As a business owner, you know that sales receipts are integral to a business’s financial management. They provide a record of all sales transactions and contain the necessary information for inventory management, record-keeping, and tax reporting. Managing sales receipts can be tedious and time-consuming. At this point, QuickBooks can help business owners handle sales receipts much more efficiently by simplifying their creation, sending, and management.

In this article, we’ll look at sales receipts and how business owners can stay on top of sales receipts management using QuickBooks.

What is a sales receipt in QuickBooks?

But let’s start with defining a sales receipt and understand the purpose of it.

In accounting, a sales receipt is a document that provides evidence of a sale transaction between a buyer and a seller. It typically includes information such as the date of the sale, the items sold, the quantities, the prices, any applicable taxes or discounts, and the payment method.

Traditionally, a sales receipt was a physical piece of paper that the seller would give to the buyer at the time of purchase. However, with the rise of digital transactions, many sales receipts are now delivered electronically, either by email or through a point-of-sale system.

Regardless of the format, a traditional sales receipt serves as a record of the transaction and can be used by both the buyer and seller for accounting and tax purposes. It is an important document for businesses to keep track of their sales and revenue, as well as for customers to keep as proof of purchase.

Level up your QuickBooks experience with Synder! Sign up for our 15-day free trial and experience the benefits firsthand. Or, if you prefer a more personal touch, reserve a spot at our Weekly Product Demo to see smart accounting automation in action.

Traditional types of sales receipts

There are various types of sales receipts that businesses may use depending on their specific needs. Here are some common types:

Point of Sale (POS) Receipts are the most common type of sales receipts and are generated by a POS system at the time of purchase. They include details such as the date and time of the sale, the items purchased, the prices, any discounts or taxes, and the payment method.

Handwritten receipts are often used by small businesses or individual sellers who do not have a POS system. They include similar information as a POS receipt but are manually written by the seller and given to the buyer at the time of purchase.

Carbon copy receipts are similar to handwritten receipts but include multiple copies that are made at the time of purchase. One copy is given to the buyer, and the other is kept by the seller for their records.

Printed receipts are generated by a printer and can be used in both POS and non-POS systems. They are often used by larger businesses or those with a higher volume of sales.

Electronic receipts are becoming increasingly popular as more businesses move towards digital transactions. They can be delivered via email, text message, or through a mobile app for receipts and provide the same information as a traditional sales receipt.

Sales receipts in QuickBooks

QuickBooks is an accounting software that provides a range of tools to help business owners manage their finances, including handling sales receipts.

In QuickBooks, a sales receipt is a type of transaction that you can use to record sales and payments all in one step. When you create a sales receipt in QuickBooks, you’re essentially telling the software that you received payment from a customer in exchange for goods or services. QuickBooks will automatically update your sales and payment records, and you can use the sales receipt to track your revenue and cash flow.

Using sales receipts in QuickBooks can be particularly useful for businesses that make a lot of sales in person, such as retailers or service providers. Instead of having to create an invoice and then receive payment separately, you can create a sales receipt on the spot and immediately record the payment, saving time and reducing the risk of errors or lost payments.

Why does a business need sales receipts?

Sales receipts are an important tool for businesses to keep track of their sales transactions, manage their inventory, and comply with applicable laws and regulations. Let’s see how businesses can leverage them.

- Record-keeping

Sales receipts provide a record of all the sales transactions made by a business. They include details such as the date of the sale, the items sold, the price, and the payment method. This information is important for tracking the business’s revenue and expenses and for preparing financial statements and tax returns.

- Customer Service

Sales receipts provide customers with proof of their purchase. If a customer has an issue with a product or wants to return it, they will need to provide a sales receipt as proof of purchase. Providing sales receipts to customers can help build trust and improve the customer experience.

- Inventory Management

Sales receipts can help businesses track their inventory levels. By keeping track of the items sold on each sales receipt, businesses can ensure that they have enough inventory to meet customer demand and avoid stockouts.

- Compliance

Sales receipts are often required for compliance purposes, such as tax reporting. By keeping accurate records of all sales transactions, businesses can ensure that they are in compliance with applicable laws and regulations.

What challenges businesses might face managing sales receipts?

So, sales receipts are crucial for record-keeping and financial management. At this point, accuracy matters, and it’s where things can become complicated. Here are some common challenges of sales receipt management:

- Manual data entry

One of the most significant challenges of sales receipt management is manual data entry. Entering sales receipts into a system can be time-consuming and error-prone, especially when businesses have a high volume of sales.

- Organization

Managing a large number of sales receipts can be challenging, and without proper organization, businesses risk losing track of important records. This can lead to errors in financial reporting and difficulties in tax preparation.

- Accessibility

When sales receipts are stored in physical files, they may not be easily accessible to all employees who need them. This can slow down the sales process and make it difficult to track sales.

- Data accuracy

Errors in sales receipt data, such as incorrect prices or payment methods, can lead to inaccurate financial reporting and impact a business’s bottom line.

- Security

Sales receipts contain sensitive financial information, so businesses need to ensure they are stored securely to prevent theft or loss.

How does QuickBook help manage sales receipts?

As you can see, there are some points at which things can go wrong (and, you know, they usually do), putting your books in a mess. And it’s where software like QuickBooks can be a solution, as it automates the sales receipt process, making it faster and more accurate. It also provides a centralized location to store sales receipts, making them easily accessible and organized.

Here are some ways in which QuickBooks helps with creating and managing sales receipts:

- QuickBooks automatically saves all sales receipts, making it easy for business owners to track their sales and revenue. This can help with inventory management, financial reporting, and tax preparation.

- QuickBooks can be accessed from anywhere with an internet connection, making it easy for business owners to create sales receipts on-the-go or from remote locations.

- QuickBooks allows users to customize their sales receipts with their logo, colors, and branding. This can help businesses create a professional and consistent look across all their sales documents. Moreover, ensuring accurate recording of gross receipts is essential for businesses to have a comprehensive view of their financial performance.

- QuickBooks integrates with other software and services, such as payment processors and shipping services, to help streamline the sales process. This can help businesses save time and reduce errors.

This way, QuickBooks can help businesses create professional-looking sales receipts, streamline the sales process, and improve record-keeping. By automating the sales receipt process, business owners can save time, reduce errors, and focus on other important aspects of running their business.

How to create sales receipts in QuickBooks?

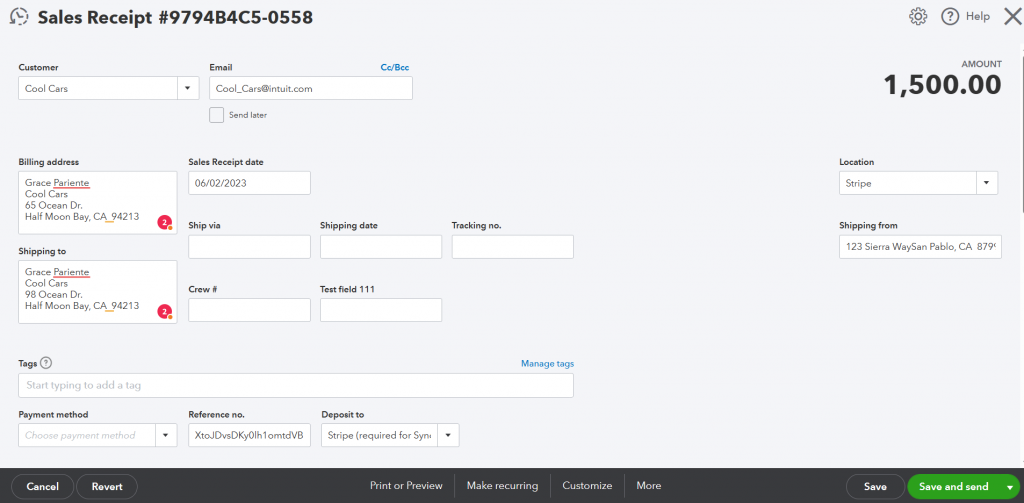

To create a sales receipt in QuickBooks, follow these steps:

- In the QuickBooks Dashboard, and click on the + New button in the upper right-hand corner of the screen.

- Select Sales Receipt from the list of options.

- Choose the customer who is making the purchase by typing their name in the Customer field.

- Select the products or services being sold by either typing in the name of the product or selecting it from the list of items in the Product/Service field.

- Enter the quantity being sold and the price for each item.

- If applicable, add any discounts or sales tax to the purchase.

- Choose the payment method being used by the customer by selecting it from the drop-down menu.

- Review the information on the sales receipt to ensure that it is correct.

- Click on the Save and Send button to send the sales receipt to the customer via email, or select Save and Close to save the sales receipt without sending it.

Once the sales receipt has been created, it will be recorded in QuickBooks and can be used for record-keeping, inventory management, and tax reporting purposes.

Bottom line

In conclusion, sales receipts are a critical component of any business’s financial management. While their management can pose several challenges, such as manual data entry, organization, accessibility, data accuracy, and security, QuickBooks provides an effective solution to these challenges. By using QuickBooks, businesses can automate their sales receipt process, making it faster and more accurate, while also providing a centralized location to store sales receipts securely. QuickBooks also offers tools to customize sales receipts to reflect a business’s branding and make them look more professional. By leveraging QuickBooks, businesses can streamline their sales receipt management and improve their financial processes.

Please note that the information provided in this article is intended for general informational purposes only and should not be relied upon as professional advice. The steps outlined may not be suitable for every situation, and it’s essential to consult with a professional accountant or financial advisor before making any significant financial decisions. Additionally, the information presented in this article is current as of the knowledge cutoff date and may not reflect any updates or changes made to QuickBooks software or policies since then.

Share your thoughts

Feel free to share your thoughts in the comments! We’d love a good discussion.

.png)

we rec’d credit card payment on Monday, made a sales receipt to record the payment. Order was canceled on Tuesday, credit card refund was made. How do I clear the sales receipt? I made a credit memo to record the refund, but QBO shows it as an unapplied payment. How do I connect the 2 transactions?

Hi Pat, credit memos are entities that are best used to change amounts in records due such as invoices. For sales receipts the simplest and quickest way is to create a refund receipt in QBO and assign it to the same account as the sales receipt. Consequently, these entities will balance themselves out as they are basically the opposites of each other. Now, before you create the refund receipt, you need to delete the memo. You can do that by accessing the account in the Chart of Accounts and deleting the entry. After removing extraneous entries, you can safely create a refund receipt. I hope this helps. Best of luck!