Over 33,020,000 is a mind-blowing number of small and large businesses operating in the USA in 2023 according to the U.S. Small Business Administration. This is the number of people who venture in the world of business in the US alone.

Starting a business can be one of the major decisions in a person’s life, which is a bit overwhelming at the beginning. It involves a lot of planning, making key financial decisions, completing some legal activities, let alone creativity to come up with an idea and resolve to continue with it.

Despite all the negative points like uncertainty, financial risks, long hours of hard work, there are some obvious benefits when you start your own business. You can make your dreams come true, be your own boss, get a great opportunity for personal growth and, if you don’t bail out easily, become successful and earn a fortune. So starting a business can be both hard and rewarding.

It’s obvious that before registering a business you must pay attention to lots of things: research, a solid business plan, funding, working with a business mentor or joining a business incubator. There are many ways and opportunities available today, but we aren’t going to get into those details. The focus of this article is registering a business in the USA.

Contents:

1. To register or not to register your business in the USA?

2. Choose your business structure

3. Pick the location for your business

4. Come up with the name for your business and register it

To register or not to register your business in the USA?

To start with, it has to be mentioned that registering a business in the USA isn’t obligatory. According to the U.S. Small Business Administration guide, if you conduct business using your legal name, you don’t need to register anywhere. The point here is that registering your business guarantees personal liability protection, legal benefits, and tax benefits, which are the things not to miss.

The process of company registration for many small businesses is as simple as getting your business name registered with the state and local government, which we’ll get to a bit later. On the whole, there are three things you should settle when you start a company as they determine how the registration process goes:

- Choose your business structure;

- Pick the location for your business;

- Come up with the name for your business and register it.

Choose your business structure

Choosing the right business organization structure should provide you with a balance of legal protection and benefits, as this choice determines your taxes, daily business operations and maybe the most important – your personal liability or how much of your personal assets are at risk.

Having said that business structure choice is crucial, it’s reasonable to mention that there’s a possibility of conversion to a different business structure in the future, but you have to be aware of certain limitations and tax implications based on your business location. Getting a professional consultation of business counselors, lawyers and attorneys for that matter wouldn’t be excessive.

Let’s look at the most common options of business structures.

Sole proprietorship

It’s the simplest business structure that doesn’t make a separate business entity, as your business assets and liabilities merge with your personal ones. In other words, a sole proprietor is personally liable for their business debts and obligations. While sole proprietors can get a trademark, it might be harder to raise money as banks aren’t really inclined to lend to sole proprietors. Sole proprietorship is considered to be a low-risk business structure, fit for testing a business idea. Unless you register a different business structure, you’re automatically considered to be a sole proprietor. The business profits are recorded on your income tax return in compliance with the regulations. The IRS gives a detailed outline on the papers you might be required to file when you register a company in the USA.

Partnership

Partnerships are owned by two or more people who share profits and losses. Based on the extent of control and liability share, two common kinds of partnerships are a limited partnership (LP) and a limited liability partnership (LLP).

While limited partnerships have one general partner with unlimited liability and control over the company and other partners with limited liability and focus on investment, limited liability partnerships join all partners with limited liabilities, which doesn’t make one partner responsible for the actions of another. Partnerships pass profits through to their personal tax returns, and, in case of LP, the general partner pays self-employment taxes (more detailed information on the taxes for partnerships is provided by the IRS). Partnerships are a good fit for professional groups like accountants or attorneys who want to test waters before starting a more formal business type.

Corporation

Corporation is a separate legal entity owned by shareholders. The owners of a corporation are protected by limited liability and the profits of a corporation are taxed separately from the personal income of the owners. Corporations require more extensive record-keeping, operational processes, and reporting. One significant advantage of corporations is that they can raise money by selling stock. Corporations are a good choice for medium- or higher-risk businesses, with the need to raise money, and businesses that plan to “go public” or eventually be sold.

There are several types of corporations:

- C corp

One of the features that is attributed to C corporations is double taxation. As corporations are separate legal entities, they pay taxes on their annual income, unlike sole proprietors, partnerships, and limited liability companies. Then shareholders who get dividend payments are liable to income tax as well, which makes it double. C corporations are totally independent from their shareholders. In case of a shareholder leaving the company or selling the shares, C corps go on without huge disturbances.

- S corp

S corporations is the type of corporation that helps avoid double taxation as their corporate income, losses, deductions, and credits are passed through to their shareholders who report the income and losses on their personal tax returns and have their individual income tax rates. According to the IRS, corporations that qualify for S corporation status must:

- Be a domestic corporation

- Have only allowable shareholders (individuals, certain trusts, and estates, not partnerships, corporations or non-resident alien shareholders)

- Have no more than 100 shareholders

- Have only one class of stock

- Not be an ineligible corporation (i.e. certain financial institutions, insurance companies, and domestic international sales corporations)

Taxation and recognition of S corps vary depending on the state: some states tax S corps on profits above a specified limit while other states don’t recognize the S corps at all and treat them as a C corp.

- B corp

B corp or a benefit corporation is a for-profit corporation recognized by a majority of U.S. states. The distinguishing feature of B corps is that there’s a mission or public benefit in addition to gaining a profit. B corps are taxed in the same way as C corps, adding annual benefit reports required by some states to prove their contribution to the public benefit.

- Nonprofit corporation

A nonprofit corporation or 501(c)(3) corporation (a reference to the tax-exempt status) is a legal structure focused on charity, education, religious, literary, or scientific work. Working for the public benefit, nonprofits can receive tax-exempt status, but they have to file with the IRS to get tax exemption. There are limitations on what can be done with any earned profits, for example, profits can’t be distributed to members or political campaigns. In all other ways they follow the practices of C corps.

Limited liability company (LLC)

A limited liability company allows getting the benefits of the corporation and partnership business structures. Thus, LLCs provide protection of personal assets if your LLC faces bankruptcy or lawsuits and helps avoid corporate taxes as profits and losses are passed through to your personal income. However, LLC members are considered self-employed, which makes them liable for self-employment tax contributions towards Medicare and Social Security.

LLC life is closely connected with its members, so joining or leaving the company may require the LLC dissolution and re-opening with new membership, according to the regulations in some states.

LLCs are normally chosen by owners with considerable personal assets for medium- or higher-risk businesses, and owners who want to avoid paying higher corporation taxes.

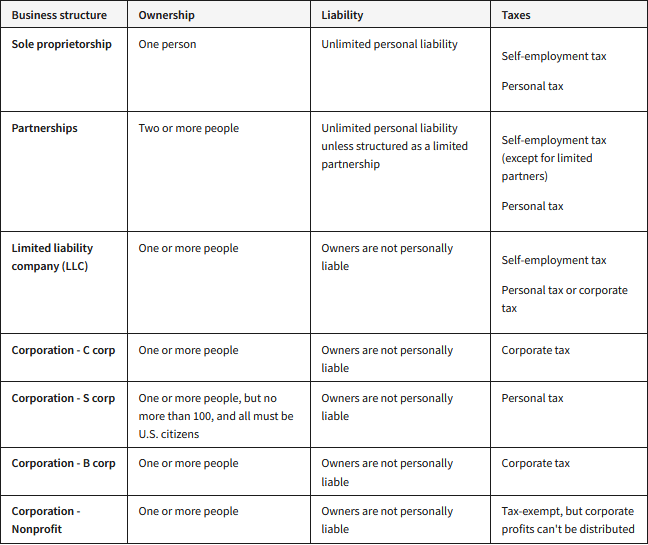

Here’s the table, provided by the US Small Business Administration to make a visual overview of different business structures.

Pick the location for your business

A business location is the factor that shouldn’t be underestimated as it determines taxation, laws and regulations your business will have to abide by, the process of registration and getting permits and licenses.

When you start your company in the United States, while choosing the place for your business, it’s wise to consider the following:

- Specific regional expenses like rent, utilities, standard salaries, minimum wage laws

- Local zoning requirements (some areas will restrict or ban some businesses from operating)

- Tax landscape (some states are more tax friendly, which attracts businesses)

- State and local governments incentives – special tax credits, business loans, etc. (you can check SBA Offices, Small Business Development Centers, Women’s Business Centers)

- Federal government incentives (like Historically Underutilized Business Zones (HUBZone) program)

Come up with the name for your business and register it

It might seem that giving your business a name is no big deal, but it’s the name the customers see first, get attracted by before even trying the product or service. It reflects your brand and makes you stand out from the crowd of competitors.

Once you’re done with the creative part, you need to think about protecting your name, which may be done by registering it. Let’s briefly look at the four ways to register your name and the purposes they serve, according to the U.S. Small Business Administration:

- Entity name (protects you at a state level)

- Trademark (protects you at a federal level)

- Doing business as (DBA) (gives no legal protection, but might be legally required)

- Domain name (protects your business website address)

Each of these four types are legally independent. You may use the same name for all 4 types of registrations, but there are no such requirements.

Entity name

The most important thing about your entity name is that it prevents anyone else in the state from doing business under this name (with some exceptions), as the entity name is how the state identifies your business. Depending on your business structure and location, registering an entity name may be obligatory and the rules about what this name can be may differ. Some states may require your entity name to reflect the business behind it. Although, in most cases states don’t allow you to register a business under the name that is already registered, you don’t really get an exclusive right to it if it’s an English word. Your name must be available for registration, but sometimes you can use the same name if you operate in a different business sphere or state, which often happens with small local businesses. This information should be checked with the state you’re planning to register in, to avoid violating trademark laws.

Trademark

A trademark guarantees that other businesses in the same (or similar) industry in the United States won’t use your trademark name. Checking the availability of a trademark name is a must as trademark infringement lawsuits may be quite costly. There are some sources that can help you do it:

Doing business as (DBA) name

Then there’s a DBA name, often called a fictitious name, assumed name or trade name. As it was mentioned, it doesn’t give any legal protection, but is required to be registered by most states. A DBA allows you to run your business under a different identity from your own personal name or your formal business entity name. The plus point is that a DBA and EIN are the prerequisites for opening a business bank account. It has to be noted that multiple businesses can go by the same DBA in one state, which means less restrictions in comparison to a trademark name.

Domain name

A domain name, URL or simply your website address is a protection in the digital world, as no company can use the same domain name if you’re still using it. Choosing the right domain name is crucial as it represents your online identity and can impact your brand’s visibility and searchability. Your domain name can differ from all your other names or be the same if it’s possible. It’s registered with registrar services and should be renewed on a regular basis.

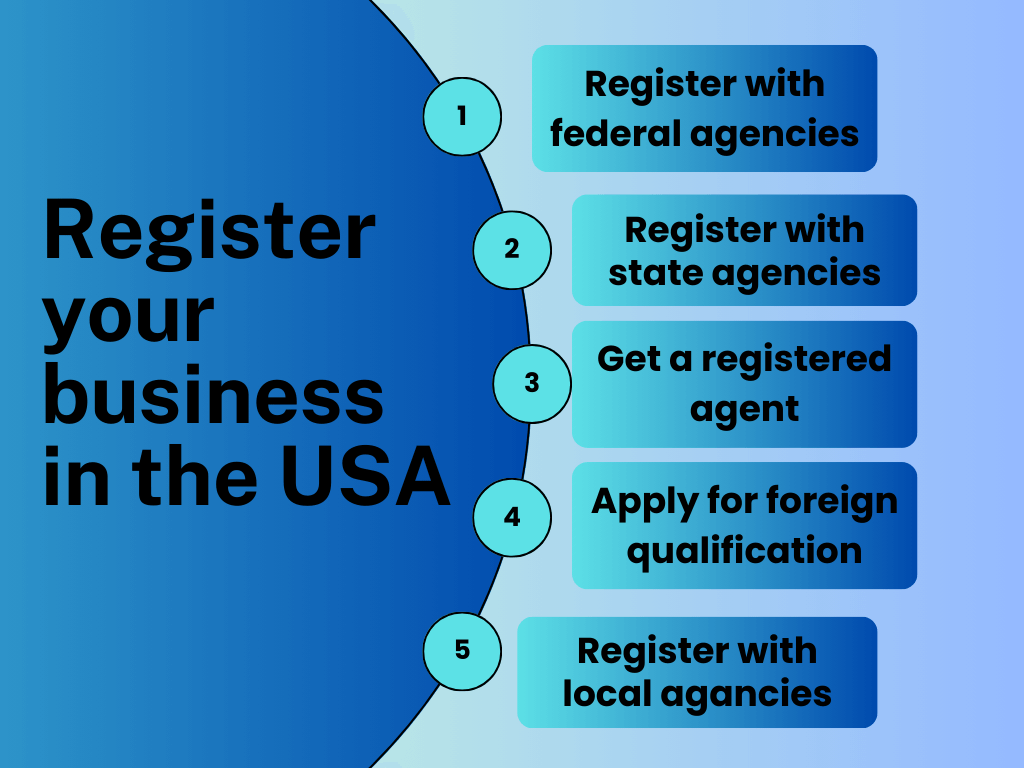

Register your business

Once you’re all set with the structure, name and location for your business, the registration process becomes predictable. As it was mentioned above, sometimes registering a business name with the state and local governments is already enough, which is true for most small businesses in the USA.

Register your business with federal agencies

When you apply for your federal tax ID, trademark protection or tax exempt status, it’s considered to be the process of legal entity registration with federal agencies in most cases.

In case of an S corp registration, you’ll need form 2553 with the IRS.

Register your business with state agencies

Choosing LLC, partnership, corporation, or nonprofit corporation means that you’ll need to register with any state agency of your business location. The criteria for defining such a state are the following:

- Physical presence;

- In-person meetings with clients;

- A big part of your company’s revenue coming from the state;

- Your employees working in the state.

The most typical state agencies you register with are: the Secretary of State’s office, a Business Bureau, or a Business Agency. The next step is filing state documents and fees, which vary depending on the state, but your business name, location, ownership, management structure, registered agent, number and value of shares (for corporations) is the most typical set.

Get a registered agent

Provided your business structure is an LLC, corporation, partnership, or nonprofit corporation, you’re required to get a registered agent in your state before you file. A registered agent must be located in the state to be able to receive official papers and legal documents on behalf of your company.

Apply for foreign qualification

If your business (LLC, corporation, partnership, or nonprofit corporation) operates in more than one state, you might be required to file for foreign qualification in all states that aren’t your domestic state (the one you registered with), which typically leads to paying taxes and annual report fees in all the states your business operates. To get a foreign qualification, you’ll need to file a Certificate of Authority with the state and sometimes a Certificate of Good Standing from your domestic state.

Register your business with local agencies

If your business is an LLC, corporation, partnership, or nonprofit corporation, you might need to file for licenses and permits from the county or city if it’s required by the local government.

Overview:

The process of registering a business in the USA can become a straightforward one if you choose the best structure, location and name for your business and check the necessary information with the local, state and federal authorities to find out about the peculiarities of business registration in your particular case.

.png)