Overview:

Having connected your accounting company – Xero and your Stripe account (and other payment processors if needed) to Synder, you can start customizing your settings for your Stripe Xero integration.

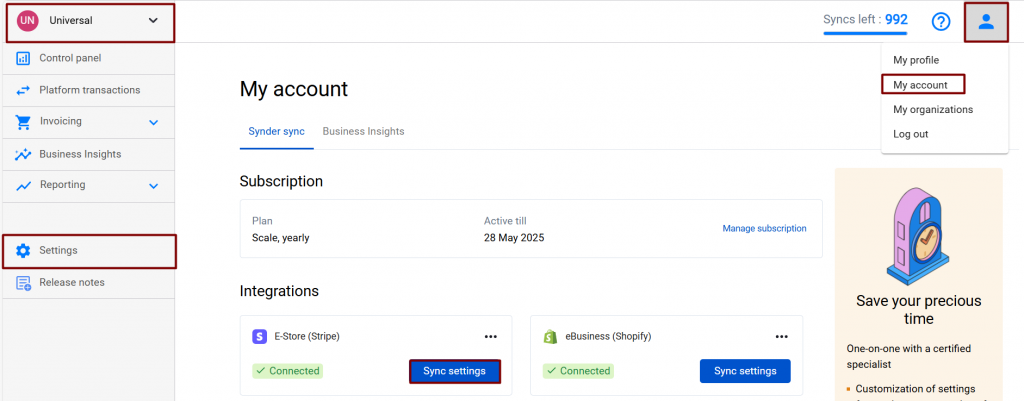

To access your Stripe settings, select the organization needed at the top left of the page → Settings button on the left menu of Synder → choose the Stripe integration from the dropdown. Alternatively, click on the Person icon in the upper-right corner → hit My account → click on Sync settings under Stripe.

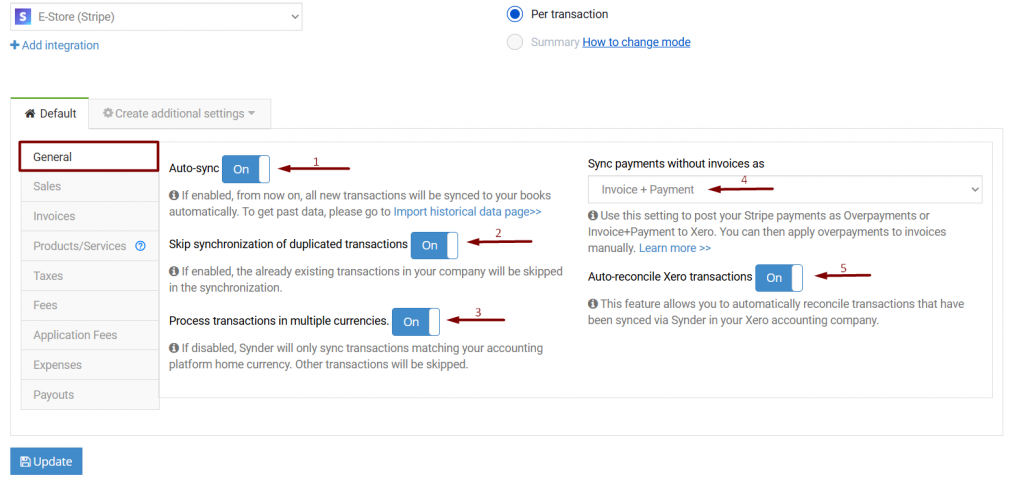

1. General tab settings

- Auto-sync – when “ON”, Synder will automatically synchronize transactions that come into the system after the setting has been enabled. When “OFF”, you can manually choose transactions to be synced.

Learn more about the auto-sync Synder mode. - Skip synchronization for duplicated transactions – when “ON”, transactions that already exist in your Xero company will not be synced again.

- Process transactions in multiple currencies – when “ON”, the system will synchronize transactions not only in your home currency, but also in multi currencies. When “OFF”, the synchronization of transactions in other currencies will be skipped.

- Opt to Sync payments without invoices as Invoices + Payments or Overpayments. Syncing payments as overpayments allows you to close any invoices created after receiving payments in your accounting system, keeping your accounts accurate and up-to-date.

- Auto-reconcile Xero transactions – this feature helps to automatically reconcile transactions that have been synced via Synder in your Xero accounting company.

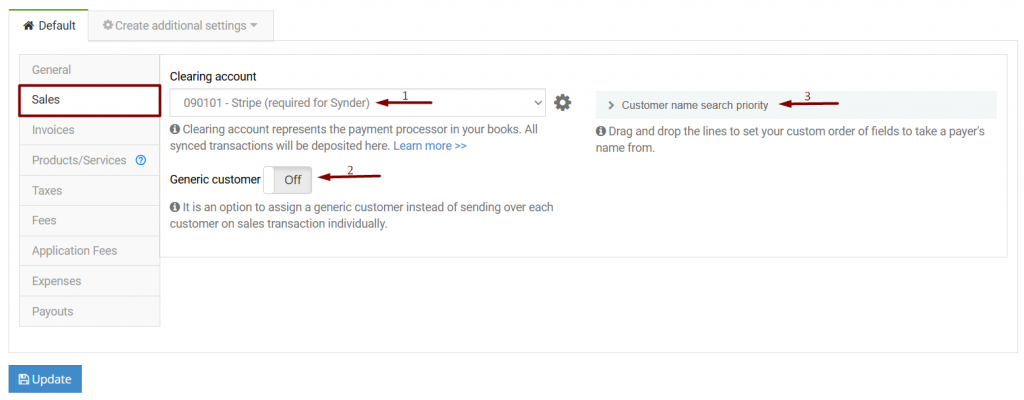

2. Sales tab settings

- Clearing account – a buffer account that Xero payments, refunds and bills will be deposited into.

- Generic customer – when “ON”, it assigns a generic customer name to all of your transactions. Click on to select a name. Choose from existing ones or type in a custom name.

- Customer name search priority – drag and drop to the top of the list the field where the name of the customer should be taken from. If the name is not in the field specified on the top of the list, then Synder will look at the second specified field and so on. Check out our helpful guide to learn more about Customer name search priority.

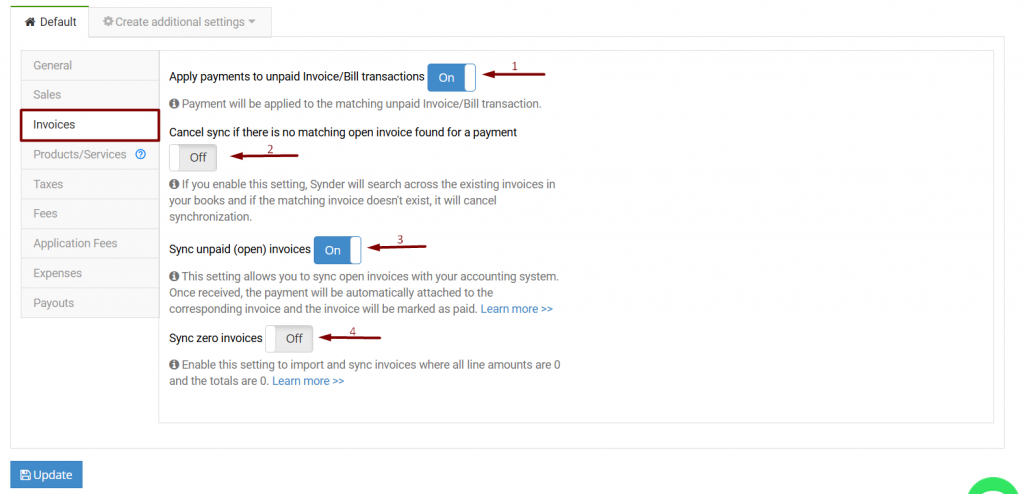

3. Invoices

- Apply payments to unpaid Invoice/Bill transactions – when “ON”, once the system encounters a payment that matches an unpaid invoice, it will be automatically applied to it.

- Cancel sync if there is no matching open invoice found for a payment – if there isn’t an open invoice that can be closed with a payment from Stripe, the system will cancel the synchronization of your payment.

- Sync unpaid (open) invoices – this setting allows syncing open invoices with your accounting system. When a payment comes in, it automatically attaches to the right invoice and marks it as paid.

- Sync zero invoices – turn on this setting to import and sync invoices with zero line amounts and total amounts.

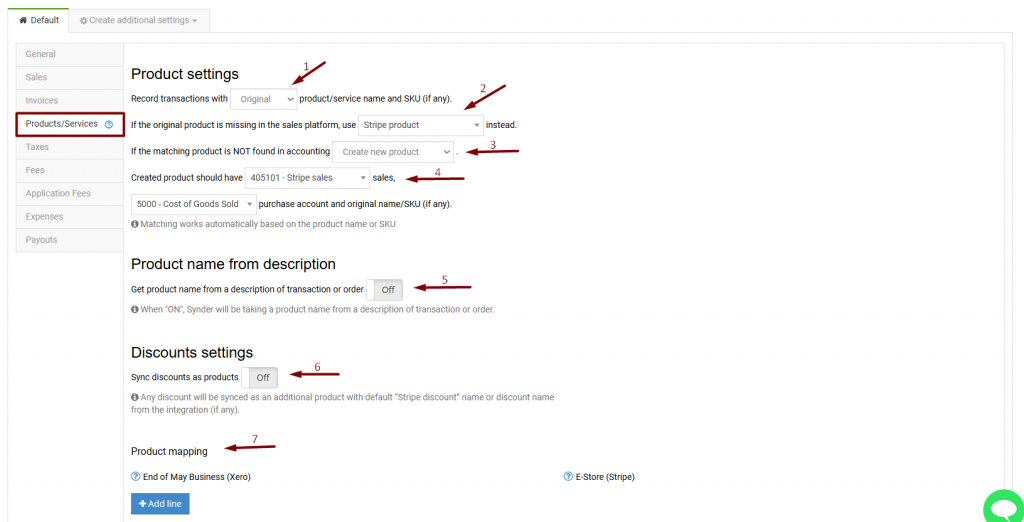

4. Products and Services tab settings

This setting tab is targeted at new products and services which are created during the synchronization. Product/service type can only be non-inventory or service, because when Synder creates a new product, it does not have access to its Quantity on hand. Existing inventory products will be properly updated.

The income account specified here will be used for creating new products and services only.

- Record transactions with Original/Common product/service name and SKU (if any) – choose whether you want Synder to record transactions with the original product name. This option will either map the product to an existing one by an item name or SKU, or create a new one if it doesn’t exist. Alternatively, record them with a common product name. This will log all further transactions with a specific name you can select below.

- If the original product is missing in the sales platform, use the item name/SKU instead – this product you select will be created if there is no matching one available.

- If the matching product is NOT found in accounting, you can choose to either let Synder create a new product or cancel the synchronization of your transaction.

- Select the type of newly created product, which can be either non-inventory or service, and choose the income account that will be assigned to the newly created product.

- Get product name from a description of transaction or order – When enabled, Synder pulls the product name from the transaction or order description, often found in Stripe charge details.

- Sync discounts as products – any discount will sync as an extra product named “Stripe discount” or another name from the integration, if available.

- Product mapping – Synder is able to identify existing products in your accounting company and apply them to transactions. If product names in your payment system and accounting company don’t match 100%, fill in the product names from your payment platform in the right field to map it to product names from your Xero in the left field. Check out an additional guide about product mapping feature.

Note: please check the plans where the product mapping feature is available by following this link.

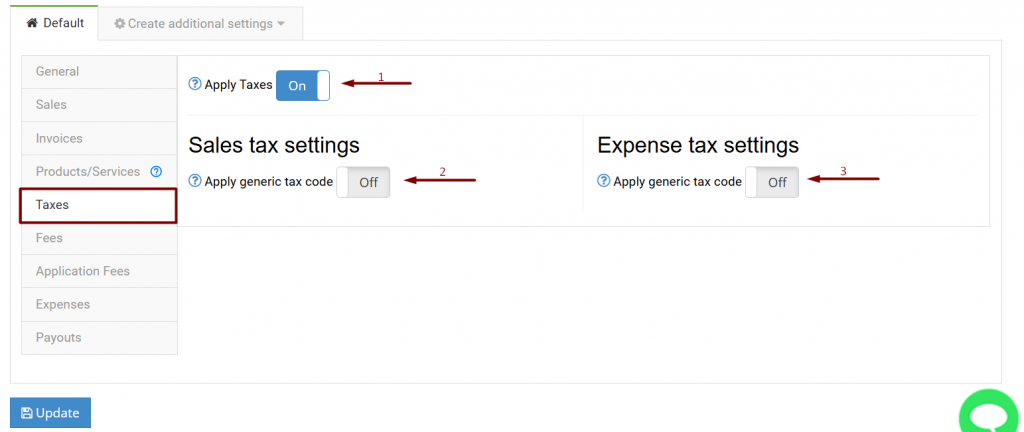

5. Taxes tab settings

Synder transfers over existing taxes into Xero respective fields so that everything will be correct in your tax reporting. However, note, if there is no tax on the payment processor side – Stripe, there is nothing to transfer over, and the system will not generally apply taxes to synced transactions (only some options like the ‘Apply generic tax’ feature may be used).

- Apply Taxes – when “ON”, the system will search for a matching tax code and apply it.

- Sales tax settings. Apply generic tax code – when “ON”, the system will apply the tax rate you specify in the settings to both taxable and non-taxable Sales transaction you sync.

- Expense tax settings. Apply generic tax code – when “ON”, the system will apply the tax rate you specify in the settings to both taxable and non-taxable Expense transactions you sync.

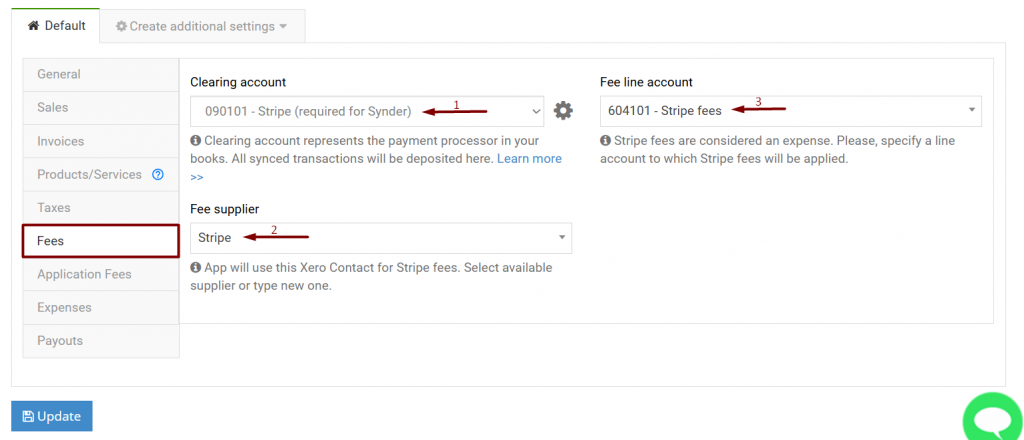

6. Fees tab settings

- Clearing account – this setting specifies the clearing account to which the Stripe fees are applied. We recommend using the same account as in Sales – Clearing account.

- Fee supplier – the system will use this Xero Supplier to associate with your Stripe fees. Select available, or type in a custom one, like “Stripe”.

- Fee line account – this setting specifies the category to which the Stripe fees are applied.

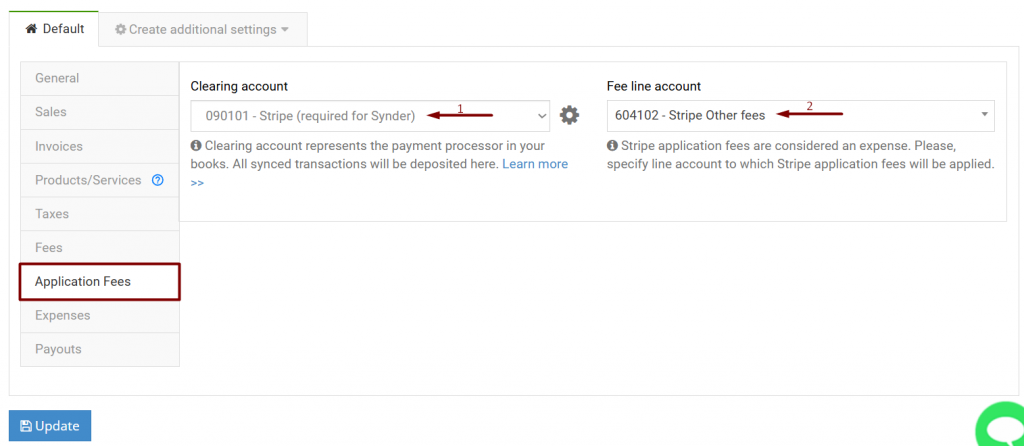

7. Application fees tab settings

- Clearing account – this setting specifies the clearing account to which the application fees are applied. We recommend using the same account as in the Sales – Clearing account.

- Fee line account – this setting specifies the category to which the application fees are applied.

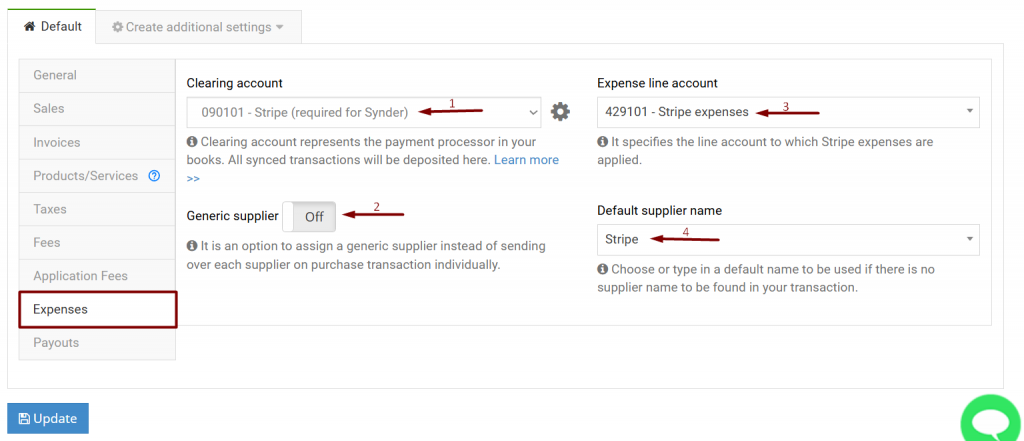

8. Expenses tab settings

- Clearing account – this setting specifies the Clearing account that the expenses are attributed to. We recommend using the same account as in Sales – Clearing account.

- Generic supplier – when “ON”, it assigns a default vendor name to all of your Stripe transactions, replacing names going from payment processor – Stripe. Click on the drop-down under “Generic vendor name” to select a name. Choose from existing ones or type in a custom name.

- Expense line account – this setting specifies the category to which the Stripe expenses are applied.

- Default supplier name – сhoose or type in a default name to be used if there is no supplier name to be found in your Stripe transaction.

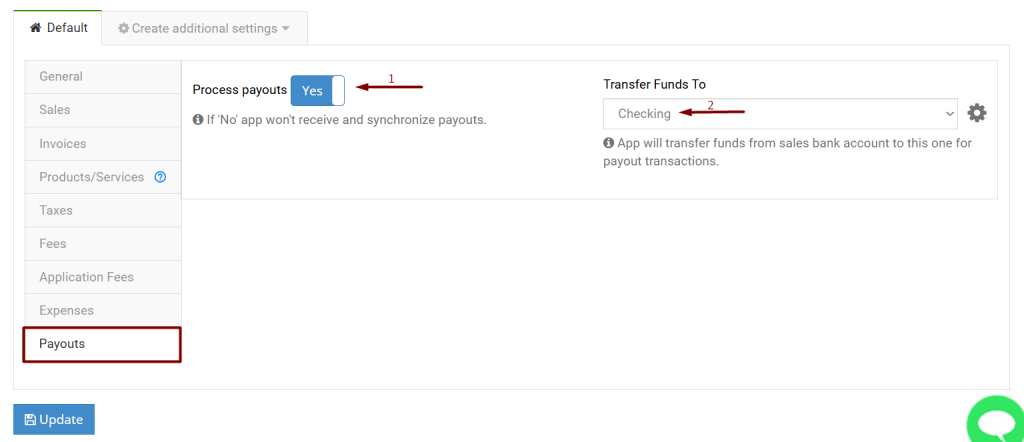

9. Payouts tab settings

This tab allows tracking Stripe Payouts – bulk daily/monthly/weekly/etc. money transfers from your payment processor to the bank. Synder will record them in an accounting company as a Bank transfer from/to clearing account to/from checking account. Payouts synchronization is needed to make the reconciliation process easier for you – by syncing Sales transactions (and expenses) along with the Payouts, Synder mirrors the actual money flow happening in your payment platform.

- Process payouts – when “ON”, Synder will track and create bank transfers reflecting Stripe payouts to your checking account.

- Transfer Funds To – Choose the checking account that you deposit the funds from Stripe to.

Reach out to the Synder team via online support chat, phone, or email with any questions you have – we’re always happy to help you!