Public accounting is a term that invokes images of professionals meticulously inspecting financial records, balancing the books, and ensuring that the financial world turns smoothly. But what, precisely, is public accounting?

Let’s delve into the heart of this financial discipline, shedding light on its inner workings, the journey to becoming a Certified Public Accountant (CPA), the landscape it traverses, and the vital role it plays in maintaining the integrity of our financial systems.

The essence of public accounting

Public accounting is the sentinel of financial integrity in the corporate world. At its core, it involves the analysis, verification, and assurance of financial information for public and private entities. Public accountants are the gatekeepers of fiscal transparency, ensuring that financial statements are accurate, reliable, and adhere to regulatory standards.

Beyond financial scrutiny, public accountants often provide advisory services to help businesses make informed decisions. They are the financial navigators in the turbulent seas of commerce, guiding companies towards prosperity and compliance.

Public accounting, in essence, is the art and science of safeguarding the financial health of businesses, both big and small.

Understanding the role of public accountants

Public accountants, often referred to as CPAs, are the architects of financial clarity. They are professionals who have undergone rigorous training and successfully passed the CPA exam, a challenging rite of passage. These individuals possess a deep understanding of accounting principles, taxation, and auditing, making them indispensable in the world of finance.

The role of a public accountant is multifaceted. They perform financial audits to verify the accuracy of a company’s financial records, ensuring that they comply with Generally Accepted Accounting Principles (GAAP). In addition to audits, CPAs offer invaluable tax services, helping businesses navigate the labyrinthine tax codes while minimizing tax liabilities legally.

A glimpse into the world of accounting services

Public accountants provide a range of accounting services that extend far beyond traditional auditing and tax preparation. Their expertise is a pillar upon which businesses lean for strategic financial guidance. Advisory services offered by CPAs encompass financial planning, risk management, and even forensic accounting, where they uncover financial irregularities and fraud.

Public accountants also play a crucial role in assisting companies with mergers and acquisitions, offering insight into the financial health of potential partners or targets. Moreover, they provide financial consulting services that help businesses optimize their operations, control costs, and drive profitability.

Becoming a Certified Public Accountant (CPA)

The road to becoming a certified public accountant is not for the faint of heart. It demands dedication, discipline, and a thirst for financial knowledge. To embark on this journey, aspiring CPAs must typically hold a bachelor’s degree in accounting or a related field. However, each state in the United States has its specific requirements for CPA licensure, which may include additional coursework.

After meeting educational prerequisites, candidates must pass the notoriously challenging CPA exam, which comprises multiple sections, including auditing and attestation, business environment and concepts, financial accounting and reporting, and regulation. This comprehensive examination is a formidable barrier to entry, testing candidates on their knowledge, analytical skills, and ability to apply accounting principles in real-world scenarios.

What’s the CPA exam?

The CPA exam is a grueling test of one’s accounting acumen, and success requires months of rigorous preparation. Candidates often turn to CPA review courses and study materials to navigate the complex terrain of the exam, from platforms like Exam-Labs, to navigate the complex terrain of the exam. The examination is not merely a test of knowledge; it assesses problem-solving abilities and the capacity to make sound judgments in complex financial situations.

Passing the CPA exam is a momentous achievement. It signifies that an individual possesses the knowledge and skills necessary to uphold the highest standards of accounting and financial reporting. Armed with this certification, they join the ranks of elite professionals who are entrusted with the financial well-being of businesses and organizations.

Private vs. public: choosing your CPA path

The journey to becoming a CPA offers a choice between two distinct paths: private accounting and public accounting. Let’s break them down.

Private accountants work within a single organization, managing its internal financial operations. They ensure that the company’s financial records are accurate and compliant with regulations. While private accountants often enjoy a stable work environment, their scope of work is limited to the specific industry or company they serve.

On the other hand, public accountants work for accounting firms that provide services to a diverse clientele. These firms may range from small local practices to global giants known as the Big Four accounting firms. Public accountants enjoy exposure to various industries, businesses, and financial challenges. They serve as external auditors, tax advisors, and financial consultants to a wide array of clients, gaining a wealth of experience and expertise.

Exploring the public accounting landscape

As mentioned above, public accounting helps buisnesses track and maintain their financial health, with accounting being a significant part of business management. So, let’s take a closer look at the connection of public accounting with businesses and how it works for different industries.

Industries served by public accountants

Public accountants have to navigate the intricate landscape of various industries and challenges they face in these sectors. Their adaptability and expertise make them indispensable in guiding businesses through the complex terrain of modern commerce.

Healthcare industry

Public accountants in the healthcare sector play a vital role in ensuring financial stability and compliance with stringent regulations. They must contend with complex reimbursement systems, healthcare reform, and evolving accounting standards.

The healthcare landscape is marked by constant changes in government policies and insurance regulations, making it a challenging environment for CPAs. Accurate financial reporting and compliance are paramount, as errors can result in regulatory penalties and financial instability for healthcare organizations.

Technology sector

Public accountants in the technology industry face the challenge of dealing with rapidly evolving products and services. The dynamic nature of tech companies necessitates agile financial reporting and forecasting. Additionally, the valuation of intangible assets, such as intellectual property and patents, requires specialized accounting knowledge. Public accountants must keep pace with technological advancements and adapt their auditing and financial analysis techniques accordingly.

Besides, they have to grapple with the advent of blockchain technology and cryptocurrencies. The decentralized and immutable nature of blockchain presents new challenges in terms of auditing and verifying transactions. Accountants must navigate the complexities of blockchain-based financial records and assess the accuracy and completeness of digital asset holdings. The rise of cryptocurrencies introduces additional considerations in financial reporting, including the valuation and classification of digital assets on balance sheets.

Financial services

Public accountants working in the financial services sector must grapple with intricate financial instruments, risk management, and regulatory compliance. They face the ever-evolving landscape of financial regulations, including those related to anti-money laundering, Basel III, and Dodd-Frank.

Maintaining transparency and accountability is essential in an industry where trust is paramount, and the repercussions of financial misconduct can be severe.

Manufacturing sector

Public accountants serving manufacturing companies encounter intricate cost accounting systems, inventory management challenges, and supply chain complexities. They must ensure accurate product costing, manage inventory fluctuations, and navigate international taxation and trade regulations.

The manufacturing industry’s global reach adds another layer of complexity, with cross-border transactions and currency exchange considerations that require CPAs to be well-versed in international accounting standards.

Nonprofit sector

Public accountants who specialize in the nonprofit sector tackle unique challenges related to maintaining tax-exempt status and preserving public trust. Nonprofits rely heavily on donor contributions and grants, necessitating accurate financial reporting to demonstrate responsible stewardship of funds.

These organizations also adhere to specific accounting standards, such as the Financial Accounting Standards Board (FASB) guidelines for nonprofits, adding complexity to the role of CPAs in this sector.

It has to be noted that challenges for public accountants across industries often revolve around staying current with industry-specific regulations, ensuring compliance with evolving accounting standards, and addressing the unique financial complexities inherent to each sector. Adaptability and a commitment to ongoing education are crucial for CPAs to provide valuable guidance and maintain the financial health and integrity of businesses in these diverse industries.

The link between public accountants and businesses

Public accountants serve as the critical bridge between businesses and the financial world at large. Their role extends beyond numbers; they are guardians of trust, ensuring that financial information remains accurate, transparent, and in compliance with regulations. In a world where investors, stakeholders, and the public demand financial accountability, public accountants play an indispensable role in maintaining the integrity of financial reporting.

Businesses rely on the expertise of public accountants to make informed decisions, manage risks, and navigate the ever-changing landscape of taxation and regulation. Whether conducting an audit, providing tax advice, or offering strategic financial counsel, CPAs are the trusted advisors who help businesses thrive in a complex financial environment.

Public accounting in action

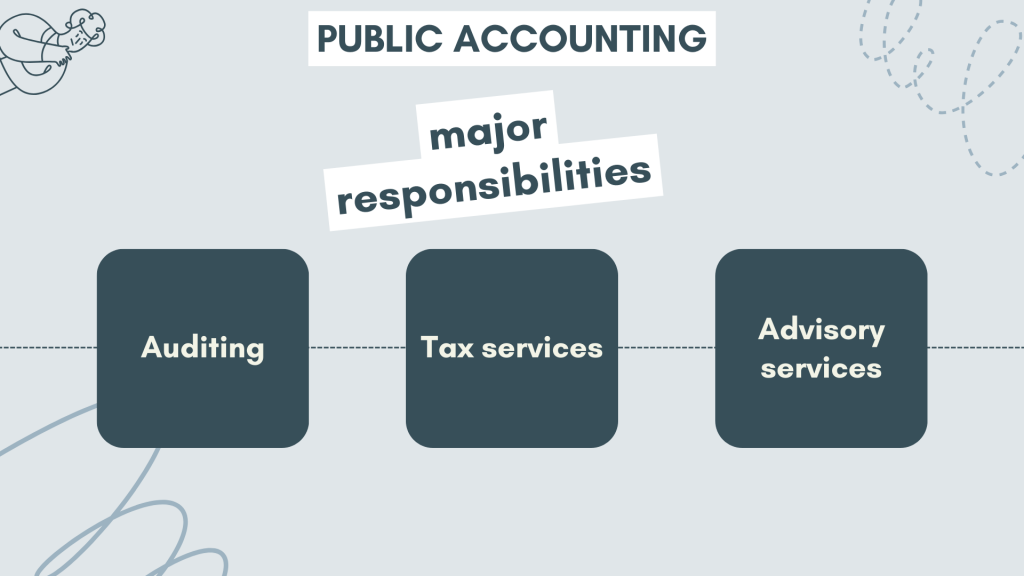

We mentioned earlier that public accounting encompasses a wide array of responsibilities, from auditing to tax services and financial advisory. So, it’s time to take a closer look at the core functions of public accountants, breaking down the major directions of their practice and the regulatory framework they work within.

Auditing – The heart of public accounting

Auditing lies at the very heart of public accounting. It is the process through which public accountants examine and verify a company’s financial records to ensure accuracy and compliance with accounting standards. The primary objective of an audit is to provide assurance to stakeholders, including shareholders, creditors, and the public, that a company’s financial statements are free from material misstatements or fraud.

During an audit, public accountants review a company’s financial statements, internal controls, and accounting procedures. They conduct tests to assess the reliability of financial information and evaluate the risk of material misstatements. Auditors also assess the overall financial health of the company and provide recommendations for improving financial operations and compliance.

Tax services – Navigating the complex financial maze

Taxation is a labyrinthine world, riddled with regulations and constantly changing laws. Public accountants specializing in tax services are the guides that help individuals and businesses navigate this intricate maze while minimizing tax liabilities legally. They provide expertise on tax planning, compliance, and strategies to optimize tax positions.

Tax services encompass a wide range of activities, from preparing tax returns to advising on tax-efficient investment strategies. Public accountants in this field stay current with tax law changes, helping clients make informed decisions that reduce tax burdens while remaining compliant with tax codes.

Advisory services – Guiding businesses to financial success

Public accountants are not mere number-crunchers, they are financial advisors who help businesses chart a course to success. Advisory services encompass a broad spectrum of activities, including financial planning, risk management, and business strategy. CPAs use their expertise to guide companies toward achieving their financial goals.

Financial planning involves helping businesses create budgets, forecasts, and financial models to make informed decisions and allocate resources effectively. Risk management focuses on identifying and mitigating financial risks to protect a company’s assets and reputation. Business strategy consulting assists companies in developing plans to grow, expand into new markets, or adapt to changing economic conditions.

The regulatory framework of public accounting

Public accountants depend on the regulatory framework with unwavering reliance in their daily practice. This framework, composed of professional standards, ethical guidelines, and regulatory oversight, is the compass that guides their work and ensures the integrity and transparency of financial reporting.

- The watchful eye of regulatory bodies

The integrity of public accounting is safeguarded by regulatory bodies that establish and enforce professional standards and ethical guidelines. In the United States, the American Institute of Certified Public Accountants (AICPA) plays a central role in setting professional standards for CPAs. Additionally, the Public Company Accounting Oversight Board (PCAOB) oversees audits of public companies to ensure compliance with auditing standards.

These regulatory bodies work in tandem to maintain the highest levels of professionalism and integrity within the public accounting profession. They periodically update accounting and auditing standards to reflect changes in the business environment and ensure that public accountants adhere to ethical principles in their practice. - Ensuring public trust

Public accountants are entrusted with a profound responsibility: ensuring the accuracy and reliability of financial information that is vital to public trust. They play a critical role in maintaining the transparency and credibility of financial reporting, which is essential for investors, creditors, and the general public.

Through their work, CPAs provide assurance to stakeholders that financial statements are free from material misstatements or fraud. This assurance is particularly crucial for publicly traded companies, where investors rely on accurate financial information to make investment decisions. Public accountants are the gatekeepers who ensure that businesses uphold the highest standards of financial reporting. - Compliance, integrity, and ethical standards

Integrity and ethics are the cornerstones of the public accounting profession. Public accountants are bound by a strict code of professional conduct that requires them to act with integrity, objectivity, and independence in their work. They must avoid conflicts of interest and prioritize the public interest above all else.

The importance of ethical behavior in public accounting cannot be overstated. Any breach of trust or ethical misconduct can have far-reaching consequences, damaging reputations and eroding public confidence in the financial system. As such, public accountants are held to the highest ethical standards, and any violations can result in disciplinary actions, including the revocation of their CPA license.

Public accountants depend on this regulatory framework not only to maintain the highest standards of professionalism but also to instill confidence in the financial markets. Investors, creditors, and the public rely on the assurance that financial information is accurate, transparent, and in compliance with established rules and regulations. Without this regulatory framework, the foundation of trust upon which the financial world rests would be significantly weakened.

The future of public accounting

Before we wrap it up, it’s worth mentioning that just like any other industry, the field of public accounting is not immune to the winds of change. Technological advancements, globalization, regulatory shifts, and evolving client demands are all catalysts for transformation.

Let’s look at what impacts the future of public accounting in more detail.

Technological disruption – challenges and opportunities

The world of public accounting is not immune to the winds of technological change. Accounting automation, artificial intelligence, and data analytics are transforming the way public accountants work. While these technological advancements bring challenges, they also open doors to new opportunities.

Automation, for instance, can streamline routine tasks like data entry and reconciliation, allowing public accountants to focus on higher-value activities such as data analysis and strategic financial planning. Artificial intelligence can help identify anomalies and potential fraud in financial data, enhancing the accuracy of audits. Data analytics can provide deeper insights into financial trends, enabling businesses to make more informed decisions.

The evolving role of the modern public accountant

As technology continues to reshape the profession, the role of the modern public accountant is evolving. CPAs are increasingly becoming strategic advisors, using their financial expertise to help businesses navigate a complex and dynamic economic landscape. They are not just historians of financial data but also forward-looking visionaries who guide businesses toward long-term success. Embracing tools like CPA Automation is part of this evolution, enabling more efficient and strategic financial management.

The modern public accountant must embrace lifelong learning, staying abreast of technological advancements and regulatory changes. Continuous education and professional development are essential to remain relevant and provide the highest level of service to clients.

Public accounting in a globalized world

In an interconnected world, the influence of public accounting extends beyond national borders. Multinational corporations and global financial markets require a harmonized approach to accounting and auditing standards. Organizations such as the International Federation of Accountants (IFAC) play a pivotal role in promoting international accounting standards and ethical principles.

Public accountants working in a globalized environment must navigate the complexities of cross-border regulations, taxation, and reporting requirements. They play a vital role in helping multinational companies maintain transparency and compliance in their financial operations, contributing to the stability and trustworthiness of the global financial system.

Bottom line

In conclusion, public accounting is far more than a ledger of numbers, it is the guardian of financial transparency and the compass for businesses in the complex world of finance. Certified Public Accountants (CPAs) stand as sentinels of integrity, ensuring that financial information remains accurate, reliable, and compliant with regulations. As technology and globalization reshape the profession, the role of public accountants is evolving, demanding adaptability and a commitment to ethical standards. For those who embark on this rewarding career path, public accounting offers a journey filled with challenges, opportunities, and the chance to make a lasting impact on the financial world.

Read more of our articles about learn about What is a proforma invoice and TIE ratio.