Diving into business is first of all about figuring out the actual expenses tied to what you’re selling. From the bits and pieces that make up your product to the work it takes to put everything together. Think of it as the lottery ticket to understanding your products’ price tag.

Proper dealing with COGS and sales management means being smart with your pricing and staying on top of how much you spend to make what you sell. And yeah, it can get really complex with sales happening left, right, and center across different channels.

So, let’s make sense of it all and see how you can keep things smooth and steady.

Contents:

1. The challenge: Managing sales and COGS as a business owner

2. The solution: Accounting automation with Synder

3. COGS tracking example using Synder Sync

4. Other ways of managing cost of goods sold

5. FAQs

Key takeaways

- COGS directly affects a business’s gross profit and net income.

- An automated solution like Synder Sync can streamline the tracking process by automatically recording sales and COGS data.

- While there are different approaches to simplifying the whole tracking process, implementing the right automated software system remains the best option for a business.

The challenge: Managing sales and COGS as a business owner

Keeping tabs on sales and COGS is a bit of a balancing act, and things can get complicated fast. At the heart of the challenge is the tricky task of matching up the expenses and revenues around every sale. You’ve got to pinpoint exactly what it costs to get that product into your customer’s hands, which is key to figuring out your profit margin.

With sales popping up across different channels and interactions with customers spreading out in all directions, you need a solid system to catch all that information and make sense of it.

So, let’s be real. Mix-ups and mismatches can turn this into a bit of a headache, especially when it comes to manual account reconciliations. Without a smooth and connected approach, making those big decisions, forecasting the future, and staying ahead in the game can be complicated. Yet, the right strategy and approach can transform it into a powerful tool.

While proper sales management is generally a fundamental skill for a business owner, let’s discuss COGS in more detail.

Why is COGS important?

Tracking COGS directly affects the gross profit and net income of a business. Understanding COGS that’s also known as “cost of sales”:

- Helps determine the actual profit margins on products sold;

- Aids in setting competitive yet profitable pricing;

- Highlights areas where costs can be reduced;

- Influences decisions on stock levels and order quantities;

- Is necessary for accurate tax filings and deductions.

Why is it problematic for ecommerce?

1. Inventory management complexity

Imagine dealing with different products, each bought at different prices, which can change if you buy more or if your supplier decides to charge differently. Managing and updating these costs accurately in real time can be complex. Especially for businesses that lack inventory management systems.

2. Shipping and handling costs

Ecommerce involves significant shipping and handling costs, which can vary widely depending on the destination, weight, and size of the package, and the speed of delivery. Figuring out how to include these varying costs in your product prices without overcharging or losing money is a bit of a puzzle.

3. Dropshipping and third-party fulfillment

Many ecommerce businesses use dropshipping or third-party fulfillment services, where the business doesn’t directly handle the product. In such cases, you have to rely on someone else to tell you what was sold and for how much, which can lead to mistakes in your numbers.

→ Learn about Shopify dropshipping in 2024.

4. Multi-channel sales

Let’s imagine you sell on multiple platforms, such as Shopify, Amazon, and eBay. Each platform has its own rules and costs. This is already complicated, and figuring out how much you’re really making is no simpler.

5. Accounting practices

It’s important to match what you earn with what you spend in the same time period, like making sure you pay your monthly bills with your monthly paycheck. However, for ecommerce businesses, especially those with high transaction volumes, ensuring everything lines up can be challenging without robust accounting software and processes.

So what does it mean?

Given these challenges, ecommerce business owners often need to invest in advanced inventory management systems, integrate their ecommerce platforms with their accounting software, and possibly seek professional accounting advice to manage cost of goods sold effectively.

But can it somehow be simpler?

Better. Most processes can be automated within one system.

The solution: Accounting automation with Synder

Imagine having a trusty sidekick that automates the entire process, from the moment a sale pops up across any of your channels to the minute the costs of getting that product to the customer are tallied up. That’s what Synder Sync is about. The software’s smart integrations work quietly in the background, syncing every transaction, expense, and revenue stream in real time.

No more manual data entry or sweating over spreadsheets at 2 a.m., trying to match expenses with sales. Synder is all about giving you accurate, up-to-the-minute insights into your profit margins, and financial health.

It’s like having a financial dashboard that tracks every cent and provides you with the most necessary information about your accounts.

Synder Sync for managing your sales

Synder Sync is a game-changer for business owners looking to streamline their sales management process. It’s a comprehensive tool that automates syncing sales data across various platforms into one centralized accounting system.

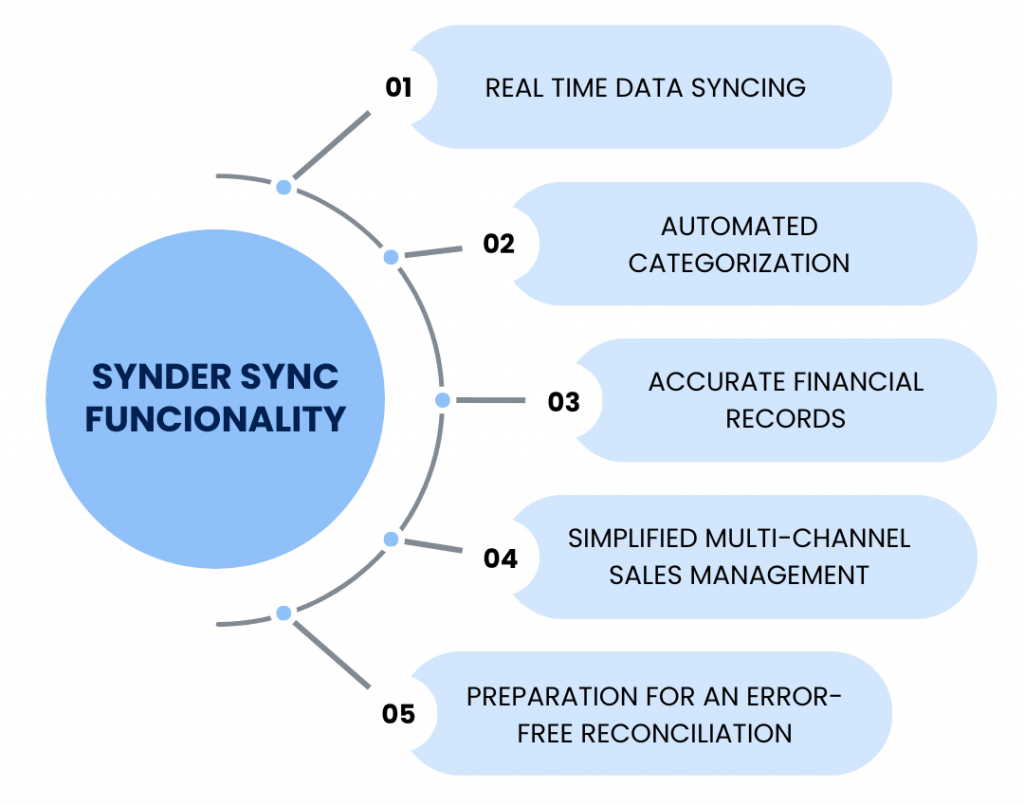

Overall, the functionality of Synder Sync includes:

1. Real time data syncing

Synder automatically syncs your financial data (sales, fees, refunds, etc.) with all the details from different channels right into your accounting software as soon as a sale or transaction happens. By providing a real time view of your sales and expenses, the software allows for better cash flow management.

2. Automated categorization

The software recognizes that businesses have unique needs and offers customizable settings to match your specific accounting practices. Whether it’s setting up custom rules for how different types of transactions are recorded or choosing how and when the data syncs, Synder gives you control over your data.

→ Learn how Synder simplifies tracking taxes and sales by countries and states.

3. Accurate financial records

With automation, the risk of human error is significantly reduced. Synder Sync ensures that every transaction is recorded accurately, providing a reliable foundation for your financial reporting, analysis, and forecasting. The software also flags discrepancies or potential errors in your sales data, so you can address issues before they escalate, ensuring your financial records are accurate and reliable.

4. Simplified multi-channel sales management

Beyond basic sales platforms, Synder Sync integrates with a wide array of payment processors, ecommerce platforms, and accounting software. This means that whether you’re using PayPal, Shopify, QuickBooks, or any combination of popular tools, Synder seamlessly pulls data from these sources, ensuring that every transaction, no matter how small, is accounted for.

5. Preparation for an error-free reconciliation

Synder accurately matches transactions recorded in your accounting software with corresponding bank deposits and expenses, ensuring that every dollar in and out is recorded. This automation minimizes the risk of discrepancies in your financial records and significantly reduces the amount of time spent on bookkeeping tasks.

Book a seat on Synder’s Weekly Public Demo to learn more about the software’s functionality and get answers to all of your questions.

Synder Sync for COGS

Synder’s workflow with COGS is pretty straightforward:

If you have a product catalog with the absolutely same names or SKUs across all your platforms (ecommerce channels, payment platforms, and accounting systems), Synder will recognize products during synchronization and match them automatically.

Case #1: If the product names are the same across all platforms

As soon as the transactions containing the products are synced, Synder will automatically start recording item names or SKUs. No duplicated products will be created.

- For the existing products: The software will update the quantity on hand and the cost of goods sold (COGS) account.

- For the new products: Synder will automatically create the new product and put it in the default account you specified in Synder settings.

Synder will categorize the income associated with each product in your books using the income account linked to that product.

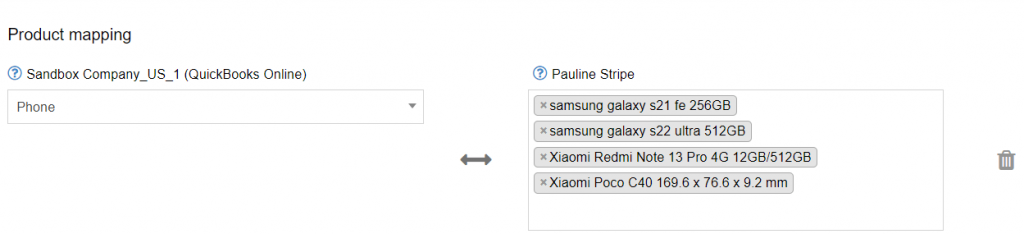

Case #2: If the product names are different across all platforms

With Synder, the correct recording is possible even in cases when your products have different names in your sales channel and accounting system. All you need to do is to set up a product mapping inside Synder to let the system know which products are a match and should be tracked as one.

How to use the product mapping feature to track inventory and COGS:

In this case, make sure the products from your accounting company are mapped to the ones from your payment platform and sales channels. This way, Synder will know which products to update in your books.

To categorize the income associated with the product, Synder will use an income account linked to the product you have in your accounting system.

→ Check Synder’s COGS tracking guide to learn more about different cases.

COGS tracking example using Synder Sync

Let’s take a business specializing in electronic goods as an example. They sell smartphones across multiple online platforms, with Stripe as their primary payment gateway and QuickBooks Online as their accounting system.

- Business sphere: Selling electronic products.

- Payment platform: Stripe.

- Accounting system: QuickBooks Online.

Goal: To ensure that the recently sold Xiaomi phone will be properly recognized in QuickBooks after the sync, and the inventory amount will decrease.

→ Learn how to make the most from Stripe QuickBooks Online integration via Synder.

Implementing the solution with Synder

First of all, the business should ensure that its product catalog has consistently named entries across their platforms.

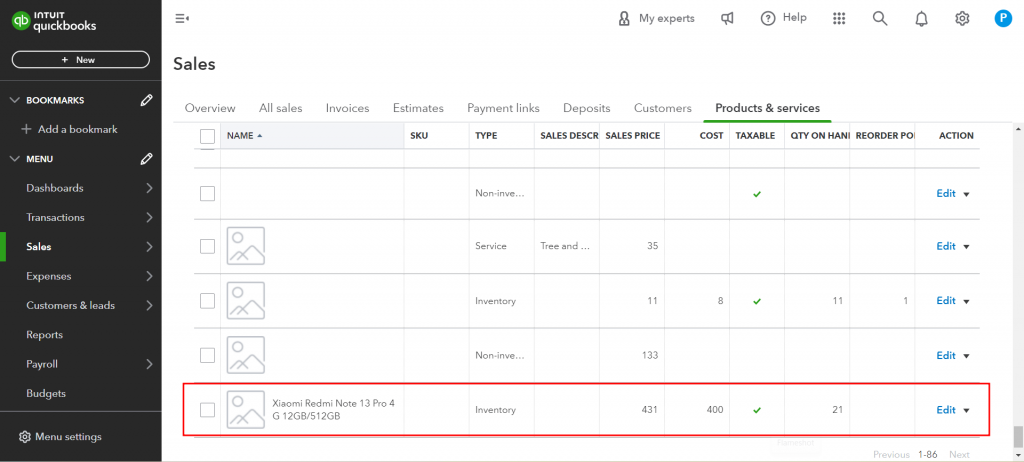

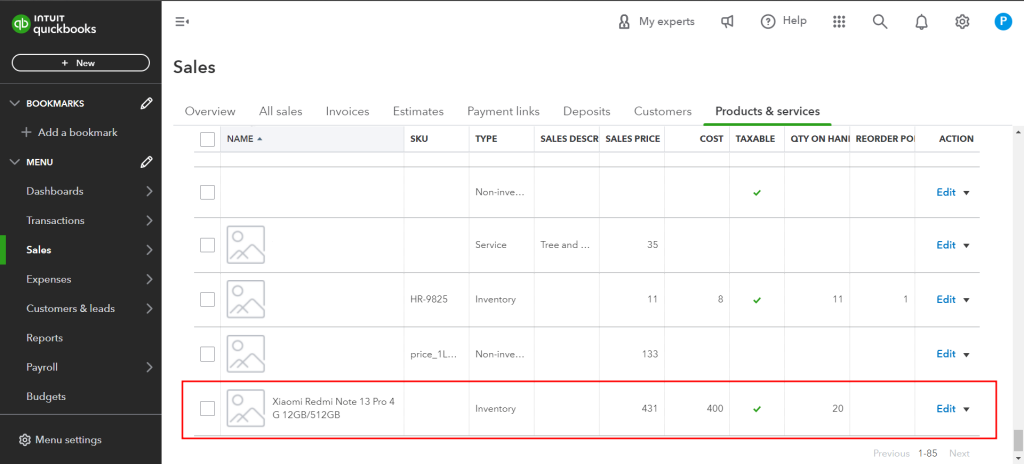

Here, we can see that the product “Xiaomi Redmi Note 13 Pro 4 G 12GB/512GB” already exists in the QuickBooks Online account. The quantity on hand right now is set to 21.

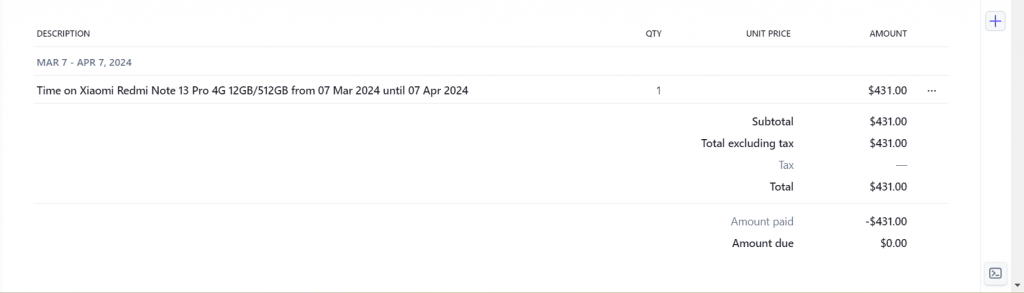

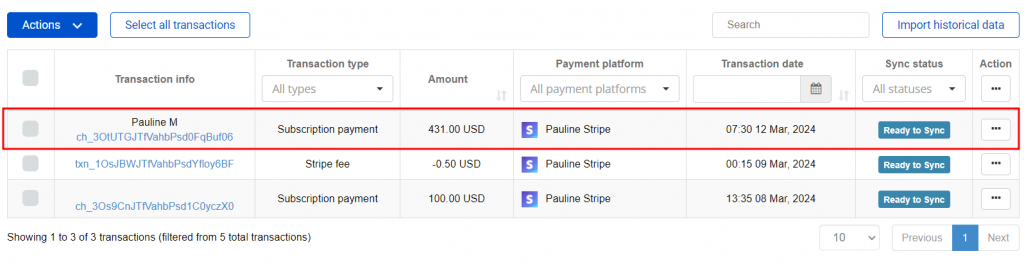

After that, a customer purchases the phone in question on the business’s online store. The payment is processed through Stripe.

As we can see, the product name is identical to the name in QuickBooks.

Once the Stripe transaction is completed, Synder gets to work.

Synder detects “Xiaomi Redmi Note 13 Pro 4 G 12GB/512GB” as an existing item in QuickBooks Online and automatically deducts one unit from the inventory, keeping the stock levels accurate.

The quantity on hand decreases from 21 to 20.

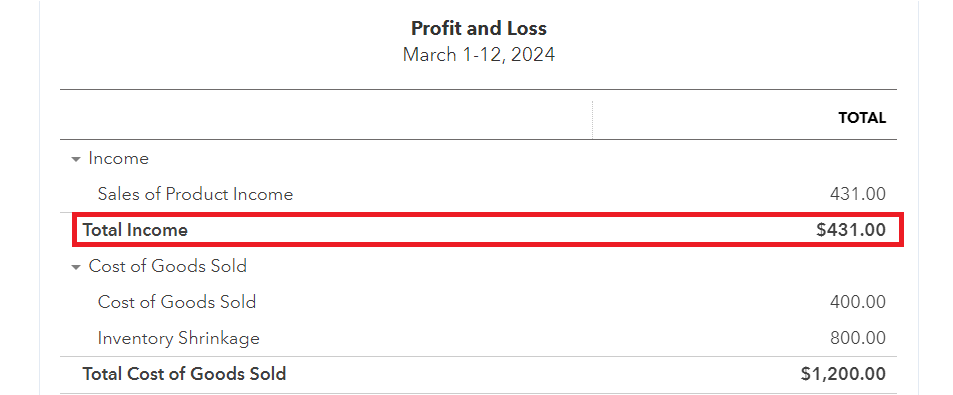

Simultaneously, Synder updates the cost of goods sold (COGS) account for the product in QuickBooks Online. It calculates the cost of the sold unit, accurately reflecting this expense in business financial records.

Synder also categorizes sales revenue. Since “Xiaomi Redmi Note 13 Pro 4 G 12GB/512GB” is linked to a specific income account in QuickBooks Online, Synder automatically allocates the sale revenue to the correct account. This automation ensures that the business financial reports accurately represent your income sources without manual intervention.

Results

- The QuickBooks Online account now accurately reflects the sale of one “Xiaomi Redmi Note 13 Pro 4 G 12GB/512GB” with the inventory levels adjusted, the cost of goods sold accounted for, and the sale income properly categorized.

- There’s no need for manual entry or adjustment since Synder has matched the product and updated the necessary accounts based on the predefined settings in your Synder configuration.

Create a free account to test how Synder can revolutionize your online business’ COGS tracking. No credit card needed.

Other ways of managing cost of goods sold

1. Maintain accurate inventory records

This involves detailed documentation of every inventory movement — be it incoming shipments, sales, returns, or adjustments for damages and losses. Utilizing barcoding or RFID systems can enhance the accuracy, allowing for real time updates and minimizing human error. Additionally, categorizing inventory by type, location, and condition can provide deeper insights into inventory levels and facilitate more accurate financial forecasting and reporting.

2. Use consistent inventory valuation methods

Selecting an inventory valuation method is a strategic decision that impacts your financial health. Whether you opt for FIFO, LIFO, or Average Cost, the chosen method affects how you assess your inventory’s cost under varying market conditions. For instance, FIFO can result in a lower cost of goods sold (COGS) during inflation, improving your reported profitability. Selecting a method that reflects your operational reality and applying it consistently is essential, ensuring compliance with accounting standards.

3. Regularly review supplier prices

In a fluctuating market, the cost of your goods can change, affecting your cost of goods sold (COGS) and, consequently, your margins. Establishing a routine for reviewing supplier prices and terms can unearth opportunities for cost savings. Consider bulk purchasing, long-term contracts, or exploring alternative materials as strategies to lower purchase costs. Building strong relationships with suppliers can also lead to preferential pricing or terms, directly benefiting your cost of goods sold.

4. Implement internal controls

Effective internal controls prevent theft or loss and encompass a framework for accurate record-keeping and reporting. Implementing cycle counts, where inventory is counted on a rotating schedule throughout the year, can supplement annual physical inventories, ensuring ongoing accuracy.

5. Understand shipping and handling costs

Shipping and handling costs can vary widely based on factors such as delivery distance, package dimensions, and shipping speed. Developing a system to track these costs by order or product can help you more accurately assign them to the cost of goods sold. Consider negotiating rates with carriers or using shipping software to find the most cost-effective shipping options for each order, thereby controlling these variable costs.

6. Categorize direct and indirect costs properly

Direct costs are the expenses that can be directly tied to the production of goods, such as raw materials and manufacturing labor. Indirect costs, however, like rent, utilities, and administrative salaries, don’t fluctuate directly with production volume and shouldn’t be included in the cost of goods sold (COGS).

7 Monitor product returns and adjustments

Handling returns efficiently requires a system that promptly adjusts inventory levels and financial records. This system should account for the physical return of goods and adjust sales revenue and cost of goods sold (COGS) accordingly. By maintaining an accurate picture of returns, you can better understand product performance and customer satisfaction.

8. Optimize your inventory levels

Optimizing inventory levels involves balancing the cost of carrying excess inventory against the risk of stockouts. Implementing the just-in-time (JIT) approach can minimize holding costs but requires accurate sales forecasting and reliable suppliers. Regular analysis of sales patterns, seasonal trends, and lead times can help fine-tune inventory levels, reducing unnecessary COGS components like storage and insurance.

9. Stay informed on tax regulations

Tax regulations regarding inventory and COGS can have significant implications for your business’s tax liability. Understanding the allowable methods for valuing inventory and deducting the cost of goods sold (COGS) can lead to substantial tax savings. Regular consultations with a tax professional can keep you informed of the latest tax laws and strategies, ensuring that your cost of goods sold records comply with current regulations and optimizes your tax position.

Summing up

Keeping track of cost of goods sold (COGS) and your sales can be really confusing. The confusion builds up when businesses expand their presence across multiple platforms, each with its own financial peculiarities. But with Synder, you can easily go through management of transactions, changes in stock, and different costs.

Synder makes it easier to keep track of COGS across different sales channels. This helps businesses figure out their profit margins more accurately. It also helps them clearly see their financial health and find ways for cost savings.

Basically, dealing with all these complicated matters requires clever solutions that can keep up with the fast pace of business. That’s exactly what Synder offers.

FAQs

What is COGS? Is it the same as the cost of sales?

The cost of goods sold is the total cost directly involved in producing or purchasing the goods that a business sells. Yes, they are the same. Both terms are used interchangeably to describe the direct expenses associated with the creation or acquisition of products sold by a company.

How is the cost of goods sold calculated?

The basic formula for calculating the cost of goods sold (COGS) is:

COGS = Beginning inventory + Purchases during the period – Ending Inventory

This calculation helps businesses understand the direct costs involved in producing the goods they sell within a specific accounting period.

Do I need a separate COGS tracking app?

No, it’s not necessary to use a standalone app. Solutions like Synder offer an integrated approach to managing your sales, cost of goods sold (COGS), and automating your accounting processes in general. With Synder, you can seamlessly manage the cost of goods sold alongside sales transactions in real time, ensuring accurate financial reporting and inventory management without the need for additional software.

How does Synder automation work?

Synder recognizes products during transaction sync across ecommerce channels, payment platforms, and accounting systems. It updates quantities on hand and cost of goods sold (COGS) accounts for existing products and automatically creates and assigns new products to specified accounts. The software provides accurate and up-to-date financial records with minimal manual intervention.

Can I track COGS in bulk and not per transaction?

Yes. You can do this using Synder’s Daily summary sync mode. After enabling the cost of goods sold (COGS) for all the channels connected to Synder, you’ll need to:

- Adjust settings and mappings (similar to what we’ve discussed in this article);

- Finish the COGS set up in Synder (checking products’ sales prices and costs);

- Sync summaries and check the results;

- Check the P&L report.

For more information, watch Synder’s guide “How to sync COGS with Daily Summaries into QuickBooks Online”:

Can the cost of goods sold affect business taxes?

Yes, COGS directly impacts a business’s taxable income. Since the cost of goods sold is deducted from a company’s revenues to determine its gross profit, a higher COGS can result in lower taxable income. Accurate reporting of the cost of goods sold (COGS) is essential for tax purposes and can lead to significant tax savings.

How often should the cost of goods sold be calculated?

Cost of goods sold (COGS) should be calculated at least at the end of each accounting period (monthly, quarterly, or annually) to ensure accurate financial reporting and insights into business performance. Some businesses may benefit from more frequent calculations for internal monitoring and decision-making purposes.

Share your thoughts

Have you ever successfully handled the challenges of tracking COGS or discovered new ways to manage sales in your business? Feel free to share your experiences, tips, and insights with our community.