Manually you can import as many historical transactions from the payment system as needed (the time range of how far back you can go can vary based on your plan and the platform limits).

Note: you are given 1 month of historical data import on a trial.

Please check out this guide to learn about Synder automatic synchronization mode.

To import transactions from the sales platform, do the following:

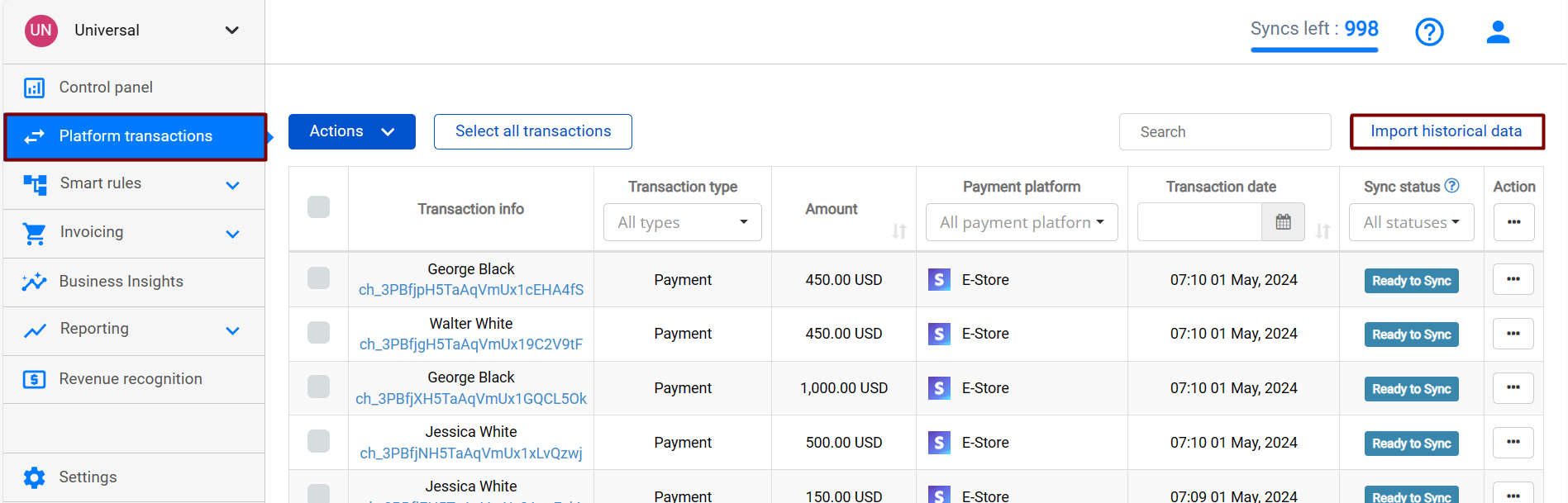

- Select the Organization needed in the top left of the page.

- Go to Platform Transactions on the left.

- Hit Import historical data in the upper right corner.

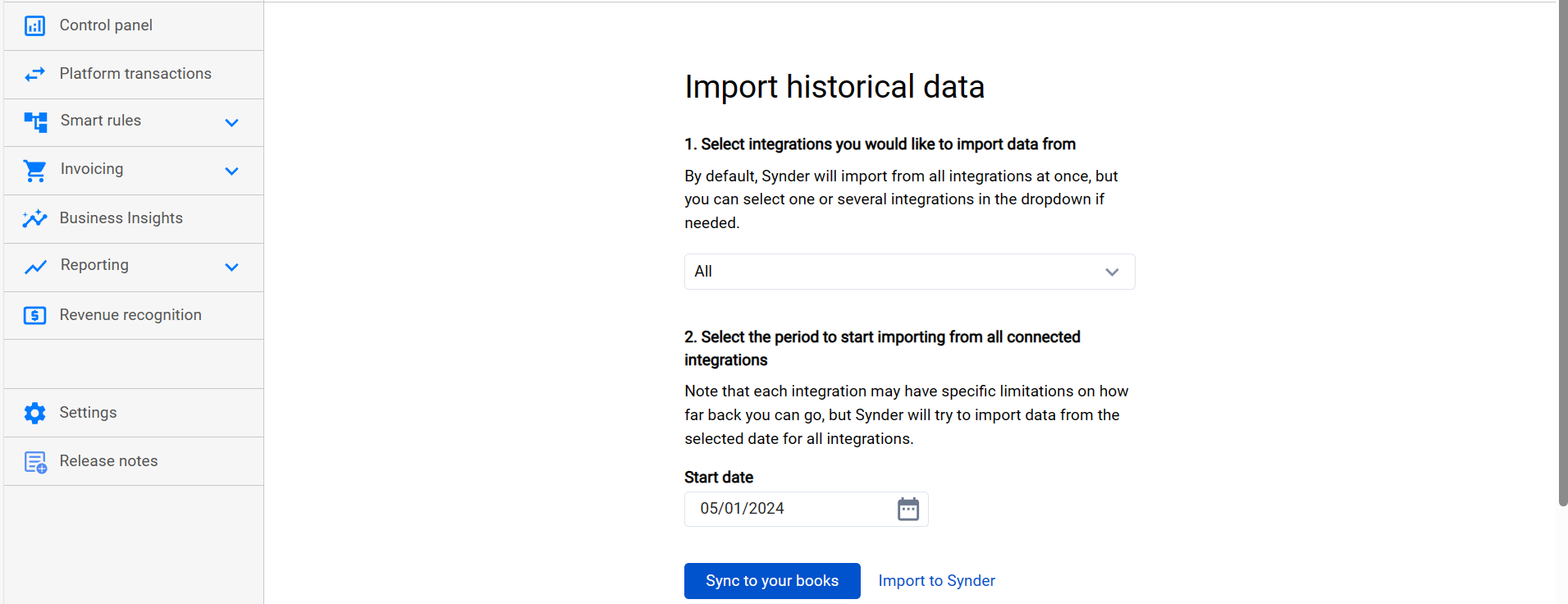

- Select the desired Payment platform if you have more than one and specify the start date needed.

- Click Import to Synder (to import transaction data to Synder) or Sync to your books (to synchronize them to your accounting company)

1) Using Import to Synder, you will import your transactions for the selected time period and for the selected payment provider (if you have several connected) under the Platform transactions tab in several minutes.

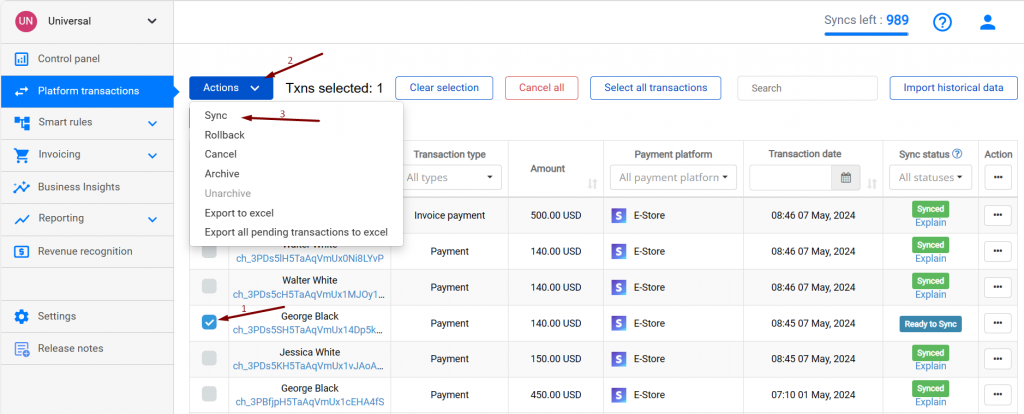

After the transactions are imported from your sales platform (Stripe/Square/PayPal/Shopify/etc.) to Synder (note your sync balance will remain untouched), you can review them and sync to your accounting company (your sync balance will go down during the sync).

Select transactions needed (our filter is available to filter out the ones you need to sync) and click Sync under the Actions menu.

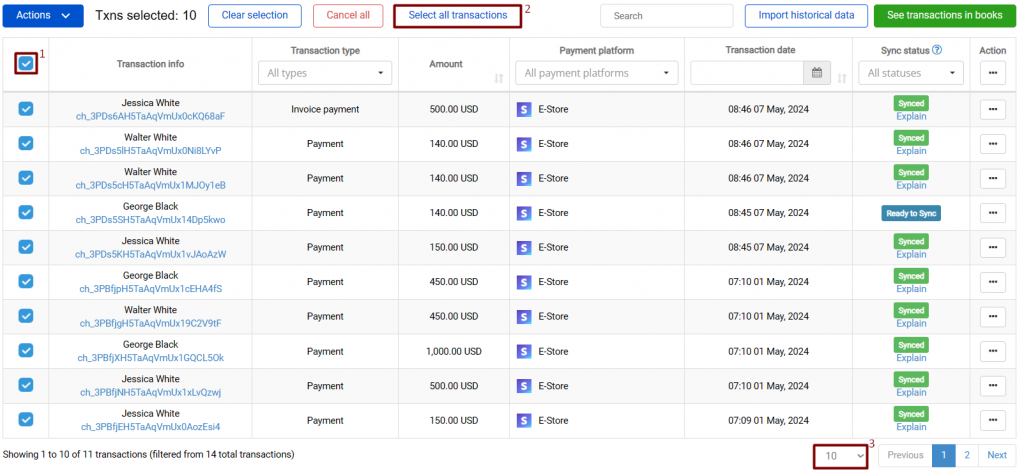

In order to mark all transactions on the page, use top selector (1). You may also select all transactions on all pages of the list by clicking on ‘Select all transactions’ (2). To adjust the amount of transactions displayed on a page, please click on the dropdown below the list (3).

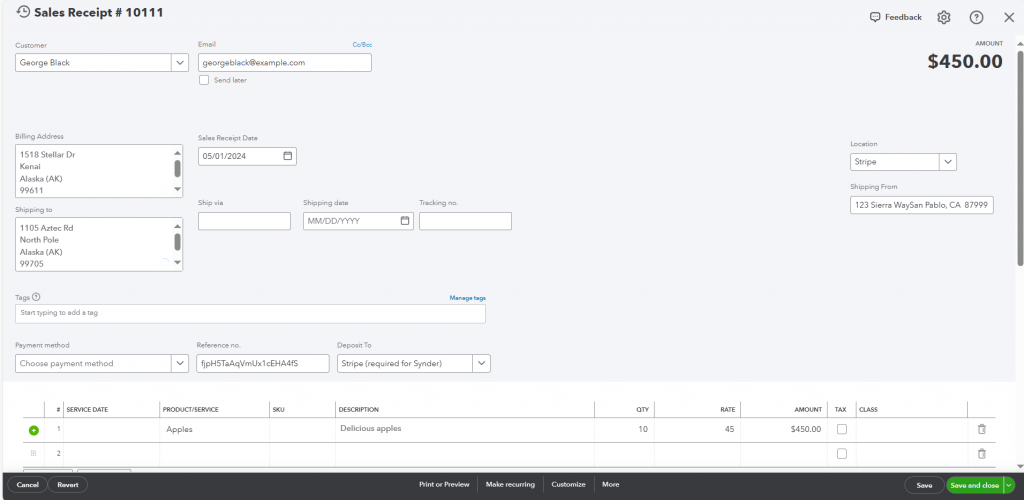

(the result in your QuickBooks after synchronizing the transaction using Synder)

2) Using Sync to your books, you will synchronize data to your QuickBooks/Xero right away, under the Transactions tab you will see the “synced” status in several minutes, which means your books are updated.

Reach out to the Synder team via online support chat, phone, or email with any questions you have – we’re always happy to help you!