One of the most essential steps when starting a business is setting up a business bank account. Not only does it make tracking business expenses and revenue more manageable, but it also adds legitimacy to your venture.

Many new business owners wonder if they can open a business bank account with an EIN only. This article provides a comprehensive look into this topic, ensuring you have all the necessary information.

Contents:

1. Can I open a business bank account with just my EIN number?

2. Why can’t you open a business bank account with just an EIN?

3. What is required to open a business bank account?

4. How to start: Steps for opening a business bank account

5. How long does it take to open a business bank account?

8. FAQs

Can I open a business bank account with just my EIN number?

No. Opening business bank accounts typically requires more than just an EIN (Employer Identification Number), even though the EIN is a critical component. You’ll probably need business formation documents and personal ID in addition to EIN.

The EIN just verifies the business’s identity and its legitimacy to operate.

Why can’t you open a business bank account with just an EIN?

Opening a business bank account with just an EIN is often not possible due to a combination of regulatory requirements, bank policies, and risk management considerations. Here are several reasons why banks typically require more than just an EIN to open a business bank account:

1. Verification of business identity and legitimacy

While the EIN confirms the business’s tax identity, banks need to ensure that the business is legitimate and operating within legal bounds. Additional documents like business licenses, Articles of Incorporation, or Articles of Organization can help validate the business’s existence and its lawful operation.

2. Know your customer (KYC) regulations

Banks are subject to KYC regulations, which require them to identify and verify the identity of the individuals behind business entities. These regulations aim to prevent financial crimes such as money laundering or fraud. Providing personal identification of the business owners or key stakeholders, in addition to the EIN, helps banks comply with these regulations.

3. Risk management

Banks need to assess the potential risks associated with a new business account. Understanding the nature of the business, its expected transaction volume, and its ownership structure helps banks determine the risk level and ensure they are not unknowingly facilitating illegal activities.

4. Protection against fraud

By requiring multiple documents, banks create a more robust barrier against fraudulent activities. If opening an account was as simple as obtaining an EIN, it could become a potential loophole for fraudsters to exploit.

5. Proof of business operation in a jurisdiction

Banks often want to confirm that the business is authorized to operate in a specific state or locality. This can be demonstrated with business licenses, permits, or other local registration documents.

What is required to open a business bank account?

Here’s what you usually need in addition to an EIN to open a business bank account:

1. Personal identification

Banks will want to know who is behind the business, even if you’re using an EIN for the business. They typically require personal identification, such as a driver’s license or passport of the business owners or primary operators.

2. Business documentation and license

Depending on your business structure, this could include:

- Articles of incorporation;

- Partnership agreements;

- LLC operating agreements;

- Fictitious name certificates or DBA (Doing Business As) documentation.

Some banks may ask for proof that you’re authorized to conduct business in your state or locality, which can be shown with a business license or permit.

3. Physical address

A physical address of a business (not a P.O. Box) is often required. This could be a storefront, office space, or even a home address for some small businesses.

4. Initial deposit

Many banks require an initial deposit to open business bank accounts. The required amount can vary widely between banks.

How to start: Steps for opening a business bank account

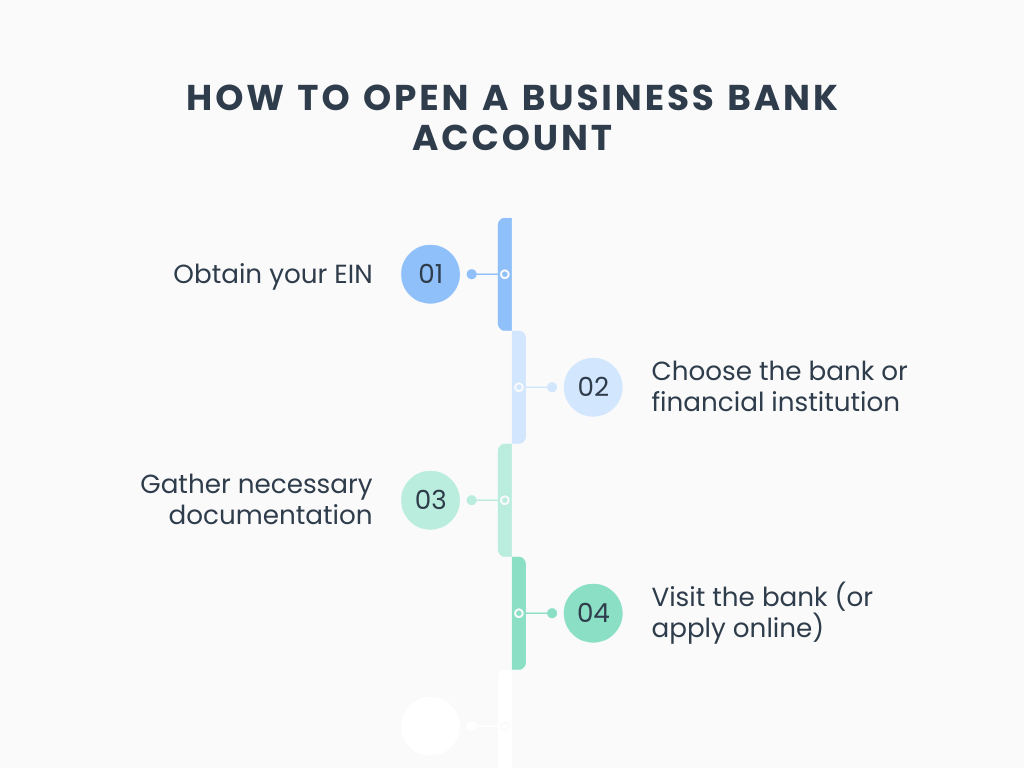

Step 1. Obtain your employer identification number

Before approaching a bank, ensure you have an EIN if your business structure requires one.

The EIN, provided by the IRS, is used for tax purposes and is often necessary for businesses with employees or those structured as corporations or partnerships. Sole proprietors may use their Social Security Number (SSN) but can also obtain an EIN if they prefer.

How to obtain EIN? Is it free?

Businesses can apply for an EIN online through the IRS’s website. The process is free, and, in most cases, the number is provided instantly upon completion of the application.

Step 2. Choose the right bank or financial institution

When selecting a bank for your business account, consider the following:

- Fees and service charges;

- Transaction limits;

- Interest rates (for savings accounts);

- Online banking services;

- Proximity to physical branches;

- Customer service reputation.

Step 3. Gather necessary documentation

When opening your bank account, ensure all the necessary documents are on hand. The exact documents required can vary, but they typically include:

- Your EIN and Social Security Number (for sole proprietors);

- Government-issued photo ID;

- Business license;

- Business legal name

- DBA name;

- Articles of Incorporation (for corporations) or Articles of Organization (for LLCs);

- Partnership agreement (if applicable);

- Organizational resolutions (if there are multiple owners).

Step 4. Visit the bank (or apply online)

While many banks prefer to open accounts in person, some offer the option to open small business accounts online.

To open your business bank account, provide the requested information about your business and its stakeholders.

Note: Be aware of potential fees, such as monthly fees, transaction fees, minimum balance fees, etc. Some banks may waive fees with a specific minimum balance.

Learn how to register your business in the USA.

How long does it take to open a business bank account?

The time it takes to open a business bank account in the US can vary depending on several factors, including the bank’s procedures, the completeness of your documentation, and the type of business you’re operating.

- Fast-track options: Some banks and fintech companies offer fast-track options for small businesses and startups, potentially opening accounts in as little as 1-2 business days, assuming all documentation is in order and no issues arise.

- Typical range: For most traditional banks, a safe estimate is anywhere from a few days to a few weeks after you’ve submitted all necessary documentation.

- Complex cases: For businesses with complex structures, such as international operations, or for those requiring specialized banking services, the process can take several weeks to a few months.

Why do you need an EIN?

1. Legal requirement

Using an EIN to open a business bank account helps maintain the legal distinction between the business owner and the business entity. This separation is crucial in protecting personal assets from business liabilities. In the eyes of the law, the business operates as its own entity, reducing personal risk in case of legal disputes or bankruptcy.

2. Tax reporting and compliance

An EIN simplifies the process of preparing and filing taxes by ensuring all business income and expenses are reported under the same identifier. This clear separation aids in more accurate tax reporting and can help in maximizing tax deductions specific to business operations.

Proper use of an EIN in financial transactions helps ensure that the business complies with tax laws, potentially avoiding penalties associated with improper filing or underpayment of taxes.

3. Enhanced credibility

Suppliers and vendors often prefer or require dealing with businesses that have an EIN, as it signifies a formal and serious approach to business operations. This can also be beneficial in negotiating payment terms and pricing.

An EIN is typically required to apply for business loans and lines of credit. Lenders use it to check the business’s credit history and assess its creditworthiness. A solid credit history linked to an EIN can improve financing terms, like lower interest rates or higher credit limits.

4. Financial transactions and operations

As your business grows, having an EIN allows for smoother expansion activities, such as opening new locations, diversifying services, or increasing the product range. It supports the scalability of business operations through financial institutions.

In the event of an IRS audit, having a business bank account tied to an EIN makes it easier to organize and present financial records. This organization can expedite the audit process and reduce the likelihood of discrepancies.

Bonus points to consider

- Beyond federal tax purposes, some states require businesses to have an EIN for state tax filings or to comply with state employment laws.

- For non-U.S. entities wishing to conduct personal business in the United States or open a U.S.-based business account, an EIN is crucial for establishing a U.S. presence and fulfilling tax obligations.

Types of bank accounts

There are several types of business bank accounts, each tailored to meet specific business financing needs. Here are the main variants:

1. Business checking account. This is the most commonly used account for handling day-to-day transactions such as deposits, withdrawals, and transfers. A business checking account is ideal for paying bills, managing payroll, and receiving payments from clients (invoice or other payment option).

A business checking account usually comes with a debit card and the ability to set up online banking. A business checking account might have transaction limits or fees, depending on the volume of activity.

- Account is best for: All businesses, from sole proprietorships to large corporations, for routine financial operations.

2. Business savings account. Used for setting aside a portion of business earnings to earn interest over time. It’s beneficial for creating an emergency fund or saving for future expenses.

These accounts typically offer higher interest rates than checking accounts but might have restrictions on the number of withdrawals or transfers you can make each month.

- Account is best for: Businesses looking to earn interest on surplus funds while keeping them accessible.

3. Merchant services account (merchant account). Essential for businesses that accept credit and debit card transactions. It allows a business to process customer card payments.

It is an intermediary between the business, the customer’s bank, and the credit card networks. Fees for merchant services vary based on transaction volumes and the account terms.

- Account is best for: Retail businesses and ecommerce websites that need to process card payments.

4. Business certificate of deposit (CD). A fixed-term savings account that holds a specified amount of money for a fixed period of time, usually offering higher interest rates than regular savings accounts.

At the end of the term, the business receives the money back plus interest. Early withdrawal might result in penalties.

- Account is best for: Businesses with excess cash reserves looking for a higher interest rate and can commit funds for a set period.

5. Business money market account. This account combines the features of both savings and checking accounts, offering the ability to write checks or use a debit card while also earning interest on the account balance.

These accounts typically offer higher interest rates than traditional savings accounts and more flexibility than CDs. However, they may require higher minimum balances and may restrict transactions.

- Account is best for: Businesses wanting to earn a higher interest rate while retaining some liquidity.

Learn how to manage multiple bank accounts.

Conclusion: Is an employer identification number the only thing you need?

So, is it possible to open a business bank account with EIN only? While the EIN is a foundational identifier for small business, especially concerning taxation, it is only a piece of the puzzle when opening a business bank account. The comprehensive process is in place to protect both the bank and the business, ensuring that the financial system remains secure, transparent, and compliant with legal regulations. If you’re looking to open a business bank account, it’s essential to prepare and gather all necessary business documents to ensure a smooth and successful process.

Disclaimer: Requirements between banks, credit unions, and other financial institutions can vary. Online banks or financial technology companies offering business banking services might have slightly different or streamlined requirements. Check directly with the institution you’re interested in to get a detailed list of requirements.

FAQs

What is an EIN?

An Employer Identification Number (EIN), sometimes referred to as a Tax Identification Number (TIN) or Federal Employer Identification Number (FEIN), is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to businesses operating in the United States. It’s used for tax reporting and other business-related purposes.

Once it has been assigned, it will not be reused or reassigned by the IRS. Even if the business closes or goes bankrupt, the EIN will not be reused.

Note: a Business Tax ID and an employer identification number refer to the same unique identifier issued by the IRS in the US for business entities. The terms are often used interchangeably, but they serve similar purposes in identifying a business for tax and administrative purposes.

Who needs an employer identification number?

Most businesses need an EIN. This includes corporations, partnerships, and limited liability companies (LLCs). Even sole proprietorships might need an EIN if they have employees or if they meet other criteria.

Business credit: Can I open business bank accounts with bad credit?

Yes, you can open a small business bank account with bad credit, but the process might be more challenging than it would be otherwise. Banks and financial institutions often run a ChexSystem report. They perform credit checks on small business owners or principals when evaluating applications for business accounts, especially if the account has overdraft facilities or lines of credit. However, a bad personal credit score doesn’t necessarily block your path to opening a business bank account.

Can you open a business account without a Social Security number?

Yes, you can open a small business bank account without a Social Security Number (SSN). Still, you will need to provide an alternative form of identification and documentation to verify the identity and the legitimacy of the business.

An EIN is the most common alternative to a Social Security Number for opening a business account for an LLC, partnership, or corporation. However, sole proprietors typically need to provide their Social Security number.

Why do you need an EIN to open a business bank account?

An EIN is often required to open a business account for several reasons. Banks and financial institutions commonly require an EIN:

- To distinguish between personal and business finances;

- For tax reporting purposes;

- To comply with IRS regulations;

- To build business credit;

- For business licenses and permits.

What is a business checking account?

A business checking account is a type of bank account specifically designed for businesses, corporations, partnerships, and sole proprietors to manage their day-to-day financial transactions. Unlike personal checking accounts, which are tailored for individual use, business checking accounts are equipped with features and services that cater to the needs of a business operation.

.png)