In our increasingly digital and fast-paced world, managing receipts has become a crucial aspect of personal and business finance. Receipts serve as evidence of transactions, aiding in budgeting, expense tracking, tax preparation, and reimbursement processes. Without effective receipt management, it’s easy to misplace or overlook important financial information, leading to disorganized records and potential financial setbacks.

Fortunately, advancements in technology have revolutionized the way we manage receipts. Traditional manual methods of storing and organizing physical receipts have given way to innovative digital solutions, which made it easier than ever to capture, store, and retrieve receipt data, eliminating the hassle of paper clutter and manual data entry. By leveraging the power of intelligent software, receipt management has become more efficient, accurate, and accessible.

In this article, we’ll highlight some of the top best receipt apps in the market and explore the criteria for evaluating the contenders. Whether you’re an individual looking to keep personal finances in order or a business or accounting professional seeking a robust expense management solution, this guide will help you make an informed choice to optimize your receipt management process.

Synder

Making sure your accounting is seamless and accurate

Before we proceed to the most popular receipt apps, let’s consider why you need them. Businesses require such solutions in order to account for their transactions and make sure they’re properly recorded in their accounting. Fortunately, manual entry of your expenses into your books is a thing of the past, as there are many apps that offer automatic data recording. There are many, but you need a truly reliable one with the ability to customize data recording to fit the needs of your business. This way you’ll have your accounting in order, and, coupled with your receipt app, you’ll have all the aspects of your business covered. This is when Synder enters the stage.

Synder is an advanced accounting software, and while its primary focus is on automating routine accounting operations, especially for ecommerce businesses, it allows for customizable data recording in various industries. All you need to do is connect Synder to your platforms in use, adjust the settings the way you need, and you’ll enjoy seamless and accurate accounting.

- Automation of Sales Transactions Syncing: Synder automates the process of syncing all your sales transactions with your books, including fees. You can choose the level of detalization needed in your books: get detailed per transaction records or summarized daily entries per connected platform.

- Historical Data Import: Synder offers not only a smooth record of ongoing transactions: the tool has no cap on historical data import, which means you can easily transfer loads of historical transactions data to your books.

- Error Minimization: Manual entry often comes with a risk of errors. By automating the syncing process, Synder can significantly reduce the chances of human errors in receipt management.

- Custom Categorization: Synder offers flexibility in categorizing transactions, helping businesses tailor their transactions management to specific operational needs and get accurate P&L reports.

- Seamless Reconciliation: By automatically syncing sales transactions, Synder ensures that all your transactions align with your accounting records, facilitating a smoother reconciliation process.

- Integration with Popular Platforms: Synder seamlessly integrates with popular sales channels, payment gateways and accounting software like QuickBooks, or Xero, which can help in managing and categorizing receipts efficiently.

- Free Trial and 24/7 Support: Synder offers a 15-day free trial without the need for a credit card. This means users can test the software’s efficiency in managing receipts without any commitments. Additionally, users can book a seat at a free webinar and get a guided tour with Synder specialists, where they can address any queries or doubts regarding Synder accounting flows.

While the primary focus of Synder is on automating accounting operations, its features can be beneficial in managing receipts, especially when integrated with other accounting software. Its automation capabilities ensure transactions are appropriately recorded, categorized, and reconciled, reducing manual efforts and errors.

Now that you’ve got the accounting side of your business covered, it’s time to consider popular receipt management apps.

Popular receipt management apps

Zoho Expense

Zoho Expense is one of the best apps that simplifies the process of capturing, organizing, and managing receipts for both personal and business expenses. While primarily known as an expense management software, Zoho Expense offers robust features specifically tailored for receipt management. Here’s an overview of Zoho Expense’s features that it offers as a receipt app:

- Receipt Capture: Zoho Expense provides various methods to capture receipts conveniently. Users can use the mobile app to snap pictures of physical receipts on the go. The app uses Optical Character Recognition (OCR) technology as a kind of a receipt scanner to extract key details like merchant name, date, and amount from the receipt image automatically.

- Digitized Receipts: By utilizing OCR technology, Zoho Expense converts physical receipts into digitized, searchable data. This eliminates the need for manual entry and ensures accuracy in expense tracking and record-keeping.

- Email Receipts: Zoho Expense allows users to forward digital receipts received via email directly to their Zoho Expense account. The software extracts the relevant information from the email and creates an expense entry with the receipt attached, saving time and reducing manual effort.

- Direct Uploads: Users can upload electronic copies of receipts directly to Zoho Expense. This feature is particularly useful for digital receipts received through online purchases or electronic invoices.

- Receipt Organization: Zoho Expense provides a centralized repository for storing and organizing receipts. Users can categorize and tag receipts, making it easy to search and retrieve specific expenses when needed. This organized approach simplifies expense tracking and ensures compliance during audits or tax filings.

- Integration with Expense Management: As a comprehensive expense management solution, Zoho Expense seamlessly integrates receipt management with expense tracking. Receipts captured or uploaded through the app are automatically associated with the corresponding expense entry, creating a complete record of each transaction.

- Mobile Accessibility: Zoho Expense offers mobile apps for iOS and Android devices, allowing users to capture receipts and manage expenses on the go. The mobile app syncs with the web version, ensuring that all data is seamlessly integrated across platforms.

- Security and Compliance: Zoho Expense prioritizes data security and complies with industry standards. Receipts and expense data are stored securely in the cloud, protected by encryption and regular backups. This ensures the confidentiality and integrity of sensitive financial information.

- Reporting and Analytics: Zoho Expense provides reporting features that enable users to generate detailed expense reports based on receipts. These reports offer insights into spending patterns, allow for expense analysis, and facilitate budgeting and financial planning.

Expensify

Expensify is a popular receipt management app that helps individuals and businesses streamline the process of capturing, tracking, and organizing receipts. It offers a range of features designed to simplify expense management and improve financial efficiency. These are the best features this app offers its users:

- Receipt Capture: Expensify allows users to capture receipts using various methods. The app supports snapping photos of paper receipts with a smartphone camera, forwarding email receipts to a designated email address, and importing electronic receipts from online purchases. This flexibility ensures that all types of receipts can be easily captured and stored.

- SmartScan Technology: Expensify uses advanced OCR technology known as SmartScan as a receipt scanner to automatically extract key information from receipt images. This includes merchant name, date, amount, and even line-item details in some cases. SmartScan saves time and reduces manual data entry, making receipt management faster and more accurate.

- Receipt Organization: Expensify provides a centralized platform for organizing and storing receipts. Users can categorize receipts by different expense types, projects, or custom tags. This organization allows for easy searching and retrieval of receipts whenever needed, ensuring efficient expense tracking and reporting.

- Real-time Expense Tracking: Expensify offers real-time tracking of expenses. Users can monitor their spending as they capture receipts, providing immediate visibility into their financials. This helps individuals and businesses with cash app business accounts stay on top of their expenses, enabling better budgeting and financial planning.

- Integration with Accounting Systems: Expensify seamlessly integrates with various accounting systems and software, such as QuickBooks, Xero, and NetSuite. This integration enables automatic syncing of expense data, eliminating the need for manual entry and ensuring accurate and up-to-date financial records.

- Policy Enforcement: Expensify allows businesses to set up expense policies and rules. The app can automatically flag potential policy violations, such as overspending or non-compliant expenses, and notify users for correction. This feature helps enforce spending guidelines and ensures compliance with company policies.

- Reimbursement Management: Expensify simplifies the reimbursement process for businesses. It calculates expense reimbursements based on policy rules and facilitates direct reimbursement to employees’ bank accounts. The app generates comprehensive expense reports that can be easily submitted for reimbursement, streamlining the entire process.

- Reporting and Analytics: Expensify provides robust reporting capabilities. Users can generate detailed expense reports, track spending trends, and analyze expense data for better financial insights. These reports help businesses make informed decisions, identify cost-saving opportunities, and maintain accurate financial records.

- Mobile Accessibility: Expensify offers mobile apps for iOS and Android devices, allowing users to capture receipts, manage expenses, and access their accounts on the go. The mobile app synchronizes seamlessly with the web version, ensuring that all data is consistently updated across devices.

- Security and Compliance: Expensify prioritizes data security and compliance. The app encrypts sensitive data, adheres to industry-standard security protocols, and undergoes regular audits to ensure the highest level of data protection. Expensify is compliant with various regulations, including GDPR and HIPAA, making it suitable for businesses that handle sensitive financial information.

Shoeboxed

Shoeboxed is a receipt management app that provides individuals and businesses with a convenient way to organize, track, and store their receipts digitally. With its focus on receipt management and expense tracking, Shoeboxed offers a range of features to streamline the process and enhance financial organization. Here’s a list of features Shoeboxed offers out of the box:

- Receipt Capture: Shoeboxed enables users to capture receipts using various methods. The app allows you to snap photos of paper receipts using your smartphone camera, forward email receipts to your Shoeboxed account, or upload digital receipts directly from your computer. This flexibility ensures that all types of receipts can be easily captured and managed.

- OCR Technology: As a receipt scanner, Shoeboxed utilizes Optical Character Recognition (OCR) technology to automatically extract relevant information from receipt images. This includes details such as vendor name, transaction date, and purchase amount. By automating data extraction, Shoeboxed saves time and reduces manual data entry.

- Organization and Categorization: Shoeboxed provides tools for organizing and categorizing receipts. Users can assign receipts to different expense categories, add tags or notes for further classification, and create custom folders or projects. This organization system makes it easy to locate specific receipts and maintain a structured approach to expense tracking.

- Data Extraction and Export: In addition to extracting key information from receipts, Shoeboxed also allows users to export their data. You can export receipt data to popular accounting software like QuickBooks or Excel, facilitating seamless integration with your financial management systems.

- Expense Reports: Shoeboxed simplifies the process of creating expense reports. The app generates comprehensive reports that include detailed expense summaries, categorized spending, and attached receipt images. These reports can be customized and exported, making it easy to share with colleagues or submit for reimbursement.

- Search and Retrieval: Shoeboxed provides a search functionality that allows users to quickly find specific receipts based on various criteria. You can search by vendor name, date range, category, or any other relevant details associated with the receipt. This feature saves time and makes it effortless to locate specific expenses when needed.

- Secure Cloud Storage: Shoeboxed stores all your receipts securely in the cloud. This eliminates the need for physical storage and reduces the risk of losing important receipts. Shoeboxed ensures data security and privacy by utilizing encryption techniques and employing industry-standard security measures.

- Mobile Accessibility: Shoeboxed offers mobile apps for iOS and Android devices. This allows users to capture and manage receipts on the go, ensuring that all expenses are promptly recorded and organized. The mobile app syncs seamlessly with the web version, ensuring data consistency across devices.

- Integration with Accounting Systems: Shoeboxed integrates with various accounting systems and financial software. You can easily export your receipt data to popular accounting tools like QuickBooks, Xero, or Wave, facilitating smooth reconciliation and expense tracking within your existing financial workflow.

Wave Receipts

Wave Receipts is a receipt management app offered by Wave Financial, a company known for its suite of financial management tools designed for small businesses and entrepreneurs. Wave Receipts provides users with a simple and convenient way to capture, organize, and track receipts digitally. Here’s an overview of Wave Receipts as a receipt management app:

- Receipt Capture: Wave Receipts allows users to capture sales receipts using their smartphone’s camera. Simply snap a photo of the receipt, and the app will automatically extract relevant information such as the merchant name, date, and amount. This eliminates the need for manual data entry and saves time.

- Organization and Categorization: The app offers tools to organize and categorize receipts for easy tracking. Users can assign receipts to different expense categories or create custom tags. This organization system ensures that all receipts are accurately categorized and can be easily retrieved when needed.

- OCR Technology: Just like all other apps we’ve mentioned, Wave Receipts’s users also take advantage of Optical Character Recognition technology as a receipt scanner to extract data from receipt images. This includes key details such as vendor name, transaction date, and purchase amount.

- Real-time Expense Tracking: Wave Receipts provides real-time expense tracking, allowing users to monitor their spending as receipts are added. This feature provides instant visibility into financials, making it easier to stay within budget and manage expenses effectively.

- Integration with Wave Accounting: Wave Receipts seamlessly integrates with Wave Accounting, Wave Financial’s accounting software. Receipts captured in Wave Receipts automatically sync with Wave Accounting, eliminating the need for manual data entry and ensuring accurate and up-to-date financial records.

- Expense Reports: Wave Receipts allows users to generate detailed expense reports. The app compiles all the receipts and associated information into comprehensive reports that can be exported or shared. This feature simplifies expense reporting, making it easier to track expenses and comply with tax requirements.

- Mobile Accessibility: Wave Receipts offers mobile apps for both iOS and Android devices, enabling users to capture and manage receipts on the go. The mobile app syncs seamlessly with the web version, ensuring that all data is consistently updated across devices.

- Data Security: Wave Receipts prioritizes data security and employs industry-standard measures to protect user information. Receipts and financial data are securely stored in the cloud, encrypted during transmission, and regularly backed up to ensure data integrity.

- Cost: Wave Receipts is offered as a free app, making it an affordable option for individuals and small businesses looking for receipt management solutions without additional costs.

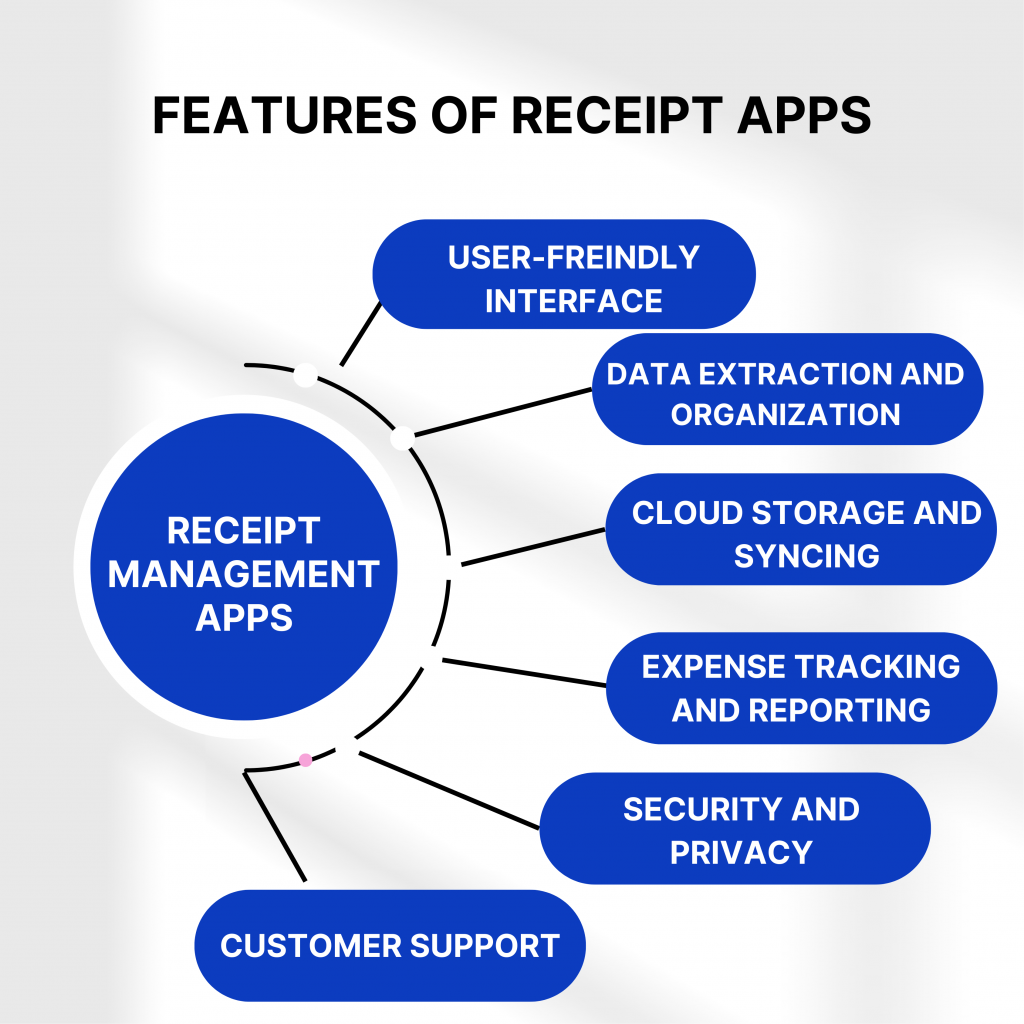

Choosing the best app for receipts: Major features of receipt management apps

Receipt management apps have emerged as a practical solution to streamline the process of organizing and tracking receipts. By digitizing receipts and storing them in a centralized receipt bank, these apps offer users a convenient way to access, manage, and analyze their financial records at any time, from anywhere.

When evaluating receipt apps, it’s crucial to consider several key features to ensure that the chosen app meets your specific needs. The following points will help you make an informed decision about the best receipt app:

User-friendly interface of the receipt app

1. Intuitive design and navigation: A user-friendly interface is one of the essential features for a seamless experience. A good app should have a clean and intuitive design that allows users to navigate effortlessly through its features and functionalities.

2. Easy receipt entry and categorization: Your app should provide simple and efficient ways to enter receipt information. It should allow users to manually input data or automatically extract it from the receipt using technology. Additionally, a good app should offer convenient options for categorizing receipts, such as assigning expense categories or creating custom tags.

3. Ability to capture receipts using various methods: One of the key features a good app should have have is supporting multiple methods for capturing receipts. This may include scanning physical receipts using the smartphone’s camera, uploading photos of receipts from the device’s gallery, or even forwarding digital receipts received via email.

Data extraction and organization of the receipt app

1. Advanced OCR capabilities: Another important feature of a good receipt app is robust Optical Character Recognition (OCR) technology that can accurately extract key information from receipts, such as the merchant name, date, amount, and item details. The OCR should be reliable even with different receipt formats, fonts, and quality.

2. Automatic extraction of key information: The best and most efficient receipt management apps should automatically extract relevant information from receipts, reducing manual data entry. This feature saves time and minimizes the chances of errors when organizing and categorizing receipts.

3. Ability to categorize and tag receipts: An effective app should allow users to categorize and tag receipts for easy searching and filtering. This feature enables users to group receipts based on specific criteria (e.g., business expenses, personal purchases) and quickly locate them when needed.

Cloud storage and syncing of the receipt app

1. Secure cloud storage for digital receipts: The best app should provide secure cloud storage for storing digital copies of receipts. This ensures that receipts are protected from loss, damage, or accidental deletion. The app should employ robust security measures, such as encryption and regular data backups, to safeguard sensitive financial information.

2. Synchronization across multiple devices: Users often access receipt management apps from different devices, such as smartphones, tablets, or computers. The app should offer seamless synchronization, ensuring that all receipts and data are up-to-date and accessible across multiple devices.

3. Integration with popular cloud storage services: Many users prefer to leverage existing cloud storage services like Google Drive, Dropbox, or OneDrive. The app should integrate with these popular cloud storage platforms, allowing users to easily export and backup receipts to their preferred cloud storage service.

Expense tracking and reporting of the receipt app

1. Ability to track expenses and generate reports: One of the best features of receipt management apps is robust expense tracking capabilities, allowing users to monitor their spending habits and track individual or overall expenses over time. It should provide clear and comprehensive reports that summarize expenses by category, time period, or custom filters.

2. Customizable expense categories and labels: The best app provides users with unique expense tracking needs. Also, the app should offer flexibility in creating and customizing expense categories and labels. This customization feature allows users to align their expense tracking system with their specific financial goals and preferences.

3. Integration with accounting software or expense management systems: For business users or those requiring more advanced financial management, integration with accounting software or expense management systems is an essential feature. The app should seamlessly integrate with popular accounting software like QuickBooks, or Xero, facilitating efficient data transfer and reducing manual entry efforts.

Check out our article about best accounting software for dropshipping in 2023 and best accounting software for Mac.

By considering these features, you can evaluate receipt management apps more comprehensively and select the one that best fits your requirements for efficient and organized receipt management.

Additional features of receipt management apps to consider

When evaluating receipt management apps, it’s also important to take into account additional factors beyond the core features. The following considerations will help you make a well-rounded assessment of the app’s suitability for your specific needs:

Security and privacy

1. Encryption and data protection measures: Ensure that the app employs strong encryption protocols to protect your sensitive financial data. Look for apps that use industry-standard encryption algorithms to safeguard your information during transmission and storage.

2. Handling of sensitive information: Verify how the app handles and stores sensitive information like receipts and financial data. Look for apps that follow best practices, such as anonymizing or pseudonymizing data, to protect your privacy and prevent unauthorized access.

3. Compliance with privacy regulations: Check if the app complies with relevant privacy regulations such as the General Data Protection Regulation (GDPR) or the California Consumer Privacy Act (CCPA). Compliance ensures that the app respects your privacy rights and handles your data in a lawful and responsible manner.

Customer support and updates

1. Availability of customer support channels: Evaluate such features as the app’s customer support options, including live chat, email, or phone support. Prompt and reliable customer support ensures that you can seek assistance or resolve issues efficiently if needed.

2. Frequency of app updates and bug fixes: Regular app updates indicate a commitment to improving functionality, addressing bugs, and implementing user feedback. Check if the app has a track record of consistent updates and bug fixes to ensure a reliable and up-to-date experience.

3. Community forums or knowledge bases: Consider whether the app provides additional resources like community forums or knowledge bases. These resources can be valuable for accessing user-generated content, tutorials, and troubleshooting tips that can enhance your understanding and usage of the app.

How can receipt apps fetch rewards

Receipt management apps can fetch rewards to their users offering several benefits for both individuals, and businesses. Here is a short overview of the key advantages of using receipt management apps:

Organization and Efficiency

Receipt management apps provide a centralized platform to capture, organize, and track receipts digitally. They eliminate the need for physical paper receipts and manual data entry, saving time and reducing clutter. Users can easily categorize and search for receipts, ensuring better organization and improved efficiency in expense tracking.

Save money

Receipt management apps help users identify cost-saving opportunities. You can save money and make your money work better by tracking and categorizing your business expenses. This way, users gain insights into their spending patterns and can identify areas where costs can be minimized. This information allows individuals and businesses to make informed decisions about budgeting and financial planning.

Compliance and Tax Preparation

Receipt management apps simplify compliance with tax regulations. Users can easily access and provide detailed records of their expenses when needed, ensuring accurate and comprehensive documentation during tax preparation or audits. This reduces the risk of penalties and helps users stay organized during tax season.

Final thoughts

When choosing the best receipt app, it’s crucial to consider several key features. Look for an app that offers a user-friendly interface with intuitive design and navigation. The best app should provide efficient receipt entry and categorization methods, such as scanning or photo upload, and have advanced OCR capabilities for automatic data extraction. The best app should offer cloud storage with secure syncing across multiple devices, integration with popular cloud storage services, and robust expense tracking and reporting features. Customizable expense categories, integration with accounting software, and strong data organization capabilities are also essential criteria to evaluate.

Ultimately, the best receipt management app for you depends on your specific needs and preferences. You might want to consider evaluating some of the top apps we’ve touched upon in the article and then, based on your requirements and/or trial periods, determine which one aligns best with your needs.

Remember, selecting the best receipt management app can significantly streamline your financial record-keeping, enhance productivity, and provide valuable insights into your financial health. But only coupled with the right accounting software you can make sure that all important aspects of your business are covered. Whether you’re a business or an individual, embracing these digital solutions will set you on the path to more efficient and organized receipt and accounting management, ultimately contributing to better financial management overall.

Read our complex guides regarding What is Authorize.net and Prenote.