TIE, or Times Interest Earned, is an important metric a business might want to understand to accurately evaluate and manage cash flow. It speaks of a company’s ability to manage its debt obligations, financial health and creditworthiness and make informed financial decisions.

In this article, we’ll tackle the concept of TIE, why it’s crucial for businesses, how to measure it, what constitutes a good TIE ratio, and strategies for improving it. Let’s get started.

What is TIE or Times Interest Earned?

Times Interest Earned (TIE) is a crucial financial indicator that offers valuable insights into a company’s financial stability by evaluating its capability to fulfill interest payments on outstanding debt obligations.

This metric quantifies the extent to which a business can offset its interest expenses using its earnings before interest and taxes (EBIT).

In other words, TIE serves as a litmus test for a company’s financial well-being, providing a clear picture of its ability to manage and service its debt through its operational income.

A higher TIE ratio usually suggests that a company has a more robust financial position, as it signifies a greater capacity to meet its interest obligations comfortably. This, in turn, may make it more attractive to investors and lenders, as it indicates lower default risk.

Conversely, a lower TIE ratio raises concerns about a company’s financial health, as it implies a reduced ability to cover interest costs with current earnings. Such a situation may lead to difficulties in securing financing or even jeopardize the company’s ongoing operations if debt servicing becomes unsustainable.

As a result, TIE plays a pivotal role in financial analysis and decision-making, helping stakeholders assess the financial resilience and risk profile of a company.

Why is TIE important for a business?

Now, let’s take a more detailed look at why businesses might want to consider TIE to manage finances wiser and get a more accurate picture of their financial stability. There are several ways in which TIE impacts business’s assessment of its financial health.

Debt service viability

As mentioned, TIE is a sort of a test for a company’s ability to meet its debt obligations. It does so by indicating whether a company can comfortably pay off its interest obligations from its operational income.

When the TIE ratio is low, it raises red flags, suggesting that the company may struggle to meet its debt payments. This situation can potentially lead to financial distress, credit rating downgrades, or even default, which can have severe consequences for the company’s operations and reputation.

Creditworthiness assessment

TIE is a critical metric in the eyes of lenders and investors alike. Lenders rely on it to gauge the creditworthiness of a company. A higher TIE ratio implies a lower risk of default on interest payments, which makes the company more appealing to creditors.

This, in turn, can translate into easier access to financing with more favorable terms, such as lower interest rates. For investors, a strong TIE ratio indicates that the company is better positioned to service its debt, reducing the investment risk associated with potential defaults.

Operational efficiency benchmark

Beyond financial stability, TIE provides valuable insights into a business’s operational efficiency.

A higher TIE ratio suggests that the company is generating substantial profits relative to its interest costs. This showcases effective financial management, as it demonstrates that the company’s core operations are generating enough income to cover its financial obligations.

Conversely, a low TIE may indicate inefficiencies in the business model, prompting management to explore strategies for improving profitability and cost management.

Investment attractiveness

Investors closely scrutinize a company’s TIE ratio when evaluating investment opportunities.

A healthy TIE ratio can make a company more attractive to potential investors, as it instills confidence in the company’s financial strength and ability to meet its financial commitments. This increased attractiveness can drive up demand for the company’s stock, potentially leading to an increase in its stock price and overall market value.

Thus, TIE plays a pivotal role not only in assessing a company’s financial health but also in shaping its investment attractiveness and market performance.

How to measure and calulate Times Interest Earned?

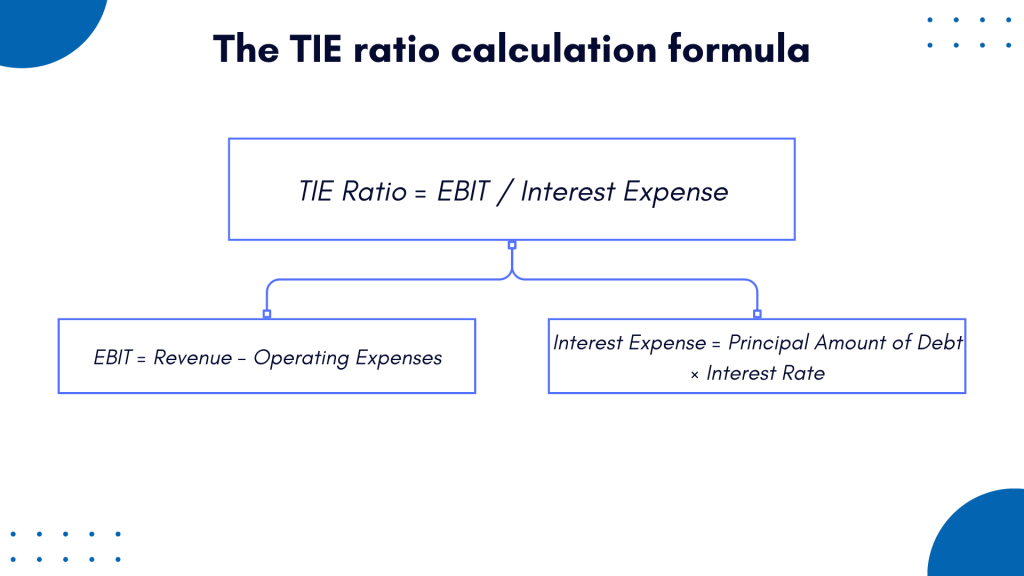

The TIE ratio is calculated using the straightforward formula:

TIE Ratio = EBIT / Interest Expense

To delve deeper into this calculation, we’ll break down its components.

EBIT (Earnings Before Interest and Taxes)

EBIT is a fundamental component of the TIE ratio and represents a company’s operating profit before accounting for interest and taxes. It serves as a key indicator of a company’s core profitability, revealing how well its day-to-day operations are performing.

EBIT is calculated by subtracting the cost of goods sold (COGS), operating expenses, and depreciation and amortization from a company’s total revenue. The resulting figure reflects the earnings generated solely from the core business activities, excluding any financial or tax-related considerations.

You can use the following formula:

EBIT = Revenue – Operating Expenses

Where:

- Revenue represents the total income generated by the company from its primary operations, such as sales of goods or services.

- Operating Expenses are the costs directly associated with the company’s day-to-day operations, including items like salaries, rent, utilities, and depreciation.

It’s worth mentioning that EBIT is often used as an intermediate step in financial analysis to calculate various financial metrics such as EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) or operating income, which provides a clearer picture of a company’s operating performance by excluding interest and taxes.

Where to find the components for EBIT calculation?

To find the components needed for calculating EBIT, you typically need to review the income statement (also known as the profit and loss statement) and possibly other parts of the financial reports. Here’s where to look for each component:

- Revenue:

- You can find the total revenue generated by the company in the income statement. Look for a line item usually labeled “Revenue,” “Sales,” or “Sales Revenue.” This figure represents the total income from the company’s primary operations.

- Operating Expenses:

- Operating expenses are also listed on the income statement. They are typically categorized into various expense items, which may include items like:

- Cost of Goods Sold (COGS): This includes the direct costs associated with producing goods or services.

- Selling, General, and Administrative (SG&A) Expenses: This category includes expenses like salaries, rent, utilities, marketing expenses, and other day-to-day operational costs.

- Depreciation and Amortization: These represent non-cash expenses related to the depreciation of assets over time.

- To calculate EBIT, you’ll want to sum up these operating expenses to get the total operating expenses for the period.

- Operating expenses are also listed on the income statement. They are typically categorized into various expense items, which may include items like:

Read more about learn about Asset Turnover Ratio.

Interest Expense

This is the second crucial element in the TIE ratio equation. It represents the total cost of interest payments a company must make on its outstanding debt.

Interest expense encompasses all interest-related obligations, such as interest on loans, bonds, or any other interest-bearing liabilities. It is a direct measure of the financial burden imposed by the company’s debt. Tracking interest expense is vital for assessing a company’s ability to manage its debt load effectively.

The formula for Interest Expense is relatively straightforward:

Interest Expense = Principal Amount of Debt × Interest Rate

Where:

- Principal Amount of Debt is the total amount of debt on which the company is paying interest. It can include loans, bonds, or any other form of borrowed funds.

- Interest Rate is the annual interest rate being charged on the debt. It’s usually expressed as a percentage.

Please note that this formula provides a straightforward calculation for interest expense if the interest rate remains constant throughout the period. In reality, interest rates can vary, especially for variable-rate debt, and interest expenses may need to be calculated over specific time periods, such as monthly or quarterly, depending on the company’s reporting practices. Additionally, there may be other factors, such as amortization of debt issuance costs or interest rate changes over time, that can affect the precise calculation of interest expense on a company’s financial statements.

Where to find the components needed to calculate Interest Expense?

To find the components needed for the calculation of Interest Expense in a company’s financial statements, you typically need to review the company’s notes to the financial statements, as well as the income statement and balance sheet. Here’s where to look for each component:

- Principal Amount of Debt:

- The principal amount of debt can be found on the company’s balance sheet, specifically under the liabilities section. Look for line items such as “Long-Term Debt,” “Bonds Payable,” “Notes Payable,” or similar terms. The balance sheet will provide the current amount of outstanding debt.

- Interest Rate:

- The interest rate can vary depending on the type of debt and the terms of the borrowing. You can find the interest rate in several places:

- In the notes to the financial statements: Companies often disclose details about their debt in the notes to the financial statements, including the interest rates on specific debt instruments.

- In the income statement: Some companies may list the interest expense as a separate line item in the income statement, and the interest rate may be disclosed there.

- In financial footnotes: Companies sometimes provide additional details about their debt in footnotes to the financial statements, including interest rates and maturity dates.

- The interest rate can vary depending on the type of debt and the terms of the borrowing. You can find the interest rate in several places:

Example of the Times Interest Earned ratio calculation

The TIE ratio provides a clear picture of how many times a company can cover its interest expenses with its operating profits. For example, if a company has an EBIT of $500,000 and an interest expense of $100,000, its TIE ratio would be 5. This means the company’s operating profit is sufficient to cover its interest expenses five times over, indicating a healthy financial position.

It’s worth mentioning that the accuracy of financial data that a company uses to calculate their TIE ratio place a significant role in the correct assessment of their financial position and decision-making. At this point, it can be challenging for businesses, especially those having to deal with large volumes of transactions from various sources to account for them correctly.

Synder can help automate accounting, integrating data from multiple sources with the high level of accuracy, and ensure always accurate data in the books, easy accounts reconciliation and informative financial reporting with just a couple of clicks. On top of that, you get a 360-degree view of your business performance in real time.

Book a seet at our free demo to learn more about Synder’s ability to help your business of sign up for a free trial to explore Synder by yourself and see whether it can fit the bill for you.

What is considered a good TIE ratio?

We mentioned that a company with a higher TIE ratio is typically considered to have a more stable financial health than a company with the lower ratio. But how to determine that good TIE ratio?

Generally, a TIE ratio above 2 is considered reasonable, indicating that a company can cover its interest payments comfortably. At this point, a higher TIE ratio is generally better, as it signifies a stronger financial position and lower financial risk. Conversely, a TIE ratio below 1 suggests that a company cannot meet its interest obligations from its operating income alone, which is a cause for concern.

However, it’s important to compare a company’s TIE ratio to industry peers and historical performance for a more accurate assessment. That’s because the interpretation of a good TIE ratio depends on the industry, company size, and specific circumstances and requires a nuanced analysis that takes into account various factors.

Let’s break them down.

- Industry considerations

Different industries have varying levels of financial risk and operational volatility. For instance, a utility company might have a higher debt load and, therefore, a lower TIE ratio compared to a tech startup, which relies on venture capital funding. A “good” TIE ratio in one industry may not be the same in another. Therefore, it’s essential to benchmark a company’s TIE ratio against industry peers to get a more accurate picture of its financial health. - Company size

The size of a company can also influence what constitutes a good TIE ratio. Larger corporations may be able to handle higher debt levels and, consequently, have lower TIE ratios compared to smaller businesses. Smaller companies often need to maintain higher TIE ratios to prove their financial stability to creditors and investors. - Specific circumstances

The specific financial circumstances of a company can significantly impact its TIE ratio assessment. For example, a company in the midst of a major expansion or acquisition may temporarily have a lower TIE ratio due to increased interest expenses. In such cases, investors and analysts need to consider the context and future outlook when evaluating the ratio. - Historical performance

Analyzing a company’s TIE ratio in isolation might not provide the full picture. Comparing it to the company’s historical performance can reveal trends and changes in its financial stability. A declining TIE ratio over several years may indicate increasing financial risk, while an improving trend may signify better financial management. - Interest rate environment

The prevailing interest rate environment also plays a role in interpreting the TIE ratio. In a low-interest-rate environment, companies can typically maintain lower TIE ratios as interest expenses are more manageable. Conversely, in a high-interest-rate environment, companies may need higher TIE ratios to comfortably meet interest payments. - Creditors’ perspective

Creditors, such as banks and bondholders, use the TIE ratio to assess the creditworthiness of a company. A “good” TIE ratio from their perspective might differ from that of equity investors. A company with a lower TIE ratio might still be able to secure debt financing if it has strong collateral or a solid track record of making timely interest payments.

How can a business ensure having a good Times Interest Earned ratio?

Now, as we know what to consider a good Times Interest Earned ratio and how it impacts the evaluation of a business’s financial position, let’s delve further into how a business can achieve a favorable TIE ratio and let’s explore these strategies in greater detail

Increase profitability

Boosting EBIT (Earnings Before Interest and Taxes) is a fundamental approach. Businesses can do this by:

- Increasing sales

Expanding the customer base or launching new products/services can drive revenue growth. - Cost control

Implementing efficient cost management strategies can lead to higher profits. - Efficiency improvements

Streamlining operations and reducing waste can increase EBIT.Enhanced profitability directly translates into a larger buffer for interest payments.

Refinance debt

Companies should keep a watchful eye on their existing debt instruments. When interest rates decrease or creditworthiness improves, refinancing high-interest debt with lower-cost options can significantly reduce interest expenses. This can involve negotiating better terms with current lenders or seeking alternative financing arrangements.

Reduce debt

Paying down debt not only reduces the principal amount owed but also lessens interest burdens. Additionally, extending the maturity of existing debt can spread out payments, making them more manageable. These actions increase the TIE ratio by lowering the interest portion of the equation.

Diversify revenue streams

Overreliance on a single product line or market can expose a business to undue risk. By diversifying and expanding into new markets or product lines, a company can increase its revenues and, subsequently, its EBIT. This provides a stronger cushion against interest expenses.

Manage working capital

Efficient management of working capital, which includes managing cash, accounts receivable, and inventory, is essential. Freeing up cash through optimized working capital practices ensures that a business has the liquidity to meet interest payments. Efficient working capital management can be achieved through practices like inventory optimization, timely collections from customers, and smart cash flow planning.

Prudent debt management

Excessive borrowing can strain a company’s finances. Maintaining a balanced debt-to-equity ratio is essential to prevent over-leveraging. A prudent approach to debt means taking on only as much debt as the business can comfortably handle, considering its cash flow and profitability.

Times Interest Earned: a final word

In conclusion, TIE, a solvency ratio indicating the ability to pay all interest on business debt obligations, plays a pivotal role as part of their credit analysis to assess a company’s creditworthiness. A robust TIE ratio serves as a beacon of financial stability and creditworthiness, making it indispensable for businesses to manage effectively. Strategies aimed at enhancing TIE encompass optimizing profitability, efficient debt management, and operational excellence.