Credit cards rule the payment world, and every modern business relies on them to keep sales flowing. But here’s the catch—processing fees are lurking in every transaction, quietly chipping away at your profits. If you want to keep your business running smoothly, you need to understand these fees and how they impact your bottom line.

So, what exactly are processing fees? How do you calculate them? These questions are as essential to running a business as breathing is to life. Let’s take a closer look and make sense of it all.

What are processing fees?

As a business owner, you know that payment processing fees are part of the game when accepting credit or debit card payments. But what exactly are you paying for? These fees help cover the costs of everyone involved in the transaction—from the card-issuing bank to the sales channels, such as Amazon, eBay, Etsy, Shopify, etc., and card networks like Visa and Mastercard.

Who pays credit card processing fees?

The answer is: businesses pay credit card transaction fees. While credit card payments boost sales by offering a fast and familiar option, they also come with a cost.

Who’s taking a cut? The transaction fee is shared among several players:

- The issuing bank: The bank that gave the customer their credit card.

- Card networks: Companies like Visa, Mastercard, American Express, and Discover that keep the payments flowing.

- Payment processor: The company behind the scenes handling the technical side—making sure the payment is authorized and settled smoothly.

The fee is usually a percentage of the total sale, but how much depends on factors like the card type, your business model, and the agreement with your payment processor. For businesses, these fees are simply part of the cost of doing business. To stay profitable, many factor them into their pricing, which means customers might end up indirectly covering some of these fees through slightly higher prices.

Sounds simple enough, right? If you want to get the full picture, you’ll need to dive deeper into these types and uncover what’s really going on.

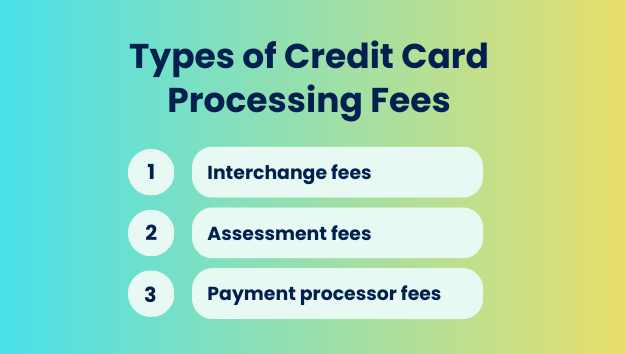

Types of credit card processing fees

To start, processing fees fall into three main categories and each plays a different role in the transaction process:

But it’s not as simple as it seems. Each type has its own pitfalls, so let’s take a closer look.

Interchange fees

Interchange fees—sounds a bit dry, right? But they’re actually an important part of the process. These are the fees merchants pay when customers use credit or debit cards to buy goods or services. Typically, it’s between 1.15% and 3.25% of the transaction, depending on the card type and payment method.

Set by card networks like Visa and Mastercard, the fees flow from the merchant’s bank (the acquiring bank) to the customer’s bank (the issuing bank), all in exchange for managing the transaction and taking on the risks.

What’s it all about?

- Purpose: Interchange fees help fund the entire payment system—everything from fraud prevention to maintaining secure transaction networks. It’s all about making sure every payment goes smoothly.

- Structure: These fees are a mix of a fixed amount plus a percentage of the transaction. The rate depends on things like the card type (rewards cards tend to be pricier) and how the payment is made (online transactions cost more).

- Impact on merchants: For businesses, interchange fees are one of the biggest chunks of the cost of accepting card payments. Knowing these fees will help you control expenses and price your products effectively.

📌 Note: The interchange rates vary by each network and are set every April and October.

Assessment fees

Assessment fees might not be the most exciting part of accepting card payments, but they help everything run smoothly. These fees are charged by card networks like Visa, Mastercard, American Express, and Discover, and they help fund the infrastructure that makes card transactions possible.

What’s it all about?

- Purpose: Assessment fees keep the wheels turning behind the scenes, covering the costs of running and securing the card networks. They help pay for things like data security, fraud prevention, and ensuring the payment system is always up and running.

- Structure: These fees are typically a small percentage of the total transaction and are passed along from your payment processor to you. While they’re not huge individually, they can add up over time—especially if your business handles a lot of transactions.

- Impact on merchants: While assessment fees are usually lower than interchange fees, these little charges add up quickly, especially for businesses with high transaction volumes. For example, Visa and Mastercard assessment fees are typically around 0.11% of the transaction amount.

Payment processor fees

Payment processor fees aren’t as simple as they seem. These fees come in different types, adding a layer of complexity to the process. There are three main types of processor fees:

- Flat-rate fees;

- Tiered fees;

- Interchange-plus pricing.

These fees can vary between providers, so it’s important to compare and understand the structure offered by different processors.

Flat-rate fees

Flat-rate fees in payment processing are as simple as they sound: you pay a fixed percentage for every transaction, no matter how it’s paid or what card is used. This no-surprise pricing makes it easy for businesses to predict and control their payment processing costs. Here’s a closer look at the key aspects of flat-rate fees:

- Simplicity: Flat-rate pricing is perfect for small businesses or those with low transaction volumes. It’s a predictable cost structure that makes budgeting a breeze.

- Uniform rates: No matter how the card is swiped—whether in-person, keyed in, or online—you pay the same rate. For instance, a flat-rate processor might charge you 2.75% plus $0.30 per transaction.

- Higher costs for some transactions: While this pricing is easy to follow, it can be more expensive for certain transactions. Transactions involving rewards cards or international payments tend to have higher interchange fees, which are already wrapped into the flat rate.

Here are the pricing rates that the most popular payment processors use for their processing fees per transaction:

- Stripe: 2.9% + $0.30 each for online transactions.

- PayPal: range from 2.99% to 4.99% + fixed fee from $0.09.

- Shopify: depending on the plan – from 2.4% to 2.9% + $0.30.

Tiered fees

Tiered pricing in payment processing breaks transactions down into three categories, each with its own fee rate. Think of it as a tiered system where the more standard and straightforward the transaction, the lower the fee. Here’s the breakdown:

- Qualified transactions: These are your bread-and-butter sales—standard consumer credit cards processed in person (card-present) with the proper authorization. These transactions usually come with the lowest fees, making them the most affordable option for businesses.

- Mid-qualified transactions: Think rewards cards, business cards, or those processed by keying in the information rather than swiping. While still relatively common, these transactions come with a higher fee because of the extra processing involved.

- Non-qualified transactions: These are the high-risk or international cards or any transactions that didn’t get proper authorization. They come with the highest fees due to the added complexity and risk, making them the priciest for merchants to handle.

Each payment processor defines these tiers a little differently, which means the fees you pay can vary based on which category your transactions fall into. This can lead to unpredictable costs, making it harder for businesses to accurately forecast their expenses.

Interchange-plus pricing

With interchange-plus pricing, you pay the actual interchange fee (the lowest available) plus a fixed fee on top. This way, you always know exactly what you’re paying and get the best possible rate for each transaction.

It makes understanding your monthly credit card processing fees much easier. However, things like your transaction volume and merchant category can still affect the total fees. So, when comparing processors, keep these factors in mind to get the best deal for your business.

Processing fee example: how to calculate them

To stay fully prepared, it’s important to learn how to calculate processing fees, as it’s key to keeping your business profitable and running smoothly. Here’s a quick and easy guide to help you break down these costs:

1. Understand the fee structure:

Credit card processing fees typically consist of:

- Percentage of the transaction amount: This varies based on the card type and transaction method.

- Fixed transaction fee: A flat fee per transaction, often ranging from $0.10 to $0.30.

2. Calculate the fee for a single transaction:

Use the formula:

Processing fee = (Transaction amount × Percentage rate) + Fixed fee

Example:

For a $100 sale with a 2.5% processing rate and a $0.10 fixed fee:

Processing fee = ($100 × 0.025) + $0.10 = $2.50 + $0.10 = $2.60

3. Calculate monthly processing fees:

To estimate monthly fees:

Monthly processing fees = (Average transaction amount × Number of transactions per month × Percentage rate) + (Fixed fee × Number of transactions per month)

Example:

If you process 500 transactions monthly, each averaging $50, with a 2.5% rate and $0.10 fixed fee:

Monthly processing fees = ($50 × 500 × 0.025) + ($0.10 × 500) = $625 + $50 = $675

| Keep in mind that rates and fees can differ between payment processors and depend on the type of business you run. For the most accurate information, it’s always a good idea to check in with your payment processor. They’ll give you a clear breakdown of the fees and help you calculate the processing costs for your transactions, ensuring you know exactly what to expect. |

Popular strategies for managing payment processing fees in accounting entries

Fees are important, but not exactly enjoyable, as they drain your budget. But are there ways to reduce them? Absolutely. Here are a few effective strategies to help lower these costs and boost your business’s profitability.

- Implement address verification services (AVS): Utilize AVS to verify the cardholder’s billing address during transactions. This practice can lower processing fees and reduce the risk of chargebacks, as it adds an extra layer of security to the transaction.

- Optimize transaction methods: Steer customers toward debit cards—they typically cost less to process than credit cards. Also, check out platforms with low or zero fees, especially if you handle high transaction volumes. The less you pay in fees, the more you keep in your business.

- Enhance security measures: Investing in strong fraud protection—like tokenization and point-to-point encryption—not only keeps cardholder data safe but can also score you lower processing rates. Processors love low-risk businesses, and that means more savings for you.

- Regularly review your processing statements: Regularly check your processing statements for errors or unexpected charges. This helps you catch overpayments early and fix them before they add up.

These moves are not big and scary, but they can make a difference, save you money, and reduce your payment processing fees, leading to improved profitability and more efficient financial operations.

How to manage your processing fees and accounting entries with Synder

Processing fees are small but still matter a lot. What if you have 100 or 1,000 transactions? The numbers quickly add up. To avoid issues during tax season, recording these fees properly and keeping your books in order is very important. That’s where Synder can help.

Synder is an automation tool that integrates with over 30 platforms, including payment gateways like Stripe and PayPal or Square, sales channels such as Amazon and Shopify, and accounting software like QuickBooks Online/Desktop, Xero, and Sage Intacct.

When it comes to processing fees, you can rely on Synder for accurate fees recording. For example, when you sync a transaction from a payment processor to QuickBooks Online, Synder automatically creates a Sales Receipt for the total amount of the sale, as well as an Expense entry for the payment processor fees.

Each transaction is synced, with fees automatically recorded, ensuring no fee is overlooked. Since Synder integrates with multiple platforms, it continuously tracks every transaction, fee, refund, and deposit as long as the platform or payment provider is connected to your business.

But Synder does much more than just record fees:

- Seamless data transfer: Real-time synchronization ensures your data is always up-to-date across all connected platforms.

- Simplified reconciliation: Synder automates reconciliation, eliminating manual entries and errors, preventing duplicates, and ensuring accuracy.

- Comprehensive reporting: You can generate detailed P&L and balance sheet reports directly from invoices, receipts, and bills, and then break down these reports by timeframe or any custom range.

Interested? Test Synder for yourself, sign up for our 15-day free trial or join the Weekly Public Demo to see Synder in action.

Conclusion

So, what’s the takeaway? Processing fees are a necessary part of doing business. They allow you to accept credit cards and keep operations running smoothly. But at the same time, they require close attention. With so many variations, it’s easy to overlook how much of your revenue is slipping away.

The good news is that it’s not as daunting as it seems. Accurately recording and calculating these fees ensures you avoid surprises at year-end and keep your books in order. Tools like Synder make the process even easier by automating accounting and giving you valuable insights into transaction costs.

.png)

Thanks for the brief, concise and easy to understand explanation of processing fees!

Thank you so much, David!