Accounting, often referred to as the “language of business,” uses a variety of terms and concepts. Among these are the concepts of “temporary” and “permanent” accounts. Understanding these terms and their implications are crucial for accurate financial reporting and decision making. This article will delve into what these accounts are, how they operate, and their impact on business accounting.

Understanding temporary accounts: The pulse of the financial year

Just as the seasons shape the rhythm of the year, temporary accounts define the pulse of the financial year. These accounts, a fundamental component of accounting, are dynamic, tracking transactions that tell the financial story of an organization during a specific period. This article will guide you through a comprehensive exploration of temporary accounts, their role, characteristics, and the critical functions they serve in business accounting.

The essence of a temporary account

Also known as nominal accounts, temporary accounts are fundamental tools for recording and summarizing the financial activities of a business within a single accounting period. Their primary role is to gather data related to income, expenses, and dividends, offering insights into the performance of the business during that time frame.

Temporary accounts, true to their name, do not carry forward their balances to the next accounting period. Instead, they begin each period with a zero balance, accumulate data throughout the period, and then reset to zero at the end of the period.

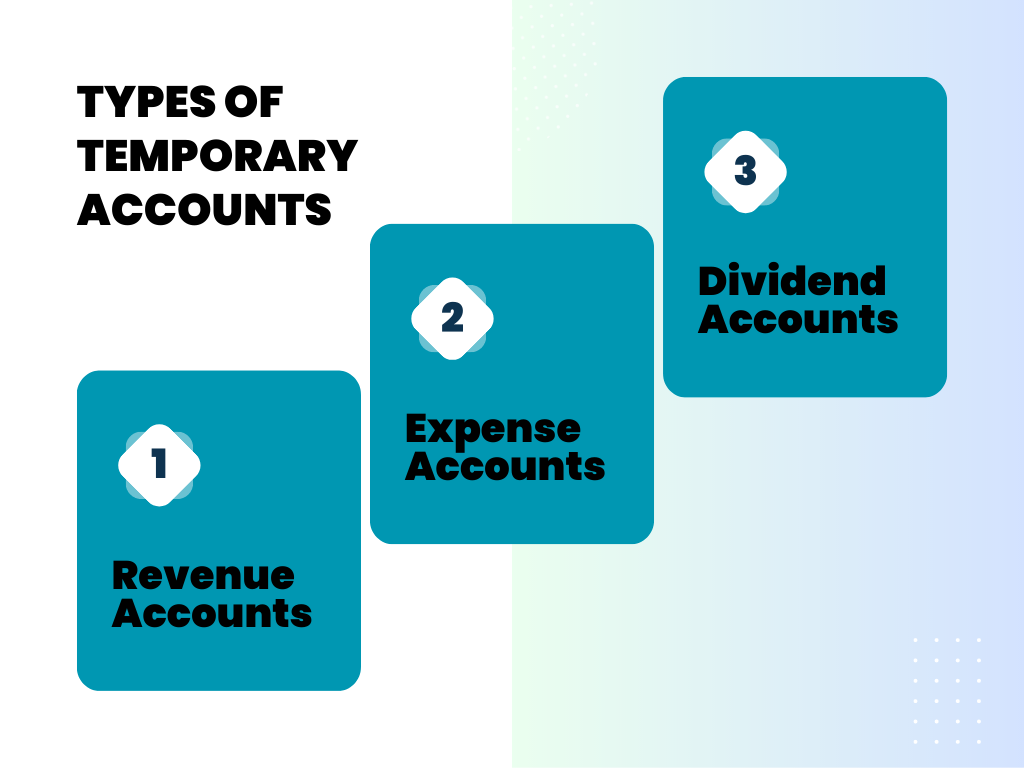

Types of temporary accounts

Temporary accounts can be broadly categorized into three types:

Let’s explore each type in more detail.

1. Revenue accounts

These accounts track all the income generated by the business during a specific accounting period. Revenue can come from various sources, such as sales, interest income, or service fees.

2. Expense accounts

Expense accounts record all the costs incurred by the business during an accounting period. This includes salaries, rent, utilities, depreciation, and cost of goods sold, among others.

3. Dividend accounts

The dividend account is used to track any dividends that a business pays out to its shareholders during an accounting period. It’s important to note that this account is closed to retained earnings at the end of the accounting period, just like other temporary accounts.

💡 Unlock the full potential of your business finances with Synder’s COGS tracking. Elevate your accounting efficiency and gain deeper insights into your operations.

Operating cycle of temporary accounts

The defining characteristic of temporary accounts is their cyclical operation. At the beginning of an accounting period, all temporary accounts are opened with zero balances. As business transactions occur throughout the period, these transactions are recorded in the appropriate temporary accounts.

At the end of the accounting period, the balances in these accounts are transferred to a permanent equity account, typically the retained earnings account. This process is known as “closing the books.” Once the balance is transferred, the temporary account balance is reset to zero, ready to track transactions in the next period.

Breaking down a temporary account: The role of temporary accounts in financial statements

Temporary accounts play a critical role in the creation of financial statements, especially the income statement and the statement of retained earnings.

The income statement, which shows the profitability of a company during a particular period, is primarily derived from the revenue and expense accounts. The difference between the totals in the revenue accounts and the expense accounts gives the net income or net loss for the period.

The statement of retained earnings is directly affected by the dividend account and net income or loss from the income statement. It shows how the company’s retained earnings have changed during the period, taking into account any dividends paid out to shareholders.

Understanding permanent accounts: Which is not a temporary account in accounting?

Just as a backbone provides essential support to the body, permanent accounts offer foundational stability to a business’s financial structure. They record the long-term financial activities of a business, creating an ongoing narrative of its economic health.

Unpacking the concept of permanent accounts

Permanent accounts, also known as real accounts, are used to record and accumulate data about a company’s financial position over multiple accounting periods. They offer a running record of a company’s assets, liabilities, and equity—elements that define its net worth.

Unlike temporary accounts, permanent accounts do not reset to zero at the end of each accounting period. Instead, they carry their balances forward, continuously accumulating data over time. This ongoing record provides a comprehensive view of the company’s financial position.

Types of permanent accounts

Permanent accounts can be broadly categorized into three types:

Let’s have a closer look at each type of permanent accounts.

1. Asset accounts

These accounts track what a company owns. This includes tangible items like cash, inventory, buildings, and equipment, as well as intangible items like patents, trademarks, or goodwill. The value recorded in these accounts is generally what the business paid for these items or their fair market value.

2. Liability accounts

Liability accounts record what a company owes to others, which also answers the question “Is unearned revenue a liability?” Indeed, it includes short-term debts such as unearned revenue, accounts payable, or wages payable, and long-term liabilities such as loans or mortgages payable.

3. Equity accounts

Equity accounts represent the residual interest in the assets of an entity after deducting liabilities. Essentially, it’s what’s left for the owners if the company were to pay off all its liabilities. It includes common stock, retained earnings, and other comprehensive income.

Operating cycle of permanent accounts

Permanent accounts follow a continuing cycle of operation. At the beginning of an accounting period, these accounts carry forward the ending balance from the previous period. As business transactions occur, they are recorded in the appropriate permanent accounts, causing the balances to increase or decrease accordingly.

Unlike temporary accounts, permanent accounts do not close at the end of the accounting or bookkeeping period. Their balances remain, providing an ongoing record of each account’s cumulative activity.

Breaking down permanent accounts: The role of permanent accounts in financial statements

Permanent accounts are integral to creating the balance sheet, one of the main financial statements. The balance sheet is a snapshot of a company’s financial position at a specific point in time. It’s composed of three sections: assets, liabilities, and equity. The information recorded in the asset, liability, and equity accounts is used to populate these sections, providing insights into the company’s financial health.

Comparing temporary and permanent accounts

While both types of accounts are essential for financial accounting and have some similarities, they serve different purposes. Let’s explore the accounts in more detail.

The similarities between temporary and permanent accounts

Temporary and permanent accounts share some fundamental similarities. Both types of accounts are essential components of the double-entry bookkeeping system, with each transaction affecting at least two accounts. They also both contribute to the generation of financial statements, with temporary accounts primarily forming the income statement and retained earnings statement, and permanent accounts forming the balance sheet and playing the vitalrole for reconciliation of a balance sheet.

Contrasting temporary and permanent accounts

Temporary and permanent accounts differ in several ways:

1. Accounting period

Temporary accounts record transactions within a single accounting period, while permanent accounts maintain a record over multiple periods.

2. Closing of accounts

At the end of each accounting period, temporary accounts are closed and reset to zero. Conversely, permanent accounts are never closed; they carry their balances forward into the next accounting period.

3. Types of transactions recorded

Temporary accounts track revenues, expenses, and dividends. In contrast, permanent accounts record assets, liabilities, and equity.

4. Purpose

Temporary accounts offer insights into the profitability of a business within a specific period, while permanent accounts provide a snapshot of the overall financial position of the business over time.

Choosing between temporary and permanent accounts

The choice between temporary and permanent accounts is not a matter of preference—it’s determined by the nature of the transaction. Misclassifying transactions can lead to inaccurate financial reports, which can mislead decision-makers and potentially violate regulatory standards.

As a best practice, accountants should understand the purpose of each account and apply transactions to the appropriate account accordingly. The principle of consistency should also be maintained to ensure accurate comparisons over different accounting periods.

Transaction classification: The heart of the matter

Not sure how to classify the transactions in your books? You do not have to be an analyst to do that. Here’s a straightforward guide on how to classify transactions:

1. Revenue or income

If the transaction involves revenue or income, it should be recorded in a temporary account. Examples include sales revenue, interest income, or service revenue.

2. Expenses

Expenses, such as cost of goods sold, rent expense, or salaries expense, are recorded in temporary accounts.

3. Dividends

Dividends paid to shareholders are also recorded in a temporary account, specifically the dividend account.

4. Assets

Transactions involving assets, such as purchase of machinery or receipt of cash, are recorded in permanent accounts.

5. Liabilities

If the transaction creates a liability (e.g., loans or accounts payable), it should be recorded in a permanent account.

6. Equity

Equity transactions, such as issuing shares or retaining earnings, are recorded in permanent accounts. It’s important to note, however, that dividends, while impacting equity, are recorded in a temporary account due to their periodic nature.

The Principle of Consistency

Once you’ve classified a type of transaction into a specific account, consistency should be maintained. For instance, if you’ve recorded sales revenue in a specific temporary account, all subsequent sales revenues should be recorded in the same account. This consistency ensures accurate comparisons over different accounting periods.

Real-world applications and challenges

Accounting in real life can be more complex than textbook examples. Transactions may sometimes seem to blur the lines between categories. For instance, a long-term prepaid expense might feel like an asset, but it’s typically recorded in a temporary account due to the eventual recognition of the expense. In such cases, generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS) provide guidelines for categorization.

Choosing between temporary and permanent accounts is a fundamental aspect of accurate financial reporting. By understanding the nature of these accounts and the transactions they’re designed to record, you can ensure the integrity of your financial data. Remember, the goal is not just to record transactions but to paint a precise financial picture of your business that informs strategic decision-making and complies with accounting standards.

Tired of spending your resources on classifying transactions? Want to ease your workload and delegate manual transaction tasks? It’s time to consider using smart automated software.

Harnessing the power of Synder for better management of your accounts

The intricacies of accounting require the right tools to navigate effectively. Synder, a powerful automated accounting software, can play a pivotal role in better managing temporary and permanent accounts in your business. Synder can streamline your accounting processes, ensuring accuracy and efficiency in handling both types of accounts and provide clear picture of your cash flow.

Synder automates and simplifies several facets of accounting and finance for e-commerce ans SaaS businesses and accounting and bookkeeping professionals serving them. It’s known for its seamless integrations with popular e-commerce and financial platforms, including Shopify, Amazon, PayPal, Stripe, and Square, as well as accounting software like QuickBooks and Xero.

Synder’s functionalities can greatly assist in the management of accounts. The tool automatically records all sales transactions from integrated platforms in real-time, no manual entry. This ensures revenues are accurately tracked in temporary accounts within the correct accounting periods. Once set up and properly configured, Synder will also capture and categorize expenses, keeping a precise record within your expense accounts. It can track both direct and indirect costs, enhancing the visibility of your business expenses.

Being a smart tool, Synder accurately records the inflow and outflow of your assets, whether it’s cash from a sales transaction or a purchase that increases your inventory. This accurate tracking helps maintain a comprehensive and accurate asset account. You can also use Synder to help you track both short-term and long-term liabilities. For instance, it can manage accounts payable by automatically recording invoices from integrated platforms.

By facilitating accurate tracking and management of both temporary and permanent accounts, Synder offers a host of benefits. For instance, automation of accounting software and bookkeeping tasks saves significant time and manpower. This way, these resources can be used other strategic aspects of your business. Thanks to its automation, Synder reduces the risk of human error associated with manual data entry, ensuring the accuracy of your financial records. The tool also provides you with the real-time financial overview – you can have an up-to-date, accurate picture of your business’s financial health at any given time. Finally, Synder simplifies the reconciliation process by matching transactions recorded in your books with actual bank statements, no hassle at all.

Proper management of temporary and permanent accounts is a cornerstone of effective accounting. With Synder, you can automate this process, ensuring accuracy, saving time, and gaining a clear real-time view of your financial status. Check what Synder offers out of the box to ease your accounting by signing up for a 15-day free trial, or sign up for a webinar to see what the tool can do and ask questions. Forget about Excel spreadsheets and automate your accounting!

Conclusion

In conclusion, understanding the difference between temporary and permanent accounts is crucial in business accounting. While temporary accounts provide insights into the financial performance of a specific period, permanent accounts provide an ongoing record of a company’s overall financial position. By applying this knowledge appropriately, accountants can ensure accurate financial reporting and contribute to sound business decision-making.

Read our articles about How to calculate operating cash flow and Ecommcer business insurance.