Return on sales is a vital metric for businesses as it reveals the percentage of profit generated from sales revenue, helping companies gauge their financial efficiency and make informed decisions about cost management and pricing strategies. Understanding this ratio enables businesses to assess their profitability and ensure sustainable operations in competitive markets.

Today, we’re talking about return on sales and their impact on a company’s profitability.

Key takeaways

- Return on sales (ROS) is a crucial metric that shows the percentage of profit from sales revenue, helping businesses understand their financial efficiency and make strategic decisions about costs and pricing.

- ROS is calculated by dividing operating profit by total revenue and is distinct from other profitability metrics like gross and net profit margins, which consider different expense factors.

- Factors influencing ROS include pricing strategy, operational efficiency, cost management, market dynamics, and economic conditions, and improving ROS requires balancing cost control with maintaining product quality and customer satisfaction.

Level up your accounting with smart automation! Integrate financial data from all your sales channels in your accounting to have always accurate records ready for reporting, analysis, and taxation. See it in action with a 15-day free trial or spare a spot at our weekly public demo to have your questions answered.

What is return on sales and how is it calculated?

Let’s get straight to the point and define return on sales.

Return on sales (ROS), or operating profit margin, is a financial metric that shows the percentage of profit a company makes from its sales revenue. It measures how efficiently a company turns its sales into profit after accounting for all operating expenses.

Return on sales is a critical metric that helps management and investors understand how effectively the company converts its sales into profits. It contributes to financial forecasting and strategic decision-making by providing insights into revenue and profitability projections, guiding budgeting and resource allocation, evaluating performance, setting strategic goals, and improving operational efficiency.

A higher ROS indicates that the company is managing its costs well and generating more profit from its sales. A lower ROS suggests a business might need to improve its operational efficiency to increase profitability.

How to calculate return on sales

ROS is a financial ratio calculated by dividing the operating profit (or earnings before interest and taxes) by the total revenue generated during a specific period, typically expressed as a percentage.

Here’s how it looks reflected in a formula.

Return on Sales (ROS) = (Operating Profit / Total Revenue) x 100%

As you can see, two major components here are operating profit and total revenue. Let’s break them down.

- Operating profit is the income generated from regular business operations after deducting all operating expenses such as cost of goods sold, wages, rent, utilities, and other overhead costs.

- Total revenue represents the total amount of money earned from selling goods or services before any deductions.

Let’s look at how it works in an example.

Let’s say a company generates $500,000 in operating profit from $2,000,000 in total revenue. The return on sales, in this case, would equal 25%.

ROS = ($500,000 / $2,000,000) x 100% = 25%

This ratio indicates that the company earns 25 cents in operating profit for every dollar in revenue.

How does return on sales differ from other profit metrics?

Return on Sales, as a profitability metric, can sometimes be confused with other business metrics used to assess a company’s profitability. Let’s look at how it differs from other profit metrics.

Is return on sales the same as profit margin?

Return on sales (ROS) and profit margin are related. Still, they’re distinct financial metrics that analyze different aspects of a company’s profitability.

Return on sales measures the percentage of profit generated from sales revenue after deducting all operating expenses, excluding taxes and interest payments. It focuses on the efficiency of converting sales into profit from core operations, considering factors like production costs, wages, and overhead expenses.

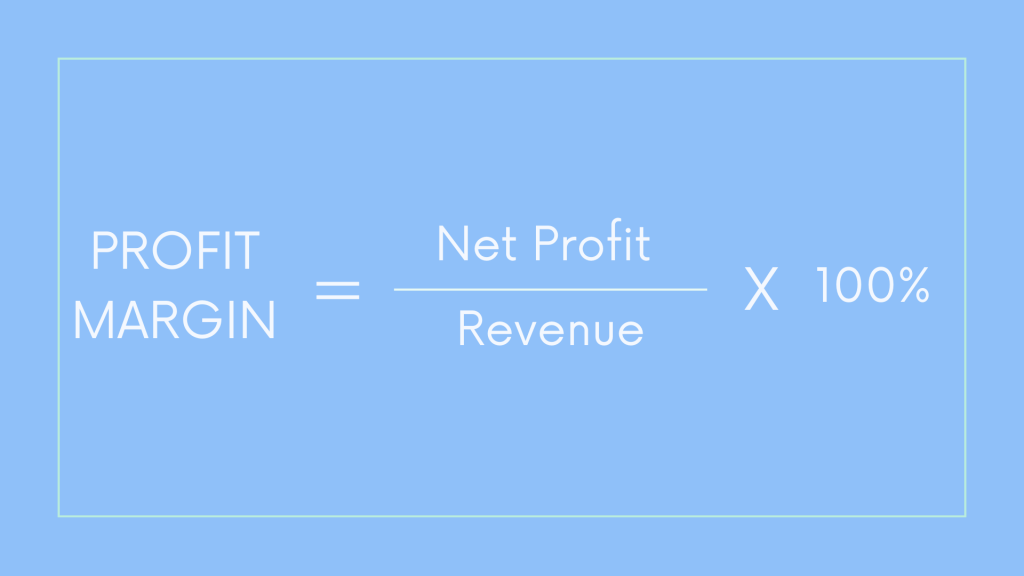

Profit Margin

Profit margin is a broader term encompassing various types of margins, including gross and net profit margins. It represents the percentage of revenue that translates into profit after deducting all expenses. Profit margin provides an overall assessment of a company’s ability to generate profit across its operations.

It’s commonly expressed as:

Profit Margin = (Net Profit / Revenue) × 100%

In this formula:

- Net profit refers to the total profit earned by the company after deducting all expenses, including operating costs, taxes, and interest.

- Revenue represents the total income generated from sales of goods or services.

Related:

Net Profit vs Revenue: What is the Difference?

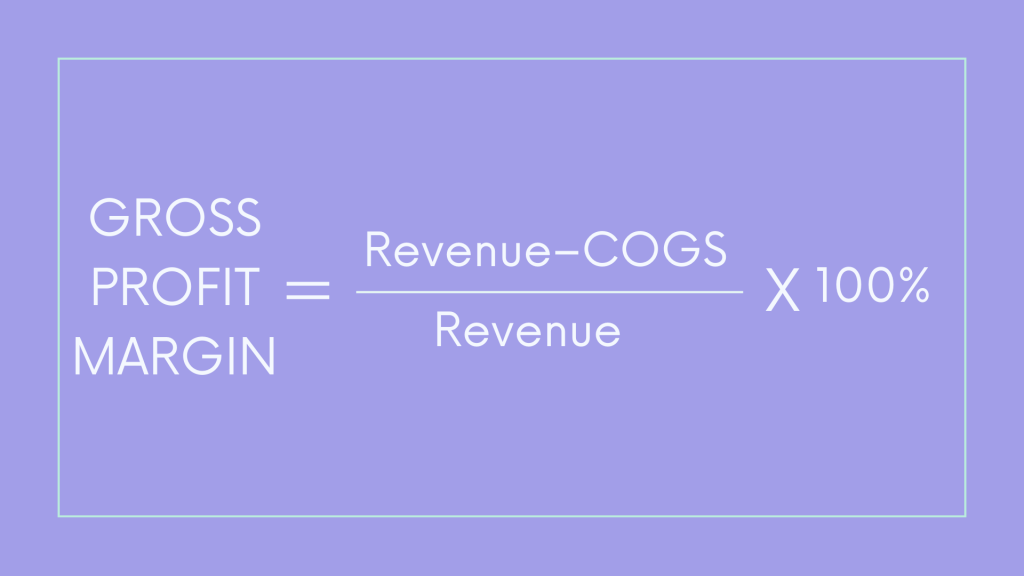

Gross profit margin (GPM)

GPM measures the percentage of revenue remaining after subtracting the cost of goods sold (COGS) from total revenue. It reflects the profitability of a company’s primary business activities before accounting for other operating expenses such as salaries, rent, and utilities. GPM evaluates a company’s production or sales activities profitability and its ability to control the costs directly associated with producing goods or services.

Gross Profit Margin = ((Revenue−Cost of Goods Sold) / Revenue)×100%

In this formula:

- Revenue represents the total income generated from sales of goods or services.

- Cost of Goods Sold (COGS) includes all direct costs of producing the goods sold, such as materials, labor, and manufacturing overhead.

Related:

What Is COGS in Business and Accounting? How to Calculate COGS: Examples and Formula

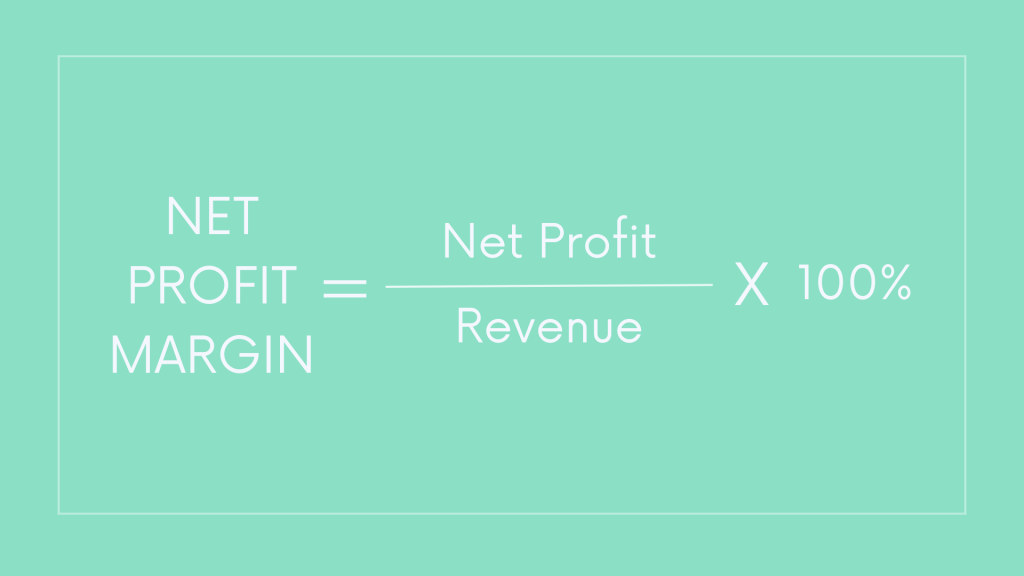

Net Profit Margin (NPM)

NPM calculates the percentage of revenue that remains as net profit after subtracting all expenses, including taxes and interest, from total revenue. It assesses a company’s overall profitability after factoring in all financial obligations. NPM reflects the company’s ability to generate profit across all its operations and its efficiency in managing expenses and tax liabilities.

Net Profit Margin = (Net Profit / Revenue) × 100%

In this formula:

- Net profit is the total profit earned by the company after deducting all expenses, including operating costs, taxes, and interest.

- Revenue represents the total income generated from sales of goods or services.

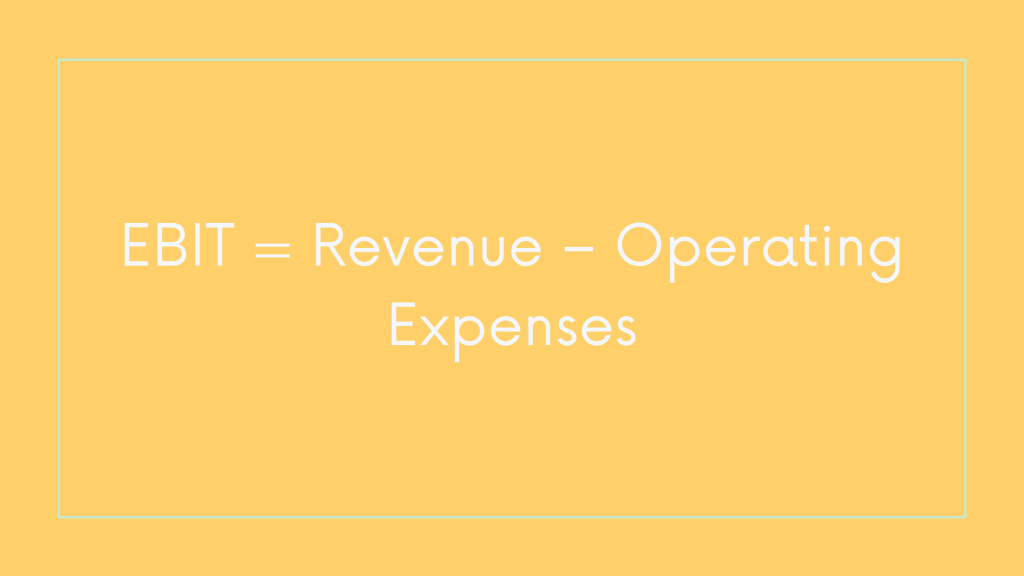

Is EBIT the same as ROS?

EBIT stands for earnings before interest and taxes. This way, it represents a company’s profit before deducting interest expenses and income taxes from its revenue.

EBIT is a financial metric that helps assess a company’s operating profitability and performance by focusing solely on its core operations, excluding the impact of financing and tax-related factors. Investors, analysts, and financial professionals often use EBIT to analyze the fundamental financial health and efficiency of a company’s operations without considering the effects of interest payments and tax obligations.

EBIT = Revenue − Operating Expenses

In this formula:

- Revenue represents the total income generated from sales of goods or services.

- Operating expenses include all expenses directly related to the company’s core operations, such as salaries, rent, utilities, and depreciation.

Return on sales, as we remember, is a metric that calculates the profit concerning operational costs, in other words, the percentage of profit generated from sales revenue after deducting all operating expenses.

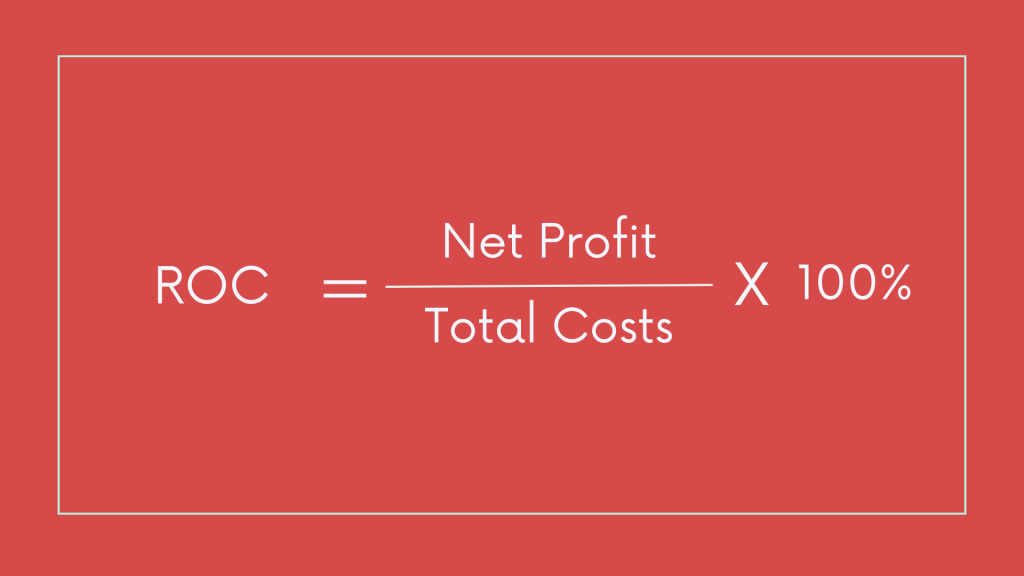

What is the difference between ROS and ROC?

Return on costs is another important financial metric that provides insights into a company’s profitability. It differs from return on sales in its focus and calculation method.

While return on sales (ROS) evaluates the efficiency of converting sales into profit from core operations, considering factors like production costs, wages, and overhead expenses, Return on costs (ROC) assesses the efficiency of a company’s cost management by measuring the percentage of profit generated from its total costs, including both operating and non-operating expenses. It considers all costs incurred by the company, such as production costs, administrative expenses, and interest payments.

ROC = (Net Profit / Total Costs )× 100%

In this formula:

- Net Profit refers to the total profit earned by the company after deducting all expenses, including operating costs, taxes, and interest.

- Total Costs represent all expenses incurred by the company, including both operating and non-operating costs.

What is a good return on sale ratio? And how the industry in which a business is operating impacts that?

In general, a higher return on sales indicates better profitability and operational efficiency. However, what constitutes a good ROS ratio varies significantly across industries due to differences in business models, cost structures, and competitive landscapes.

For example, industries with high overhead costs, such as manufacturing or retail, typically have lower ROS ratios than service-based industries with lower operating expenses. Industries with high competition or low profit margins, like retail or grocery, may consider a ROS ratio of 2% to 5% good. Technology or healthcare companies may aim for the return on sales ratios exceeding 20%.

Pricing strategies, production efficiency, economies of scale, and market conditions might greatly influence ROS ratios within specific industries. Therefore, companies might want to benchmark against industry standards and competitors to determine a good return on sales ratio for their particular sector.

With all the above in mind, it’s safe to say that a good ROS ratio is one that allows a company to remain competitive, sustain profitability, and achieve its financial objectives within its industry context.

What factors influence return on sales, and how do they impact profitability of a company?

Above, we mentioned some factors influencing return on sales (ROS). Let’s take a closer look at them and how they impact a company’s profitability.

Pricing strategy

A company’s pricing strategy significantly influences its ROS. Pricing decisions directly affect revenue and profit margins. Opting for higher prices can boost revenue and potentially increase profits, provided that costs remain stable. Conversely, lowering prices may stimulate sales but could reduce profit margins unless there are also cost reductions to maintain profitability.

Operational efficiency

Operational efficiency is critical for achieving a favorable ROS. Streamlining processes, minimizing waste, and optimizing resource utilization are essential to operational efficiency. Companies that operate efficiently can control expenses and maximize the value generated from each dollar of revenue. It results in improved return on sales as a larger proportion of revenue translates into profit.

Cost management

Effective cost management also helps maintain a healthy ROS. Controlling labor, materials, and overhead costs directly impacts profitability. Companies that implement cost management best practices can enhance return on sales by ensuring that costs are kept in check, allowing for retaining more revenue as profit.

Market dynamics and competitive pressures

Market dynamics and competitive pressures significantly influence ROS. Companies operating in highly competitive markets may face pricing pressure, impacting their ability to maintain healthy profit margins. Understanding market trends and adjusting strategies accordingly can help mitigate these challenges and sustain profitability.

Economic conditions and industry-specific factors

Economic conditions and industry-specific factors also play a crucial role in determining ROS. Economic downturns may decrease consumer spending, affecting sales volumes and profitability. Moreover, industry-specific regulations, technological advancements, and shifts in consumer preferences can create opportunities or challenges that impact ROS.

How can businesses improve their return on sales without compromising product quality or customer satisfaction?

Improving return on sales (ROS) demands a balanced approach that enhances profitability while prioritizing product quality and customer satisfaction.

Businesses achieve this by streamlining operations, managing costs effectively, employing strategic pricing strategies, nurturing customer relationships, exploring market expansion opportunities, leveraging technology, and investing in employee development.

Thoughtfully following these best practices, companies can achieve sustainable growth and profitability while maintaining their competitive edge in the market.

Bottom line

As you can see, return on sales is a business-critical metric, offering an overview of a business’s profitability and operational efficiency. Understanding ROS allows companies to evaluate their financial health and compare performance against industry standards. Businesses might want to benchmark their return on sales against industry peers to identify areas for improvement and set realistic targets.

Meanwhile, following proven best practices, such as efficient cost management, strategic pricing, leveraging customer relationships, market expansion opportunities, and more, helps improve and maintain a healthy return on sales ratio.

Continue reading: What are liquidity ratios?

Share your thoughts

Do you have any questions or remarks to add? Feel free to share your thoughts in the comments section below!

.png)