If you’re a business owner, you’ve likely heard the term EBIT thrown around when discussing financial performance. EBIT, or earnings before interest and taxes, is a crucial metric that can help you understand your company’s profitability and potential for growth. But what is EBIT, how is it calculated, and why is it so important?

In this ultimate guide to EBIT, we’ll cover everything you need to know about this financial metric, from its definition to its significance for your business. Whether you’re just getting started with financial analysis or you’re a seasoned pro, this guide will provide you with the knowledge and tools you need to make informed decisions about your company’s financial health. So, let’s dive in and explore EBIT together!

Financial modeling terms: What is EBIT or operating income?

EBIT stands for earnings before interest and taxes. It is a financial metric that measures a company’s operating profit or income, which is calculated by subtracting operating expenses from revenue, but before accounting for interest and taxes.

In other words, EBIT measures the profitability of a company’s core business operations and indicates how much money a company earns from its operations before taking into account the cost of financing (interest) and taxes. It is often used as a gauge of a company’s overall financial health and operating efficiency.

EBIT vs cash flow

EBIT and cash flow are both important financial metrics, but they measure different aspects of a company’s financial health.

EBIT is a measure of profitability and operating performance. As it was mentioned before, it represents the income a business generates from its core business operations, before accounting for financing costs and taxes. EBIT is often used to evaluate a company’s ability to generate profits from its operations and is a useful metric for comparing the profitability of different companies within the same industry.

Cash flow, on the other hand, is a measure of a company’s liquidity and cash position. It represents the amount of cash that flows in and out of a business over a specific period of time, including cash generated from operating activities, investing activities, and financing activities. Cash flow is important because it indicates whether a company has enough cash to cover its expenses, pay its debts, and invest in future growth opportunities.

While EBIT and cash flow are related, they are not interchangeable. A business can have a high EBIT but a negative cash flow if it is not able to collect its accounts receivable or manage its inventory effectively. Similarly, a business can have a positive cash flow but a low EBIT if it is not generating enough revenue to cover its operating expenses.

How to calculate EBIT: Where is EBIT on income statement?

EBIT can be found on the income statement, also known as the profit and loss statement.

To calculate EBIT, start with the revenue generated from the company’s operations and subtract the cost of goods sold (COGS) to arrive at the gross profit. Next, deduct the operating expenses (selling, general, and administrative expenses) from the gross profit to arrive at the EBIT.

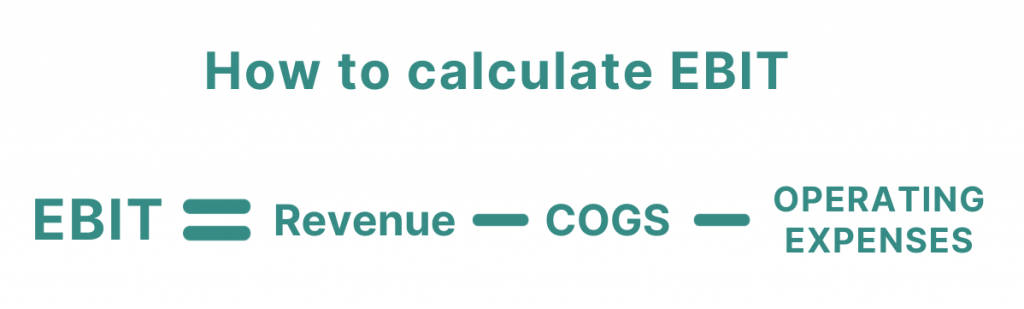

The formula for calculating EBIT looks as follows:

EBIT = Revenue – COGS – Operating Expenses

For example, let’s say a company has revenue of $1,000,000 and expenses of $750,000, excluding interest and taxes. To calculate the company’s EBIT, you would subtract the expenses from the revenue:

EBIT = $1,000,000 – $750,000 = $250,000

This means that the company has an EBIT of $250,000, or an operating profit of $250,000.

Once calculated, EBIT is typically listed as a separate line item on the income statement, below the gross profit and before the interest expense and income tax expense.

Read our expert article on how to calculate cost of goods sold.

Importance of EBIT

EBIT is an important metric for several reasons. First, it’s one of the most useful resources of insights into a company’s profitability from its core business operations. This can help investors and analysts understand how well the company is performing and whether it has the potential for growth.

Second, EBIT can be used to compare the financial performance of different companies, regardless of their financing decisions or tax implications. This makes it a useful metric for benchmarking and evaluating companies in the same industry. By looking at the EBIT of companies within a specific industry, investors and analysts can gain a better understanding of the average profitability of companies within that industry and identify which companies are performing well and which are not.

Third, EBIT is an important metric for evaluating a company’s financial health. It provides insight into a company’s ability to generate profits from its operations and indicates whether the company is generating enough revenue to cover its operating expenses.

Finally, EBIT can also be used to calculate other financial ratios, such as the EBIT margin, which measures the percentage of revenue that is earned as operating profit. This can provide additional insights into a company’s financial performance and profitability.

EBIT vs EBITDA

Before diving into the specifics of EBIT, it’s important to understand the difference between EBIT and EBITDA. EBITDA, or earnings before interest, taxes, depreciation, and amortization, is a financial metric that measures a company’s profitability before accounting for non-cash expenses such as depreciation and amortization. EBIT, on the other hand, measures a company’s profitability before accounting for interest and taxes.

Depreciation and amortization are non-cash expenses that are recorded as a reduction in the value of a company’s fixed assets over time. By adding these expenses back to EBIT, EBITDA provides a better representation of a company’s cash flow from operations. EBITDA is often used in industries where large fixed assets are common, such as manufacturing and construction.

While both EBIT and EBITDA are important metrics for assessing a company’s financial health, they have different strengths and weaknesses. EBITDA can be a useful metric for companies that have high levels of depreciation and amortization, as EBITDA allows them to assess profitability without accounting for these non-cash expenses. However, EBIT can be a more accurate representation of a company’s true profitability, as it accounts for interest expenses and taxes, which are important factors in determining a company’s financial health.

Struggling with depreciation? Find out how to calculate asset’s depreciation with the help of Excel.

Now that you know the difference between EBIT and EBITDA, we can proceed to some examples.

Examples of EBIT

To better understand EBIT, let’s examine a few examples. Let’s say that Company A has total revenues of $1,000,000 and total expenses of $500,000. Of these expenses, $100,000 are interest expenses and $50,000 are taxes. To calculate EBIT, we would subtract the interest and taxes from the total expenses, giving us:

EBIT = $500,000 – $100,000 – $50,000 = $350,000

This means that Company A’s earnings before interest and taxes are $350,000.

Now let’s look at Company B, which has total revenues of $2,000,000 and total expenses of $1,600,000. Of these expenses, $200,000 are interest expenses and $100,000 are taxes. To calculate EBIT for Company B, we would subtract the interest and taxes from the total expenses, giving us:

EBIT = $1,600,000 – $200,000 – $100,000 = $1,300,000

This means that Company B’s earnings before interest and taxes are $1,300,000.

EBIT margin

Another important metric to consider when analyzing EBIT is the EBIT margin. The EBIT margin measures a company’s EBIT as a percentage of its total revenues. This can be a useful metric for comparing the profitability of different companies, as it accounts for differences in revenue.

To calculate the EBIT margin, we would divide the EBIT by the total revenues and multiply by 100.

The formula would look as follows:

EBIT Margin = EBIT / Total Revenues x 100

Using the examples from earlier, we can calculate the EBIT margin for Company A and Company B:

Company A EBIT margin = ($350,000 / $1,000,000) x 100 = 35% Company B EBIT margin = ($1,300,000 / $2,000,000) x 100 = 65%

This means that Company B has a higher EBIT margin than Company A, indicating that it is more profitable relative to its revenue.

Limitations of EBIT

While EBIT can be a useful metric for assessing a company’s financial health, it has some limitations that should be considered. One limitation of EBIT is that it does not account for non-operating income and expenses, such as gains or losses from investments or one-time expenses. This can make it difficult to compare the profitability of companies that have different levels of non-operating income and expenses.

Another limitation of EBIT is that it does not account for differences in tax rates between companies. This can make it difficult to compare the profitability of companies that operate in different countries or regions with different tax rates. Taxes can vary depending on a company’s location, the industry it operates in, and other factors.

Company’s financing costs, such as interest on debt, are also not accounted for. This means that EBIT does not provide insight into a company’s ability to generate profits after accounting for the cost of borrowing money.

Moreover, EBIT neglects the cost of depreciation and amortization, which are important expenses for companies with significant fixed assets. Depreciation and amortization can be substantial expenses, especially in industries such as manufacturing and construction.

Finally, EBIT does not account for changes in working capital, such as changes in accounts receivable or inventory levels. Changes in working capital can significantly impact a company’s cash flow and financial performance.

How to improve EBIT

If you’re looking to improve your company’s EBIT, there are a few strategies you can consider.

Increase Revenue

One way to improve EBIT is to increase revenue. Companies can achieve this by expanding their customer base, introducing new products or services, or entering new markets. Increasing revenue can provide a boost to EBIT by increasing the amount of income generated from the company’s core business operations.

Reduce Operating Expenses

Another strategy to improve EBIT is to reduce operating expenses. Companies can achieve this by identifying areas where costs can be cut, such as reducing employee salaries or benefits, renegotiating supplier contracts, or outsourcing certain functions. By reducing operating expenses, a company can increase its EBIT by improving its operating efficiency and profitability.

Improve Pricing Strategies

Companies can improve their EBIT by implementing better pricing strategies. This can involve increasing prices for certain products or services or introducing dynamic pricing strategies that take into account customer demand and other market factors. Improving pricing strategies can help a company increase revenue and profitability.

Increase Operational Efficiency

Improving operational efficiency can also help a company improve its EBIT. This can involve streamlining processes, reducing waste, or investing in new technologies that increase productivity. By improving operational efficiency, a company can reduce operating expenses and increase profitability.

Manage Working Capital

Managing working capital effectively can also help a business improve its EBIT. This involves optimizing inventory levels, reducing accounts receivable, and improving accounts payable management. By managing working capital effectively, a company can improve cash flow and reduce costs, which can increase EBIT.

EBIT in financial analysis

EBIT is an important metric that is used in a variety of financial analyses, including valuation, investment analysis, and credit analysis. In valuation, EBIT is used to calculate the enterprise value of a company, which is a measure of the company’s total value. In investment analysis, EBIT is used to assess the potential return on investment for a company. In credit analysis, EBIT is used to assess a company’s ability to service its debt obligations.

Tips and tricks for successful EBIT analysis

Conducting a successful EBIT analysis requires careful attention to detail and a solid understanding of financial statements. Here are some tips and tricks to help you get started:

1. Use the right tools

To conduct an effective EBIT analysis, you’ll need access to the company’s financial statements, including its income statement and balance sheet. You may also want to use specialized software or tools to help you analyze the data more effectively. There are a number of tools available online that can help you calculate EBIT and other financial metrics, such as QuickBooks, Xero, and Wave.

2. Focus on trends

When analyzing a company’s EBIT, it’s important to look for trends over time. This can help you identify areas of the business that are improving or declining, which can inform your strategic decisions. For example, if a company’s EBIT has been declining steadily over the past few years, it may be a sign that the business is not performing well and that changes need to be made.

3. Compare to industry benchmarks

To get a more accurate picture of a company’s EBIT performance, it’s important to compare it to industry benchmarks. This can help you determine whether the company is performing above or below average for its industry, which can inform your strategic decisions. You can find industry benchmarks for EBIT and other financial metrics through industry associations, trade publications, or specialized financial analysis tools.

4. Consider the impact of changes

When conducting an EBIT analysis, it’s important to consider the impact of changes on the company’s financial performance. For example, if the company has recently undergone a major restructuring or implemented a new cost-cutting measure, this may have a significant impact on its EBIT. By considering the impact of changes, you can gain a more accurate picture of the company’s financial performance.

5. Look beyond EBIT

While EBIT is an important metric for measuring a company’s profitability, it’s not the only metric you should consider. Other metrics, such as net income and gross profit margin, can provide valuable insights into a company’s financial performance. By looking beyond EBIT, you can gain a more comprehensive understanding of the company’s financial health.

Conclusion

In conclusion, EBIT is a crucial metric for assessing a company’s financial health and potential for growth. By understanding the definition and calculation of EBIT, as well as its strengths and limitations, you can make informed decisions about the financial performance of your business.

Want to make sure you make the right decisions for your business? Unlock the power of smart data analytics with Synder Business Insights – a plug-n-play data analytics tool offering mutli-source KPI reports, including Gross Sales, COGS, Platform Fees, Top-Performing Products, etc. The tool connects all your channels in use and presents the data from them on a single dashboard – no need to juggle multiple apps or hire an analyst! You get a panoramic view of your sales, products and customers which enables you to spot trends and patterns and direct your strategies accordingly. Unlock the insights by signing up for our 15-day free trial, or feel free to book office hours with our specialist to ask questions.