PayPal stands out as a leading platform for online financial transactions, widely embraced for its convenience and security. This guide delves into the nuances of how to receive money on PayPal, catering to a broad spectrum of users from freelancers to business entities and even individuals splitting bills. We’ll cover the essentials, from setting up an account to accessing your funds, ensuring a seamless experience in managing digital payments.

Is it possible to receive money through PayPal without a PayPal account?

No, it is not possible to receive money through PayPal without having a PayPal account. In order to receive money via PayPal, both the sender and the recipient must have their own PayPal accounts. The process involves the sender using the recipient’s email address or phone number associated with their PayPal account to transfer the funds.

When someone sends money to an email address or phone number that is not yet associated with a PayPal account, the recipient will typically receive an email or a message instructing them to create a PayPal account to claim the funds. The money is usually returned to the sender if the recipient does not create an account within a certain timeframe.

Therefore, for any transaction where PayPal is used to send or receive money, having a PayPal account is a necessary prerequisite.

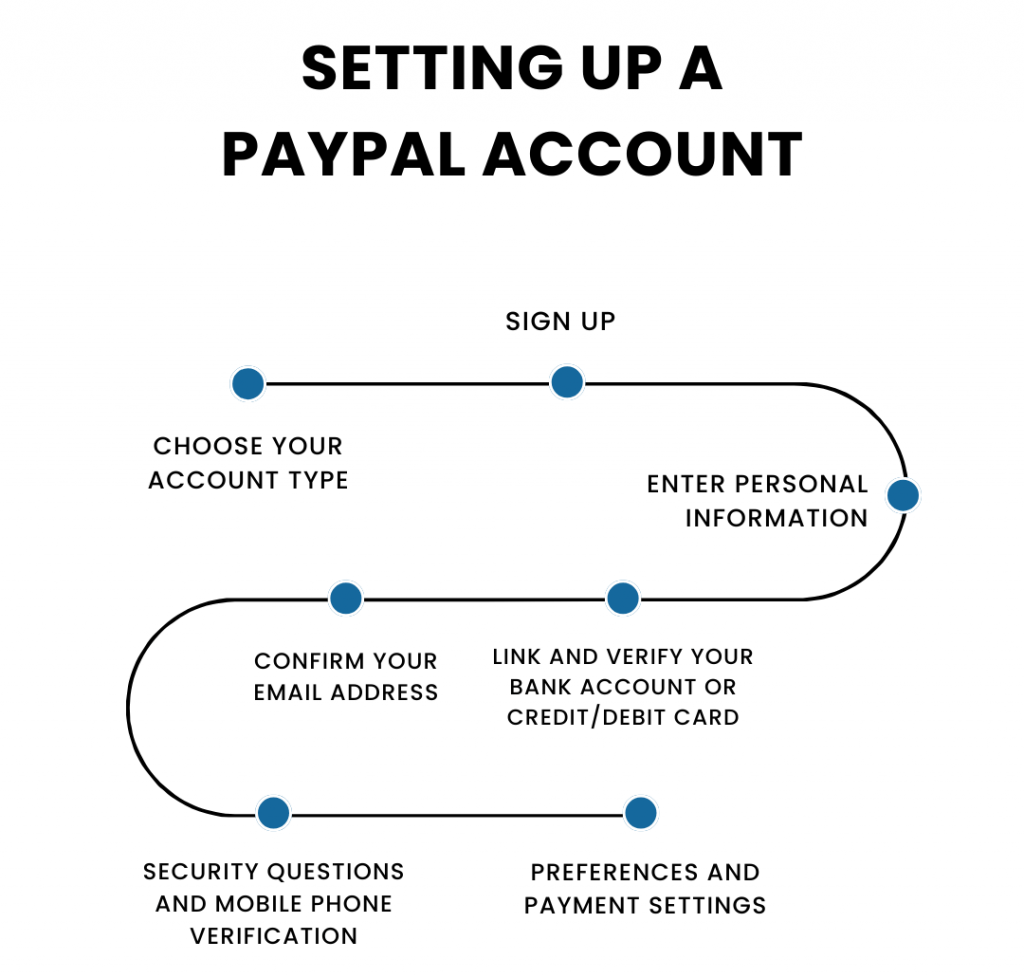

Setting up a PayPal account

Here’s how to set up your PayPal account for the first time:

1. Choose your account type

Go to the PayPal website or download the PayPal app. Decide between a Personal or Business account.

- A Personal account is suitable for shopping and sending money to family and friends.

- A Business account is ideal for merchants who operate under a company/group name.

2. Sign up

Click on the ‘Sign Up‘ button and provide your email address. This will be your primary identifier for your PayPal account. Create a strong password to ensure your account’s security.

3. Enter personal information

Fill in your personal details, including your legal first and last name, address, and phone number. PayPal requires this information for account verification and security purposes.

4. Link and verify your bank account or credit/debit card

To fully utilize PayPal’s features, link your bank account or card.

- For a bank account: PayPal will make two small deposits (less than a dollar) into your bank account. You’ll need to verify these amounts in your PayPal account.

- For a credit/debit card: PayPal will charge a small amount to your card, which will be refunded once you confirm the card. The statement will include a 4-digit code and you need to enter this code in your PayPal account to verify the card.

5. Confirm your email address

PayPal will send an email to the address you provided. Open this email and click on the link provided to activate your account.

6. Security questions and mobile phone verification

Set up security questions for added security. You may also be asked to verify your mobile phone number. This helps in securing your account and in recovering your account if you forget your password.

Learn how to verify your PayPal account.

7. Preferences and payment settings

Customize your payment settings, such as preferred payment methods for online purchases.

Note: Set up features like one-touch payments for quicker transactions.

Once your account is set up and verified, you can start using PayPal to send and receive money, shop online, and more. Remember to keep your account information secure and regularly monitor your transactions for any unauthorized activity.

Receiving money on PayPal

1. Have a PayPal account

As said above, you must have a PayPal account to receive money. You can create an account based on the guide we’ve provided in the previous section.

2. Share your PayPal link or email

Once your account is set up, you can receive money by giving the sender your PayPal email address or your personalized PayPal.me link.

Your PayPal email is the email address you used to create your account. The PayPal.me link is a unique link that PayPal provides to its users, which can be created and customized in your account settings.

3. Receiving an invoice or money request

If you are a freelancer or a business owner, you can send an invoice to your clients through PayPal. This invoice will detail the services or products offered and the amount due. Alternatively, you can send a money request to anyone via PayPal. This is a simpler form compared to an invoice and is suitable for personal transactions.

Learn how to send an invoice on PayPal.

4. The sender initiates the payment

The sender can then use your email address or PayPal.me link to send you money. If you’ve sent an invoice or request, they can pay directly through that. They can pay using their PayPal balance, a linked bank account, or a credit/debit card.

5. Notification of received payment

Once the sender completes the transaction, you’ll receive an email notification from PayPal indicating that you’ve received money. The funds will be added to your PayPal balance, which you can view by logging into your PayPal account.

6. Accessing your funds

You can keep the money in your PayPal account for future online transactions, or you can transfer it to your linked bank account. Depending on your region, you may also have options like getting a check from PayPal or using a PayPal debit card.

7. Transaction fees

Be aware that receiving money via PayPal may incur transaction fees, especially for goods and services. These fees vary by country and the type of transaction.

Learn about payment options on Amazon.

PayPal fees

When receiving money on PayPal, the fees you may incur depend on the nature of the transaction and the countries involved. Here’s a breakdown of typical scenarios where PayPal fees are applied:

Personal transactions

- Domestic transactions: If you’re receiving money from friends or family within the same country, there’s usually no fee if the sender uses their PayPal balance or a linked bank account. However, if the sender uses a credit or debit card, they might be charged a fee.

- International transactions: Receiving personal payments from someone in another country may incur a fee, depending on the countries involved and the payment method used.

Commercial transactions (Goods and Services)

- Standard fee: For business transactions, such as when you’re selling goods or services, PayPal typically charges a fee. This fee is usually a percentage of the amount received plus a fixed fee.

- International sales: Additional fees may apply for international sales, including a currency conversion fee if the payment is made in a currency different from the one linked to your account.

Currency conversion

If you receive money in a currency different from your primary PayPal account currency, PayPal will charge a currency conversion fee. This fee is a percentage added to the exchange rate.

Withdrawal fees

Transferring money from your PayPal account to your bank account is typically free for standard transfers. However, there may be fees for instant transfers or withdrawals to credit/debit cards.

Invoice fees

If you use PayPal’s invoicing services to bill customers, additional fees may apply.

Discover the method to record PayPal fees right into your QuickBooks Online account with ease.

How long does it take to receive money with PayPal?

The time it takes to receive money with PayPal typically depends on the method of payment used by the sender. Here’s a breakdown of different scenarios:

From PayPal to PayPal account

When money is sent from one PayPal account to another, the transfer is usually instant. As soon as the sender completes the transaction, the recipient should see the funds in their PayPal balance immediately.

From a bank account to a PayPal account

If the sender is transferring money directly from their bank account to your PayPal account, it may take a few business days for the transaction to complete, depending on the banks’ processing times.

From credit or debit card to PayPal account

Payments made using a credit or debit card are typically processed quickly, and the funds should appear in your PayPal account almost immediately after the sender completes the transaction.

International transfers

For international transfers, the time it takes can vary significantly. Factors such as currency conversion, intermediary banks, and the receiving country’s banking processes can influence the duration. It can range from a few hours to several business days.

eChecks

If the sender pays with an eCheck, which is a digital version of a traditional check, it can take several business days to clear. The funds will only appear in your PayPal account once the eCheck has been cleared by the sender’s bank.

Withdrawal to bank account

After receiving money in your PayPal account, transferring it to your bank account usually takes 1 business day, but it can take longer depending on your bank’s processing time. PayPal also offers instant withdrawal options to eligible bank accounts or cards, which may incur additional fees.

It’s important to keep in mind that weekends and public holidays can affect processing times for banks, potentially leading to delays. Additionally, new PayPal accounts or those with infrequent activity might experience a brief holding period for incoming funds as a security measure.

PayPal benefits

PayPal offers several benefits that make it a popular choice for online transactions, both for personal and business use.

Convenience

PayPal simplifies online payments. You don’t need to re-enter your details for every transaction once you link your bank account, credit, or debit cards. It’s particularly handy for frequent online shoppers or businesses managing multiple transactions.

PayPal security

PayPal is known for its robust security measures. It encrypts and monitors every transaction to help prevent fraud and identity theft. Users don’t have to share their card details with multiple websites, adding an extra layer of security.

Flexibility

With PayPal, users can link multiple bank accounts, credit cards, and debit cards to their accounts. This flexibility allows users to choose different funding sources for different transactions.

Widely accepted

PayPal is accepted by millions of businesses worldwide, making it a universally accepted payment method for online shopping.

PayPal instant transfers

Sending and receiving money through PayPal is generally instant, which is particularly useful for urgent transactions or when transferring money to friends and family.

International transactions

PayPal supports international payments and currency conversions, making shopping from foreign websites or sending money abroad easier.

Buyer protection

PayPal offers a buyer protection program that can help you get a refund if an item you’ve purchased online doesn’t arrive or doesn’t match the seller’s description.

Seller protection

Similarly, PayPal protects sellers. If you sell an item and the buyer claims they never received it, or if the buyer claims the transaction was unauthorized, PayPal’s Seller Protection program can help protect you against these types of claims.

PayPal mobile app

PayPal’s mobile app allows users to manage their finances on the go, making it easy to send, receive, and request money, check your balance, and more, all from your smartphone.

Learn more about PayPal’s pros and cons.

PayPal common issues

However, when receiving money on PayPal, you might encounter certain issues or troubleshooting scenarios. Here are some common problems and their potential solutions:

Payment not received

Cause: The sender may have entered the wrong email address, or the payment could still be processing.

Solution: Confirm with the sender that they used the correct email address associated with your PayPal account. Also, check if the payment is pending in your PayPal account.

Account limitations

Cause: PayPal may place limitations on your account due to suspected fraudulent activity, unverified account status, or if you’ve reached certain transaction limits.

Solution: Follow the instructions provided by PayPal to lift the limitation. This may include providing additional information, verifying your identity, or linking and confirming a bank account.

Pending or unclaimed status

Cause: Payments may be pending due to PayPal’s review process or if the money is sent to an email address not linked to an active PayPal account.

Solution: If the payment is pending, you may need to wait until PayPal completes its review. If the payment is unclaimed, check to ensure the email address is correct and linked to your PayPal account.

Learn how to cancel a pending PayPal payment.

Currency conversion issues

Cause: If you’re receiving money in a currency different from your primary account currency, PayPal will need to convert it, which may result in delays or unexpected fees.

Solution: Review your currency settings in PayPal and be aware of the currency conversion rates and fees.

Withdrawal problems

Cause: Issues with withdrawing money from your PayPal account to your bank account may arise due to incorrect bank details or limitations on your account.

Solution: Verify that all bank details are correct. If everything is accurate, contact PayPal for assistance.

Technical issues

Cause: Occasionally, technical issues such as website downtime or app glitches can hinder transactions.

Solution: Wait and try again later. If the problem persists, contact PayPal support or check their community forums for any reported widespread issues.

Disputes and claims

Cause: The sender may open a dispute or claim regarding the transaction, which can freeze the funds temporarily.

Solution: Communicate with the sender to resolve the dispute. Provide any requested documentation to PayPal to help resolve the claim.

In any troubleshooting scenario, the key is clear communication with the sender and prompt attention to any requests or instructions from PayPal. If issues persist, contacting PayPal’s customer service for assistance is often the best course of action.

Conclusion

In summary, receiving money through PayPal is a straightforward and secure process. Whether you’re managing personal transactions, running a business, or dealing with international payments, PayPal offers a convenient and reliable way to handle your financial exchanges. With its user-friendly interface and robust security measures, it continues to be a popular choice for online payments. Remember to stay informed about any applicable fees and limitations, and take advantage of PayPal’s customer support and resources for a smooth experience.

%20(1).png)