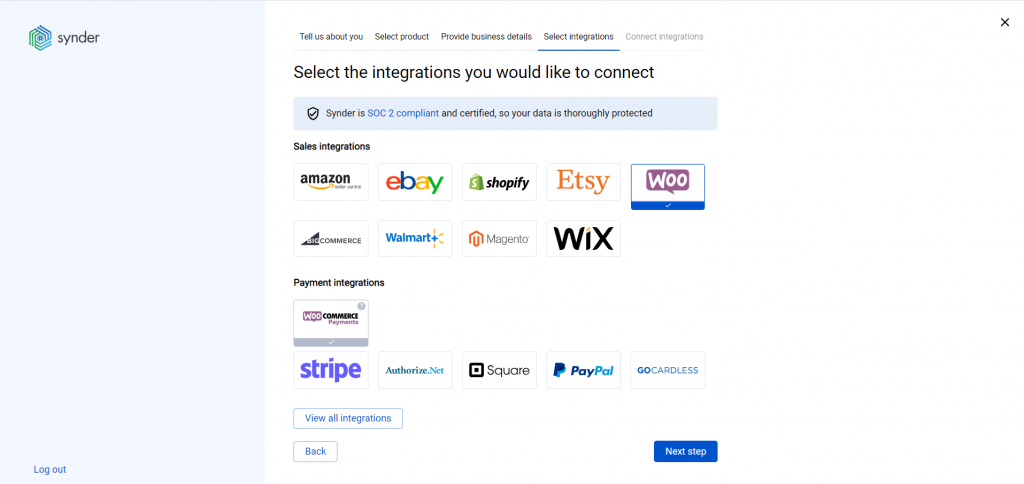

3. Select WooCommerce as your platform

Among the platforms, choose WooCommerce as your main sales channel.

For WooCommerce stores that use payment methods other than WooCommerce Payments, it’s strongly recommended to also connect these payment systems. Synder will be able to store all the sales details, fees, refunds, and invoices made through these payment platforms. Thanks to this information, it will also be able to add more details to the WooCommerce orders purchased through the connected platform, giving you a complete financial picture.

Note: Click ‘View all integrations’ to see all the platforms available for integration with QuickBooks.

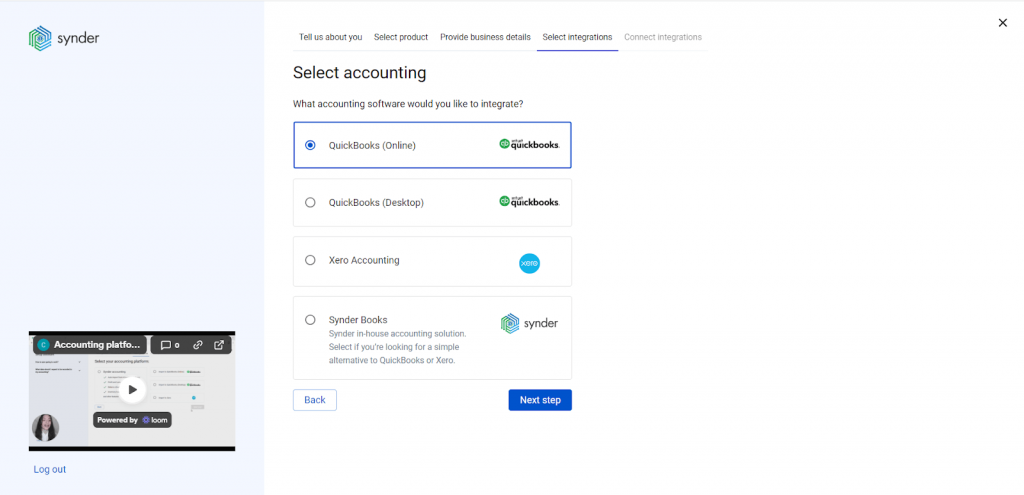

4. Select QuickBooks Online among accounting software

Choose QuickBooks Online among the provided options.

Synder is also available for integrations with QuickBooks Desktop, Xero and its own accounting software – Synder Books.

5. Choose the sync mode

As said above, Synder provides two sync modes: Per Transaction and Daily Summary. This is the step where you choose the most suitable option for your WooCommerce and QuickBooks integration.

Don’t know which one to choose? Check out our guide to learn more about the workflow and benefits of both modes.

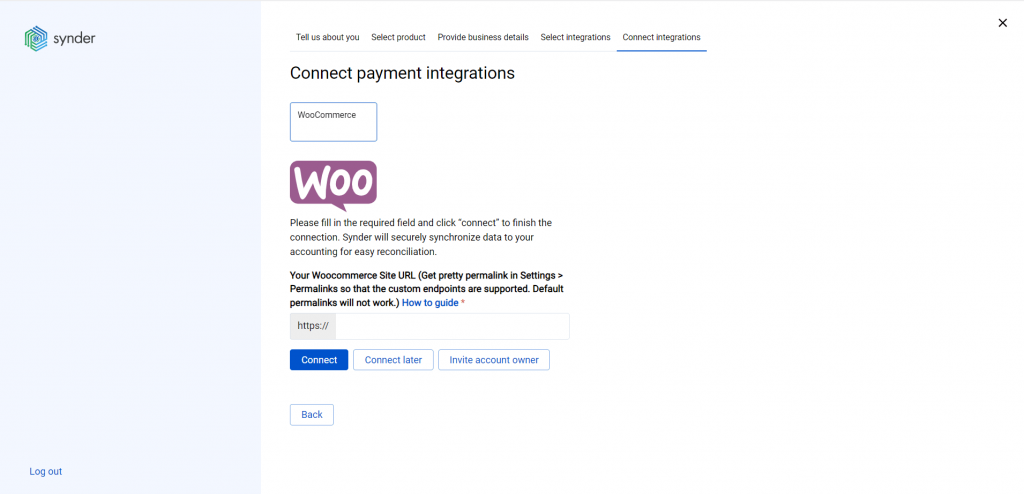

6. Connect platforms

To finish the setup, simply link your WooCommerce and any other sales platforms you use to Synder. Choose WooCommerce as your option and provide the permalink to your store. After that you’ll need to grant permission for Synder to store the info from your WooCommerce store. Simply click ‘Approve’.

The last step of your WooCommerce and QuickBooks integration setup is to choose a payout account (usually your QuickBooks Online Checking account) that’ll prepare your books for the reconciliation process. The data in your checking account won’t be duplicated.

Once WooCommerce and QuickBooks accounts are connected to Synder, the software will begin syncing the latest orders and transactions. The WooCommerce data will be stored right in your accounting records.

If you already have a Synder account and want to add WooCommerce, check out Synder’s integration guide on how to connect WooCommerce to an already existing account.

Your Synder account is now ready to sync your WooCommerce data right into your QuickBooks Online account! It’s essential to customize your Synder account to fit your unique needs, so make sure to enable or edit all the necessary functions in the settings to get the most out of it.

Get all your QuickBooks and WooCommerce integration questions answered at a live session! Attend our Weekly Product Demo, where Synder specialists will show you how to set up your account and how Synder can help you automate manual bookkeeping tasks – reserve your spot.

Key features of the QuickBooks and WooCommerce integration via Synder

Instant synchronization and historical data import

Synder automates the process of syncing sales, expenses, and inventory data between WooCommerce and QuickBooks Online. Get instant updates of your current WooCommerce orders in QuickBooks as they happen. The software records every critical piece of information for your accounting and bookkeeping, guaranteeing that final reports have all income and expense details. The type of data recording depends on the sync mode you’ve chosen during the setup.

To gather additional financial data from transactions made via payment gateways other than WooCommerce Payments, it’s necessary to connect each of these payment platforms to Synder. This integration allows the software to recognize and store every transaction that is important for your WooCommerce business final reports.

Note: There might be some limitations in recorded data due to WooCommerce API.

Error-free multi-channel reconciliation

Ease the reconciliation process with Synder. Verify all transactions entered into your QuickBooks Online account from every platform added to Synder and be prepared for the tax season with no fear of entry errors. It’s recommended to connect WooCommerce Payments or other payment gateways in use so that the software is able to store payouts, fees and partial refunds.

When a payout from any payment platform is synced, it’s instantly updated in your QuickBooks account under the ‘Bank feeds‘ and matches with what you have coming from your real bank account in the Bank Feed. Synder helps minimize discrepancies, aiming for a zero difference between the accounts during the actual reconciliation process. The magical secret is that the software matches the payouts with actual transactions reducing the risk of double entries in the outcome.

Note: Payouts won’t duplicate your bank feed records in your QuickBooks Online account.

Automated categorization and classification

One of the most efficient features of QuickBooks integration with WooCommerce via Synder is creating your own personalized rules for the recorded data. These rules aim to automate various tasks such as categorizing WooCommerce products, giving classes, adding locations for particular records and filling out missing data. Once these rules are created and enabled, the software will automatically apply them to the next synced transactions. There are two options for how you can add these rules to your bookkeeping strategy:

- Create your own rules from scratch: Set a trigger that activates the action you want the software to perform. For example, you can classify the product in QuickBooks Online by name or track the income/expense per each platform connected.

- Use a template: Edit the pre-made templates in your Synder account so that the rule meets your specific needs or utilize them as they are.

Inventory tracking

Minimize the chances of excess inventory or stock shortages by connecting WooCommerce with QuickBooks via Synder. The software takes product information and their corresponding SKUs from your WooCommerce store and records them in QuickBooks Online. With the correct setup, Synder categorizes revenue according to the product income accounts specified in your records. Products sharing the same SKUs in both WooCommerce and QuickBooks are automatically identified as the same product. If SKUs differ, you can optimize the recording process using Synder’s product mapping feature to ensure accurate inventory management for your QuickBooks and WooCommerce integration.

Multicurrency management

Integrate WooCommerce to QuickBooks using Synder for a smooth synchronization of payments with an accurate exchange rate on the day when the transaction happened. Synder records transactions from connected platforms in their original currency right into the QuickBooks Online account. After that, the amount is converted into your preferred home currency. Synder takes the exchange rate from WooCommerce or the payment platform through which the payment was made.

It’s recommended to link all your active business channels together with WooCommerce to Synder to achieve thorough and accurate financial reporting.

Sync rollback

You can undo the sync if you want to add any changes to the synchronization results in your QuickBooks Online account. Your books won’t be affected by the rollback. Once you undo the sync, you can easily update the settings or add an automated categorization/classification rule. When the settings are changed, resync the transaction with the corrected data back into your QuickBooks Online account. You can rollback per transaction or in bulk, depending on your needs.

Note: Rollback doesn’t reinstate the number of syncs available.

Conclusion

The integration of QuickBooks and WooCommerce itself is a smart move for any online business. It means your sales data and financial records talk to each other, so everything stays up-to-date and accurate. You get a clear picture of how your business is doing financially, which is super important for making good business decisions.

However, connecting WooCommerce with QuickBooks through Synder makes managing your online business’s money matters a lot easier. This setup automates and simplifies the way your sales data moves from WooCommerce to QuickBooks. It means less work for you and fewer mistakes in your accounts. Synder helps by correctly recording all your WooCommerce incomes and expenses in your QuickBooks Online. The software even works well with additional payment methods you might use.

Using Synder to link WooCommerce and QuickBooks is a smart choice. It saves you time, reduces errors, and gives you a better understanding of your business finances. It’s a powerful tool for anyone running an online store and looking for an easier way to handle the financial side of things.

WooCommerce and QuickBooks integration FAQ

Do I need to connect WooCommerce Payments as an additional payment platform?

No. When connecting WooCommerce to QuickBooks Online via Synder, the software links WooCommerce Payments by default. The payments received through WooCommerce Payments will be recorded to your account—no need for additional QuickBooks WooCommerce Payments setup.

Is it possible to get an instant low-stock alert?

Synder can do that. To enable this action for your WooCommerce QuickBooks integration, you’ll need to utilize the Automated Categorization feature. The rule you’ll create for the WooCommerce integration will monitor the quantity on hand for your products in the QuickBooks account and notify you via email once the levels are below your specified inventory threshold.

Two options are available:

Option 1

Go to Categorization Rules → Rules → Create Rule → (choosing the trigger) Sales Receipt: Created → (choosing the condition) IF: Line Product or Service → Less (enter the amount you need) → Yes → (choosing the action) THEN: Email → Inventory for [product name] went down → [Product name] went down. Please, repurchase.

This will tell Synder that an email should be sent to the company owner with any text you specify in your condition.

Note: The Rule will be activated once a sales receipt is created.

Option 2

You can use a Synder template and edit it so it suits your needs.

Go to Categorization Rules → Templates → Inventory → Alert inventory goes down in Sales Receipt → Try it out.

Check out a detailed Synder guide to learn more – How To Get Instant Low Stock Alerts.

Can I add more platforms to Synder?

Yes. In addition to a WooCommerce account, you can also connect other ecommerce platforms, such as eBay, Shopify, Amazon, etc, to QuickBooks Online via Synder. We recommend connecting both ecommerce platforms and payment gateways such as Stripe so Synder Sync is able to recognize all transactions and record them into your QuickBooks account.

.png)