In QuickBooks, you might stumble upon the opening balance equity account, which can be confusing (especially if you’ve just started to work with the software) as you look at something you didn’t set up. While there’s nothing to worry about, you can’t ignore it since it’s a temporary account you should close. If not closed out, this account signifies an erroneous journal entry in your QuickBooks accounting records, which results in an unprofessional-looking balance sheet.

Let’s try to beat up the confusion about the opening balance equity account and figure out its purpose and how to reconcile it in QuickBooks to present professional balance sheets to banks, auditors, and potential investors.

Contents:

1. What is opening balance equity in QuickBooks Online and Desktop?

- Why might you have never met the opening balance equity account before?

- So, what is the opening balance equity account?

2. How does opening balance equity work?

3. Why do you have an opening balance equity account in your chart of accounts?

- You create a company file in QuickBooks for the first time

- You start a new business

- You start a new period in the books

- You have errors in the previous period

- You add a new item to the chart of accounts

- You merge your business with another

4. Why do you need to zero opening balance equity?

5. How do you clear opening balance equity in QuickBooks?

Master QuickBooks Online with our comprehensive workflow guide! 📚

Discover the insider tips and best practices to streamline your financial workflows, boost productivity, and maximize profits. Download our guide!

Key takeaways

- Opening balance equity is a temporary account in QuickBooks created to reconcile discrepancies during setup or adjustments. It’s crucial for ensuring accurate accounting records and a balanced financial equation (assets = liabilities + equity).

- Unallocated funds in the opening balance equity account can lead to misrepresentation in financial statements, complicating analysis and potentially causing compliance issues. Closing out this account is essential for transparent and accurate financial reporting.

- To zero out the Opening Balance Equity account, create a journal entry in QuickBooks to transfer the balance to appropriate equity accounts. This process ensures that your financial records are accurate, professional, and compliant with accounting standards.

What is opening balance equity in QuickBooks Online and Desktop?

So, let’s hop right on to find out what the opening balance equity account is and why it can confuse you.

We’ll deal with the confusion first.

Why might you have never met the opening balance equity account before?

Setting up your business accounting in QuickBooks (or other accounting software) for the first time, it’s likely that you may not have encountered an opening balance equity account yet. The opening balance equity account typically does not appear on financial statements like the balance sheet, so you might be unaware of its existence.

But imagine you creating a company file in QuickBooks, and it pops up seemingly out of nowhere, showing some balance on it. No need to worry because QuickBooks creates it automatically as you start setting your accounts and inserting your opening balances there.

So, what is the opening balance equity account?

The opening balance equity account (OBE) is a temporary holding account QuickBooks creates to reconcile discrepancies between actual and expected balances during the setup process or in cases there are funds it can’t allocate for some reasons (we’ll get to those a bit further on).

The balance on this account represents the difference between the assets and liabilities of a business at the beginning of a new accounting period, which is the start of a new fiscal year or when a new company is established.

But that’s the definition. Let’s proceed and look at how it works in more detail.

Want to always have accurate records in your QuickBooks? You might want to automate your accounting to eliminate errors, have your transactions categorized correctly and funds allocated properly. Book your seat at our Weekly Public Demo to see how you can do it with Synder, or explore it yourself with a 15-day all-inclusive free trial.

How does opening balance equity work?

As mentioned above, opening balance equity is needed to ensure that your accounting remains balanced and that the financial records of a business are accurate.

We need to break it down, shall we?

As you know, the accounting equation is Assets = Liabilities + Equity.

It’s the fundamental principle in accounting, and QuickBooks obviously follows it. So, to ensure your assets are in balance with liabilities and equity, QuickBooks might introduce the opening balance equity in your chart of accounts to put the difference there (should it occur).

Opening balance equity is an equity account (as you can see by the name). As soon as you start setting your asset accounts with opening balances in the chart of accounts, QuickBooks will put the equal balance amounts to this account to offset them and, this way, balance the equation. Adding opening balances to your liability and equity account should, ideally, put the OBE’s balance to zero.

However, it might not happen, so you might need to invest some effort into searching for the cause of the discrepancy and fixing it. At this point, I suggest looking at various scenarios where you might end up with a non-zero opening balance equity.

But before we get there, let’s recall what opening balances are, as they, as you can see, relate to the OBE occurrence.

What is opening balance?

An opening balance is the amount in a financial account when a new period begins, like a new year or month (it also applies to when you set up a new company file in QuickBooks). It’s the starting point for keeping track of money coming in and going out. In other words, it’s the first number you see when looking at your finances for a new period.

You might want to know your opening balance, as it tells you what you had before any new transactions or changes happened. It’s like the foundation of your financial records, helping you keep track of everything accurately.

You can have an opening balance for different types of accounts, like how much money you have in the bank (assets), what you owe to others (liabilities), or what your business is worth (equity). There also can be opening balances for your revenue and expense accounts.

Here’s some more articles about accounts you might want to read:

- What is a clearing account and how to use it for e-commerce business purposes

- Checking Account as a Type of Bank Account: Understanding the Nature of Checking Accounts

- Reconciling a Checking Account: Beginners Guide to Smooth Bank Reconciliation

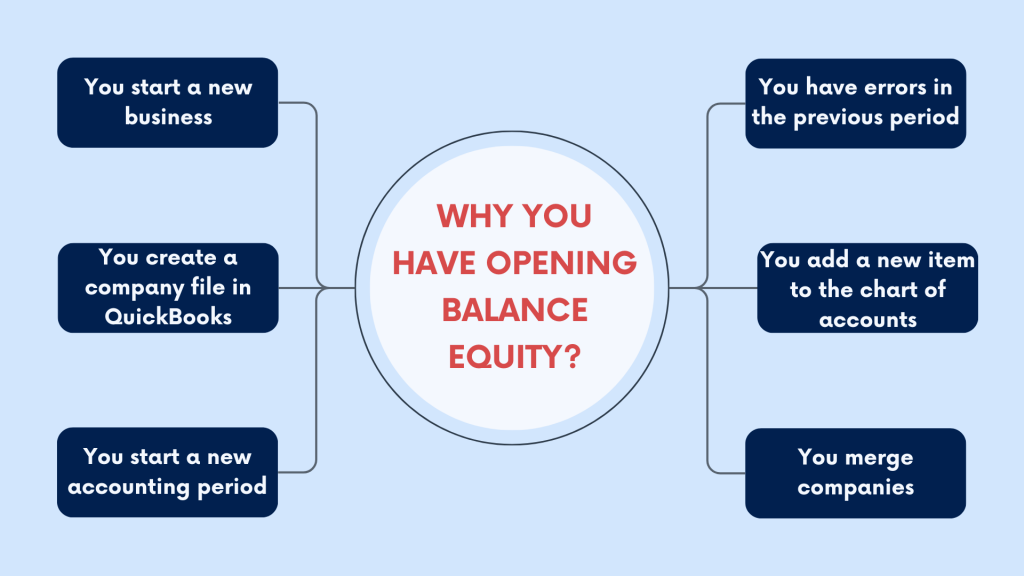

Why do you have an opening balance equity account in your chart of accounts?

Now that we clarified the terms, let’s look at the scenarios where you have an opening balance equity in your chart of accounts. It’s worth noting that some of them are a normal course of things, but others might require more of your attention.

1. You create a company file in QuickBooks for the first time

When you create a company file in QuickBooks for the first time (it’s the most frequent scenario, as mentioned), the OBE account is automatically generated to ensure that your accounting records are balanced from the start.

Here’s how it looks, step-by-step.

Step #1 – Entering opening balances for assets

During the setup process, QuickBooks prompts you to enter the initial balances for your accounts, including balances for assets, liabilities, equity, income, and expenses. You get these initial balances from various sources such as your previous accounting system, bank statements, financial statements, or other records.

As a rule, you start with assets. As you enter the initial balances for your accounts, QuickBooks calculates the total of all the balances entered. It also automatically creates the opening balance equity account and assigns it a balance equal to the total of the initial balances entered for all accounts.

Step #2 – Entering opening balances for liabilities

Next, you might want to create your liability accounts and enter their initial (or opening, if you will) balances.

At this point, you will see how the balance on your opening balance equity account decreases to the total of your liability accounts.

Step #3 – Entering or distributing opening balances for equity.

The final step of this journey is to create equity accounts and assign balances to them. You can do it two ways, actually.

First, you create the accounts and enter the opening balances there, as you did for the assets and liabilities accounts. Ideally, it should reduce the amount on the opening balance equity to zero.

Another way is to create equity accounts with zero balances and then distribute the amount still remaining on the OBE account to them accordingly through journal entries.

To do so, you might want to create a journal entry to transfer the balance of the OBE account to the appropriate equity accounts.

Debit the equity accounts you want to allocate the funds to, and credit the opening balance equity account for the same amount. This will effectively reduce the balance of the opening balance equity account and set it to zero.

2. You start a new business

When starting a new business, you do it from scratch, as you don’t yet have any previous financial history or transactions to work with. Still, you create accounts for your assets, liabilities, and equity and enter initial balances.

Where do they come from?

In this case, your assets usually represent your initial investment, the starting capital of the business. You might also have a business loan to help you kick-start your operation and the supplies. That’s where your liabilities might come from.

As you enter the initial balances for your assets and liabilities, QuickBooks will automatically put the amount to the open balance equity account to, as we mentioned, keep the accounting equation balanced. However, you don’t want to leave that money sitting there. So, we need to allocate it to the appropriate accounts in your chart of accounts.

There can be several options, depending on your business structure.

- Owner’s equity or capital account

If you’re a sole proprietor, you can move the funds from the opening balance equity account to your owner’s equity or capital account. - Retained earnings

Another option is to allocate these funds to the retained earnings accounts. It’s more typical when a business has been operating for some time and might have accumulated profits you haven’t taken out as owner’s withdrawals. - Other equity accounts

Depending on your business structure and specific circumstances, you may have other equity accounts where you can allocate the funds. The most frequent case is the business having several owners, so you distribute the funds from the opening balance equity account to their respective equity accounts.

3. You start a new period in the books

At the beginning of a new accounting period, such as a new month or year, you typically have account balances from the previous period, representing the financial position of your business at the end of it.

Starting the new period may come with the OBE showing some balance. At this point, the balance might come from several sources, including adjustments and accruals.

- Adjustments

Any adjustments or corrections made to account balances at the end of the previous period may result in a balance temporarily held in the OBE account - Accruals

Accruals for expenses or revenues recognized in the previous period but not yet recorded may also contribute to it.

As you might want to allocate these funds to the appropriate accounts, you might want to look at the nature of the funds and distribute them to either income statement accounts – revenues or expenses – or balance sheet accounts – such as assets or liabilities.

4. You have errors in the previous period

This one might be a part of the previous scenario. But since it needs more attention and effort to fix, we’ll look at it separately.

In accounting, errors in recording transactions or maintaining financial records can happen for various reasons, leading to discrepancies in your financial statements. In other words, your balances don’t balance correctly. At this point, the OBE account will reflect the erroneous amount to compensate for it.

The cause can hide in errors in the previous accounting period due to transaction misclassification, omissions, or calculation errors. So, after you identify and correct them, you’ll need to allocate the funds from the OBE account to the appropriate accounts to reflect the corrections. You can do it in several ways based on the nature of the errors and the accounts affected.

- Reversal entries

If transactions were recorded incorrectly, you may need to make reversing entries to undo the effects of the errors and reclassify them to the correct accounts. - Adjusting entries

For errors that require adjustments to account balances, you’ll make adjusting entries to update the affected accounts and ensure that they reflect the accurate amounts.

5. You add a new item to the chart of accounts

Adding a new item to your chart of accounts – a new inventory item, a customer, or a vendor entry – may result in the appearance of the opening balance equity account. Let’s look at how it happens.

Adding a new inventory item

When you add a new inventory item to your chart of accounts, QuickBooks may ask you to specify an opening balance for this item. It can be the initial quantity of inventory on hand or the value of the inventory at the moment of setup. Shouldn’t this balance have a corresponding entry in another account, the OBE account will reflect it.

So, upon completing the setup, you might want to allocate this balance to the appropriate accounts, such as inventory assets or equity accounts.

Adding a new vendor or customer entry with value balances

Another possible cause, as mentioned, is adding a new vendor or customer entry to your records, along with value balances (e.g., outstanding balances). Without corresponding entries in other accounts to offset these balances, QuickBooks may create balancing entries in the OBE account.

At this point, to zero this balance, you might want to distribute it to the correct accounts. In this case, they might be accounts receivable or accounts payable.

6. You merge your business with another

As you can imagine, when merging companies, you’re merging their financial records. And there is a potential for discrepancies of all sorts. We’ll look at the most typical causes for these discrepancies, including:

- Differences in account balances, accounting methods, or reporting standards between the merging companies;

- Valuation adjustments for assets and liabilities, such as fair value adjustments or write-offs;

- Changes or corrections made to align the financial records of the merging companies.

In this scenario, the funds from the OBE account should be allocated based on the nature of the adjustments.

- Balance sheet accounts

Adjustments related to asset and liability balances, such as goodwill, intangible assets, or deferred taxes, may be allocated to the appropriate balance sheet accounts. - Equity accounts

Adjustments related to equity balances, such as stock issuance or retained earnings, may be allocated to equity accounts to reflect the ownership structure of the merged entity.

As you can see, many things can cause having a non-zero balance on the OBE account. You can quickly fix some of them, while others require more effort investment, as you need to first investigate their nature. But at the end of the day, you need to zero the opening balance equity account.

Why do you need to zero opening balance equity?

As you can see, having a balance in the opening balance equity account doesn’t necessarily mean something is seriously wrong. It often indicates some things might need your attention.

Seeing a balance in the OBE account during the initial setup of an accounting system or after making adjustments is even a frequent occurrence connected mostly with unallocated funds. Still, these funds should be allocated correctly.

In other cases, such as complex accounting adjustments or ongoing errors, a balance in the OBE account signals of a more critical impact on your accounting. In such situations, it’s essential to investigate the cause of the balance and take appropriate actions to resolve any discrepancies or errors in the accounting records.

Whichever the reason is, having funds left in the opening balance equity account can cause problems for financial reporting. They mess up financial statements, making it hard for people to properly analyze a company’s financial performance and see how the company’s doing. It results in wrong decisions by investors, lenders, and experts who rely on accurate financial info. Besides, not sorting out these funds means you break the compliance rules, which might lead to legal trouble and harm the company’s reputation.

How do you clear opening balance equity in QuickBooks?

Closing the opening balance equity account in QuickBooks is a straightforward process that involves creating a journal entry to transfer the balance in the account to the appropriate equity accounts. Here’s how to close the opening balance equity account in QuickBooks:

- Navigate the Lists menu in QuickBooks down to select Chart of Accounts.

- Locate the Opening Balance Equity account in the Equity section of the chart of accounts.

- Right-click on the account and select Make Journal Entry.

- In the journal entry window, debit the appropriate equity accounts for the amounts that contributed to the opening balance equity account. For example, if the opening balance equity account included amounts for retained earnings and common stock, debit those accounts accordingly.

- Credit the opening balance equity account for the total amount being transferred to the equity accounts.

- Review the journal entry to ensure that it is accurate and balanced.

- Save and close the journal entry.

After creating the journal entry to transfer the balance in the opening balance equity account to the appropriate equity accounts, the opening balance equity account should have a zero balance, meaning that you’re good.

Find out How to Delete Deposits in QuickBooks.

Conclusion

To sum it up, opening balance equity is a temporary account that is automatically created by QuickBooks to ensure that the accounting equation (assets = liabilities + equity) is balanced. While it may seem confusing to some users, understanding how to properly handle this account is important for maintaining accurate accounting records and presenting a professional balance sheet to banks, auditors, and potential investors.

So a good rule of thumb is closing out the opening balance equity account in QuickBooks and transferring the balance to the appropriate equity accounts, ensuring that your accounting records are accurate and up-to-date.

Disclaimer:

Please note that the information provided in this article is intended for general informational purposes only and should not be relied upon as professional advice. The steps outlined may not be suitable for every situation, and it’s essential to consult with a professional accountant or financial advisor before making any significant financial decisions. Additionally, the information presented in this article is current as of the knowledge cutoff date and may not reflect any updates or changes made to QuickBooks software or policies since then.

Share your thoughts

Sharing is caring! Share your thoughts and ideas in the comments section below. We’d fancy a good discussion.

%20(1).png)