According to experienced business specialists, the key to gain new customers is to cover more channels of communication with potential clients. Sales platforms such as Stripe, PayPal, Shopify, and eBay provide your customers with an easy and convenient way to complete purchases online so that business owners can enjoy the benefits of an incoming stream of customers. However, many business owners struggle to handle the accounting part that might seem tricky at first glimpse.

This is where Synder comes into play, being a smart accounting software Synder mirrors the actual money flow happening in your Afterpay and records live transactions and historical data in your accounting system providing you with precise tax, customer, item, and other transaction details. With the Synder solution, you will be able to track inventory and manage Accounts Receivable by closing open invoices with Afterpay payments automatically.

Follow easy steps in this helpful guide, and enjoy seamless synchronization with Synder.

Overview:

Start the Afterpay integration from scratch

- Create an account

If you’re getting started with Synder you’ll need to create a free Trial account and connect your accounting system first. Check out this guide if you would like to integrate Stripe with Synder accounting, QuickBooks Online or Xero and this article to connect your QuickBooks Desktop company.

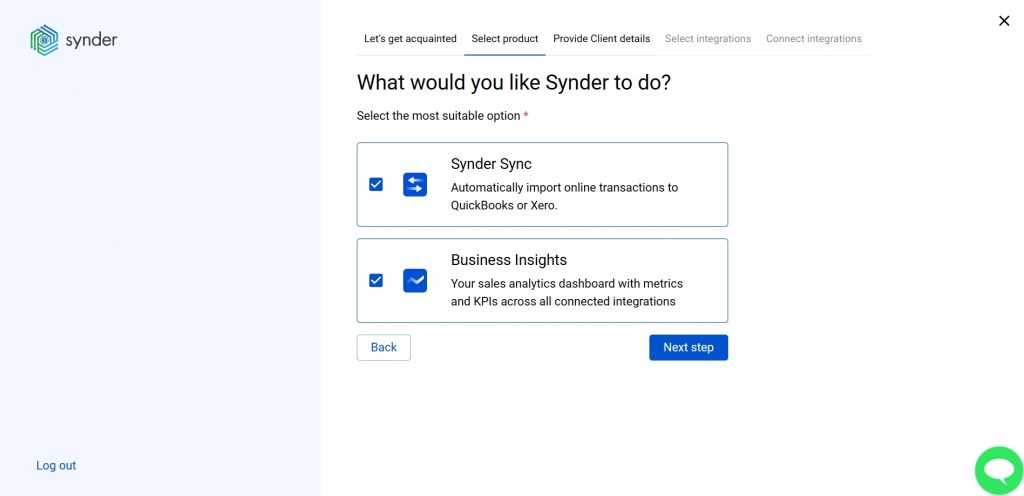

Select the product(s) you are going to use:

- Synder Sync;

- Business Insights;

- Or both of them for perfect control of your business.

Synder Sync: choose this product to push all of your transaction data from all sales channels into QuickBooks Online, QuickBooks Desktop, Xero, or Synder Books – our native accounting solution.

Business Insights: this Synder product lets you see how your business is doing. It aggregates data across all of your connected sales channels and payment gateways and provides you with timely insights into your products’ performance and your customer behaviors, as well as financial health indicators such as total sales, average order value, etc. The data is updated every hour!

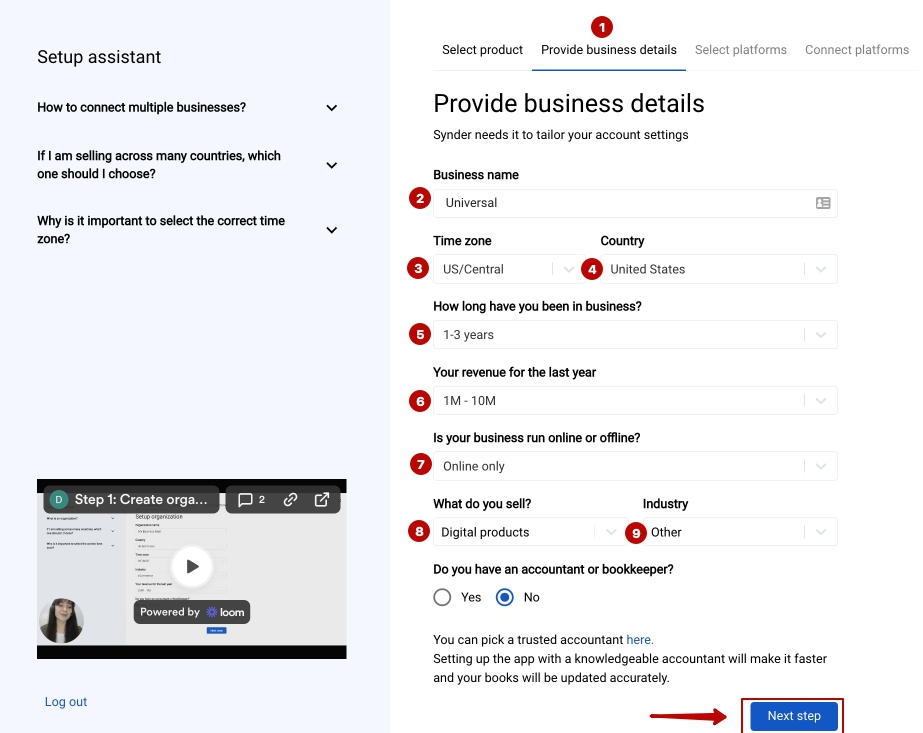

- Provide your business details

Going through the set-up process of an Organization for your QuickBooks/Xero company or Synder Books – just fill in the information about your business and hit the Next step button.

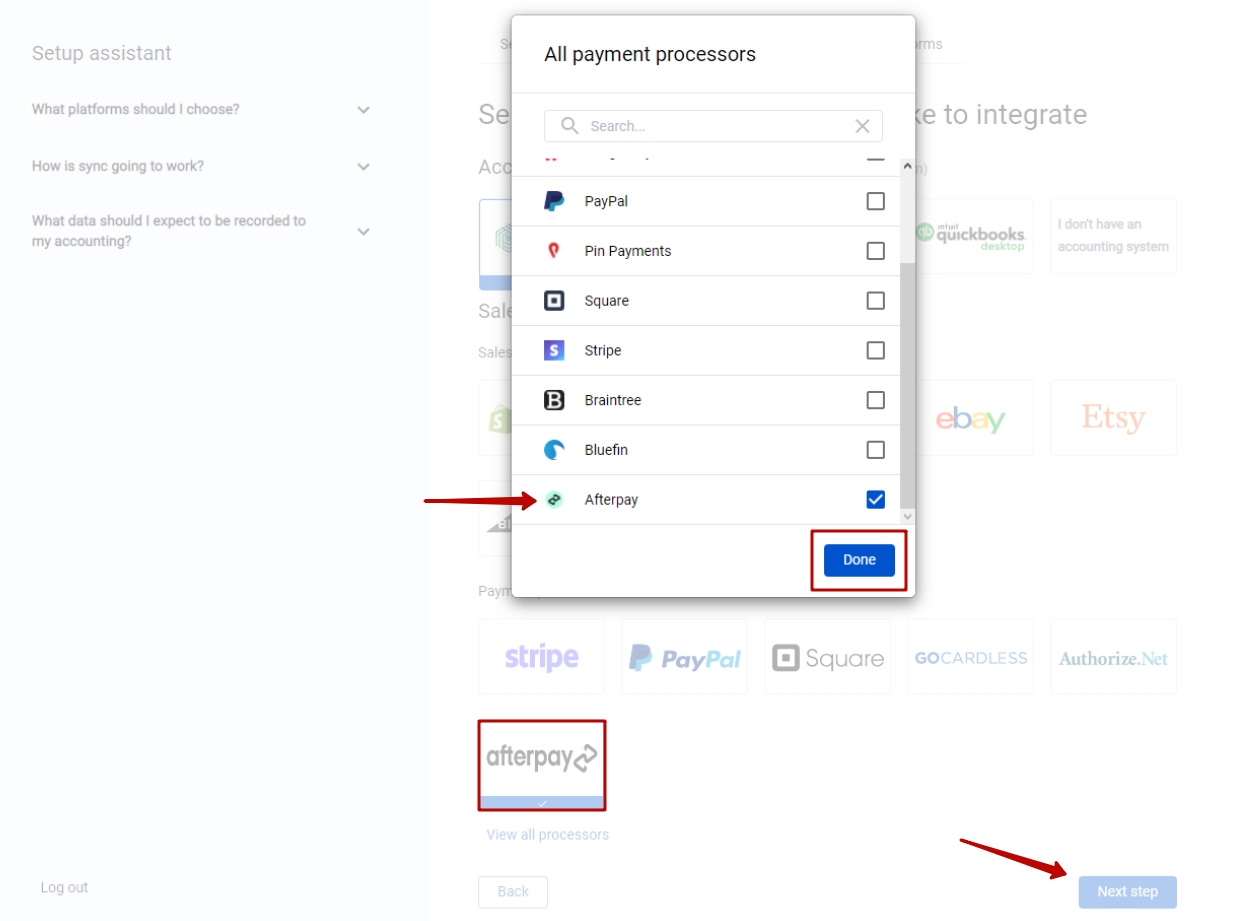

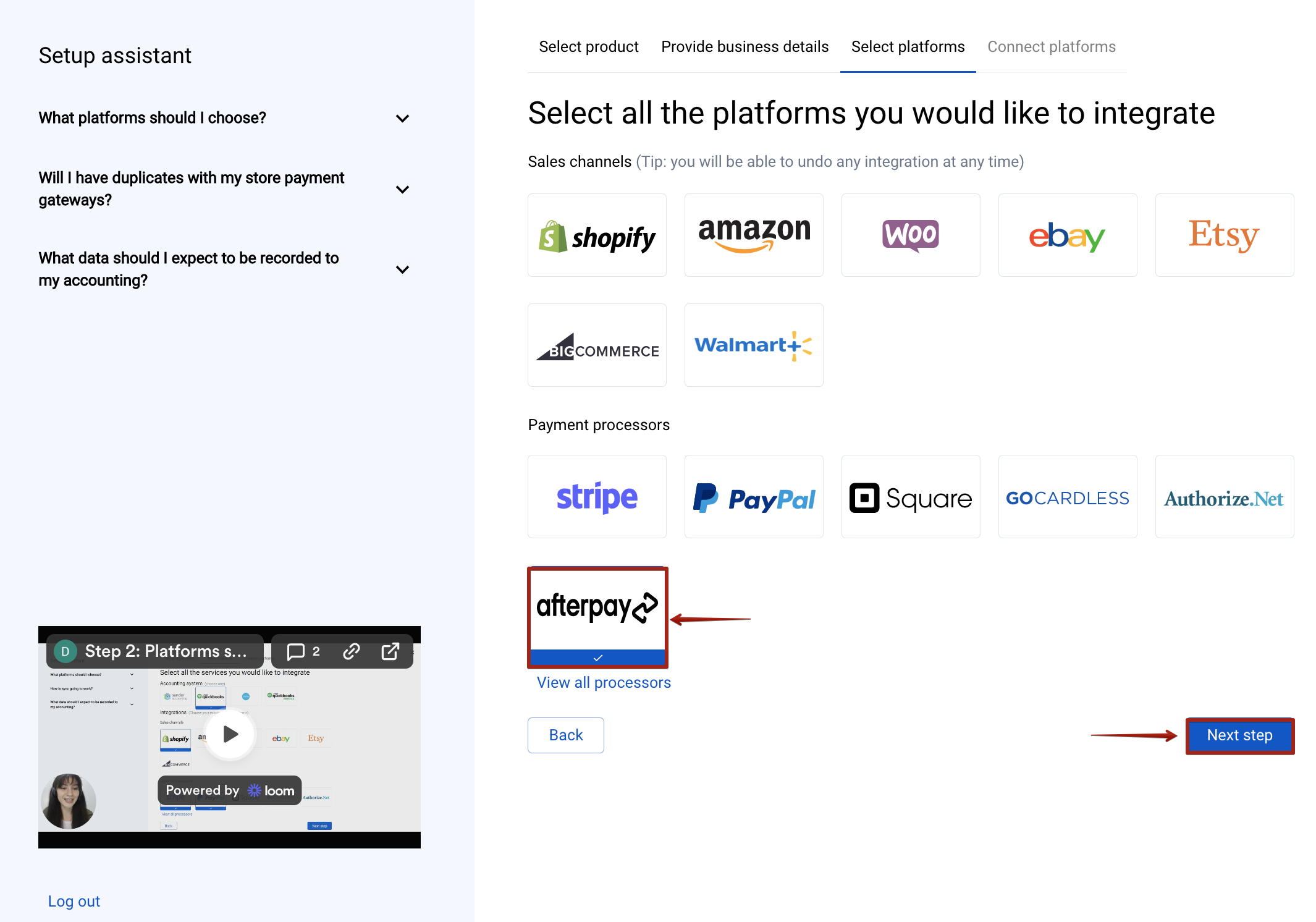

- Select the platforms you would like to integrate

Now you need to select the platforms you would like to connect to Synder. Mark Synder, QuickBooks or Xero, Afterpay, and other platforms you would like to integrate with Synder (click View all processors to see the list of all available platforms).

Note: Mark all the services you are using to receive payments, you will be able to connect all of them right away or skip the connection of particular integrations and set them up any time later.

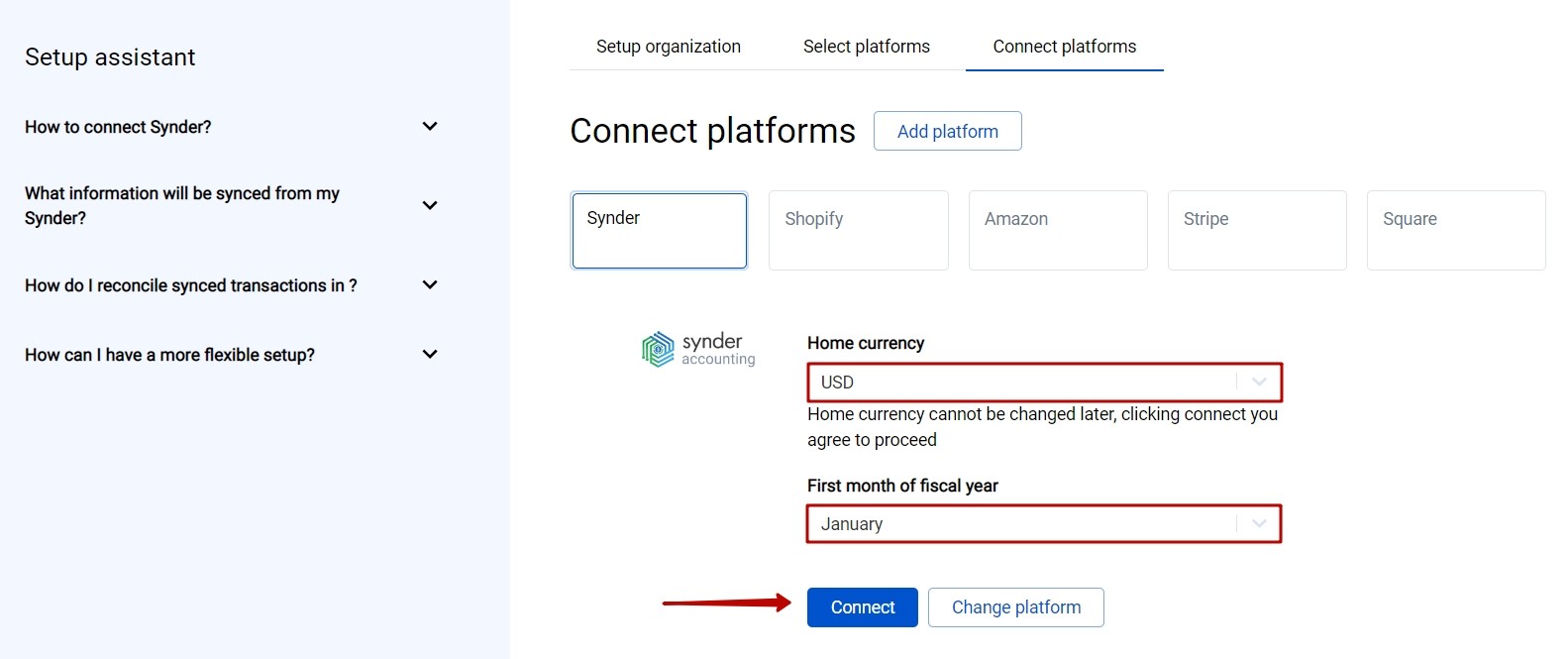

- Connect your accounting platform

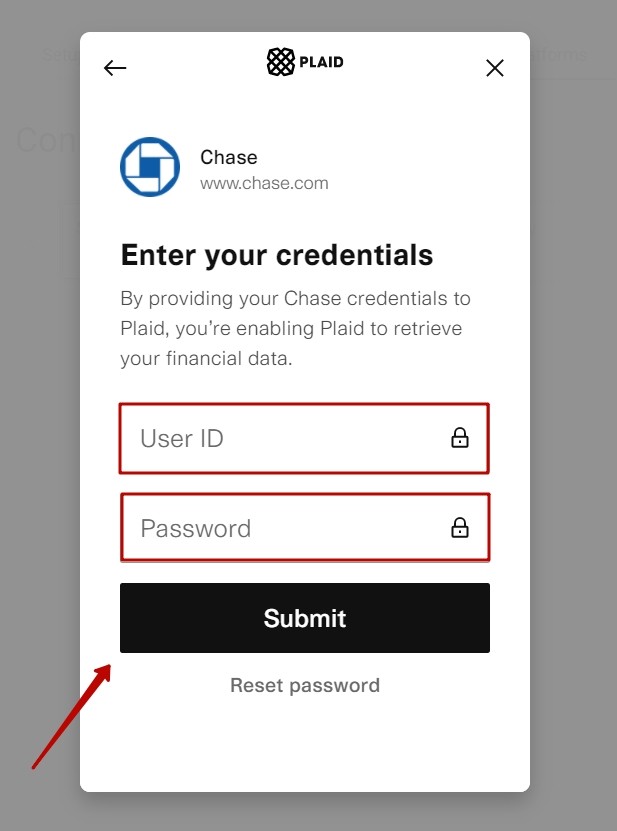

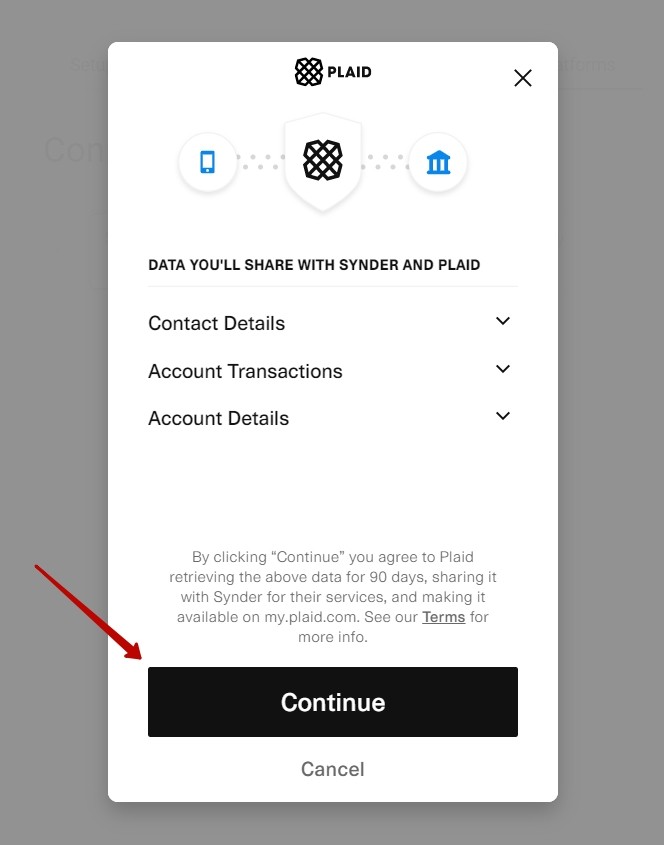

Set up Synder accounting by selecting your home currency, the first month of the fiscal year, and connecting your bank account following the steps in this article.

Alternatively, follow the steps on the screen to grant permission to Synder to record data in your QuickBooks or Xero company. If you are a QuickBooks Desktop user, check out this video tutorial to learn How to connect and sync data into QuickBooks Desktop.

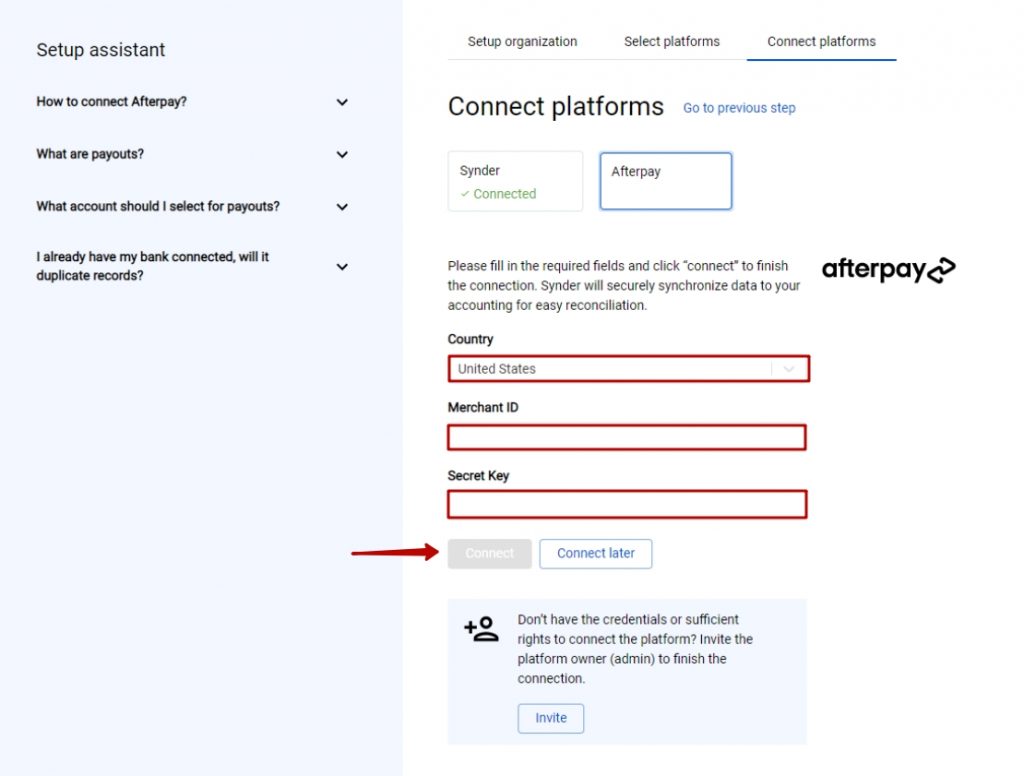

- Connect your Afterpay account

Almost there! To complete the setup you just need to connect your Afterpay and other sales platforms to Synder:

- Select the country where your business is registered.

- Enter your Afterpay credentials: Merchant ID and Secret Key (see detailed steps How to acquire Afterpay Merchant ID and Secret Key). The Afterpay team should have sent your Merchant ID and Secret Key to the email associated with your Afterpay account.

Note: You can obtain your Afterpay credentials by reaching out to your Business Development Manager. Alternatively, you can reach Afterpay Merchant Support by raising a ticket or contacting the team directly. - Hit the Connect button.

You can integrate sales platforms one by one straight away or skip the connection for other additional payment processors and set them up later in the Settings: tap the Settings button on the left side menu → hit the Add payment platform button.

Note: You can find our detailed guides on how to connect your sales channels and payment providers to QuickBooks Online/Xero via Synder in our Help center.

Tips and tricks on the Afterpay integration

Note 1. Synder mirrors real money flow in your accounting by recording sales in the Clearing account (Afterpay Bank account in your books) that Synder creates automatically during the initial setup.

Note 2. The Afterpay integration does not provide apps with information regarding merchant fees and payouts, so you will need to add them manually or with help of QuickBooks automation (such as banking rules). Please feel free to contact our support if you need help with the setup.

Note 3. Synder protects your data with two flagship features: duplicate detector and rollback. You can give yourself peace of mind knowing that all the power is in your hands and your accounting is secured.

Note 4. Get familiar with the software in our 3 Must-Watch beginner guides and Features of Synder taking your experience to the next level to find out how Synder can help you automate your bookkeeping.

That’s it, you’ve successfully connected your Afterpay account to Synder, enjoy the ride! If you feel like some adjustments are necessary (e.g. you would like to change tax, item, or customer configs), you can manage that in Synder settings. Open them on the left menu → hit the Configure button under your Afterpay platform. If you need to fill in gaps with missing data after the sync into your QuickBooks Online, like applying classes or locations to transactions, the Smart Rules feature will be of great service. Now, you can customize your Synder according to your needs.

Get in touch with the Synder team via online support chat, phone, or email with any questions you might have so far – we are always happy to help you!